Corporate Governance | UPSC Mains: Ethics, Integrity & Aptitude PDF Download

Introduction

Corporate governance and ethics are two closely related concepts that are essential for shaping the behavior and decision-making processes within organizations. The connection between corporate governance and the importance of ethics is fundamental for maintaining transparency, accountability, and sustainable business practices.Ethics is closely tied to transparency and accountability, which are two key pillars of good corporate governance. When an organization is governed ethically, it is more likely to provide accurate and transparent information to its stakeholders.

What is Corporate governance ?

Corporate governance refers to the framework of rules and practices that ensure a company is directed and controlled in a responsible and transparent manner. Its primary aim is to protect the interests of various stakeholders, including shareholders, employees, customers, and the community, while preventing corporate misconduct and promoting ethical behavior.By establishing clear standards and holding individuals accountable, corporate governance plays a crucial role in maintaining trust and integrity within the business environment.

Principles of Corporate Governance

- Fairness: The board of directors must treat shareholders, employees, vendors, and communities fairly and with equal consideration.

- Transparency: The board should provide timely, accurate, and clear information about such things as financial performance, conflicts of interest, and risks to shareholders and other stakeholders.

- Risk Management: The board and management must determine risks of all kinds and how best to control them. They must act on those recommendations to manage them. They must inform all relevant parties about the existence and status of risks.

- Responsibility: The board is responsible for the oversight of corporate matters and management activities. It must be aware of and support the successful, ongoing performance of the company. Part of its responsibility is to recruit and hire a Chief Executive Officer (CEO). It must act in the best interests of a company and its investors.

- Accountability: The board must explain the purpose of a company's activities and the results of its conduct. It and company leadership are accountable for the assessment of a company's capacity, potential, and performance. It must communicate issues of importance to shareholders.

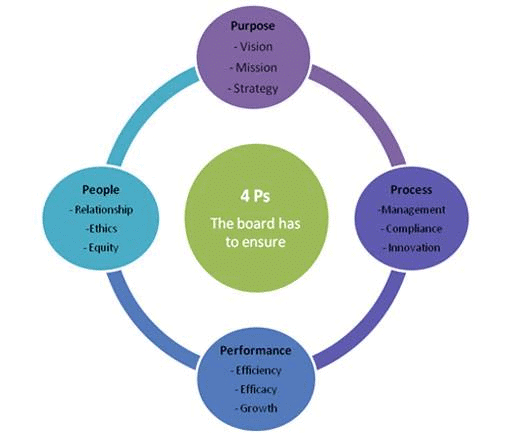

Four Ps of Corporate Governance

- People: This 'P' highlights the significance of the individuals involved in corporate governance, such as the board of directors, executives, and employees. The board's composition, including their skills, independence, and diversity, plays a crucial role in effective governance.

- Purpose: Purpose pertains to the company's overarching mission and goals. Corporate governance ensures that the company's purpose aligns with ethical standards and is geared towards creating long-term value for both shareholders and stakeholders.

- Processes: This 'P' focuses on the systems and procedures established to oversee and manage the company. Governance processes encompass decision-making methods, risk assessment and management, and maintaining accountability within the organization.

- Practices: Performance in corporate governance relates to the company's success in achieving its goals while adhering to ethical standards. The governance framework continuously monitors and evaluates the company's performance against established benchmarks.

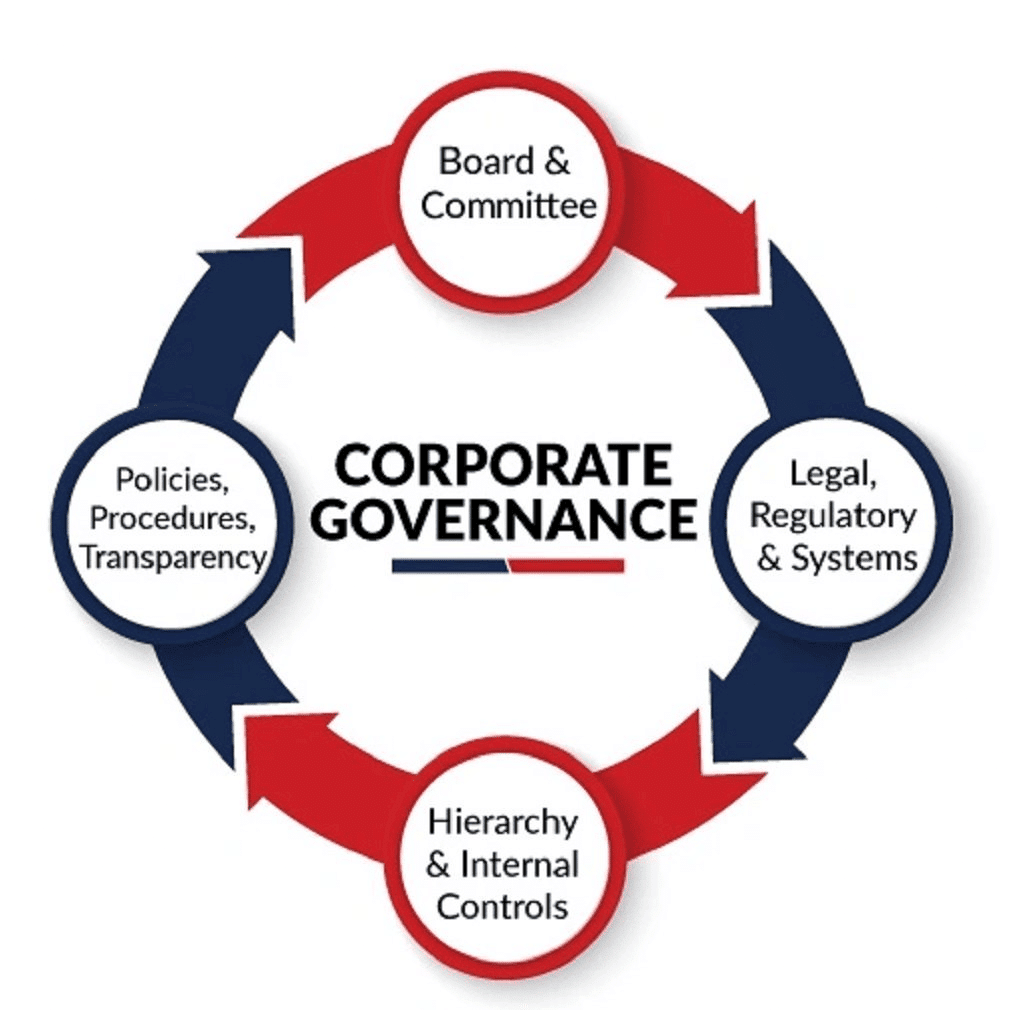

Key Components of Corporate Governance?

Board of Directors

Composition and Independence:- The number of directors on the board varies based on the company's size:

- Public companies must have a minimum of three directors.

- Private companies need at least two directors.

- One-person companies require just one director.

- The maximum number of directors is fifteen.

- Every company must have at least one director who has lived in India for at least 182 days in the previous year.

- A woman director is required on the board of every company.

- Listed companies must have at least one-third of their board as independent directors.

Board Committees

Board committees are specialized sub-groups within the board of directors, established to concentrate on specific areas of responsibility. While not every board has committees, they are prevalent in larger organizations.

- Audit Committees: These committees oversee the financial reporting process, internal controls, and the audit process.

- Compensation Committees: They are responsible for setting and reviewing the compensation of the company’s executives.

- Nominating Committees: These committees handle the selection and nomination of candidates for the board of directors.

Shareholders and Stakeholders

Rights and Responsibilities

- Voting Rights: Shareholders can vote on crucial decisions like electing the board, approving mergers, and changing company rules.

- Dividend Rights: Shareholders have the right to receive a share of the company's profits.

- Inspection Rights: They can look at the company’s financial records.

Minority Shareholder Protection

Minority shareholders, owning less than 50% of a company’s shares, have specific rights to ensure their interests are protected.

- Voting Rights: Minority shareholders can vote on key issues, such as electing directors and approving major decisions.

- Accountability: They have the right to hold directors and officers accountable for their actions, ensuring the company is run efficiently.

- This accountability helps improve the company’s performance and financial returns.

Disclosure and Transparency

Financial Reporting

- Financial reporting involves sharing financial details with stakeholders through documents like balance sheets and income statements.

- This process is regulated by standards such as GAAP and IFRS to ensure accuracy and consistency.

Non-Financial Disclosure

Non-financial disclosure involves sharing information related to a company's Environmental, Social, and Governance (ESG) practices. This includes details about the company's impact on the environment, social responsibility initiatives, and governance structures, which are increasingly important to stakeholders.

Environmental, Social, and Governance (ESG) Goals

ESG goals represent a set of standards that guide a company's operations towards better governance, ethical practices, environmental sustainability, and social responsibility. These goals focus on non-financial factors as a metric for guiding investment decisions, emphasizing that increased financial returns is no longer the sole objective for investors.

Environmental Criteria. This aspect evaluates how a company acts as a steward of nature. It involves assessing the company’s impact on the environment, including its efforts to reduce carbon emissions, manage waste, and conserve natural resources.

Social Criteria. This criterion examines how a company manages its relationships with various stakeholders, including employees, suppliers, customers, and the communities where it operates. It involves looking at factors such as labor practices, diversity and inclusion, community engagement, and customer satisfaction.

Governance. Governance focuses on a company’s leadership and internal practices. This includes evaluating executive compensation, the effectiveness of audits, internal controls, and the rights of shareholders. Strong governance ensures that a company is run ethically and in the best interests of its stakeholders.

The ESG framework has gained recognition as an essential aspect of modern business since the introduction of the United Nations Principles for Responsible Investing (UNPRI) in 2006. It differs from Corporate Social Responsibility (CSR) in that it addresses intangible aspects of corporate governance. While CSR involves tangible projects aimed at social development and aligning good governance with corporate practices, ESG focuses on the broader impact of a company’s operations on society and the environment.

In developing economies like India, CSR is often viewed as corporate philanthropy, where companies contribute to social development initiatives that support government efforts. This aligns with the concept of good governance, ensuring that corporate actions contribute positively to societal goals.

Regulatory Framework for Corporate Governance in India

The regulatory framework for corporate governance in India has evolved significantly over the years, with various authorities and committees playing crucial roles in shaping the guidelines and standards. Here’s a detailed overview of the evolution and current state of corporate governance regulation in India:Evolution of Regulatory Framework

Regulatory Authorities for Corporate Governance:

- The Ministry of Corporate Affairs (MCA) and the Securities and Exchange Board of India (SEBI) are the primary regulatory authorities overseeing corporate governance in India.

- Their roles involve establishing and enforcing regulations to ensure ethical business practices and protect stakeholder interests.

Corporate Governance Regulation in the 1990s:

- During the 1990s, SEBI began regulating corporate governance in India through various laws, including the Security Contracts (Regulation) Act, 1956; Securities and Exchange Board of India Act, 1992; and the Depositories Act of 1996.

- This period marked the beginning of formal regulatory oversight in corporate governance.

Introduction of Formal Regulatory Framework:

- In 2000, SEBI established the first formal regulatory framework for corporate governance, following the recommendations of the Kumar Mangalam Birla Committee (1999).

- This framework aimed to enhance corporate governance standards and promote transparent and accountable business practices in India.

Subsequent Governance Initiatives:

- In 2002, the Naresh Chandra Committee on Corporate Audit and Governance made further recommendations to address governance issues, leading to the establishment of organizations like the Confederation of Indian Industry (CII), National Foundation for Corporate Governance (NFCG), and the Institute of Chartered Accountants of India (ICAI).

- These bodies work collectively to promote responsible and transparent corporate practices in India.

Companies Act, 2013

Provisions Related to Corporate Governance:

- The Companies Act, 2013 introduced various provisions to enhance corporate governance, including:

- Appointment of Key Managerial Personnel (KMPs) to ensure accountability.

- Role of audit committees and independent audits to strengthen oversight.

- Stricter regulation of related party transactions to prevent conflicts of interest.

- Restrictions on the number of layers of companies to improve corporate structure.

- Enhanced disclosures through board reports, financial statements, and filings with the Registrar of Companies to ensure transparency.

Amendments and Updates to the Companies Act:

- Key amendments to the Companies Act include:

- Establishment of the National Company Law Tribunal (NCLT) and National Company Law Appellate Tribunal (NCLAT) to replace the Company Law Board.

- Introduction of the Insolvency and Bankruptcy Code, 2016.

- Amendment of the definition of “related party” to include entities holding 10% or more equity shares in the listed entity.

- Requirement for the appointment of an independent director in companies with a paid-up share capital of ten crore rupees or more.

- Necessity of a special resolution for the appointment of an auditor.

National Financial Reporting Authority (NFRA)

- The NFRA, established in 2018 under the Companies Act, 2013, is responsible for recommending accounting and auditing policies and standards to be adopted by companies.

- The NFRA plays a crucial role in ensuring compliance with accounting and auditing standards in India.

Ethical Challenges Associated with Corporate Governance

- Selection Procedure and Term of Board: The process of selecting board members and determining their term is often misused in Indian corporate governance. Board members' terms should be long enough to ensure stability but not so long that they become complacent. For instance, the Tata-Mistry conflict in 2016 arose from disagreements over the appointment of independent directors.

- Performance Evaluation of Directors: Evaluating the performance of directors is a complex aspect of corporate governance. It is essential for identifying areas of improvement and ensuring the board functions effectively. However, the evaluation process must be transparent and objective. In 2018, SEBI mandated listed companies to disclose the criteria for evaluating independent directors' performance.

- Missing Independence of Directors: The independence of directors is often compromised due to their close ties with promoters or management. For example, the ICICI Bank controversy in 2018 involved allegations that the bank’s CEO approved a loan to Videocon Industries in exchange for a quid pro quo deal for her husband.

- Removal of Independent Directors: Removing independent directors raises serious concerns in corporate governance. It is crucial to ensure that independent directors are not dismissed for expressing concerns or dissenting opinions. For instance, in 2018, the board of Fortis Healthcare removed an independent director who raised concerns about the company’s acquisition by IHH Healthcare.

- Liability Toward Stakeholders: Companies often prioritize the interests of promoters or management over those of stakeholders. The Infrastructure Leasing & Financial Services (IL&FS) crisis in 2019 exemplified this issue, as the company’s mismanagement and failure to meet financial obligations to stakeholders came to light.

- Founder/Promoter’s Extensive Role: The role of a founder or promoter in governance can be beneficial but also problematic. While their vision and leadership are valuable, their extensive involvement can lead to conflicts of interest and lack of transparency. In 2019, SEBI required companies to disclose reasons for appointing founders or promoters as board chairpersons.

- Transparency and Data Protection: Lack of transparency and inadequate data protection are detrimental corporate practices. Companies must ensure the protection of sensitive data and information. For example, in 2018, the Reserve Bank of India (RBI) directed banks to safeguard customers’ data and information.

- Business Structure and Internal Conflicts:. clear and well-defined business structure is essential to avoid internal conflicts. Companies should have mechanisms in place to resolve internal conflicts. The public dispute within the board of IndiGo Airlines in 2019 over CEO appointment raised concerns about corporate governance.

- Conflict of Interest: Managers enriching themselves at the expense of shareholders is a significant challenge in corporate governance. In 2018, SEBI mandated companies to disclose related party transaction details to address this issue.

- Weak Board: Lack of diversity in experience and background among board members is a major weakness. Companies should ensure their boards comprise members with diverse backgrounds and experiences for effective decision-making. SEBI's directive in 2018 for companies to have at least one woman director on the board aimed to address this issue.

- Insider Trading: Insider trading involves corporate insiders using confidential information for personal gain. The challenge lies in SEBI's lack of a robust investigative mechanism, allowing culprits to evade consequences.

Reforms Needed in Corporate Governance

- Strengthening Board Independence: Ensure a balanced board composition with a substantial number of independent directors who can provide unbiased perspectives. Conduct periodic assessments of the board's performance and individual director effectiveness. Infosys is often cited as a benchmark for corporate governance in India. The company has a strong board structure, with a majority of independent directors.

- Enhancing Transparency and Disclosure: Implement rigorous financial reporting practices to provide stakeholders with accurate and timely information. Disclose non-financial information, such as ESG factors, to give a holistic view of the company's performance. Tata Sons, the holding company of the Tata Group, has a history of transparency and adherence to governance norms. The removal of Cyrus Mistry as the Chairman in 2016 and subsequent legal battles highlighted the group's commitment to governance principles.

- Empowering Shareholders: Encourage the use of proxy advisory services to facilitate informed shareholder decision-making, especially during critical votes. Promote shareholder activism to hold the board and management accountable for their actions.

- Effective Risk Management: Establish a dedicated committee to identify, assess, and manage risks, ensuring that potential threats to the business are proactively addressed. Conduct regular risk assessments to stay ahead of emerging risks and vulnerabilities.

- Ethical Conduct and Compliance: Develop and enforce a comprehensive code of ethics that outlines expected behavior and ethical standards for all employees and stakeholders. Implement a robust whistleblower mechanism to encourage the reporting of unethical practices without fear of retaliation.

- Executive Compensation Policies: Align executive compensation with the company's performance to ensure that leaders are motivated to drive sustainable growth. Clearly disclose executive compensation structures to shareholders, promoting accountability.

- Corporate Social Responsibility (CSR): Integrate socially responsible practices into business operations and disclose CSR activities to showcase the company's commitment to broader societal well-being.

- Board Training and Development: Provide ongoing training for board members to keep them updated on industry trends, regulatory changes, and governance best practices. Develop a robust succession plan for key leadership positions to ensure continuity and stability.

- Regulatory Compliance: Conduct regular audits to ensure compliance with all relevant laws and regulations. Follow established corporate governance codes and guidelines set by regulatory authorities.

- Engagement with Stakeholders: Foster open communication with stakeholders, including shareholders, employees, and customers, to build trust and transparency. Actively seek and consider feedback from stakeholders to address their concerns and expectations. Mahindra & Mahindra is known for its commitment to ethical business conduct and sustainability. The company's governance practices focus on stakeholder engagement and risk management.

Committee Reports and Supreme Court Judgments on Corporate Governance

Kotak Panel Report: The panel constituted by SEBI under the chairmanship of Uday Kotak has suggested a host of changes for improving corporate governance standards of firms in 2017:- Chairman of the board cannot be the Managing Director/ CEO of the company.

- Boards should have a minimum of six directors. Of these, 50% should be independent directors, including at least one woman independent director.

- Mandate minimum qualification for independent directors and disclose their relevant skills.

- Create a formal channel for sharing of information between the company and its promoters.

- Public sector companies should be governed by listing regulations, not by the nodal ministries.

- Auditors should be penalized if lapses are found.

- SEBI should have powers to grant immunity to whistleblowers.

- Companies should disclose medium-to-long term business strategy in annual reports.

TK Viswanathan Committee: The recommendations of the TK Viswanathan committee on fair market conduct which submitted its report in 2018 are:

- Among a number of recommendations on insider trading, is the creation of two separate codes of conduct.

- Minimum standards on dealing with insider information by listed companies.

- Standards for market intermediaries and others who are handling price-sensitive information.

- Companies should maintain details of immediate relatives of designated persons who might deal with sensitive information and of people with whom the designated person might share a material financial relationship or who share the same address for a year.

- Such information may be maintained by the company in a searchable electronic format. It may also be shared with the SEBI when sought on a case-to-case basis.

- The committee has recommended direct power for SEBI to tap telephones and other electronic communication devices. This is to check insider trading and other frauds. Currently, SEBI has the power to only ask for call records including numbers and durations.

Kumar Mangalam Birla Committee Report, 2000: Some of the key recommendations of the report include:

- The separation of the roles of Chairman and CEO.

- The appointment of independent directors to the board of directors.

- The establishment of an audit committee to oversee financial reporting.

- The requirement for companies to disclose their financial and non-financial performance.

- The establishment of a code of conduct for directors and senior management.

Supreme Court Judgements:

- Satyam Computer Services Ltd. Fraud (2009): Satyam's founder and chairman, Ramalinga Raju, admitted to inflating the company's financial statements and engaging in accounting fraud. The Supreme Court's intervention led to a reconstitution of the board and management of Satyam and highlighted the need for robust corporate governance mechanisms.

- SEBI v. Sahara (2012): The Sahara case involved a long-standing dispute between SEBI and Sahara Group regarding the issuance of optionally fully convertible debentures (OFCDs). The Supreme Court emphasized the importance of protecting the interests of investors and ensuring compliance with securities laws. This judgment had implications for corporate fundraising practices.

Conclusion

Addressing the different aspects of corporate governance in India needs a complete approach that includes:

- Legal reforms to update and improve existing laws.

- Regulatory enhancements to strengthen oversight and compliance.

- A cultural shift towards more ethical business practices.

- It is important to keep monitoring and adjusting to the changing global standards.

- This helps in maintaining investor trust and supports economic growth.

|

78 videos|95 docs

|

FAQs on Corporate Governance - UPSC Mains: Ethics, Integrity & Aptitude

| 1. What is corporate governance? |  |

| 2. Why is corporate governance important for businesses? |  |

| 3. What are the key principles of corporate governance? |  |

| 4. How does corporate governance affect investor confidence? |  |

| 5. What are the consequences of poor corporate governance? |  |

|

Explore Courses for UPSC exam

|

|