Costing and Budgetary Control Methods: Absorption and Marginal Costing | Management Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Absorption Costing |

|

| Marginal Costing |

|

| Absorption Costing and Marginal Costing: Differences |

|

| Marginal Cost |

|

Introduction

We introduced you to the various components of cost, namely materials, labor, and expenses. These cost elements can be broadly classified into two groups: Fixed and variable costs. Fixed costs remain constant over a specific time period regardless of production fluctuations, encompassing expenses like rent, insurance charges, and management salaries. Conversely, variable costs change proportionally with shifts in output volume, including direct material and direct wages.

The determination of product or process costs can be achieved using two approaches:

- Absorption Costing

- Marginal Costing

Absorption Costing

The Absorption Costing technique is also known as the Traditional or Full Cost Method. This method calculates the cost of a product by taking into account both fixed and variable costs. Variable costs, like direct materials and direct labor, are directly allocated to the products. Meanwhile, fixed costs are distributed proportionally among various products produced over a specific period. In essence, Absorption Costing attributes all costs to the manufactured products.

Example

Example: Tripura Ltd. is manufacturing three products : A, B and C. The costs of manufacture are as follows:

The total overheads are Rs. 12,000 out of which Rs. 9,000 are fixed and the rest are variable. It is decided to apportion these costs over different products in the ratio of output. We would prepare a statement showing the cost and profit of each product according to Absorption Costing.

Ans:

This system of costing has a number of disadvantages:

- It assumes prices are simply a function of costs.

- It does not take account of demand.

- It includes past costs which may not be relevant to the pricing decision at hand.

- It does not provide information which aids decision-making in a rapidly changing market environment

Marginal Costing

The Marginal Costing method represents a clear advancement compared to Absorption Costing. In this approach, only variable costs are taken into account when determining the product's cost, with fixed costs being offset against the period's revenue. The income resulting from the surplus of sales over variable costs is termed as Contribution in Marginal Costing.

Example

Example: Tripura Ltd. is manufacturing three products : A, B and C. The costs of manufacture are as follows:

The total overheads are Rs. 12,000 out of which Rs. 9,000 are fixed and the rest are variable. It is decided to apportion these costs over different products in the ratio of output. We would prepare a statement showing the cost and profit of each product according to Absorption Costing.

Let us prepare a statement of cost and profit according to Marginal Costing Technique.

Thus, the total contribution from the three products, A, B and C is Rs. 21,000. The profit will now be computed as follows:

Absorption Costing and Marginal Costing: Differences

The distinction between Absorption Costing and Marginal Costing centers around the treatment of recovering fixed overheads, leading to differences in inventory valuation. To clarify, we will explore this contrast from two perspectives: overhead recovery and stock valuation.

Overhead Recovery

Under Absorption Costing, both fixed and variable overheads are applied to production. In contrast, Marginal Costing charges only variable overheads to production, transferring fixed overheads entirely to the profit and loss account. Consequently, Marginal Costing results in under-recovery of overheads due to the exclusive allocation of variable overheads to production.

Stock Valuation

In Absorption Costing, work-in-progress and finished goods are valued at works cost and total production cost, respectively. Works cost includes fixed overheads. In Marginal Costing, only variable costs are considered when valuing work-in-progress or finished goods. Consequently, the closing stock in Marginal Costing is undervalued compared to Absorption Costing. Importantly, this undervaluation in Marginal Costing doesn't lead to the carryover of fixed overheads from one period to another, a characteristic of Absorption Costing.

Example

Example 1: Tripura Ltd. is manufacturing three products : A, B and C. The costs of manufacture are as follows:

The total overheads are Rs. 12,000 out of which Rs. 9,000 are fixed and the rest are variable. It is decided to apportion these costs over different products in the ratio of output. We would prepare a statement showing the cost and profit of each product according to Absorption Costing. Let us compute the amount of profit under Marginal and Traditional Costing systems, in case units sold of products A, B and C are 900 each.

Thus, total profit under Marginal Costing will be:

Thus, total profit under Marginal Costing will be:

The profit under Traditional Costing system is Rs. 10,800 while it is Rs. 9,900 under Marginal Costing system. This is on account of the difference in valuation of closing stock. The closing stock under Traditional Costing system includes fixed cost of Rs. 900.

That is why the profit under Traditional Costing System is higher by Rs. 900 compared to Marginal Costing system.

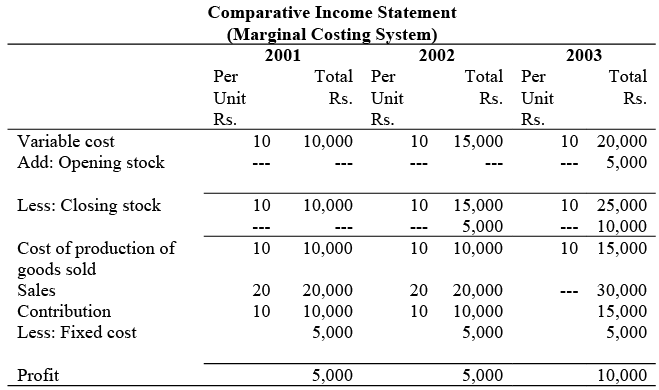

Example 2: From the following cost, production and sales data of Competent Motors Ltd., prepare comparative income statement for three years under (i) absorption costing method, and (ii) marginal costing method. Indicate the unit cost for each year under each method. Also evaluate the closing stocks. The company produces a single article for sale.

Marginal Cost

The concept of marginal costing revolves around the notion of marginal cost. It is crucial for a proper understanding of the term 'Marginal Cost.' According to the Institute of Cost and Management Accountants, London, Marginal Cost is defined as "the amount by which aggregate costs change at any given volume of output if the production volume is increased by one unit." Analyzing this definition, we can infer that "Marginal Cost" pertains to the increase or decrease in costs resulting from a one-unit rise or fall in production. This unit can represent a single item or a batch of similar items. This clarification is illustrated in the subsequent example.

A factory produces 500 tricycles per annum. The variable cost per tricycle is Rs. 100. The fixed expenses are Rs. 10,000 per annum.

Thus, the cost sheet of tricycles will appear as follows:

If production is increased by one unit, i.e. it becomes 501 tricycles per annum, the cost sheet will then appear as follows:

Marginal cost per unit is, therefore, Rs 100

Marginal cost ordinarily is equal to the increase in total variable cost because within the existing production capacity an increase of one unit in production will cause an increase in variable cost only. The variable cost consists of direct materials, direct labour, variable direct expenses and variable overheads. The term 'all variable overheads' includes variable overheads plus the variable portion contained in semivariable overheads. This portion has to be segregated from the total semi-variable overheads according to the methods to be discussed later.

The accountant's concept of marginal cost is different from the economist's concept of marginal cost. According to economists, the cost of producing one additional unit of output is the marginal cost of production. This shall include an element of fixed cost also. Thus, fixed cost is taken into consideration according to the economist's concepts of marginal cost, but not according to the accountant's concept. Moreover, with additional production the economist's marginal cost per unit may not be uniform since the law of diminishing (or increasing) returns may be applicable, while the accountant's marginal cost is taken as constant per unit of output with additional production.

Example

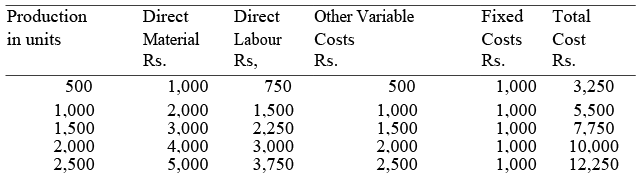

Example: Following information related to a factory which manufactures fans: Let us see the effect of increase in output on per unit cost of production through a graph and calculate the marginal cost of production.

Let us see the effect of increase in output on per unit cost of production through a graph and calculate the marginal cost of production.

The above graph shows that with an increase in production the total cost per unit is decreasing. This happens because the fixed overheads which are constant at all levels of output are spread over successively larger outputs. Hence cost of output per unit goes on decreasing with every increase in volume of output. It will be seen that while the marginal cost of production per unit remains constant (at Rs. 4. 50), the fixed cost per unit decreases from Rs. 2 to 0.40. This phenomenon will have considerable effect in motivating the firm in its decision to increase production, as in the present illustration.

Marginal cost under the present illustration can be calculate with the help of the following formula:

Marginal Cost = Direct Material Cost + Direct Labour Cost + Other Variable Costs

Total Cost - Fixed Cost

When the production is 500 units, the marginal cost of production shall be equal to Rs. 1,000 +Rs. 750 + Rs. 500, i.e, Rs. 2,250 (or Rs. 3,250 - Rs. 1,000). Marginal cost at other levels of output can be figured out in a similar fashion.

FAQs on Costing and Budgetary Control Methods: Absorption and Marginal Costing - Management Optional Notes for UPSC

| 1. What is the difference between absorption costing and marginal costing? |  |

| 2. How does absorption costing differ from marginal costing in terms of profit calculation? |  |

| 3. What are the advantages of absorption costing over marginal costing? |  |

| 4. What are the advantages of marginal costing over absorption costing? |  |

| 5. Which costing method is more suitable for short-term decision making? |  |