UPSC Exam > UPSC Notes > Economics Optional Notes for UPSC > Crowding-Out Effects

Crowding-Out Effects | Economics Optional Notes for UPSC PDF Download

Introduction

- Crowding out refers to the negative impact that government spending can have on private investment. The theory of crowding out suggests that when the government increases its spending, it will increase the demand for goods and services, which can lead to higher interest rates and inflation. This, in turn, can make borrowing more expensive for private investors, reducing their ability to invest in new projects and businesses. As a result, private investment may decrease or "crowd out" as the government spending increases.

- The effect of crowding out can also occur through the use of monetary policy. When the central bank increases the money supply to finance government spending, it can lead to inflation and higher interest rates. This can make borrowing more expensive for private investors and reduce their ability to invest in new projects and businesses.

- Crowding out can be more or less pronounced depending on the state of the economy, if the economy is at full employment and resources are scarce, the crowding out effect is more likely to happen, while if the economy is in a recession and resources are idle, the crowding out effect is less likely to happen.

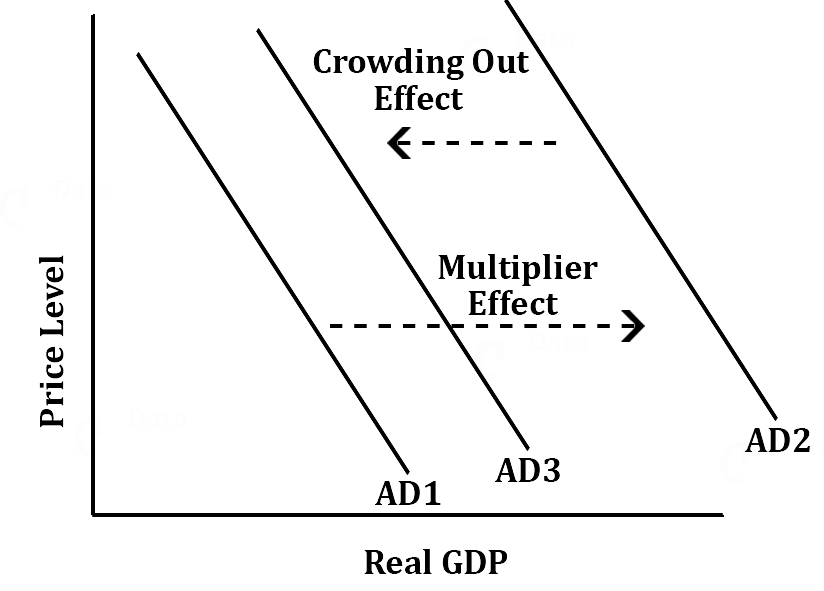

- It's important to note that crowding out is not a universally accepted theory and there are other arguments that suggest that government spending can have a positive impact on private investment. For example, the Keynesian theory of multiplier effect suggests that government spending can increase economic activity and boost private investment.

- Additionally, some critics argue that the crowding out effect is overstated and that government spending can have a positive impact on private investment by increasing aggregate demand and creating a more stable economic environment. Thus, the crowding out effect is still a matter of debate among economists and it's important to consider the specific economic conditions of a country when evaluating the potential impact of government spending.

- When the increased interest rates lead to a fall in the private investment spending in such a way that it depresses the initial increase of the total investment spending, it is known as the crowding-out effect.

- It happens when the government raises the taxes to fund the introduction of new welfare programs or the expansion of the existing ones. Due to higher taxes, the individuals and businesses are left with lesser discretionary income to spend.

Question for Crowding-Out EffectsTry yourself: What is the crowding out effect?View Solution

The document Crowding-Out Effects | Economics Optional Notes for UPSC is a part of the UPSC Course Economics Optional Notes for UPSC.

All you need of UPSC at this link: UPSC

|

66 videos|170 docs|74 tests

|

FAQs on Crowding-Out Effects - Economics Optional Notes for UPSC

| 1. What are crowding-out effects in the context of economics? |  |

Ans. Crowding-out effects refer to a situation in which increased government spending or borrowing reduces private sector spending or investment. When the government increases its spending, it often needs to borrow money, which leads to higher interest rates. This increase in interest rates can discourage private sector investment and consumption, thus crowding out private sector spending.

| 2. How does crowding-out affect the economy? |  |

Ans. Crowding-out can have several effects on the economy. Firstly, it can lead to higher interest rates, making it more expensive for businesses and individuals to borrow money. This can dampen investment and consumption, which can slow down economic growth. Additionally, crowding-out can also lead to a decrease in private sector confidence, as businesses may be less willing to invest in an uncertain economic environment.

| 3. Are there any benefits to crowding-out effects? |  |

Ans. While crowding-out effects are generally seen as negative, there can be some potential benefits. When the government increases its spending, it can stimulate demand and help to boost economic activity, especially during recessions. Additionally, government spending on infrastructure or public goods can have positive long-term effects on productivity and economic growth.

| 4. How can the government mitigate crowding-out effects? |  |

Ans. The government can take certain measures to mitigate crowding-out effects. One approach is to carefully manage its borrowing and debt levels, ensuring that it does not excessively compete with the private sector for available funds. Additionally, the government can implement policies that promote private sector investment, such as tax incentives or deregulation, to encourage businesses to continue investing despite higher interest rates.

| 5. Can crowding-out effects be avoided altogether? |  |

Ans. It may be challenging to completely avoid crowding-out effects, as government spending and borrowing are often necessary in certain situations. However, policymakers can aim to minimize the negative effects by carefully designing fiscal policies that strike a balance between stimulating the economy and avoiding excessive crowding out. This requires careful consideration of the economic conditions, interest rate dynamics, and the potential impact on private sector behavior.

|

Explore Courses for UPSC exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.

Related Searches