Economic Development: December 2024 Current Affairs | General Test Preparation for CUET UG - CUET Commerce PDF Download

SC Panel Report on Agriculture Distress

Why in News?

Recently, the Supreme Court (SC) appointed a committee that has submitted its interim report on agrarian distress in India. The report underscores the severe crisis affecting the agricultural sector in the country.

Key Takeaways

- Farmers earn an average of Rs 27 per day from agricultural activities, indicating significant poverty.

- The average monthly income of agricultural households is Rs 10,218, which is well below the minimum living standards.

- Farmers are facing escalating debts, particularly in Punjab and Haryana, where institutional loans have reached Rs 73,673 crore and Rs 76,630 crore respectively.

- Since 1995, more than 4 lakh farmers have committed suicide, driven largely by high indebtedness.

- Punjab and Haryana have seen stagnation in agricultural growth, with rates of 2% and 3.38% respectively from 2014-15 to 2022-23, below the national average.

- Climate change impacts, including depleting water tables and erratic weather patterns, are worsening the crisis.

Additional Details

- Income Crisis: The report reveals that the income levels of farmers are alarmingly low, limiting their ability to sustain their livelihoods.

- Farmer Suicides: A study conducted in Punjab recorded 16,606 suicides between 2000 and 2015, primarily among small and marginal farmers.

- Employment Disparity: Although 46% of the workforce is engaged in agriculture, it only accounts for 15% of the national income, highlighting underemployment issues.

- Climate Change Effects: Issues such as droughts and extreme weather are jeopardizing food security and agricultural productivity.

Natural Pearl Farming in India

Why in News?

The Ministry of Fisheries, Animal Husbandry and Dairying, in collaboration with State Governments, Research Institutes, and other concerned agencies, has initiated several projects aimed at promoting natural pearl farming in India.

Key Takeaways

- Pearl farming involves cultivating pearls within freshwater or saltwater oysters in controlled environments.

- India ranks as the 19th largest exporter of pearls globally, with significant pearl culture practices across various states.

- Government initiatives, such as the Pradhan Mantri Matsya Sampada Yojana (PMMSY), aim to enhance pearl farming infrastructure and support.

Additional Details

- Pearl Farming: Pearl farming is the process of cultivating pearls by inserting an irritant (nucleus) into the body of mollusks, which then secretes layers of nacre around it, forming a pearl over time.

- Mollusks: These are soft-bodied invertebrates found in marine, freshwater, and land environments, including snails, octopi, and oysters.

- Procedure:The freshwater pearl farming operation involves six major steps:

- Collection of mussels

- Pre-operative conditioning

- Implantation of nuclei or graft tissues

- Post-operative care, including antibiotic treatment

- Pond culture lasting 12-18 months

- Harvesting of pearls

- Global Context: China leads global pearl production, especially freshwater pearls, followed by Japan, Australia, Indonesia, and the Philippines.

- Challenges: The sector faces limitations such as a lack of organized freshwater pearl farmers, standardized protocols, and poor extension networks.

- Government Initiatives: The government has approved the establishment of bivalve cultivation units under PMMSY, promoting pearl farming through training and capacity building.

Concerns Over Cess and Surcharges in India

Why in News?

Arvind Panagariya, Chairman of the 16th Finance Commission, has highlighted the increasing reliance of the Centre on cesses and surcharges as a "complicated issue."

Key Takeaways

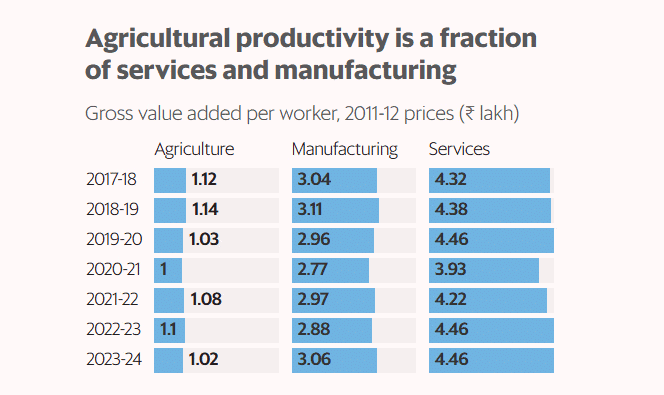

- Cesses and surcharges are becoming a permanent feature in India's tax system, raising concerns about fiscal federalism.

- The allocation of revenue from cesses and surcharges is not shared with the states, limiting their fiscal flexibility.

- There is a need for greater transparency and accountability in the use of cesses and surcharges.

Additional Details

- Cess: A tax levied for a specific purpose, imposed in addition to existing taxes. The revenue is earmarked for designated uses, such as the Education Cess for primary education and the Swachh Bharat Cess for cleanliness initiatives.

- Surcharge: An additional tax on existing duties or taxes, which can vary based on income levels. It is designed to promote social equity by ensuring higher earners contribute more.

- Concerns: The Centre's fiscal constraints have led to an increased reliance on cesses and surcharges, which are not shared with states. The share of states in the divisible tax pool has decreased, limiting their financial autonomy.

- Lack of Transparency: Cesses, collected for specific purposes, reduce transparency in tax revenue allocation. This raises concerns about equitable revenue sharing.

- Inequitable Taxation: Cesses and surcharges disproportionately affect wealthier individuals, leading to fairness issues and potential tax avoidance.

- The growing use of cesses and surcharges in India has led to significant concerns regarding efficiency, transparency, and fiscal federalism. It is critical to implement clear guidelines, conduct periodic reviews, and ensure that these levies are used only in exceptional circumstances to maintain accountability and fairness in the tax system.

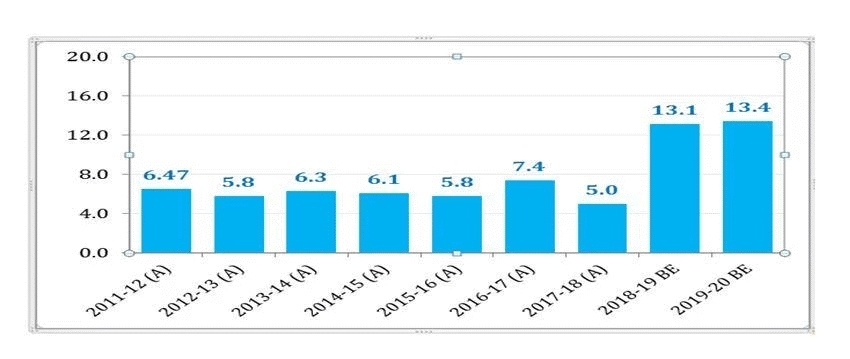

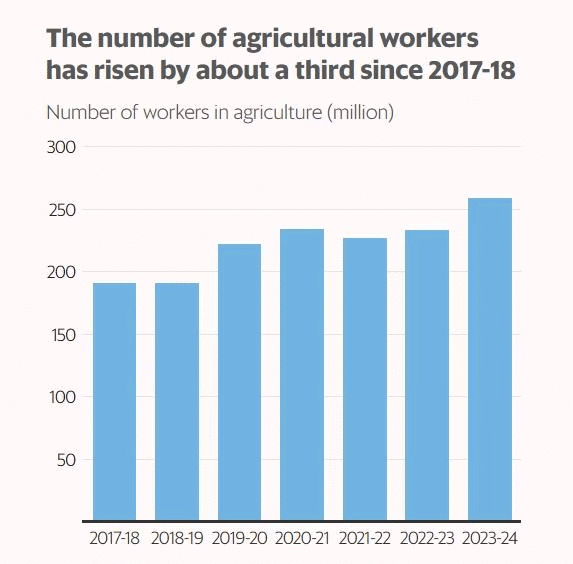

Surge in Agricultural Employment

Why in News?

The workforce engaged in agriculture in India has seen a substantial increase, with an addition of 68 million workers between 2017-18 and 2023-24. This marks a significant turnaround from the previous decline in agricultural employment, primarily driven by women workers and concentrated in economically weaker states. This trend raises concerns regarding the structural challenges within the labor market.

Key Takeaways

- The number of agricultural workers has increased significantly after a previous decline.

- Women have been the primary contributors to this increase in agricultural employment.

- The surge is most prominent in economically disadvantaged states such as Uttar Pradesh, Bihar, and Madhya Pradesh.

Additional Details

- Economic Reversal: Following a decline of 66 million agricultural workers from 2004-05 to 2017-18, the current increase signals a reversal of trends in employment dynamics.

- Impact of Covid-19 Pandemic: The pandemic prompted many urban informal sector workers to return to family farms during lockdowns, leading to a sustained rise in agricultural employment despite economic recovery.

- The increase in agricultural jobs is largely attributed to women, whose numbers rose by 66.6 million during this period.

- The rise in employment is particularly noted in states with limited job opportunities outside agriculture.

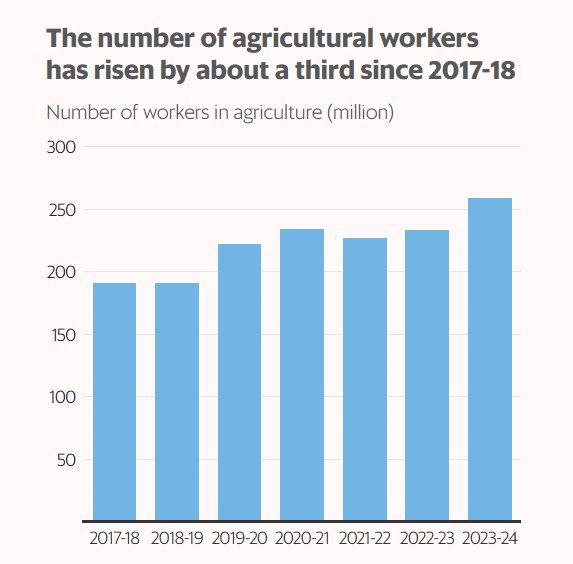

Concerns Regarding the Surge in Agricultural Employment

- Reversal of Economic Transition: As economies develop, it is expected that workers transition from agriculture to manufacturing and services. The current trend in India indicates that many workers are unable to move to more productive sectors, leading to a stagnation in economic mobility.

- Economic Inefficiency: The increase in agricultural employment during GDP growth periods suggests a lack of job creation in higher productivity sectors, reflecting structural issues in India's economic policies.

- Underemployment in Agriculture: Many agricultural jobs are characterized by seasonality and low pay, indicating underemployment and perpetuating rural poverty.

- Increased Informality: The rise in informal employment leaves workers without legal protections, making them vulnerable to economic shocks.

- Gender Disparity and Unequal Wages: Women in agriculture face significant pay gaps compared to men, exacerbating gender inequalities and reducing overall rural income stability.

Factors Contributing to India's Insufficient Non-Agricultural Employment

- Stagnant Manufacturing Sector: Unlike developed economies that transitioned through manufacturing, India has heavily relied on service sector growth, resulting in limited manufacturing output and job creation.

- Service Sector Growth Challenges: India's service sector is polarized, with high-tech services generating growth and low-skilled services providing most jobs, limiting overall employment opportunities.

- Skill Deficit and Education Quality: Despite producing millions of STEM graduates, many remain unemployable due to inadequate educational quality, leading to a mismatch in job opportunities.

- Informal Economy: The post-pandemic shift toward informal work indicates economic distress, with many workers unable to find formal employment.

Way Forward

- Non-Agricultural Employment: There is a need to enhance investment in manufacturing and service sectors to create high-productivity jobs.

- Gender-Specific Interventions: Ensuring pay parity for women in agriculture and promoting women-centric entrepreneurship can improve outcomes.

- Increase Agricultural Productivity: Promoting mechanization and modern farming techniques can help raise productivity levels in agriculture.

- Strengthen Rural Infrastructure: Building robust rural infrastructure is essential for supporting industrial and service sector growth.

- Green Jobs: Transitioning to green technologies and adopting ESG standards can create new job opportunities in the green economy.

- Implement Universal Social Security: Providing a safety net for rural workers through targeted social security schemes is crucial for their stability.

India's Strategy for Deregulation and Growth

Why in News?

Recently, the Chief Economic Advisor (CEA), Dr. V. Anantha Nageswaran, announced that deregulation will be a major theme in the Economic Survey for 2024-25. This announcement underscores the government’s intention to ease restrictive regulations across various sectors to spur economic growth and enhance the productivity of Small and Medium Enterprises (SMEs).

Key Takeaways

- Deregulation is identified as a key growth catalyst, especially at state and local levels.

- Wage stagnation for contractual employees has led to reduced purchasing power, necessitating a correction in wage structures.

- The informalization of the workforce has weakened job security and benefits, impacting consumption and growth.

- SMEs face challenges in accessing resources, and ending concessions could enhance their contribution to GDP.

- India needs to create around 8 million jobs annually to accommodate its growing workforce.

Additional Details

- Deregulation as a Catalyst for Growth: The Economic Survey emphasizes the need to address outdated restrictions, especially those impacting women's labor force participation, to unlock greater economic potential.

- Wage Growth and Consumption: Stagnant wages, particularly for contractual employees, need alignment with living costs to stimulate demand.

- Informalisation of the Workforce: The shift towards informal employment has been accelerated by the COVID-19 pandemic, affecting savings and investment capabilities.

- Importance of SMEs: Learning from countries like Germany and Switzerland, India must focus on enhancing the SME sector to achieve a 25% share of GDP from manufacturing.

- Job Creation: Policies like cash incentives for first-time hires are essential for job creation, with the private sector playing a crucial role.

- Deregulation is expected to foster private sector growth, enhance innovation, attract foreign investments, and increase market efficiency.

- By reviving economic growth post-pandemic and addressing unemployment and underemployment, deregulation can significantly contribute to India's economic recovery and long-term growth.

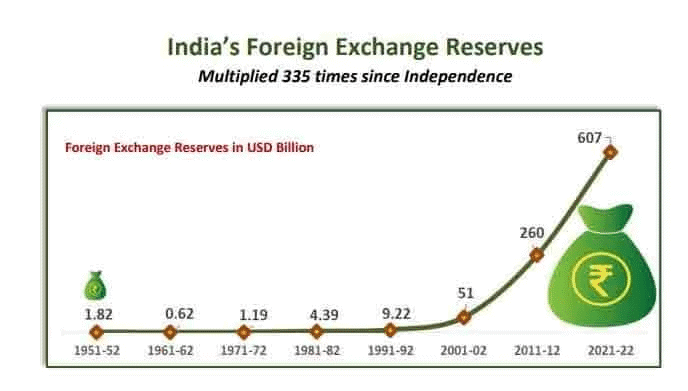

Rise in Forex Reserves

Why in News?

India's foreign exchange reserves have increased to USD 658.09 billion in November 2024, ending an eight-week decline after reaching a peak of USD 704.89 billion in September 2024. Concurrently, the Reserve Bank of India (RBI) has announced several initiatives aimed at strengthening the banking system.

Key Takeaways

- Forex reserves have shown a positive trend after a previous decline.

- The RBI is implementing initiatives to bolster banking stability.

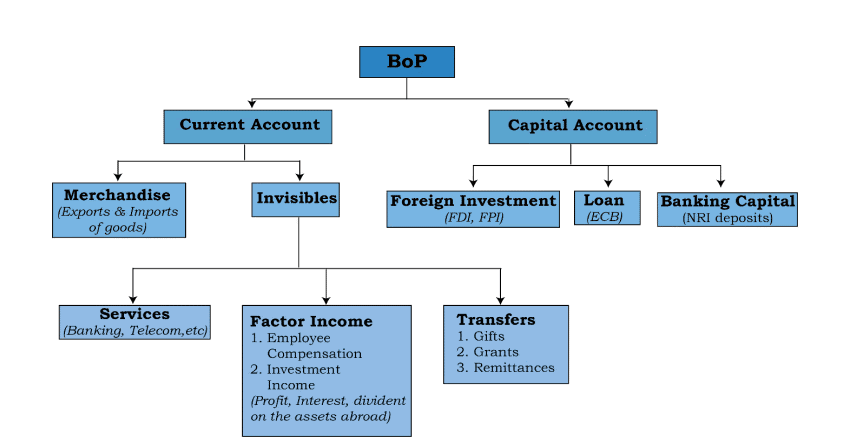

Additional Details

- Forex Reserves Movement: The fluctuations in forex reserves are closely tied to India’s merchandise trade deficit and service exports.

- Merchandise Trade Deficit: In 2023-24, India recorded a trade deficit of USD 242.07 billion, with imports at USD 683.55 billion and exports at USD 441.48 billion.

- Services and Remittances: Software service exports grew from USD 60.96 billion in 2011-12 to USD 142.07 billion in 2023-24, largely due to increased global digitization post-COVID. Private remittances also rose from USD 63.47 billion in 2011-12 to USD 106.63 billion in 2023-24.

- Current and Capital Account Position: The Current Account Deficit (CAD) narrowed from USD 78.16 billion to USD 23.29 billion in 2023-24, despite ongoing merchandise trade deficits.

- FDI and FPI Trends: There has been a decline in Foreign Direct Investment (FDI) from USD 56.01 billion in 2019-20 to USD 26.47 billion in 2023-24, while net Foreign Portfolio Investment (FPI) flows reached USD 44.08 billion in 2023-24.

- Future Outlook: Though FDI fluctuates and geopolitical uncertainties persist, the overall situation remains manageable.

What are Foreign Exchange Reserves?

- About: Foreign exchange reserves are assets held by a central bank in various foreign currencies, including banknotes, deposits, bonds, treasury bills, and other government securities.

- Historical Context: Following the 1990-91 economic crisis, recommendations were made to maintain forex reserves sufficient to cover 12 months of imports.

- Components:India’s forex reserves comprise:

- Foreign Currency Assets (FCA): Mainly consist of major global currencies like the US Dollar, Euro, and Japanese Yen.

- Gold Reserves: Recognized as a key reserve asset for its stability and universal acceptance.

- Special Drawing Rights (SDRs): Created by the IMF, these are reserve assets that supplement member countries' official reserves.

- Reserve Position in IMF: This refers to the quota of currency each member country must provide to the IMF.

What is the Role of Forex Reserves in Economic Stability?

- Economic Buffer: Reserves help countries manage downturns, stabilize currency, and maintain investor trust.

- Trade Equilibrium: They allow countries to address trade imbalances when imports exceed exports.

- Monetary Strategy: Reserves enable central banks to control currency value, manage inflation, and implement monetary policies.

- Fulfilling External Obligations: Adequate reserves assist countries in meeting external debt, enhancing international credibility.

- Exchange Rate Management: Central banks utilize reserves to intervene in the foreign exchange market, ensuring competitiveness and reducing volatility.

- Liquidity Provision: Reserves ensure that a country can meet financial obligations, such as debts and imports, during crises.

What are the RBI’s Recent Initiatives to Create a Robust Banking System?

- FCNR(B) Deposits: To attract more capital inflows, the RBI has increased the interest rate ceilings on Foreign Currency Non-Resident Bank (FCNR(B)) account deposits, which are term deposits that non-resident Indians can open with Indian banks.

- SORR Benchmark: The RBI plans to introduce the Secured Overnight Rupee Rate (SORR) as a new benchmark for secured money market transactions, which will aid in developing the interest rate derivatives market in India.

- Collateral-Free Agriculture Loans: The limit for collateral-free agricultural loans has been raised from Rs 1.6 lakh to Rs 2 lakh per borrower.

- Panel on AI: The RBI will establish a panel of experts to recommend a framework for the responsible and ethical use of AI in the financial sector.

- MuleHunter.AI: The RBI has developed an AI/ML-based model called MuleHunter.AI to assist banks in managing and combating mule bank accounts.

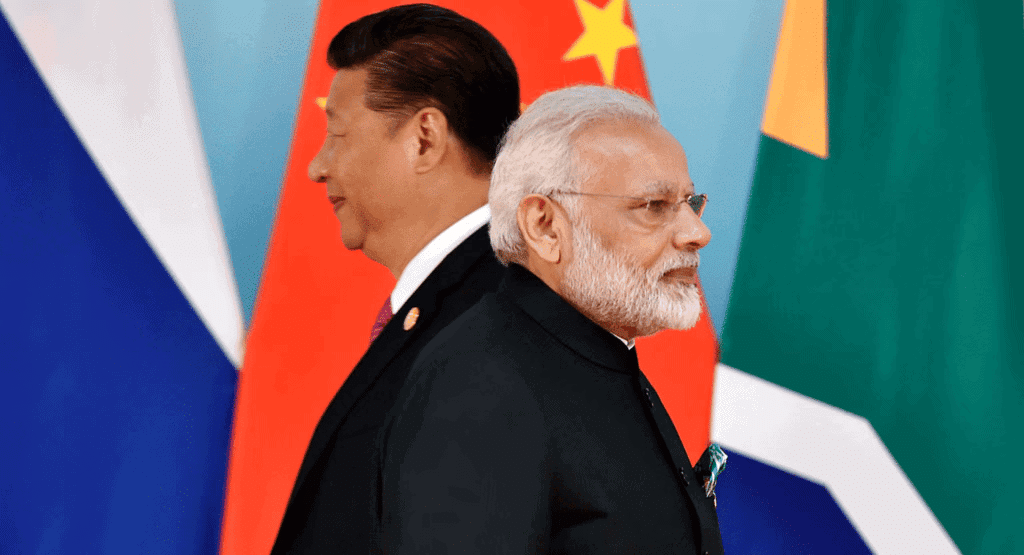

India Lags In Leveraging China+1 Strategy

Why in News?

The recently released NITI Aayog’s Trade Watch report highlights India’s trade prospects, challenges, and growth potential, especially in light of the US-China trade conflict and the 'China Plus One' strategy. It stated that India has had limited success so far in capitalizing on the 'China Plus One' strategy adopted by multinational companies to diversify and de-risk their supply chains.

Key Takeaways

- India faces competitive disadvantages compared to countries like Vietnam and Thailand in attracting multinational corporations.

- Geopolitical tensions, such as the US-China trade conflict, create both opportunities and uncertainties for India.

- India's infrastructure and regulatory challenges hinder its ability to attract foreign investment.

- Potential growth drivers for India include a large domestic market and strategic economic partnerships.

Additional Details

- Competitive Disadvantages: Countries like Vietnam, Thailand, Cambodia, and Malaysia have leveraged cheaper labor, simplified tax laws, and lower tariffs to attract foreign investments, while India’s complex regulations and bureaucratic hurdles deter potential investors.

- Free Trade Agreements (FTAs): South-Asian countries have been more proactive in signing FTAs, enhancing their trade shares, while India's slower pace puts it at a disadvantage.

- Supply Chain Disruptions: Fragmentation of supply chains due to US tariffs on China offers India an opportunity, but poor infrastructure and high logistics costs limit its attractiveness.

- Growth Drivers: With a population of 1.3 billion and a youthful demographic, India has a growing consumer base. The real GDP is projected to grow between 6.5-7% in 2024-25.

- Strategic Economic Partnerships: Agreements like the India-UAE CEPA aim to boost bilateral trade significantly, enhancing India's global trade position.

India's journey to capture the 'China Plus One' opportunity includes overcoming challenges such as competitive disadvantages and regulatory hurdles. However, with strategic investments in infrastructure, regulatory reforms, and a focus on innovation, India can position itself as a viable alternative in the global supply chain landscape, unlocking significant economic growth potential.

International Debt Report 2024

Why in News?

The World Bank’s recently released "International Debt Report 2024" reveals a deteriorating debt crisis faced by developing nations. The year 2023 has recorded the highest levels of debt servicing in two decades, driven largely by escalating interest rates and significant economic challenges. Additionally, a UNCTAD report titled "A World of Debt 2024: A Growing Burden to Global Prosperity," released earlier in June 2024, highlights the severe global debt crisis affecting the world.

Key Takeaways

- The total external debt of Low- and Middle-Income countries (LMICs) reached a record USD 8.8 trillion by the end of 2023, reflecting an 8% increase since 2020.

- External debt for countries eligible for the International Development Association (IDA) increased by nearly 18%, totaling USD 1.1 trillion.

- IDA countries incurred record debt servicing costs of USD 1.4 trillion, with interest payments rising by 33% to USD 406 billion.

- Interest rates on loans from official creditors doubled to over 4% in 2023, and rates from private creditors reached 6%, the highest in 15 years.

- IDA-eligible countries paid USD 96.2 billion in debt servicing, including USD 34.6 billion in interest costs, which are four times higher than in 2014.

Additional Details

- Rising Debt Levels: The substantial increase in external debt reflects the financial struggles of developing nations, necessitating urgent actions to manage this burden effectively.

- Debt Servicing Costs: The sharp rise in interest payments has severely affected investments in essential sectors such as health, education, and environmental sustainability, exacerbating developmental challenges.

- Global Public Debt: Projections indicate that global debt could reach USD 315 trillion in 2024, which is three times the global GDP, with developing nations' public debt escalating significantly.

- Impact on Climate Initiatives: Approximately 50% of developing countries now allocate at least 8% of their government revenues to debt servicing, which has doubled in the past decade, constraining their ability to invest in climate change initiatives.

- Measures Taken: Various initiatives like the Debt Management and Financial Analysis System (DMFAS) Programme and the Heavily Indebted Poor Countries (HIPC) Initiative have been implemented to alleviate the debt crisis.

- The World Bank's International Debt Report 2024 underscores the urgent need for renewed multilateral support and enhanced transparency in debt management. As developing nations face mounting financial pressures, the importance of international cooperation and assistance becomes increasingly critical to reconcile debt repayments with necessary developmental priorities.

Rise and Challenges of India's Gig Economy

Why in News?

According to a white paper by the Forum for Progressive Gig Workers, the gig economy in India is projected to grow at a compounded annual growth rate (CAGR) of 17%, reaching USD 455 billion by 2024. This growth is expected to drive significant economic development and create numerous employment opportunities.

Key Takeaways

- The gig economy refers to a labor market characterized by short-term, flexible jobs, often facilitated through digital platforms.

- Gig workers are paid for each task they complete, engaging in activities such as freelance work and food delivery services.

- The sector encompasses low, medium, and high-skilled jobs, with substantial growth expected in e-commerce, transportation, and delivery services.

- By 2030, the gig economy is anticipated to contribute 1.25% to India's GDP and generate around 90 million jobs.

Additional Details

- What is the Gig Economy: The gig economy is defined by short-term engagements rather than traditional full-time employment contracts. It allows workers flexibility in choosing their schedules and locations.

- Market Size: The gig workforce in India was around 7.7 million in 2020-21, projected to grow to 23.5 million by 2029-30.

- Driving Factors: Key drivers include digital penetration, the rise of startups and e-commerce, consumer demand for convenience, and changing work preferences among younger generations.

- Challenges Faced: Gig workers experience job insecurity, income volatility, regulatory gaps, and delayed payments, leading to dissatisfaction and financial instability.

Way Forward

Legal reforms, portable benefits systems, technology-driven solutions, and skill development initiatives are essential for improving the conditions of gig workers.

Changing Trends in Fertilizer Use

Why in News?

The sales of Di-Ammonium Phosphate (DAP) have decreased by 25.4% from April to October FY25. In contrast, the sales of NPKS fertilizers have increased by 23.5% during the same period. The decline in DAP sales is due to reduced imports and higher costs, leading farmers to choose alternatives like NPKS, which offer more balanced soil nutrition.

Factors Influencing the Shift in Fertilizer Usage Preferences

- Decline in DAP Usage: The shift is primarily driven by the increasing costs and supply chain challenges associated with DAP, prompting farmers to explore alternative options.

- Global Challenges: Factors like the Russia–Ukraine conflict and sanctions on Belarus have disrupted potash markets, resulting in rising prices for Muriate of Potash (MOP) in FY23. These countries are significant producers of potash globally.

- Impact of the Persian Gulf Crisis: DAP sales experienced a 30% decline to 2.78 million tonnes due to the Persian Gulf crisis, which caused prolonged shipping delays. Transit times increased from the usual 20-25 days to nearly 45 days.

- Rising DAP Prices: As a result of these challenges, DAP prices escalated to approximately USD 632 per tonne in September 2024.

- Shift in Fertilizer Preferences: Farmers are increasingly opting for NPKS fertilizers, which are perceived as more beneficial than DAP due to their balanced nutrient composition. The 20:20:0:13 NPKS grade, offering balanced quantities of nitrogen, phosphorus, potash, and sulphur, has witnessed significant sales growth.

Benefits of Using NPKS Fertilizer

- Balanced Nutrient Supply: NPKS fertilizers offer a comprehensive supply of essential nutrients- Nitrogen (N), Phosphorus (P), Potassium (K), and Sulfur (S)- crucial for plant growth, thereby enhancing the overall health and productivity of crops. This balance ensures that plants receive adequate nutrients for various growth stages, from vegetative to reproductive phases.

- Improved Soil Health and Sustainable Agriculture: Sulfur, often deficient in soils, plays a vital role in root development, enzyme activation, and disease resistance. By including sulfur, NPKS fertilizers enhance soil health and fertility, promoting more efficient nutrient uptake by plants.

- Enhanced Crop Yield: NPKS fertilizers boost crop yield by improving photosynthesis, strengthening plant immunity, and promoting better flowering, fruiting, and seed formation. This is particularly beneficial for food security.

- Optimal Plant Growth: NPKS fertilizers support overall plant growth by improving root and stem development, increasing chlorophyll production, and enhancing drought resistance, helping crops thrive in varying environmental conditions.

Challenges with Fertilizer Usage in India

- Imbalance in Fertilizer Use: The actual NPK ratio in India (9.8:3.7:1 in Kharif 2024) significantly deviates from the recommended 4:2:1 ratio. This imbalance leads to nutrient deficiencies, soil degradation, and reduced crop yields, with excessive nitrogen and insufficient phosphorus and potassium.

- Excessive Use of Nitrogenous Fertilizers: India is the second-largest consumer of urea globally, but its overuse causes soil degradation, water pollution, and greenhouse gas emissions. Subsidies distort the fertilizer market and promote inefficiency.

- Low Production and High Consumption: Despite a slight increase in fertilizer production from 385.39 LMT in 2014-15 to 503.35 LMT in 2023-24, domestic production remains inadequate to meet the country’s demand. In 2020-21, total fertilizer consumption was about 629.83 LMT.

- Dependence on Imports: India imports around 20% of its urea, 50-60% of diammonium phosphate (DAP), and 100% of muriate of potash (MOP) fertilizers from countries such as China, Russia, Saudi Arabia, UAE, Oman, Iran, and Egypt. This dependence makes India vulnerable to global supply chain disruptions and price fluctuations.

Way Forward

- Balanced Fertilizer Usage: Emphasizing balanced fertilizer usage, particularly NPKS, can address the NPK ratio imbalance, improve soil health, and reduce reliance on nitrogen-dominant fertilizers like urea.

- Promotion of Organic and Bio-fertilizers: Encouraging organic farming and the use of bio-fertilizers can decrease dependence on chemical fertilizers, enhance soil fertility, and minimize environmental impacts.

- Efficient Fertilizer Distribution: Streamlining fertilizer subsidies and distribution through a targeted approach can reduce inefficiencies and promote balanced, cost-effective fertilizer use.

- Domestic Production Capacity Expansion: Increasing domestic production of phosphatic and potassic fertilizers through investments in technology and infrastructure can reduce import dependence and strengthen supply chain resilience.

- Sustainable Fertilizer Policies: Designing policies that encourage judicious fertilizer use, considering regional soil types and crop-specific nutrient requirements, can promote sustainable agricultural practices.

SFBs to Offer UPI-Based Credit Lines

The Reserve Bank of India (RBI) has recently authorized Small Finance Banks (SFBs) to provide pre-sanctioned credit lines through the Unified Payment Interface (UPI). This move aims to enhance financial inclusion and formal credit, especially for customers who are new to credit.

Credit Line through UPI by SFBs

- New Facility: SFBs can now enable payments using a pre-sanctioned credit line via UPI, with the prior consent of the customer.

- Previous Approval: In September 2023, the RBI had permitted Scheduled Commercial Banks to operate pre-sanctioned credit limits through UPI for individuals.

- Objective: The initiative aims to deepen financial inclusion and enhance formal credit, particularly for customers who are new to credit.

About Small Finance Banks (SFBs)

- Origin: SFBs were announced in the Union Budget for 2014-15.

- Objective:The primary goal of SFBs is to promote financial inclusion by:

- Providing savings options to unserved and underserved populations.

- Offering credit to small business units, small and marginal farmers, micro and small industries, and other entities in the unorganised sector through high technology and low-cost operations.

- Registration: SFBs must register as a public limited company under the Companies Act, 2013.

- Licensing: SFBs are licensed under Section 22 of the Banking Regulation Act, 1949.

- Capital Requirement: SFBs are required to have a minimum paid-up voting equity capital of ₹200 crore, except for those converted from Urban Cooperative Banks.

- Priority Sector Lending (PSL) Norms: SFBs must extend 75% of their Adjusted Net Bank Credit (ANBC) to priority sectors as classified by the RBI.

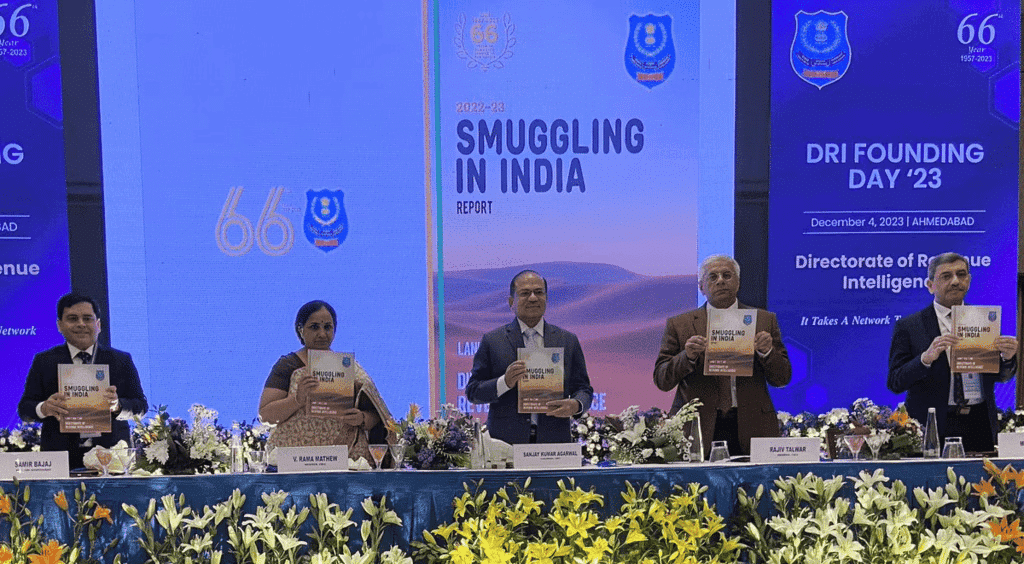

DRI Report on Smuggling

The Directorate of Revenue Intelligence (DRI) has published its annual report titled "Smuggling in India - Report 2023-24," highlighting various aspects of smuggling activities in the country.

Major Highlights

- Cocaine Trafficking: There has been a significant rise in cocaine trafficking in India, particularly through direct routes from South America and via African countries. The DRI recorded 47 cases of cocaine smuggling through the air route in 2023-24, up from 21 cases the previous year.

- Hydroponic Marijuana: This form of marijuana is being smuggled into India from countries such as the US and Thailand.

- Black Cocaine:. new and concerning trend is the emergence of "black cocaine," a drug variety that is challenging to detect using standard methods. This substance is chemically masked with materials like charcoal or iron oxide, creating a black powder that can evade drug-sniffing techniques.

- Illicit Gold Imports: India has become a major destination for illicit gold imports, primarily originating from West Asia, including countries like the UAE and Saudi Arabia, where these metals are sourced at lower prices. Smuggling syndicates are now using "mules" with diverse profiles, including foreign nationals and families, alongside insiders.

- Porous Eastern Borders: Smuggling through India's porous eastern borders, especially with Bangladesh and Myanmar, has raised concerns for law enforcement agencies. There has been an increase in methamphetamine smuggling, particularly in northeastern states like Assam and Mizoram.

- Misuse of Free Trade Agreements (FTAs): Traders are misusing FTAs by misclassifying imports and using fake letters.

- Environment and Wildlife Crime: The illegal trade in elephant tusks continues to drive illegal poaching. There is a potential increase in the smuggling of star tortoises from India due to rising demand in Southeast Asian countries. Peacocks, pangolins, and leopards are also hunted for illegal trade.

Narco Trafficking Routes

- The Death Crescent (Golden): This region, comprising Afghanistan, Iran, and Pakistan, is a primary source of heroin trafficked into India. Heroin from this area is routed to India through African and Gulf regions, as well as traditional routes through the India-Pakistan border and maritime routes.

- The Death Triangle (Golden): This triangle includes Myanmar, Laos, and Thailand, which are significant sources of synthetic drugs and heroin. Drugs from this region enter India through northeastern states, where the challenging terrain and porous borders facilitate trafficking at multiple entry points.

- Maritime Routes: India’s extensive coastline offers opportunities for drug traffickers. Cases of drugs being smuggled through concealment in shipping containers and fishing vessels have been reported.

- Air Routes: Air trafficking has become a potent method for smugglers due to the speed and increasing volume of international air traffic. Drugs are often concealed in luggage, courier packages, or ingested by carriers known as “mules.”

Decline in 10-Year Bond Yield

Why in News?

Recently, there has been a notable drop in Indian government bond yields, with the 10-year benchmark yield reaching its lowest point since 2021. This decline is linked to increasing optimism regarding the Reserve Bank of India (RBI) possibly easing interest rates in its upcoming monetary policy review.

What Factors Have Contributed to the Decline in the Bond Yields?

- Economic Growth Slowdown: India's GDP growth slowed to 5.4% in the September 2024 quarter, marking the lowest growth in 7 quarters.

- The economic slowdown has raised concerns, driving expectations of RBI monetary easing, through rate cuts or liquidity measures leading to increased demand for bonds and a consequent decline in yields.

- Measures Taken by RBI: Anticipations of liquidity infusion through Open Market Operations (OMO) or a cut in the Cash Reserve Ratio (CRR) of around 50 basis points by the RBI could release approximately Rs 1.1 lakh crore into the banking system.

- This move would likely reduce shorter-term bond yields and boost liquidity.

- Foreign Investments: Increased foreign investments in Indian bonds, including Rs 7,700 crore in net purchases in a short period and Rs 20,200 crore by foreign lenders, have boosted demand, contributing to declining yields and signaling investor confidence in the economy.

What are Bonds and Bond Yields?

- Bonds:. bond is a financial instrument used to borrow money, similar to an IOU (I owe you). Bonds can be issued by a country's government or by a company to raise funds. Government bonds, known as G-secs in India, Treasury bonds in the US, and Gilts in the UK, are considered one of the safest investments because they come with the sovereign's guarantee.

- Bond Yield: Bond yield represents the return an investor can expect from a bond, expressed as a percentage. However, this return is not fixed and varies with changes in the bond's market price. Bond yield is inversely related to bond prices, meaning when bond prices rise, yields fall, and vice versa.

- Face Value: The nominal value of the bond, which is typically repaid at maturity.

- Coupon Payment: The fixed annual payment made to the bondholder.

- Coupon Rate: The annual interest rate expressed as a percentage of the bond's face value.

|

164 videos|800 docs|1158 tests

|