Economic Development: May 2022 Current Affairs | Indian Economy for State PSC Exams - BPSC (Bihar) PDF Download

| Table of contents |

|

| Report of SC Appointed Committee on Farm Laws |

|

| Decoding Rbi’s Standing Deposit Facility (Sdf) |

|

| Special Purpose Acquisition Companies (SPACs) |

|

| Pm Mudra Yojana Completes 7 Years |

|

Report of SC Appointed Committee on Farm Laws

Importance of Agricultural Marketing

Importance:

- Enables the farmers to buy agricultural inputs such as fertilizers, seeds etc. at affordable prices.

- Provides price signals to the farmers with respect to planning for sowing of crops.

- An integrated domestic marketing system would considerably reduce the price variations in the agricultural commodities across India.

- 25 to 30 % of fruit and vegetables and 8 to 10 % of food grains are wasted annually due to lack of postharvest losses.

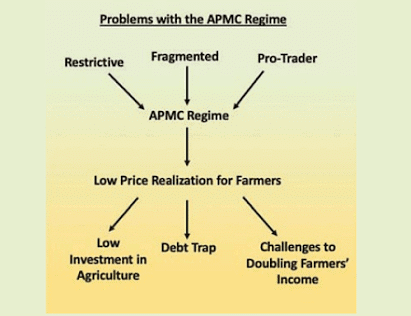

Problems With Agricultural Marketing in India

Agricultural is a subject placed under State List and accordingly, most of the State governments have enacted the Agricultural Produce Market Regulation Act (APMC Act) to regulate marketing.

Restrictive Regime: Under the present APMC Act, farm produce should be sold only at APMCs to the traders and middlemen. The farmers do not have the freedom to sell their produce outside APMCs directly to exporter, processor or end consumer. Hence, it leads to exploitation of the farmers by the middlemen and traders. Fragmented Agricultural Marketing with about 2500 regulated APMCs, 5000 sub-market yards and thousands of Rural Markets or Grameen Haats. Hence, due to this fragmented marketing the agricultural commodities pass through multiple middlemen and traders leading to escalation in prices and also prevents the farmers from getting remunerative prices.

Lack of Access to APMCs: An average APMC in India serves an area of around 450 sq.km as against the recommendation of 80 sq.km given by M.S. Swaminathan Committee. On account of this, the farmers are forced to sell their produce at lower prices outside the APMCs. Against Interests of Small and Marginal farmers who are forced to sell at lower prices due to their low marketable surplus and poor bargaining power. Poor Infrastructure of the APMCs leading to improper storage and consequently higher post-harvest losses; No electronic auction platform Imposition of Multiple Fees in APMCs which is estimated to be around 15% of the value of the agricultural produce; Increased prices and affect food processing Industries Higher Post-harvest Losses in the range of 20-25% of produce accounting for Rs 92,000 crores loss

Restrictive Regime: Under the present APMC Act, farm produce should be sold only at APMCs to the traders and middlemen. The farmers do not have the freedom to sell their produce outside APMCs directly to exporter, processor or end consumer. Hence, it leads to exploitation of the farmers by the middlemen and traders.

Fragmented Agricultural Marketing with about 2500regulated APMCs, 5000 sub-market yards and thousands of Rural Markets or Grameen Haats. Hence, due to this fragmented marketing the agricultural commodities pass through multiple middlemen and traders leading to escalation in prices and also prevents the farmers from getting remunerative prices.

Lack of Access to APMCs: An average APMC in India serves an area of around 450 sq.km as against the recommendation of 80 sq.km given by M.S. Swaminathan Committee. On account of this, the farmers are forced to sell their produce at lower prices outside the APMCs.

Against Interests of Small and Marginal farmers who are forced to sell at lower prices due to their low marketable surplus and poor bargaining power.

Poor Infrastructure of the APMCs leading to improper storage and consequently higher post-harvest losses; No electronic auction platform Imposition of Multiple Fees in APMCs which is estimated to be around 15% of the value of the agricultural produce; Increased prices and affect food processing Industries Higher Post-harvest Losses in the range of 20-25% of produce accounting for Rs. 92,000 crores loss

Observations of Sc Appointed Committee

Flexibility to the States: State APMC Acts will continue to govern the APMCs/regulated markets under that Act. The Central Acts would provide alternative marketing channels to farmers. So, a farmer would have option to either sell the produce within APMCs regulated through State APMC Act or in the trade area regulated under the Central act.

Redundant APMC Regime:

- Presently, Livestock and fishery form 40 percent of the Gross Value of Agricultural output. This sector is outside the procurement support through MSP. These sectors are also growing much faster than other crops. Hence, the argument that only the APMCs and procurement support through MSP can offer remunerative price to farmers is flawed.

- Even for commodities that come under the purview of MSP, only around 25-30 percent of the production is transacted through the APMCs/regulated mandis. So, already a major chunk of agricultural commodities are sold outside the APMC regime.

- Hence, the Central act seeks to regulate the sale of agriculture produce outside APMCs. Procurement of Rice and Wheat: Around 90 percent of rice production and 70 percent of wheat production is procured in Punjab and Haryana through the APMCs. This has in turn led to skewed cropping pattern with more emphasis on Rice and wheat and less focus on agricultural diversification in Punjab and Haryana. Higher Mandi Charges and Cess imposed by the state Governments lead to increase in prices of agricultural commodities.

Observations of SC Appointed Committee

Existing legal framework: All States except Arunachal Pradesh, Meghalaya, Uttar Pradesh, West Bengal, Delhi, Chandigarh and Puducherry already have legal provisions for contract farming in their APMC Acts. Punjab and Tamil Nadu have separate contract farming Acts. Hence, the argument that the Central Act to promote contract farming would be exploitative seems flawed.

Success of Contract farming: Contract farming is not new in India and various variants exist in several sectors. For example, contract farming has transformed the poultry sector from a mere backyard activity into a major organized commercial one with almost 80 percent production coming from organized commercial farms. Similar, NESTLE's contract farming with the dairy farmers in Punjab has led to improvement in livelihood opportunities for the farmers.

Amendments to Essential Commodities Act (ECA), 1955 (Amendments- Repealed)

Essential Commodities Act and Its Rationale

Used by the Government to regulate the production, supply and distribution of commodities which are declared as essential under the act. The list of items under the Act includes drugs, fertilizers, pulses and edible oils, and petroleum and petroleum products. The Central Government may add or remove a commodity from the schedule in consultation with the State Governments.

How Does it Work ?

If the Centre finds that a certain commodity is in short supply and its price is increasing, it can notify stockholding limits on it for a specified period. Anybody trading or dealing in a such a commodity, be it wholesalers, retailers or even importers are prevented from stockpiling it beyond a certain quantity. This improves supplies and brings down prices.

How Essential Commodities Act Hinders the Agricultural Marketing?

Fails to realize stocking is essential: The fear of bringing the agricultural commodities under the act has prevented the traders and processors from undertaking bulk procurement of agricultural commodities during bumper harvest season. Further, since almost all crops are seasonal, ensuring round-the-clock supply requires adequate build-up of stocks during the season. Poor investment in Storage infrastructure: With frequent stock limits, traders have not invested in better storage infrastructure.

Adverse impact on Food Processing Industry since Stock limits curtails their Operations. Impact on agriculture exports: Whenever the Government declares an agricultural commodity as essential, it imposes several restrictions on it including ban of export of such commodities.

Amendments to Ec Act, 1955 (Repealed)

Reduced Scope of ECA, 1955: Agricultural commodities to be outside the purview of Essential commodities Act, 1955. They would be brought out ECA only under exceptional circumstances such as war, famine, extra ordinary price rise, and natural calamity of grave nature . Stockholding Restrictions: Stockholding restrictions to be based on price rise - 100 percent increase in retail price for horticulture products or 50 percent increase in retail price in case of non-perishable agri products;

Observations of SC Appointed Committee

The Amendment attempts to balance the interests of all stakeholders – farmers, traders, food processors, exporters and consumers – to enable agri-produce to move up the value chain. As agriculture is a seasonal activity, it is essential to store produce for the off-season to ensure smoothened availability of a product at stable prices throughout the year.

Broad Recommendations of the Committee on 3 Farm Laws

- Need for Farm laws: A repeal of these Farm Laws would be unfair to the 'silent' majority who support the Farm Laws.

- Flexibility to States: States may be allowed some flexibility in implementation and design of the Laws, with the prior approval of the Centre, so that the basic spirit of these Laws for promoting effective competition in agricultural markets and creation of ‘one nation, one market’ is not violated.

- Dispute Resolution Mechanism: Alternative mechanisms for dispute settlement, via Civil courts or arbitration mechanism, may be provided to the stakeholders.

- High level Coordination body: Agriculture Marketing Council, under the chairpersonship of Union Minister of Agriculture, with all States and UTs as members may be formed on lines of the GST Council to reinforce cooperative efforts to monitor and streamline the implementation of these Acts.

- Compensation Mechanism: The implementation of Central Acts would lead to loss of revenues which states earn from APMCs. Hence, to compensate the states for their loss, a compensation mechanism on the lines of GST compensation mechanism may be incorporated.

- Essential Commodities Act, 1955: The Government should consider in favour of completely abolishing the ECA Act, 1955 or take steps to substantially liberalize its provisions.

To read more information on this topic:

- New Strategy: Agriculture

- Ramesh Singh Summary: Agriculture Food Management -1

- Ramesh Singh Summary: Agriculture Food Management - 2

Draft Policy on Battery Swapping

How Battery Swapping Works?

Step 1: People would be allowed to buy electric vehicles without batteries.

Step 2: People would lease or subscribe to batteries provided by battery recharging companies. People would either pay monthly or yearly subscription for the batteries or may decide to pay as per the use basis.

Step 3: Replace drained batteries with recharged batteries.

Success Story

Bounce Infinity is a Bangalore based startup in the field of Electric Two-wheelers. It offers two choices to the customers -

(a) Purchase electric scooter with a battery

(b) Purchase Electric Scooter without a battery. Battery can be subscribed on a monthly or yearly basis. Apart from manufacturing electric scooters, this company also operates network of battery charging stations. Hence, customers can easily replace their drained batteries with the newly charged batteries. Recently, it has become the first Indian company to achieve the feat of 10 lakh battery swaps in India.

Benefits of Battery Swapping

- Reduce cost of Electric Vehicles: The Battery alone accounts for more than 50% of the cost of electric vehicles. Hence, Battery swapping policy would lead to decrease in the initial cost of the vehicles and encourage more people to adopt electric mobility.

- Reduce Maintenance Cost: The Electric batteries can be recharged for only finite cycles. Beyond 4-5 years, the older batteries would have to be replaced with the new ones. This can lead to higher maintenance costs. In case of Battery Swapping, Customers do not own batteries and hence this maintenance cost gets eliminated.

- Address anxiety issues related to Charging and Range: Normally, people are reluctant to buy electric vehicles due to lower range (250-300 km) of electric vehicles and higher time taken for charging batteries. The introduction of Battery swapping would enable seamless travel without the need to worry much about range and charging. As people move from one place to another, they can simply switch their drained batteries with recharged ones and continue their travel without hassles.

Problems and Challenges

- Demand-Supply Mismatch: Presently, we need one electric battery for one vehicle. However, with the introduction of battery swapping, the number of batteries needed would increase.

- Non-Removable batteries: Only few companies provide for removable batteries. If the batteries are in-built and cannot be removed, then battery cannot be swapped. For example, In case of Ola e-scooter, batteries cannot be removed from the vehicles and hence drained batteries cannot be replaced with the recharged ones.

- Lack of interoperability standards: If the battery swapping policy has to be successful, batteries should be made interoperable across different manufacturers. For example, it should be possible for the batteries used in Ola e-scooters to be used in any other electric scooters such as Bounce infinity, Bajaj etc. Such interoperability standards would make it easier for the people to adopt electric mobility.

- Higher GST rate on Electric Batteries: Presently, the GST rate on stand-alone electric batteries is quite higher at 18% and hence higher tax rate can be a disincentive for the battery recharging stations.

- Waste Management: At the end of the battery lifespan, enormous amounts of electronic wastes such as cobalt, lithium, manganese oxide, nickel etc. get generated. Hence, there is a need to put in place efficient waste recycling programme aimed at optimum recovery and minimal destruction of environment.

Niti Aayog' Draft Battery Swapping Policy

Interoperability standards: Battery swapping services will need to ensure interoperability between EVs and batteries for the successful mainstreaming of battery swapping as an alternative. Accordingly, the policy aims to lay down the interoperability standards.

Registration of vehicles with swappable batteries: The policy provides for easier registration of the vehicles without electric batteries.

Unique Identification Number (UIN) to be assigned to the electric batteries for their tracking and monitoring. Similarly, a UIN number will be assigned to each Battery Swapping Station.

Fiscal Support:

- Demand side incentives offered under FAME Scheme for EV purchase can be made available to EVs with swappable batteries.

- Subsidies may be given by the Centre to the entities setting up battery swapping stations.

- State Governments may provide additional capital subsidies for the setting up of battery swapping stations.

Rationalise GST Rates: The GST council may recommend for the reduction in the GST rates on the electric batteries.

Re-use and Recycling Ecosystem: The Policy aims to promote the re-use of swap batteries after their End-ofLife (EOL) and fix the Extended Producer Responsibility (EPR).

Nodal agencies: The Bureau of Energy Efficiency (BEE) will be responsible for the implementation of battery swapping networks across the country. States and union territories (UTs) are responsible for the implementation and governance of the battery swapping ecosystem. Appointed state nodal agencies (SNAs) for EV public charging infrastructure will facilitate the rollout of battery swapping.

To read more information on this topic:

Decoding Rbi’s Standing Deposit Facility (Sdf)

Understanding Reverse Repo

The Reverse Repo is the rate at which the RBI absorbs liquidity from the economy. Under this route, the Banks can park their surplus funds with the RBI and earn an interest which is equal to Reverse Repo. However, when the Banks Park their funds under this route, the RBI would be required to give G-Secs as collateral to the Banks. So, the problem with the Reverse Repo route is that the RBI has to provide G-Secs every time the banks provide funds.

During times such as recent Demonetization, the RBI may not have adequate G-Secs to absorb huge amount of liquidity from the economy. Hence, to handle such kind of situations, the Urjit Patel Committee had recommended for the introduction of new tool known as "Standing Deposit Facility".

Understanding Standing Deposit Facility (Sdf)

Introduced through an amendment to the RBI Act, 1934. The SDF works similar to Reverse Repo. However, SDF would be different from Reverse Repo in the following ways:

- Under the SDF route, the RBI would not be required to provide G-Secs as collateral to the Banks. Hence, it would enable RBI to absorb huge amount of liquidity from the economy without G-Secs acting as collateral.

- The SDF would be available for parking funds with the RBI on an overnight basis. But the duration of Reverse Repo could be longer.

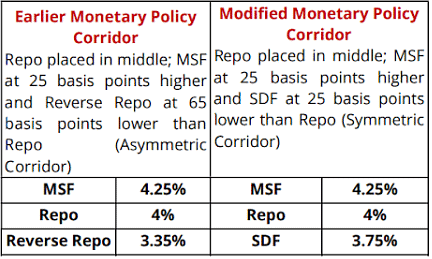

- Presently, Reverse Repo is 3.35%, while the SDF rate has been fixed higher at 3.75%.

Changes in the Monetary Policy Corridor

The RBI has also decided to replace Fixed Rate Reverse Repo in the monetary policy corridor with the Standing Deposit Facility.

To read more information on this topic:

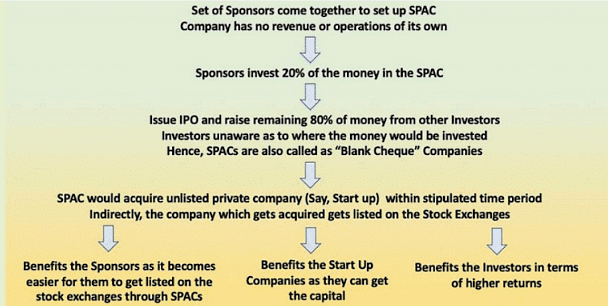

Special Purpose Acquisition Companies (SPACs)

What Are Special Purpose Acquisition Companies?

Present Status of Special Purpose Acquisition Companies

Global:

SPACs are currently regulated and recognised across multiple jurisdictions such as the UK, USA, Canada, Singapore and Malaysia. The SPACs have raised more than 50% of the capital in the stock market in USA in 2020.

India:

International Financial Services Centre (IFSC): The GIFT city located in Gujarat enables raising of Capital through SPACs. The International Financial Services Centre Authority (IFSCA) has already provided regulatory clarity on listing SPACs in International Financial Services Centre.

Domestic Market: The Capital market regulator i.e., SEBI has so far not enabled raising of capital through SPACs. Hence, the current regulatory framework of India is not supportive of the SPAC structure.

- Need to have Operations: The Companies Act 2013 requires that companies must commence operation within one year of incorporation. SPACs typically take 2 years to identify a target and perform due diligence. If SPACs are to be made functional in India, enabling provisions will have to be inserted in the Companies Act.

- Criteria for listing: If a company must get listed on the stock exchanges, it must be able to fulfil the eligibility criteria in terms of having certain assets and minimum profits etc. The absence of operational profits and net tangible assets would prevent SPACs from making an IPO in India.

To read more information on this topic:

Pm Mudra Yojana Completes 7 Years

About Mudra Scheme

Need: Small scale enterprises lack access to formal credit from the Banks. Over 60% of such units are owned by persons belonging to Scheduled Caste, Scheduled Tribe or Other Backward Classes. Hence, MUDRA scheme aims to promote financial inclusion and socio-economic development.

Launched in: 2015

Implemented by: Ministry of Finance Objective: Provide loans of up to Rs. 10 lakhs to Non Corporate Small Business Sector (NCSBS) which includes small manufacturing units, shopkeepers, fruits / vegetable vendors, truck & taxi operators, food-service units, repair shops, machine operators, small industries, artisans, food processors, street vendors and many others.

Who can provide loans?

Loans are provided by last mile financers such as Public Sector Banks, Regional Rural Banks, Cooperative Banks, Private and Foreign Banks, Small Finance Banks, NBFCs and Micro-finance

institutions.

Benefits for last mile financers: The loans provided by last mile financers get refinanced by Micro Units Development & Refinance Agency Ltd (MUDRA). Hence, MUDRA does not directly lend to individuals/Microenterprises. MUDRA is a refinancing institution.

Eligible borrowers: Both Individuals and Companies.

Purpose of Loans

- Business loan for Vendors, Traders, Shopkeepers and other Service Sector activities

- Working capital loan.

- Equipment Finance for Micro Units.

- Transport Vehicle loans such as auto rickshaws, small goods transport vehicles, tractors, tiller, two wheelers used for commercial use only

- Loans for agri-allied non-farm income generating activities such as pisciculture. bee keeping, poultry farming, etc. It does not include crop loans and loans for land improvement.

Types of Loans

- Shishu (loans up to Rs. 50,000);

- Kishore (loans from Rs. 50000 to Rs. 5 lakh);

- Tarun (loans from Rs.5 lakh to Rs. 10 lakh)

Note: The Pradhan Mantri Jan Dhan Yojana (PMJDY) provides for overdraft facility on Jan Dhan accounts. Overdrafts of up to Rs 5000 availed on such Jan Dhan accounts are also classified as MUDRA Loans.

Rate of Interest on MUDRA loans: The interest rates are deregulated and the banks have been advised to charge reasonable interest rates.

Need for Collateral: Banks have been mandated by RBI not to insist for collateral for the loans given under MUDRA Scheme. Hence, MUDRA loans are collateral free.

Details About Mudra Card

MUDRA Card is a debit card provided to the borrowers to withdraw the working capital given to them in the form of MUDRA loans. It is a RuPay debit card and can be used for withdrawing cash from the ATMs and to make payment through any ‘Point of Sale’ machines.

Details About Micro Units Development & Refinance Agency Ltd (Mudra)

Genesis: Announced in the Union Budget 2015-16 and later incorporated as a company under the Companies Act. Registered as a NBFC with the RBI.

Ownership: Subsidiary of Small Industries Development bank of India (SIDBI). Presently, the authorized capital of MUDRA is 1000 crores.

Roles and Responsibilities:

- Refinance support to the last mile financers involved in giving MUDRA loans.

- Credit Guarantee support for the micro-loans.

- Imparting Financial Literacy at the grassroots level.

- Development support to micro-enterprises in terms of addressing knowledge and skill gaps.

To read more information on this topic:

|

156 videos|430 docs|144 tests

|