Economic Development: November 2022 Current Affairs | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

Rooftop Solar Installations

Context

Rooftop solar capacity installations in India fell 29% to 320 megawatt (MW) in July-September 2022, according to Mercom Research India.

What are the Findings?

- Cumulative Installations:

- At the end of Q3 2022, cumulative rooftop solar (RTS) installations reached 8.3 GW.

- Gujarat became the leading state with the highest rooftop solar installations, followed by Maharashtra and Rajasthan.

- The top 10 states accounted for approximately 73% of cumulative rooftop solar installations.

- Decline in Installations:

- During January-September, the installations at 1,165 MW were also down 11% compared with 1,310 MW in the corresponding nine-month period of 2021.

- Causes of Decline:

- Solar installations are trending down because their costs have risen.

- The market is struggling with supply issues because of the Approved List of Module and Manufacturers (ALMM), and installers are finding it a tough environment to operate in overall.

What is Rooftop Solar?

About:

- Rooftop solar is a photovoltaic system that has its electricity-generating solar panels mounted on the rooftop of a residential or commercial building or structure.

- Rooftop mounted systems are small compared to ground-mounted photovoltaic power stations with capacities in the megawatt range.

- Rooftop PV systems on residential buildings typically feature a capacity of about 5 to 20 kilowatts (kW), while those mounted on commercial buildings often reach 100 kilowatts or more.

Challenges

- Flip-Flopping Policies:

- Although many companies began using solar energy, flip-flopping (sudden real or apparent change of policy) policies remained a major hurdle, especially when it came to power distribution companies (discoms).

- Industry executives point out RTS was becoming attractive for several consumer segments when discoms and state governments started tightening regulations for the sector.

- India's Goods and Service Tax (GST) Council recently hiked the GST of many components of the solar system from 5% to 12%.

- It will increase RTS's capital cost by 4-5%.

- Regulatory Framework:

- The growth of the RTS segment is highly dependent on the regulatory framework.

- Slow growth has been primarily caused by the absence or withdrawal of state-level policy support for the RTS segment, especially for the business and industrial segment, which makes up the bulk of target consumers.

- Inconsistent Rules on Net and Gross Metering:

- Net metering regulations are one of the major obstacles facing the sector.

- According to a report, Power ministry’s new rules that excludes rooftop solar systems above 10 kilowatts (kW) from net-metering would stall adoption of larger installations in India affecting the country’s rooftop solar target.

- The new rules mandate net-metering for rooftop solar projects up to 10 kW and gross metering for systems with loads above 10 kW.

- Net metering allows surplus power produced by RTS systems to be fed back into the grid.

- Under the gross metering scheme, state DISCOMS compensate consumers with a fixed feed-in-tariff for the solar power supplied to the grid by the consumer.

- Low Financing:

- The Union Ministry of New and Renewable Energy (MNRE) has advised banks to give loans for RTS at subsidised rates. However, nationalised banks hardly offer loans to RTS.

- Thus, many private players have come into the market that offer loans for RTS at higher rates like 10-12%.

What are the Schemes for Promoting Solar Energy?

- Rooftop Solar Scheme: To generate solar power by installing solar panels on the roof of the houses, the Ministry of New and Renewable Energy is implementing Grid-connected Rooftop Solar Scheme (Phase II).

- It aims to achieve a cumulative capacity of 40,000 MW from Rooftop Solar Projects by 2022.

- Kisan Urja Suraksha evam Utthaan Mahabhiyan: The scheme covers grid-connected Renewable Energy power plants (0.5 – 2 MW)/Solar water pumps/grid connected agriculture pumps.

- International Solar Alliance (ISA): The ISA, is an Indian initiative that was launched by the Prime Minister of India and the President of France on 30th November 2015 in Paris, France on the side-lines of the Conference of the Parties (COP-21), with 121 solar resource rich countries lying fully or partially between the tropic of Cancer and tropic of Capricorn as prospective members.

- One Sun, One World, One Grid: It has been taken up under the technical assistance program of the World Bank. Its objective is to aid in developing a worldwide grid through which clean energy can be transmitted anywhere, anytime.

- National Solar Mission (A part of National Action Plan on Climate Change).

Way Forward

- The RTS needs easy financing, unrestricted net metering, and an easy regulatory process. Public Financial Institutions and other key lenders could be mandated to lend to the segment.

- Some of the existing bank lines of credit could be adapted to meet the challenges of the Indian RTS segment, making it more attractive to developers in this area.

MAARG Portal

Context

- The Department for Promotion of Industry and Internal Trade (DPIIT), under the Ministry of Commerce and Industry, has launched a call for startup applications for registration on the MAARG portal, the National Mentorship Platform by Startup India.

Start-Ups in India

- The Indian start-up ecosystem, is currently ranked third largest globally. Startup India is focused on catalyzing the start-up culture and building a strong and inclusive ecosystem for innovation and entrepreneurship in India.

- In this context, the MAARG portal - Mentorship, Advisory, Assistance, Resilience, and Growth, is a one-stop platform to facilitate mentorship for start-ups across diverse sectors, functions, stages, geographies, and backgrounds.

MAARG Portal by Startup India

- Aiming to strengthen the startup ecosystem in the country, the Department for Promotion of Industry and Internal Trade (DPIIT) launched the MAARG portal, the National Mentorship Platform by Startup India.

- The MAARG Portal by Startup India is a one-stop mentorship platform to facilitate mentorship for startups across diverse sectors, functions, stages, geographies, and backgrounds. Startups can connect with academicians, industry experts, successful founders, seasoned investors, and others to get personalized advice on growth strategy, seek clarity, and get practical advice.

Objectives of MAARG Portal by Startup India

- To provide guidance and support to startups throughout their lifecycle.

- To establish a formalized and structured platform that facilitates intelligent matchmaking between mentors and startups across varied sectors at a scale.

- To establish an outcome-oriented mechanism that allows tracking of progress of the mentor-startup engagements.

The benefit of the MAARG Portal by Startup India

- With this single platform, the startup can get a Mentorship, Advisory, Assistance, Resilience, and Growth portal.

- The portal is enabled to send multiple mentorship requests to several mentors at the same time.

Key Functions of the MAARG Program

The key function of the MAARG Program is listed as follows:

AI engine to match relevant mentors and startups.

- Track mentor and startup interactions to deliver impact.

- Enable video calls and communication via the platform.

- Mobile-friendly interface for ease of use.

- Recognition and benefits of mentor contribution.

- Facilitate ecosystem enablers to host custom programs.

- Provide feedback, query, and grievance mechanism.

A Mentor through MAARG Portal

- All DPIIT-recognized startups, from all sectors and stages of the startup lifecycle, are eligible to apply for mentorship on the platform all year-round.

Eligible Startup

- All DPIIT-recognized startups, from all sectors and stages of the startup lifecycle, are eligible to apply for mentorship on the platform all year-round.

Tea Industry of India

Context

- The Tea Association of India (TAI) has expressed concern over decline in prices and drop in production, and cautioned that the industry could be heading towards a crisis.

About

- Indian tea is among the finest in the world owing to strong geographical indications, heavy investment in tea processing units, continuous innovation, augmented product mix and strategic market expansion.

Major Tea growing regions

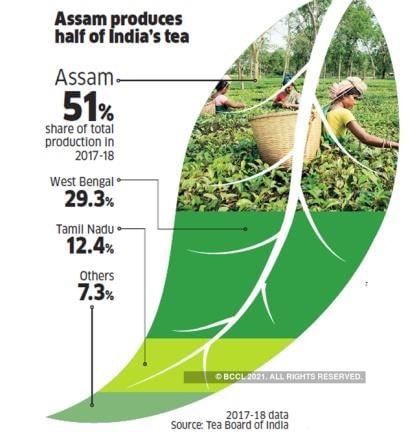

- The main tea-growing regions are in the Northeast (including Assam) and in north Bengal (Darjeeling district and the Dooars region).

- Dibrugarh is currently known as Tea City of India.

- The soil of the district is mostly fertile, alluvial soil.

- It is the gateway to the three tea-producing districts of Tinsukia, Dibrugarh, and Sivasagar.

- These three areas account for approximately 50% of India's Assam tea crop, and this gives Dibrugarh its rightly earned sobriquet as the "Tea City of India".

- The state of Assam is the world's single largest tea-growing region.

- Tea is also grown on a large scale in the Nilgiris in south India.

- India is one of the world’s largest consumers of tea, with about three-fourths of the country’s total produce consumed locally.

Market Size of Tea Industry in India

- In 2020, nearly 1.10 million tons of tea was consumed in the country.

- The market in the country is projected to witness a further growth in the forecast period of 2022-2027, growing at a CAGR of 4.2%. In 2026, the tea industry in India is expected to attain 1.40 million tons.

Issues faced by the Tea Industry

Shutdowns of tea plantations

- There are many tea gardens which have closed down in recent years due to various problems affecting the industry.

- Some of these are Red Bank, Dharanipur, Dheklapara, Surendranagar and Bundapani of the Dooars and Raipur Tea estate in West Bengal.

- In Assam too, many tea estates have closed down or are operating just minimally.

Causes

Tea prices started declining

- Across the world, tea’s auction price has declined by almost 44% in real terms in the recent past as per World Bank’s report.

- In India, all the profits from the tea gardens were siphoned off and there was no real or proper reinvestment in improving quality of tea.

- The burgeoning growth of the small-holder sector (currently 50 per cent of Indian production of 1,390 million kg), consistent with their ability to produce teas at a lower cost, also added pressure to the price lines.

- These have resulted in closing down of the tea gardens.

Less Production

- Financial problems, power problems, labor issues, poor labor schemes, inadequate communication system, increased pollution fee, less subsidy for transport etc. have put the tea industry in North East India in a difficult situation, resulting in low production of tea and tea leaves.

Pest Problem

- Along with the mosquito bug, a disease called the bacterial black spot has also affected many plantations in North East Tea Estates.

Low wages for laborers

- As price realization of tea is very less in the international market and as temporary laborers are used in the peak seasons, usually the wages paid for tea industry laborers are very less.

- This made some of them starve and leave out the industry.

High production costs

- Low yields and High production costs are pulling the legs of Small Tea Growers backward.

- Even the corporate companies are slowly exiting out of the industry and were concentrating only on the retailing part instead of production.

Sick industry

- A considerable number of tea gardens have gone sick due to lack of infrastructure, modernization and efficient management.

No proper storage

- The problem of storing premium quality tea has always been there.

- Due to delay in transportation and lack of storage facilities, the processed tea gains moisture from the atmosphere and deteriorates in quality.

Climatic Conditions

- Unfavourable climatic conditions for tea plantations owing to scanty or very heavy rainfall have badly affected the tea industry.

Political turmoil

- In Darjeeling, due to political agitation, production of flag bearer variety of tea has suffered a lot.

- This has forced lot of exporters to substitute that with Nepal tea to compensate the flavor and aroma.

Health problems

- The poor living conditions make these labourers vulnerable to various diseases.

- The major health problems faced by the labourers are worm infestation, respiratory problems, diarrhoea, skin infections, filariasis and pulmonary tuberculosis.

No health benefits

- Under the Plantation Labour Act 1951, each tea garden should have a health centre with proper medical facilities.

- However, the gardens are remotely located and the health centres are located in distant towns.

- The workers do not have proper connectivity to these centres.

- There are no maternity benefit schemes available for the female tea garden workers.

- It has been found that women are engaged in hard jobs even during pregnancy and post natal period.

Wage/Price Movement

- The wage/price movement has been adverse.

- Taking 1995 as the base year, and measuring over a 24-year duration up to 2019, wages have gone up by eight times whereas tea prices have gone up only by 2 per cent. Consequently, many companies turned red.

Collapse of the captive Russian market

- South Indian plantations took an earlier and bigger hit because of the collapse of the captive Russian market.

Exit from captive production

- Branding and moving up the value chain were seen as a means to insulate oneself from the commodity price insecurity.

- But the integrated (forward and backward) tea companies soon figured out that captive production was a burden and exited, either fully or partially from captive production.

Under the circumstances, the industry, in general, is in crying need to have a structural change in the way it operates.

Suggestions

Need for Organized Business

- Indian tea industry is still unorganized and even though Government is controlling this industry with Tea Board, it’s not that effective as expected.

- Thus it is the Tea Board that has to undergo structural reforms in order to safeguard the industry as well as so many people who is dependent totally on tea for their survival

Quality Enhancement

- Only quality tea production paves the way to preserve and significantly increase the export prices.

- Moreover this also will increase the demand for Indian tea among international products in the global arena and thereby increasing the profit margins as well as improving the living standards of people who is dependent on tea industry.

Awareness Programs

- Growing Small Tea Growers become a biggest challenge for the Tea Industry that only production is given importance by them because of ignorance.

- Thus to improve the standards of Tea Production, Government and Tea board have to organize more awareness programs on Tea plantations and on entrepreneurship skills, so as to run the business with better profits.

Distribute Land-Ownership

- One way of ensuring a holistic sustainability of the plantation industry would appear to be to distribute land-ownership in favour of the plantation employees and buy back the raw material through a co-operative outfit.

Price Formula

- The green leaf purchase can be based on a price-formula linked to, the published industry auction price.

- Individual corporates may want to pay a higher price, based on their end price realisation (as is being done in the case of bought leaf purchases).

- In consideration of transfer of land ownership, it should be made obligatory for ex-employees to sell the raw materials to the corporate which has the infrastructure and technology for processing the primary produce, adding value as appropriate and marketing the same.

Land disinvestment

- The land disinvestment should also be viewed in the light of the increasing uncertainty over land ownership both due to ‘land title’ issues, as well as political, social and economic pressure for land ownership.

- The value of a plantation, be it in terms of Rs/kg of production or Rs/hectare of plantation will simply be based on operational profits.

Social and Welfare amenities

- Once the workmen become owners of land and cease to be plantation employees, it will be incumbent on the government to provide them with social and welfare amenities, currently provided by the plantation managements, through their various existing schemes.

- This will further bring down production costs for the corporates.

- The government can thus ensure complete social and welfare care for this populace.

- Such a proposal could also be used to negotiate a trade-off with the government, with respect to use of a certain percentage of land for independent-use by the corporate, without any strictures whatsoever from the government in terms of its use (this freedom currently is not available to plantation companies).

- Thus, the corporates would insulate themselves from the wage increase cycle and their raw material cost would get linked to their end price realisation.

- The onus of improved conditions of the workmen would shift to the government, for which various schemes already exist.

- The workmen, on the other hand, will have the social and financial security net of owning land, with an assured buyback arrangement for the crop.

- They will also be able to build a house, by themselves or through government schemes.

Conclusion

- India being the second largest producer of Tea has numerous opportunities to develop the Tea Industry as it is providing employment to a huge number of people in the north eastern states.

- A win-win for all and therefore a truly sustainable and transparent model — is the key requirement for a highly labour-centric industry like tea plantations.

IIPDF Scheme

Context

- The Department of Economic Affairs (DEA), Ministry of Finance, Government of India, has notified the Scheme for Financial Support for Project Development Expenses of PPP Projects – India Infrastructure Project Development Fund Scheme (IIPDF Scheme).

About

- As a central sector scheme, the IIPDF Scheme will aid the development of quality PPP projects by providing necessary funding support to the project sponsoring authorities in the central and state governments.

- Funding under IIPDF Scheme is in addition to the already operational Viability Gap Funding Scheme that provides Financial Support to PPPs in Infrastructure that is economically justified, but commercially unviable.

Note: In PPP, public and private stakeholders sign up to jointly develop, finance, execute and operate a (mostly) infrastructure project.

Aim

- To improve the country's quality and pace of infrastructure development by encouraging private sector participation.

- The Scheme is for creating a shelf of bankable viable PPP projects to achieve the country's vision of modern infrastructure.

Advisory to PSAs

- A key step in structuring quality PPP projects is to provide quality advisory/consultancy services to the Project Sponsoring Authorities (PSAs). However, the procurement of such services is a time-consuming and difficult process often resulting in delays.

- There is a lack of appropriate transaction advisers (TAs) and there is non-optimal structuring of PPP projects.

- To address these issues, the Department of Economic Affairs (DEA) notified a panel of pre-qualified TAs in July 2022.

- Now, the IIPDF scheme will provide the necessary support to the PSAs, both in the Central and state governments. Financial assistance will be extended to meet the cost of transaction advisors and consultants engaged in developing PPP projects.

India Chem 2022

Context

Recently, 12th Biennial International Exhibition and Conference India Chem 2022 was inaugurated at Pragati Maidan, New Delhi.

- The theme for India Chem 2022 is “Vision 2030: Chemicals and Petrochemicals Build India”.

What is the Status of Chemical Industry in India?

- India’s chemical industry is extremely diversified and can be broadly classified into bulk chemicals, specialty chemicals, agrochemicals, petrochemicals, polymers and fertilisers.

- Globally, India is the fourth-largest producer of agrochemicals after the United States, Japan and China.

- India is the sixth-largest producer of chemicals in the world.

- India is the second-largest manufacturer and exporter of dyes and accounts for ~16% of the world's production.

- The country’s chemicals industry is de-licensed, except for few hazardous chemicals.

- India holds a strong position in exports and imports of chemicals at a global level and ranks 14th in exports and 8th in imports at global level (excluding pharmaceuticals).

What are the Related Government Initiatives?

- Under the Union Budget 2022-23, the government allocated Rs. 209 crores to the Department of Chemicals and Petrochemicals.

- Production linked incentive (PLI) Schemes have been introduced to promote Bulk Drug Parks.

- The government plans to implement PLI system with 10-20% output incentives for the agrochemical sector; to create an end-to-end manufacturing ecosystem through the growth of clusters.

- A 2034 vision for the chemicals and petrochemicals sector has been set up by the government to explore opportunities to improve domestic production, reduce imports and attract investments in the sector.

Report on Municipal Finances: RBI

Context

Recently, the Reserve Bank of India (RBI) has released the Report on Municipal Finances, compiling and analyzing budgetary data for 201 Municipal Corporations (MCs) across all States.

- The RBI Report explores ‘Alternative Sources of Financing for Municipal Corporations’ as its theme.

What is a Municipal Corporation?

About:

- In India, the Municipal Corporation is the urban local government that is responsible for the development of any Metropolitan City having a population of more than one million people.

- Mahanagar Palika, Nagar Palika, Nagar Nigam, City Corporation, and so on are some of the other names for it.

- The Municipal Corporations are established in the states by the acts of the state legislatures, whereas in the Union Territories through the acts of the Parliament.

- Municipal governments rely heavily on property tax revenue to fund their operations.

- The first municipal corporation in India was created in Madras in 1688, followed by municipal corporations in Bombay and Calcutta in 1726.

Constitutional Provisions:

- In the Constitution of India, no provision was made for the establishment of local self-government, except the incorporation of Article 40 in the Directive Principles of State Policy.

- The 74th Amendment Act, 1992 has inserted a new Part IX-A into the Constitution which deals with the administration of Municipalities and Nagar Palikas.

- It consists of Article 243P to 243ZG. It also added a new twelfth schedule to the Constitution. The 12th schedule consists of 18 items.

What are the Findings?

- Poor working of MCs:

- There have been several lacunae in the working of MCs and no appreciable improvement in their functioning despite institutionalisation of the structure of local governance in India.

- The availability and quality of essential services for urban populations in India has consequently remained poor.

- Lack of Financial Autonomy:

- Most municipalities only prepare budgets and review actuals against budget plans but do not use their audited financial statements for balance sheet and cash flow management, resulting in significant inefficiencies.

- While the size of the municipal budgets in India are much smaller than peers in other countries, revenues are dominated by property tax collections and devolution of taxes and grants from upper tiers of government, resulting in lack of financial autonomy.

- Minimal Capital Expenditure:

- MCs’ committed expenditure in the form of establishment expenses, administrative costs and interest and finance charges is rising, but capital expenditure is minimal.

- MCs mostly rely on borrowings from banks and financial institutions and loans from centre/ state governments to finance their resource gaps in the absence of a well-developed market for municipal bonds.

- Stagnant Revenues/Expenditure:

- Municipal revenues/expenditures in India have stagnated at around 1 % of GDP (Gross Domestic Product) for over a decade.

- In contrast, municipal revenues/ expenditures account for 7.4 % of GDP in Brazil and 6 % of GDP in South Africa.

- Ineffective State Financial Commissions:

- Governments have not set up State Financial Commissions (SFCs) in a regular and timely manner even though they are required to be set up every five years. Accordingly, in most of the States, SFCs have not been effective in ensuring rule-based devolution of funds to Local governments.

What are the Suggestions?

- MCs need to adopt sound and transparent accounting practices with proper monitoring and documentation of various receipt and expenditure items, and explore different innovative bond and land-based financing mechanisms to augment their resources.

- The rapid rise in urban population density, however, calls for better urban infrastructure, and hence, requires greater flow of financial resources to Local governments.

- With the revenue generation capacity of municipal corporations declining over time, dependence on the devolution of taxes and grants from the upper tiers has risen. This calls for innovative financing mechanisms.

- Municipalities in India need to balance their budgets by law, and any municipal borrowing needs to be approved by the State government.

- In order to improve the buoyancy of municipal revenue, the Centre and the States may share one-sixth of their GST (Goods and Services Tax).

India’s First Floating Financial Literacy Camp

Context

Recently, India Post Payments Bank (IPPB) conducted India’s First Floating Financial Literacy Camp with an initiative called ‘Niveshak Didi’ to promote Financial Literacy ‘By the women, for the women’, in Srinagar, J&K.

What is the Niveshak Didi Initiative?

- About:

- It is based on the ideology of women for women, as rural area women feel more comfortable to share their queries with a female herself.

- Implementing Agency:

- It is launched by IPPB, in collaboration with Investor Education and Protection Fund Authority (IEPFA) under the aegis of Ministry of Corporate Affairs (MCA).

- Floating Financial Literacy Camp:

- The session covered topics ranging from banking and financial products, importance of joining the mainstream financial services offered by regulated entities & protection against various types of risks involved with investments and measures of fraud prevention.

What are India’s other Initiatives for Financial Literacy?

- Pradhan Mantri Jan-Dhan Yojana:

- Pradhan Mantri Jan Dhan Yojana (PMJDY) is the National Mission for Financial Inclusion.

- It ensures access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner.

- PMJDY has been the foundation stone for people-centric economic initiatives. Whether it is Direct Benefit Transer (DBT), Covid-19 financial assistance, PM-KISAN, increased wages under Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGA), life and health insurance cover, the first step of all these initiatives is to provide every adult with a bank account, which PMJDY has nearly completed.

- Pradhan Mantri Jeevan Jyoti Bima Yojana:

- Pradhan Mantri Jeevan Jyoti Bima Yojana provide for life insurance and accident insurance respectively to the migrants and labourers.

- Pradhan Mantri Kisan Maan Dhan Yojana:

- PMKMDY was started to provide social security to all landholding Small and Marginal Farmers (farmers whose land holdings are less than two hectares of land in the country).

- It is a voluntary and contribution-based pension scheme.

- Pension will be paid to the farmers from a Pension Fund managed by the Life Insurance Corporation of India.

- Farmers will have to contribute an amount between Rs.55 to Rs.200 per month in the Pension Fund till they reach the retirement date i.e., the age of 60 years.

- Pradhan Mantri Mudra Yojana:

- The PMMY is a scheme launched in 2015 for providing loans up to 10 lakh to the non-corporate, non-farm small/micro enterprises.

- These loans are classified as MUDRA loans under PMMY.

- These loans are given by Commercial Banks, RRBs, Small Finance Banks, Cooperative Banks, MFIs and NBFCs.

|

63 videos|5408 docs|1146 tests

|

FAQs on Economic Development: November 2022 Current Affairs - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC

| 1. What is economic development and why is it important? |  |

| 2. How does economic development impact employment opportunities? |  |

| 3. What are the key indicators of economic development? |  |

| 4. How does economic development affect the environment? |  |

| 5. What role does government play in promoting economic development? |  |