Economic Development: September 2023 UPSC Current Affairs | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

Gresham’s Law and Currency Exchange Rate

Central Idea

- The law, known as the Gresham's law, was invoked in response to the economic crisis in Sri Lanka that occurred last year.

- During this crisis, the Central Bank of Sri Lanka established a fixed exchange rate for the Sri Lankan rupee in relation to the U.S. dollar.

About Gresham’s Law

- The law is attributed to Thomas Gresham, an English financial advisor to the English monarchy, and it applies not only to paper currencies but also to commodity currencies and various goods.

- The maxim "Bad money drives out good" describes a situation in which government-set exchange rates deviate from market rates, causing undervalued currency to be taken out of circulation.

- Gresham's Law comes into play when governments arbitrarily establish prices, leading to a commodity being undervalued compared to its market exchange rate. As a result, the commodity exits the official market.

- In such cases, the sole means of obtaining the undervalued commodity is through the black market, as it is no longer accessible through legitimate channels.

- Countries can also witness the outflow of specific goods when the government forcibly undervalues their prices.

Application to Commodity Money

- Gold and Silver Coins: Gresham’s Law is particularly evident when a government fixes the exchange rate of commodity money, like gold and silver coins, well below their market value. In response, people may hoard or melt these coins to obtain their intrinsic value, which is higher than the government-set rate.

Recent Example in Sri Lanka

- Economic Crisis in Sri Lanka: Gresham’s Law was observed during the economic crisis in Sri Lanka, where the central bank fixed the exchange rate between the Sri Lankan rupee and the U.S. dollar.

- Rupee Overvaluation: The government mandated that the price of the U.S. dollar should not exceed 200 Sri Lankan rupees, even though the black market rate indicated a higher value. This overvaluation of the rupee led to a decline in the supply of dollars and pushed the U.S. dollar out of the formal foreign exchange market.

- Black Market Transactions: Individuals seeking U.S. dollars for foreign transactions were compelled to purchase them from the black market at rates exceeding 200 Sri Lankan rupees per dollar.

Conditions for Gresham’s Law to Apply

- Government-Imposed Fixed Rates: Gresham’s Law operates when government authorities establish and enforce fixed exchange rates between currencies.

- Effective Implementation: Effective enforcement of these rates by authorities is essential for the law to take effect.

Anti-thesis Concept: Thiers’ Law

- “Good Money Drives Out Bad”: In the absence of government-imposed exchange rate fixes, the opposite phenomenon occurs. People tend to abandon currencies they perceive as of lower quality in favour of those they consider better, leading to the dominance of “good money.”

- Thiers’ Law: This concept, known as Thiers’ Law and named after French politician Adolphe Thiers, complements Gresham’s Law.

RBI to Discontinue I-CRR

Why in news?

RBI to discontinue ICRR, which was announced as a temporary measure to absorb excess liquidity from the banking system.

What is Cash Reserve Ration (CRR)?

- Banks are required to maintain liquid cash amounting to a certain proportion of their deposits and certain other liabilities with the RBI.

- This is a tool at the disposal of the RBI to control the liquidity in the economy and can also act as a buffer in periods of bank stress.

- Banks are currently required to maintain 4.5 per cent of their Net Demand and Time Liabilities as CRR with the RBI.

- RBI has the option to impose incremental credit reserve ratio, in addition to the CRR, in periods of excess liquidity in the system.

What is Incremental Cash Reserve Ratio (ICRR)?

- All scheduled banks must uphold an additional cash reserve ratio equating to 10% of the surge in their net demand and time liabilities (NDTL) recorded between May 19, 2023, and July 28, 2023.

- It will apply to all scheduled banks, including commercial banks, cooperative banks, and regional rural banks.

- It is a temporary measure which will be reviewed in 3 months.

Why ICRR is needed?

- ICRR is a temporary measure to drain excess liquidity from the banking system due to its withdrawal of Rs 2,000 notes.

- As liquidity is withdrawn, banks will have limited funds for lending, thereby decreasing demand for goods and services.

- RBI’s surplus transfer to the government, pick up in government spending and capital inflows.

What was the impact of ICRR?

- The banking system’s liquidity turned deficit for the first time in the current fiscal mandate.

- The tight liquidity condition was also contributed by outflows on account of goods and services tax (GST) and the selling of dollars by the central bank to stem the rupee’s fall.

Cotton Production in India

Why in News?

- Cotton is a versatile crop that provides food, feed, and fiber for various uses, including textiles, cooking oil, and livestock feed. It is also a major source of income and employment for millions of farmers in India.

- However, in recent years, cotton production and yields have declined significantly, posing a challenge for the country’s agriculture and textile sectors.

What is the Significance of Cotton for India?

- About:

- Cotton is one of the most important commercial crops cultivated in India and accounts for around 25% of the total global cotton production.

- Due to its economic importance in India, it is also termed as “White-Gold”.

- In India, around 67% of India’s cotton is grown on rain-fed areas and 33% on irrigated areas.

- Growing Conditions:

- Cotton cultivation necessitates a hot, and sunny climate with a long frost-free period. It is most productive in warm and humid climatic conditions.

- Cotton can be successfully grown in a range of soil types, including well-drained deep alluvial soils in northern regions, variable-depth black clayey soils in the central region, and mixed black and red soils in the southern zone.

- While cotton exhibits some tolerance to salinity, it is highly sensitive to waterlogging, emphasizing the importance of well-drained soils in cotton farming.

- Species of Cultivated Cotton:

- India is the country to grow all four species of cultivated cotton Gossypium arboreum and Herbaceum (Asian cotton), G.barbadense (Egyptian cotton) and G. hirsutum (American Upland cotton).

- Majority of the cotton production comes from ten major cotton growing states, which are grouped into three diverse agro-ecological zones, as under:

- Northern Zone: Punjab, Haryana and Rajasthan

- Central Zone: Gujarat, Maharashtra and Madhya Pradesh

- Southern Zone: Telangana, Andhra Pradesh, Karnataka and Tamil Nadu

- Significance:

- Cotton, often likened to coconut, serves as a source of three essential components:

- Fiber: The white fluffy fiber or lint, constituting about 36% of the raw unginned cotton, is the primary source for the textile industry. The rest is seed (62%) and wastes (2%) separated from the lint during ginning.

- Cotton commands a two-thirds share in India's total textile fiber consumption.

- Food: Cottonseed contains 13% oil, which is commonly used for cooking and frying.

- Cottonseed cake/meal is India's second-largest feed cake, following soybean.

- Feed: The leftover cottonseed cake, comprising 85% of the seed, is a valuable, protein-rich feed ingredient for livestock and poultry.

- Cottonseed oil ranks as the country's third-largest domestically-produced vegetable oil, following mustard and soybean.

What led to Rapid Increase and Subsequent Decline in Cotton Production in India?

- Surge:

- Between 2000-01 and 2013-14, India experienced a significant upturn in cotton production due to the widespread adoption of Bt (Bacillus thuringiensis) technology. The key developments during this period were as follows:

- The introduction of genetically-modified (GM) cotton hybrids with Bt genes, which were designed to combat the American bollworm insect pest.

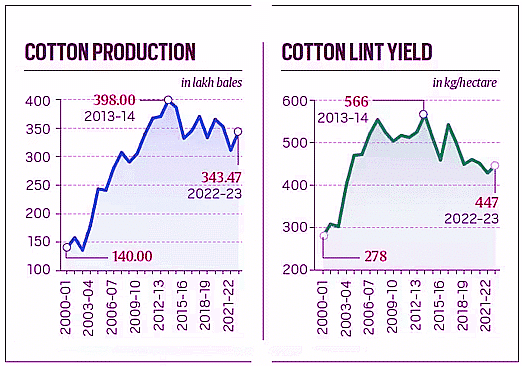

This innovation resulted in a substantial increase in lint yields, with production per hectare surging from 278 kg in 2000-01 to 566 kg in 2013-14.

Simultaneously, there was a corresponding rise in the production of cottonseed oil and cake.

- Decline:

- The primary reason for the decline in cotton production was the emergence of the pink bollworm (Pectinophora gossypiella).

- When pink bollworm larvae infest cotton bolls, it leads to reduced cotton production and lower-quality cotton.

- Unlike the versatile American bollworm, the pink bollworm is specialized and primarily feeds on cotton, which contributed to its resistance against Bt proteins.

- Continuous cultivation of Bt hybrid cotton varieties led to pink bollworm populations developing resistance and replacing susceptible strains.

- In 2014, Gujarat experienced an unusual increase in pink bollworm larvae survival on cotton flowers between 60-70 days after planting. In 2015, Andhra Pradesh, Telangana, and Maharashtra also reported pink bollworm infestations.

- In 2021, even Punjab, Haryana, and northern Rajasthan faced a severe infestation of this pest for the first time.

- Current Methods Employed to Manage the PBW Pest:

- Traditional insecticides had limited success in controlling PBW larvae. Instead, a different method called "mating disruption" has been used.

- It entails the use of Gossyplure, a pheromone signaling chemical that is secreted by female PBW moths to attract male adults. In this case, the pheromone is artificially synthesised and filled into pipes or lures.

- This method hinders male moths from locating females and engaging in mating, thereby causing disruption in their reproductive cycle.

- There are two approved products for mating disruptions:

- PBKnot, which uses ropes with these chemicals on cotton plants to reduce infestation and boost yields.

- SPLAT-PBW, which is a special emulsion that disrupts PBW mating with synthetic chemicals.

What are the Other Issues Associated with the Cotton Sector in India?

- Yield Fluctuations: Cotton production in India can be quite unpredictable due to several factors.

- Limited access to irrigation systems, declining soil fertility, and erratic weather patterns, including unexpected droughts or excessive rainfall, contribute to the uncertainty surrounding cotton yields.

- Smallholder Dominance: The majority of cotton farming in India is carried out by small-scale farmers.

- These farmers often rely on traditional agricultural practices and have limited access to modern farming technologies, which in turn affects overall cotton production.

- Limited Market Access: A significant number of cotton growers in India face constraints in reaching markets and are compelled to sell their harvest at reduced rates to intermediaries.

Way Forward

- Integrated Pest Management: There is a need to advocate for integrated pest management (IPM) strategies that combine natural controls, trap crops, and beneficial insects to reduce pesticide dependency while effectively managing pests.

- Community-Based Seed Banks: Establishing seed banks at the community level to conserve and share traditional cotton seed varieties, preserving genetic diversity and promoting higher-yielding strains.

- Market Linkage Platforms: Establishing digital platforms that directly connect cotton farmers with buyers and textile manufacturers, reducing middlemen involvement and ensuring fair pricing.

- Value Addition Through Local Processing: Promoting value addition by establishing local cotton processing units that can gin, clean, and process cotton fiber, creating employment opportunities and adding value to the cotton supply chain.

Measurement of Unemployment In India

Context

In order to successfully tackle, it is important to understand how unemployment is defined and measured in a developing economy like India.

More on News.

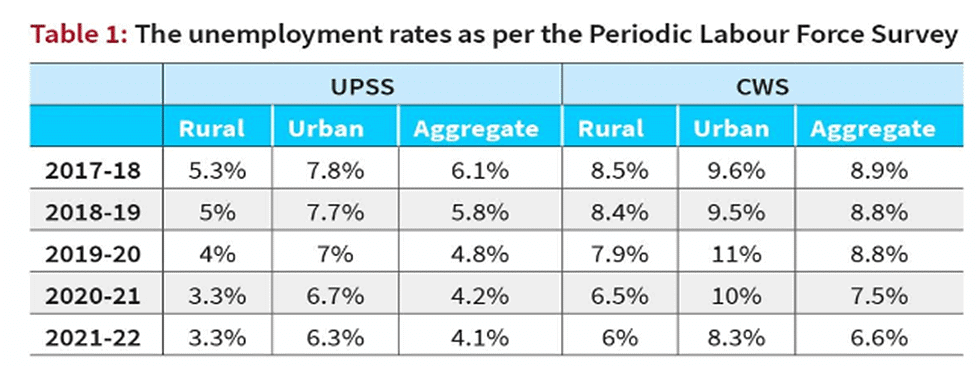

- According to the Periodic Labour force Survey (PLFS) 2017, unemployment rate of India was highest i.e 6.1%. However a recent PLFS report (2021-22) showed declining trends i.e 4.1%.

- One Size Does Not Fits All: The economies of the U.S (industrialized) and India (developing) are very different. As such, the methods used to measure unemployment are very different.

About Unemployment

- Definition: According to the International Labour Organisation (ILO), an unemployed person is a person aged 15 or over who simultaneously meets three conditions

- Unemployment is being out of a job.

- Being available to take a job.

- Actively engaged in searching for a job.

- Trends in unemployment rates in india: Refer table 1.

Methodology of measuring unemployment in India

- The National Sample Survey Office (NSSO) launched the PLFS with the primary objectives of providing more frequent and comprehensive labor force data. The PLFS has two main objectives:

- To estimate the key employment and unemployment indicators (viz. Worker Population Ratio, Labour Force Participation Rate, Unemployment Rate) for the urban areas only in the ‘Current Weekly Status’ (CWS).

- To estimate employment and unemployment indicators in both ‘Usual Status’ and CWS in both rural and urban areas annually

- Center for Monitoring the Indian economy (CMIE) conducts its own survey and periodically presents data and reports on unemployment following different methodology.

Key Challenges in Methodology of Measuring Unemployment

- Conceptual framework of key employment and unemployment indicators

- An individual’s principal status is based on the activity in which they spent relatively a long time in the previous year.

- The CWS adopts a shorter reference period of a week.

- Informal nature of job markets: In terms of employment share the unorganized sector employs 83% of the work force and 17% in the organized sector.

- There are 92.4% informal workers (with no written contract, paid leave and other benefits) in the economy.

- Agrarian Economy: The low bar for classifying an individual as employed is why rural areas tend to have lower unemployment rates than urban areas.

- For instance, in agrarian economies, individuals have better chances of finding some kind of work, even if it is informal.

- Social Norms and Gender Roles:

- Traditional gender roles often place the responsibility of domestic work and caregiving on women.

- For instance, 29.4% of women (aged 15-59) were part of India’s labor force in 2021-22, in contrast, men’s LFPR was 80.7% in 2021-22.

- Lockdown Effect (Covid-19) : the different measurement criteria may not fully capture the effects of such disruptions, leading to discrepancies in reported unemployment rates.

Steps taken to address unemployment by Central government

- Atma Nirbhar Bharat Package: The government announced the Aatmanirbhar Bharat package to stimulate business and mitigate the impact of COVID-19. It includes various long-term schemes and policies for self-reliance and employment opportunities.

- Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS): Statutory guaranteed 100 days employment for an unskilled worker in rural areas.

- Flagship Programme: Initiatives like and Deen Dayal Upadhyaya Grameen Kaushalya Yojana (DDU-GKY) are encouraged for employment generation.

- Others: Make in India, Start-up India, Digital India, Smart City Mission, Housing for All, and Industrial Corridors are also oriented towards creating employment opportunities.

Way Forward

- Incorporate Underemployment: The current methodology primarily focuses on open unemployment and does not adequately capture underemployment.

- Expanding the definition to include those who are employed but not fully utilizing their skills or working fewer hours than desired.

- Regular and Comprehensive Surveys: It can help capture fluctuations in employment patterns and provide policymakers with timely information.

- Improve Data Quality and Consistency: By investing in training for surveyors and adopting modern data collection technologies to minimize errors.

- Include Informal Sector: A significant portion of India’s workforce is employed in the informal sector, which often goes unaccounted for in official statistics.

- Develop methodologies to better capture informal employment and its dynamics.

- Seasonal Employment Adjustment: Develop methods for seasonally adjusting unemployment rates, especially in sectors like agriculture where employment patterns vary throughout the year.

- Utilize Technology: To track employment trends in real-time.

- This can include analyzing online job portals, social media, and other digital sources for labor market insights.

Safeguarding the Global Financial Ecosystem

Why in News?

Recently, the Union Finance & Corporate Affairs Minister addressed the Global Fintech Fest 2023 in Mumbai.

- The importance of global cooperation in addressing threats to the Global Financial Ecosystem is highlighted.

- India Under the G20 Presidency has sought for global cooperation and collaboration in the areas where we have continued challenges.

What is Global Fintech Fest (GFF)?

- It is the largest fintech conference, jointly organized by the National Payments Corporation of India (NPCI), the Payments Council of India (PCI), and the Fintech Convergence Council (FCC).

- Aim is to provide a singular platform for fintech leaders to foster collaborations and develop a blueprint for the future of the industry.

- GFF is a platform where policymakers, regulators, industry leaders, academics, and all major FinTech ecosystem stakeholders converge once a year to exchange ideas, share insights, and drive innovation.

- GFF’23 Theme:

- Global Collaboration for a Responsible Financial Ecosystem.

- The theme of GFF 2023 highlights the critical need for global collaboration to build a financial ecosystem that is inclusive, resilient, and sustainable.

What is Fintech?

- Fintech (Financial technology) is used to describe new technology that seeks to improve and automate the delivery and use of financial services.

- The key segments within the FinTech space include Digital Payments, Digital Lending, BankTech, and Cryptocurrency.

- FinTech spans various sectors, including education, retail banking, fundraising, nonprofit, and investment management, making it a rapidly growing industry with significant business expansion and job creation.

- Additionally, FinTech plays a crucial role in advancing financial inclusion goals.

What Threats Does the Global Financial Ecosystem Face?

- Crypto Threats

- Cybersecurity: Cryptocurrencies are vulnerable to cyberattacks, hacking, theft, fraud, and scams due to their anonymity and decentralization.

- Regulation: Crypto faces regulatory challenges globally, leading to uncertainty and inconsistency in approaches and standards among countries.

- Stability: Cryptocurrency prices are highly volatile, impacting user confidence and business investments.

- Sustainability: Crypto mining consumes excessive energy and generates electronic waste, raising environmental concerns.

- Cyber Threats:

- Phishing: Fraudulent emails and messages trick users into revealing sensitive information, compromising financial institutions.

- Ransomware: Malware encrypts victim files and demands ransom, targeting financial services for extortion.

- Data Breaches: Unauthorized access to confidential data can compromise the privacy, identity, and assets of financial entities and individuals.

- Supply Chain Attacks: Hackers infiltrate suppliers of financial institutions to compromise their systems and services.

- Drug Wars and Mafias: Drug traffickers and mafias use money laundering to integrate illegal funds into the legitimate financial system.

- Tax Havens and Evasion: A tax haven is a country or jurisdiction that offers foreign individuals and businesses little or no tax liability. Tax evasion is the illegal avoidance or reduction of taxes by concealing or misreporting income or assets.

- Major threats Posed by Tax Havens and Evasion:

- Revenue Loss: Tax havens and evasion result in significant revenue loss for governments, especially in developing countries.

- Inequality: Tax havens and evasion worsen inequality by benefiting the wealthy at the expense of the poor.

- Corruption: These practices facilitate corruption by providing safe havens for illicit financial flows and tax fraud.

Why is Global Collaboration Essential for the Security of the Global Financial Ecosystem?

- Complexity of Threats:

- Threats to the global financial ecosystem, such as cyberattacks, crypto challenges, and drug mafias, are multifaceted and transcend national boundaries.

- A global collaborative effort is needed to counter these challenges and work together to create a responsible, inclusive, resilient, and sustainable financial ecosystem.

- Cross-Border Nature:

- Many financial threats, like cyberattacks and money laundering, originate in one country but impact institutions and individuals across the world.

- Collaboration is necessary to track and mitigate these threats effectively.

- Consistency in Regulation:

- Inconsistent regulations across countries create opportunities for criminals to exploit regulatory gaps.

- Global collaboration can help establish uniform standards and regulations, reducing the risk of regulatory arbitrage.

- Information Sharing:

- Collaboration enables information sharing, expertise development, and unified regulations to mitigate threats effectively. It also allows proactive identification and prevention of potential financial crises through shared intelligence.

How Can Fintech Address Global Financial Ecosystem Threats?

- Fintech companies can invest heavily in robust security measures utilizing advanced encryption and other measures to protect user data and financial transactions.

- Fintechs use innovative solutions like machine learning and blockchain to bolster cybersecurity and deter malicious activities.

- Fintechs can promote financial inclusion by offering underserved populations access to services that boost economic well-being and reduce financial vulnerability.

- Fintechs can also play a crucial role in developing and implementing regulatory frameworks for emerging technologies like crypto assets, which can help mitigate the risks associated with these assets while promoting innovation and growth in the financial sector.

One-Hour Trade Settlement

Central Idea

- SEBI aims to implement a One-Hour trade Settlement by March 2024.

- Additionally, an Application Supported by Blocked Amount (ASBA)-like facility for secondary market trading is anticipated to launch in January 2024.

Understanding Trade Settlement

- Trade settlement involves the exchange of funds and securities on the settlement date.

- It is considered complete when purchased securities are delivered to the buyer, and the seller receives the funds.

- India transitioned to a T+1 settlement cycle earlier this year, facilitating faster fund transfers, share deliveries, and operational efficiency.

SEBI’s Stance

- SEBI believes that achieving instantaneous trade settlement will take additional time due to necessary technology development.

- Therefore, SEBI plans to implement a one-hour trade settlement before the instantaneous settlement.

- SEBI expects instantaneous trade settlement to be launched by the end of 2024.

Benefits of One-Hour Trade Settlement

- In the current T+1 settlement cycle, the seller receives funds in their account the day after a trade.

- With one-hour settlement, the seller would receive funds within an hour of selling shares, and the buyer would have shares in their demat account within an hour.

Back2Basics: T+1 Settlement Cycle

- The T+1 settlement cycle means that trade-related settlements must be done within a day, or 24 hours, of the completion of a transaction.

- For example, under T+1, if a customer bought shares on Wednesday, they would be credited to the customer’s demat account on Thursday.

- This is different from T+2, where they will be settled on Friday.

- As many as 256 large-cap and top mid-cap stocks, including Nifty and Sensex stocks, come under the T+1 settlement.

- Until 2001, stock markets had a weekly settlement system.

- The markets then moved to a rolling settlement system of T+3, and then to T+2 in 2003.

- In 2020, Sebi deferred the plan to halve the trade settlement cycle to one day (T+1) following opposition from foreign investors.

Central Bank Digital Currency

Why in News?

Recently, the Reserve Bank of India (RBI) Governor has highlighted the potential of Central Bank Digital Currency (CBDC) or E-rupee in improving cross-border payments' efficiency.

- RBI is gradually expanding its CBDC pilots to include more banks, cities, diverse use cases, and a broader audience.

- The RBI launched pilots for digital rupee in the wholesale in November 2022 and in the retail segment in December 2022.

What is Central Bank Digital Currency (CBDC)?

- About:

- CBDCs are a digital form of a paper currency and unlike cryptocurrencies that operate in a regulatory vacuum, these are legal tenders issued and backed by a central bank.

- It is the same as a fiat currency and is exchangeable one-to-one with the fiat currency.

- A fiat currency is a national currency that is not pegged to the price of a commodity such as gold or silver.

- The digital fiat currency or CBDC can be transacted using wallets backed by blockchain.

- Though the concept of CBDCs was directly inspired by Bitcoin, it is different from decentralised virtual currencies and crypto assets, which are not issued by the state and lack the ‘legal tender’ status.

- Objectives:

- The main objective is to mitigate the risks and trim costs in handling physical currency, costs of phasing out soiled notes, transportation, insurance and logistics.

- It will also wean people away from cryptocurrencies as a means for money transfer.

- Global Trends:

- Bahamas has been the first economy to launch its nationwide CBDC — Sand Dollar in 2020.

- Nigeria is another country to have roll out eNaira in 2020.

- China became the world's first major economy to pilot a digital currency e-CNY in April 2020.

What is the Significance of CBDC?

- Cross-Border Transactions:

- CBDCs possess unique attributes that can revolutionize cross-border transactions.

- Instant settlement feature of CBDCs as a significant advantage, making cross-border payments cheaper, faster, and more secure.

- Faster, cheaper, transparent, and inclusive cross-border payment services can yield substantial benefits for individuals and economies worldwide. These improvements can support economic growth, international trade, and financial inclusion on a global scale.

- Traditional and Innovative:

- CBDC can gradually bring a cultural shift towards virtual currency by reducing currency handling costs.

- CBDC is envisaged to bring in the best of both worlds:

- The convenience and security of digital forms like cryptocurrencies

- The regulated, reserved-backed money circulation of the traditional banking system.

- Financial Inclusion:

- The increased use of CBDC could be explored for many other financial activities to push the informal economy into the formal zone to ensure better tax and regulatory compliance.

- It can also pave the way for furthering financial inclusion.

What are the Challenges in Adopting CBDC Across India?

- Privacy Concerns:

- The first issue to tackle is the heightened risk to the privacy of users—given that the central bank could potentially end up handling an enormous amount of data regarding user transactions.

- This has serious implications given that digital currencies will not offer users the level of privacy and anonymity offered by transacting in cash.

- Compromise of credentials is another major issue.

- Disintermediation of Banks:

- If sufficiently large and broad-based, the shift to CBDC can impinge upon the bank’s ability to plough back funds into credit intermediation.

- If e-cash becomes popular and the Reserve Bank of India (RBI) places no limit on the amount that can be stored in mobile wallets, weaker banks may struggle to retain low-cost deposits.

- Other Risks are:

- Faster obsolescence of technology could pose a threat to the CBDC ecosystem calling for higher costs of upgradation.

- Operational risks of intermediaries as the staff will have to be retrained and groomed to work in the CBDC environment.

- Elevated cyber security risks, vulnerability testing and the costs of protecting the firewalls.

- Operational burden and costs for the central bank in managing CBDC.

Way Forward

- Central banks should continue their efforts to research, develop, and pilot CBDCs. Collaboration with financial institutions, technology experts, and other stakeholders is essential to ensure the successful implementation of CBDCs.

- Central banks and financial authorities from different countries should collaborate closely on CBDC initiatives. Cross-border payments inherently involve multiple jurisdictions, so international cooperation is vital to address regulatory, security, and technical challenges.

- CBDCs must prioritize security and privacy. Robust cybersecurity measures should be in place to protect against hacking and fraud. Simultaneously, mechanisms for ensuring user privacy and data protection should be established and maintained.

India’s Fiscal Deficit

Why in News?

Recently, the Centre's fiscal deficit in the first four months of 2023-24 touched 33.9% of the full-year target.

- In the Union Budget, the government projected to bring down the fiscal deficit to 5.9% of the gross domestic product (GDP) in the current FY.

- The deficit was 6.4% of the GDP in 2022-23 against the earlier estimate of 6.71%.

What is Fiscal Deficit?

- About:

- Fiscal deficit is the difference between the government's total expenditure and its total revenue (excluding borrowings).

- It is an indicator of the extent to which the government must borrow in order to finance its operations and is expressed as a percentage of the country's GDP.

- High and Low FD:

- A high fiscal deficit can lead to inflation, devaluation of the currency and an increase in the debt burden.

- While a lower fiscal deficit is seen as a positive sign of fiscal discipline and a healthy economy.

- Positive Aspects of Fiscal Deficit:

- Increased Government Spending: Fiscal deficit enables the government to increase spending on public services, infrastructure, and other important areas that can stimulate economic growth.

- Finances Public Investments: The government can finance long-term investments, such as infrastructure projects, through fiscal deficit.

- Job Creation: Increased government spending can lead to job creation, which can help reduce unemployment and increase the standard of living.

- Negative Aspects of Fiscal Deficit:

- Increased Debt Burden: A persistent high fiscal deficit leads to an increase in government debt, which puts pressure on future generations to repay the debt.

- Inflationary Pressure: Large fiscal deficits can lead to an increase in money supply and higher inflation, which reduces the purchasing power of the general public.

- Crowding out of Private Investment: The government may have to borrow heavily to finance the fiscal deficit, which can lead to a rise in interest rates, and make it difficult for the private sector to access credit, thus crowding out private investment.

- Balance of Payments Problems: If a country is running large fiscal deficits, it may have to borrow from foreign sources, which can lead to a decrease in foreign exchange reserves and put pressure on the balance of payments.

|

63 videos|5408 docs|1146 tests

|

FAQs on Economic Development: September 2023 UPSC Current Affairs - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly

| 1. What is Gresham's Law and how does it relate to currency exchange rates? |  |

| 2. Why is RBI discontinuing I-CRR? |  |

| 3. What is the current status of cotton production in India? |  |

| 4. How is unemployment measured in India? |  |

| 5. What is the significance of safeguarding the global financial ecosystem? |  |