Economic Reforms: Economics | Indian Economy for UPSC CSE PDF Download

Economic Reforms

- The process of economic reforms was launched on 23 July 1991 in response to a fiscal and Balance of Payment crisis.

- The crisis was immediate by the first Gulf War (1991) which had two –ve impacts:

(i) Increased oil prices led to faster use of Forex Reserve in a short period

(ii) Private remittance from the Indians working in the Gulf region fell down fast - The Balance of Payment crisis also reflected deeper problems of rising foreign debt, a fiscal deficit of over 8% of GDP and a hyperinflation (13%) situation.

- Under the IMF’s Extended Fund facility Programme, member countries get external currency support from the fund to mitigate their Balance of Payment crisis but on certain conditions.

IMF’s Conditions

- Devaluation of the rupee by 22%

- Drastic reduction in peak import tariff (130 to 30%)

- Excise duty (now CENVAT) to be hiked by 20% to neutralize the revenue shortfalls due to custom cut

- All govt expenditure to be cut down by 10% annually

- LPG: The process of reforms a to be completed via three other processes namely – Liberalisation, Privatisation & Globalisation (LPG).

- Liberalisation: It is a pro-market or pro-capitalist inclination in the economic policies of an economy

- Privatisation: It means de-nationalisation i.e. transfer of the state ownership of the assets to the private sector to the tune of 100%

- Globalisation: It means economic integration among the nations.

First Generation Reforms (1991-2000)

- Promotion to private sector This includes de-licensing and de-reservation of industries, abolition of MRTP limit etc.

- Public sector reforms Steps taken to make public sector undertakings profitable, efficient; Disinvestment, corporatisation was its major part.

- External sector reforms Abolishing quantitative restrictions on imports, announcing full account convertibility, permission to foreign investment

- Financial sector reforms Reforms in the banking sector, insurance etc.

- Tax reforms Policy initiative directed towards simplifying, modernization, broad basing, checking evasion etc.

Second Generation Reforms (2000-01 onwards)

- Factor market reforms It consisted of the dismantling of the Administered Price Mechanism (APM). Products like petrol, sugar, drugs were to be brought into the market fold.

- Public sector reforms These included greater functional autonomy, international tie-ups and Greenfield ventures etc

- Reforms in government & public institution It involves all those moves which go to convert the role of the government from the “controller” to “facilitator”

- Legal sector reform Reforms in Labour Law, Company Laws, enacting Cyber Laws etc

- Reforms in critical areas Such as power, road, telecom, education, healthcare etc

Third Generation Reforms

- Made on the margins of launching Xth Plan (2002-07)

- Commits to the cause of fully functional PRIs so that benefits can reach the grass-root level.

Agriculture in India

- Agriculture remains the most important sector of the Indian economy. Today, India ranks second worldwide in farm output. Agriculture and allied sectors like forestry and fisheries accounted for 16.6% of the GDP in 2009, about 50% of the total workforce.

- The economic contribution of agriculture to India's GDP is steadily declining with the country's broad-based economic growth. Still, agriculture is demographically the broadest economic sector and plays a significant role in the overall socio-economic fabric of India.

- 65-70% people of India depend of agriculture sector. it is the biggest unorganised sector of the economy accounting for more than 90% share in the total unorganised labour force.

- It accounts for 10.23% of the total export income of India and 2.74% of the import.

Agrarian Reform in India

- Agrarian Reform in India had been adopted to reallocate the agricultural resources among all the people directly connected with agriculture.

- After independence, the Government of India started the process of building equity in rural population and improvement of the employment rate and productivity. So for this reason the Government had started agrarian reform.

Reasons Behind Agrarian Reform

- Since India had been under several rulers for a long time, i.e right from the beginning of the middle age, that's why it's rural economic policies kept changing. The main focus of those policies was to earn more money by exploiting the poor farmers.

- In the British period the scenario had not changed much. The British Government introduced the "Zamindari" system where the the authority of land had been captured by some big and rich landowners called Zamindar. Moreover they created an intermediate class to collect tax easily.

- This class had no direct relationship with agriculture or land. Those Zamindars could acquire land from the British Government almost free of cost. So the economic security of the poor peasants lost completely. After independence, the Government's main focus was to remove those intermediate classes and secure a proper land management system. Since India is a large country, the redistribution process was a big challenge for the Government.

Objectives

According to agrarian reform land was declared as a property of State Government. So agrarian reform varied from state to state. But the main objectives of agrarian reform in India were:

- Setting proper land management,

- Abolition of Intermediaries

- Preventing fragmentation of lands,

- Tenancy reform.

The land policies of different states faced several controversies. In some state the reform measures were biased in favour of th big land owners who could wield their political influence. However, agrarian reform in India had set a healthy socio-economic structure in the rural areas.

The reforms have been undertaken along the following lines

- Abolition of zamindars and other intermediaries (jagirdars, inamdars, malgujars, etc) between the/state and the cultivator;

- Tenancy reforms and the reconstruction of the land ownership system;

- Fixation of ceiling on holdings and distribution of surplus land among the landless;

- Reorganization of agriculture through consolidation of holding and prevention of further fragmentation; and

- Development of co-operative farming and co-operative village management systems.

Review of Land Reform Measures

Reasons for Low Progress of Land Reforms

The task force on agrarian relations set up by the Planning Commission to appraise the progress and problems of land reforms, identified the following reasons for the poor performance of land reform measures.

Lack of political will

In the context of the socio-economic conditions prevailing in the country, no tangible progress can be expected in the field of land reforms in the absence of requisite political will. The sad truth is that this crucial factor has been wanting. In no sphere of public activity in our country since independence has had such a big gap between precept and practice i.e. between policy pronouncement and actual execution.

Absence of pressure from below

Except in a few scattered and localized pockets, practically allover the country, the poor peasants and agricultural workers are passive, unorganized and inarticulate. The basic difficulty in our situation arises from the fact that the beneficiaries of land reforms do not constitute a homogeneous social or economic group.

Negative attitude of the bureaucracy

Towards the implementation of land reforms, attitude of bureaucracy has been generally lukewarm and indifferent. This is, of course, inevitable because, as in the case of men who wield political power, those in the high echelons of the administration also are either big land- owners themselves or have close nexus with big land- owners.

Legal hurdles

Legal hurdles also stand in the way of land reforms. The task force categorically states: "in a society in which the entire weight of civil and criminal laws, judicial pronouncements and precedents, administrative procedure and practice is thrown on the side of the existing social order based on the inviolability of the private property, an isolated law aiming at the restructuring of the property relation in the rural area has little chance of success. And whatever little chance of success was there, completely evaporated because of the loopholes in the laws and protracted legislations".

Absence of correct and up-to-date land records

The absence of correct and complete land records further added a good deal of confusion. It is because of this that no amount of legislative measures could help the tenant in the court unless he could prove that he is the e actual tenant. This he could only do if there were reliable, and up-to-date records of tenants.

The main reason for the unsatisfactory state of affairs are

- Many of the areas in the country have never been cadastrally surveyed,

- In some areas where cadestral surveys were done for a long time, no resurveys have been taken,

- No machinery, of any kind, existed for maintaining village records,

- Even where records were kept by government officials, there is no uniform system, and

- It has been found that even official records in many cases have not been correct.

Lack of financial support

Lack of financial support plagued the Land Reform Act from the beginning. No separate allocation of funds was made in the fifth plan for financing land reforms. Many states declined to include even expenditure of such essential items like preparation of records of rights in their plan budget. The state plans which are nothing but aggregate of expenditure programmes hardly made any reference to land reforms. Whatever funds were needed for finalizing of this programme had to be provided in non-plan budgets. It is because of this that the expenditure for land reforms was always postponed. or kept to ' the minimum.

Land reforms have been treated as an administrative issue

The implementation of land reforms is not an administrative issue, it is more of a political issue. Therefore, it is necessary to strengthen the political will for implementing land reforms. The task force of the Planning Commission in a very forthright manner states: "it should, however, be clearly understood that the mere setting up of an efficient administrative machinery will not by itself lead to any substantial improvement unless the political and economic hurdles operating against the programme are removed."

Green Revolution in India

Components of Green Revolution

High Yielding Varieties of Seeds (HYV)

- One of the basic pre- requisite of technical changes is the high yielding variety of seeds (HYV). With this programme it becomes possible to lead intensive agriculture. It was, thus, during mid-sixties that the high yielding variety of wheat was evolved. Since then a number of HYV seeds of wheat, paddy, maize, and bajra have been developed and widely distributed throughout the country.

- In 1966-67, only 1.89 million hectares of land had been brought under HYV seeds which rose to 56.18 million hectares in 1986-87. During 1991-92, the area under high yielding varieties of seeds was 64.7 million hectares which rose to 79.0 million hectares in 2000-01.

Chemical Fertilizers

- The use of chemical fertilizer is another reason promoting for accelerating the growth of agricultural output in the short period. In this regard, National Commission on Agriculture has rightly said, "It has been the experience throughout the world that increased agricultural production is related to increased consumption of fertilizers. Since 1950-51 Indian fertilizer industry has continuously expanded.

- The total production capacity which was 0.31 million tonnes in 1950-51 has reached to 9.04 million tonnes in 1990-91 and further to 15.23 million tonnes in 2002-03, As regards the consumption of fertilizers it was only 0.13 million tonnes at the beginning of the First five year plan.

- The consumption of fertilizers increased from 5.51 million tonnes in 1980-81 to 12.9 million tonnes in 1990-91. In 2001-02, consumption was recorded to be 17.3 million tonnes.

Irrigation

- Water along with HYV seeds and fertilizer forms a significant input, to raise agricultural production. Thus, availability of water is possible either from rain or surface flow or below ground. In India, availability of irrigation is highly scanty and more than 70 per cent of agriculture is dependent on rainfall.

The rainfall is confined to few months i.e., June to September. - Moreover, rainfall in most parts of the country is very low, where, it is high, and the available soil moisture is not adequate to support multiple cropping. Hence, there is an urgent need for providing assured supplies of irrigation.

Pesticides

- It has been estimated that about 10 per cent crop is damaged every year due to defective and inadequate plant protection measures. The adoption of HYV has strengthened the need of such measures because it is conducive to the growth of the plant population.

- In order to meet these problems, central insecticides laboratory with its two branches at Hyderabad and Bombay and two regional centres at Kanpur and Chandigarh continue to augment efforts to ensure pesticides to cultivators.

Credit Facilities

- Farmers have been getting more credit facilities. Previously, farmers have to depend on money lenders for their credit requirements. But now most of the credit needs are filled by credit institutions. Thus, with the availability of cheap credit, farmers are in position to use improved seeds, fertilizers, machines etc. They have also arranged for minor irrigation facilities.

Impact of Green Revolution on Indian Economy

The green revolution has two types of effects on Indian economy, namely, (a) economic effects and (b) sociological effects.

Economic Effects

Increase in agricultural production and productivity

- Due to adoption of HYV technology the production of food grains increased considerably in the country. The production of wheat has increased from 8.8 million tones in 1965-66 to 184 million tones in 1991-92. The productivity of other food grains has increased considerably. It was 71% in case of cereals, 104% for wheat and 52% for paddy over the period 1965-66 and 1989-90.

The index number of productivity on agriculture (Base -1969 - 70) increased from 88.9 in 1965-66 to 156 in 1991-92 indicating an increase of about 100% in productivity over the period. - Though the food grain production has increased considerably but the green revolution has no impact on coarse cereals, pulses and few cash corps. In short the gains of green revolution have not been shared equally by all the crops.

Employment

The new agricultural technology has created more amounts of employment opportunities in the agricultural sector. The new technology is early maturing and makes multiple cropping possible.

Market Orientation

The new technology has made the farmers market-oriented. Due to excess production the farmers have to go to the market for selling their surplus production.

Forward and Backward Linkage

Due to new technology the demand for industrial products like fertilizers, pesticides and insecticides increased which gave rise to industrialization of the economy. Similarly due to excessive production more employments were created in the tertiary sector like transportation, marketing and storage.

Sociological Effects

Personal inequalities

Due to Green Revolution the income of rich farmers increased considerably whereas the poor farmers couldn't reap any benefit. Hence in Punjab it led to concentration of wealth, income and assets with the rich farmers on the one hand and gradual pauperization of the rural poor. This led to a class conflict between the rich and the poor farmers. The small and marginal farmers were deprived of enjoying the gains of new technology.

Regional Inequality

The new technology was successfully implemented in the wheat-producing belt of the country whereas the rice producing zones were not at all affected by this Green Revolution. Hence the disparity between the two regions increased considerably. Father Green Revolution became successful in irrigated areas whereas in the rained belt the new technology couldn't be properly implemented.

Positives

- Increase in Production / yield.

- Advantage to farmers: this includes their economic situation improving, even small and marginal farmers (although they were late in joining) getting better yield, control on many insects and pests, mechanizing improved working conditions.

- Better land use by employing two and three crop pattern

- better scientific methods applied as per requirement of farms.

- New seeds have been developed with better yield and disease fighting capability.

Negative

- Degradation of land: Due to change in land use pattern and employing two and three crop rotation every year land quality has gone down and yield has sufferred.

- Degradation of land part 2: Due to heavy chemical fertilizer inputs land has become hard and carbon material has gone down.

- Weeds have increased: Due to heavy crop rotation pattern we do not give rest to land nor we have time to employ proper weed removal system which has increased weeds.

- Pest infestation has gone up: Pests which we used to control by bio degradable methods have become resistant to many pesticides and now these chemical pesticides have become non effective.

- Loss of bio diversity: Due to heavy use of chemical pesticides, insecticides and fertilizers we have lost many birds and friendly insects and this is a big loss in long term.

- Chemicals in water: These chemicals which we have been using in our farms go down and contiminate ground water which effect our and our children health.

- Water table has gone down: Water table has gone down due to lack of water harvesting systems and now we have to pull water from 300 to 400 ft. depth which was 40 to 50 feet earlier.

- Loss of old seeds: We have started using new seeds and lost old once since new once give better yield but due to this we have lost many important geens in these seeds.

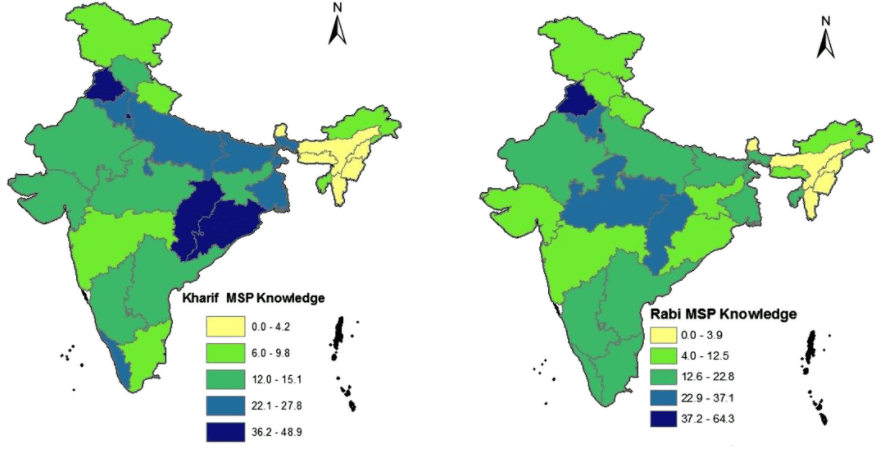

Minimum support price

The price at which the government purchases crop from the farmers, whatever may be the price of the crops.

The MSP was announced by the govt for the first time in 1966-67 for the wheat in the wake of the Green Revolution and extended harvest, to save the farmers from depleting profits.

- Since then the MSP regime has been extended for many crops.

- MSP is announced every year for a number of crops

Main objectives

- To prevent fall in prices in the situation of over production

- To protect the interest of farmers by ensuring them a minimum price for their crops in the situation of a price fall in the market

- MSP is announced on the recommendation of the : Commission for Agriculture Cost & Prices (CACP)” which takes into consideration the inputs costs and favourable returns to the farmers.

Agricultural Credit and Insurance

Kisan Credit Card

- Launched in 1998 to provide short-term credit

- Simple, flexible procedures

- Helps buy seeds and fertilizers at farmer’s convenience

- Operated by major nationalized banks

- Includes personal accident insurance coverage

National Agricultural Insurance Scheme (NAIS) / Rashtriya Krishi Bima Yojana (RKBY)

- Launched in 2008

- Provides insurance coverage in the event of failure of crop due to natural causes, pests and diseases

- Covers food crops, oilseeds, sugarcane, cotton and potato

- Joint programme of Central and State governments

- 50% subsidy for small and medium farmers

- Implemented by Agriculture Insurance Company of India (combination of NABARD and other nationalized insurance companies)

Livestock Insurance Scheme

- Launched in 2005

- Provides protection to farmers and cattle rearers against loss due to animal death

- Covers crossbred and high yielding cattle and buffaloes

- Fully funded by the Central government

- 50% subsidy

- Implemented by livestock development boards of each state

Rainfall Insurance / Varsha Bima

- Launched in 2004

- Provides protection against anticipated shortfall in crop yield due to deficit rainfall

- Implemented by Agriculture Insurance Company of India Ltd. (AIC)

Weather Based Crop Insurance Scheme (WBCIS)

- Launched in 2003

- Provides protection against loss due to adverse weather conditions including rainfall, frost, temperature etc

- Jointly funded by Central and State governments

- Up to 50% subsidy

Rainfall Insurance Scheme for Coffee Growers (RISC)

- Launched in 2009

- Protects against loss due to deficit rainfall during blossom and backing periods and excess rains during monsoon period

- Covers Robusta/Arabica variety of coffee in Karnataka, Kerala, TN

- Funded by the Coffee Board (Central government)

- 50% subsidy

- Implemented by AIC

Agricultural Schemes and Programmes

Agriculture is important to the Indian economy, accounting for approximately 17% of the total GDP and employing over 58% of the population. Recognising the importance of agriculture, the Indian government has undertaken several plans and efforts to help the industry, boost productivity, and improve farmers’ livelihoods across the country.

Soil Health and Micronutrients

Soil Health Card Scheme:

- Initiative by Government of India since 2015.

- Aims to provide farmers with detailed information on soil nutrient status.

- Prescribes strategies for enhancing soil health and fertility.

- Focuses on promoting sustainable agriculture and increasing farm output.

- Regulates urea use and enhances nitrogen availability to crops.

- Coating with neem slows down fertilizer release for better crop uptake.

- Mandatory for all domestically manufactured and imported urea.

- Expected savings of 10% in urea usage, reducing cultivation costs and improving soil health.

PM-PRANAM:

- Encourages states and union territories to adopt alternative fertilizers.

- Promotes balanced utilization of chemical fertilizers for environmental protection.

- Incentivizes eco-friendly farming practices.

Agricultural and Livestock Insurance

Pradhan Mantri Fasal Bima Yojana (PMFBY)

- Launched in Kharif 2016.

- Offers comprehensive crop insurance against non-preventable natural risks.

- Covers losses from pre-sowing to post-harvest stages.

- Premium rates: 2% for Kharif crops, 1.5% for Rabi crops, and 5% for annual commercial/horticultural crops.

- Remaining actuarial premium split equally between Central and State Governments.

- Voluntary for states and available only in designated areas and crops.

- Mandatory for loanee farmers and optional for non-loanee farmers.

- Aims to provide protection to farmers and cattle rearers against animal loss due to death.

- Seeks to demonstrate the benefits of livestock insurance and popularize it.

Irrigation

- Objective: Provide protected irrigation to all agricultural farms nationwide.

- Aims to enhance crop productivity and achieve rural prosperity.

- Strategy involves comprehensive planning at district/state level.

- Focuses on end-to-end solutions in irrigation supply chain including water sources, distribution networks, farm-level applications, and extension services on new technologies.

- Government approved dedicated fund of Rs. 5,000 crores.

- Objective: Expand adoption of micro-irrigation techniques.

- Aims to increase agricultural production and boost farmers’ income.

- Fund established under NABARD, providing to states at concessional interest rate.

- Goal: Promote micro-irrigation, currently utilized on 10 million hectares, with potential for 70 million hectares.

Agricultural Marketing

- Implemented by the Ministry of Agriculture and Farmers Welfare.

- Part of the Integrated Scheme for Agricultural Marketing (ISAM).

- Combines former schemes: Grameen Bhandaran Yojana (GBY) and Scheme for Strengthening/Development of Agricultural Marketing Infrastructure, Grading & Standardisation (AMIGS).

- Aims to create agricultural marketing infrastructure, including storage facilities.

- GBY supports farmers in creating or renovating rural storage infrastructure, improving capacity, promoting product standardization, and preventing distress sales.

E-NAM (National Agriculture Market):

- Launched in 2015 to reform the agri-marketing sector and promote online marketing of agro commodities.

- Deploys a web-based platform across 585 regulated markets for online trading.

- Aims to remove information asymmetry, increase transparency, and improve access to markets for farmers.

Scheme for Formation and Promotion of Farmer Producer Organization (FPO):

- Central Sector Scheme named "Formation and Promotion of Farmer Produce Organisations (FPOs)".

- Aims to establish and promote 10,000 new FPOs.

- Implementing agencies: Small Farmers Agri-business Consortium (SFAC), National Cooperative Development Corporation (NCDC), and National Bank for Agriculture and Rural Development (NABARD).

- FPOs aim to strengthen negotiating power, productivity, and income through collective marketing and other activities.

Organic Farming

Paramparagat Krishi Vikas Yojana (PKVY):

- Part of the Soil Health Management (SHM) scheme under the National Mission of Sustainable Agriculture (NMSA).

- Aims to promote organic farming by blending traditional wisdom with modern science.

- Goals include ensuring sustainability, enhancing long-term soil fertility, conserving resources, and producing safe and healthy food without harming the environment.

- Focuses on empowering farmers through institutional development, including clusters, to manage farming practices, produce high-quality inputs, ensure quality assurance, and explore innovative techniques for value addition and direct commercialization.

Mission Organic Value Chain Development for Northeastern Region:

- Central Sector Scheme for North Eastern states.

- Aims to develop certified organic production in a value chain mode.

- Supports the entire value chain, from inputs and seeds to collection, processing, marketing, and brand building.

National Mission on Natural Farming (NMNF):

- Aims to encourage farmers to switch to chemical-free farming.

- Scaled up from Bhartiya Prakritik Krishi Paddati (BPKP).

- Requires a behavioral shift in farmers toward cow-based locally generated inputs.

- Focuses on awareness creation, training, handholding, and capacity building of farmers.

National Project on Organic Farming (NPOF):

- Central sector initiative since 2004.

- Aims to promote organic farming through various measures including technical capacity building, technology transfer, production of organic inputs, quality control, certification through Participatory Guarantee System (PGS-India), and financial assistance for specific activities.

- Focuses on awareness creation and publicity through media.

Other Schemes

Pradhan Mantri Kisan Samman Nidhi (PM-KISAN):

- Provides direct income support to small and marginal farmers.

- Eligible farmers with up to 2 hectares of land receive Rs. 6,000 per year in three instalments.

- Operates through Direct Benefit Transfer mechanism to beneficiaries' bank accounts.

- Aims to promote farmers’ financial well-being and sustain their livelihoods.

National Mission for Sustainable Agriculture (NMSA):

- Aims to increase agricultural output, particularly in rainfed areas.

- Focuses on integrated farming, water usage efficiency, soil health management, and resource synergy.

- Addresses dimensions of water use efficiency, nutrient management, and livelihood diversification.

- Implements various schemes including Rainfed Area Development (RAD), Soil Health Management (SHM), Sub Mission on Agro-Forestry (SMAF), Paramparagat Krishi Vikas Yojana (PKVY), Soil and Land Use Survey of India (SLUSI), National Rainfed Area Authority (NRAA), Mission Organic Value Chain Development in North Eastern Region (MOVCDNER), National Centre of Organic Farming (NCOF), and Central Fertilizer Quality Control and Training Institute (CFQC&TI).

National Scheme on Welfare of Fishermen:

- Provides financial support for various purposes including housing construction, community halls, and drinking water access.

- Assists fishermen during lean periods through a savings cum relief component.

Rashtriya Krishi Vikas Yojana– Beneficial Approach for Transformation of Agriculture and Allied Sector (RKVY-RAFTAAR):

- Aims to enhance farming profitability by empowering farmers and encouraging entrepreneurial ventures.

- Establishes agribusiness incubators (ABI) and reinforces existing ones as Raftaar-ABI (R-ABI).

- Provides infrastructure, equipment, and staff to support agricultural innovation and entrepreneurship.

- Atmanirbhar Clean Plant Programme: Led by the National Horticulture Board, this program aims to improve the quality of horticulture crops in India, promote exports in the sector, and focus on enhancing crop yields, environmental preservation, and resilient plant varieties.

- Transition to Natural Farming: The government plans to support one crore farmers in transitioning to natural farming over the next three years. This will involve establishing 10,000 Bio-Input Resource Centres to produce micro-fertilizers and pesticides, forming a decentralized national system.

- PM Matsya Sampada Yojana Sub Scheme: With an investment of ₹6,000 crores, this sub-scheme aims to enhance the operations of fishermen, fish vendors, and micro and small enterprises. It aims to improve value chain efficiencies, expand market access, and promote overall growth in the fisheries sector.

- Digital Public Infrastructure for Agriculture: To support farmer-centric solutions and the development of agricultural technology startups, a digital public infrastructure will be established. This open-source and interoperable resource aims to foster innovation and inclusivity in the agricultural sector.

|

108 videos|425 docs|128 tests

|

FAQs on Economic Reforms: Economics - Indian Economy for UPSC CSE

| 1. What are the main objectives of economic reforms in India? |  |

| 2. How did the Green Revolution impact the Indian economy? |  |

| 3. What is the minimum support price in Indian agriculture? |  |

| 4. What are some of the agricultural credit and insurance schemes in India? |  |

| 5. How have land reform measures been reviewed in India's agriculture sector? |  |