Factors Determining National Income | Economics Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| The Circular Flow of Income |

|

| Value Added Method or Product Method |

|

| Income Method |

|

| Expenditure Method |

|

Introduction

- National Accounts Statistics (NAS) in India are compiled by National Accounts Division in the Central Statistics Office, Ministry of Statistics and Programme Implementation. Annual as well as quarterly estimates are published. This publication is the key source-material for all macroeconomic data of the country. As per the mandate of the Fiscal Responsibility and Budget Management Act 2003, the Ministry of Finance uses the GDP numbers (at current prices) to determine the fiscal targets.

- The Ministry of Statistics and Programme Implementation has released the new series of national accounts, revising the base year from 2004-05 to 2011-12. In the revision of National Accounts statistics done by Central Statistical Organization (CSO) in January 2015, it was decided that sector-wise estimates of Gross Value Added (GVA) will now be given at basic prices instead of at factor cost. In simple terms, for any commodity the ‘basic price’ is the amount receivable by the producer from the purchaser for a unit of a product minus any tax on the product plus any subsidy on the product.

The Circular Flow of Income

Circular flow of income refers to the continuous circulation of production, income generation and expenditure involving different sectors of the economy. There are three different interlinked phases in a circular flow of income, namely: production, distribution and disposition as can be seen from the following figure.

- In the production phase, firms produce goods and services with the help of factor services.

- In the income or distribution phase, the flow of factor incomes in the form of rent, wages, interest and profits from firms to the households occurs

- In the expenditure or disposition phase, the income received by different factors of production is spent on consumption goods and services and investment goods. This expenditure leads to further production of goods and services and sustains the circular flow.

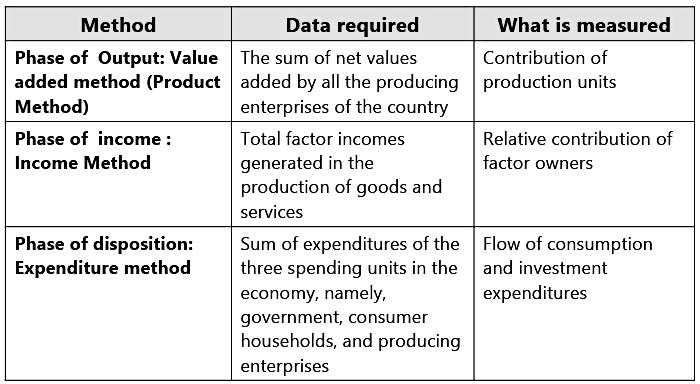

These processes of production, distribution and disposition keep going on simultaneously and enable us to look at national income from three different angles namely: as a flow of production or value added, as a flow of income and as a flow of expenditure. Each of these different ways of looking at national income suggests a different method of calculation and requires a different set of data. The details in respect of what is measured and what data are required for all three methods mentioned above are given in the following table.

Data requirements and Outcomes of Different Methods of National Income Calculation

Corresponding to the three phases, there are three methods of measuring national income. They are: Value Added Method (alternatively known as Product Method); Income Method; and Expenditure Method.

Corresponding to the three phases, there are three methods of measuring national income. They are: Value Added Method (alternatively known as Product Method); Income Method; and Expenditure Method.

Value Added Method or Product Method

- Product Method or Value Added Method is also called Industrial Origin Method or Net Output Method. National income by value added method is the sum total of net value added at factor cost across all producing units of the economy.

- The value added method measures the contribution of each producing enterprise in the domestic territory of the country in an accounting year and entails consolidation of production of each industry less intermediate purchases from all other industries. This method of measurement shows the unduplicated contribution by each industry to the total output.

This method involves the following steps:

Step 1: Identifying the producing enterprises and classifying them into different sectors according to the nature of their activities All the producing enterprises are broadly classified into three main sectors namely:

- Primary sector,

- Secondary sector, and

- Tertiary sector or service sector

These sectors are further divided into sub-sectors and each sub-sector is further divided into commodity group or service-group.

Step 2: Estimating the gross value added (GVAMP) by each producing enterprise

- Gross value added (GVA MP) = Value of output – Intermediate consumption = (Sales + change in stock) – Intermediate consumption

Step 3. Estimation of National income For each individual unit, Net value added is found out.

- ∑ (GVAMP) – Depreciation = Net value added (NVAMP)

Adding the net value-added by all the units in one sub-sector, we get the net valueadded by the sub-sector. By adding net value-added or net products of all the subsectors of a sector, we get the value-added or net product of that sector. For the economy as a whole, we add the net products contributed by each sector to get Net Domestic Product. We subtract net indirect taxes and add net factor income from abroad to get national income.

- Net value added (NVA MP) – Net Indirect taxes = Net Domestic Product (NVA FC)

- Net Domestic Product (NVA FC) + (NFIA) = National Income (NNP FC)

The values of the following items are also included:

- Own account production of fixed assets by government, enterprises and households.

- Production for self- consumption, and

- Imputed rent of owner occupied houses.

Income Method

- Production is carried out by the combined effort of all factors of production. The factors are paid factor incomes for the services rendered. In other words, whatever is produced by a producing unit is distributed among the factors of production for their services.

- Under Factor Income Method, also called Factor Payment Method or Distributed Share Method, national income is calculated by summation of factor incomes paid out by all production units within the domestic territory of a country as wages and salaries, rent, interest, and profit. By definition, it includes factor payments to both residents and non- residents. Thus, NDP FC = Sum of factor incomes paid out by all production units within the domestic territory of a country

- NNP FC or National Income = Compensation of employees

+ Operating Surplus (rent + interest+ profit)

+ Mixed Income of Self- employed

+ Net Factor Income from Abroad

- NNP FC or National Income = Compensation of employees

- Only incomes earned by owners of primary factors of production are included in national income. Transfer incomes are excluded from national income. Thus, while wages of labourers will be included, pensions of retired workers will be excluded from national income. Labour income includes, apart from wages and salaries, bonus, commission, employers’ contribution to provident fund and compensations in kind. Non-labour income includes dividends, undistributed profits of corporations before taxes, interest, rent, royalties and profits of unincorporated enterprises and of government enterprises.

- However, normally, it is difficult to separate labour income from capital income because in many instances people provide both labour and capital services. Such is the case with self-employed people like lawyers, engineers, traders, proprietors etc. In economies where subsistence production and small commodity production is dominant, most of the incomes of people would be of mixed type. In sectors such as agriculture, trade, transport etc. in underdeveloped countries (including India), it is difficult to differentiate between the labour element and the capital element of incomes of the people. In order to overcome this difficulty a new category of incomes, called ‘mixed income’ is introduced which includes all those incomes which are difficult to separate.

Expenditure Method

In the expenditure approach, also called Income Disposal Approach, national income is the aggregate final expenditure in an economy during an accounting year. In the expenditure approach to measuring GDP, we add up the value of the goods and services purchased by each type of final user mentioned below.

1. Final Consumption Expenditure

- Private Final Consumption Expenditure (PFCE): To measure this, the volume of final sales of goods and services to consumer households and nonprofit institutions serving households acquired for consumption (not for use in production) are multiplied by market prices and then summation is done. It also includes the value of primary products which are produced for own consumption by the households, payments for domestic services which one household renders to another, the net expenditure on foreign financial assets or net foreign investment. Land and residential buildings purchased or constructed by households are not part of PFCE. They are included in gross capital formation. Thus, only expenditure on final goods and services produced in the period for which national income is to be measured and net foreign investment are included in the expenditure method of calculating national income.

- Government Final Consumption Expenditure: Since the collective services provided by the governments such as defence, education, healthcare etc are not sold in the market, the only way they can be valued in money terms is by adding up the money spent by the government in the production of these services. This total expenditure is treated as consumption expenditure of the government. Government expenditure on pensions, scholarships, unemployment allowance etc. should be excluded because these are transfer payments.

2. Gross Domestic Capital formation

- Gross domestic fixed capital formation includes final expenditure on machinery and equipment and own account production of machinery and equipments, expenditure on construction, expenditure on changes in inventories, and expenditure on the acquisition of valuables such as, jewelry and works of art.

3. Net Exports

- Net exports are the difference between exports and imports of a country during the accounting year. It can be positive or negative. How do we arrive at national income or NNP FC using expenditure method? We first find the sum of final consumption expenditure, gross domestic capital formation and net exports. The resulting figure is gross domestic product at market price (GDP MP). To this, we add the net factor income from abroad and obtain Gross National Product at market price (GNP MP). Subtracting indirect taxes from GNP MP, we get Gross National Product at factor cost (GNP FC). National income or NNP FC is obtained by subtracting depreciation from Gross national product at factor cost (GNP FC).

- Ideally, all the three methods of national income computation should arrive at the same figure. When national income of a country is measured separately using these methods, we get a three dimensional view of the economy. Each method of measuring GDP is subject to measurement errors and each method provides a check on the accuracy of the other methods. By calculating total output in several different ways and then trying to resolve the differences, we will be able to arrive at a more accurate measure than would be possible with one method alone.

- Moreover, different ways of measuring total output give us different insights into the structure of our economy. Income method may be most suitable for developed economies where people properly file their income tax returns. With the growing facility in the use of the commodity flow method of estimating expenditures, an increasing proportion of the national income is being estimated by expenditure method.

- As a matter of fact, countries like India are unable to estimate their national income wholly by one method. Thus, in agricultural sector, net value added is estimated by the production method, in small scale sector net value added is estimated by the income method and in the construction sector net value added is estimated by the expenditure method.

|

66 videos|161 docs|74 tests

|

FAQs on Factors Determining National Income - Economics Optional Notes for UPSC

| 1. What is the Circular Flow of Income? |  |

| 2. What is the Value Added Method or Product Method? |  |

| 3. What is the Income Method? |  |

| 4. What is the Expenditure Method? |  |

| 5. What are the factors determining national income? |  |

|

Explore Courses for UPSC exam

|

|