Farm Planning - 2 | Agriculture Optional for UPSC PDF Download

Depreciation

Depreciation refers to the decrease in the value of an asset due to factors such as its usage, wear and tear, accidental damage, and the passage of time leading to obsolescence.

The extent of depreciation an asset experiences is determined by three main factors:

- the remaining lifespan of the asset,

- the nature and degree of its usage, and

- the possibility of it becoming obsolete.

The significance of these factors can vary depending on the type of asset and how intensively it is employed. Depreciation can be allocated uniformly over the entire useful life of an asset, or it can be weighted more heavily towards the initial years of an asset's life. The amount of depreciation should reflect the reduction in the asset's value over time. If all purchased items were completely used up by the end of the year of their acquisition, calculating depreciation would not be necessary. However, items like buildings, equipment, and livestock are gradually consumed over many years, raising the question of how to determine their cost for a specific accounting year.

There are two perspectives on an asset's lifespan. In developing economies, assets remain in use as long as they can be maintained. In developed countries, new and improved assets, particularly more efficient and cost-effective machines, are constantly introduced, leading to the replacement of assets even before they reach their full working life. In such cases, the "time" depreciation, known as obsolescence, is as significant as "use" depreciation. When considering an asset's working life, it is important to seek input from past experience, insights from neighboring farmers, and opinions from experts like engineers. Factors such as the likelihood of obsolescence and the asset's residual or scrap value should also be carefully taken into account. At the end of its useful life, the asset's value may be entirely depleted or reduced to its scrap value.

(a) Depreciation Computation: Depreciation charges essentially serve as a way to apportion the cost of assets over their period of utilization. When calculating depreciation, both aspects of depreciation, namely, usage and time, should be taken into account. There are three approaches to determining annual depreciation, as outlined below:

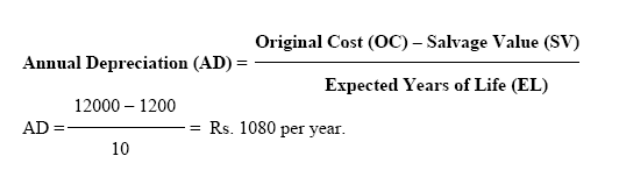

- Straight-Line Method: This technique is relatively straightforward and easy to grasp. It involves calculating the annual depreciation of an asset by dividing the original cost of the asset (less any salvage value) by the anticipated number of years of useful life.

The lifespan of an asset can be expressed in either years (time) or in terms of units of production, such as acres or hours of operation. For instance, the useful life of a tractor could be defined as 10 years or 10,000 hours of operation. It's worth noting that the actual depreciation of an asset may not remain constant in value each year throughout its entire useful life. It might be more substantial during the initial years when the asset depreciates more rapidly, and less in the later years of its lifespan. The reverse scenario is also possible. Consequently, the straight-line method may not be a realistic approach for estimating the depreciation of all assets. However, it could be appropriate for durable assets like buildings and fences, which generally require consistent maintenance over their lifetimes.

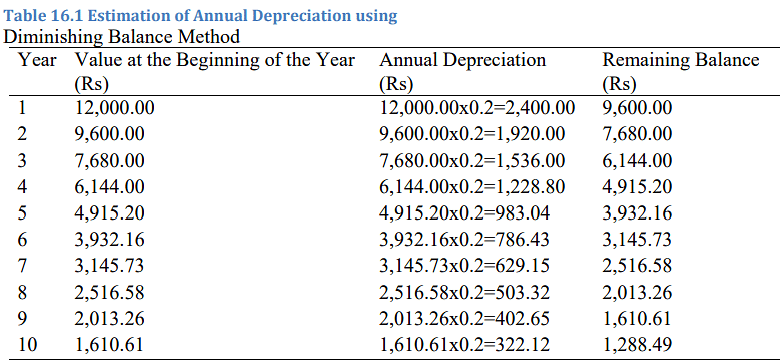

The lifespan of an asset can be expressed in either years (time) or in terms of units of production, such as acres or hours of operation. For instance, the useful life of a tractor could be defined as 10 years or 10,000 hours of operation. It's worth noting that the actual depreciation of an asset may not remain constant in value each year throughout its entire useful life. It might be more substantial during the initial years when the asset depreciates more rapidly, and less in the later years of its lifespan. The reverse scenario is also possible. Consequently, the straight-line method may not be a realistic approach for estimating the depreciation of all assets. However, it could be appropriate for durable assets like buildings and fences, which generally require consistent maintenance over their lifetimes. - Diminishing Balance Method (or Declining Balance Method): In this approach, a fixed depreciation rate is applied each year to the remaining value of the asset at the beginning of that year. It's important to note that, unlike the straight-line method, the salvage value is not subtracted from the original cost. A fixed depreciation rate, which should be approximately twice that used in the straight-line method, is applied to the remaining balance each year until the salvage value is reached. After reaching the salvage value, no further depreciation is calculated.

The annual depreciation under this method can be calculated as follows:

Depreciation (AD) = (Original Cost - Accumulated Depreciation from prior years) x Depreciation Rate (R)

Here, "Original Cost" represents the initial cost of the asset, "D" is the cumulative depreciation recorded in previous years, and "R" is the depreciation rate.

With this method, the depreciation amount decreases from year to year, ultimately reducing the asset's value to its scrap or salvage value. This method is well-suited for assets that depreciate more rapidly during their initial years, such as tractors or pump-sets. For instance, let's assume an oil engine with an initial cost of Rs. 12,000, an expected lifespan of 10 years, and a salvage value of Rs. 1,200. In this case, the depreciation rate would be 20 percent for this method, compared to the 10 percent used in the straight-line method. - Sum-of-the-Year Digit Method (or Reducing Fraction Method): This approach is used when you want to allocate depreciation expenses more heavily during the initial years of an asset's life and reduce them in the later years. The sum-of-year digits method offers an advantage over the diminishing balance method because it does not leave an undistributed balance. With the declining balance method, the value at the end of an asset's useful life is different from its expected salvage value.

In the sum-of-year digits method, annual depreciation is calculated by multiplying a fraction by the amount to be depreciated (original cost minus salvage value). This fraction is determined by the number of years remaining in the asset's life at the beginning of the accounting period (N) and the sum of the years of the asset's life (SD).

The sum of the years can be calculated using a formula:

n (n + 1) / 2, where "n" represents the total number of years of the asset's life.

As you apply this method each year, the value of the N/SD fraction decreases, leading to a decline in annual depreciation as the asset ages. This is similar to the diminishing balance method in that depreciation decreases over time.

For instance, consider an oil engine with an original cost of Rs. 12,000, an expected life of 10 years, and a salvage value of Rs. 1,200. You can calculate the annual depreciation for this asset over its life as shown in the table below:

This method is suitable for assets that require a higher depreciation charge during their early years. Unlike the diminishing balance method, the sum-of-year digits method ensures a uniform rate of depreciation reduction from year to year.

|

52 videos|224 docs

|