Financial Statements of Not for Profit Organisations (Part - 4) | Accountancy Class 12 - Commerce PDF Download

Page No 1.64:

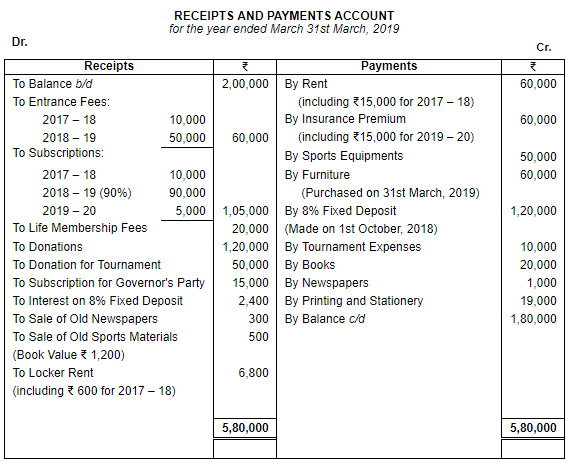

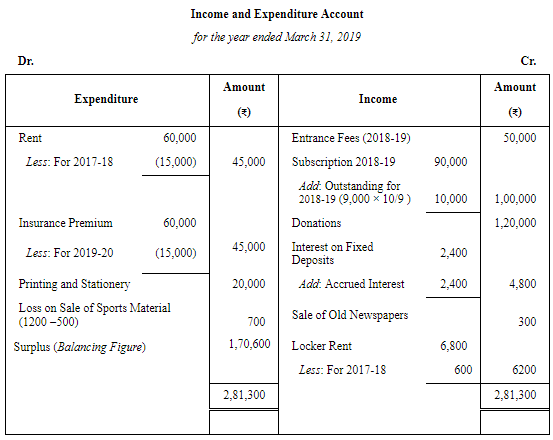

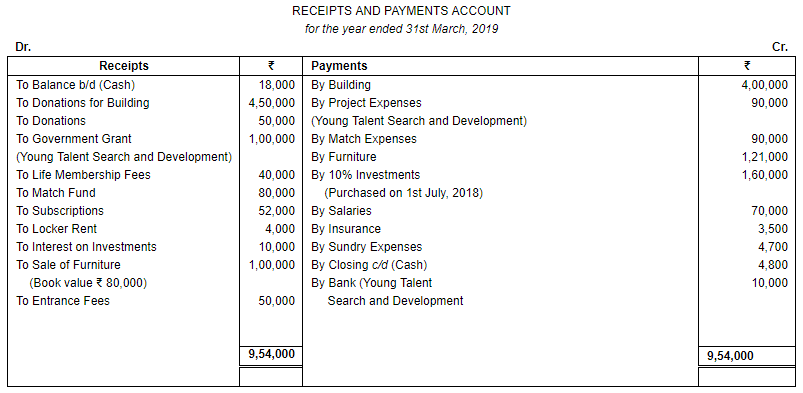

Question 38: From the following Receipts and Payments Account of Jaipur Sports Club, prepare Income and Expenditure Account for the year ended 31st March, 2019:

ANSWER:

Page No 1.65:

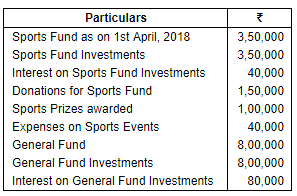

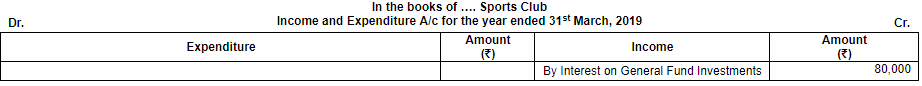

Question 39: Following is the information given in respect of certain items of a Sports Club. Show these items in the Income and Expenditure Account and the Balance Sheet of the Club as at 31st March, 2019:

ANSWER:

Note: General Fund will be shown on the liabilities side and general fund investments will be shown on the asset side of the balance sheet as on 31st March, 2019.

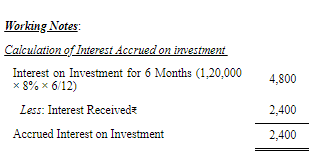

Working Notes:

1)

Page No 1.65:

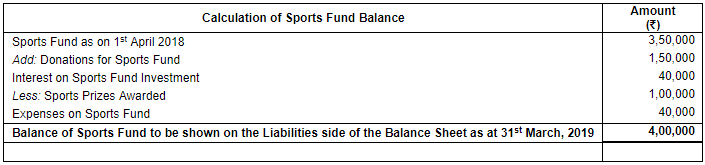

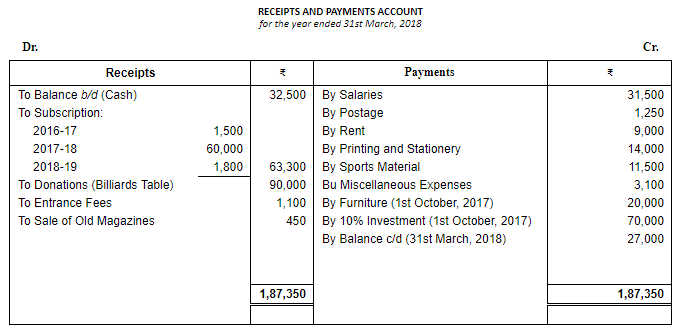

Question 40: Prepare Income and Expenditure Account from the following particulars of Youth Club for the year ended on 31st March, 2018:

Additional Information:

(i) Subscription outstanding as at 31st March, 2018 ₹ 16,200.

(ii) ₹ 1,200 is still in arrears for the year 2016-17 for subscription.

(iii) Value of sports material at the beginning and at the end of the year was ₹ 3,000 and ₹ 4,500 respectively.

(iv) Depreciation to be provided @ 10% p.a. on furniture.

ANSWER:

Note: If nothing is mentioned, Entrance fee is to be treated as a revenue receipt. Working Notes: 1)

Sports Material Consumed = Opening Stock + Purchases – Closing Stock

= ₹ (3,000 + 11,500 – 4,500) = ₹ 10,000

Page No 1.66:

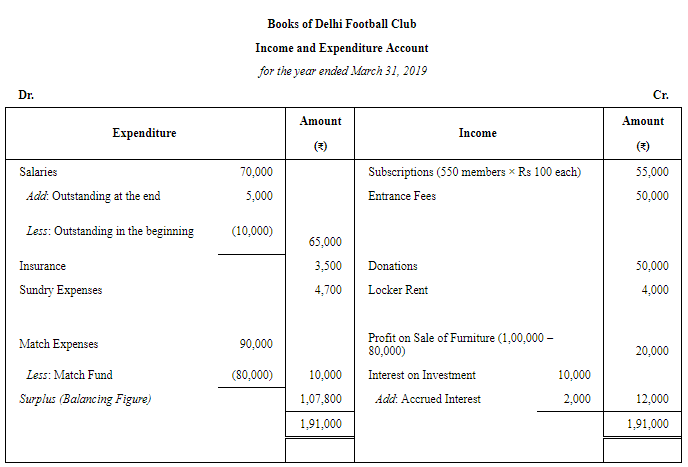

Question 41: Following is the Receipts and Payments Account of Delhi Football Club for the year ended 31st March, 2019: Additional Information:

Additional Information:

(i) During the year ended 31st March, 2019, the club had 550 members and each paying an annual subscription of ₹ 100.

(ii) Salaries Outstanding as at 1st April, 2018 were ₹ 10,000 and as at 31st March, 2019 were ₹ 5,000.

Prepare Income and Expenditure Account of the Club for the year ended 31st March, 2019.

ANSWER:

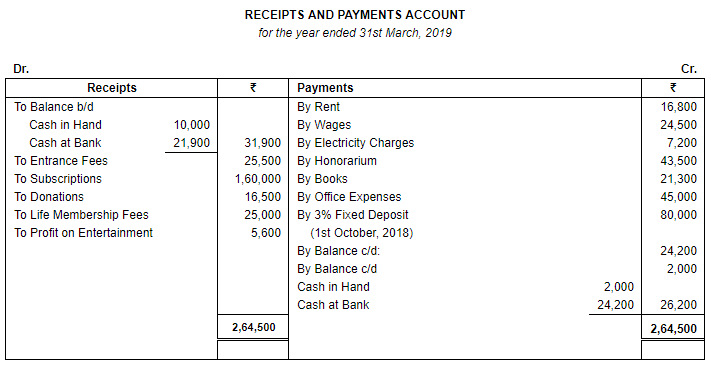

Working Notes:

Page No 1.66:

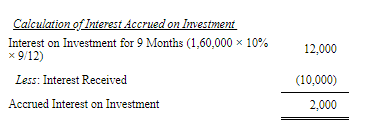

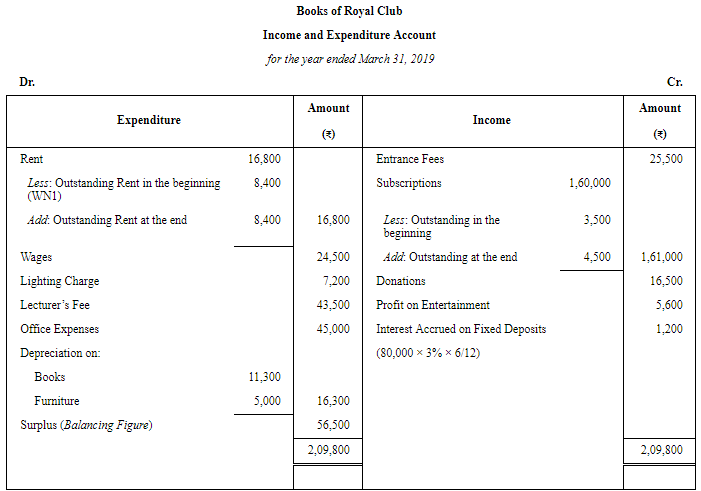

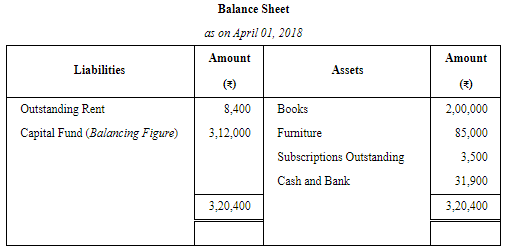

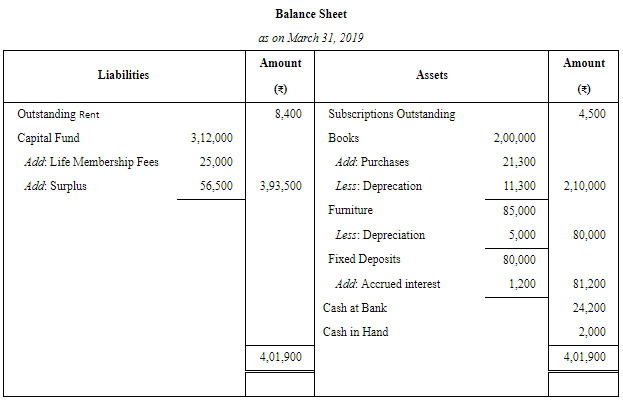

Question 42:Following is the summary of cash transactions of the Royal Club for the year ended 31st March, 2019:

In the beginning of the year, the club possessed Books of ₹ 2,00,000 and Furniture of ₹ 85,000. Subscriptions in arrears in the beginning of the year amounted to ₹ 3,500 and at the end of the year ₹ 4,500 and six months Rent was due both in the beginning of the year and at the end of the year.

Prepare Income and Expenditure Account of the club for the year ended 31st March, 2019 and its Balance Sheet as at that date after writing off ₹ 5,000 and ₹ 11,300 on Furniture and books respectively.

ANSWER:

Working Notes:

1)

Rent space received space in space Cash space left parenthesis including space 6 space months space rent space of space the space previous space year right parenthesis equals ₹ 16 comma 800

Rent space due space for space straight a space 6 space months space will space be equals ₹ open parentheses 16 comma 800 cross times 6 over 12 close parentheses equals ₹ 8 comma 400

Page No 1.67:

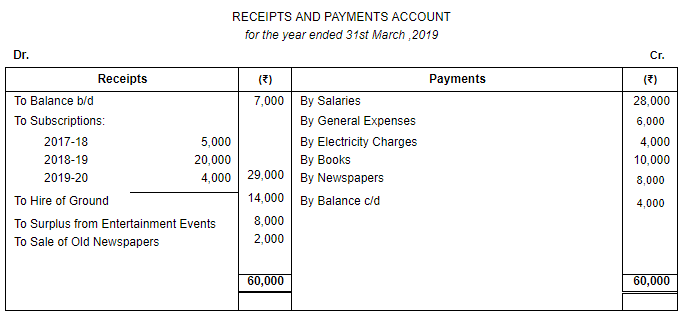

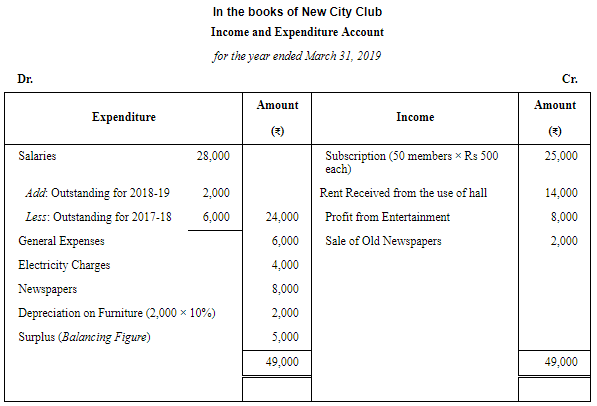

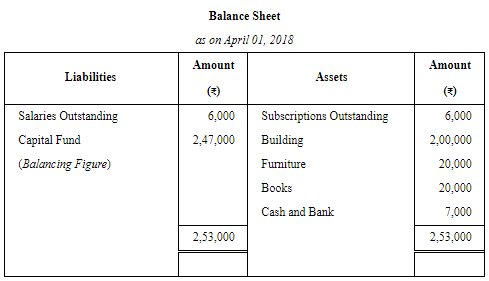

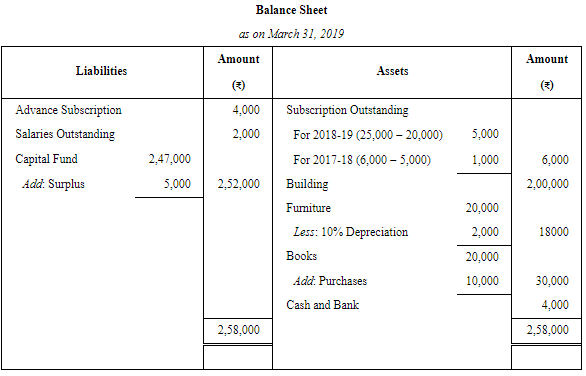

Question 43: From the following Receipts and Payments Account of Social Club and the information supplied, prepare Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheet as at that date:

(a) The club has 50 members each paying an annual subscription of ₹ 500. Subscriptions Outstanding on 31st March,2018 were ₹ 6,000.

(b) On 31st March, 2019, Salaries Outstanding amounted to ₹ 2,000. Salaries paid in the year ended 31st March, 2019 included ₹ 6,000 for the year ended 31st March, 2018.

(c) On 1st April, 2018, the club owned Building valued at ₹ 2,00,000; Furniture ₹ 20,000 and Books ₹ 20,000.

(d) Provide depreciation on Furniture at 10%.

ANSWER:

Page No 1.67:

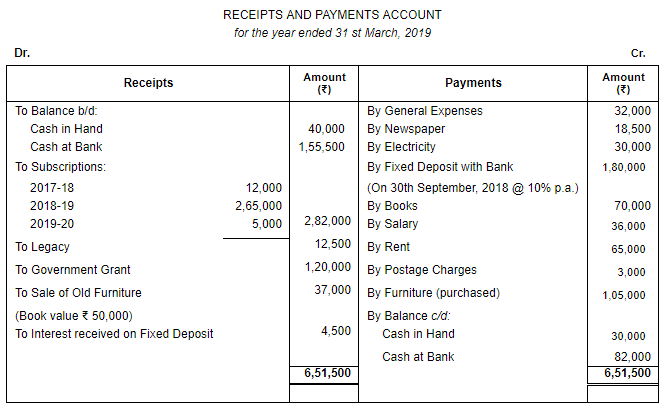

Question 44: From the following Receipts and Payments Account and additional information given below, prepare Income and Expenditure Account and Balance Sheet of Rural Literacy Society as on 31st March, 2019:

Additional information:

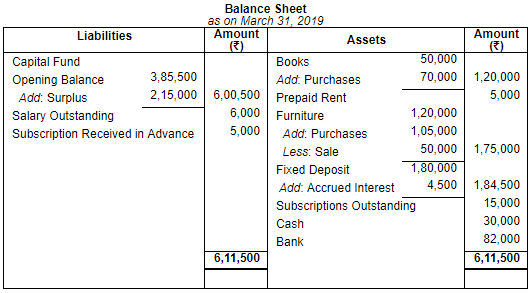

(i) Subscription outstanding as on 31st March, 2018 ₹ 20,000 and on 31st March, 2019 ₹ 15,000.

(ii) On 31st March, 2019, salary outstanding ₹ 6,000 and one month rent paid in advance

(iii) On 1st April, 2018, society owned furniture ₹ 1,20,000 and books ₹ 50,000.

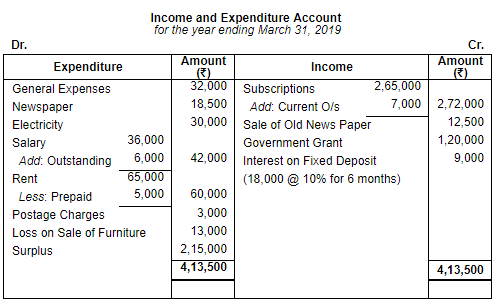

ANSWER:

Working Notes

WN1: Ascertainment of Capital Fund

Page No 1.68:

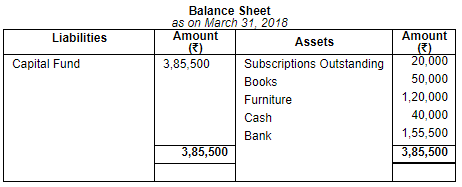

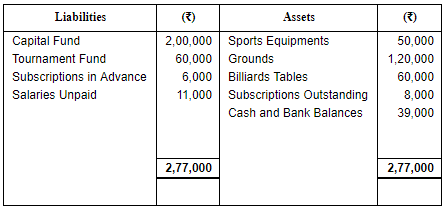

Question 45: Glaxo Club's Balance Sheet as at 1st April, 2018 was as under:

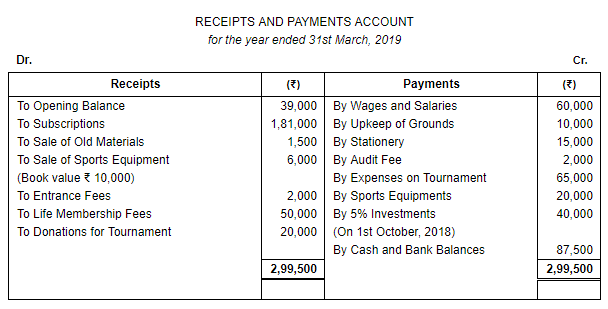

Receipts and Payments Account for the year ended 31st March, 2019 was:

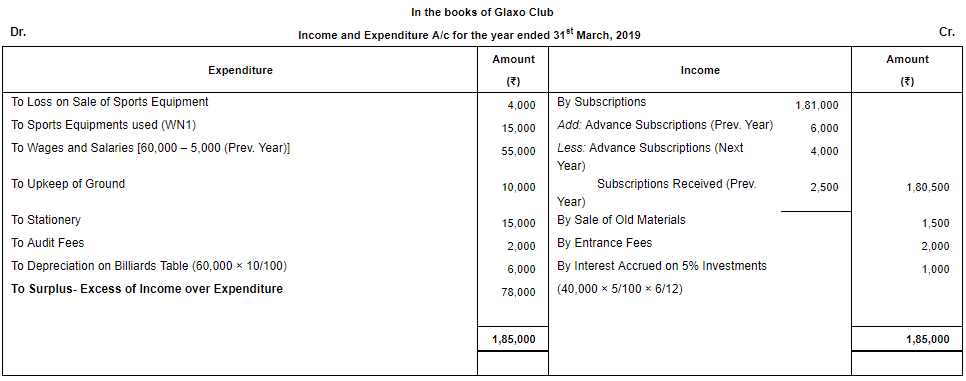

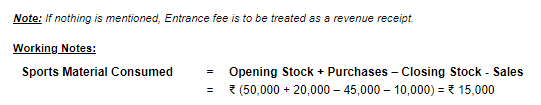

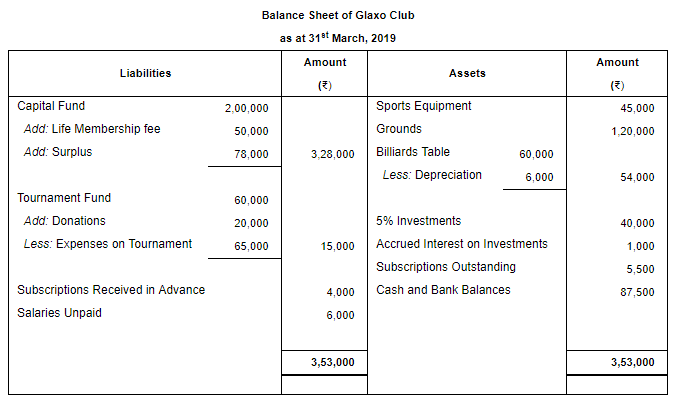

Subscriptions still to be received are ₹ 5,500 but subscriptions already received include ₹ 4,000 for next year. Salaries still unpaid are ₹ 6,000. Sports Equipments are now valued at ₹ 45,000. Prepare Income and Expenditure Account and the Balance Sheet, after charging 10% depreciation on Billiards Tables.

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Financial Statements of Not for Profit Organisations (Part - 4) - Accountancy Class 12 - Commerce

| 1. What are financial statements of not-for-profit organizations? |  |

| 2. How are financial statements of not-for-profit organizations different from those of for-profit organizations? |  |

| 3. What information can be found in the statement of financial position of a not-for-profit organization? |  |

| 4. How can the statement of activities of a not-for-profit organization be analyzed? |  |

| 5. Why is the statement of functional expenses important for not-for-profit organizations? |  |