Financial Statements of Not for Profit Organisations (Part - 5 ) | Accountancy Class 12 - Commerce PDF Download

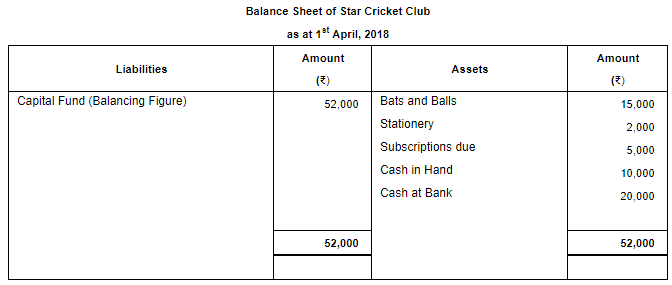

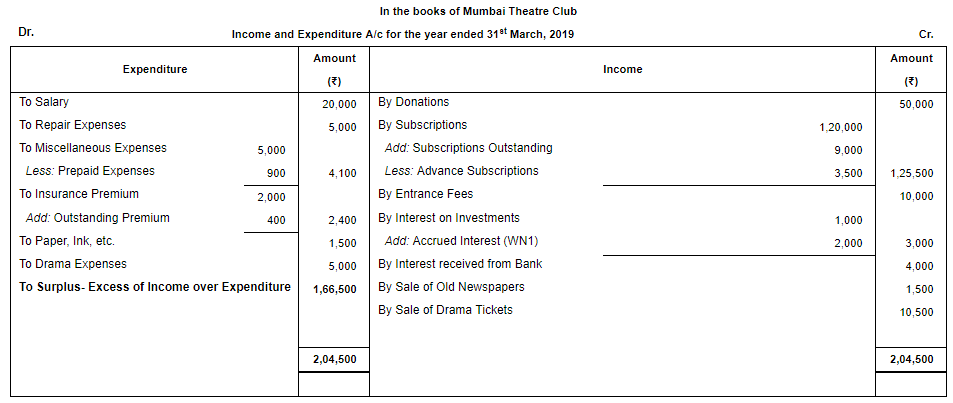

Page No 1.68:

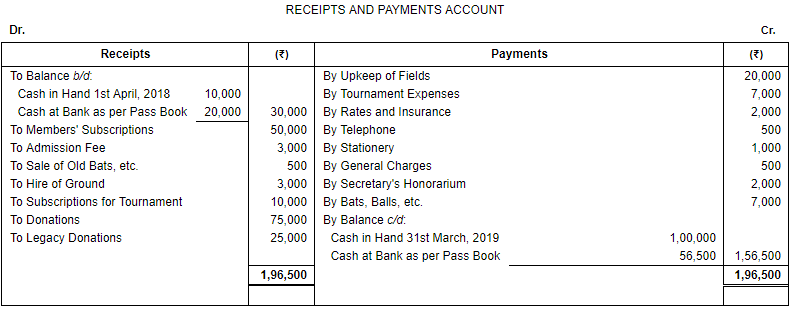

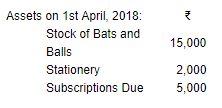

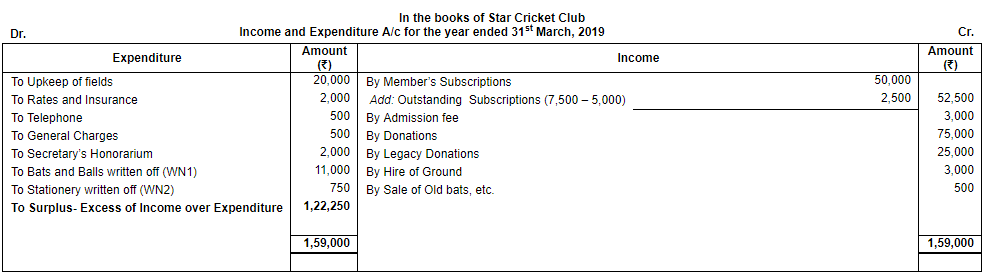

Question 46: From the following Receipts and Payments Account and

additional information relating to the star Cricket Club, prepare Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheet as at that date:

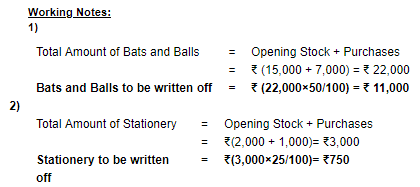

Subscriptions due on 31st March, 2019 amounted to ₹ 7,500. Write off 50% of Bats, Balls (not considering sale) and 25% of Stationery.

ANSWER:

3)

Page No 1.69:

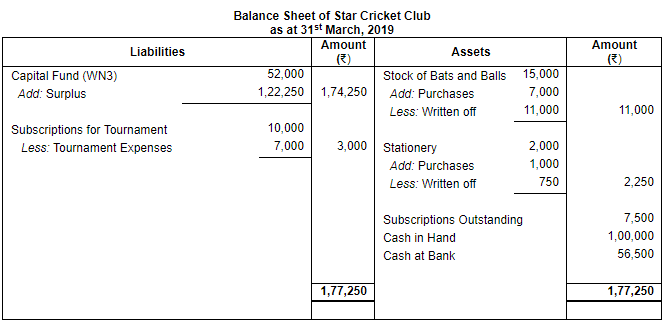

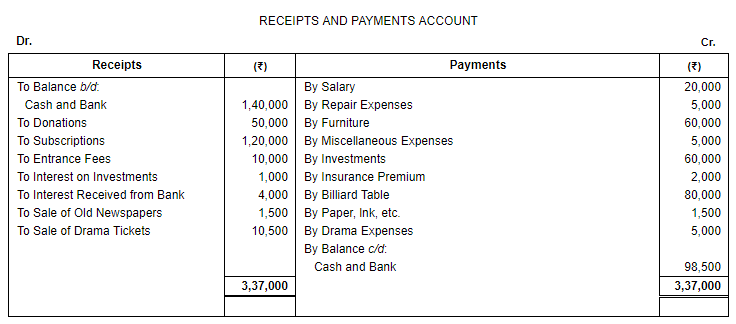

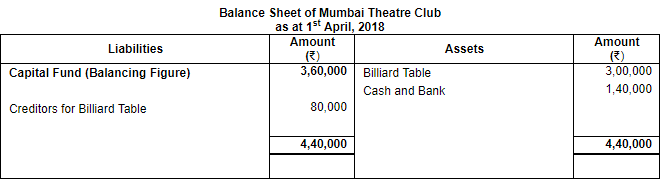

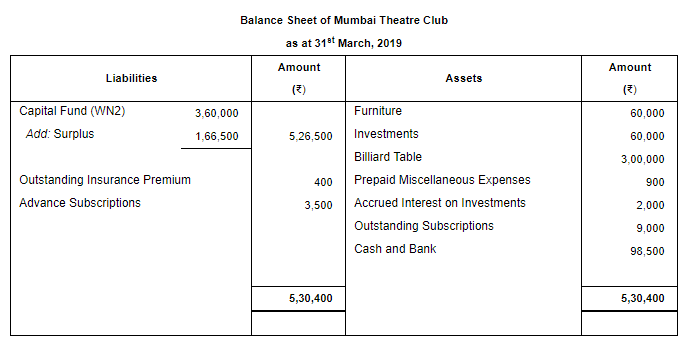

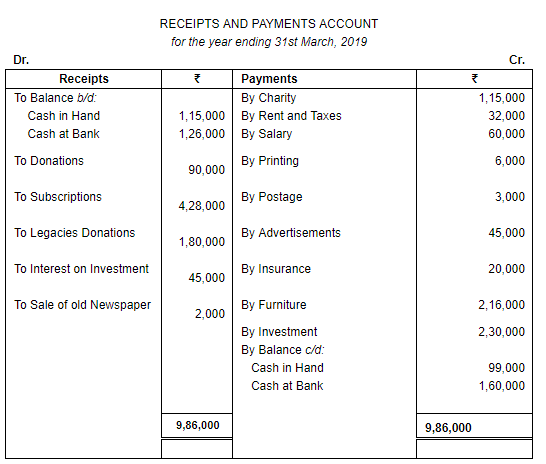

Question 47: From the following Receipts and Payments Account of Mumbai Theatre Club, prepare Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheet as at that date:

Additional Information:

(i) Subscriptions in arrear for the year ended 31st March, 2019 ₹ 9,000 and subscriptions in advance for the year ending 31st March, 2020 ₹ 3,500.

(ii) Insurance Premium outstanding ₹ 400.

(iii) Miscellaneous expenses prepaid ₹ 900.

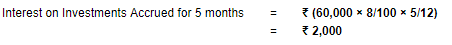

(iv) 8% interest has accrued on investment for five months.

(v) Billiard Table costing ₹ 3,00,000 was purchased during last year and ₹ 2,20,000 were paid for it.

ANSWER:

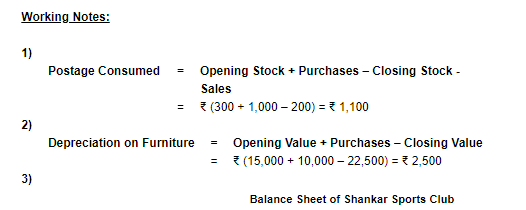

Working Notes: 1)

2)

Page No 1.69:

Question 48: Following Receipts and Payments Account was prepared from the Cash Book of Delhi Charitable Trust for the year ending 31st March, 2019:

Prepare Income and Expenditure Account for the year ended 31st March, 2019, and Balance Sheet as on that date after the following adjustments:

(i) Insurance premium was paid for insurance taken w.e.f. 1st July, 2018.

(ii) Interest on investment ₹ 11,000 accrued was not received.

(iii) Rent ₹ 6,000; Salary ₹ 9,000 and advertisement expenses ₹ 10,000 outstanding as on 31st March, 2019.

(iv) Legacy Donation is towards construction of Library Block.

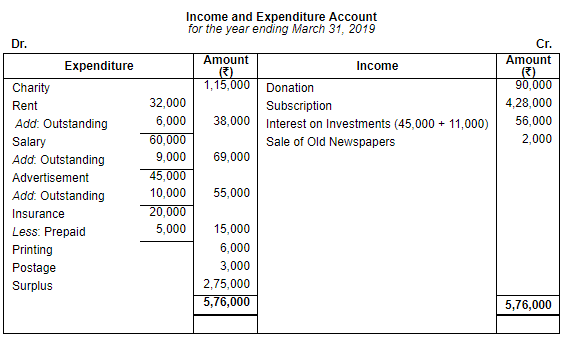

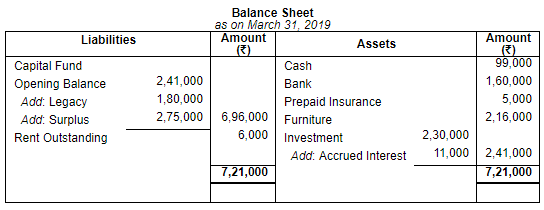

ANSWER:

Working Notes

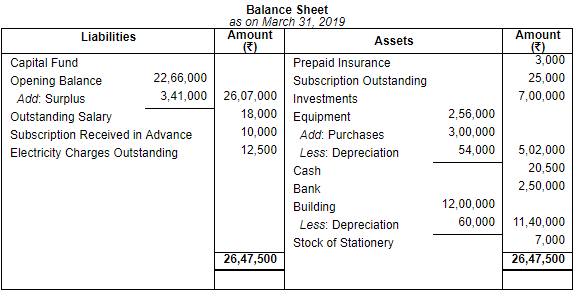

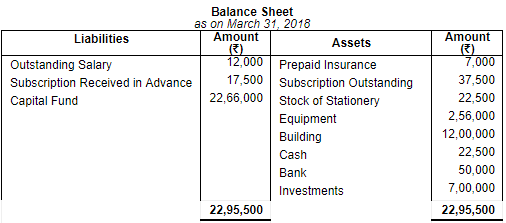

WN1: Ascertainment of Capital Fund

Page No 1.70:

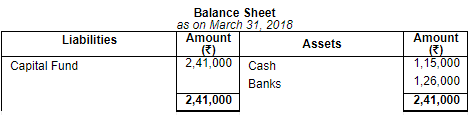

Question 49: Given Below is the Receipts and Payments Account of a Mayur Club for the year ended 31st March, 2019:

Prepare club's Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheet as at that date after taking the following information into account:

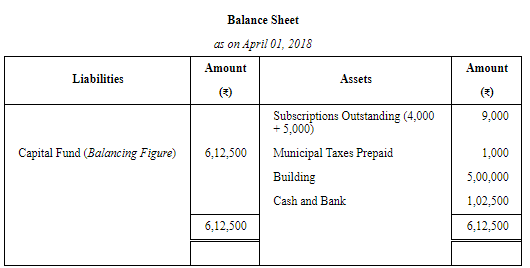

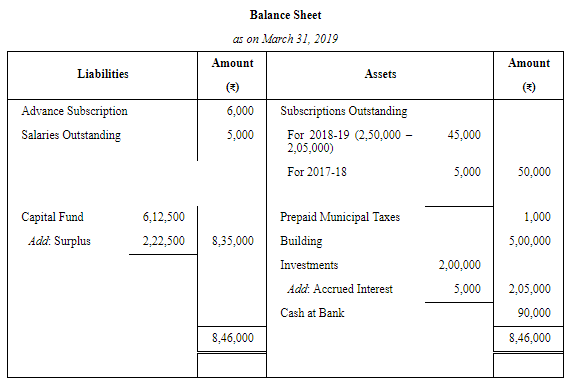

(i) There are 500 members, each paying an annual subscription of ₹ 500, ₹ 5,000 are still in arrears for the year ended 31st March, 2018.

(ii) Municipal Taxes amounted to ₹ 4,000 per year is paid up to 30th June and ₹ 5,000 are outstanding of salaries.

(iii) Building stands in the books at ₹ 5,00,000.

(iv) 6% interest has accrued on investments for five months.

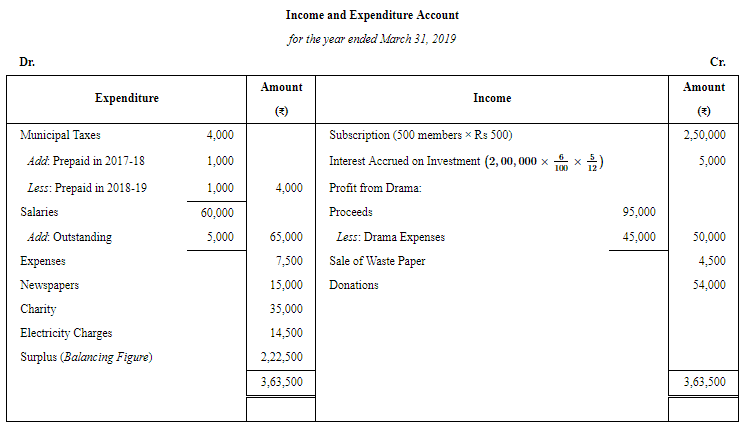

ANSWER:

Page No 1.70:

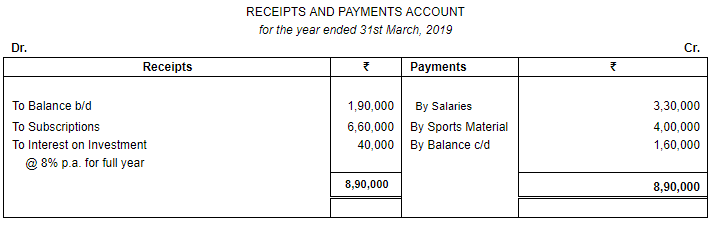

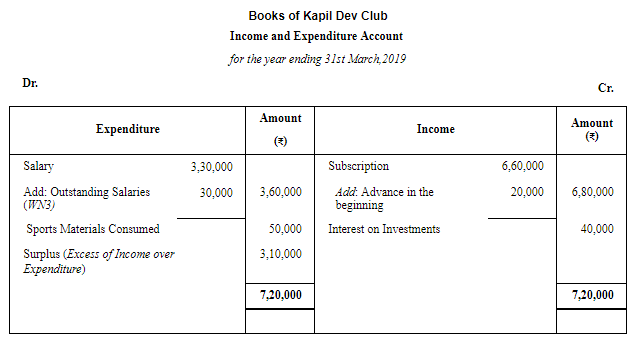

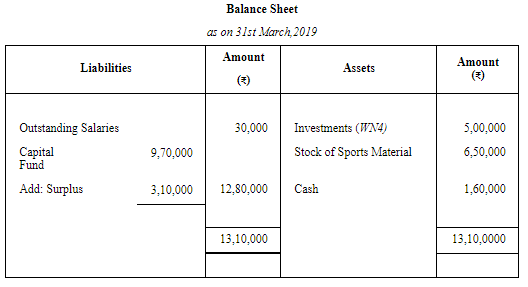

Question 50: From the following Receipts and Payments Account of Kapil Dev Club and from the given additional information, prepare Income and Expenditure Account for the year ending 31st December, 2019 and the Balance Sheet as at that date:

Additional Information:

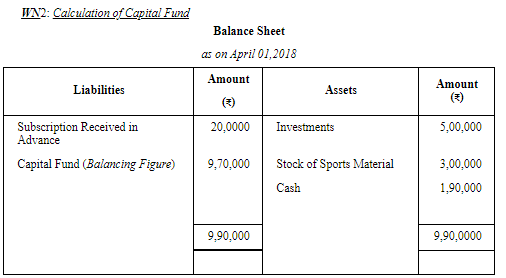

(i) The club had received ₹ 20,000 for subscription in 2017-18 for 2018-19.

(ii) Salaries had been paid only for 11 months.

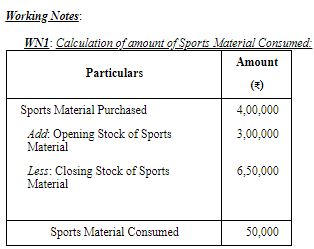

(iii) Stock of sports materials on 31st March, 2018 was ₹ 3,00,000 and on 31st March, 2019 ₹ 6,50,000.

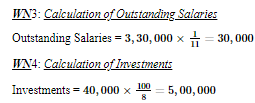

ANSWER:

Page No 1.71:

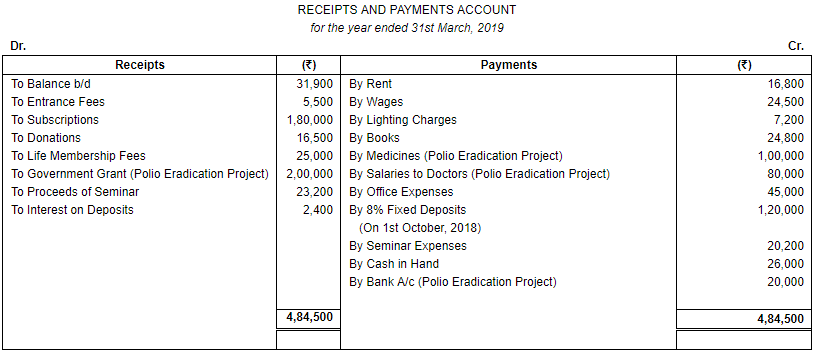

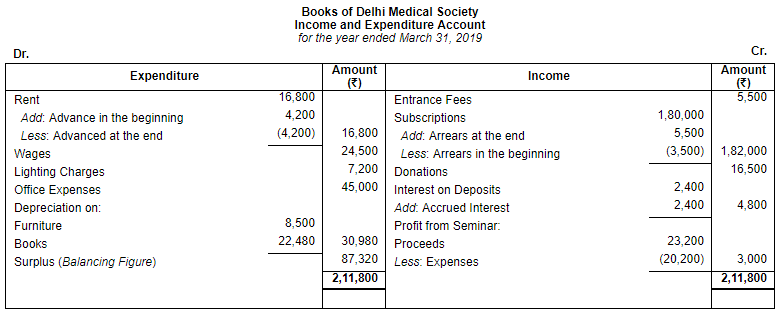

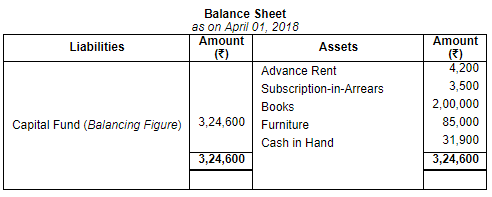

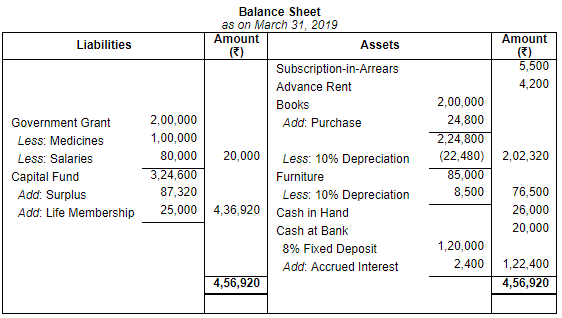

Question 51: From the following information and Receipts and Payments Account of Delhi Medical Society, prepare Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheet as at that date.

Other information:

On 31st March, 2018, the Club possessed books of ₹ 2,00,000 and Furniture of ₹ 85,000. Provide depreciation on these assets @ 10% including the purchases during the year.

Subscriptions in arrears in the beginning of the year amounted to ₹ 3,500 and at the end of the year ₹ 5,500 were outstanding.

The Club paid three months' rent in advance both in the beginning and at the end of the year.

ANSWER:

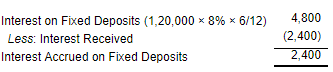

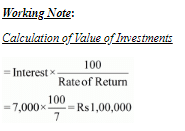

Working Note:

Calculation of Interest Accrued on Fixed Deposits

Page No 1.71:

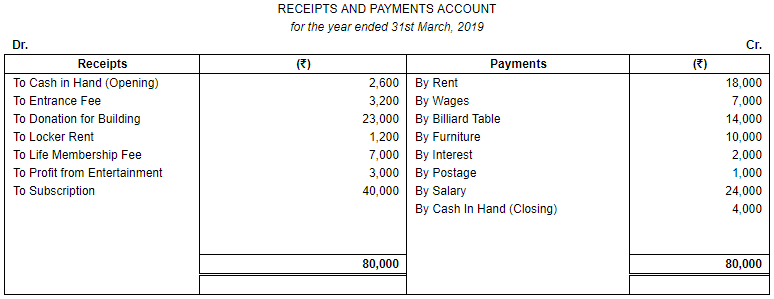

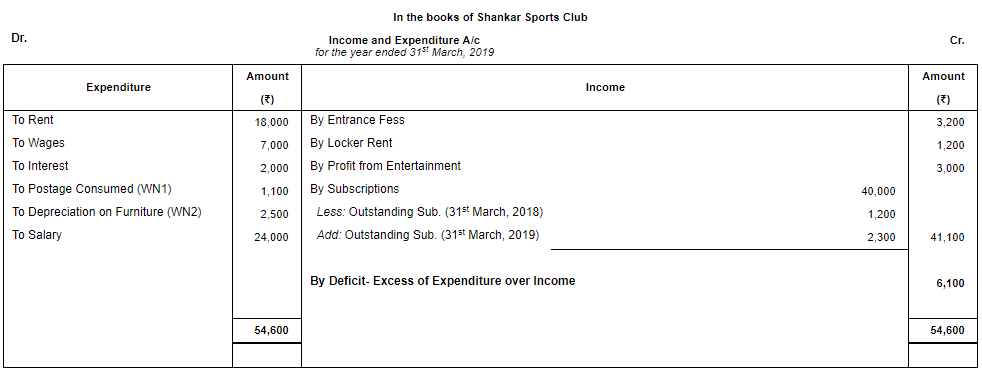

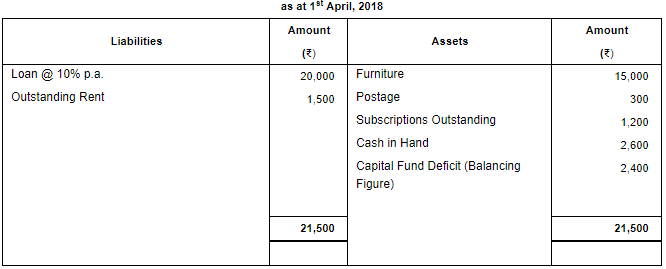

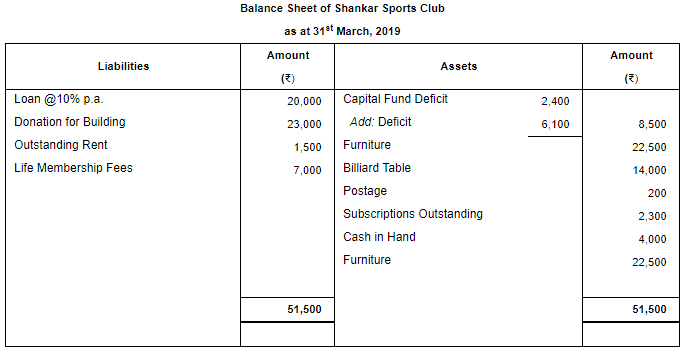

Question 52: Receipts and Payments Account of Shankar Sports Club is given below for the year ended 31st March, 2019:

Prepare Income and Expenditure Account and Balance Sheet with the help of following information:

Subscription outstanding on 31st March, 2018 is ₹ 1,200 and ₹ 2,300 on 31st

March, 2019; opening stock of postage stamps is ₹ 300 and closing stock is ₹ 200; Rent ₹ 1,500 related to the year ended 31st March, 2018 and ₹ 1,500 is still unpaid. On 1st April, 2018 the club owned furniture ₹ 15,000, Furniture valued at ₹ 22,500 on 31st March, 2019. The club has a loan of ₹ 20,000 (@ 10% p.a.) which was taken, in year ended 31st March, 2018.

ANSWER:

Page No 1.72:

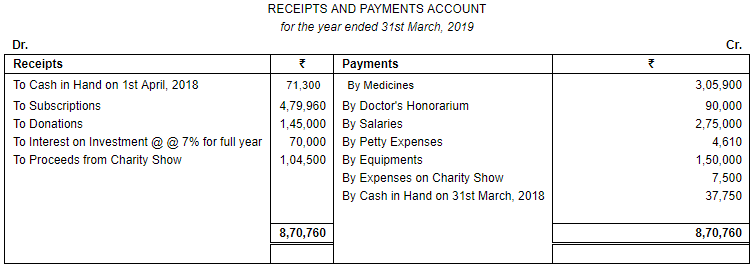

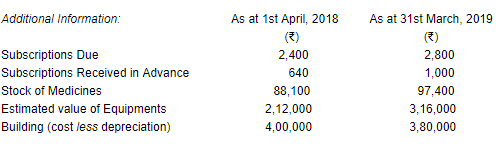

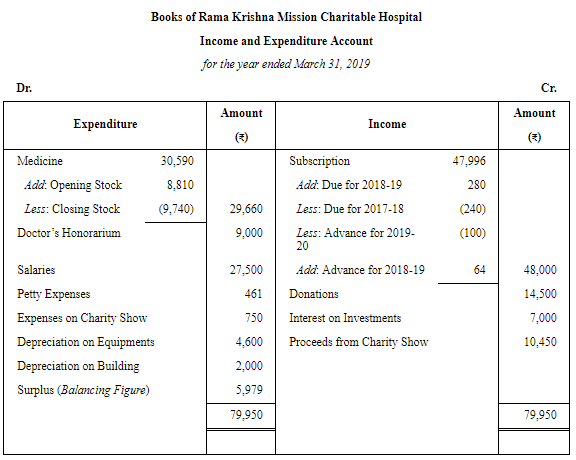

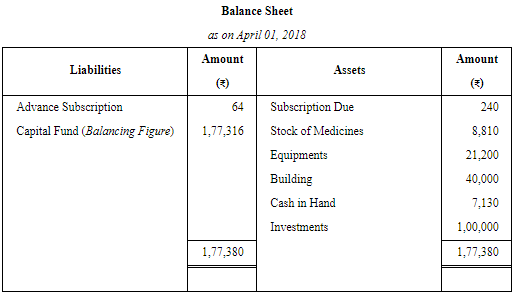

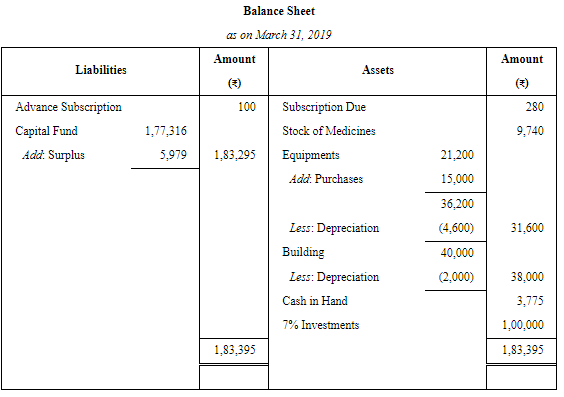

Question 53: From the following particulars relating to the Ramakrishna Mission Charitable Hospital, prepare Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheet as at that date.

ANSWER:

Page No 1.72:

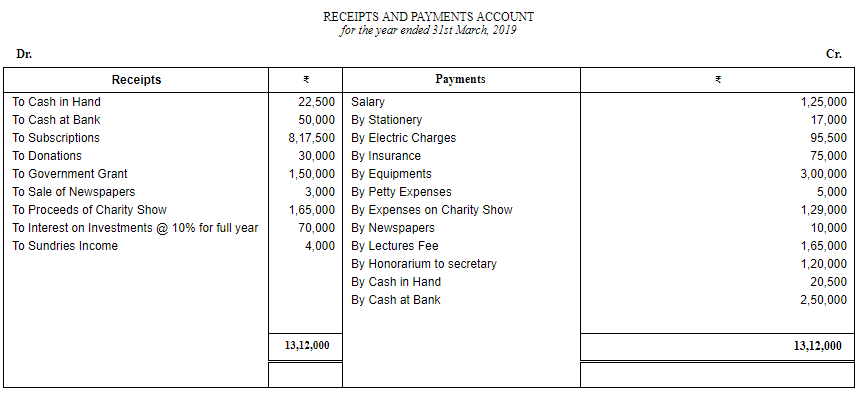

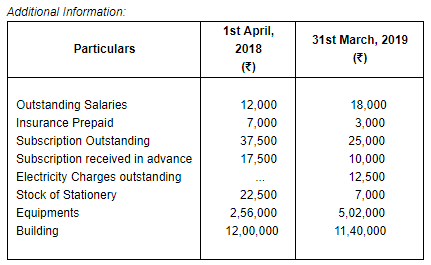

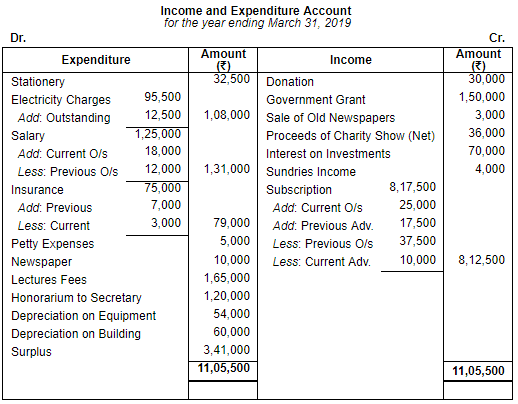

Question 54: Following is the Receipt and Payment Account of Women's Welfare Club for the year ended 31st March, 2019:

Prepare Income and Expenditure Account for the year ended 31st March, 2019,and Balance Sheet as on that date.

ANSWER:

Working Notes

WN1: Ascertainment of Capital Fund

|

42 videos|199 docs|43 tests

|

FAQs on Financial Statements of Not for Profit Organisations (Part - 5 ) - Accountancy Class 12 - Commerce

| 1. What are financial statements of not-for-profit organizations? |  |

| 2. How are financial statements of not-for-profit organizations different from those of for-profit organizations? |  |

| 3. What is the purpose of the balance sheet in the financial statements of not-for-profit organizations? |  |

| 4. How does the income statement in the financial statements of not-for-profit organizations differ from that of for-profit organizations? |  |

| 5. What is the significance of the cash flow statement in the financial statements of not-for-profit organizations? |  |