Goodwill: Nature and Valuation (Part - 2) | Accountancy Class 12 - Commerce PDF Download

Page No 3.30:

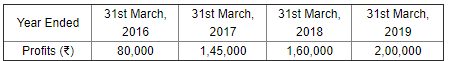

Question 11: Sumit purchased Amit's business on 1st April, 2019. Goodwill was decided to be valued at two years' purchase of average normal profit of last four years. The profits for the past four years were:

Books of Account revealed that:

(i) Abnormal loss of ₹ 20,000 was debited to Profit and Loss Account for the year ended 31st March, 2016.

(ii) A fixed asset was sold in the year ended 31st March, 2017 and gain (profit) of ₹ 25,000 was credited to Profit and Loss Account.

(iii) In the year ended 31st March, 2018 assets of the firm were not insured due to oversight. Insurance premium not paid was ₹ 15,000.

Calculate the value of goodwill.

ANSWER:

Goodwill=Average Profit×No. of years' purchase

=1,41,250×2=₹ 2,82,500

Working Notes:

WN: 1 Calculation of Normal Profits

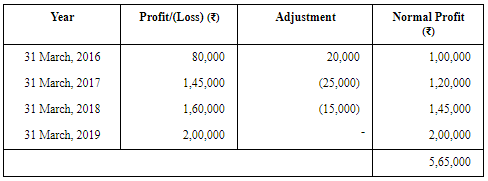

WN: 2 Calculation of Average Profit

Page No 3.30:

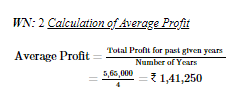

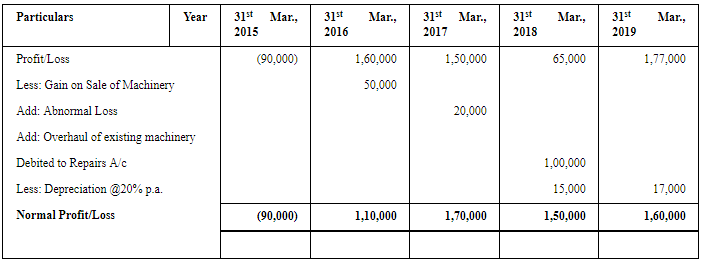

Question 12: Geet and Meet are partners in a firm. They admit Jeet into partnership for equal share. It was agreed that goodwill will be valued at three years' purchase of average profit of last five years. Profits for the last five years were:

Books of Account of the firm revealed that:

(i) The firm had gain (profit) of ₹ 50,000 from sale of machinery sold in the year ended 31st March, 2016. The gain (profit) was credited in Profit and Loss Account.

(ii) There was an abnormal loss of ₹ 20,000 incurred in the year ended 31st March, 2017 because of a machine becoming obsolete in accident.

(iii) Overhauling cost of second hand machinery purchased on 1st July, 2017 amounting to ₹ 1,00,000 was debited to Repairs Account. Depreciation is charged @ 20% p.a. on Written Down Value Method.

Calculate the value of goodwill.

ANSWER:

Page No 3.30:

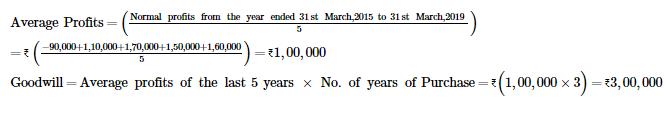

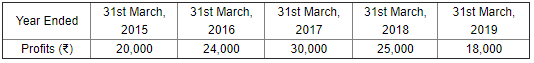

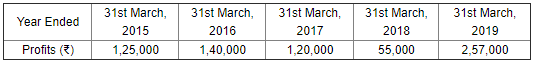

Question 13: Profits of a firm for the year ended 31st March for the last five years were:

Calculate value of goodwill on the basis of three years' purchase of Weighted Average Profit after assigning weights 1, 2, 3, 4 and 5 respectively to the profits for years ended 31st March, 2015, 2016, 2017, 2018 and 2019.

ANSWER:

Page No 3.30:

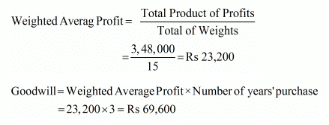

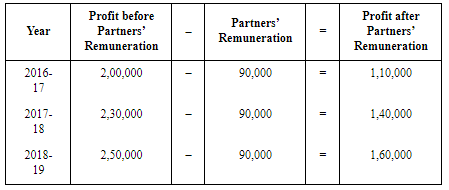

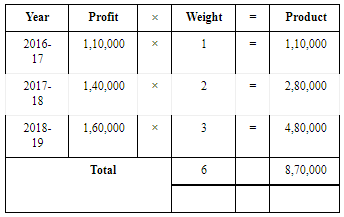

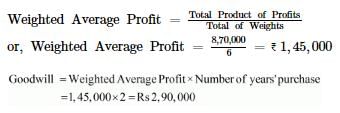

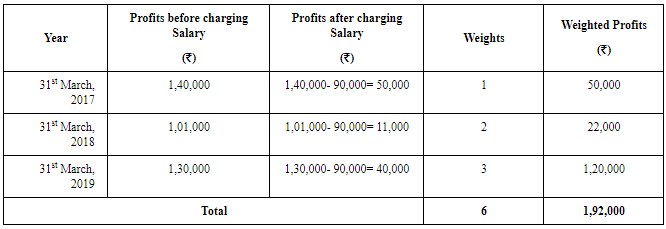

Question 14: A and B are partners sharing profits and losses in the ratio of 5 : 3. On 1st April, 2019, C is admitted to the partnership for 1/4th share of profits. For this purpose, goodwill is to be valued at two years' purchase of last three years' profits (after allowing partners' remuneration). Profits to be weighted 1 : 2 : 3, the greatest weight being given to last year. Net profit before partners' remuneration were: 2016-17 : ₹ 2,00,000; 2017-18 : ₹ 2,30,000; 2018-19 : ₹ 2,50,000. The remuneration of the partners is estimated to be ₹ 90,000 p.a. Calculate amount of goodwill.

ANSWER:

Page No 3.30:

Question 15: Raman and Daman are partners sharing profits in the ratio of 60 : 40 and for the last four years they have been getting annual salaries of ₹ 50,000 and ₹ 40,000 respectively. The annual accounts have shown the following net profit before charging partners' salaries:

Year ended 31st March, 2017 − ₹ 1,40,000; 2018 − ₹ 1,01,000 and 2019 − ₹ 1,30,000.

On 1st April, 2019, Zeenu is admitted to the partnership for 1/4th share in profit (without any salary). Goodwill is to be valued at four years' purchase of weighted average profit of last three years (after partners' salaries); Profits to be weighted as 1 : 2 : 3, the greatest weight being given to the last year. Calculate the value of Goodwill.

ANSWER:

Page No 3.31:

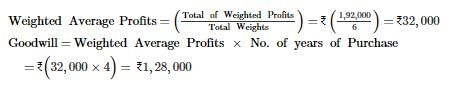

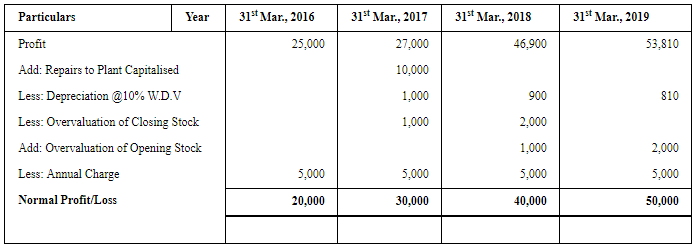

Question 16: Calculate goodwill of a firm on the basis of three years' purchase of the Weighted Average Profit of the last four years. The profits of the last four financial years ended 31st March, were: 2016 − ₹ 25,000; 2017 − ₹ 27,000; 2018 − ₹ 46,900 and 2019 − ₹ 53,810. The weights assigned to each year are: 2016 − 1; 2017 − 2; 2018 − 3; 2019 − 4. You are supplied the following information:

(i) On 1st April, 2016, a major plant repair was undertaken for ₹ 10,000 which was charged to revenue. The said sum is to be capitalised for goodwill calculation subject to adjustment of depreciation of 10% on Reducing Balance Method.

(ii) The Closing Stock for the years ended 31st March, 2017 and 2018 were overvalued by ₹ 1,000 and ₹ 2,000 respectively.

(iii) To cover management cost an annual charge of ₹ 5,000 should be made for the purpose of goodwill valuation.

ANSWER:

Page No 3.31:

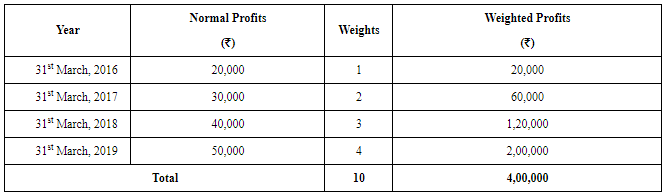

Question 17: Dinesh and Mahesh are partners sharing profits and losses in the ratio of 3 : 2. They admit Ramesh into partnership for 1/4th share in profits. Ramesh brings in his share of goodwill in cash. Goodwill for this purpose shall be calculated at two years' purchase of the weighted average normal profit of past three years. Weights being assigned to each year 2017−1; 2018−2 and 2019−3. Profits of the last three years were:

2017 − Profit ₹ 50,000 (including profits on sale of assets ₹ 5,000).

2018 − Loss ₹ 20,000 (including loss by fire ₹ 35,000).

2019 − Profit ₹ 70,000 (including insurance claim received ₹ 18,000 and interest on investments and dividend received ₹ 8,000).

Calculate the value of goodwill. Also, calculate the goodwill brought in by Ramesh.

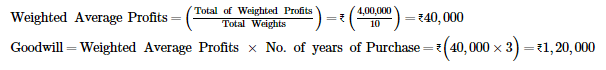

ANSWER:

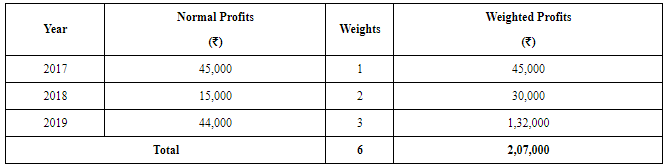

Normal Profits for the year 2017=(Total Profits−Profit on Sale of Assets)=₹(50,000−5,000)=₹45,000

Normal Profits for the year 2018=(Loss by Fire − Total Loss)=₹(35,000 − 20,000)=₹15,000

Normal Profits for the year 2019=(Total Profit−Insurance Claim Received − Dividend Received)=₹(70,000−18,000−8,000)=₹44,000

Page No 3.31:

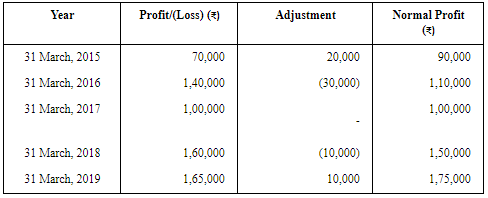

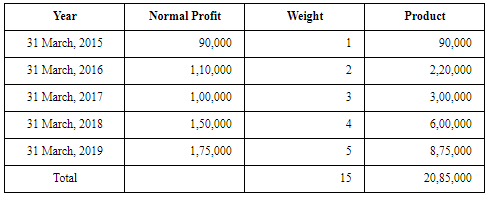

Question 18: Manbir and Nimrat are partners and they admit Anahat into partnership. It was agreed tovalue goodwill at three years' purchase on Weighted Average Profit Method taking profits of last five years. Weights assigned to each year as 1, 2, 3, 4 and 5 respectively to profits for the year ended 31st March, 2015 to 2019. The profits for these years were: ₹ 70,000, ₹ 1,40,000, ₹ 1,00,000, ₹ 1,60,000 and ₹ 1,65,000 respectively.

Scrutiny of books of account revealed following information:

(i) There was an abnormal loss of ₹ 20,000 in the year ended 31st March, 2015.

(ii) There was an abnormal gain (profit) of ₹ 30,000 in the year ended 31st March, 2016.

(iii) Closing Stock as on 31st March, 2018 was overvalued by ₹ 10,000.

Calculate the value of goodwill.

ANSWER:

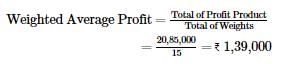

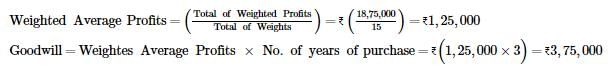

Goodwill=Weighted Average Profit×No. of years' Purchase

=1,39,000×3=₹ 4,17,000

Working Notes:

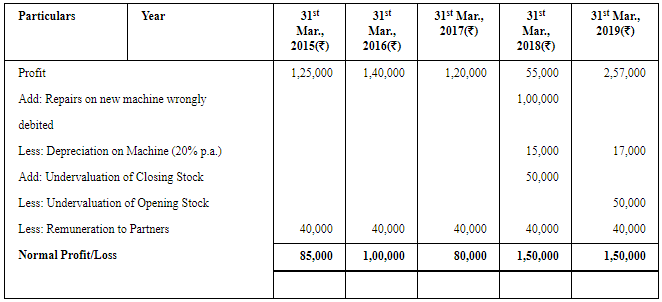

WN: 1 Calculation of Normal Profits:

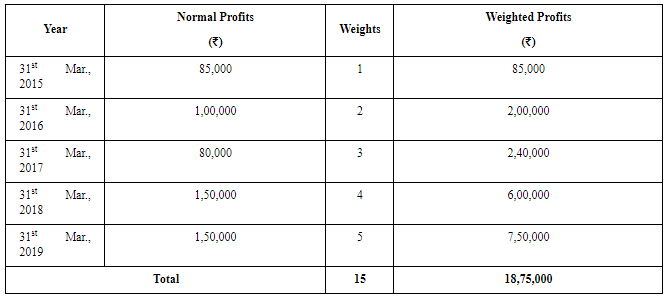

WN: 2 Calculations of Weighted Average Profits:

Page No 3.31:

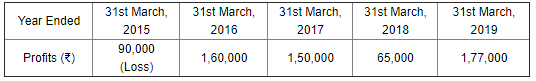

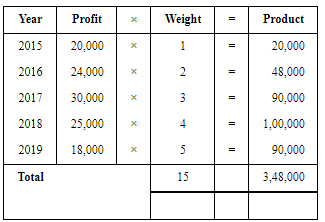

Question 19: Mahesh and Suresh are partners and they admit Naresh into partnership. They agreed to value goodwill at three years' purchase on Weighted Average Profit Method taking profits for the last five years. They assigned weights from 1 to 5 beginning from the earliest year and onwards. The profits for the last five years were as follows:

Scrutiny of books of account revealed the following:

(i) A second-hand machine was purchased for ₹ 5,00,000 on 1st July, 2017 and ₹ 1,00,000 were spent to make it operational. ₹ 1,00,000 were wrongly debited to Repairs Account. Machinery is depreciated @ 20% p.a. on Written Down Value Method.

(ii) Closing Stock as on 31st March, 2018 was undervalued by ₹ 50,000.

(iii) Remuneration to partners was to be considered as charge against profit and remuneration of ₹ 20,000 p.a. for each partner was considered appropriate.

Calculate the value of goodwill.

ANSWER:

Page No 3.32:

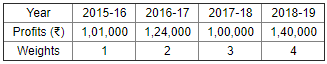

Question 20: Calculate the goodwill of a firm on the basis of three years' purchase of the weighted average profit of the last four years. The appropriate weights to be used and profits are:

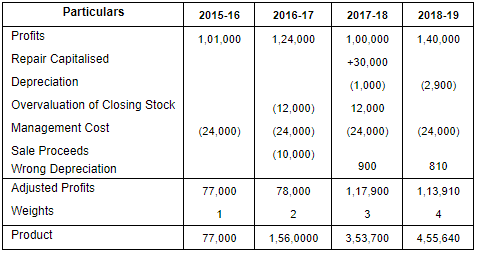

On a scrutiny of the accounts, the following matters are revealed:

(i) On 1st December, 2017, a major repair was made in respect of the plant incurring ₹ 30,000 which was charged to revenue. The said sum is agreed to be capitalised for goodwill calculation subject to adjustment of depreciation of 10% p.a. on Reducing Balance Method.

(ii) The closing stock for the year 2016-17 was overvalued by ₹ 12,000.

(iii) To cover management cost, an annual charge of ₹ 24,000 should be made for the purpose of goodwill valuation.

(iv) On 1st April, 2016, a machine having a book value of ₹ 10,000 was sold for ₹ 11,000 but the proceeds were wrongly credited to Profit and Loss Account. No effect has been given to rectify the same. Depreciation is charged on machine @ 10% p.a. on reducing balance method.

ANSWER:

Working Notes:

Goodwill equals Weighted space Average space Profits cross times Number space of space Years apostrophe space Purchase

table row cell table attributes columnalign right center left columnspacing 0px end attributes row cell Weighted space Average space Profits end cell equals cell fraction numerator Total space of space Product over denominator Total space of space Weights end fraction end cell row blank equals cell fraction numerator 77 comma 000 plus 1 comma 56 comma 000 plus 3 comma 53 comma 700 plus 4 comma 55 comma 640 over denominator 10 end fraction equals ₹ space 1 comma 04 comma 234 end cell end table end cell end table

Goodwill equals 1 comma 04 comma 234 cross times 3 equals ₹ space 3 comma 12 comma 702

Note 1: Depreciation on ₹ 30,000 machinery is charged for only 4 months in the year 2016-17.

Note 2: Sale proceeds wrongly credited in 2015-16 have been deducted after adjusting for profit of ₹ 1,000. No depreciation is charged, since date of sale is not given (assumed that the machinery is sold at the end of the year).

Page No 3.32:

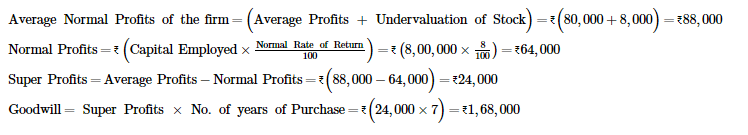

Question 21: Average profit earned by a firm is ₹ 80,000 which includes undervaluation of stock of ₹ 8,000 on an average basis. The capital invested in the business is ₹ 8,00,000 and the normal rate of return is 8%. Calculate goodwill of the firm on the basis of 7 times the super profit.

ANSWER:

Page No 3.32:

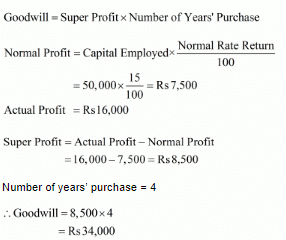

Question 22: Gupta and Bose had a firm in which they had invested ₹ 50,000. On an average, the profits were ₹ 16,000. The normal rate of return in the industry is 15%. Goodwill is to be valued at four years' purchase of profits in excess of profits @ 15% on the money invested. Calculate the value goodwill.

ANSWER:

Page No 3.32:

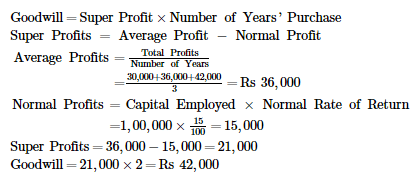

Question 23: The total capital of the firm of Sakshi, Mehak and Megha is ₹ 1,00,000 and the market rate of interest is 15%. The net profits for the last 3 years were ₹ 30,000; ₹ 36,000 and ₹ 42,000. Goodwill is to be valued at 2 years' purchase of the last 3 years' super profits. Calculate the goodwill of the firm.

ANSWER:

Page No 3.32:

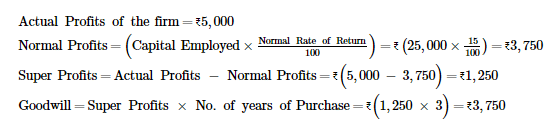

Question 24: Rakesh and Ashok earned a profit of ₹ 5,000. They employed capital of ₹ 25,000 in the firm. It is expected that the normal rate of return is 15% of the capital. Calculate amount of goodwill if goodwill is valued at three years' purchase of super profit.

ANSWER:

Page No 3.32:

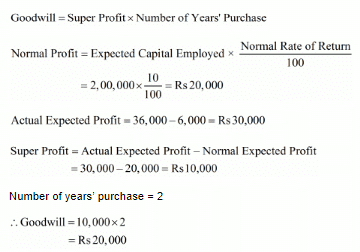

Question 25: Average net profit expected in future by XYZ firm is ₹ 36,000 per year. Average capital employed in the business by the firm is ₹ 2,00,000. The normal rate of return from capital invested in this class of business is 10%. Remuneration of the partners is estimated to be ₹ 6,000 p.a. Calculate the value of goodwill on the basis of two years' purchase of super profit.

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Goodwill: Nature and Valuation (Part - 2) - Accountancy Class 12 - Commerce

| 1. What is goodwill and how is it defined in the context of business? |  |

| 2. How is goodwill calculated and valued for accounting purposes? |  |

| 3. Can goodwill be transferred or sold separately from a business? |  |

| 4. What factors contribute to the increase or decrease in goodwill? |  |

| 5. How is goodwill treated in financial statements and its impact on a company's valuation? |  |