Indian Polity: April 2023 UPSC Current Affairs | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

Stand-Up India Scheme

Why in News?

Recently, the Prime Minister of India has acknowledged the role that the Stand-Up India initiative has played in empowering the SC/ ST communities and ensuring women empowerment.

What are the Key Details of the Stand-Up India Scheme?

- About:

- Stand up India Scheme was launched by Ministry of Finance on 5th April 2016 to promote entrepreneurship at grassroot level focusing on economic empowerment and job creation.

- This scheme has been extended up to the year 2025.

- Purpose:

- Promote entrepreneurship amongst women, Scheduled Caste (SC) and Scheduled Tribe (ST) category.

- Provide loans for greenfield enterprises in manufacturing, services or the trading sector and activities allied to agriculture.

- Facilitate bank loans between Rs.10 lakh and Rs.100 lakh to at least one SC/ST borrower and at least one-woman borrower per bank branch of Scheduled Commercial Banks.

- Facilitates Bank Loans:

- The scheme aims to encourage all bank branches in extending loans. The desiring applicants can apply under the scheme:

- Directly at the branch or,

- Through Stand-Up India Portal (www.standupmitra.in) or,

- Through the Lead District Manager (LDM).

- Eligibility for a Loan:

- SC/ST and/or women entrepreneurs, above 18 years of age.

- Loans under the scheme are available for only green field projects. Green field signifies, in this context, the first-time venture of the beneficiary in manufacturing, services or the trading sector and activities allied to agriculture.

- In case of non-individual enterprises, 51% of the shareholding and controlling stake should be held by either SC/ST and/or Women Entrepreneur.

- Borrowers should not be in default to any bank/financial institution.

- The Scheme envisages ‘up to 15%’ margin money which can be provided in convergence with eligible Central/State schemes.

- In any case, the borrower shall be required to bring in a minimum of 10 % of the project cost as own contribution.

- Achievements:

- Rs.40,710 crore has been sanctioned under Stand-Up India Scheme to 180,636 accounts in the last 7 years.

- More than 80% of loans given under this scheme have been provided to women.

Ranganath Report and Quota for Dalit Converts

Why in News?

- Recently, the Supreme Court revisited a 2007 report by the Justice Ranganath Mishra Commission for Religious and Linguistic Minorities, which recommended Scheduled Caste (SC) reservation for Dalit converts to Christianity and Islam.

- The Centre had discredited the report, but the apex court believes it contains valuable information that could help determine if excluding Dalit converts from the SC category is unconstitutional according to the Constitution Order of 1950.

Note

- Rejecting the Mishra report, the government had recently constituted a new Commission headed by a former CJI K.G. Balakrishnan, giving it two years to prepare a report on the question of granting SC status to “new persons who have historically belonged to the Scheduled Castes but have converted to religions other than Hinduism, Buddhism and Sikhism”.

- For rejecting the report, the Centre has argued that “Dalits who converted to Christianity or Islam to overcome the burdens of caste cannot claim reservation benefits enjoyed by those who chose to stay back in the Hindu religious system”.

What are the Key Highlights of the Ranganath Report?

- The recommendation of Scheduled Caste reservation for Dalit converts to Christianity and Islam was made in the 2007 report of the Justice Ranganath Mishra Commission for Religious and Linguistic Minorities.

- Dalit Christians and Muslims face discrimination not only from upper-caste members of their own religion but also from the broader Hindu-dominated society.

- The exclusion of Dalit converts to Christianity and Islam from the SC category violates the constitutional guarantee of equality and is against the basic tenets of these religions, which reject caste discrimination.

- The denial of SC status to Dalit converts to Christianity and Islam has led to their socio-economic and educational backwardness and has deprived them of access to reservations in education and employment opportunities (as provided under article 16).

Who is Included in the Constitution Order of 1950?

- When enacted, the Constitution (Scheduled Castes) Order of 1950, initially provided for recognizing only Hindus as SCs, to address the social disability arising out of the practice of untouchability.

- The Order was amended in 1956 to include Dalits who had converted to Sikhism and once more in 1990 to include Dalits who had converted to Buddhism.

- Both amendments were aided by the reports of the Kaka Kalelkar Commission in 1955 and the High-Powered Panel (HPP) on Minorities, Scheduled Castes, and Scheduled Tribes in 1983 respectively.

- The 1950 Order (post amendments in 1956 and 1990), mandates that anybody who is not a Hindu, Sikh or Buddhist cannot be granted SC status.

Why are Dalit Christians and Muslims Excluded?

- Avoid Surge in SC Population: The Office of the Registrar General of India (RGI) had cautioned the government that SC status is meant for communities suffering from social disabilities arising out of the practice of untouchability, which it noted was prevalent in Hindu and Sikh communities.

- It also noted that such a move would significantly swell the population of SCs across the country.

- Diverse Ethnic Groups who Converted: In 2001, RGI stated that Dalits who converted to Islam or Christianity are not a single ethnic group as they belong to different caste groups.

- Therefore, they cannot be included in the list of Scheduled Castes (SC) as per Clause (2) of Article 341, which requires a single ethnic group for inclusion.

- Untouchability not Prelavent in Other Religions: The RGI further opined that since the practice of “untouchability” was a feature of the Hindu religion and its branches, allowing the inclusion of Dalit Muslims and Dalit Christians as SCs could result in being “misunderstood internationally” as India trying to “impose its caste system” upon Christians and Muslims.

- The 2001 note also stated that Christians and Muslims of Dalit origin had lost their caste identity by way of their conversion and that in their new religious community, the practice of untouchability is not prevalent.

What is the Registrar General of India?

- The Registrar General of India was founded in 1961 by the Government of India under the Ministry of Home Affairs.

- It arranges, conducts, and analyses the results of the demographic surveys of India including the Census of India and Linguistic Survey of India.

- The position of Registrar is usually held by a civil servant holding the rank of Joint Secretary.

UGC releases National Credit Framework (NCrF)

Why in News?

The University Grants Commission (UGC) released the National Credit Framework (NCrF), which will allow students to earn educational credits at all levels, irrespective of the mode of learning i.e. offline, online, or blended.

What is National Credit Framework (NCrF)?

- The NCrF is a meta-framework that integrates the credits earned through school education, higher education, and vocational and skill education.

- It consists of three verticals:

- National School Education Qualification Framework (NSEQF)

- National Higher Education Qualification Framework (NHEQF) and

- National Skills Qualification Framework (NSQF)

- The NCrF provides a mechanism for the integration of general academic education and vocational and skill education, ensuring equivalence within and between these two education streams.

- Institutions would be free to notify their detailed implementation guidelines with flexibility for catering to their academic requirements.

Key features

- Credit System

- Under the NCrF, one credit corresponds to 30 notional learning hours in a year of two semesters.

- A student is required to earn a minimum of 20 credits every semester.

- A student can earn more than 40 credits in a year.

- Maximum credits a student can earn during schooling period is 160.

- A three-year bachelor’s degree course will result in a total of 120 credits earned.

- A Ph.D. degree is at Level 8 and earns 320 credits upon completion.

- Study of Vedas: Students can obtain credits for their proficiency in diverse areas of the Indian knowledge system, including the Puranas, Vedas, and other related components.

- Indian Knowledge System (IKS): UGC notified the final report, which includes the components of the IKS. The IKS comprises 18 theoretical disciplines called vidyas and 64 practical disciplines, including vocational areas and crafts. These disciplines were the foundation of the 18 sciences in ancient India, as per the report.

- Educational Acceleration: The NCrF supports educational acceleration for students with gifted learning abilities. It provides scope for crediting national/international achievers in any field, including but not limited to sports, Indian knowledge system, music, heritage, traditional skills, performing & fine arts, master artisans, etc.

- International Equivalence: The international equivalence and transfer of credits shall be enabled through various multilateral/bilateral agreements between respective regulators of the countries concerned. NCrF would lend credibility and authenticity to the credits being assigned and earned under various programs in India, making these credits more acceptable and transferable internationally.

Role of Parliamentary Committees in Indian Democracy

Why in News?

- Parliamentary committees are constituted to delve deeper into matters of public concern and develop expert opinions.

What are Parliamentary Committees?

- Evolution of Committees:

- The structured committee system was established in 1993, but individual committees have been formed since independence.

- For instance, five of the many crucial committees of the Constituent Assembly are

- The Ad Hoc Committee on the Citizenship Clause was formed to discuss the nature and scope of Indian citizenship.

- The Northeast Frontier (Assam) Tribal and Excluded Areas Sub-Committee and the Excluded and Partially Excluded Areas (Other than Assam) Sub-Committee were significant committees during independence.

- The Expert Committee on Financial Provisions of the Union Constitution and the Advisory Committee on the Subject of Political Safeguards for Minorities were formed to give recommendations on taxation and abolition of reservations for religious minorities, respectively.

- About:

- A parliamentary committee means a committee that:

- Is appointed or elected by the House or nominated by the Speaker / Chairman.

- Works under the direction of the Speaker / Chairman.

- Presents its report to the House or to the Speaker /Chairman.

- Has a secretariat provided by the Lok Sabha / Rajya Sabha.

- The consultative committees, which also consist of members of Parliament, are not parliamentary committees as they do not fulfill the above four conditions.

- Types:

- Standing Committees: Permanent (constituted every year or periodically) and work on a continuous basis.

- Standing Committees can be classified into the following six categories:

- Financial Committees

- Departmental Standing Committees

- Committees to Enquire

- Committees to Scrutinise and Control

- Committees Relating to the Day-to-Day Business of the House

- House-Keeping Committees or Service Committees

- Ad Hoc Committees:

- Temporary and cease to exist on completion of the task assigned to them. E.g. Joint Parliamentary Committee.

- Constitutional Provisions:

- Parliamentary committees draw their authority from Article 105 (on privileges of Parliament members) and Article 118 (on Parliament’s authority to make rules for regulating its procedure and conduct of business).

What is the Role of Parliamentary Committees?

- Provides Legislative Expertise:

- Most MPs are not subject matter experts on the topics being discussed. Parliamentary committees are meant to help MPs seek expertise and give them time to think about issues in detail.

- Acting as a Mini-Parliament:

- These committees act as a mini parliament, as they have MPs representing different parties are elected into them through a system of the single transferable vote, in roughly the same proportion as their strength in Parliament.

- Instrument for Detailed Scrutiny:

- When bills are referred to these committees, they are examined closely and inputs are sought from various external stakeholders, including the public.

- Provides a Check on the Government:

- Although committee recommendations are not binding on the government, their reports create a public record of the consultations that took place and put pressure on the government to reconsider its stand on debatable provisions.

- By virtue of being closed-door and away from the public eye, discussions in committee meetings are also more collaborative, with MPs feeling less pressured to posture for media galleries.

How has the Role of Parliamentary Committees Declined Recently?

- During the course of the 17th Lok Sabha, only 14 Bills have been referred for further examination so far.

- As per data from PRS, as little as 25% of the Bills introduced were referred to committees in the 16th Lok Sabha, as compared to 71% and 60% in the 15th and 14th Lok Sabha, respectively.

Way Forward

- Strengthen the role of parliamentary committees by giving them more resources, powers, and authority to hold the executive accountable.

- Encourage greater participation from civil society, experts, and stakeholders in the committee proceedings to ensure diverse perspectives and informed decision-making.

- Ensure transparency and accountability in committee proceedings by live streaming and recording meetings and making reports and recommendations publicly available.

- Develop a culture of bipartisan consensus-building within committees to ensure that the interests of all stakeholders are represented and to promote a more productive and efficient legislative process.

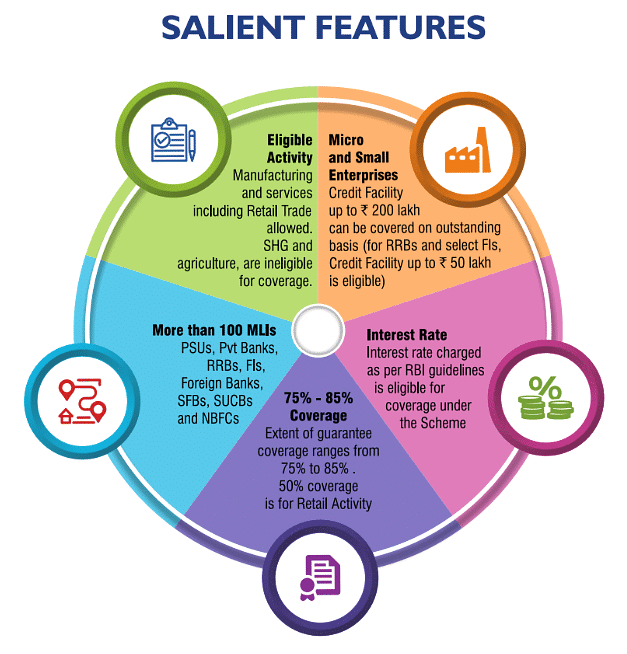

Credit Guarantee Scheme for Micro & Small Enterprises

Context

- In Union Budget 2023-24, Union Finance Minister Mrs Nirmala Sitharaman announced the revamping of Credit Guarantee Scheme for Micro & Small Enterprises with effect from 01.04.2023.

- Step taken: An infusion of Rs 9,000 crore to the corpus to enable additional collateral-free guaranteed credit of Rs. 2 lakh crore and the reduction in the cost of the credit by about 1 per cent.

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) is jointly set up by Ministry of Micro, Small & Medium Enterprises (MSME), Government of India and Small Industries Development Bank of India (SIDBI) in Aug’2000 to catalyse flow of institutional credit to Micro & Small Enterprises (MSEs).

- Credit Guarantee Scheme (CGS) was launched to

- strengthen credit delivery system and to facilitate flow of credit to the MSE sector,

- create access to finance for unserved, under-served and underprivileged,

- making availability of finance from conventional lenders to new generation entrepreneurs.

Eligibility

- Under CGTMSE, guarantee cover is provided by the trust for the credit facilities to an extent of Rs 200 lakh that have been sanctioned without any collateral security and/or third party guarantees to all new and existing Micro and Small Enterprises (both Mfg as well as services) except Educational & Training Institutions.

- CGTMSE has recently modified the scheme by introducing Hybrid Security product wherein loans sanctioned to MSE units with partial collateral coverage can be covered under the credit guarantee scheme (CGS) of CGTMSE i.e., A portion of loan which is not covered by collateral security (Max. of Rs 2.00 Crs) sanctioned to MSE units can be covered under CGTMSE.

- Retail Trade activity is eligible for coverage under CGTMSE with exposure limit for coverage being fixed at maximum of Rs 1.00 Cr.

- Loans sanctioned under Agriculture segment and SHGs are also not eligible to cover under CGTMSE.

Extent of guarantee

The extent of guarantee provided by the trust is based on the category of the borrowers/location of the unit and amount of credit facility being covered under guarantee. The same is as under:

Category | Maximum extent of guarantee where credit facility is | ||

Upto Rs 5 lakh | Above Rs 5 lakh & upto Rs 50 lakh | Above Rs 50 lakh & upto Rs 200 lakh | |

Micro Enterprise | 85% of the amount in default subject to a maximum of Rs 4.25 lakh | 75% of the amount in default subject to a maximum of Rs 37.50 lakh | 75% of the amount in default subject to a maximum of Rs 150 lakh |

Women Entrepreneurs/ Units located in NE region(incl. Sikkim) {other than credit facilities upto Rs 5 lakh to Micro Enterprises} | 80% of the amount in default subject to a maximum of Rs 40 lakh | ||

All other categories of borrowers | 75% of the amount in default subject to a maximum of Rs 37.50 lakh | ||

Retail Trade Activity [Max of Rs 1.00 Cr] | 50% of the amount in default subject to maximum of Rs 50 lakh | ||

- Credit facilities sanctioned beyond Rs 200 lakh to a single eligible borrower can also be covered under CGTMSE. However, the limit that shall be covered under guarantee will be restricted to Rs 200 lakh only even though the credit facility sanctioned is above Rs 200 lakh.

- Guarantee Fees: The guarantee fees vary from 1% to 2% p.a. (plus risk premium) depending on type of account. As on date banks Risk premium is 15%.

Recent steps taken and changes made in CGTMSE

- Consequent upon this, the following significant steps have been taken:

- The corpus of Credit Guarantee Fund Trust for Micro & Small Enterprises (CGTMSE) has been infused with a sum of Rs. 8,000 crore on 30.03.2023.

- CGTMSE has issued guidelines regarding reduction of annual guarantee fee for loans upto Rs. 1 crore from a peak rate of 2% per annum to as low as 0.37% per annum. This will reduce the overall cost of credit to the Micro & Small Enterprises to a great extent.

- The limit on ceiling for guarantees has been enhanced from Rs. 2 crore to Rs. 5 crore.

- For settlement of claims in respect of guarantees for loan outstanding upto Rs. 10 lakh, initiation of legal proceedings will no longer be required.

Regulating Virtual Digital Asset

Why in News?

- Recently, the Ministry of Finance has extended the Anti-money Laundering provisions to Virtual Digital Assets (VDA) businesses and service providers.

- The Ministry has extended the scope of Prevention of Money Laundering Act (PMLA) Act of 2002 by adding the activities related to VDA and Crypto currency under the Act.

How will be VDAs covered under PMLA 2002?

- Extended Activities:

- Exchange between VDA and Fiat Currencies (Legal Tender by the Central Government).

- Exchange between one or more forms of VDAs

- Transfer of VDAs

- Safekeeping or administration of VDAs or instruments enabling control over VDAs

- Participation in and provision of financial services related to an issuer’s offer and sale of a VDA

- Now the VDA will have to register as a reporting entity with the Financial Intelligence Unit-India (FIU-IND).

- The FIU-IND performs the same functions as FinCEN in the USA. Under the Finance Ministry, this was set up in 2004 as the nodal agency for receiving, analyzing and disseminating information relating to suspect financial transactions.

- For instance, Reporting entity platforms such as CoinSwitch are now mandated to know your customer, record and monitor all transactions, and report to the FIU-IND as and when any suspicious activity is detected.

- In Line with Global Guidelines: This risk-mitigation measures is in line with global guidelines put forward by the International Monetary Fund (IMF) and the Financial Action Task Force (FATF).

- FATF has a comprehensive definition of Virtual Asset Service Providers (VASPs), an extensive list covering intermediaries, brokers, exchanges, custodians, hedge funds, and even mining pools.

- Such guidelines acknowledge the role VASPs play in regulating and monitoring the virtual digital assets ecosystem.

What is the Significance of the Move and What are the Concerns

- Significance:

- Such rules are already applicable to banks, financial institutions and certain intermediaries in the securities and real estate markets.

- Extending them to virtual digital assets provides virtual digital assets platforms with a framework to diligently monitor and take actions against malpractices.

- A standardization of such norms will go a long way in making the Indian virtual digital assets sector transparent.

- It will also build confidence and assurance in the ecosystem and give the government more oversight on virtual digital asset transactions, which will be a win-win for all.

- Concerns:

- There is a concern that without a central regulator, VDA entities could end up dealing directly with enforcement agencies, like ED (Enforcement Director).

- Owing to current tax regime, many Indian VDA users have already switched from domestic exchanges to foreign counterparts, causing a decrease in tax revenues and transaction traceability. This could also discourage international investors and result in capital outflow.

Way Forward

- India should reconsider its high tax rates on virtual digital assets, which are currently higher than other asset classes.

- With the new PMLA notification reducing the risks of money laundering and terror financing, there is an opportunity to align virtual digital assets taxes with other asset classes.

- Doing so would reduce tax arbitrage, which would help retain capital, consumers, investments, and talent within the country and reduce the size of the grey economy for virtual digital assets.

- In Asia, Japan and South Korea have established a framework to licence VASPs, while in Europe, the Markets in Crypto-Assets (MiCA) regulation has been passed by the European Parliament. Going forward, a progressive regulatory framework will instill the animal spirit in India’s innovation economy and establish India’s virtual digital assets leadership.

- Crypto assets are by definition borderless and require international collaboration to prevent regulatory arbitrage. Therefore, any legislation for regulation or for banning can be effective only with significant international collaboration on the evaluation of the risks and benefits and evolution of common taxonomy and standards.

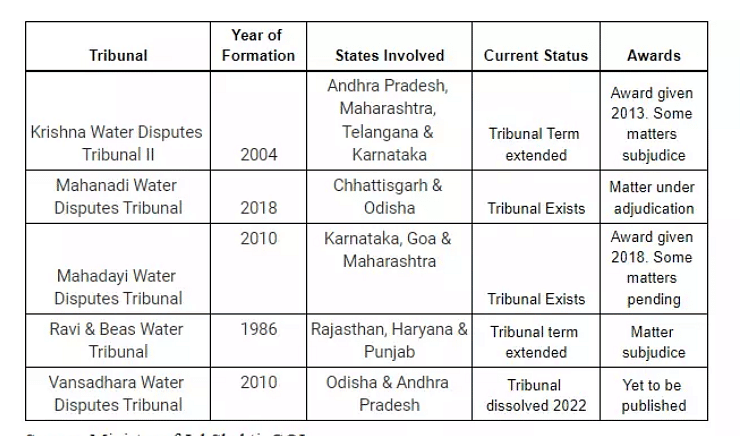

Inter-State Water Dispute

Why in News?

- Odisha has complained to the Ministry of Jal Shakti under the Inter-State River Water Disputes (ISRWD) Act 1956 accusing Chhattisgarh of misleading the Mahanadi Water Disputes Tribunal (MWDT) by releasing water in Mahanadi river in the Non-Monsoon Season.

- The MWDT was formed in March 2018. The tribunal has been asked to submit its report by December 2025 by the Ministry of Jal Shakti.

- There is no inter-state agreement between Odisha and Chhattisgarh regarding Mahanadi basin water allocation.

What is the Concern of Odisha?

- Chhattisgarh has opened 20 gates at Kalma Barrage through which 1,000-1,500 cusecs of water is flowing into Mahanadi’s low catchment area during the non-monsoon season.

- Chhattisgarh’s reluctance to release water during non-monsoon seasons has often resulted in the non-availability of water in the lower catchment of Mahanadi.

- This also affects the Rabi crops and aggravates the drinking problem in Odisha.

- However, this time Chhattisgarh has released water without any intimation, which raised concerns over its management of Mahanadi River water.

- The state faced flood in upper catchment during monsoon and thus, opened gates without any intimation to Odisha.

What are the Inter-State River Disputes in India?

- About:

- The Inter-State River Water Disputes are one of the most contentious issues in Indian federalism today.

- The recent cases of the Krishna Water Dispute, Cauvery Water Dispute and the Satluj Yamuna Link Canal are some examples.

- Various Inter-State Water Disputes Tribunals have been constituted so far, but they had their own problems.

- Constitutional Provisions:

- Entry 17 of the State List deals with water i.e., water supply, irrigation, canal, drainage, embankments, water storage and hydro power.

- Entry 56 of the Union List empowers the Union Government for the regulation and development of inter-state rivers and river valleys to the extent declared by Parliament to be expedient in the public interest.

- According to Article 262, in case of disputes relating to waters:

- Parliament may by law provide for the adjudication of any dispute or complaint with respect to the use, distribution or control of the waters of, or in, any inter-State River or river valley.

- Parliament may, by law, provide that neither the Supreme Court nor any other court shall exercise jurisdiction in respect of any such dispute or complaint as mentioned above.

What is the Mechanism for Inter-State River Water Disputes Resolution

- As per Article 262, the Parliament has enacted the following:

- River Board Act, 1956: This empowered the GoI to establish Boards for Interstate Rivers and river valleys in consultation with State Governments. To date, no river board has been created.

- Inter-State Water Dispute Act, 1956: In case, if a particular state or states approach the Centre for the constitution of the tribunal, the Central Government should try to resolve the matter by consultation among the aggrieved states. In case, if it does not work, then it may constitute the tribunal.

- Note: Supreme Court shall not question the Award or formula given by tribunal, but it can question the working of the tribunal.

- The Inter-State Water Dispute Act, 1956 was amended in 2002, to include the major recommendations of the Sarkaria Commission.

- The amendments mandated a one-year time frame to set up the water disputes tribunal and also a 3-year time frame to give a decision.

What are the Issues with Interstate Water Dispute Tribunals?

What are the Issues with Interstate Water Dispute Tribunals?

- Protracted proceedings and extreme delays in dispute resolution. Water disputes such as the Godavari and Cauvery disputes in India have faced long delays in resolution.

- Opacity in the institutional framework and guidelines that define these proceedings; and ensuring compliance.

- The composition of the tribunal is not multidisciplinary, and it consists of persons only from the judiciary.

- The absence of water data that is acceptable to all parties currently makes it difficult to even set up a baseline for adjudication.

- The growing nexus between water and politics has transformed the disputes into turfs of vote bank politics.

- This politicisation has led to increasing defiance by states, extended litigations and subversion of resolution mechanisms.

What Measures can be taken to Resolve Water Disputes?

- Bring Inter-state water disputes under interstate council constructed by the president under article 263 and need for consensus-based decision making.

- States must be motivated for water use efficiency in every domain and water harvesting and water recharging to reduce the demand on river water and in situ water source.

- Need of a single water management agency for both ground and surface water on scientific basis and also for technical advice on union, river basin, state and district level for water conservation and water management.

- Tribunals must be fast track, technical and also have a verdict enforceable mechanism in a time bound manner.

- A central repository of water data is necessary for informed decision making. It is important for the central government to take a more active role in resolving inter-state water disputes.

Sports Governance in India

- Context

- Half of the national sports federations in India do not have a sexual harassment panel mandated by the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013, which requires every organisation with more than 10 employees to have an internal complaints committee (ICC) to deal with cases of sexual harassment.

- Details

- A report has revealed that half of the national sports federations in India do not have a sexual harassment panel mandated by law.

- This is a clear violation of the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013, which requires every organisation with more than 10 employees to have an internal complaints committee (ICC) to deal with cases of sexual harassment.

- Findings of the report

- The absence of an internal complaints committee (ICC) in these national sports federations (NSFs) means that women athletes, coaches, officials and staff working in these organisations have no recourse to justice if they face sexual harassment at their workplace.

- Poor functioning of some of the ICCs that were constituted by the NSFs.

- Some of them did not have a proper composition as per the Act, which requires at least one external member who is familiar with issues relating to sexual harassment.

- Some of them did not have any women members at all, while some had only one woman member out of four or five.

- Some of them did not have any records of their meetings or cases handled by them.

Sports Governance in India

About

- India is a country with a rich and diverse sporting culture. From cricket to hockey, from badminton to chess, India has produced many world-class athletes and champions in various sports. However, the governance of sports in India has often been criticized for being inefficient, corrupt, and politicized.

Sports Governance Structure

- The Indian sports governance consists of two separate bodies managing sports in the country:

- The Ministry of Youth Affairs and Sports (MYAS)

- The Indian Olympic Association (IOA)

- The MYAS is a government body that oversees various institutions such as the Sports Authority of India (SAI), which provides infrastructure, training and financial assistance to athletes and coaches.

- The IOA is an autonomous body that represents India in the International Olympic Committee (IOC) and other international sports federations. It also organizes national games and championships for various sports disciplines.

Challenges

- Lack of autonomy and accountability of the national sports federations (NSFs)

- NSFs are the bodies that regulate and promote different sports in India and are affiliated with the Indian Olympic Association (IOA), which is the apex body for Olympic sports in India.

- NSFs are supposed to be independent and democratic organizations that follow the principles of good governance, such as transparency, participation, and fairness. However, many NSFs are plagued by nepotism, favouritism, and interference from political and bureaucratic forces.

- Some NSFs have been headed by the same person or family for decades, without any elections or term limits.

- Some NSFs have also been accused of misusing funds, violating rules, and discriminating against athletes on various grounds.

- Lack of coordination and cooperation among different stakeholders

- There are multiple agencies and authorities involved in sports development and management in India, such as the Ministry of Youth Affairs and Sports (MYAS), the Sports Authority of India (SAI), the IOA, the NSFs, the state governments, the private sector, and the civil society.

- However, there is often a lack of clarity and consensus on their roles and responsibilities, leading to duplication of efforts, wastage of resources, and conflicts of interest.

- Lack of a long-term vision and strategy for sports development

- India has a huge potential to become a sporting powerhouse, given its large population, young demographic, and diverse talent pool.

- However, there is no clear and coherent policy framework or roadmap to harness this potential and achieve excellence in sports at all levels.

- Sports policy in India has often been reactive and ad hoc, rather than proactive and systematic.

- There is also a lack of adequate investment and innovation in sports infrastructure, technology, research, education, and grassroots development.

What can be done to improve sports governance in India?

- Reforming NSFs

- NSFs should be made more accountable and transparent by ensuring regular elections, audits, disclosures, and grievance redressal mechanisms.

- NSFs should also be made more inclusive and representative by ensuring gender parity, regional diversity, and stakeholder participation.

- NSFs should also be made more professional and competent by hiring qualified staff, adopting best practices, and enhancing their capacity building.

- Strengthening coordination

- There should be better coordination and alignment among different agencies and authorities involved in sports governance in India.

- There should be a clear division of roles and responsibilities among them, based on their expertise and mandate.

- There should also be regular dialogue and consultation among them to avoid conflicts and ensure synergy.

- There should also be greater involvement of the private sector and civil society in sports governance in India.

- Developing a vision

- There should be a comprehensive and long-term vision and strategy for sports development in India. This vision should be.

- Based on a thorough analysis of the strengths, weaknesses, opportunities, and threats facing Indian sports.

- Aligned with the national goals and aspirations of India.

- Translated into concrete action plans with measurable outcomes and indicators.

Conclusion

Reform in the Sports governance structure would require political will, legal framework and public awareness. It would also require learning from the best practices of other countries that have achieved success in sports through good governance. By adopting such a reform, India can hope to achieve its potential as a sporting nation and enhance its image and pride on the global stage.

|

63 videos|5408 docs|1146 tests

|