Laxmikanth Summary: Municipality | Indian Polity for UPSC CSE PDF Download

| Table of contents |

|

| Introduction |

|

| Evolution of Urban Bodies |

|

| Types of Urban Government |

|

| Municipal Personnel |

|

| Municipal Revenue |

|

| Central Council of Local Government |

|

Introduction

The term 'Urban Local Government' in India signifies the governance of urban areas by elected representatives chosen by the people. The jurisdiction is limited to a specific urban area demarcated by the state government.

There are eight types of urban local governments in India:

- Municipal Corporation

- Municipality

- Notified Area Committee

- Town Area Committee

- Cantonment Board

- Township

- Port Trust

- Special Purpose Agency

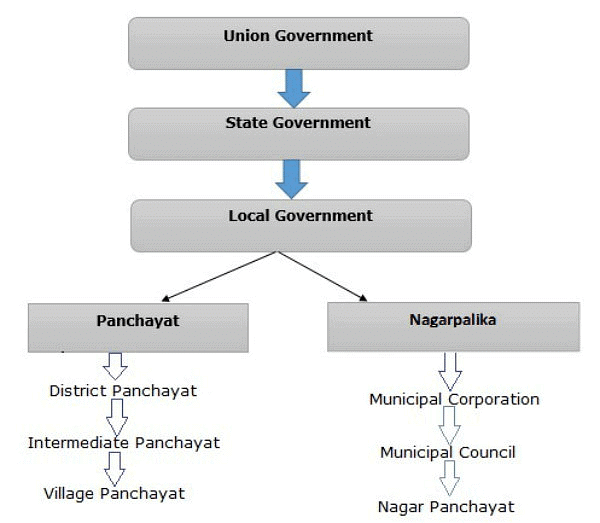

Urban Local Government

Urban Local Government

The system of urban government was constitutionalized through the 74th Constitutional Amendment Act of 1992. At the Central level, the subject of 'urban local government' is managed by three ministries:

- Ministry of Housing and Urban Affairs

- Ministry of Defence (for cantonment boards)

- Ministry of Home Affairs (for Union Territories)

Evolution of Urban Bodies

Historical Perspective

The institutions of urban local government originated and developed in modern India during the period of British rule. The major events in this

(i) In 1687-88, the first municipal corporation in India was set up at Madras.

(ii) In 1726, the municipal corporations were set up in Bombay and Calcutta.

(iii) Lord Mayors Resolution of 1870 on financial decentralisation visualised the development of local selfgovernment institutions.

(iv) Lord Ripon's Resolution of 1882 has been hailed as the ‘Magna Carta" of local self-government. He is called as the father of local-self-government in India.

(v) Under the provincial autonomy scheme introduced by the Government of India Act of 1935, local selfgovernment was declared a provincial subject.

Constitutionalisation

- In August 1989, the Rajiv Gandhi government introduced the 65th Constitutional Amendment Bill (i.e., Nagarpalika Bill) in the Lok Sabha. The bill aimed at strengthening and revamping the municipal bodies by conferring a constitutional status on them.

- The National Front Government under V P Singh introduced the revised Nagarpalika Bill in the Lok Sabha again in September 1990. However, the bill was not passed and finally lapsed due to the dissolution of the Lok Sabha.

- P V Narasimha Rao's Government also introduced the modified Municipalities Bill in the Lok Sabha in September 1991. It finally emerged as the 74th Constitutional Amendment Act of 1992 and came into force on 1 June 1993.

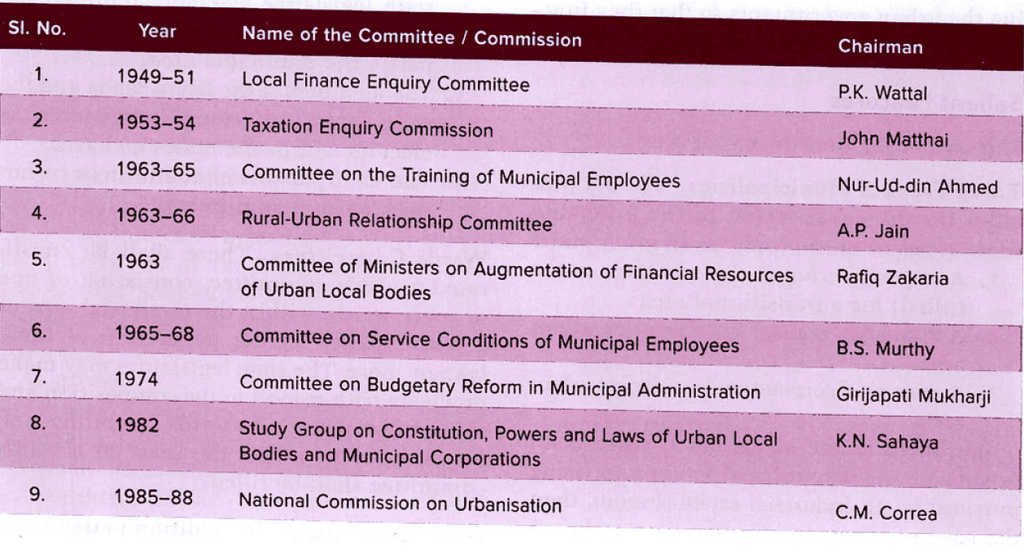

Committees and Commissions

The Central Government has appointed various committees and commissions to enhance the performance of urban local governments, as outlined in the table below:

Various Committees and Commissions

Various Committees and Commissions

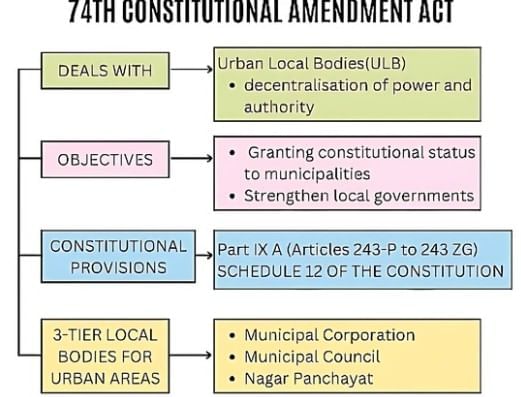

74th Amendment Act of 1992

This Act has added a new Part IX-A to the Constitution of India. This part is entitled as The Municipalities' and consists of provisions from Articles 243P to 243-ZG. In addition, the act has also added a new Twelfth Schedule to the Constitution. This schedule contains eighteen functional items of municipalities. It deals with Article 243-W.

- The act aims at revitalising and strengthening the urban governments so that they function effectively as units of local government.

Salient Features of 74th Amendment Act

Three Types of Municipalities

The act outlines the establishment of three types of municipalities in each state:

1. A nagar panchayat (by whatever name called) for a transitional area, that is, an area in transition from a rural area to an urban area.

2. A municipal council for a smaller urban area.

3. A municipal corporation for a larger urban area.

Composition

All the members of a municipality shall be elected directly by the people of the municipal area.

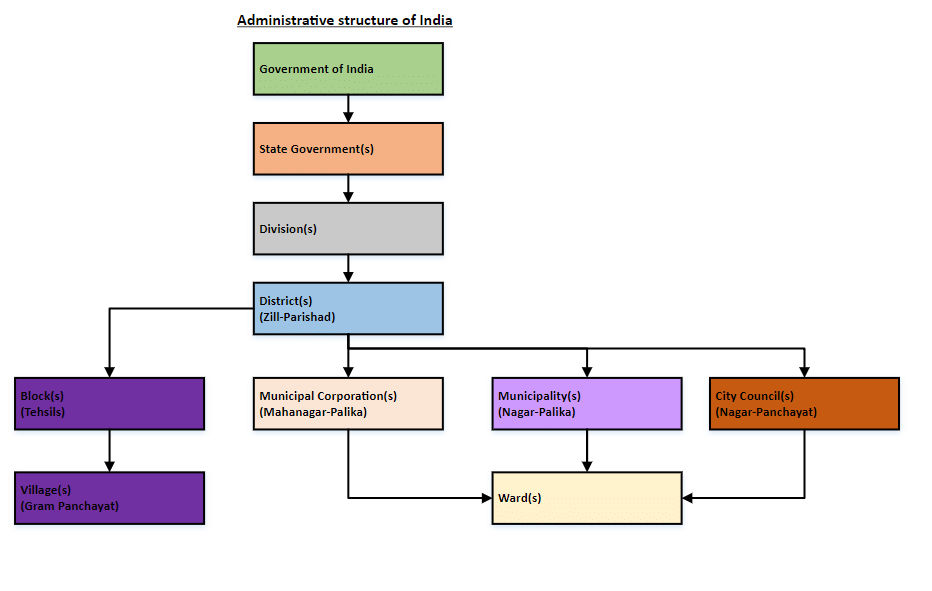

Administrative Structure of India

Administrative Structure of India

Wards Committees

There shall be constituted a wards committee, consisting of one or more wards, within the territorial area of a municipality having population of three lakh or more.

Other Committees

Aside from wards committees, the state legislature is also empowered to establish additional committees. Provision may be made for the constitution of these committees, and the chairpersons of such committees may become members of the municipality.

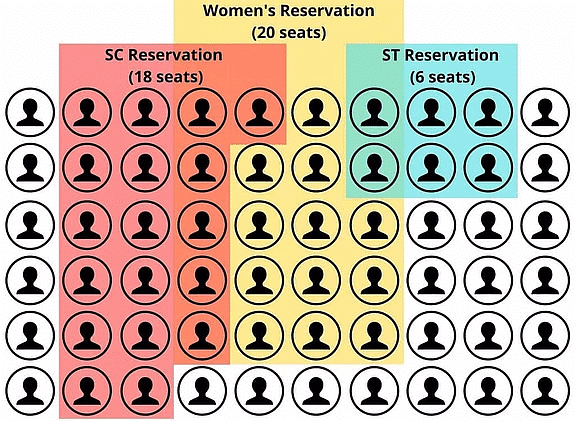

Reservation of Seats

The act provides for the reservation of seats for the scheduled castes and the scheduled tribes in every municipality in proportion of their population to the total population in the municipal area.

Seat Reservation

Seat Reservation

Duration of Municipalities

The act provides for a five-year term of office for every municipality.

Disqualifications

- under any law for the time being in force for the purposes of elections to the legislature of the state concerned; or

- under any law made by the state legislature. However, no person shall be disqualified on the ground that he is less than 25 years of age if he has attained the age of 21 years.

State Election Commission

The superintendence, direction and control of the preparation of electoral rolls and the conduct of all elections to the municipalities shall be vested in the state election commission.

Powers and Functions:

1. the preparation of plans for economic development and social justice;

2. the implementation of schemes for economic development and social justice as may be entrusted to them, including those in relation to the eighteen matters listed in the Twelfth Schedule.

Finances

The state legislature may

(a) authorise a municipality to levy, collect and appropriate taxes, duties, tolls and fees;

(b) assign to a municipality taxes, duties, tolls and fees levied and collected by state government;

(c) provide for making grants-in-aid to the municipalities from the consolidated fund of the state; and

(d) provide for constitution of funds for crediting all moneys of the municipalities.

Finance Commission

The finance commission (which is constituted for the panchayats) shall also, for every five years, review the financial position of municipalities and make recommendation to the governor as to:

1. The principles that should govern:

(i) The distribution between the state and the municipalities, the net proceeds of the taxes, duties, tolls and fees levied by the state.

(ii) The determination of the taxes, duties, tolls and fees that may be assigned to the municipalities.

2. The measures needed to improve the financial position of the municipalities.

Audit of Accounts

The state legislature may make provisions with respect to the maintenance of accounts by municipalities and the auditing of such accounts.

Application to Union Territories

The president of India may direct that the provisions of this act shall apply to any union territory subject to such exceptions and modifications as he may specify

Exempted Areas

The act does not apply to scheduled and tribal areas in states, nor does it affect the functions and powers of the Darjeeling Gorkha Hill Council of West Bengal. Parliament may extend these provisions to scheduled and tribal areas with specified exceptions and modifications.

District Planning Committee

- Each state is required to constitute a district planning committee at the district level to consolidate plans from panchayats and municipalities, preparing a draft development plan for the entire district.

Metropolitan Planning Committee

- Every metropolitan area shall establish a metropolitan planning committee to formulate draft development plans.

- Two-thirds of the committee members should be elected by the municipalities and chairpersons of panchayats in the metropolitan area. Representation of these members should be proportional to the ratio between the population of municipalities and panchayats in the metropolitan area.

Continuance of Existing Laws and Municipalities

- All state laws related to municipalities remain in effect until one year from the commencement of this act. States are required to adopt the new municipal system outlined in this act within one year from June 1, 1993, the act's commencement date.

- Existing municipalities at the act's commencement shall continue until the completion of their term, unless dissolved by the state legislature earlier.

Bar to Interference by Courts in Electoral Matters

- The act prohibits court interference in electoral matters of municipalities.

- It specifies that the validity of any law related to constituency delimitation or seat allotment cannot be challenged in any court.

- No election to any municipality can be questioned except through an election petition presented to the authority specified by the state legislature.

Twelfth Schedule

It contains the following 18 functional items placed within the purview of municipalities: Urban planning, Regulation of land, economic and social development; Roads, Water supply for domestic, industrial and commercial purposes;, Public health, environment and promotion, Slum improvement, Urban poverty alleviation; 12. Provision of urban amenities and facilities such, educational.

Types of Urban Government

India has established eight types of urban local bodies for administering urban areas:

- Municipal Corporation

- Municipality

- Notified Area Committee

- Town Area Committee

- Cantonment Board

- Township

- Port Trust

- Special Purpose Agency

1. Municipal Corporation

- Municipal corporations are created for the administration of big cities like Delhi, Mumbai, Kolkata, Hyderabad, Bangalore and others. They are established in the states by the acts of the concerned state legislatures, and in the union territories by the acts of the Parliament of India.

- A municipal corporation has three authorities, namely, the council, the standing committees and the commissioner.

- The municipal commissioner is responsible for the implementation of the decisions taken by the council and its standing committees. Thus, he is the chief executive authority of the corporation. He is appointed by the state government and is generally a member of the IAS.

2. Municipality

- The municipalities are established for the administration of towns and smaller cities.

- Like a municipal corporation, a municipality also has three authorities, namely, the council, the standing committees and the chief executive officer.

3. Notified Area Committee

- A notified area committee is created for the administration of two types of areas—a fast developing town due to industrialisation, and a town which does not yet fulfil all the conditions necessary for the constitution of a municipality, but which otherwise is considered important by the state government.

4. Town Area Committee

- A town area committee is set up for the administration of a small town.

- It is a semimunicipal authority and is entrusted with a limited number of civic functions like drainage, roads, street lighting, and conservancy, wholly nominated by the state government or partly elected and partly nominated.

5. Cantonment Board

- A cantonment board is established for municipal administration for civilian population in the cantonment area. It is set up under the provisions of the Cantonments Act of 2006—a legislation enacted by the Central government. It works under the administrative control of the defence ministry of the Central government.

- At present (2016), there are 62 cantonment boards in the country. They are grouped into four categories on the basis of the civil population.

6. Township

- This type of urban government is established by the large public enterprises to provide civic amenities to its staff and workers who live in the housing colonies built near the plant.

- The enterprise appoints a town administrator to look after the administration of the township.

7. Port Trust

- The port trusts are established in the port areas like Mumbai, Kolkata, Chennai and so on for two purposes:

(a) to manage and protect the ports; and

(b) to provide civic amenities.

8. Special Purpose Agency

- They are known as single purpose', "uni-purpose' or "special purpose’ agencies or “functional local bodies’. Some such bodies are:

(i) Town improvement trusts.

(ii) Urban development authorities.

(iii) Water supply and sewerage boards.

(iv) Housing boards.

(v) Pollution control boards.

(vi) Electricity supply boards.

(vii) City transport boards.

Municipal Personnel

There are three types of municipal personnel systems in India. The personnel working in the urban governments may belong to any one or all the three types. These are:

1. Separate Personnel System: Under this system, each local body appoints, administers, and controls its own personnel. They are not transferable to other local bodies. It is the most widely prevalent system.

2. Unified Personnel System: In this system, the state government appoints, administers, and controls the municipal personnel.

3. Integrated Personnel System: Under this system, the personnel of the state government and those of the local bodies form part of the same service.

National Level Training Institutions for Municipal Personnel:

- All-India Institute of Local Self-Government (Mumbai): Constituted in 1927, a private registered society.

- Centre for Urban and Environmental Studies (New Delhi): Established in 1967 based on the recommendation of Nur-uddin Ahmed Committee on Training of Municipal Employees (1963-1965).

- Regional Centres for Urban and Environmental Studies (Kolkata, Lucknow, Hyderabad, and Mumbai): Set up in 1968 based on the recommendation of Nur-uddin Ahmed Committee on Training of Municipal Employees (1963-1965).

- National Institute of Urban Affairs (New Delhi): Established in 1976.

- Human Settlement Management Institute (New Delhi): Established in 1985.

Municipal Revenue

There are five sources of income of the urban local bodies. These are as follows:

(i) Tax Revenue: The revenue from the local taxes include property tax, entertainment tax, taxes on advertisements, professional tax, water tax, tax on animals, lighting tax, pilgrim tax, market tax, toll on new bridges, octroi and so on.

(ii) Non-Tax Revenue: This source include rent on municipal properties, fees and fines, royalty, profits and dividends, interest, user charges and miscellaneous receipts.

(iii) Grants: These include the various grants given to municipal bodies by the Central and State Governments for several development programmes, infrastructure schemes, urban reform initiatives and so on.

(iv) Devolution: This consists of the transfer of funds to the urban local bodies from the state government.

(v) Loans: The urban local bodies raise loans from the state government as well as financial institutions to meet their capital expenditure.

Central Council of Local Government

The Central Council of Local Government was set up in 1954. It was constituted under Article 263 of the Constitution of India by an order of the President of India. Originally, it was known as the Central Council of Local Self-Government. The Council performs the following functions with regard to localgovernment:

(i) Considering and recommending the policy matters

(ii) Making proposals for legislation

(iii) Examining the possibility of cooperation between the Centre and the states

(iv) Drawing up a common programme of action

(v) Recommending Central financial assistance

(vi) Reviewing the work done by the local bodies with the Central financial assistance

Articles related to Municipality at a Glance

Articles related to Municipality at a Glance

|

142 videos|780 docs|202 tests

|

FAQs on Laxmikanth Summary: Municipality - Indian Polity for UPSC CSE

| 1. What is a municipality? |  |

| 2. What are the key functions of a municipality? |  |

| 3. How are municipalities governed? |  |

| 4. What is the role of a municipality in urban planning? |  |

| 5. How can residents engage with their municipality? |  |