Leasing, Hire Purchase, and Venture Capital: Leasing and Hire Purchase | Management Optional Notes for UPSC PDF Download

Introduction

Securing long-term funds of significant magnitude is essential for financing capital assets within a firm. Various avenues have been explored to raise such funds, including equity, debt instruments, and development finance in the form of term loans. Each of these sources comes with its own set of advantages and disadvantages for both borrowers and lenders or investors. Opting for long-term funds through debt instruments or long-term debts entails certain obligations and risks for borrowers. Consequently, alternative methods have been developed to acquire capital assets without an immediate need for fund-raising. Leasing and hire purchase of capital assets represent two such methods that serve as alternatives to traditional financing. In this unit, we will explore these two means of acquiring capital assets for use within a firm.

Leasing: Definition And Main Features

- Leasing is a contractual agreement wherein the owner of an asset (the lessor) grants exclusive rights to another party (the lessee) to use the asset for a specified period in exchange for the payment of rent, known as lease rental. Capital assets such as land, buildings, equipment, machinery, and vehicles are commonly acquired through lease agreements. In such arrangements, the lessor retains ownership of the asset, while the lessee possesses and economically utilizes it.

- In India, as there is no specific legislation governing leasing contracts, the provisions of the Indian Contract Act apply, treating leasing akin to a contract of bailment. According to Section 146 of the Indian Contract Act, bailment is defined as "the delivery of goods by one person to another person for some purpose, upon a contract that they shall, when the purpose is accomplished, be returned or otherwise disposed of according to the directions of the person delivering them." The person delivering the goods is the bailor, and the recipient is the bailee.

- Since an equipment lease transaction falls under the category of a bailment contract, the obligations of the lessor and the lessee resemble those of the bailor and the bailee as outlined in the Indian Contract Act, unless specified otherwise in the lease agreement. These obligations can be summarized as follows:

- The lessor must deliver the asset to the lessee, authorize the lessee to use the asset, and ensure peaceful possession of the asset by the lessee during the lease period.

- The lessor is obligated to pay the lease rentals as specified, safeguard the lessor's title, maintain reasonable care of the asset, and return the leased asset at the lease period's end.

Main Elements of Leasing:

The key features of a leasing contract include:

- A Valid Leasing Contract: Both the lessor and the lessee must enter into a valid contract, meeting the requirements of competency and clear title as per the Indian Contract Act.

- Delivery of Goods: The lessor must deliver the movable property (goods) to the lessee, either through actual or constructive delivery.

- Purpose: Goods are delivered to the lessee for specific lawful use throughout the lease period.

- Consideration: The lessee agrees to pay lease rentals regularly as consideration for using the goods.

- Return of Goods: The goods must be returned to the lessor in the same condition at the end of the lease period.

- Ownership: The lessor remains the owner of the asset throughout the lease period and afterward.

- Methodology: The lessee identifies the equipment and supplier, enters into a lease agreement with a leasing company, and provides relevant details for evaluation of creditworthiness by the lessor.

Benefits of Leasing

Leasing offers numerous advantages to the lessee compared to outright purchase. These benefits include:

- Convenience for Short-term Needs: Leasing is highly convenient for short-term requirements, such as one or two years, eliminating the formalities and expenses associated with purchasing and selling assets after a short period.

- Mitigation of Technological Obsolescence Risk: Ownership of assets entails the risk of technological obsolescence. In today's rapidly evolving technological landscape, owning outdated assets can lead to competitiveness issues and significant losses. Leasing transfers the risk of asset obsolescence to the lessor, particularly in operating leases, which allow for cancellation and replacement with technologically superior equipment. Although lease rentals for such equipment may be higher, the benefits of risk mitigation outweigh the costs.

- Access to Efficient Maintenance Services: With operating or full-service leases, lessees benefit from maintenance and other services provided by experienced lessors. These lessors are equipped to deliver efficient services, albeit at higher rental costs to the lessee.

- Reduction of Administrative and Transaction Costs: Specialized leasing companies often focus on leasing specific types of equipment, allowing them to negotiate favorable prices with suppliers and streamline administrative processes. Lessees may receive rental concessions based on the economies achieved by the lessor.

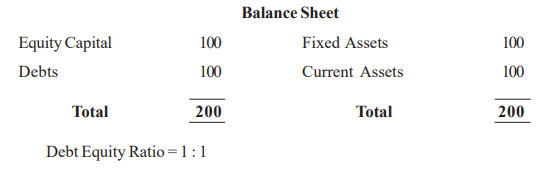

- Unchanged Debt-Equity Ratio: Lease rentals are recorded as expenses in the lessee's profit and loss account when an asset is leased, without reflecting the leased asset or liability on the balance sheet. Consequently, the debt-equity ratio remains unaffected compared to a scenario where the asset is purchased with borrowed funds.

Firm A borrows Rs. 100 to buy a fixed asset, while firm B takes it on lease. The respective balance sheets of the two firms will appear as follows:

Benefits of Leasing:

Leasing offers several advantages to the lessee compared to outright purchase, including:

- Convenience for Short-term Needs: Leasing is highly convenient for short-term requirements, such as one or two years, eliminating the formalities and expenses associated with purchasing and selling assets after a short period.

- Mitigation of Technological Obsolescence Risk: Ownership of assets entails the risk of technological obsolescence. In today's rapidly evolving technological landscape, owning outdated assets can lead to competitiveness issues and significant losses. Leasing transfers the risk of asset obsolescence to the lessor, particularly in operating leases, which allow for cancellation and replacement with technologically superior equipment. Although lease rentals for such equipment may be higher, the benefits of risk mitigation outweigh the costs.

- Access to Efficient Maintenance Services: With operating or full-service leases, lessees benefit from maintenance and other services provided by experienced lessors. These lessors are equipped to deliver efficient services, albeit at higher rental costs to the lessee.

- Reduction of Administrative and Transaction Costs: Specialized leasing companies often focus on leasing specific types of equipment, allowing them to negotiate favorable prices with suppliers and streamline administrative processes. Lessees may receive rental concessions based on the economies achieved by the lessor.

- Unchanged Debt-Equity Ratio: Lease rentals are recorded as expenses in the lessee's profit and loss account when an asset is leased, without reflecting the leased asset or liability on the balance sheet. Consequently, the debt-equity ratio remains unaffected compared to a scenario where the asset is purchased with borrowed funds.

- Tax Shield Benefits: Lessees can claim lease rentals as tax-deductible expenses each year during the lease period, reducing their tax liability. Additionally, lease arrangements may offer larger deductible expenses compared to asset purchase with borrowed funds, thereby lowering the lessee's tax liability further.

- Benefits for Lessors: Lease rentals received by lessors are taxable as profits from business or professions, subject to deductions for asset depreciation and interest on borrowed funds, if applicable.

Types of Leases

The terms and conditions governing an asset lease, along with the rights and responsibilities of both the lessor and lessee, are clearly outlined in the Lease Agreement. Based on various factors, leases are categorized into the following types:

Operating Lease:

An operating lease involves the lessor leasing an asset while retaining ownership and providing associated services such as maintenance and repairs. This type of lease is suitable for assets like computers, office equipment, automobiles, and trucks. Key features of an operating lease include:

- Typically, the lease duration is significantly shorter than the asset's useful life. For instance, a machine may be leased for 5 years while its useful life spans 10 years.

- The lessor does not recover the full asset cost from a single lessee; instead, the asset is returned at the end of the lease period for leasing to another lessee or eventual sale.

- Operating leases often include a cancellation clause, allowing the lessee to terminate the lease early if the asset becomes obsolete or if their need for it ends.

- Maintenance services are typically included in the lease agreement, with the lessor responsible for repairs, fuel, and support staff as agreed upon.

- Lease rentals comprise a portion of the equipment's cost amortization, maintenance costs, and the lessor's profit.

Financial Lease:

- In a financial lease, the lessor retains ownership during the lease period but does not provide maintenance services. Lease rentals fully amortize the equipment cost, and the lessor earns a profit. Financial leases are non-cancellable and may include an option for the lessee to purchase the asset at an agreed price.

Sale and Lease Back:

- This arrangement involves a lessee selling owned assets to the lessor and then leasing them back. It provides immediate liquidity to the lessee, who can utilize the funds for working capital or other investments. The leaseback arrangement allows the lessee to continue using the assets while making periodic lease payments.

Leveraged Lease:

- In a leveraged lease, the lessor finances the asset purchase using a mix of debt and equity. Creditors retain recourse to the lessee, allowing them to recover claims from both the lessor and lessee. Lease rentals are paid directly to the creditor, often through a trustee, who allocates payments between the creditor and lessor.

Domestic and International Lease:

- Leases are classified based on the domicile of the parties involved. A lease involving parties residing in the same country is termed a domestic lease, while those involving parties from different countries are termed international leases.

- Depending on the domicile of the lessor and lessee, leases may be further categorized as import or cross-border leases, with additional risks such as country and currency risks in international leases.

Main Clauses In The Lease Agreement

Upon finalizing the lease transaction, a lease agreement is drafted and executed by the involved parties to establish their legal rights and obligations, serving as evidence in case of disputes during the lease term. The primary clauses typically included in a lease agreement are outlined below:

- Lease Nature and Parties: This clause delineates the type of lease (e.g., operating, financial, or leveraged) and identifies the parties involved.

- Asset Description: Details of the leased equipment, including make, model, size, and specifications, are provided in this clause.

- Lease Duration: The period of the lease, known as the primary period, is specified here, often with an option for the lessee to renew for a secondary period.

- Lease Rentals: This clause stipulates the amount and payment frequency of lease rentals, considering factors like cost of funds, depreciation, and expected profit.

- Delivery and Return: Terms regarding the delivery of leased equipment to the lessee and its return to the lessor at the end of the lease period are outlined.

- Right to Use: The lessee's right to proper and lawful use of the equipment is granted in this clause.

- Repairs and Maintenance: Responsibilities for maintaining and repairing the equipment, along with associated costs, are detailed here, usually assigned to the lessee.

- Equipment Alterations: The lessee's obligation to obtain written consent from the lessor before making any alterations or additions to the equipment is addressed.

- Inspection Rights: The lessor's right to inspect the equipment at their discretion is outlined in this clause.

- Equipment Damage: This clause specifies the lessee's liability for risks, losses, damages, theft, or destruction of the equipment while in their custody.

- Sub-leasing Prohibition: The lessee is typically prohibited from sub-leasing the equipment or selling it to any other party.

- Lessee Default and Remedies: Events constituting lessee default and the lessor's available remedies, such as demanding immediate payment of unpaid rentals or seizing the equipment, are delineated.

- Insurance Requirements: The lessee is required to obtain and maintain a fire insurance policy for the equipment, with premiums to be paid by the lessee and the policy renewed annually.

- Other Charges: This clause specifies which party is responsible for various expenses and charges related to the purchase and installation of the equipment.

Deciding Between Buying And Leasing: Considerations

When a firm intends to acquire a capital asset, it faces a pivotal decision: whether to purchase it outright or opt for a lease agreement. This decision hinges on careful evaluation of both options and their associated costs. The following steps outline the evaluation process:

- Capital Budgeting Decision: Acquiring a specific asset is essentially a capital budgeting decision, requiring thorough analysis through appropriate methods.

- Choice Between Buying and Leasing: Once the decision to acquire the asset is made, the firm must choose between purchasing it or leasing it, based on cost comparisons.

- Outright Purchase: If opting for outright purchase, the firm needs funds equivalent to the asset's cost. If sufficient internal funds are available, outright purchase may be preferred.

- Fundraising: Insufficient internal funds necessitate raising capital through shares or long-term borrowings, each incurring costs to the firm.

- Tax Implications: Purchasing allows the firm to claim depreciation and interest as tax-deductible expenses, reducing the after-tax cost of the buying option.

- Scrap Value Consideration: When purchasing, the asset's scrap value is factored in.

- Leasing Costs: With leasing, regular lease rental payments are made, fully tax-deductible. The after-tax cost of lease rentals is calculated accordingly.

- Uniform Cash Outflow Period: Cash outflows must be compared over identical periods for both alternatives.

- Present Value Comparison: The present value of cash outflows under each alternative is compared, using the after-tax cost of debt as the discount rate.

- Decision Criterion: The alternative with the lower present value of cash outflows is selected.

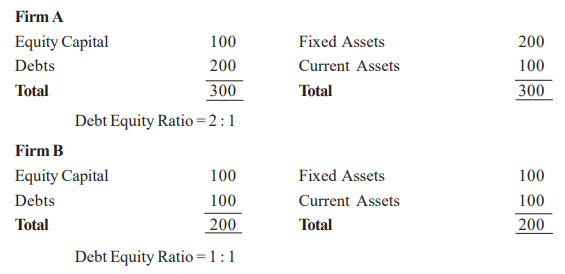

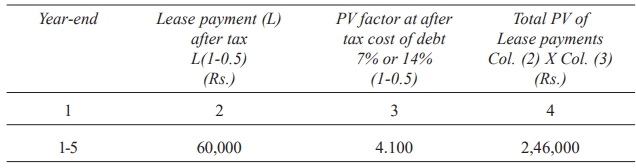

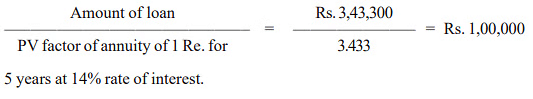

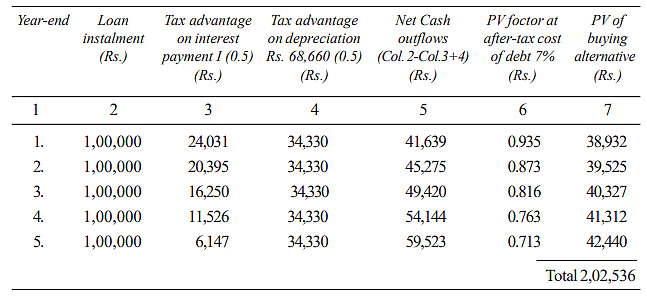

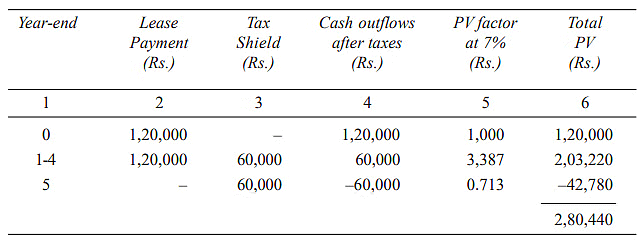

Example: Consider A Limited company weighing options for acquiring a machine over 5 years. It can lease the machine or borrow the required amount at 14% to purchase it. The company falls into the 50% tax bracket.In the leasing scenario, the firm would pay year-end lease rents of Rs.1,20,000 for 5 years, covering maintenance, insurance, and other costs. For machine purchase (costing Rs.3,43,300), a 14% five-year loan with 5 equal annual instalments would be arranged, with straight-line depreciation and no salvage value.

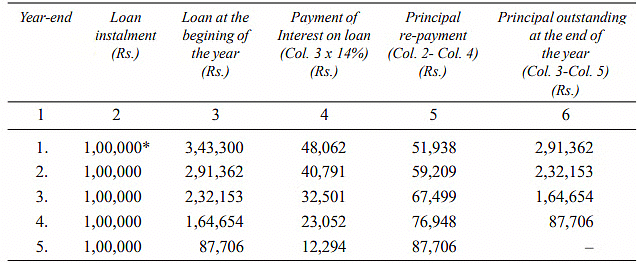

Solution: The analysis is presented in Tables (year-end lease rental payments) and Table (advance lease payments).

Table: Present value of total lease payments

Table: Determination of the interest and Principal Components and Loan Instalment

Table: Present Value of After-Tax Cash Outflows under Buying (Borrowing) Alternative

Table: PV of Cash Outflows under Leasing Alternative, when Lease Rent is Paid in Advance

The operational implication of advance payment for tax purposes is that it qualifies for tax shield only in the year for which payment applies. For instance, Rs.1,20,000 payment at the beginning of the period (t = 0) represents a pre-paid expense and is not deductible for tax purposes until year 1. Similarly, the other 4 payments are not deductible until the following year. The schedule of cash flows under leasing alternative when the payment is made in advance is shown in Table.

Lessor’s Viewpoint

When considering whether to lease out an asset, the lessor must assess whether the potential return from leasing surpasses their weighted average cost of capital. Essentially, the after-tax cash inflows generated by the leased asset should yield a rate of return higher than the cost of capital, ensuring a positive Net Present Value (NPV). The following steps outline the cost-benefit analysis process for the lessor:

- Determine Cash Outflows: Cash outflows encompass the cost of the asset, adjusted for any available tax benefits such as investment allowances or subsidies.

- Determine Cash Inflows:

- Lease revenue

- Minus depreciation

- Equals earnings before taxes

- Minus taxes

- Equals earnings after taxes

- Plus depreciation

- Equals cash inflows after taxes

- Depreciation is added back to earnings after taxes since it's a non-cash expense and doesn't result in a cash outflow.

- Calculate Present Value (PV) of Cash Inflows: Discount cash inflows after taxes by the lessor's appropriate weighted cost of capital to determine the present value of cash inflows.

- Decision: The lessor should opt for leasing the asset if the present value of cash inflows exceeds the present value of cash outflows.

Key Leasing Entities in India

Equipment Leasing Companies:

- These entities primarily focus on leasing equipment and are categorized as Non-Banking Finance Companies (NBFCs). They are regulated by the Reserve Bank of India (RBI) under the Reserve Bank of India Act, 1934. All NBFCs, including equipment leasing companies, are required to obtain a Certificate of Registration from the RBI to operate.

- The minimum net owned funds for registration were set at Rs.25 lakh for existing companies and Rs.2 crore for new companies seeking registration after April 21, 1999. The number of Equipment Leasing Companies increased from 56 as of March 2002 to 58 as of March 2003, although their assets decreased from Rs. 3112 crore to Rs. 2011 crore during the same period.

- These companies also solicit public deposits, which declined from Rs. 668 crore to Rs. 511 crore during the same period. The RBI supervises these companies through on-site inspections, off-site monitoring, market intelligence, and exception reports from statutory auditors.

All India Financial Institutions:

- These institutions primarily provide financial assistance in the form of project finance but also engage in offering non-project finance to industries. Equipment leasing is one of the avenues through which they provide non-project finance.

Commercial Banks:

- Commercial banks are permitted by the RBI to engage in equipment leasing activities and/or invest in shares of equipment leasing companies within specified limits through their subsidiary companies.

- As a result, the involvement of commercial banks in leasing activities is limited to some extent through their subsidiaries.

Understanding Hire Purchase

Hire purchase presents an alternative method for acquiring a capital asset without an immediate upfront payment of its full price. In this arrangement, the goods are leased to the hirer, who can pay the purchase price through instalments and has the option to buy the goods after completing all the payments. Ownership of the asset transfers to the hirer upon the payment of the final instalment. The number and amount of instalments are predetermined at the outset. If the hirer defaults on any payment, the seller retains the right to repossess the asset. Additionally, the hirer can choose to return the asset, treating the paid instalments as hire charges. Until the hirer exercises the purchase option by completing all payments, the seller retains ownership of the asset.

The process of a hire purchase transaction unfolds as follows:

- The seller acquires the asset from the supplier/manufacturer and leases it to the hirer, who typically pays a cash down payment, typically around 20-25% of the asset's cost.

- The remaining balance of the asset's cost, along with interest, is paid in equated monthly instalments (EMIs) over a fixed period, typically ranging from 36 to 48 months.

- In some cases, instead of a cash down payment, the hirer may be required to make a fixed deposit with the seller, with the entire cost recovered through EMIs. The deposited amount, along with interest, is returned upon completion of all instalments.

- Each instalment includes both the cost of the asset and the interest thereon. Interest is usually calculated at a flat rate, with the effective rate applied to the reducing balance of the asset's original cost to determine the interest component of each instalment.

- The hirer has the option to terminate the hire purchase contract by providing due notice to the seller.

A hire purchase arrangement differs from an instalment payment sale in that ownership of the asset transfers to the hirer only upon completion of all instalments, and the hirer has the right to terminate the agreement before full payment.

Comparison with Leasing:

- In a hire purchase, ownership transfers to the hirer upon completion of payments, whereas in a lease, the lessor retains ownership. The hirer can claim depreciation on the asset, whereas in a lease, only the lessor can do so. The hirer is responsible for maintenance costs in hire purchase, whereas in an operating lease, the lessor bears these costs.

- Additionally, the hirer can charge depreciation and other expenses, while the lessor can only claim interest on borrowed capital. Leases cover the full value of the equipment, while hire purchase typically requires a cash down payment.

Splitting Hire Purchase Instalments

- To illustrate how hire purchase instalments are divided between interest and principal repayment, consider the following example:

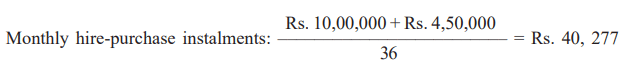

Example: Nidhi Finance offers Synthetic Chemicals an equipment costing Rs.10 lakhs on hire purchase terms with a flat interest rate of 15% and a 36-month period.

Total interest burden: Rs. 10,00,000 * 0.15 * 3 = Rs. 4,50,000

The annual hire-purchase instalment would simply be:

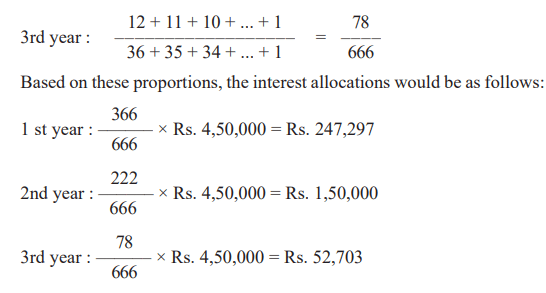

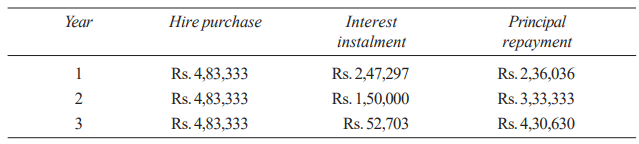

(Rs. 10,00,000 + Rs. 4,50,000)/3 = Rs. 4,83,333

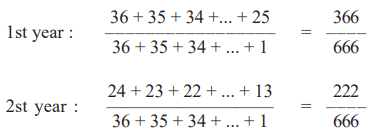

To determine the split of the hire-purchase instalments between interest and principal repayments, let us first allocate the interest burden of Rs. 4,50,000 over the three years as per the sum of the years digit method. According to this method, the proportions of interest allocated to the three years would be as follows:

Given these interest allocations, the annual hire-purchase instalments would be split as follows:

Given these interest allocations, the annual hire-purchase instalments would be split as follows:

Choice Between Leasing And Hire Purchase

Before delving into the process of selecting between leasing and hire purchase options, it's important to highlight the differences between them from the perspective of the lessee (hirer):

Leasing:

- Depreciation and investment allowance cannot be claimed by the lessee.

- The entire lease rental is considered a tax-deductible expense.

- As the lessee is not the owner of the asset, they do not benefit from the salvage value.

Hire Purchase:

- The hirer can claim depreciation and investment allowance.

- Only the interest component of the hire purchase instalment is tax-deductible.

- The hirer, as the owner of the asset, enjoys the salvage value.

FAQs on Leasing, Hire Purchase, and Venture Capital: Leasing and Hire Purchase - Management Optional Notes for UPSC

| 1. What is leasing and what are its main features? |  |

| 2. What are the benefits of leasing? |  |

| 3. What are the types of leases? |  |

| 4. What are the main clauses in a lease agreement? |  |

| 5. How do you decide between buying and leasing? |  |