Leasing, Hire Purchase, and Venture Capital: Venture Capital | Management Optional Notes for UPSC PDF Download

Introduction

- Securing timely and adequate finance is a crucial prerequisite for establishing an industrial enterprise. This need becomes more pronounced for entrepreneurs who are new and relatively unknown in the industry, yet possess innovative ideas for developing new products. However, lacking sufficient capital of their own poses a significant challenge in transforming these ideas into successful commercial ventures. Financing such ventures is inherently risky, as these innovative ideas have not been tested on a commercial scale.

- Nevertheless, if successful, they hold the potential for substantial returns. Traditional sources of finance often prove inaccessible to entrepreneurs in such situations due to limited availability of funds from personal sources. In such scenarios, Venture Capitalists play a pivotal role by offering risk-bearing capital, commonly known as Venture Capital.

- Venture Capital can be broadly defined as long-term investment in businesses with significant growth potential and financial returns. Typically provided in the form of equity, alongside conditional and conventional loans, Venture Capitalists not only act as financiers but also assume risks. Their returns depend on the success achieved by the invested enterprise.

- The defining characteristic of Venture Capital lies in its ability to meet the needs of businesses characterized by high probabilities of loss due to uncertainties inherent in the venture, while also offering the prospect of higher-than-normal returns. Venture Capitalists invest in ventures where uncertainties have yet to be quantified into risks, hence the term "high risk, high return capital."

Distinguishing Features

Venture Capital stands apart from other forms of finance due to its unique characteristics:

- Predominantly provided in the form of equity, Venture Capital fills the gap left by the inability of investee companies to independently float equity shares or secure funds from other sources in the initial stages, owing to the high risk associated with the venture.

- While participating in equity, Venture Capitalists do not seek to take ownership of the enterprise. Instead, they provide guidance and support to the management, leveraging their skills, experience, and expertise to nurture the new enterprise until it reaches profitability.

- Venture Capitalists typically aim to divest their shares once the company becomes profitable, reinvesting the proceeds into new ventures.

- Capital gains from the sale of equity holdings, rather than regular interest returns, constitute the primary source of earnings for Venture Capitalists.

- Venture Capitalists may also provide conditional loans, entitling them to royalties on sales based on the anticipated profitability of the business. Such loans may be partially or fully waived if the business fails to succeed.

Stages Of Venture Capital Financing

Venture capital funding is provided to ventures at various stages of their life cycle to meet specific requirements. These stages are broadly categorized into two: Early Stage Financing and Later Stage Financing, each with further subdivisions. Let's explore them individually.

Early Stage Financing comprises:

- Seed Capital Stage: This initial stage focuses on research and development, where concepts, ideas, or innovative processes are tested on a laboratory scale. Typically, these ideas originate from the Research and Development departments of companies or scientific research institutions. Venture capital funds invest in this high-risk stage, often providing low-interest personal loans to innovators.

- Start-up Stage: Venture capital finance is extended at the start-up phase of projects selected for commercial production. Start-ups involve launching new activities derived from the Research and Development stage or technology transfer. The product or service must demonstrate effective demand and market potential. Venture capital funds evaluate the project's viability, assessing the entrepreneur's managerial ability and commitment. They may offer managerial expertise and supervision to ensure successful implementation, bearing a high degree of risk.

- Second Round Financing: Once a product is launched in the market, further funding may be required as the business is not yet profitable, making it challenging to attract new investors. Venture capital funds provide finance at this stage, which is relatively less risky than the earlier stages. Financing may include debt instruments, providing a regular income stream.

Later Stage Financing addresses the additional finance needs of established businesses, which cannot be met through public share offerings. Venture capital funds prefer later stage financing for shorter-term income and potential capital gains. This may take several forms:

- Expansion Finance: Enterprises may require funding to expand production capacity after gaining market share and anticipating demand growth. Expansion can occur organically or through acquisition, with venture capitalists holding varying equity stakes.

- Replacement Finance: Venture capitalists may purchase shares from existing shareholders looking to exit the company. This strategy is common when investors seek to exit, and the company does not intend to list shares publicly.

- Turnaround Financing: When a company operating at a loss seeks to revitalize its operations through modernization, product adjustments, or aggressive marketing, additional capital infusion is necessary. Venture capitalists provide turnaround financing, often continuing their support from the early stages due to the higher risk involved.

- Buyout Deals: Venture capitalists may finance management buyout deals, where active shareholders purchase shares from passive shareholders to take control of the organization's operations. Such financing is known as buyout financing, enabling active shareholders to benefit fully from their managerial efforts.

Each stage of venture capital financing presents unique opportunities and risks, requiring careful evaluation and strategic support from venture capitalists to foster success.

Modes of Financing

Venture capital funds provide financing to venture capital undertakings through various modes or instruments, traditionally categorized into (i) equity and (ii) debt instruments. Often, investments are made using a combination of both equity and debt. The selection of the financing instrument depends on factors such as the stage of financing, the level of risk, and the nature of the required finance. Let's explore these instruments in detail:

Equity Instruments: Equity instruments represent ownership and confer ownership rights upon the investor or venture capital fund. These include:

- Ordinary Shares: These shares do not guarantee dividends. Non-voting equity shares may also be issued, offering slightly higher dividends but no voting rights. Variants such as deferred equity shares postpone ordinary share rights until a specified period or event. Preferred ordinary shares provide additional fixed income.

- Preference Shares: These shares offer a guaranteed dividend at a specified rate. They may be cumulative or non-cumulative, with participating preference shares granting additional dividends after equity shareholder payments. Convertible preference shares can be exchanged for equity shares after a specified period.

Debt Instruments: Venture capital funds often prefer debt instruments to ensure returns in the early years when equity shares may not yield returns. Debt instruments come in various types:

- Conditional Loans: These loans have no specified interest rate or payment period. Venture capital funds recover their funds, along with returns, by sharing in the venture's sales for a predetermined period. The recovery depends on the venture's success, making these loans "conditional."

- Convertible Loans: Loans may be provided with the option to convert into equity at a later stage, either at the lender's discretion or as agreed upon.

- Conventional Loans: These are standard term loans with a specified interest rate and repayable in installments over several years.

Exit Strategies

Once a venture capital company or fund has financed a venture capital undertaking and nurtured it to success, it does not intend to maintain its investment indefinitely. As the venture capital undertaking commences commercial operations and becomes profitable, the venture capitalist seeks to divest its investments in the company promptly. The primary objective of the venture capitalist is to realize appreciation in the value of the shares held and then reinvest in another venture capital undertaking. This process is known as the exit route. There are several alternatives available to the venture capitalist to exit from an investee company, as outlined below:

- Initial Public Offering (IPO): When the shares of the investee company are listed on the stock exchange(s) and are trading at a premium, the venture capitalist offers its holdings for public sale through an IPO.

- Share Buyback by the Promoters: According to the agreement with the investee company, the promoters are given the first opportunity to repurchase the shares held by the venture capitalist at the prevailing market price. If they decline, the venture capitalist explores other exit options.

- Sale of Enterprise to Another Company: The venture capitalist can recover its investments by selling its holdings to an outside party interested in acquiring the entire enterprise from the entrepreneur.

- Sale to Another Venture Capitalist: The venture capitalist can sell its equity holdings in the enterprise to another venture capital company interested in acquiring a stake. This sale may occur either as a distressed sale to realize investments and exit the enterprise or as a means to bring in a new venture capitalist willing to provide further funding.

- Self-Liquidation Process: If the venture capitalist provided debt financing, the process is self-liquidating, with the principal amount and interest realized in installments over a specified period.

- Liquidation of the Investee Company: If the investee company fails to achieve profitability and sustains losses, the venture capitalist seeks to recover its investment through negotiation or settlement with the entrepreneur. If unsuccessful, the venture capitalist may resort to winding up the enterprise through legal means.

Regulatory Framework

Venture capital funds and venture capital companies in India were initially regulated by guidelines issued by the Controller of Capital Issues, Government of India, in 1988. However, in 1995, amendments to the Securities and Exchange Board of India (SEBI) Act empowered SEBI to register and regulate venture capital funds in India. Subsequently, in December 1996, SEBI issued regulations to govern these funds, replacing the previous government guidelines. The amended SEBI guidelines, enacted in 2000, are summarized as follows:

Definitions:

- Venture Capital Fund: A fund, established as a trust or company, including a body corporate, registered with SEBI, having a dedicated pool of capital raised in a specified manner, and investing in venture capital undertakings in accordance with these regulations.

- Venture Capital Undertaking: A domestic company whose shares are not listed on a recognized Indian stock exchange, engaged in services, production, or manufacture, excluding activities or sectors specified in the negative list by the Board.

Registration of Venture Capital Funds:

- SEBI grants certification of registration to venture capital funds upon application, subject to various conditions ensuring the integrity and suitability of the applicant.

Resources for Venture Capital Funds:

- Venture capital funds may raise funds from any investor, Indian or foreign, through the issue of units, with a minimum investment of Rs. 5 lakh per investor.

Investment Restrictions:

- Venture capital funds must adhere to investment restrictions, including disclosure of investment strategy, limitations on investment concentration, and prohibitions on investments in associated companies.

Prohibition on Listing:

- Securities or units issued by venture capital funds cannot be listed on any recognized stock exchange until three years from the date of issuance.

Private Placement of Securities/Units:

- Venture capital funds may raise funds for investment in venture capital undertakings only through private placement of securities/units, subject to SEBI regulations.

Winding up of Venture Capital Fund Scheme:

- Venture capital fund schemes may be wound up under various circumstances, including expiration of the scheme period, investor resolution, or SEBI direction in the interest of investors.

Powers of the Securities and Exchange Board of India:

- SEBI has extensive powers, including the appointment of inspecting/investigating officers, suspension or cancellation of certificates for non-compliance or fraudulent activities, and other regulatory measures to ensure compliance with regulations.

Regulations For Foreign Venture Capital Investors By Sebi, 2000

Foreign venture capital investors (FVCIs) can invest in venture capital funds or venture capital undertakings in India, and to oversee such investments, SEBI introduced regulations in 2000. The key features of these regulations are outlined below:

Registration:

- To be registered with SEBI, a FVCI must meet certain eligibility criteria and pay an application fee of US $1000:

- Demonstrate a track record, professional competence, financial stability, and reputation for fairness and integrity.

- Obtain approval from the Reserve Bank of India (RBI) for investing in India.

- Be incorporated outside India as an investment company, trust, partnership, pension or mutual fund, charitable institution, or any other entity.

- Function as an asset/investment management company, investment manager, or other investment vehicle outside India.

- Be authorized to invest in venture capital funds or engage in venture capital activities.

- Be regulated by a foreign regulatory authority or provide a certificate from its bankers regarding the promoters' track record if not regulated.

- Be deemed a fit and proper entity.

Upon receipt of the registration fee of US $10,000, SEBI will grant the Certificate of Registration under the following conditions:

- Appoint a domestic custodian for securities custody.

- Enter into an agreement with a bank to operate a special non-resident rupee/foreign currency account.

Investment Criteria:

FVCIs must disclose their investment strategy to SEBI and adhere to the investment norms prescribed by SEBI for domestic venture capital funds when investing in venture capital undertakings. While they can invest their total committed funds in one venture capital fund, specific norms apply to investments in venture capital undertakings.

Powers of SEBI:

SEBI possesses several powers concerning FVCIs:

- Authority to conduct inspections/investigations into the conduct and affairs of FVCIs.

- Ability to issue directives in the interest of the capital market and investors.

- Authority to suspend or revoke registration.

- Capability to request any necessary information.

Tax Exemptions

- In 1995, Section 10 of the Income Tax Act was amended to introduce Clause 23F, granting exemptions for income derived from dividends or long-term capital gains of venture capital funds/companies. This exemption applied to investments in equity shares of venture capital undertakings, subject to specific conditions.

- Furthermore, starting from the financial year 2000-01, under Clause 23FB, complete income exemption was extended to venture capital funds. This exemption encompassed all income as it passes through dividends to investors. Consequently, since the assessment year 2001-02, all income of venture capital funds/companies has been exempted from taxation. This exemption persists even after the shares of venture capital undertakings are listed on recognized stock exchanges. However, income distributed by venture capital funds is taxed in the hands of investors at their applicable rates. Additionally, the services sector has been included in the scope of venture capital functions.

Venture Capital Funds In India

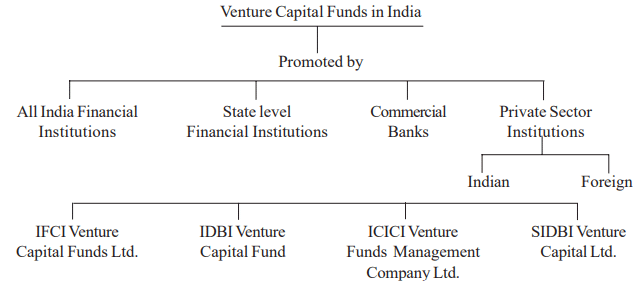

- Venture capital funds are relatively recent developments in India. Over the last two to three decades, with the emergence of new technological advancements and growth in entrepreneurship, numerous venture capital funds have been established in the country. These funds have been promoted by institutions at the national and state levels, banks, and private sector individuals.

- In 2003, there were 43 domestic venture capital funds and 6 foreign capital funds registered with SEBI.

- Among commercial banks, ANZ Grindlays Bank established the first private sector venture capital fund named India Investment Fund, with an initial capital of Rs. 10 crore subscribed by Non-Resident Indians. Indian banks like the subsidiaries of State Bank of India and Canara Bank have also launched venture capital funds.

- Gujarat Venture Capital Finance Ltd., established by Gujarat Industrial and Investment Corporation Ltd. in collaboration with the World Bank, is a pioneering venture capital firm in India. Its investors include the World Bank, Gujarat Industrial and Investment Corporation, Industrial Development Bank of India, CDC (UK), SIDBI, and other private and public sector organizations. Currently, it manages four funds.

- IL&FS Venture Corporation Ltd. is a fund management company, a subsidiary of Infrastructure Leasing and Financial Services Ltd., jointly set up with Bank of India and multilateral development agencies. Formerly known as Credit Capital Venture Fund (India) Ltd., it now manages seven domestic venture capital funds.

- IFB Venture Capital Finance Ltd., promoted by IFB Industries Ltd. in collaboration with IDBI and ICICI, is also active in the venture capital domain.

- IFCI Venture Capital Funds Ltd. (IVCF), established by IFCI Ltd., focuses on providing direct equity to companies and managing venture capital funds. It transitioned from providing soft loans to promoting innovative projects and managing venture capital. The company concentrates solely on venture capital management.

- IDBI has formed a Venture Capital Fund to encourage the commercial application of indigenous or imported technologies and the development of innovative products and services. The fund prioritizes ventures with high growth prospects, potential for capital appreciation, and a clear exit route within 3 to 5 years.

- ICICI Venture Funds Management Company Ltd., a wholly owned subsidiary of ICICI Bank Ltd., supports small and medium industries led by technocrat entrepreneurs through project loans, direct equity subscriptions, and conditional loans. The company manages eleven funds with investments in both Indian and global companies.

SIDBI Venture Capital Limited, a subsidiary of Small Industries Development Bank of India (SIDBI), specializes in setting up and managing venture capital funds in the small-scale sector. It manages the National Venture Fund for Software and Information Technology Industry (NFSIT), which focuses on investments in the IT sector, software industry, and related businesses. The fund has raised a committed corpus of Rs. 100 crore, contributed by SIDBI, IDBI, and the Ministry of Communications and Information Technology, Government of India.

FAQs on Leasing, Hire Purchase, and Venture Capital: Venture Capital - Management Optional Notes for UPSC

| 1. What are the stages of venture capital financing? |  |

| 2. What are the modes of financing in venture capital? |  |

| 3. What are exit strategies in venture capital? |  |

| 4. What is the regulatory framework for venture capital in India? |  |

| 5. What tax exemptions are available for venture capital funds in India? |  |