Mergers and Acquisitions | Management Optional Notes for UPSC PDF Download

Introduction

- Definition: Mergers and acquisitions are common strategies used by businesses to grow and increase their value.

- Decade Focus: In the 1980s, there was a lot of attention on mergers and acquisitions. In the 1990s, businesses began to approach these activities more strategically, considering ethical implications.

- Merger Defined: A merger is when two or more companies join together to form one entity, aiming to increase profits and value for stakeholders.

- Purpose: The main goal of a merger is to scale up operations, usually between companies with similar businesses.

- Acquisition: An acquisition occurs when a larger company buys a smaller one, either with consent or by acquiring a large amount of its shares.

- Example: United Breweries acquired Shaw Wallaces liquor business.

Merger

- A merger happens when two companies decide to combine their operations on an equal basis.

- It's like blending two companies into one to increase profits and create more value for stakeholders.

- Mergers usually involve companies in similar businesses aiming to grow together.

- The goal is to scale up operations and become more competitive in the market.

Acquisition:

- Acquisition means a big company buys a smaller one, often in the same line of business.

- It can be a friendly agreement or a forced takeover by buying a large amount of the smaller company's shares.

- For example, United Breweries acquired Shaw Wallace's liquor business, which means United Breweries bought Shaw Wallace's alcohol business.

Types of Mergers

- Definition: A conglomerate merger happens when one company buys a different kind of business.

- Explanation: The acquiring company adds the purchased company to its group but usually doesn't change much internally.

- Impact: Changes within the purchased company are minimal, and it remains relatively independent.

- Potential Issues: Sometimes, the acquiring company might send its own team to manage the purchased company, causing conflicts among senior executives and leading to higher employee turnover.

2. Vertical Mergers

- Definition: A vertical merger occurs when a company buys one of its suppliers or customers.

- Explanation: Interaction between the two companies mainly happens at the corporate level.

- Impact: The acquired company may lose some autonomy and see its executives demoted, leading to higher turnover.

- Potential Issues: Executives of the acquired company may feel inferior or lose social standing, impacting morale.

3. Horizontal Mergers

- Definition: Horizontal mergers involve two companies in the same or similar business.

- Explanation: The aim is to increase revenue by offering more products to existing customers.

- Example: When two soft drink companies merge, they become competitors in the same market.

4. Market Extension Merger

- Definition: This type of merger involves companies selling similar products in different markets.

- Example: A multinational software company buying a local software developer.

5. Product-Extension Merger

- Definition: Companies manufacturing different but related products merge.

- Example: A laptop manufacturer acquiring a company making portable hard drives.

- Explanation: Both products fall under the category of computers.

6. Concentric Mergers

- Definition: These mergers occur between companies with similar technologies or serving the same customers.

- Explanation: Though they offer different products, these may complement each other.

- Example: Companies in the same industry but with different product lines may merge.

Reasons for Mergers

- Growth Strategy:

- Key Point: Companies merge to grow externally instead of relying solely on internal growth.

- Benefits: This can help diversify products, expand existing lines, and increase market share.

- Economies of Scale:

- Key Point: Merging can lead to cost savings through economies of scale.

- Explanation: Larger companies may enjoy lower production costs per unit, for example.

- Tax Advantages:

- Key Point: Mergers may provide tax benefits.

- Example: Consolidating operations can lead to tax efficiencies.

- Considerations for Mergers:

- Compatibility:

- Key Point: Companies should assess compatibility before merging.

- Explanation: It's important to ensure the companies' goals, product mix, and core beliefs align.

- Strategic Planning:

- Key Point: Managers must carefully plan mergers.

- Role of Management Accountants: They play a crucial role in evaluating potential mergers and ensuring strategic alignment.

Mergers and acquisitions strategies:

Understanding the Acquisition Process

Acquisition refers to the process wherein one company purchases a controlling, 100 percent interest in another company with the aim of incorporating the acquired company as a subsidiary within its portfolio. The acquisition process is delineated into five distinct stages according to scholarly analysis.

Stage One: Setting Goals and Strategies

- The acquiring company decides what it wants to achieve and how it plans to do it, including considering other options besides buying another company.

- The company looks at how the business environment is changing and how it can adapt to those changes. Management accountants play a big role in making decisions about the company's strategy.

Stage Two: Finding Potential Targets

- The company looks for other businesses it might want to buy.

- Management accountants help by looking at financial information to find companies that might be a good fit for acquisition.

- They use computer models and financial data to predict how well a company might perform if it's bought.

- They also consider things like the target company's growth potential, market share, technology, and how well it might work with the acquiring company.

Stage Three: Evaluating Forecasts

- The company looks at the financial predictions of the target company.

- Management accountants check the forecasts carefully, looking at things like assumptions, risks, and how realistic the predictions are.

- They analyze past financial statements to see if the predictions match up with what has happened before.

- They also look at things like cash flow, accounts receivable, and inventory to understand the financial health of the target company.

Stage Four: Financial Analysis

- The company analyzes the financial projections to see if the acquisition is a good investment compared to other options.

- Management accountants calculate things like the internal rate of return to see if the acquisition makes financial sense.

Stage Five: Management Review and Decision

- Top management reviews the reports and analysis done by the management accountants.

- They use this information to decide how much the company should pay for the acquisition and whether it's a good decision financially.

- They consider things like the company's future earnings and how the acquisition fits with its long-term goals.

Stage Six: Negotiating the Acquisition

- Once a decision is made to acquire a company, negotiations begin.

- Both companies try to agree on a fair price for the acquisition, considering ethical principles.

- The people involved in the negotiations are responsible for making sure the acquisition benefits both companies in the long run.

The Reasons behind Mergers and Acquisitions

There are several reasons for companies and businesses for mergers and acquisitions:

Reasons for Mergers and Acquisitions:

- Companies merge or acquire other businesses to enter new markets, expand product lines, and increase distribution.

- They aim to enhance shareholder value by reducing costs through combining departments, operations, and reducing the workforce.

- Mergers and acquisitions can also help in changing corporate identity and spreading business risks.

- They seek operational synergies where the combined entity becomes more valuable than its parts.

- Some mergers and acquisitions aim for market dominance and achieving economies of scale.

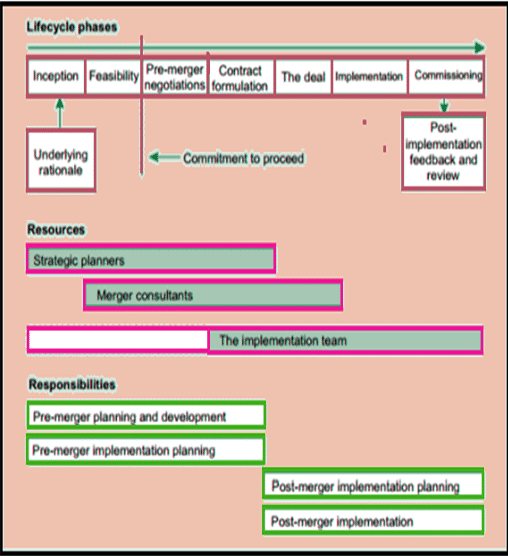

Life Cycle of Mergers and Acquisitions:

- Inception Phase: Senior managers initiate the process and consider the feasibility of the merger or acquisition.

- Feasibility Stage: Financial and logistical aspects are analyzed, considering factors like financial position, synergy generation, and timeframes.

- Commitment Phase: The organization decides to proceed and allocates resources accordingly.

- Pre-Merger Phase: Negotiations between senior managers of both companies begin, with the involvement of external consultants.

- Merger Contract: A contract is formed outlining the rights, duties, and obligations of both parties.

- Implementation: The mechanics of the merger take place, with a focus on making the transition smooth and effective.

- The life cycle can be complex, so it's important to break it down into manageable phases and maintain control and oversight throughout. Managers establish reviews and reporting procedures to keep the merger on track and focused.

life cycle of mergers and acquisitions (Alexander, 2010)

Mergers and Acquisitions in India

History of Mergers and Acquisitions in India

- Mergers and acquisitions gained importance in India after the economic reforms of 1991.

- Initially, the process was slow due to regulatory hurdles like the MRTP Act, 1969.

- However, after 1988, Indian companies increasingly pursued mergers and acquisitions to expand horizontally and vertically.

- Sectors like pharmaceuticals, IT, telecommunications, and steel saw significant merger and acquisition activity.

Drivers of Mergers and Acquisitions in India

- Access to Developed Markets: Indian companies acquire firms abroad to enter developed markets.

- Technology Transfer: Acquiring foreign companies gives access to advanced technologies.

- Hedging Country Risks: Mergers and acquisitions help reduce reliance on Indian markets and mitigate local business cycles.

Major Mergers and Acquisitions Deals in India

- Tata Steel acquired Corus Group for $12.2 billion in 2007.

- Vodafone bought 67% of Hutch-Essar for $11.1 billion in 2007.

- Hindalco Industries purchased Novelis Inc for $6 billion in 2007.

- Ranbaxy acquired Daiichi Sankyo for $4.5 billion in 2008.

- ONGC purchased Imperial Energy Plc for $2.8 billion in 2009.

Recent Mergers and Acquisitions Trends in India

- In 2014, Indian companies were involved in 1,177 merger and acquisition deals valued at about $50 billion, the highest in a decade.

- Significant deals include Flipkart acquiring Myntra, RIL taking over Network 18, and TCS merging with CMC.

Challenges to Mergers and Acquisitions in India

- Regulatory Ambiguity: Laws and regulations regarding mergers and acquisitions are still evolving.

- Legal Developments: New laws like the Competition Act, 2002, and the Companies Act, 2013, pose challenges in deal valuations and processes.

- Shareholder Involvement: Institutional investors now play an active role in observing investee companies.

Tactics of Merger and Acquisition

- Internal capabilities: A business development team evaluates and integrates target companies.

- Strategic goals and alignment: Assessing if strategic and financial goals can be achieved faster through organic growth or acquisition.

- Selection criteria: Based on post-acquisition market share, cost reduction, and synergy opportunities, with flexibility across industries.

- Target selection: Quick and transparent process to identify suitable companies for acquisition.

Importance of Merger and Acquisition

- Allows companies to expand rapidly by combining strengths.

- Drives weaker companies out of the market.

- Vital for a strong economy and provides returns to owners and investors.

- A key growth mechanism for companies of all sizes and industries.

Benefits of Merger and Acquisition:

- Cost effectiveness through economies of scale.

- Increased revenue and market share.

- Potential for tax gains.

- Often leads to increased shareholder value.

Drawbacks of Merger and Acquisition

- Culture clash due to different company cultures.

- Leadership issues and dissatisfaction.

- Diseconomies of scale.

- Changes in consumer perception.

- Mergers and acquisitions can be complex and may not always lead to the expected outcomes.

Summary

- Mergers and acquisitions involve buying, selling, and combining companies to utilize strengths and increase market value.

- Companies merge or acquire others to survive and thrive in industries like finance, pharmaceuticals, telecommunications, and IT.

- The idea is that combined companies are more valuable than separate entities, leading to increased profitability and market share.

FAQs on Mergers and Acquisitions - Management Optional Notes for UPSC

| 1. What are the main reasons behind mergers and acquisitions? |  |

| 2. How is the merger and acquisition trend in India? |  |

| 3. What are some common tactics used in mergers and acquisitions? |  |

| 4. Why are mergers and acquisitions important? |  |

| 5. What are some drawbacks of mergers and acquisitions? |  |