Methods of Costing: Activity Based Costing | Commerce & Accountancy Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Importance of Activity Based Costing (ABC) |

|

| Merits and Demerits of Activity Based Costing (ABC) |

|

| Process of Activity Based Costing (ABC) |

|

| Examples |

|

| Summary |

|

Introduction

Activity-Based Costing (ABC) is a cost accounting system that follows a two-step process: costs are initially linked to activities, and then these costs are assigned to specific products. This system operates on the premise that activities bear the responsibility for the incurred costs. In this approach, costs are allocated to products according to each product's utilization of various activities. The Chartered Institute of Management Accountants, UK (CIMA), defines ABC as "an method for costing and monitoring activities, involving the tracking of resource consumption and costing final outputs. Resources are allocated to activities, and activities are then linked to cost objects based on consumption estimates. These estimates utilize cost drivers to associate activity costs with outputs."

The key points from the definition include:

- ABC is a strategic approach to cost management and activity monitoring within a process.

- It involves tracking the consumption of resources and subsequently determining the costs of the resulting outputs.

- The process begins with allocating resources to activities and then linking activities to cost objects based on estimated consumption.

- Identified cost drivers are used to link activity costs to specific outputs.

Another interpretation of Activity-Based Costing describes it as a two-step costing method for assigning indirect costs and overheads to products and services. It addresses the challenge of allocating certain costs to products or services by establishing the connection between overheads and the manufactured products, assigning indirect costs accordingly. Compared to traditional costing systems, this method is less arbitrary.

Features of Activity Based Costing (ABC)

Characteristics of Activity-Based Costing (ABC) include:

- ABC represents a contemporary method for assigning indirect costs, where costs attributed to each activity represent the resources consumed by that activity.

- Unlike traditional costing that confines itself to assigning indirect costs to departments, ABC goes a step further to pinpoint individual activities as the smallest unit for indirect cost allocation.

- Resources are allocated to each activity and subsequently to cost objects based on their consumption.

- ABC identifies activities using activity cost drivers, leading to a more precise cost calculation.

- This method allows for the straightforward identification of costs based on activity cost drivers.

- ABC is particularly suitable when there are multiple products in the manufacturing line, and overhead costs contribute significantly to the total cost.

- The approach establishes a direct cause-and-effect relationship with various resources.

Development of Activity Based Costing

- The limitations of the traditional costing system prompted the development of Activity-Based Costing (ABC). The traditional method categorizes costs as fixed and variable, but as businesses expand, costs become more intricate. In such cases, the traditional approach may not be suitable for making complex decisions related to production and developing product strategies.

- Traditional methods are adept at facilitating financial reporting and primarily focus on calculating overhead rates for valuing stocks. However, it became evident that the traditional absorption costing approach struggled to align with scenarios involving multiple products or product diversification. The need for accurate product cost ascertainment became apparent due to growing market competition, both domestically and internationally.

- In the 1980s, Kaplan and Bruns first conceptualized ABC as a modern alternative to absorption costing, providing a more effective way to define product costs and profitability. ABC emerged as a superior method for offering valuable information to make informed and strategic decisions.

Activity Based Costing Vs Traditional Costing System

The main difference is presented in Figure no.8.1.

Figure 8.1 Differences between Activity Based Costing and Traditional Costing Other differences are compiled as follows:

Other differences are compiled as follows:

Importance of Activity Based Costing (ABC)

- Decision-making is a crucial managerial function, and while traditional costing systems may have inaccuracies in costing due to allocation and absorption methods, ABC enhances the decision-making process by providing accurate and pertinent product cost information.

- ABC employs multiple transaction-based cost drivers rather than relying solely on product-based drivers. This approach aids in the calculation of costs for both new and existing products.

- ABC extends its scope beyond factory premises, encompassing various activities, processes, and managerial functions to calculate overheads more comprehensively.

- A key focus of ABC is on establishing a cause-and-effect relationship in costing, enhancing precision and reliability in cost determination. This approach attributes costs to products based on the activities they consume.

- ABC makes costs associated with activities more visible and evident. It can pinpoint actions that do not contribute value to the product, allowing managers to exercise better control over activities and manage fixed overhead costs generated by those activities.

Objectives of Activity Based Costing (ABC)

Some objectives of ABC are listed as under:

- To recognise several activities in the process of production, including the activities that add value.

- To eliminate the non value-adding activities.

- To put emphasis on the high-cost activities

- To incorporate activities based on distribution overheads.

- To help in decision-making process in the identification of a suitable price of product and services.

- To ensure accurate and precise cost determination of products and services.

- To find options to improve the process and reduction of costs.

Merits and Demerits of Activity Based Costing (ABC)

Merits

- Addresses Cross Subsidization Issues: Traditional costing systems often lead to over and under-costing issues. ABC resolves this problem by introducing activities between costs and products, making the relationship more explicit.

- Handles Complex Processes: With the growth in industries and the complexity of various processes, ABC effectively deals with the intricate nature of costing that arises due to interconnected production processes.

- Accommodates Product Customizations: In contemporary production, variations in sizes and designs are common. ABC facilitates refined costing processes to appropriately price products, especially when production involves multiple variations.

- Identifies Cost Saving Opportunities: ABC makes it easier to identify opportunities for cost savings by considering costs across various areas, including processes, products, managerial responsibilities, customers, and departments. It minimizes issues related to estimation errors.

- Long-term Cost Management: ABC emphasizes managing activities rather than costs directly. By addressing the activities (cost drivers) that influence costs, it aims to achieve long-term cost management.

Demerits

- Complex System: ABC, involving various cost pools and drivers, is considered more complex than traditional product costing. The selection of drivers, handling common costs, and establishing driver rates contribute to the system's complexity.

- Requires In-Depth Knowledge: The application of ABC demands individuals with significant experience in the specific products and processes of the industry. This knowledge is crucial for effective implementation.

- Relies on a Sophisticated System: ABC relies on a certain level of information technology within an organization. Small or new organizations with inadequate information technology systems may not fully leverage ABC.

- Time-Consuming: The ABC process is time-consuming, involving multiple steps and substantial groundwork. While larger manufacturing firms may find it beneficial, smaller organizations may face challenges due to the required time and effort.

- Increase in Indirect Costs: The integration of technology in ABC can lead to a significant increase in indirect costs.

Process of Activity Based Costing (ABC)

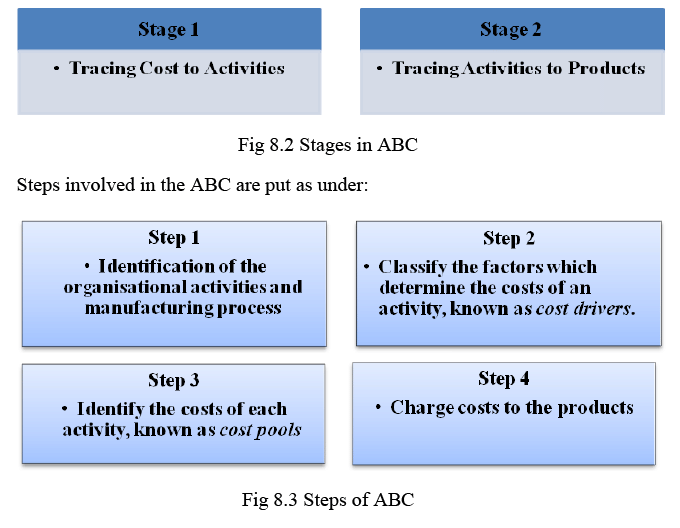

Stages in ABC

Stages of ABC costing are mentioned as follows:

- Identification of Organizational Activities and Manufacturing Processes: In the context of ABC, a crucial step involves studying organizational activities and manufacturing processes to ascertain the number of stages involved. This facilitates the identification of all activities contributing to the production of a product or service. ABC operates on the principle that activities incur costs.

- Classification of Factors Determining Activity Costs (Cost Drivers): Cost drivers, defined by CIMA as factors causing a change in the cost of an activity, are critical in ABC. For instance, the quality of parts received can influence the resources required for an activity. In contrast to traditional product costing, ABC aligns cost drivers more closely with resource consumption and activities. ABC emphasizes the interconnectedness between activities and their associated cost drivers.

- Identification of Costs for Each Activity (Cost Pools): The concept of cost pools in ABC resembles the traditional notion of cost centers. CIMA defines a cost pool as "the point of focus for the costs relating to a particular activity in an activity-based costing system." It represents the sum of cost elements allocated to an activity. Cost pools serve as the focal point for assigning total costs to an activity.

- Allocation of Costs to Products: ABC is recognized as a method for tracing and allocating costs, moving from resources to activities and subsequently from activities to specific products. The objective is to allocate indirect costs to products and services systematically. ABC ensures that costs are appropriately charged to products in a detailed and accurate manner.

Examples

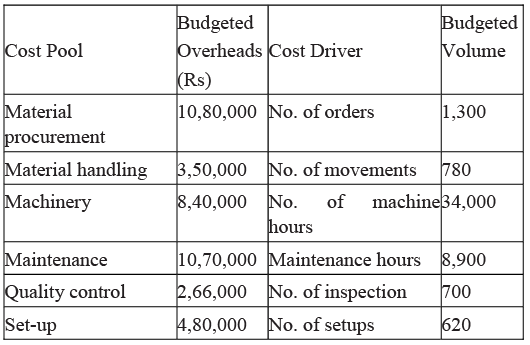

Example 1: The budgeted overheads and cost driver volumes of DSS Ltd are as follows. The company produces 2,450 components of A-1. Its material cost was Rs. 1,50,000and the labour cost Rs. 2,55,000.

The company produces 2,450 components of A-1. Its material cost was Rs. 1,50,000and the labour cost Rs. 2,55,000.

The usage activities are:

Material orders are 29. Maintenance hours are 680. Material handling is 21, Quality control inspection are 31, setups are 22, and machine hours are 1,950

Calculate cost driver rates and ascertain the cost of a batch of components using ABC.

Ans: Computation of Cost Driver Rates Computation of Batch Cost of 2600 units of A- 1

Computation of Batch Cost of 2600 units of A- 1 Grouping of Activities

Grouping of Activities

For a manufacturing company, activities are classified as follows: Cost Drivers

Cost Drivers

Various cost drivers at different levels, as mentioned above, are as follows:

Example 2: Suraj Enterprise has decided to use Activity based costing (ABC) method based on the following activities:

- All factory overhead costs to products are based on 300% of direct labour cost.

- Compare the total annual costs of the product using both the traditional and ABC system.

Ans:

The total cost of the product under ABC is Rs. 24,620, whereas under the traditional cost system, it is Rs. 42,000.

Few other Terms

Activity Based Costing (ABC) and Activity Based Management(ABM)

Similarities and differences between ABC and ABM are presented as follows:

Similarities

- Both ABC and ABM help in managing business activities and improving the performance of an organisation.

Difference

- The ABC relates to the cost measurement and the presentation of the various activities. It relates cost drivers to activities. But, the ABM put emphases on the activities as a way for refining the value obtained as it identifies several activities and processes that customer needs and pay for.

- The ABC may be called a subsection of ABM. It helps refine the costing by outlining the numerous expenses like salaries, rent etc., to activities. Activity Based Costing (ABC) and Kaizen Costing (KC)

Activity Based Budgeting (ABB)

ABB is dissimilar from traditional budgeting as it makes available a relation amid the aims of an organisation and a specific activity. Traditional budgeting is built on a traditional costing system based on allocation, apportionment, and absorption of overheads.

ABB needs to identify:

- Various activities of the business

- Identify the elements that create costs and their drivers

- Then cost pools are created to collect the costs of the activities.

ABB involves:

- Classification of the activities and allocating them into value adding and non-value adding activities. In due course, the non-value adding activities are removed.

Features of ABB are as follows:

- It relates costs to activities.

- Further, it identifies opportunities for cost improvement.

Limitations of Activity Based Costing (ABC)

Limitations of ABC are mentioned as under:

- ABC requires ample investment of money and time and needs trained professionals. A small organisation may not have these.

- ABC further requires support from top management; otherwise process cannot be completed efficiently.

- ABC, being a bit complex, requires the compilation of a number of records and complex calculations. As mentioned earlier also, it may be suitable for large organisations, but traditional cost accounting may be more favourable for smaller ones due to its simplicity.

- Cost determination may not be easy as single cost support several activities.

Summary

- Activity-Based Costing (ABC) is a cost system that involves tracing costs to activities and subsequently to products. This method operates on the premise that activities are responsible for incurring costs. Costs are assigned to products based on the specific product's utilization of each activity. ABC is an approach to costing that monitors activities, tracing resource consumption, and costing final outputs. It allocates resources to activities and then activities to cost objects based on consumption estimates, using cost drivers to connect activity costs to outputs.

- Another perspective on Activity-Based Costing is that it is a two-stage product costing method assigning indirect costs and overheads to products and services. ABC recognizes the challenge of assigning some indirect costs to products and offers a less arbitrary approach compared to traditional costing methods by establishing a relationship between overheads and manufactured products.

- The limitations of the traditional costing system led to the development of ABC, as the traditional method segregates costs into fixed and variable categories. As businesses grow and costs become more complex, the traditional approach may not be suitable for making intricate decisions related to production and product strategy development. Traditional methods focus on financial reporting and emphasize calculating overhead rates for stock valuation. However, these approaches face challenges in multi-product scenarios, necessitating a shift.

- The merits of ABC include addressing cross-subsidization issues, handling complicated processes and product customizations, and identifying opportunities for cost savings. On the other hand, demerits involve its complexity, the necessity for a thorough understanding of products and processes, reliance on sophisticated systems, time and resource consumption, and an increase in indirect costs due to technology involvement.

- For the successful implementation of ABC, it is essential to study organizational activities and manufacturing processes to identify all stages involved. However, ABC comes with limitations such as requiring significant investments in money and time, trained professionals, and top management support. Its complexity may be more suitable for large organizations, while traditional cost accounting may be favored for smaller ones due to its simplicity. Cost determination may not be easy, as a single cost may support multiple activities.

- Activity-Based Management (ABM) focuses on managing activities to enhance value by identifying customer needs and processes. It emphasizes the linkage between the organization's objectives and specific activities. Activity-Based Budgeting (ABB) differs from traditional budgeting, as it aligns with the ABC approach, connecting the organization's goals with specific activities. Traditional budgeting relies on the traditional costing system, using allocation, apportionment, and absorption of overheads.

|

180 videos|153 docs

|

FAQs on Methods of Costing: Activity Based Costing - Commerce & Accountancy Optional Notes for UPSC

| 1. What is Activity Based Costing (ABC)? |  |

| 2. Why is Activity Based Costing (ABC) important? |  |

| 3. What are the merits of Activity Based Costing (ABC)? |  |

| 4. What are the demerits of Activity Based Costing (ABC)? |  |

| 5. What is the process of Activity Based Costing (ABC)? |  |

|

180 videos|153 docs

|

|

Explore Courses for UPSC exam

|

|