NCERT Summary: Stock Markets in India- 1 | Indian Economy for UPSC CSE PDF Download

STOCKMARKETS

A stock exchange is an organization which provides a platform for trading shares-either physical or virtual. The origin of the stock market dates back to the year 1494, when the Amsterdam Stock Exchange was first set up. In a stock exchange, investors through stock brokers buy and sell shares in a wide range of listed companies. A given company may list in one or more exchanges by meeting and maintaining the listing requirements of the stock exchange.

In financial terminology, stock is the capital raised by a corporation, through the issuance and sale of shares. In common parlance, however, stocks and shares are used interchangeably. A shareholder is any person or organization which owns one or more shares issued by a corporation. The aggregate value of a corporation’s issued shares, at current market prices, is its market capitalization. Stock broker buys and sells for an investor and does the work of arranging the transfer of stock from a seller to a buyer.

Importance of Stock Exchanges

- For efficient working of the economy and for the smooth functioning of the corporate form of organization, the stock exchange is an essential institution. an efficient medium for raising long term resources for business

- Help raise savings from the general public by the way of issue of equity debt capital

- Attract foreign currency

- Exercise discipline on companies and make them profitable Investment in backward regions for job generation another vehicle for investors’ savings.

Stock Exchanges in India

The first company that issued shares was the VOC or Dutch East India Company in. the early 17th century (1602). Since then we have come a long way. With over 25m shareholders today, India has the third largest investor base in the world after the USA and Japan. Over 9,000 companies are listed on the stock exchanges, which are serviced by approximately 7,500 stockbrokers. The Indian capital market is significant in terms of the degree of development, volume of trading and its tremendous growth potential.

Stock exchanges provide an organised market for transactions in securities and other securities. There are 24 stock exchanges in the country, 21 of them being regional ones with allocated areas. Three other are set up in the reforms era, viz. National Stock Exchange (NSE), the Over the Counter Exchange India Limited (OTCEI) and Inter-connected Stock Exchange of India Limited (1SE) Important Stock Exchanges in India are Bombay Stock Exchange, popularly known as BSE and National Stock Exchange located in Bombay.

Stock Exchanges in India

Bombay Stock Exchange (BSE):

- Location: Mumbai, Maharashtra.

- Established: 1875.

- Key Features: Oldest stock exchange in Asia; widely recognized benchmark for the Indian stock market.

National Stock Exchange (NSE):

- Location: Mumbai, Maharashtra.

- Established: 1992.

- Key Features: Largest stock exchange in India by market capitalization; introduced electronic trading.

Calcutta Stock Exchange (CSE):

- Location: Kolkata, West Bengal.

- Established: 1908.

- Key Features: One of the oldest stock exchanges; historically significant in India's financial landscape.

Multi Commodity Exchange (MCX):

- Location: Mumbai, Maharashtra.

- Established: 2003.

- Key Features: Focuses on commodity trading; one of the leading commodity exchanges in the world.

National Commodity and Derivatives Exchange (NCDEX):

- Location: Mumbai, Maharashtra.

- Established: 2003.

- Key Features: Specializes in agricultural commodities; facilitates trading in futures contracts.

Indian Commodity Exchange (ICEX):

- Location: Mumbai, Maharashtra.

- Established: 2009.

- Key Features: Focuses on commodity derivatives trading; known for trading in diamond and steel contracts.

BSE Institute Limited (BIL):

- Location: Mumbai, Maharashtra.

- Established: 2006.

- Key Features: Subsidiary of BSE; provides education and training in financial markets.

National Commodity Exchange Limited (NCEL):

- Location: Ahmedabad, Gujarat.

- Established: 2002.

- Key Features: Facilitates trading in various commodities; offers a platform for commodity-based derivatives.

Inter-Connected Stock Exchange of India Ltd (ISE):

- Location: Mumbai, Maharashtra.

- Established: 1998.

- Key Features: A national-level stock exchange; focuses on enhancing market access.

Metropolitan Stock Exchange of India (MSEI):

- Location: Mumbai, Maharashtra.

- Established: 2008.

- Key Features: Multi-asset class exchange; offers trading in equities, debt, and derivatives.

Bombay Stock Exchange

BSE The Bombay Stock Exchange, or (BSE) is the oldest stock exchange in Asia located at Dalal Street in Mumbai, India. Established in the year 1875, it is the largest securities exchange in India with more than 6,000 listed Indian companies. BSE is also the fifth largest exchange in the world with market capitalization of US $1.6 trillion (2011). About 5000 companies are listed on the BSE.

Overall performance of BSE is measured using the BSE SENSEX or the BSE 30 index. This index is composed of 30 BSE stocks. These stocks are selected from specified group shares on the basis of market cap, liquidity, depth, trading frequency and industry representation. BSE 3D was introduced in 1986. Apart from BSE 30, there are various other indices used in the BSE: Some of these include BSE 100, BSE 200, BSE 500, BSE PSU, BSE MIDCAP. BSE SMLCAP etc. One of the unique features inside the BSE includes the automatic online trading system known as BOLT that ensures an efficient and transparent market for trading in equity, debt instruments and derivatives. BSE contributes phenomenally to the overall economic development and capital markets in India.

In 2005, the status of the exchange changed from an Association of Persons (AoP) to a full fledged corporation under the BSE (Corporatization and Demutualization) Scheme, 2005 and its name was changed to The Bombay Stock Exchange Limited.

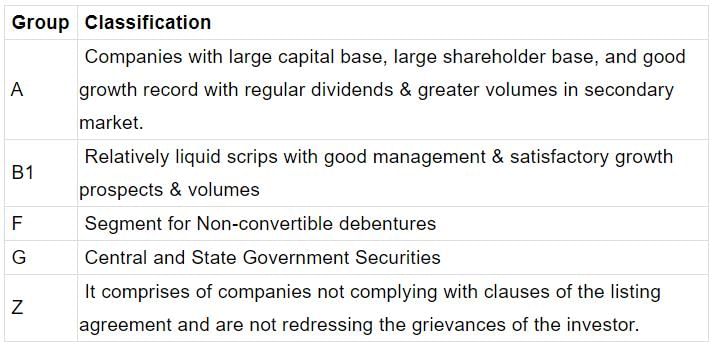

Classification of companies listed in BSE

Sensex

Sensex or Sensitive Index is a value-weighted index composed of 30 companies with the base 1978- 1979 = 100. It consists of the 30 largest and most actively traded blue chip stocks, representative of various sectors, on the Bombay Stock Exchange. Inclusion of the company is basically on the basis of market capitalization. The 30 companies in the index are revised periodically- some are replaced by others and new sectors may find representation as the economy evolves. The Sensex is generally regarded a mirror or barometer of the Indian stock markets and economy.

Demutualization

Demutualization is when management and ownership are separated. Ownership is divested from the brokers and the company becomes a public company. All stock exchanges are to be demutualised according to the Government law made in 2004. Demutualization, thus means that ownership, management and trading rights are separated in a stock exchange.

National Stock Exchange of India

The National Stock Exchange of India (NSE), is one of the largest and most advanced stock exchanges in India. In the year 1991 Pherwani Committee recommended to establish National Stock Exchange (NSE) in India. In 1992 the Government of India authorized IDBI for establishing this exchange. The National Stock Exchange of India was promoted by leading Financial Institutions and was incorporated in 1992. In 1993, it was recognized as a stock exchange. NSE commenced operations in 1994. It is located in Mumbai, the financial capital of India. Following financial institutions were the promoters of National Stock Exchange:

- Industrial Development Bank of India (IDBI).

- Industrial Finance Corporation of India (IFCI).

- Industrial credit and Investment corporation of India (ICICI).

- Life Insurance Corporation of India (LIC).

- General Insurance Corporation of India (GIC).

- SBI Capital Markets Limited.

- Stock Holding Corporation of India Limited.

- Infrastructure Leasing and Financial services Limited.

The Standard & Poor’s CRISIL NSE Index 50 or S&P CNX Nifty - Nifty 50 or simply Nifty is the leading index for large companies on the National Stock Exchange of India. The Nifty is a well diversified 50 stock index accounting for 21 sectors of the economy. The CNX Nifty Junior is an index for companies on the National Stock Exchange of India. It consists of 50 companies on the National Stock Exchange of India. It has the second tier of stocks in terms of market cap and don’t make it into Nifty.

The Inter-Connected Stock Exchange of India Limited (ISE)

The Inter-Connected Stock Exchange of India Limited (ISE) is being promoted by regional stock exchanges to set up a new national level stock exchange. The ISE would provide a national market in addition to the trading facility at the regional stock exchanges

Indonext

BSE, Federation of Indian Stock Exchanges and regional stock exchanges have promoted Indonext. The regional stock exchanges that are part of Indonext include Madras Stock Exchange, Bangalore Stock Exchange, Interconnected Stock Exchanges of India, Ludhiana Stock Exchange and Vadodara Stock Exchange. Indonext is envisaged to bring liquidity and attention to stocks that are listed on RSEs.

Over the Counter Exchange of India (OTCEI)

The OTC Exchange of India (OTCEI) incorporated under the provisions of the Companies Act 1956, is a public limited company. It allows listing of small and medium sized companies. OTCEI is promoted by the Unit Trust of India, Industrial Development Bank of India, the Industrial Finance Corporation of India and others and is a recognised stock exchange.

SEBI(Securities and Exchange Board of India)

The capital markets in India are regulated by the Securities and Exchange Board of India. (SEBI) It was established in 1988 and given a statutory basis in 1992 on the basis of the Parliamentary Act- SEBI Act 1992 to regulate and develop capital market. SEBI regulates the working of stock exchanges and intermediaries such as stock brokers and merchant bankers, accords approval for mutual funds, and registers Foreign Institutional Investors who wish to trade in Indian scrips.

Section 11(1) of the SEBI Act says that it shall be the duty of the Board to protect the interests of investors in securities. SEBI promotes investor’s education and training of intermediaries of securities markets. It prohibits fraudulent and unfair trade practices relating to securities markets, and inter trading in securities, with the imposition of monetary penalties, on erring market intermediaries. It also regulates substantial acquisition of shares and takeover of companies and calling for information from, carrying out inspection, conducting inquiries and audits of the stock exchanges and intermediaries and self regulatory organizations in the securities market. SEBI has its head office in Mumbai and its three regional offices in New Delhi, Calcutta and Chennai. SEBI’s powers were enhanced in 2002 -strengthen the SEBS board, enlarge it to nine from six and appoint three full-time directors; given enhanced powers to conduct search and seizure etc.

SEBI and the Reforms

The Stock Exchange Seam of 1992 (Harshad Mehta) and the scam in 2000 (Ketan Parekh) led to various measures by the Government to protect the interests of the small investors. SEBI introduced reforms like improved transparency, computerisation, enactment against insider trading, restrictions on forward trading, introduction of T + 2 system of settlement etc. The restriction and elimination of forward or Contango trading, referred to in India as ‘Badla’ is a bold step to check speculation and manipulation of the market. Some more steps taken by SEBI to strengthen markets are:

- SEBI reconstituted governing boards of the stock exchanges, introduced capital adequacy norms for brokers, and makes rules for making client/ broker relationship more transparent

- SEBI enforces corporate disclosures.

- Enforces ban on insider trading Protects retail investors

- SEBI is empowered to register and regulate mutual funds

- Introducing a code of conduct for all credit rating agencies operating in India.

- Clause 49 of the listing agreement that SEBI introduced mandates that all listed companies should have half the Directors on the Board as Independent Directors.

Sebi makes new rules 2009

In 2009, the Securities and Exchange Board of India (SEBI) introduced the innovative "anchor investor" concept, revolutionizing the participation of institutional investors in Initial Public Offerings (IPOs).

Key Rules: Under this concept, institutional investors can subscribe to a substantial 30 percent of the institutional investor quota in an IPO. The application process involves a two-step payment mechanism. Initially, anchor investors pay 25 percent of the total investment at the time of applying for the IPO. The remaining balance is due within two days of the closure of the issue. Importantly, anchor investors are subject to a mandatory one-month lock-in period from the date of share allotment.

Capital Market Reforms

Since 1991 when the Government launched economic reforms, the following measures were taken.

- SEBI's Statutory Status: Following the launch of economic reforms in 1991, SEBI was granted statutory status through an Act of Parliament, solidifying its role as the regulatory authority overseeing the securities market.

- Market Infrastructure: Several significant measures were taken to enhance market infrastructure. Electronic trade was introduced, and the concept of rolling settlement was implemented to reduce speculation. The permission for Foreign Institutional Investors (FIIs) in 1992 facilitated international investment. Additionally, clearing houses and settlement guarantee funds were established at all stock exchanges, fortifying the market structure.

- Dematerialization and Corporate Governance: Compulsory dematerialization of share certificates was enforced to eliminate challenges associated with paper trading, ensuring a faster and more secure transfer process. The introduction of Clause 49 in the listing agreement focused on improving corporate governance standards, reinforcing transparency and accountability among listed companies.

- PN Restrictions: To regulate foreign investments and ensure stability in the market, SEBI imposed restrictions on Participatory Notes (PNs), curbing potential speculative activities.

Primary Market

IPOs and FPOs: The primary market, responsible for the issuance of new securities directly to investors, witnesses two essential processes. An Initial Public Offering (IPO) involves the sale of new stock by a company, while a Follow-on Public Offer (FPO) occurs when a company with existing shares returns to the market with a new stock issue.

Types of shares

Common Stock:

Common stock represents ownership in a company and typically entitles shareholders to voting rights in major company decisions. Common shareholders receive dividends, but these payments are discretionary and depend on the company's profitability and management decisions. In the event of liquidation, common stockholders are paid after preferred stockholders and bondholders.

Preferred Stock:

Preferred stock, on the other hand, holds certain advantages over common stock. It is often issued to both banks and retail investors. Key features include:

Dividend Priority: Preferred stockholders receive dividends before common stockholders, providing a steady income stream even if common dividends are reduced or not paid.

Liquidation Preference: In the event of company closure or liquidation, preferred stockholders have a higher claim on the company's assets compared to common stockholders. They receive their share of the proceeds before common stockholders.

Enhanced Voting Rights: Some preferred stocks come with additional voting rights, giving holders the ability to influence company decisions, veto mergers or acquisitions, or exercise a right of first refusal for new share issuances.

Derivatives

Definition:

A derivative is a financial instrument whose value is derived from an underlying asset, such as securities, debt instruments, or commodities. The value of derivatives is directly linked to the present value of the underlying asset and its projected future trends.

Classes of Derivatives:

Futures: Futures contracts obligate the buyer to purchase, or the seller to sell, a specified amount of the underlying asset at a predetermined future date and price. They are often used for hedging and speculation.

Options: Options provide the holder with the right (but not the obligation) to buy or sell the underlying asset at a predetermined price within a specified timeframe. Options can be used for risk management and to capitalize on market movements.

Buyback of Shares

Buyback of shares is the process by which a corporation repurchases its own outstanding shares from the open market. This strategic move aims to reduce the number of shares in circulation, resulting in a higher ownership percentage for each remaining shareholder.

Reasons for Buybacks:

Utilizing Unused Cash: Companies often engage in buybacks to efficiently utilize excess cash that may not be generating significant returns.

Earnings Per Share Enhancement: By reducing the number of outstanding shares, companies increase their earnings per share (EPS), making each share more valuable to existing shareholders.

Cost Reduction: Reducing the number of shareholders through buybacks can lead to cost savings related to shareholder servicing, communications, and administration.

Process and Impact:

Cancellation of Shares: Shares bought back are typically canceled, leading to a contraction of total equity. This benefits existing shareholders by increasing their ownership percentage.

Buyback Price: The buyback price is often set higher than the market prices, signaling management's confidence in the company's future and belief that current share prices are undervalued.

Funding and Restrictions:Companies are allowed to buy back shares with reserves but are restricted from borrowing for this purpose. Buybacks have been permitted in India since 1998.

Rolling Settlement

Definition: A Rolling Settlement is a mechanism for settling trades where transactions executed on a single day are settled separately from trades on other days. Settlement in Rolling Settlements occurs on a daily basis, with a standard settlement cycle of Trade day + 2 days (T+2). This means that trades executed on a given day are settled within two business days.

Key Points:

- Daily Settlements: Rolling Settlement involves settlements on a daily basis, preventing the bundling of trades from different days.

- Trade Day + 2 (T+2): The settlement cycle is typically two business days after the trade day.

- Reduction of Speculation: By settling trades daily and not allowing the grouping of trades from different days, Rolling Settlement significantly reduces speculation in the market.

Commodity Exchanges

Definition: Commodity exchanges are institutions providing a platform for trading in commodity futures, similar to how stock markets facilitate trading in equities and derivatives. They play a crucial role in price discovery, where numerous buyers and sellers interact to determine the most efficient price for commodities.

Types of Commodity Exchanges in India:

- National Level Exchanges:

- National Commodity & Derivatives Exchange Limited (NCDEX)

- Multi Commodity Exchange of India Limited (MCX)

- National Multi-Commodity Exchange of India Limited (NMCEIL)

- ACE Derivatives and Commodity Exchange

- Indian Commodity Exchange (ICEX)

- Unique Features of National Level Commodity Exchanges:

- Demutualized: Operate as demutualized entities.

- Online Platforms: Provide online platforms or screen-based trading.

- Multicommodity Exchanges: Allow trading in various commodities.

- National Reach: Facilitate trading from anywhere in the country.

- Regulatory Body:

- Forward Markets Commission (FMC):

- Regulatory authority overseeing commodity exchanges.

- Established under the Forward Contracts (Regulation) Act, 1952.

- Monitors, disciplines, and can withdraw recognition of exchanges.

- Collects and publishes information on trading conditions.

- Inspects accounts and documents when necessary.

- Forward Markets Commission (FMC):

Mutual Fund

Definition: A mutual fund is a financial intermediary that pools money from a group of investors to invest in the capital market with the goal of generating returns. Mutual funds charge fees for managing the fund and offer two main types:

Open-Ended Mutual Funds:

- Issue shares directly to investors at any time.

- Prices based on the fund's net asset value (NAV).

- No time duration, can be bought or redeemed at any time on demand.

- Not traded on the stock market.

Closed-End Mutual Funds:

- Issue a fixed number of shares in an initial public offering.

- Trade on stock exchanges after the offering.

- Redeemable only when the fund liquidates.

Foreign Institutional Investors (FIIs)

Definition: Foreign Institutional Investors (FIIs) are organizations that invest significant sums of money in financial assets, both debt and shares, in countries other than where they are incorporated. FIIs include banks, insurance companies, retirement or pension funds, hedge funds, and mutual funds.

Key Points:

- Portfolio Investment Scheme (PIS):

- FIIs invest in India's primary and secondary capital markets through the Portfolio Investment Scheme (PIS).

- Investment ceilings vary for different companies.

- Regulation by SEBI:

- SEBI prescribes norms for registering FIIs and regulates FII investments.

- Investment Volume:

- In 2010, FIIs invested about $30 billion in Indian equities and debt.

- Over 1,660 registered FIIs and 5,000 registered sub-accounts.

- Reasons for Favoring India:

- Growing economy.

- High corporate profits.

- Favorable government policies.

- Brighter prospects compared to other countries.

Global Depository Receipts (GDR)

Definition: Global Depository Receipts (GDRs) allow Indian companies to raise equity capital in the international market. GDRs are denominated in dollars or euros and are listed on exchanges such as London Stock Exchange or Luxembourg.

Use of GDR Proceeds:

- Financing capital goods imports.

- Capital expenditure, including plant, equipment, and building purchases.

- Investment in software development.

- Repayment of earlier external borrowings.

- Equity investment in Joint Ventures (JVs) in India.

Key Points:

- Listing Locations: GDRs are listed on international exchanges.

- Currency Denomination: Can be designated in dollars or euros.

- Also Called Euro Issues: GDRs are sometimes referred to as euro issues.

Regulatory Development:

- The Forward Contracts (Regulation) Amendment Bill, 2010 aimed to make FMC an independent regulator, similar to SEBI. It proposed to increase penalties for legal contraventions up to Rs 25 lakh from the existing Rs 1,000.

|

107 videos|311 docs|135 tests

|

FAQs on NCERT Summary: Stock Markets in India- 1 - Indian Economy for UPSC CSE

| 1. What is the Bombay Stock Exchange? |  |

| 2. What is Sensex? |  |

| 3. What is demutualization in the context of stock markets? |  |

| 4. What is SEBI and its role in Indian stock markets? |  |

| 5. What are derivatives in the context of stock markets? |  |

|

Explore Courses for UPSC exam

|

|