Overview: Profit & Loss | Quantitative Techniques for CLAT PDF Download

Profit and Loss

- Profit(P): The amount gained by selling a product with more than its cost price.

- Loss(L): The amount the seller incurs after selling the product less than its cost price is mentioned as a loss.

- Cost Price (CP): The price at which an article is purchased is called its cost price (C.P.)

- Selling Price (SP): The price at which the article is sold is called its selling price (S.P.)

Profit and Loss Formula

- If the cost price (C.P.) of the article is equal to the selling price (S.P.), then there is no loss or gain.

- If the selling price (S.P.) > cost price (C.P.), then the seller is said to have a profit or gain. Gain/Profit = S.P. – C.P.

- If the cost price (C.P.) > selling price (S.P.), then the seller is said to have a loss. Loss = C.P. – S.P.

- Gain % = (Gain × 100)/(C.P.)

- Loss% = (Loss × 100)/(C.P.)

- When the selling price and gain percent are given: C.P.= (100/(100+Gain%))×S.P.

- When the cost and gain percent are given: S.P=((100+Gain%)/100)×C.P.

- When the cost and loss percent are given: S.P.=((100-Loss%)/100)×C.P

- When the selling price and loss percent are given: C.P=(100/(100-Loss%))×S.P

- If a man buys x items for Rs. y and sells z items for Rs. w, then the gain or loss percent made by him is given by: (xw/zy-1)×100%

- If the cost price of m articles is equal to the selling price of n articles, then % gain or loss = ((m – n)/n) × 100 (If m > n, it is % gain, and if m < n, it is % loss)

- If an article is sold at a price S.P.₁, then % gain or % loss is x and if it is sold at a price S.P.₂, then % gain or % loss is y. If the cost price of the article is C.P., then

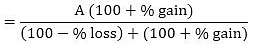

(S.P₁)/(100+x)=(S.P₂)/(100+y)=(C.P.)/100=(S.P_1-S.P_2)/(x-y); Where x or y is –ve, if it indicates a loss, otherwise it is +ve. - If ‘A’ sells an article to ‘B’ at a gain/loss of m% and ‘B’ sells it to ‘C’ at a gain/loss of n%. If ‘C’ pays Rs. z for it to ‘B’ then the cost price for ‘A’ is

where m or n is –ve, it indicates a loss, otherwise, it is +ve.

where m or n is –ve, it indicates a loss, otherwise, it is +ve. - If ‘A’ sells an article to ‘B’ at a gain/loss of m% and ‘B’ sells it to ‘C’ at a gain/loss of n%, then the resultant profit/loss percent is given by (m+n+mn/100), where m or n is –ve, if it indicates a loss, otherwise it is +ve.

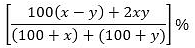

- When two different articles are sold at the same selling price, getting a gain/loss of x% on the first and a gain/loss of y% on the second, then the overall% gain or % loss in the transaction is given by

The above expression represents overall gain or loss accordingly as its sign is +ve or –ve.

The above expression represents overall gain or loss accordingly as its sign is +ve or –ve. - When two different articles are sold at the same selling price getting a gain of x% on the first and loss of x% on the second, then the overall% loss in the transaction is given by (x/10)² %. (Note: In such questions, there is always a loss.)

- A merchant uses faulty measures and sells his goods at a gain/loss of x%. The overall % gain/loss(g) is given by (100+g)/(100+x)=(True measure)/(Faulty measure). (Note: If the merchant sells his goods at cost price, then x = 0.)

- A merchant uses y% less weight/length and sells his goods at a gain/loss of x%. The overall % gain/loss is given by [((y+x)/(100-y))×100]%

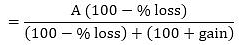

- A person buys two items for Rs. A and sells one at a loss of l% and the other at a gain of g%. If each item was sold at the same price, then

(a) The cost price of the item sold at a loss

(b) The cost price of the item sold at a gain

20. If two successive discounts on an article are m% and n%, respectively, then a single discount equivalent to the two successive discounts will be (m+n-mn/100)%

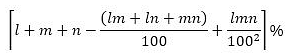

If three successive discounts on an article are l%, m%, and n%, respectively, then a single discount equivalent to the three successive discounts will be

A shopkeeper sells an item at Rs. z after giving a discount of d% on the labeled price. Had he not given the discount, he would have earned a profit of p% on the cost price. The cost price of each item is given by

Profit and Loss Questions

Here are some profit and loss examples which will help candidates for understanding the profit and loss properly and according to the exam point of view. Candidates must try to solve thes profit and loss examples given below and verify your answers.

Q1. How much percent more than the cost price should a shopkeeper mark his goods so that after allowing a discount of 25% on the marked price, he gains 20%?

(A) 60%

(B) 55%

(C) 70%

(D) 50%

Ans: (A)

Solution: Let the cost price of goods be Rs 100.

Gain = 20%

Therefore, Selling price = Rs 120

Discount = 25%

Marked Price = (100/100-25)x120 = Rs. 160 = 60% more

Q2. A dishonest dealer professes to sell his goods at the cost price but uses a false weight of 850 g instead of 1 kg. His gain percent is?

(A) 71 11/17%

(B) 11 11/17%

(C) 17 12/17%

(D) 17 11/17%

Ans: (D)

Solution: If a trader professes to sell his goods at cost price, but uses false weights, then

Gain% = {Error/(True value – Error) x 100}%

In the given question, Error = 1000 – 850 = 150

Thus, Gain% = {150/(1000 – 150) x 100}% = 17 11/17%

|

57 videos|108 docs|73 tests

|

FAQs on Overview: Profit & Loss - Quantitative Techniques for CLAT

| 1. What is a profit and loss statement? |  |

| 2. How is net profit calculated in a profit and loss statement? |  |

| 3. What is the significance of a profit and loss statement for a business? |  |

| 4. What are the components of a profit and loss statement? |  |

| 5. How can a profit and loss statement be used to analyze a company's performance? |  |

|

Explore Courses for CLAT exam

|

|

where m or n is –ve, it indicates a loss, otherwise, it is +ve.

where m or n is –ve, it indicates a loss, otherwise, it is +ve. The above expression represents overall gain or loss accordingly as its sign is +ve or –ve.

The above expression represents overall gain or loss accordingly as its sign is +ve or –ve.