Preparation of Financial Statements - 1 | Management Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Objectives |

|

| Trading Account |

|

| Profit and Loss Account |

|

| Difference between Trading and Profit & Loss Account |

|

| Balance Sheet |

|

| Constructing a Balance Sheet |

|

Introduction

The main purpose of accounting is to gather financial data for calculating a business firm's profit and loss over a specific period and to assess its financial standing on a given date. This is achieved through the creation of Final Accounts, which represents the concluding phase in the accounting process. Final accounts encompass the preparation of the Trading and Profit and Loss Account, as well as the Balance Sheet – the latter being a statement rather than an account. The Trading and Profit and Loss Account consists of two sections, namely the Trading Account and the Profit and Loss Account. For manufacturing concerns, Final Accounts also incorporate the Manufacturing Account.

Objectives

Upon completion of this module, you should be able to:

- clarify the concept of Final Account;

- grasp their purposes and the process of preparing Trading and Profit and Loss Account;

- distinguish between Trading Account and Profit and Loss Account, as well as understand the distinctions between Gross Profit and Net Profit;

- comprehend and articulate the terminology employed in a balance sheet;

- apply basic principles for asset valuation;

- recognize the role of depreciation in asset valuation and in determining a firm's accurate profit;

- grasp Adjustment entries and their significance;

- acknowledge the importance of Adjustment entries in determining the financial position of a business firm.

Trading Account

The purpose of preparing a Trading Account is to determine the Gross Profit or Loss of a firm. Gross Profit is the surplus of net revenue over the cost of goods sold, evident when the credit side of the trading account surpasses the debit side. Conversely, Gross Loss occurs when the cost of goods sold exceeds net revenue, resulting in the debit side of the trading account exceeding the credit side.

Mathematically:

Gross Profit = Net Sales Revenue - Cost of Goods Sold Gross Loss = - (Net Sales Revenue - Cost of Goods Sold)

Where:

Net Sales Revenue = Cash Sales + Credit Sales - Sales Returns

Cost of Goods Sold = Opening Stock + Net Purchases + Direct Expenses - Closing Stock

Net Purchase = Cash Purchases + Credit Purchases - Purchases Returns.

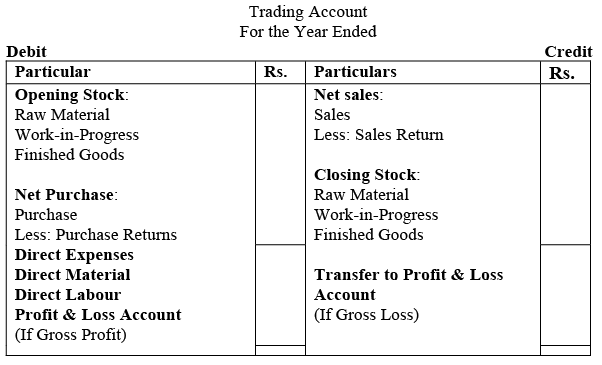

The Trading Account is typically presented in a 'T' form. The debit side includes opening stock, purchases, and direct expenses, while the credit side features sales and closing stock. The format of the Trading Account is elucidated along with the format of the Profit and Loss Account.

Opening/Closing Stock

The Opening Stock signifies the inventory of goods held at the commencement of an accounting year, encompassing raw materials, work-in-progress, and finished goods. It is recorded in the debit column of the trial balance and serves as the first entry on the debit side of the Trading Account. Valuation is typically done at the lower of cost or market price. Conversely, Closing Stock represents the inventory of goods at the conclusion of the accounting year, including raw materials, work-in-progress, and finished goods. It is presented on the credit side of the Trading Account and is usually provided as additional information rather than being included in the trial balance.

Net Purchases

Net Purchases comprise goods acquired specifically for production and sales purposes, excluding items used as assets and not intended for sale. Net purchases are calculated as the difference between total purchases and purchase returns, with purchases being the sum of cash and credit purchases. Note that in some instances, purchase returns may be referred to as Return Outward.

Direct Expenses

Direct expenses encompass all costs incurred in bringing goods to the business location or trade, or during the production process until the goods are ready for sale.

The following expenses fall under the category of direct expenses:

- Wages paid to workers engaged in production, debited to the trading account unless a separate manufacturing account is prepared.

- Carriage/freight inwards, representing transportation expenses to bring goods or raw materials to the business location or the firm's warehouse/factory. Such expenses, whether paid or outstanding, are debited to the trading account.

- Octroi, paid upon the entry of goods into municipal limits, is considered a direct expense and is debited to the trading account.

- Custom duty paid on imported goods for selling purposes is debited to the trading account. If the duty is paid on sales export, it is treated as selling expenses and reflected in the profit and loss account.

- Factory rent, insurance, lighting & power, and heating expenses are costs incurred in transforming raw materials into finished goods. These expenses are debited to the trading account.

Net Sales

Net Sales encompass both cash and credit sales of goods. The total sales figure is used as the starting point, and any sales returns (also known as Returns Inward) are subtracted in the inner column. The resulting net sales amount is then presented in the outer column on the credit side of the Trading Account. It's important to highlight that sales of assets are not recorded in the Trading Account.

It's crucial to note that if goods have been sold but not yet dispatched, they should not be categorized under sales. Instead, they are included in the closing stock if the property or ownership of the goods has not transferred to the customer. Conversely, if the property or ownership has passed to the customer for goods sold but not yet dispatched, they will not be part of the closing stock but will be treated as sales.

The proforma of the Trading Account follows this structure:

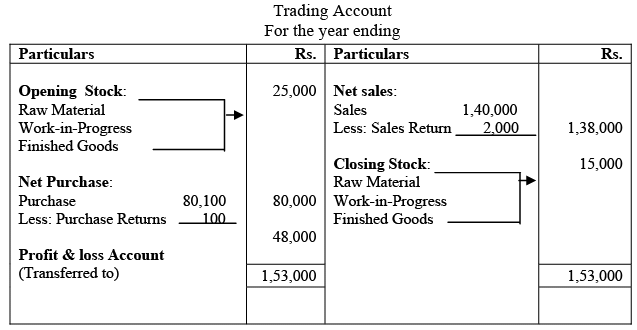

Example

Example: Prepare the Trading Account from the following details:

Opening stock Rs.25,000; Purchases Rs. 80,100; Carriage Inward Rs. 12,000; Stock at the end Rs. 15,000; Carriage Outward Rs. 2,000; Office Rent Rs. 5,000;

Sales Rs. 1,40,000; Sales Return Rs. 2,000; Purchases Return Rs. 100.

Ans:

Profit and Loss Account

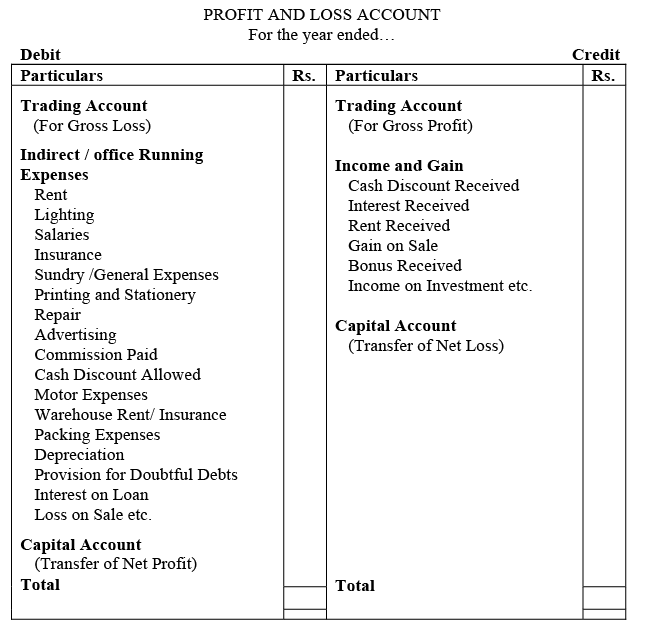

The Profit and Loss Account serves the purpose of determining whether a firm has achieved a net profit or incurred a net loss during a specific accounting period. This account primarily deals with indirect expenses such as administrative, selling, distribution expenses, and similar costs. The Profit and Loss Account picks up where the Trading Account concludes, starting with the gross profit brought forward from the trading account on the credit side. In cases of a gross loss brought forward from the trading account, the Profit and Loss Account begins with gross loss as the first item on the debit side.

All indirect or running expenses related to selling, distributing goods, and general business administration are listed on the debit side. Conversely, items of income and gains are recorded on the credit side. When the credit side (revenue) surpasses the debit side (expenses), the difference represents net profit. Conversely, if the debit side exceeds the credit side, the difference indicates a net loss. The Profit and Loss Account is balanced by transferring net profit to the capital account(s) in the balance sheet, thereby increasing the capital. Conversely, net loss is deducted from the capital account(s) in the balance sheet, reducing the capital.

The following items are debited in the Profit and Loss Account:

- Administrative Expenses, including Office Salaries, Office Rent, Office Lighting, Printing, Director’s Fees, Telephone Rent, Postage, Insurance, etc.

- Sales and Distribution Expenses, including Salesmen's salary, Commission, Traveling expenses, Advertising, Packing expenses, Royalty, etc.

- Financial Expenses, including Interest on loan/Capital, Cash Discount Allowed, Bad Debts, Bank Charges, etc.

- Depreciation of Assets and various provisions.

- Other Expenses and Losses, including Loss on Sales of Fixed Assets, Loss by Fire, by Theft, by Accident, etc.

- Taxes, including Sales Taxes, Income Taxes, etc.

The following items are credited in the Profit and Loss Account:

- Cash Discount Received

- Interest Received

- Rent Received

- Gain on Sale of Fixed Assets

- Apprentice Premium

- Dividend Received.

It's noteworthy that the personal expenses of the proprietor paid by the firm do not appear in the Profit and Loss Account. Instead, these are treated as personal drawings of the proprietor and are deducted from the capital in the balance sheet.

The Following is the proforma of Trading and Profit & Loss Account:

Note:

- Either gross profit or gross loss as opening balance will be reflected.

- Similarly, the ending balance will also reflect either net profit or net loss.

Example

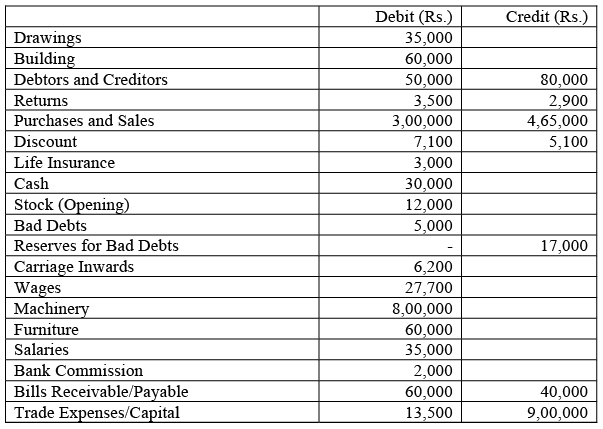

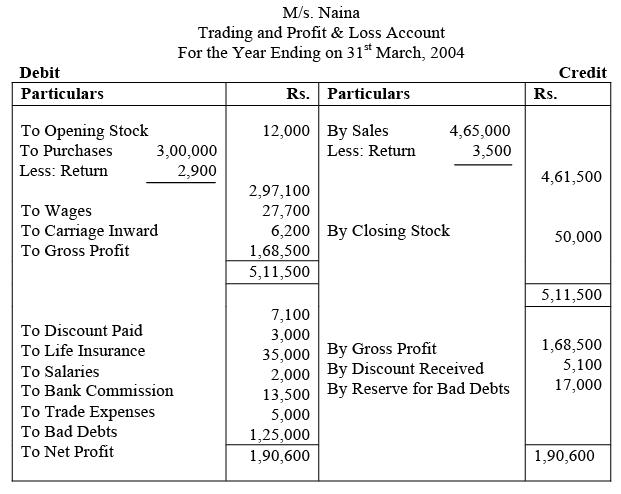

Example: The Following figures from trial balance has been extracted from the books of M/s. Naina Prepare the Trading and Profit & Loss Account for the year ended 31 March 2004.

Adjustment: Stock on 31st March 2004 was valued at Rs. 50,000.

Ans:

Difference between Trading and Profit & Loss Account

- The primary purpose of preparing the trading account is to compute gross profit or loss, whereas the profit and loss account is designed to reveal net profit or loss.

- The trading account focuses on sales and the cost of goods sold, encompassing direct expenses. In contrast, the profit and loss account addresses indirect expenses like administrative and financial costs, and these are deducted from gross profit along with other revenues.

- The outcome of the trading account, presented as gross profit or loss, is transferred to the profit and loss account. Subsequently, the net profit or loss disclosed in the profit and loss account is then transferred to the capital account.

Balance Sheet

The balance sheet serves the purpose of presenting the financial position of an entity at a specific point in time. This representation includes listing all valuable possessions owned by the entity, as well as the corresponding claims against these assets, referred to as liabilities. The balance sheet captures this position by detailing assets and liabilities. It is crucial to note that the balance sheet is only accurate until another transaction occurs within the entity.

The above statement can be elaborated by an example:

I want to purchase a car costing Rs. 8,00,000. To do so, I have to borrow capital/money. A bank agrees to finance me if I can invests. 3,00,000 on my own.

Now let us follow the sequence of events when I approach the bank with the proposal. Granting my ability to repay the loan, the banker will ask two specific questions:

- What are the things of value you own?

- How much do you owe, and to whom?

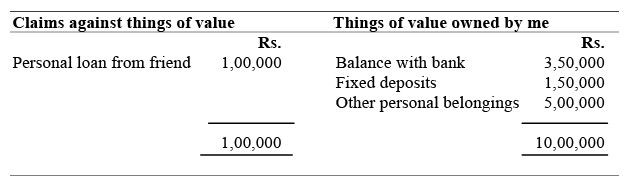

In other words, the banker would like to know what I am worth in material terms. My replies to the questions could be tabulated as follows:

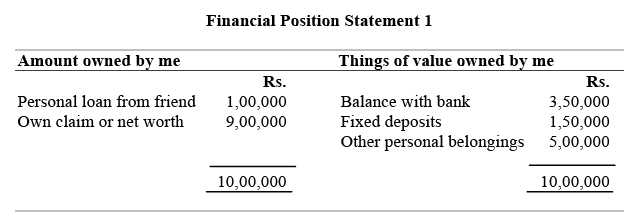

This implies I own Rs. 10,00,000 worth things of value, Rs. 3,50,000 of this could be withdrawn at any time in cash. We say I have Rs. 3,50,000 in liquid form. Another Rs. 1,50,000 is in monetary investment and the remaining Rs. 5,00,000 is in non-monetary property. Further, I owe Rs. 1,00,000 to friend of mine. In other words, he has got a claim against the things of value owned by me to the extent of Rs. 1,00,000. In brief, we can say I am worth Rs. 10,00,000, claim against my worth is Rs. 1,00,000 and hence my net worth is Rs. 9,00,000. This implies Rs. 9,00,000 is my own claims against the things of value owned by me or my net worth.

Now I can present my financial position in the following form:

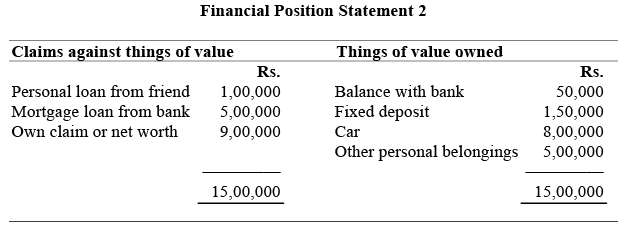

Now that the bank grants me the loan of Rs. 5,00,000 and I buy the car for Rs.8,00,000. After purchase of the car my financial position statement will change as follows:

Now that the bank grants me the loan of Rs. 5,00,000 and I buy the car for Rs.8,00,000. After purchase of the car my financial position statement will change as follows: Now, as a result of this transaction my worth has increased from Rs. 10,00,000 to Rs.15,00,000. However, since there is also an equal increase in claims against my worth in the form of mortgage loan from the bank, my net worth remains the same.

Now, as a result of this transaction my worth has increased from Rs. 10,00,000 to Rs.15,00,000. However, since there is also an equal increase in claims against my worth in the form of mortgage loan from the bank, my net worth remains the same.

Assets refer to the items of monetary value owned by an entity. Accountants use the term assets to describe things that possess measurable value in monetary terms. On the other hand, liabilities represent the amount owed by an entity or an individual, constituting claims against their assets by external parties. Liabilities specifically denote the legally enforceable claims against an individual or entity by outsiders.

The net worth of an entity is determined by deducting liabilities (outsider's claims) from its total assets. This net worth, representing the claims of the owner(s) in the case of an entity, is termed owner's equity.

In summary, the financial position statement provides a concise overview of the assets, liabilities, and net worth of a firm at a particular point in time. This statement helps in understanding the financial standing of an entity by presenting a snapshot of what it owns (assets), what it owes (liabilities), and the residual interest of the owner(s) (net worth or owner's equity).

Constructing a Balance Sheet

After exploring the conceptual foundation of the balance sheet, let's delve into the study of the balance sheet itself. Recognizing that every transaction impacts the financial position, it is impractical to construct a balance sheet after each transaction. Hence, it is typically prepared at the conclusion of a defined period, commonly a year, referred to as the accounting period, fiscal year, or financial year. The convention has established this period as one calendar year, even though there is no inherent accounting justification for it.

The preparation of the balance sheet involves organizing the assets and liabilities of a firm in a systematic manner. The balance sheet, crafted at the conclusion of the accounting period, reflects the year-end status of each asset, along with the various claims against these assets. It essentially displays the year-end balances in the asset, liability, and capital accounts. It's important to note that two conventions are employed for balance sheet preparation – the American and the English. According to the American convention, assets are presented on the left-hand side, while liabilities and owner's equity are on the right-hand side. Conversely, the English convention reverses this arrangement, displaying assets on the right-hand side and liabilities and owner's equity on the left-hand side. In India, the English convention is generally followed.

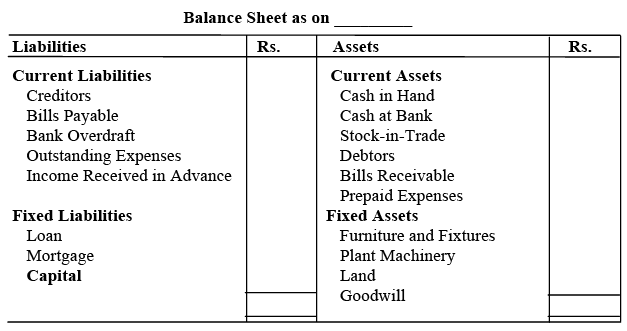

The balance sheet format provided below follows the order of liquidity, wherein the assets are arranged based on the ease of conversion into cash. More liquid assets are presented first, followed by less liquid ones. Similarly, on the liabilities side, current liabilities are listed first in the order of payment, followed by fixed or long-term liabilities, and lastly, the proprietor's capital. The pro-forma is structured to reflect this sequence.

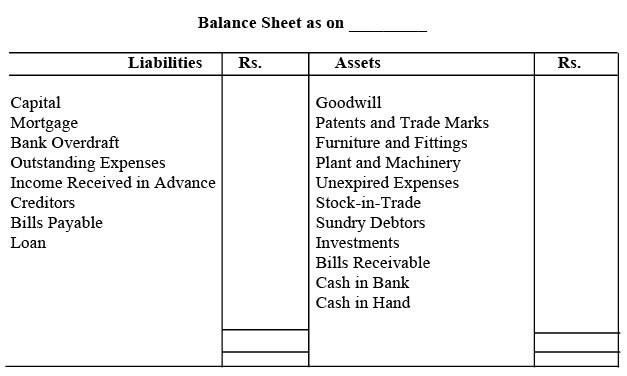

The assets of a business can also be shown in the balance sheet in order of permanence, i.e., in order of the desire to keep them in use.

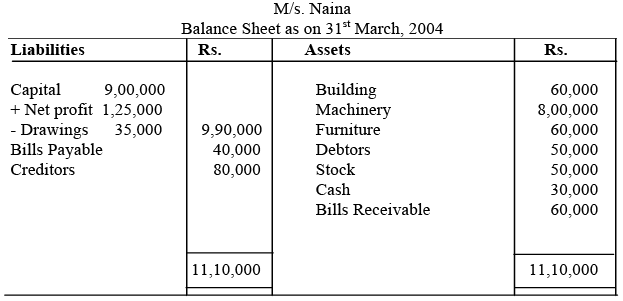

Now, let us examine how the ideas what we have learnt so far could be used in a business situation. Please recall that based on the entity principle we shall be dealing with the ‘business’ as distinct and separate from the owners. We shall demonstrate this by means of an illustration. Following is the Balance sheet of the above mentioned profit and loss account:

Now, let us examine how the ideas what we have learnt so far could be used in a business situation. Please recall that based on the entity principle we shall be dealing with the ‘business’ as distinct and separate from the owners. We shall demonstrate this by means of an illustration. Following is the Balance sheet of the above mentioned profit and loss account:

Several accounting concepts are integral to the evaluation of the balance sheet:

- Dual Aspect Principle: This principle is particularly relevant to the balance sheet. According to the dual aspect principle, every transaction has dual effects and is recorded on both the debit and credit sides. This ensures the equality of assets to liabilities and owner's equity in the balance sheet.

- Monetary Unit Assumption: All figures in the balance sheet are expressed in monetary units, regardless of their nature. In the given example, cash, merchandise inventory, and shop premises were all quantified in monetary terms.

- Business Entity Concept: All transactions reflected in the balance sheet pertain exclusively to the business entity. As a result, the balance sheet represents the financial position of the business entity and not that of the owners.

- Going Concern Assumption: All valuations are based on the assumption that the business is a going concern, rather than being valued on a liquidated basis. This assumption implies that the total value of assets is spread over time through a mechanism known as depreciation.

- Historical Cost Basis: All assets are valued based on historical cost. This means that the original cost incurred to acquire the assets is used as the basis for their valuation.

FAQs on Preparation of Financial Statements - 1 - Management Optional Notes for UPSC

| 1. What is a Trading Account? |  |

| 2. What is a Profit and Loss Account? |  |

| 3. What is the difference between a Trading Account and a Profit & Loss Account? |  |

| 4. What is a Balance Sheet? |  |

| 5. How do you construct a Balance Sheet? |  |