Retirement/Death of a Partner (Part - 3) | Accountancy Class 12 - Commerce PDF Download

Page No 6.87:

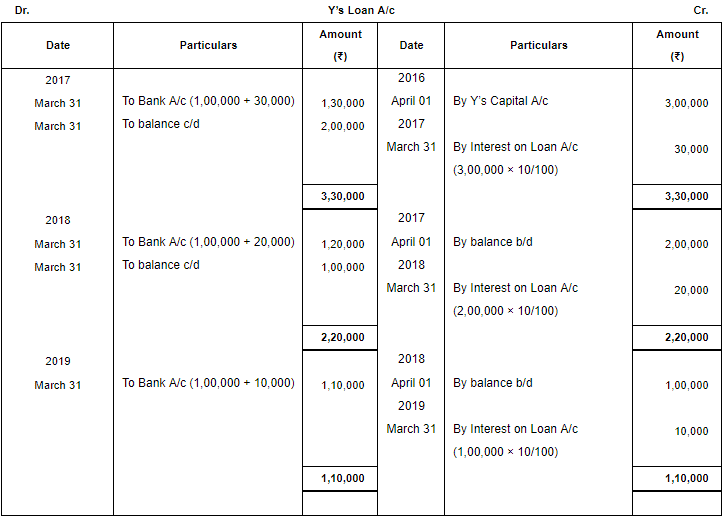

Question 41: X, Y and Z were in partnership sharing profits and losses equally. 'Y' retires from the firm. After adjustments, his Capital Account shows a credit balance of ₹ 3,00,000 as on 1st April, 2016. Balance due to 'Y' is to be paid in three equal annual instalments along with interest @ 10% p.a. Prepare Y's Loan Account until he is paid the amount due to him. The firm closes its books on 31st March every year.

ANSWER:

Working Notes: Amount payable per Installment = ₹ (3,00,000/3) = ₹ 1,00,000

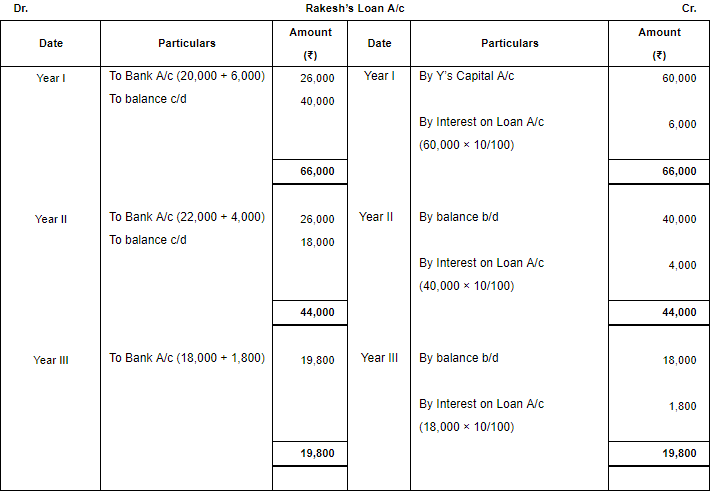

Question 42: Rakesh retired from the firm. The amount due to him was determined at ₹ 90,000. It was decided to pay the due amount as follows:

On the date of retirement − ₹ 30,000

Balance in three yearly instalments − First two instalments being of ₹ 26,000, including interest; and Balance amount as last instalment.

Interest was payable @ 10 p.a. Prepare retiring Partners' Loan Account.

ANSWER:

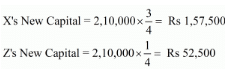

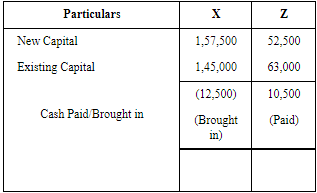

Question 43: X, Y and Z are partners in a firm sharing profits in the ratio of 3 : 2 : 1. On 1st April, 2009, Y retires from the firm. X and Z agree that the capital of the new firm shall be fixed at ₹ 2,10,000 in the profit-sharing ratio. The Capital Accounts of X and Z after all adjustments on the date of retirement showed balance of ₹ 1,45,000 and ₹ 63,000 respectively. State the amount of actual cash to be brought in or to be paid to the partners.

ANSWER: Old Ratio (X, Y, and Z) = 3 : 2 : 1

Y retires from the firm.

∴ New Ratio (X and Z) = 3 : 1

Total capital of the New Firm = Rs 2,10,000

Ascertainment of Actual Cash to be brought in or to be paid to the partners

Page No 6.88:

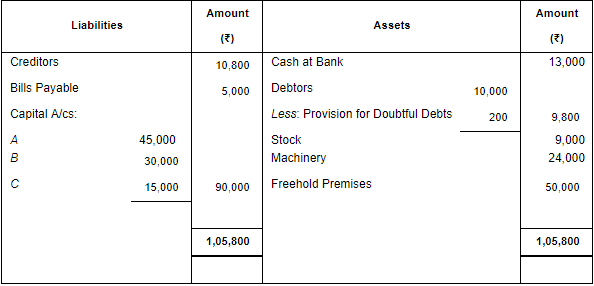

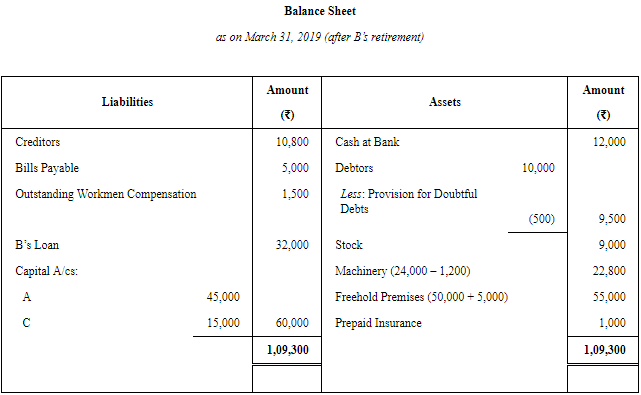

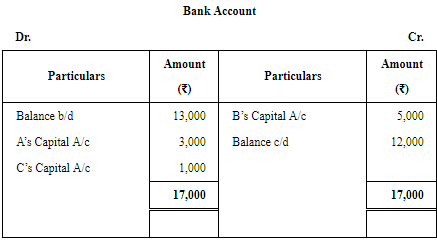

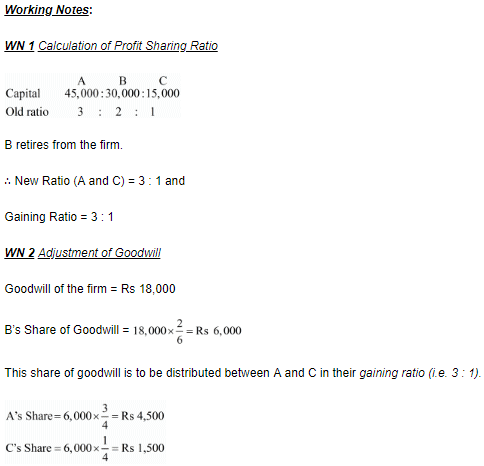

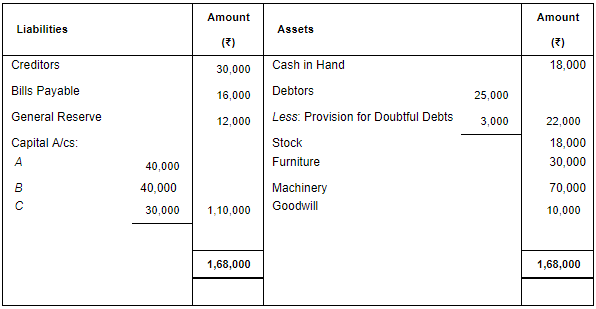

Question 44: On 31st March, 2019, the Balance Sheet of A, B and C who were sharing profits and losses in proportion to their capitals stood as:

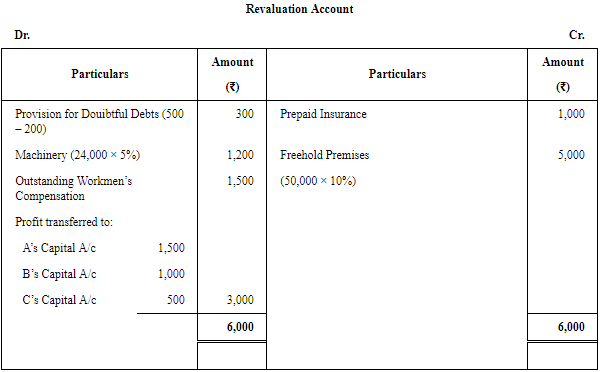

B retired and following adjustments were agreed to determine the amount payable to B:

(a) Out of the amount of insurance premium debited to Profit and Loss Account, ₹ 1,000 be carried forward as prepaid Insurance.

(b) Freehold Premises be appreciated by 10%.

(c) Provision for Doubtful Debts is brought up to 5% on Debtors.

(d) Machinery be reduced by 5%.

(e) Liability for Workmen Compensation to the extent of ₹ 1,500 would be created.

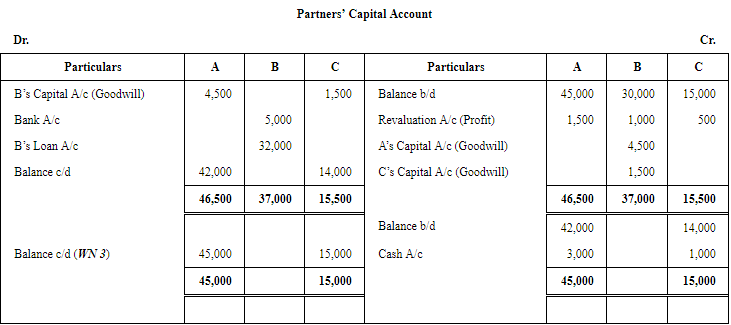

(f) Goodwill of the firm be fixed at ₹ 18,000 and B's share of the same be adjusted into the accounts of A and C who will share future profits in the ratio of 3/4th and 1/4th.

(g) Total capital of the firm as newly constituted be fixed at ₹ 60,000 between A and C in the proportion of 3/4th and 1/4th after passing entries in their accounts for adjustments, i.e., actual cash to be paid or to be brought in by continuing partners as the case may be.

(h) B be paid ₹ 5,000 in cash and the balance be transferred to his Loan Account.

Prepare Capital Accounts of Partners and the Balance Sheet of the firm of A and C.

ANSWER:

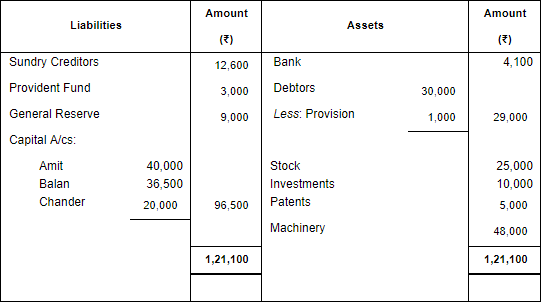

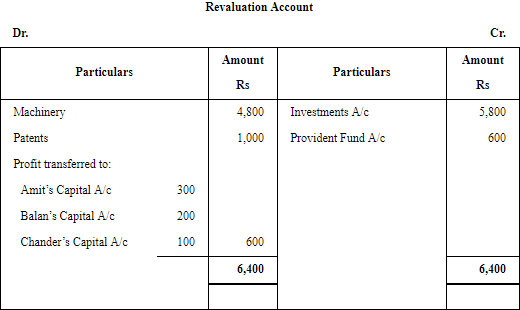

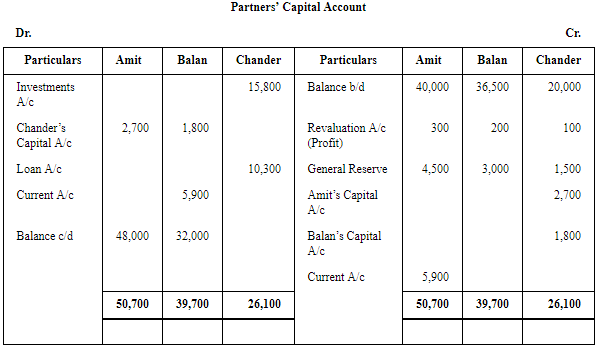

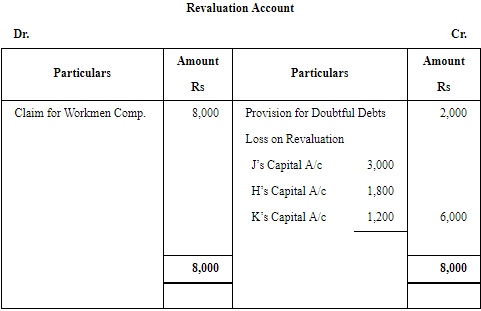

Question 45: Amit, Balan and Chander were partners in a firm sharing profits in the proportion of 1/2, 1/3 and 1/6 respectively. Chander retired on 1st April, 2014. The Balance Sheet of the firm on the date of Chander's retirement was as follows:

It was agreed that:

(i) Goodwill will be valued at ₹ 27,000.

(ii) Depreciation of 10% was to be provided on Machinery.

(iii) Patents were to be reduced by 20%.

(iv) Liability on account of Provident Fund was estimated at ₹ 2,400.

(v) Chander took over Investments for ₹ 15,800.

(vi) Amit and Balan decided to adjust their capitals in proportion of their profit-sharing ratio by opening Current Accounts.

Prepare Revaluation Account and Partners' Capital Accounts on Chander's retirement.

ANSWER:

Note: Since, here no information is given regarding the share acquired by Amit and Balan, therefore, their gaining ratio is same as their new profit sharing ratio i.e. 3 : 2.

Page No 6.89:

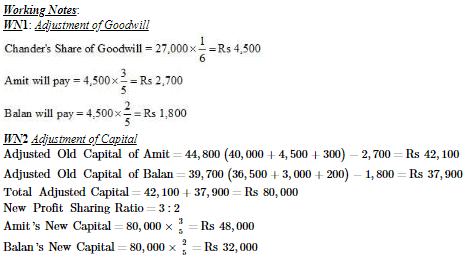

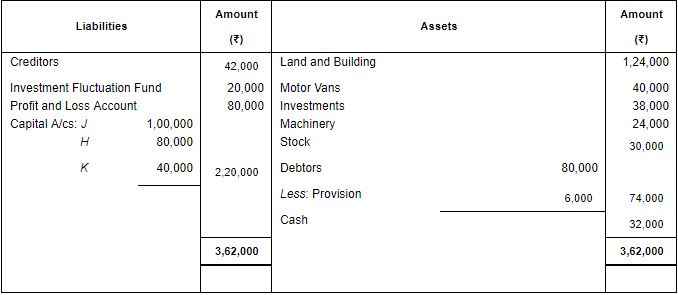

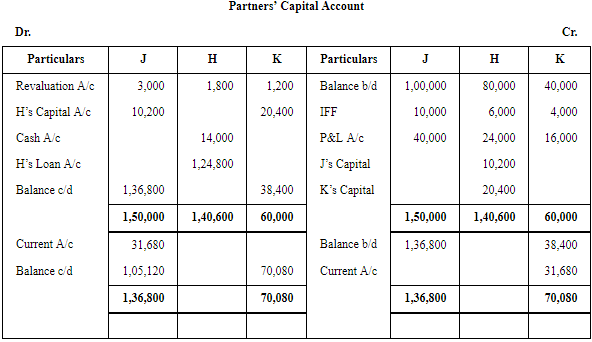

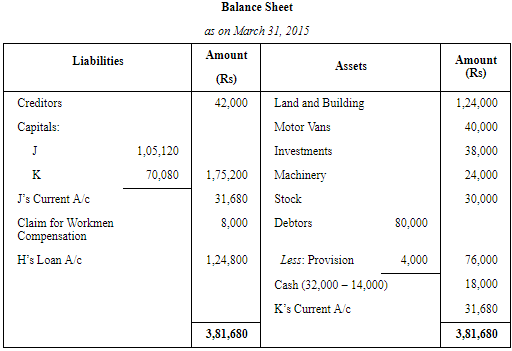

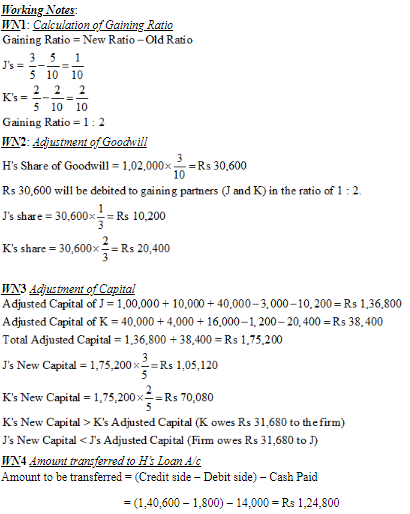

Question 46: J, H and K were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 31st March, 2015, their Balance Sheet was as follows:

On the above date, H retired and J and K agreed to continue the business on the following terms:

(i) Goodwill of the firm was valued at ₹ 1,02,000.

(ii) There was a claim of ₹ 8,000 for workmen's compensation.

(iii) Provision for bad debts was to be reduced by ₹ 2,000.

(iv) H will be paid ₹ 14,000 in cash and balance will be transferred in his Loan Account which will be paid in four equal yearly instalments together with interest @ 10% p.a.

(v) The new profit-sharing ratio between J and K will be 3 : 2 and their capitals will be in their new profit-sharing ratio. The capital adjustments will be done by opening Current Accounts.

Prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet of the new firm.

ANSWER:

Question 47: X, Y and Z are partners in a firm sharing profits in the ratio of 3 : 1 : 2. On 31st March, 2019, their Balance Sheet was:

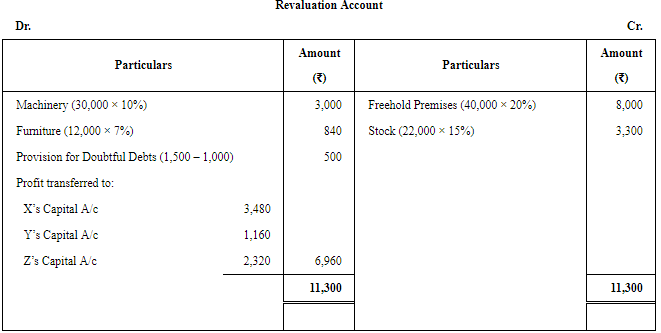

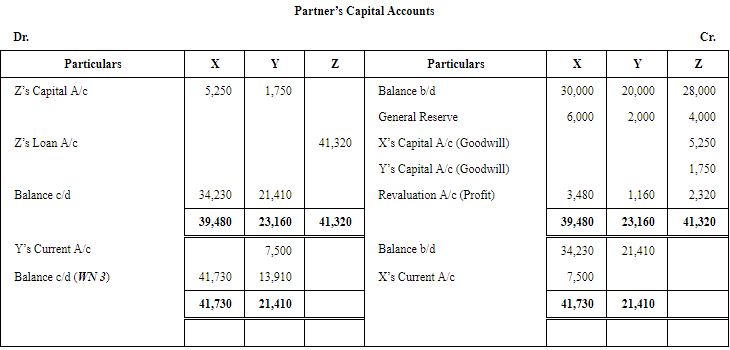

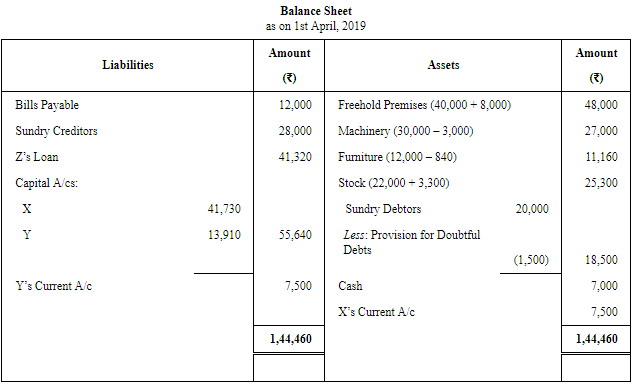

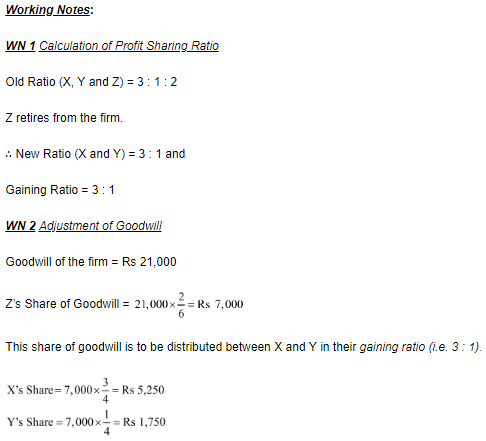

Z retired on 1st April, 2019 from the business and the partners agree to the following:

(a) Freehold Premises and Stock are to be appreciated by 20% and 15% respectively.

(b) Machinery and Furniture are to be reduced by 10% and 7% respectively.

(c) Provision for Doubtful Debts is to be increased to ₹ 1,500.

(d) Goodwill of the firm is valued at ₹ 21,000 on Z's retirement.

(e) Continuing partners to adjust their capitals in their new profit-sharing ratio after retirement of Z. Surplus/deficit, if any, in their Capital Accounts will be adjusted through Current Accounts.

Prepare necessary Ledger Accounts and draw the Balance Sheet of the reconstituted firm.

ANSWER:

Page No 6.90:

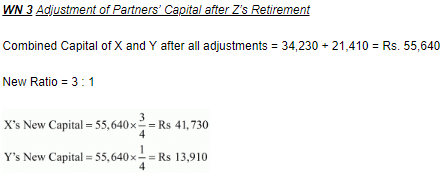

Question 48: X, Y and Z are partners sharing profits in the ratio of 5 : 3 : 7. X retired from the firm. Y and Z decided to share future profits in the ratio of 2 : 3. The adjusted Capital Accounts of Y and Z showed balance of ₹ 49,500 and ₹ 1,05,750 respectively. The total amount to be paid to X is ₹ 1,35,750. This amount is to be paid by Y and Z in a manner that their capitals become proportionate to their new profit-sharing ratio. Calculate the amount to be brought in or to be paid to partners.

ANSWER:

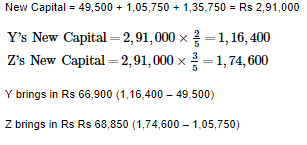

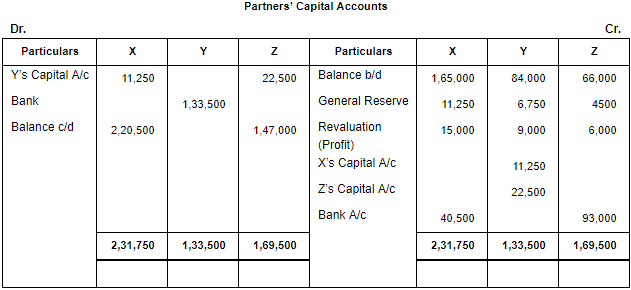

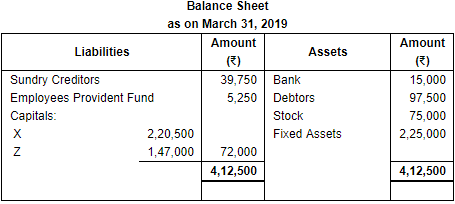

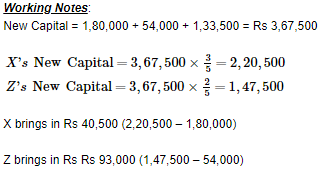

Question 49: Balance Sheet of X, Y and Z who shared profits in the ratio of 5 : 3 : 2, as on 31st March, 2019 was as follows:

Y retired on 1st April, 2019 and it was agreed that:

(i) Goodwill of the firm is valued at ₹ 1,12,500 and Y's share of it be adjusted into the accounts of X and Z who are going to share future profits in the ratio of 3 : 2.

(ii) Fixed Assets be appreciated by 20%.

(iii) Stock be reduced to ₹ 75,000.

(iv) Y be paid amount brought in by X and Z so as to make their capitals proportionate to their new profit-sharing ratio.

Prepare Revaluation Account, Capital Accounts of all partners and the Balance Sheet of the New Firm.

ANSWER:

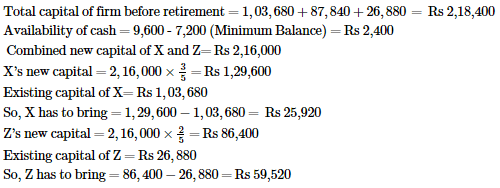

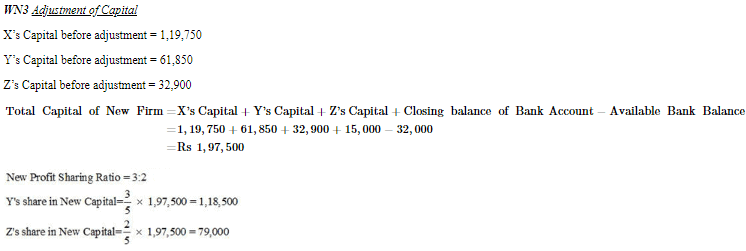

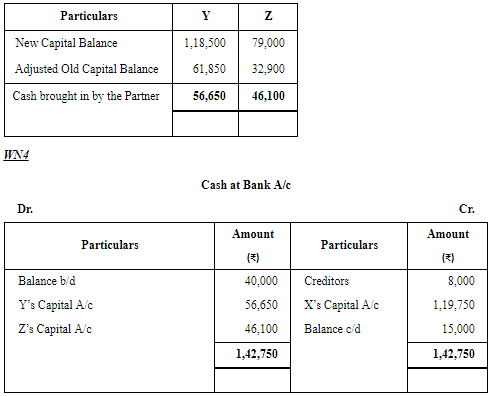

Question 50: X, Y and Z are partners sharing profits in the ratio of 5 : 3 : 2. Y retires on 1st April, 2019 from the firm, on which date capitals of X, Y and Z after all adjustments are ₹ 1,03,680, ₹ 87,840 and ₹ 26,880 respectively. The Cash and Bank Balance on that date was ₹ 9,600. Y is to be paid through amount brought in by X and Z in such a way as to make their capitals proportionate to their new profit-sharing ratio which will be X 3/5 and Z 2/5. Calculate the amount to be paid or to be brought in by the continuing partners assuming that a minimum Cash and Bank balance of ₹ 7,200 was to be maintained and pass the necessary Journal entries.

ANSWER:

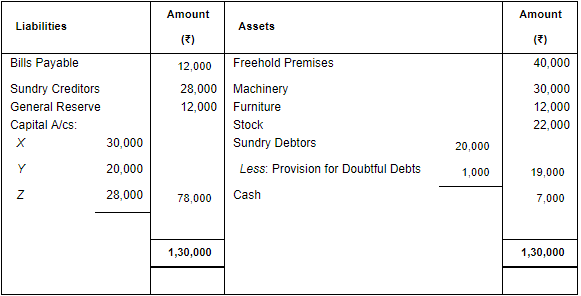

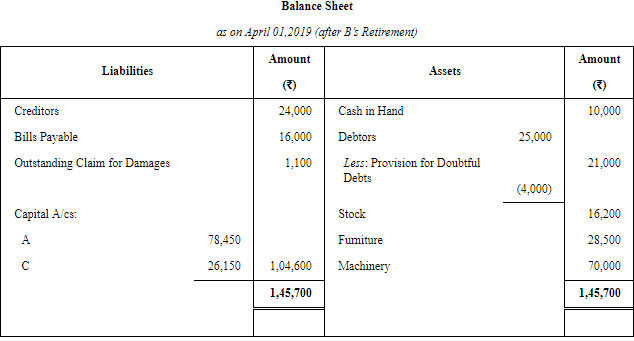

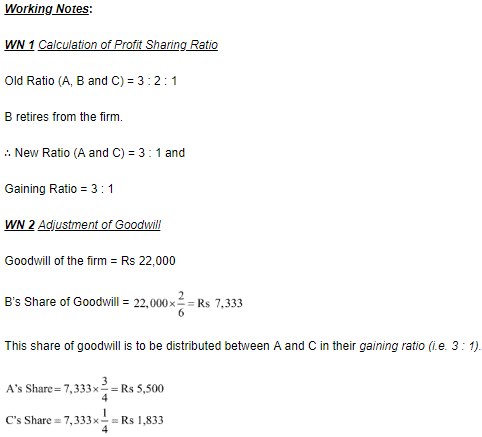

Question 51: A, B and C are partners in a firm sharing profits and losses in the ratio of 3 : 2 : 1. Their Balance Sheet as at 31st March, 2019 is:

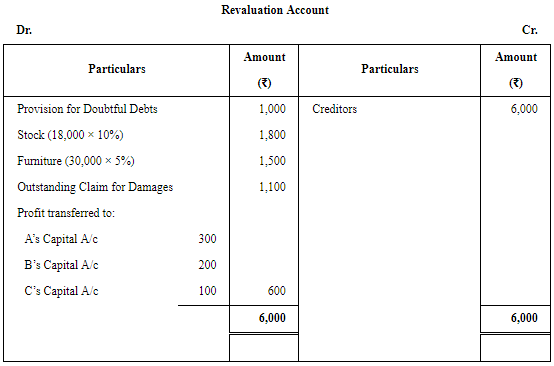

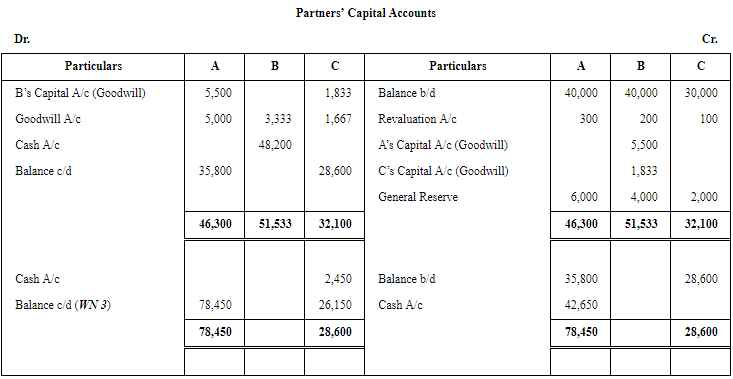

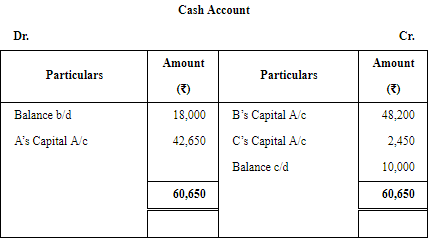

B retires on 1st April, 2019 on the following terms:

(a) Provision for Doubtful Debts be raised by ₹ 1,000.

(b) Stock to be reduced by 10% and Furniture by 5%.

(c) Their is an outstanding claim of damages of ₹ 1,100 and it is to be provided for.

(d) Creditors will be written back by ₹ 6,000.

(e) Goodwill of the firm is valued at ₹ 22,000.

(f) B is paid in full with the cash brought in by A and C in such a manner that their capitals are in proportion to their profit-sharing ratio and Cash in Hand remains at ₹ 10,000.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of A and C.

ANSWER:

Page No 6.91:

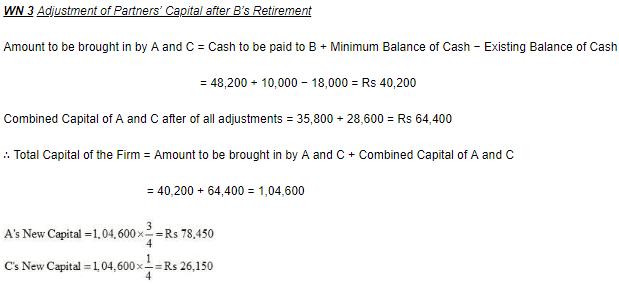

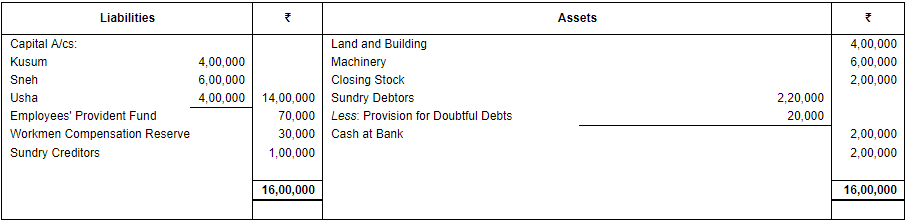

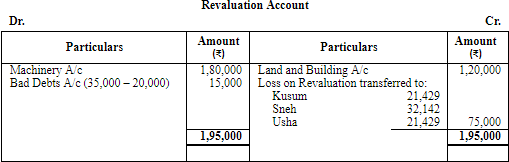

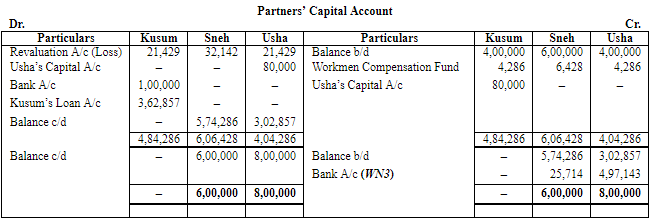

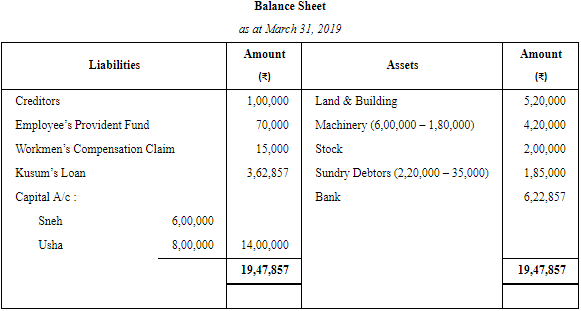

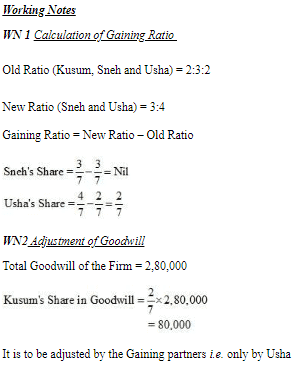

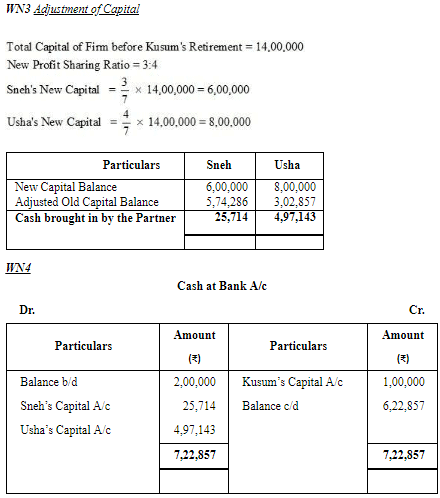

Question 52: Following is the Balance Sheet of Kusum, Sneh and Usha as on 31st March, 2019, who have agreed to share profits and losses in proportion of their capitals:

On 1st April, 2019, Kusum retired from the firm and the remaining partners decided to carry on the business. It was agreed to revalue the assets and reassess the liabilities on that date, on the following basis:

(a) Land and Building be appreciated by 30%.

(b) Machinery be depreciated by 30%.

(c) There were Bad Debts of ₹ 35,000.

(d) The claim against Workmen Compensation Reserve was estimated at ₹ 15,000.

(e) Goodwill of the firm was valued at ₹ 2,80,000 and Kusum's share of goodwill was adjusted against the Capital Accounts of the continuing partners Sneh and Usha who have decided to share future profits in the ratio of 3 : 4 respectively.

(f) Capital of the new firm in total will be the same as before the retirement of Kusum and will be in the new profit-sharing ratio of the continuing partners.

(g) Amount due to Kusum be settled by paying ₹ 1,00,000 in cash and balance by transferring to her Loan Account which will be paid later on.

Prepare Revaluation Account, Capital Accounts of Partners and Balance Sheet of the new firm after Kusum's retirement.

ANSWER:

Page No 6.92

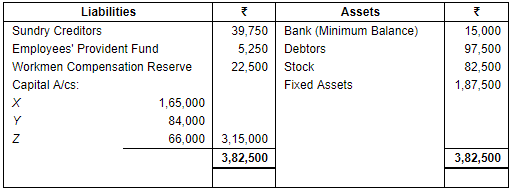

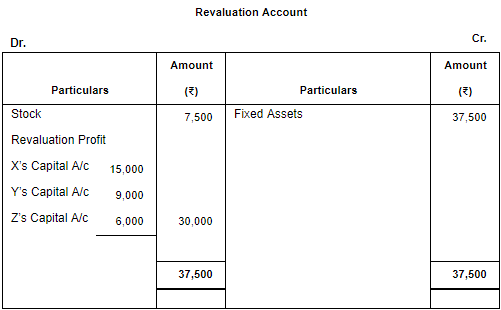

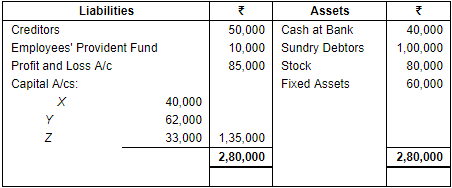

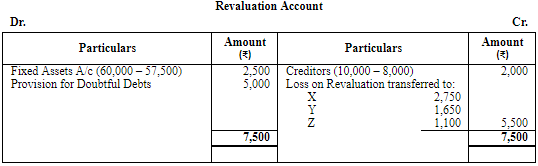

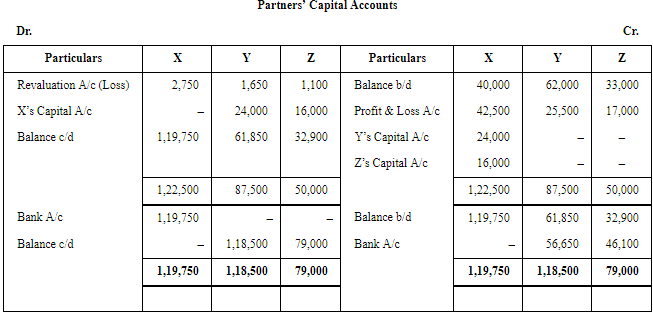

Question 53: The Balance Sheet of X, Y and Z who were sharing profits in the ratio of 5 : 3 : 2 as at 31st March, 2019 is as follows:

X retired on 1st April, 2019 and Y and Z decided to share profits in future in the ratio of 3 : 2 respectively.

The other terms on retirement were:

(a) Goodwill of the firm is to be valued at ₹ 80,000.

(b) Fixed Assets are to be depreciated to ₹ 57,500.

(c) Make a Provision for Doubtful Debts at 5% on Debtors.

(d) A liability for claim, included in Creditors for ₹ 10,000, is settled at ₹ 8,000.

The amount to be paid to X by Y and Z in such a way that their Capitals are proportionate to their profit-sharing ratio and leave a balance of ₹ 15,000 in the Bank Account.

Prepare Profit and Loss Adjustment Account and Partners' Capital Accounts.

ANSWER:

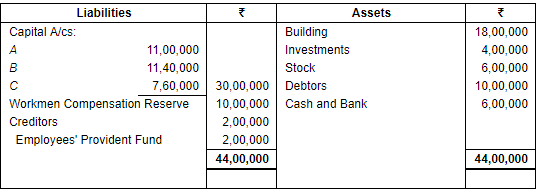

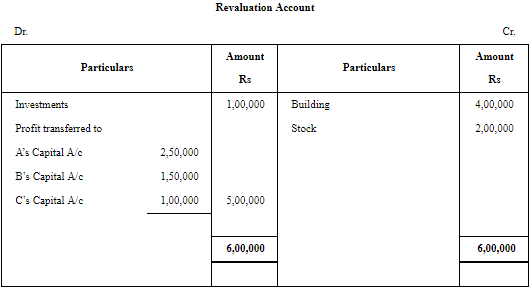

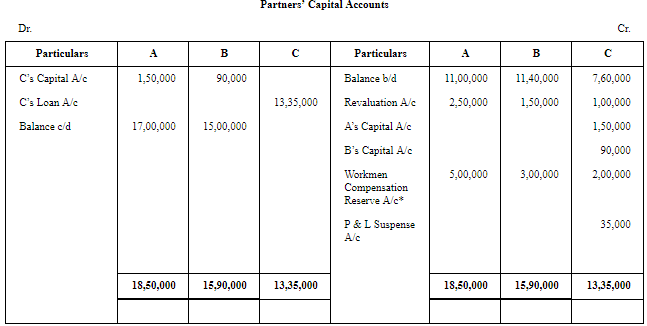

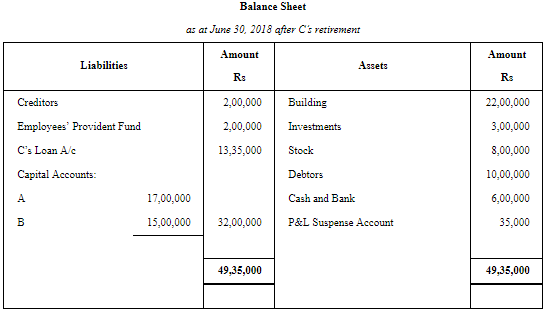

Question 54: A, B and C are partners sharing profits in the ratio of 5 : 3 : 2. Their Balance Sheet as on 31st March, 2018 is given below:

C retires on 30th June, 2018 and it was mutually agreed that:

(a) Building be valued at ₹ 22,00,000.

(b) Investments to be valued at ₹ 3,00,000.

(c) Stock be taken at ₹ 8,00,000.

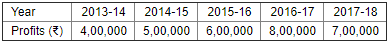

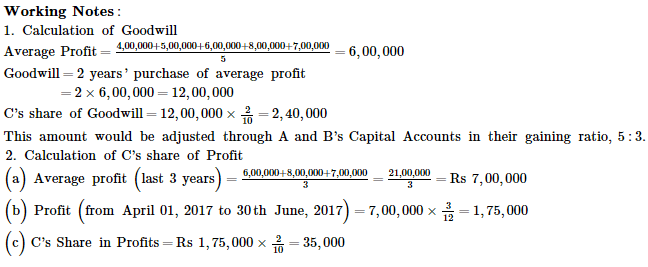

(d) Goodwill of the firm be valued at two years' purchase of the average profit of the past five years.

(e) C's share of profits up to the date of retirement be calculated on the basis of average profit of the preceding three years.

The profits of the preceding five years were as under:

(f) Amount payable to C to be transferred to his Loan Account carrying interest @ 10% p.a.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet as at 30th June, 2018.

ANSWER:

Page No 6.93:

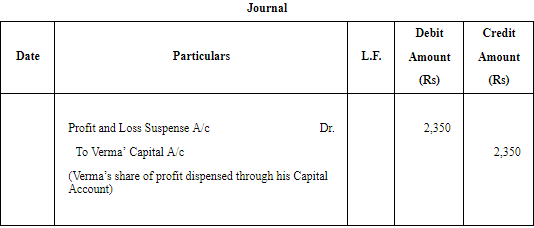

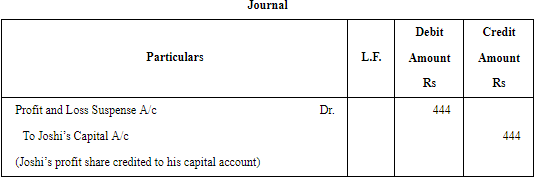

Question 55: Kumar, Verma and Naresh were partners in a firm sharing Profit and Loss in the ratio of 3 : 2 : 2. On 23rd January, 2015 Verma died. Verma's share of profit till the date of his death was calculated at ₹ 2,350. Pass necessary Journal entry for the same in the books of the firm.

ANSWER: The Journal entry for transferring Verma’s share of profit to his capital account is given below

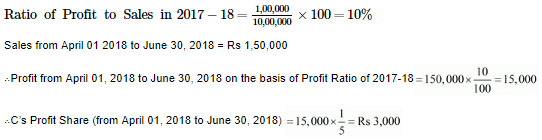

Question 56: A, B and C were partners sharing profits and losses in the ratio of 2 : 2 : 1. C died on 30th June, 2018. Profit and Sales for the year ended 31st March, 2018 were ₹ 1,00,000 and ₹ 10,00,000 respectively. Sales during April to June, 2018 were ₹ 1,50,000. You are required to calculate share of profit of C up to the date of his death.

ANSWER: Profit for the year 2017-18 = Rs 1,00,000

Sales for the year 2017-18 = Rs 10,00,000

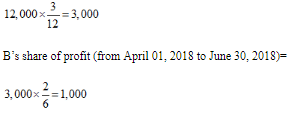

Question 57:A, B and C are partners sharing profits and losses in the ratio of 3 : 2 : 1. B died on 30th June, 2018. For the year ended 31st March, 2019, proportionate profit of 2018 is to be taken into consideration. During the year ended 31st March, 2018, bad debts of ₹ 2,000 had to be adjusted. Profit for the year ended 31st March, 2018 was ₹ 14,000 before adjustment of bad debts. Calculate B's share of profit till the date of his death.

ANSWER: Profit for the year 2017-18 before adjusting bad debts = Rs 14,000

Bad debts = Rs 2,000

Profits after adjusting bad debts =14,000 – 2,000= Rs.12,000

Proportionate profit of the firm (from April 01, 2018 to June 30, 2018)=

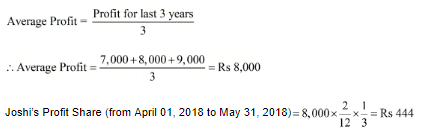

Question 58: Ram, Manohar and Joshi were partners in a firm. Joshi died on 31st May, 2018. His share of profit from the closure of the last accounting year till the date of death was to be calculated on the basis of the average of three completed financial years of profits before death. Profits for the years ended 31st March, 2016, 2017 and 2018 were ₹ 7,000; ₹ 8,000 and ₹ 9,000 respectively. Calculate Joshi's share of profit till the date of his death and pass necessary Journal entry for the same.

ANSWER:

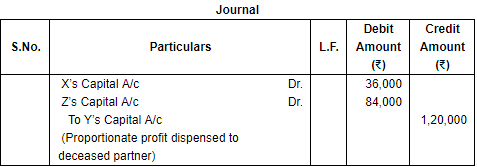

Question 59: X, Y and Z were partners sharing profits and losses in the ratio of 3 : 2 : 1. Y died on 30th June, 2018. Profit from 1st April, 2018 to 30th June, 2018 was ₹ 3,60,000. X and Z decided to share the future profits in the ratio of 3 : 2 respectively with effect from 1st July, 2018. Pass the necessary Journal entries to record Y's share of profit up to the date of death.

ANSWER:

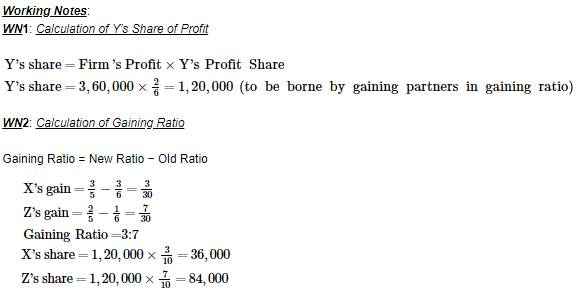

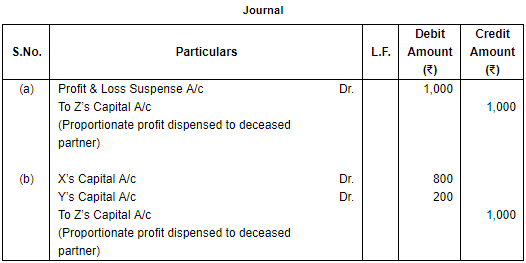

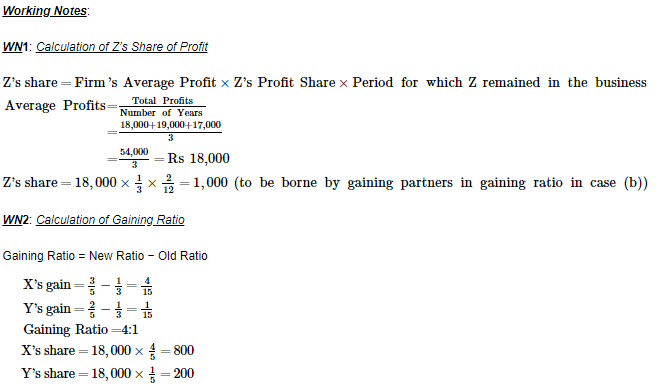

Question 60: X, Y and Z were partners in a firm. Z died on 31st May, 2018. His share of profit from the closure of the last accounting year till the date of death was to be calculated on the basis of the average of three completed ₹ 19,000 and ₹ 17,000 respectively.

Calculate Z's share of profit till his death and pass necessary Journal entry for the same when:

(a) there is no change in profit-sharing ratio of remaining partners, and

(b) there is change in profit-sharing ratio of remaining partners, new ratio being 3 : 2.

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Retirement/Death of a Partner (Part - 3) - Accountancy Class 12 - Commerce

| 1. What is retirement planning? |  |

| 2. How much money do I need for retirement? |  |

| 3. What is a pension plan? |  |

| 4. What happens to my partner's pension if they pass away before retirement? |  |

| 5. Can I receive Social Security benefits based on my deceased partner's earnings record? |  |