Class 10 Exam > Class 10 Notes > Business Studies for GCSE/IGCSE > Short-term & Long-term Sources of Finance

Short-term & Long-term Sources of Finance | Business Studies for GCSE/IGCSE - Class 10 PDF Download

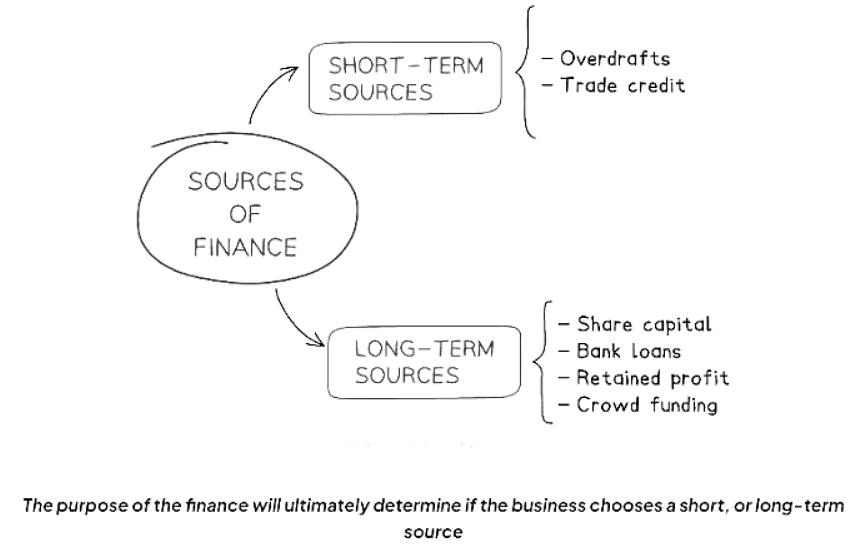

Short-term Sources of Finance

- Short-term sources of finance are essential for covering unexpected expenses or paying immediate bills and suppliers.

- These financial resources typically involve relatively small amounts and are generally required for a duration not exceeding a year.

Diagram of Short and Long-term Sources of Finance

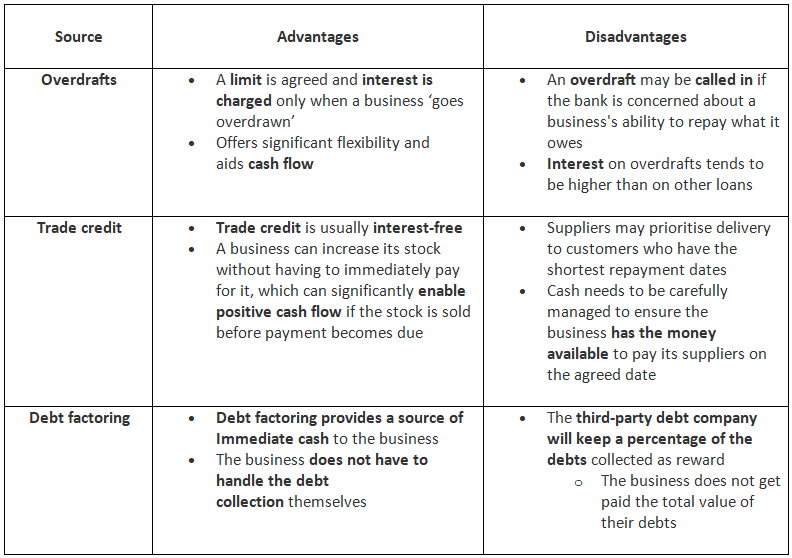

Evaluating Short-term Sources of Finance

Long-term Sources of Finance

- Long-term finance, typically extending beyond a year, allows for repayment over an extended duration.

- Various types of long-term finance are represented on the balance sheet as non-current liabilities.

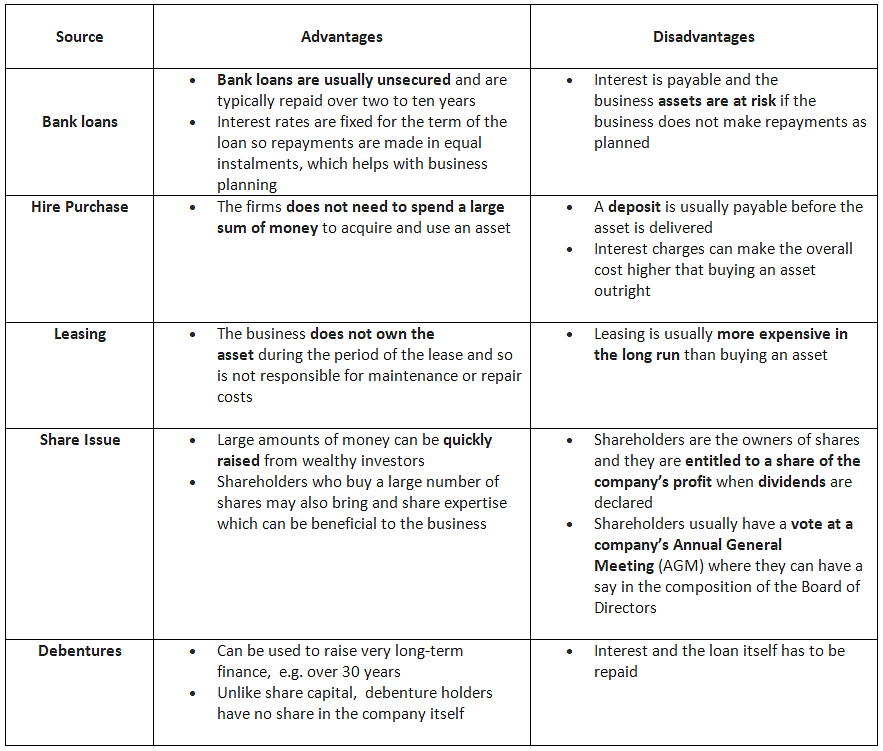

Evaluating Long-term Sources of Finance

The document Short-term & Long-term Sources of Finance | Business Studies for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Business Studies for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

70 videos|93 docs|26 tests

|

FAQs on Short-term & Long-term Sources of Finance - Business Studies for GCSE/IGCSE - Class 10

| 1. What are some examples of short-term sources of finance? |  |

Ans. Some examples of short-term sources of finance include bank overdrafts, trade credit, commercial paper, and factoring.

| 2. How do long-term sources of finance differ from short-term sources? |  |

Ans. Long-term sources of finance involve obtaining funds for a period exceeding one year, such as bank loans, equity financing, and debentures, while short-term sources are for a period of one year or less.

| 3. What are the advantages of using short-term sources of finance? |  |

Ans. Short-term sources of finance provide quick access to funds, allow businesses to manage seasonal fluctuations in cash flow, and are generally easier to obtain compared to long-term sources of finance.

| 4. Can a business use a combination of short-term and long-term sources of finance? |  |

Ans. Yes, businesses often use a combination of short-term and long-term sources of finance to meet their funding needs. This strategy helps maintain a balance between short-term liquidity requirements and long-term capital investment.

| 5. How can a business determine the most suitable source of finance for its needs? |  |

Ans. A business should consider factors such as the amount of funding required, the purpose of the financing, the repayment terms, and the business's financial stability when choosing between short-term and long-term sources of finance. Consulting with financial advisors can also help in making an informed decision.

Related Searches