Statement of Cash Flows | Management Optional Notes for UPSC PDF Download

Cash Flow Statement

- Cash, in a narrow context, represents a readily available resource that can be utilized as needed. In this context, the term "cash" encompasses both physical currency and cash equivalents. Cash equivalents refer to highly liquid short-term investments that can be swiftly converted into cash.

- It's essential to recognize that daily business obligations and liabilities are typically addressed through cash or checks. However, in practice, this isn't always the case. Moreover, it's crucial to differentiate between "Profit" and "Cash." Net profit alone cannot settle payments like creditor dues, electricity bills, taxes, or dividends. To meet such commitments, businesses require a cash balance or credit facilities with banks. Failing to fulfill these financial obligations promptly, even with a robust working capital base and profitable earnings, can lead to severe consequences for a business.

- While the balance sheet and profit and loss account provide insights into the financial position and operational outcomes for a specific period, the funds flow statement traces fund movement within the organization. Nevertheless, neither of these financial statements offers a detailed breakdown of cash flows related to operating, financing, and investing activities.

- To ensure that an appropriate amount of cash aligns with business needs, effective "cash planning" becomes necessary. This involves determining the cash inflow and outflow by understanding the changes in the cash position between two periods. The document that articulates these changes is known as the cash flow statement.

- The cash flow statement serves as a vital tool for management in short-term planning, coordination of various operations, and forecasting future cash flows. Providing a comprehensive overview of cash movement, it identifies potential sources for acquiring cash when needed. Comparing the actual cash flow statement with the projected one aids in understanding cash movement trends and determining the success or failure of cash planning.

- While cash flow and fund flow statements share similarities, they differ in their interpretation of "fund" and "cash." In the fund flow statement, "fund" encompasses a broader meaning, representing current assets minus current liabilities. This statement assesses the impact of changes in the fund's position on the working capital (current assets minus current liabilities).

- In contrast, the cash flow statement focuses solely on cash and balances with banks, constituting a smaller but crucial portion of the total fund. The cash flow statement begins with the opening cash balance, detailing additional cash sources and its uses, ultimately concluding with the closing balance at the period's end. In contrast, fund flow statements lack opening and closing balances. An increase in current assets or a decrease in current liabilities boosts working capital, while a decrease in current assets or an increase in current liabilities enhances cash flow.

Sources and Uses of Cash

- A cash flow statement is a financial document that outlines a company's cash sources and expenditures during a specific timeframe. It plays a crucial role in compensating for the potential impact of various accrual accounting methods that companies might employ, revealing discrepancies between reported profits and the actual cash available for sustaining operations.

- By categorizing cash sources and uses, the cash flow statement provides insight into the cash a company generates and consumes within its operations, distinguishing it from external sources like loans or stockholders' funds. This statement also sheds light on expenses not reflected in the income statement, such as loan repayments, long-term asset acquisitions, and cash dividend disbursements.

- Cash flow statements organize cash transactions into three primary categories: Operating Activities, Investing Activities, and Financing Activities. Each category represents a distinct aspect of a company's financial operations, contributing to a comprehensive understanding of its cash flow dynamics.

- Operating Activities: These involve cash inflows from sales and service provision, along with outflows for operating expenses like payments to suppliers, wages, interest, and taxes. Changes in current assets (e.g., receivables, inventory) and current liabilities (e.g., accounts payable, wages payable) also reflect operating activities.

- Investing Activities: This category includes cash flows related to the acquisition and sale of fixed assets such as land, buildings, and machinery, as well as transactions involving investments. Acquiring assets leads to cash outflows, while their disposal results in cash inflows.

- Financing Activities: Financing activities encompass changes in equity, preference capital, debentures, and long-term loans. Issuing equity, preference shares, debentures, and obtaining long-term loans result in cash inflow. Conversely, retiring capital, paying dividends, redeeming debentures, and amortizing long-term loans are associated with cash outflow.

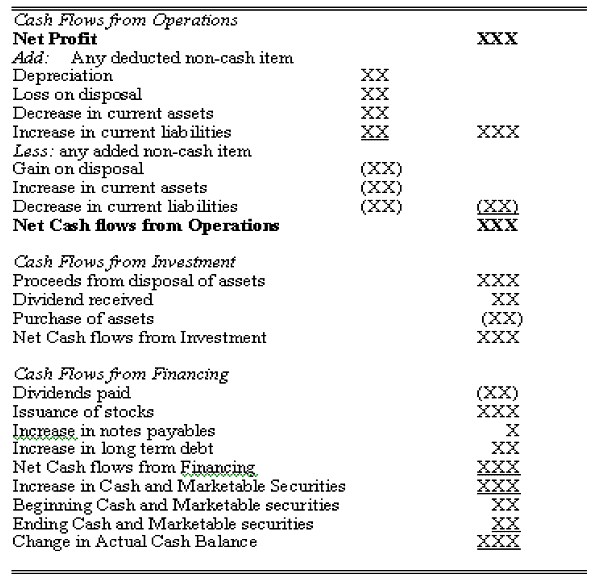

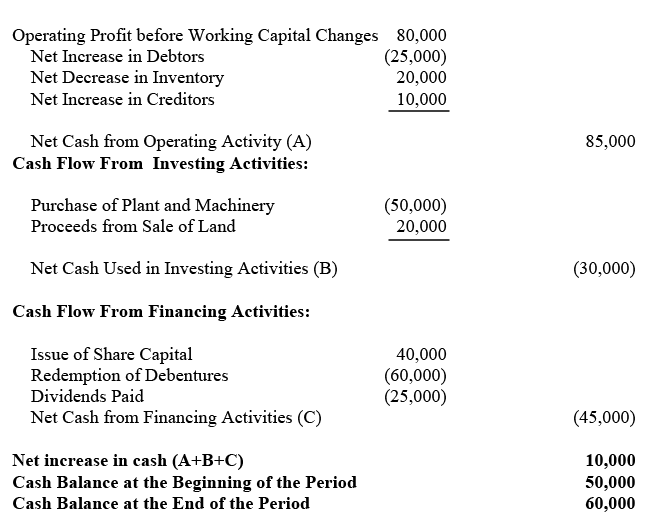

- The net increase or decrease in cash flow is computed by combining the results from each section. The format of the cash flow statement is as follows:

- The summarised cash statement is:

Preparation of Cash Flow Statement

- To initiate the creation of a cash flow statement, two consecutive balance sheets and the operating statement (profit and loss account) connecting the two balance sheets are necessary.

- There are two approaches to constructing this statement. The first is the direct method, which involves presenting major categories of gross cash receipts and gross cash payments. The second method is referred to as the shortcut or indirect method. In this approach, the starting point is the net profit or loss, which is then adjusted for the impact of non-cash transactions, changes in current assets and liabilities, and activities related to financial cash flows.

Direct Method

- Under the direct method, the analysis focuses on scrutinizing cash and bank accounts to identify cash flows throughout the period. This can be accomplished by utilizing a detailed general ledger report that outlines all entries to the cash and bank accounts or by employing cash receipts and disbursements journals. For each cash entry, the corresponding offsetting entry is determined to allocate each cash movement appropriately on the cash flow statement.

- An alternative approach involves creating a worksheet for each major line item, aiming to eliminate the impacts of accrual basis accounting and deriving the net cash effect for that specific line item during the period. For the operating activities section, some examples include:

- Cash Receipts from Customers:

- Net sales as per the Income Statement

- Plus beginning balance in Accounts Receivable

- Minus ending balance in Accounts Receivable

- Equals Cash Receipts from Customers

- Cash Payments for Inventory:

- Ending Inventory

- Minus Beginning Inventory

- Plus Beginning Balance in Accounts Payable to Vendors

- Minus Ending Balance in Accounts Payable to Vendors

- Equals Cash Payments for Inventory

- Cash Paid to Employees:

- Salaries and Wages as per the Income Statement

- Plus beginning balance in Salaries and Wages Payable

- Minus ending balance in Salaries and Wages Payable

- Equals Cash Paid to Employees

- Cash Paid for Operating Expenses:

- Operating Expenses as per the Income Statement

- Minus Depreciation Expenses

- Plus Increase or Minus Decrease in Prepaid Expenses

- Plus Decrease or Minus Increase in Accrued Expenses

- Equals Cash Paid for Operating Expenses

- Taxes paid:

- Tax Expense per the Income Statement

- Plus Beginning Balance in Taxes Payable

- Minus Ending Balance in Taxes Payable

- Equals Taxes Paid

- Interest paid:

- Interest Expense per the Income Statement

- Plus Beginning Balance in Interest Payable

- Minus Ending Balance in Interest Payable

- Equals Interest Paid

Under the direct method, for this example, you would then report the following in the cash flows from the operating activities section of the cash flow statement:

- Cash Receipts from Customers

- Cash Payments for Inventory

- Cash Paid to Employees

- Cash Paid for Operating Expenses

- Taxes Paid

- Interest Paid

- Equals Net Cash provided by (used in) Operating Activities.

Similar types of calculations can be made of the balance sheet accounts to eliminate the effects of accrual accounting and determine the cash flows to be reported in the investing activities and financing activities sections of the cash flow statement.

Indirect Method

In the indirect method of preparing the cash flows from operating activities section, the process begins with the net income derived from the income statement. This method involves reversing entries related to income and expense accounts that do not involve cash movements, along with demonstrating the change in net working capital. Entries that affect net income but do not represent cash flows may encompass earned income yet to be received, amortization of prepaid expenses, accrued expenses, and depreciation or amortization. The indirect method entails analyzing income and expense accounts along with working capital.

The following is an illustrative example of how the indirect method is presented on the cash flow statement:

- Net Income as per the Income Statement

- Minus Entries to Income Accounts that do not Represent Cash Flows

- Plus Entries to Expense Accounts that do not Represent Cash Flows

- Equals Cash Flows before Movements in Working Capital

- Plus or Minus the Change in Working Capital, as Follows:

- An increase in current assets (excluding cash and cash equivalents) is shown as a negative figure, indicating cash was spent or converted into other current assets, thereby reducing the cash balance.

- A decrease in current assets is represented as a positive figure, signifying that other current assets were converted into cash.

- An increase in current liabilities (excluding short-term debt in financing activities) is depicted as a positive figure, indicating that more liabilities result in less cash being spent.

- Conversely, a decrease in current liabilities is shown as a negative figure, signifying that cash was used to reduce liabilities.

The overall impact is then reported as cash provided by (used in) operating activities. The cash flows from investing activities and financing activities are reported in the same manner as under the direct method.

While the direct method offers a straightforward approach in preparing a cash flow statement, the indirect method, as outlined above, involves adjusting net income for non-cash items and changes in working capital. The following illustration, presented in Illustration 2, further examines the indirect method for preparing a cash flow statement.

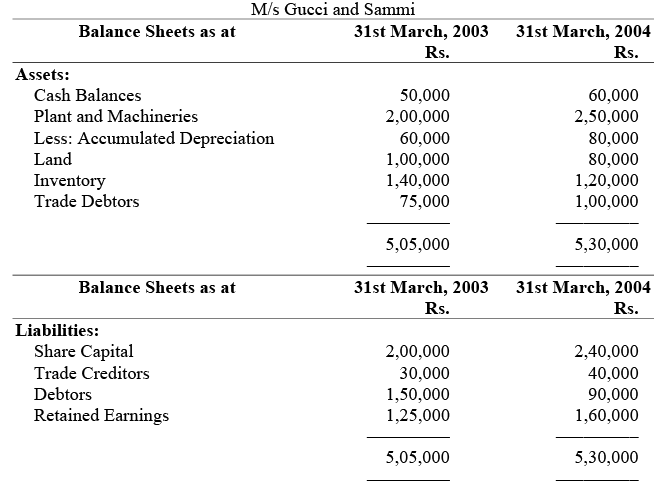

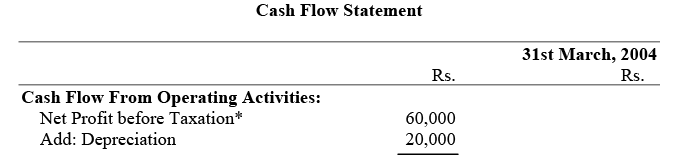

Illustration 2: The balance sheet of M/s. Gucci and Sammi Limited as at March 2003 and 2004 are given below: Additional Information: Cash dividends of Rs.25,000 has been paid during the year. You are required to prepare cash flow statement following the indirect method.

Additional Information: Cash dividends of Rs.25,000 has been paid during the year. You are required to prepare cash flow statement following the indirect method.

Note: *Profit for the period = Increase in retained earnings + Dividends paid

Note: *Profit for the period = Increase in retained earnings + Dividends paid

= 35,000 + 25,000

= 60,000

FAQs on Statement of Cash Flows - Management Optional Notes for UPSC

| 1. What is a cash flow statement? |  |

| 2. What are the sources and uses of cash in a cash flow statement? |  |

| 3. How is a cash flow statement prepared? |  |

| 4. Why is a cash flow statement important for businesses? |  |

| 5. What are the key differences between a cash flow statement and an income statement? |  |