Techniques of Cost Control and Cost Reduction: Standard Costing and Variance Analysis - 1 | Commerce & Accountancy Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Definition of Standard Costing |

|

| Types of Standards |

|

| Variance Analysis |

|

Introduction

- In the corporate sector, there exists a separation between ownership and management. Owners typically do not directly manage the business, especially in large enterprises where it becomes impractical for them to handle the day-to-day operations. Consequently, owners delegate authority to managers. Since these managers lack a personal stake in the business, there is a potential for inefficiency and negligence, which may lead to a decline in sales, increased costs, and higher rejection rates, resulting in significant financial losses or gains.

- Recognizing this, owners rightly feel the need to subject the performance of managers to stringent control, employing a combination of rewards and penalties. Effective control requires predefined standards or benchmarks. Before a period begins, detailed standards are set for various managers, outlining expectations.

- For instance, sales managers are provided with specifications on the types and quantities of products to be sold, along with the applicable pricing. At the end of the period, actual results are compared to these standards, and the variations, known as variances, are analyzed to identify the specific factors responsible for the differences. While this concludes the examination, real-life scenarios often involve further investigation if the variances are significant. Corrective actions are then implemented to prevent adverse outcomes from recurring in the future.

Definition of Standard Costing

- According to the Institute of Cost and Works Accountants (ICWA), standard costing is defined as "the preparation of standard costs and applying them to measure the variance of actual costs from standard cost and analyzing the causes of variations with a view to maintaining maximum efficiency in production." In essence, it involves comparing the differences between standard and actual costs.

- The ICWA further defines standard cost as "a predetermined cost based on a technical estimate for material, labor, and overheads for a selected period of time and for a prescribed set of working conditions."

- The utilization of standard costing offers several advantages:

- Cost Control and Reduction: Variance analysis aids in cost control, reduction, and increased profitability by identifying and addressing wastage and inefficiency.

- Incentive and Motivation: Standards provide incentives and motivation for workers, as they strive to achieve the set standards, leading to increased efficiency and productivity.

- Prompt Cost Information: The system ensures that cost information is readily available, facilitating various aspects of costing, such as fixing selling prices and valuing work in progress.

- Management by Exception: The analysis of variances and reporting supports the principle of 'management by exception.' Top-level management focuses on understanding the causes of variances to take corrective action.

- Budgetary Control and Decision Making: Standard costing contributes to budgetary control and aids in decision-making processes.

- The standard costing system involves the following steps or procedures:

- Preparation and Use of Standard Costs

- Comparison of Standard Costs with Actual Costs

- Analysis of Variances and Determination of Causes

Types of Standards

Standard refers to a pre-determined specification, and in the context of cost accounting, standards are established for both quantity and price.

There are two main types of standards:

- Quantity Standard: This standard is determined by production engineers and involves specifying the quantity of inputs required to produce a unit of output. For example, a production engineer may establish that 150 units of raw material are needed to produce 130 units of output. This determination also sets the standard for waste or scrap.

- Price Standard: Price standards involve setting the expected cost per unit for various cost components, such as direct materials, direct labor, and overheads. These standards are based on technical estimates and are predetermined for a specified period and under defined working conditions.

Total Standard Cost

The total standard cost is made up of -

- Standard Direct Material Cost

- Standard Direct Labour Cost

- Standard Overheads (Fixed & Variable)

Standard Direct Material Cost:

Quantity standard are fixed by production engineers. Standard are fixed of the quantity of input required for obtaiing a unit of output.

For example: A production engineer may determine that 150 units of raw material are required to produced 130 units of output. This automatically determine the standard waste or scrap. The standard Quantity for a given actual output is calculated as under -

Standard Direct Labour Cost:

Standard Direct Labour Cost means fixing the standard time and also the standard Rate of wages.

Standard Time: It means the time expected to be required for the workers to complete a job or to produce one unit of output.

Standard wages of all worker are determined by the accounts manager with the co-operation of the personal manager. The standard wages may be fixed on the basis of historical data or expected rates of wages.

Standard Hours - (SH): A hypothetical hour which represents the amount of work which should be performed in one hour under standard condition according to CIMA.

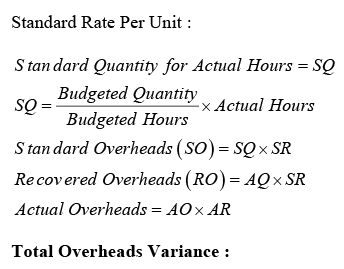

Standard Overheads: Standard Overheads means the standard Rate for Absorption of overheads. It may be for per unit or per hour, depending upon the method of absorption.

Therefore,

The above formula also can be used to calculate separately, the standard fixed overheads and variable overheads.

Variance Analysis

- Variance denotes the distinction between the Actual Cost (AC) and the Standard Cost (SC). If AC is less than SC, indicating efficiency, the difference is deemed a "favorable" variance (F). Conversely, if AC exceeds SC, signaling inefficiency, the difference is termed an "unfavorable" or "adverse" variance (A).

- However, these variances are not inherently good or bad for the firm. A qualitative assessment is only possible after identifying the underlying cause of the variance.

- Variances, as a control mechanism, serve to allocate responsibility for deviations from standard costs and, consequently, control costs. For control purposes, variances are categorized as controllable and uncontrollable cost variances. A controllable variance is one that can be linked to the responsibility of a specific individual. On the other hand, if a variance arises from factors beyond the control of the accountable individual, it is labeled as uncontrollable.

- The three elements of the costs of such enterprises.

(i) Material variances

(ii) Labour variances

(iii) Ovherhead Variances

Material Variances

(1) Material Cost Variances (MCV): Material Cost Variances refer to the difference between the standard cost of materials that was anticipated for manufacturing the actual output and the actual cost of materials incurred. In essence, it represents the variance between the standard cost of materials allocated for the achieved output and the actual cost of direct materials utilized.

MCV = Standard Cost for Standard Quantity - Actual cost for Actual Quantity = ( SQ x SP)-(AQ x AP)

Where, SQ = Standard Quantity

SP = Standard Price

AQ = Actual Quantity

AP = Actual Price

MCV is favourable when the actual cost is less than the standard cost and vice-versa.

It is further dividend into:

- Material Price Variance (MPV)

- Material Usage Variance (MUV)

(2) Material Price Variance (MPV): Material Price Variance is the segment of material cost variance attributable to the difference between the standard price specified for the actual output and the actual price paid. MPV arises when the actual price paid for materials deviates from the standard price.

MPV = (Standard Price - Actual Price) x Actual Quantity = ( SP - AP )x AQ

Where,

SP = Standard Price

AP = Actual Price

AQ = Actual Quantity

An unfavorable variance occurs when the actual price surpasses the standard price, whereas a favorable variance arises when the standard price exceeds the actual price.

(3) Material Usage Variance (MUV): Material Usage Variance constitutes the portion of material cost variance resulting from the difference between the standard quantity specified for the actual output and the actual quantity used.

This variance, the second component of MCV, gauges the efficiency of material utilization in production. MUV occurs when the actual usage of materials deviates from the standard usage.

MUV= (Standard Quantity - Actual Quantity) x Standard Price = ( SQ - AQ )x SP

If the actual consumption of materials surpasses the standard quantity required for producing the actual output, MUV is deemed favorable, and vice versa.

(4) Material Mix Variance (MMV): Material Mix Variance is that portion of material usage variance which is due to difference between the standard mixture specified for actual output and the Actual Mixture.

It is possible that a product may use more than one type of raw material or combination of materials. This combination is called as Material Mix. It is necessary to compute standard mixture of each input for actual output known as Revised Standard Quantity (RQ).

Thus it is assumed that to Produced ‘A’ product material input x, y, z is required, then the revised quantity of input x is calculated as

When the actual mix is less than the standard mix then MMV is favourable and when the actual mix is more than the standard mix than MMV is adverse.

(5) Material Yield Variance (MYV): Material Yield Variane is that portion of material usage variance which is due to the difference between standard yield specified and the actual yield.

MYV = (Standard Quantity - Revised Quantity ) x Standard Price = ( SQ - RQ ) x SP

When the revised quantity is less than the standard quantity then MYV is favourable and when the revised quantity is more than the standard quantity then MYV is adverse. It shows the abnormal loss or abnormal gain arising in a process.

Verification:

MCV = MUV + MPV

MUV = MYV + MMV

Labour Variances

(1) Labour Cost Variances: It is the second component of standard cost. Labour cost variance is the difference between the standard cost of labour specified for output achieved and the actual cost of direct labour used. It is calculated as

LCV = (SH x SR) - (AH x AR)

Where,

SH = Standard Hours

SR = Standard Rate

AH = Actual Hours

AR = Actual Rate

When the actual cost of labour is less than the standard cost then LCV is favourable and when the actual cost is more than the standard cost then LCV is adverse. This variance is caused by the variation in the efficiency of labour and wage rate.

LCV is further divided in 2 points.

- Labour Efficiency Variance (LEV)

- Labour Rate Variance (LRV)

(2) Labour Efficiency Variance (LEV) (Time Variance): LEV is that portion of LCV which is due to the difference between the standard hours specified for the actual output and the actual hours used for the production of actual output.

LEV = (Standard Hours - Actual Hours) x Standard Rate

= (SH - AH) x SR

When the actual hours is less than the standard hours then LEV is favourable and vice-versa. The labours are used for production purpose either it is of one kind or may be different kinds. If only one kind of labour is used and the variance show the difference then it is due to yield. On the other hand if different kinds of labour is used and the variance shows the difference due to the mix.

Therefore labour efficiency variance is again divided into:

- Labour Yield Variance

- Labour Mix Variance

(3) Labour Rate Variance (LRV): Labour Rate Variance is that portion of labour cost variance which is due to the difference between the standard rate specified for the actual output and the actual rate paid.

LRV = (Standard Rate - Actual Rate) x Actual Hour

= (SR - AR) x AH

When the actual rate is less than the standard rate then LRV is favourable and when the actual rate is more than the Standard Rate the LRV is adverse. LRV may be caused by several factors such as changes in basic wage rate, different method of wage payment, overtime and so on.

(4) Labour Mix Variance (LMV): Labour Mix Variance is that portion of the Labour Efficiency Variance which due to the different between the Standard Mix Specified for the actual output and the Actual Mix. Mostly this variance is arises when two or more types of workers are used. It is necessary to compute the standard mix of each type of worker. Which is known as Revised Standard Hour, before calculating the actual variance.

It is assumed that to produce a material 3 types of labour are required A, B & C.

LMV= (Revised Hours - Actual Hours) x Standard Rate

= ( RH - AH )x SR

When the Actual Mix is less than the standard mix then the Labour Mix Variance is favourable and when the actual mix is more than the standard then Labour Mix Variance is adverse.

(5) Labour Yield Variance (LYV): Labour Yield Variance is that portion of the Labour Efficiency Variance (LEV) which is due to the difference between the Standard Yield specified and the actual yield.

LYV= (Standard Hours - Revised Hours ) x Standard Rate

= (SH - RH) x SR

When the revised hours are less than the standard hours then the LYV in favourable & when the revised hours are more than the standard hours then the LYV is adverse.

Verification: LCV = LEV + LRV LEV = LYV + LMV

Overhead Variances

At the outset, it may be noted that unlike direct materials and labour, the manufacturing overhead is not entirely variable with the level of production. Therefore, standard costs for factory overheads are based upon budgets and not on standards.

Overheads means the total indirect costs. It is nothing but variation in absorption or recovery of overheads. i.e. under absorption or over absorption.

Overheads are absorbed on the basis of Standard Overhead Rate (SR) such rate may be calculated per hour

(i) Total Overheads Variance (TOV) is the difference between the standard overheads specified for the output achieved and the Actual Overheads.

(i) Total Overheads Variance (TOV) is the difference between the standard overheads specified for the output achieved and the Actual Overheads.

TOV = Standard Overheads for standard Hours - Actual Overheads for Actual Hours

( SH x SR ) - ( AH x AR)

When the actual overheads are less than the standard overheads then total overheads variance is favourable and when the actual overheads are more than the standard overheads then total overheads variance is adverse.

(ii) Total Overheads Volume Variance (TVV) is the portion of total overheads variance due to difference between the standard volume of output and the budgeted volume of output.

TVV = (Standard Hours - Budgeted Hours) x Standard Rate

= ( SH - BH) x SR

When the budgeted hours are less than the standard hours then the total overheads volume variance is favourable and vice-versa.

It is further divided into:

- Total Overheads Efficiency Variance (TEFV)

- Total Overheads Capacity Variance (TCV)

(iii) Total Overheads Expenditure Variance (TEXV) is the portion of total overheads variance due to the difference between the budgeted expenditure specified and the actual expenditure.

TEXV = Budgeted Overheads for Budgeted Hours - Actual Overheads for Actual Hours

= (BH x SR) - (AH x AR)

When the actual overheads are less than the budgeted overheads then total overheads expenditure variance is favourable and when the actual overheads are more than the budgeted overheads then the total overheads expenditure is adverse.

(iv) Total Overheads Efficiency Variance (TEFV), is the portion of total overheads volume variance due to the difference between the standard volume of output specified and the actual volume of output.

TEFV = (Standard Hours - Actual Hours) x Standard Rate

= (SH - AH) x SR

When the actual hours are less than the standard hours than the total overheads efficiency variance is favourable and when the actual hours are more than the standard hours then the total overheads efficiency variance in adverse.

(v) Total Overheads capacity variance (TCV) is the portion of total overheads volume variance due to the difference between the actual volume of output specified and the budgeted volume of output.

TCV = (Actual Hours - Budgeted Hours) x Standard Rate

= (AH - BH) x SR

When the actual hours are less than the budgeted hours then the total overheads capacity variance is favourable and when the actual hours are more than the budgeted hours then the total overheads capacity variance is adverse.

Verification:

TOV = TVV + TEXV

TVV = TEFV + TCV

|

180 videos|153 docs

|

FAQs on Techniques of Cost Control and Cost Reduction: Standard Costing and Variance Analysis - 1 - Commerce & Accountancy Optional Notes for UPSC

| 1. What is standard costing? |  |

| 2. What are the types of standards used in standard costing? |  |

| 3. What is variance analysis in standard costing? |  |

| 4. How does standard costing help in cost control? |  |

| 5. What is the role of standard costing in cost reduction? |  |

|

180 videos|153 docs

|

|

Explore Courses for UPSC exam

|

|