UPSC Daily Current Affairs: 18 July 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS3/Science and Technology

Govt’s U-Win Portal to Redraw Immunisation Map

Source: Indian Express

Why in news?

U-Win, a digital platform set to launch on August 15, aims to transform maternal and child healthcare across India. By digitizing vaccination records, it will replace the current manual system used by ASHA and other healthcare workers, streamlining record-keeping and marking a significant shift in primary healthcare delivery.

Universal Immunization Programme (UIP)

- About

- UIP is one of the largest public health programmes targeting close of 2.67 crore newborns and 2.9 crore pregnant women annually.

- It is one of the most cost-effective public health interventions and largely responsible for the reduction of vaccine-preventable under-5 mortality rate.

- A child is said to be fully immunized if the child receives all due vaccines as per the national immunization schedule within the first year of the child's age.

- Vaccines covered

- Under UIP, immunization is provided free of cost against 12 vaccine-preventable diseases:

- Nationally against 9 diseases - Diphtheria, Pertussis, Tetanus, Polio, Measles, Rubella, severe form of Childhood Tuberculosis, Hepatitis B, and Meningitis & Pneumonia caused by Hemophilus Influenza type B.

- Sub-nationally against 3 diseases - Rotavirus diarrhoea, Pneumococcal Pneumonia, and Japanese Encephalitis.

- Two major milestones of UIP

- The two major milestones of UIP have been the elimination of polio in 2014 and maternal and neonatal tetanus elimination in 2015.

The U-WIN Portal

- Features

- The platform generates a uniform QR-based, digitally verifiable e-vaccination certificate, similar to the Covid vaccination certificate.

- It will update vaccination status, delivery outcomes, among others, in real-time.

- Citizens can self-register for vaccinations via the U-WIN web portal or its Android mobile application, select preferred vaccination centers, and schedule appointments.

- Automated SMS alerts inform citizens about registration confirmations, administered doses, and upcoming dose reminders, ensuring timely and age-appropriate vaccinations.

- Benefits

- Real-time registration of children and the digital vaccination record on U-Win will help in reducing the number of "zero-dose" children.

- This will be beneficial for migrant workers, who can get their children vaccinated at any center in the country without the hassle of carrying their child's vaccination cards.

- The U-Win portal is one of the important steps towards halving the number of zero-dose children by 2030.

WHO and UNICEF Estimates

- As per the recently released WHO and UNICEF estimates of national immunization coverage (WUENIC), there was a slight dip in childhood immunization in 2023 compared to 2022.

- WUENIC shows that there were 1.6 million zero-dose children in India in 2023, up from 1.1 million in 2022, but much less than 2.73 million seen in 2021.

GS1/Indian Society

The Problems with Sub-Caste Reservations

Source: The Hindu

Why in News?

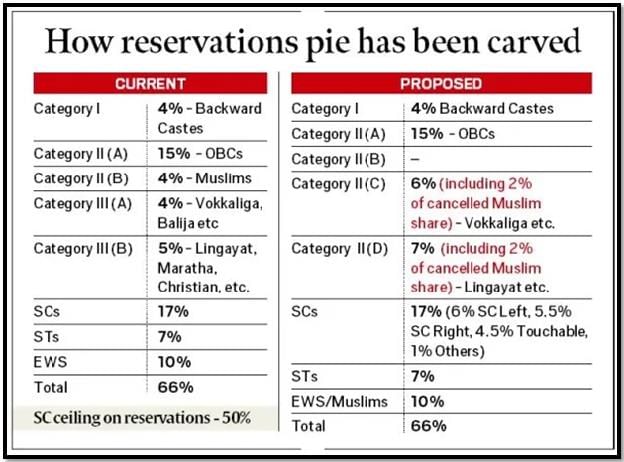

The Supreme Court has reserved its decision on sub-caste reservations for SC/STs. Any ruling on this matter must be substantiated not only legally but also academically.

What is the Sub-categorization of castes?

- It refers to the practice of further dividing larger caste categories into smaller groups or sub-groups based on specific criteria such as socio-economic status, geographical location, historical background, or specific needs for policy implementation.

Background of the Case:

- The case involves the validity of sub-classification within the SC and ST categories for providing reservations in government jobs and education.

- In 2004, the Supreme Court strikes down Andhra Pradesh Scheduled Castes (Rationalisation of Reservations) Act, 2000, citing violation of the right to equality E.V. Chinnaiah v State of Andhra Pradesh case and emphasised that the SC list should be treated as a single, homogeneous group.

- Only Parliament has the power to sub-classify SCs and STs for reservations.

- The Supreme Court is now considering whether states have the power to create sub-classifications within these reserved categories.

- The case stems from a 1975 Punjab government notification that divided its 25% reservation for SCs into two categories: half for Balmikis (Valmikis) and Mazhabi Sikhs, and the other half for the remaining groups within the SC category.

Objectives behind the implementation of reservations and present SC scenario:

- Objective of Reservations: The primary objective of reservations, as advocated by Dr. B.R. Ambedkar, is to ensure equitable representation and opportunities for historically marginalized communities, particularly Scheduled Castes (SCs).

- Present SC scenario: Despite reservations, certain sub-castes within SCs continue to face challenges in securing adequate representation in jobs and education. This under-representation is often attributed to factors such as inadequate educational opportunities, economic disparities, and historical discrimination.

The policy of economic empowerment in India and its associated challenges:

- Policies for Economic Empowerment: These policies complement reservations by focusing on enhancing the ownership of capital assets (like land and businesses) and improving educational attainment among SC individuals.

- Challenges: There are challenges in implementing economic empowerment policies including inadequate access to credit and financial resources, lack of skill development initiatives, and persistent socio-economic barriers that hinder the upward mobility of SC communities.

- Intersection with Reservations: Integrating economic empowerment with reservations is crucial to ensure that individuals from SC backgrounds not only secure reserved positions but also have the necessary skills and resources to thrive in competitive environments.

What must be our focus? (Way Forward)

- Holistic Approach: There is a need for a holistic approach that combines reservations with targeted economic and educational interventions. This approach should address both systemic discrimination and socio-economic barriers faced by SC communities.

- Capacity Building: There should be an emphasis on enhancing the educational infrastructure and skill development programs tailored to the needs of SC individuals.

- Data-Driven Policy: The policy decisions related to sub-caste reservations should be informed by empirical data that assesses the actual impact of discrimination versus socio-economic factors on under-representation.

Mains PYQ:

Whether National Commission for Scheduled Castes (NCSC) can enforce the implementation of constitutional reservation for the Scheduled Castes in the religious minority institutions? Examine (UPSC IAS/2018)

GS3/Science and Technology

Cave on the Moon: What this Discovery means for Space Exploration?

Source: Indian Express

Why in news?

Scientists have confirmed the presence of a cave on the Moon, near the site of the first lunar landing 55 years ago. This discovery could provide astronauts with a potential habitat on the Moon in the future.

About the Cave on Mare Tranquillitatis

- A study titled "Radar evidence of an accessible cave conduit on the Moon below the Mare Tranquillitatis pit" was published in the journal Nature Astronomy.

- The study established the presence of a moon cave at the Sea of Tranquillity, a large, dark, basaltic plain on the Moon's surface.

- The cave is located 400 kilometers from where astronauts Neil Armstrong and Buzz Aldrin landed in 1969.

- It is roughly 45 meters wide, up to 80 meters long, with an area equivalent to 14 tennis courts.

Research Method

- Researchers analyzed photos taken in 2010 by NASA's Lunar Reconnaissance Orbiter (LRO) spacecraft.

- They concluded that the pit was the entry point to a cave created by the collapse of a lava tube, a tunnel formed when molten lava flows beneath a field of cooled lava.

Back2Basics:

- NASA launched the LRO on June 18, 2009.

- LRO's primary mission is to map the Moon's surface in high detail to identify safe landing sites and locate potential resources.

- It is equipped with seven scientific instruments, including a camera, a laser altimeter, and a radiation detector.

- LRO has provided critical data on lunar topography, temperature, and radiation levels, significantly enhancing our understanding of the Moon.

Characteristics of Lunar Caves

- Craters are bowl-shaped and result from asteroid or comet strikes.

- Pits, in contrast, appear as massive steep-walled depressions.

- At least 200 such pits have been discovered, with 16 believed to have formed from collapsed lava tubes due to volcanic activity over a billion years ago.

Benefits for Human Exploration

- The Moon is exposed to solar radiation 150 times stronger than Earth.

- The lunar surface heats to about 127 degrees Celsius during the day and cools to around -173 degrees Celsius at night.

- Caves, however, maintain stable average temperatures of around 17 degrees Celsius.

- They could shield human explorers from radiation and micrometeorites, making them viable for future lunar bases or emergency shelters.

Challenges and Further Research

- The depth of such caves could present challenges for accessibility.

- There are risks of potential avalanches and cave-ins.

- Further research is needed to understand and map the structural stability of the caves.

- This could be done using ground-penetrating radar, robots, or cameras.

Need for Further Research

- To become viable habitats, caves would need systems to monitor movement or seismic activity and safety zones for astronauts in case of a cave collapse.

GS3/Economy

Union Govt. eases Procurement Rules for Scientific Research Goods

Source: The Hindu

Why in news?

The Finance Ministry has announced new rules under the General Finance Rules (GFR) to give scientific Ministries more flexibility in importing and buying research equipment. These changes address scientists’ concerns about strict rules that have slowed down research.

Changes introduced in GFR

- Limit for buying goods without needing a tender has been raised from ₹25,000 to ₹1,00,000.

- For goods priced between ₹25,000 and ₹250,000, a committee of three members must check the market for the best value and quality. This limit has been raised from ₹1,00,000 to ₹10,00,000.

- Note: These changes apply only if the goods are NOT available on the Government e-Marketplace (GeM).

What are General Finance Rules (GFR)?

- The General Finance Rules (GFR) are a set of rules issued by the Government of India to regulate financial matters in public administration.

- They provide a framework for financial management, ensuring accountability, transparency, and efficiency in the use of public funds.

- The GFR were first issued in 1947 post-independence.

- The rules have been revised multiple times, with significant updates in 1963, 2005, and the latest in 2017.

- The GFR applies to all central government departments, ministries, and organizations funded by the government.

Key Provisions

- General System of Financial Management: Guidelines on budgeting, accounting, and auditing.

- Procurement of Goods and Services: Rules for procurement, emphasizing transparency and competition.

- Contract Management: Procedures for awarding, managing, and terminating contracts.

- Inventory Management: Guidelines for managing government inventories and assets.

- Grants-in-Aid: Procedures for providing grants to institutions and individuals.

Major Highlights

- Emphasis on e-procurement to enhance transparency and efficiency.

- Use of the Government e-Marketplace (GeM) for procurement of common use goods and services.

- Requirement for performance security in government contracts to ensure compliance and reduce risk.

- Strengthening of internal controls and audit mechanisms to ensure compliance with rules and regulations.

Back2Basics

- The GeM is a one-stop National Public Procurement Portal to facilitate online procurement of common use Goods & Services required by various Government Departments / Organizations / PSUs.

- It was launched in 2016 by the Ministry of Commerce and Industry, developed by the Directorate General of Supplies and Disposals (under MCI) with technical support from the National E-Governance Division (MEITy).

GS1/History & Culture

Political Representation of Women

Source: The Hindu

Why in news?

In the recent general elections in the U.K., a historic number of 263 women MPs (40%) have secured seats in the House of Commons.

- India granted universal suffrage to women from its first general elections in 1952. However, female representation in the Lok Sabha and State legislative assemblies has been notably inadequate.

Women representatives in independent India

- The presence of women MPs in the Lok Sabha remained low, ranging from 5% to 10% until 2004. It saw a slight increase to 12% in 2014 and presently stands at 14% in the 18th Lok Sabha.

- Representation in State Legislative Assemblies is even more dismal, with a national average of approximately 9%.

- As of April 2024, India is ranked 143rd in the 'Monthly ranking of women in national parliaments' by the Inter-Parliamentary Union.

- The Trinamool Congress boasts the highest percentage of female MPs in the current Lok Sabha at 38%.

- The ruling Bharatiya Janata Party and the principal Opposition Congress party each have around 13%.

- Naam Tamilar Katchi, a Tamil Nadu State party, has consistently maintained a voluntary 50% quota for female candidates in the last three general elections.

Global Perspective on Women MPs

- Female representation in parliaments varies globally, with efforts ongoing to enhance women's representation, considering they constitute half of the population in most countries.

- Common methods to boost female representation include voluntary or mandated quotas within political parties and reserved seats in parliament.

- Quotas within political parties offer voters more options and provide parties flexibility in selecting female candidates.

- Opponents of parliamentary reserved quotas for women argue that it might undermine the principle of meritocracy. Additionally, the rotational nature of reserved seats may reduce MPs' motivation to engage with their constituencies effectively.

The 106th Amendment

- The 106th constitutional amendment mandates one-third reservation for women in the Lok Sabha and State legislative assemblies.

- This reservation will be implemented post the delimitation process following the first Census conducted after the enactment of this amendment.

- The overdue Census, pending since 2021, must be promptly conducted to ensure the initiation of this reservation starting from the 2029 general elections.

GS3/Economy

SEBI’s Proposal on New Asset Class

Source: Money Control

Why in News?

The Securities and Exchange Board of India (SEBI) has put forth a new asset class proposal to bridge the gap between mutual funds and portfolio management services (PMS). This initiative targets investors with investible funds ranging from Rs 10 lakh to Rs 50 lakh.

About SEBI (Objective, Need, Powers, etc.)

- SEBI is a statutory regulatory body established by the Government of India in 1992 with the aim of regulating the securities market and safeguarding investors' interests.

- It was granted statutory powers through the SEBI Act, 1992.

Why Was SEBI Formed?

- SEBI was instituted to monitor unfair practices and protect investors from such misconduct.

- The organization caters to the needs of issuers, intermediaries, and investors by ensuring transparency and fair play in the market.

Powers of SEBI:

- SEBI possesses quasi-judicial powers to address frauds and unethical practices in the securities market.

- It exercises quasi-executive powers to investigate violations and take appropriate actions against offenders.

- SEBI also has quasi-legislative powers to develop rules and regulations to safeguard investors' interests and eliminate market malpractices.

SEBI's Proposal on New Asset Class

- SEBI has introduced a new asset class to fill the void between mutual funds and PMS, targeting investors with a higher risk appetite.

- This new class is designed to cater to individuals seeking potentially higher returns.

Need for the New Asset Class

- SEBI identified a gap in the current investment landscape where retail investors opt for mutual funds and high-net-worth individuals choose PMS or alternative investment funds.

- The new asset class aims to offer an intermediate investment option that balances risk and returns effectively.

Investment Strategies

- The proposed asset class will include SEBI-approved strategies like Long-Short Equity Funds and Inverse ETFs/Funds.

- These strategies involve long and short positions in equity instruments and aim to generate returns that are negatively correlated with the underlying index.

Global Availability

- Similar strategies are already in place globally, such as long-short equity funds in the US and inverse ETF products in Australia.

Investment Threshold

- The minimum investment requirement for this new asset class is Rs 10 lakh per investor to attract individuals with investible funds ranging from Rs 10 lakh to Rs 50 lakh.

Eligibility for Launch

- Mutual funds meeting specific criteria are eligible to introduce this new asset class.

Proposed Relaxations

- SEBI suggests certain relaxations regarding debt securities and credit risk-based limits for the new asset class.

Conclusion

SEBI's proposed asset class aims to provide a regulated investment option, catering to the needs of sophisticated investors and managing risks effectively.

GS3/Economy

Choosing the Right Track to Cut Post-Harvest Losses

Source: The Hindu

Why in News?

India, as the second-largest agricultural producer globally, faces challenges due to post-harvest losses, impacting its global export ranking.

A closer look at India's post-harvest loss:

Economic Impact:

- India experiences annual post-harvest losses of around ₹1,52,790 crore, affecting farmer incomes and the agricultural economy significantly.

Perishable Commodities:

- The highest losses occur in perishable items such as livestock produce (22%), fruits (19%), and vegetables (18%).

- Export processes exacerbate these losses, especially during importation.

Supply Chain Inefficiencies:

- Inefficiencies in storage, transportation, and marketing, coupled with a lack of market connectivity, contribute significantly to post-harvest losses.

- Small and marginal farmers, constituting 86% of the farming community, struggle with economies of scale and market access.

Initiatives by the Railways Department:

- Truck-on-Train Service: Indian Railways has introduced this service to transport loaded trucks on railway wagons, with successful trials for commodities like milk and cattle feed.

- Parcel Special Trains: Railway's initiative during the pandemic to transport perishables and seeds efficiently.

- DFI Committee Recommendations: Streamlining loading/unloading processes and addressing staffing shortages.

- Kisan Rail Scheme: Connecting surplus production regions with consumption areas for efficient transportation of perishables.

Specialized Wagons and Facilities:

- Investment in specialized wagons for temperature-controlled transport and rail-side facilities for safe cargo handling.

Untapped Opportunities:

- Enhanced Environmental Benefits: Rail transport is more environmentally friendly compared to road transport.

- Public-Private Partnerships: Involving the private sector for operational efficiency and infrastructure enhancement through partnerships.

- Budgetary Support and Infrastructure: Allocations in 2024 aim to bridge farm-to-market gaps with modern infrastructure.

- Technology Integration: Incorporating advanced technologies for better logistics.

Way Forward:

- Expand climate-controlled storage and cold storage capacity.

- Provide access to storage facilities for small farmers through cooperatives or subsidies.

- Invest in specialized rail wagons for temperature-controlled transport and rail-side cargo handling facilities.

GS3/Economy

The State of India’s Informal Economy

Source: The Hindu

Why in News?

According to the Annual Survey of Unincorporated Enterprises (ASUSE), the informal sector in India faces many challenges. Over the last seven years, many small and medium enterprises have shut and about 16.45 lakh jobs have been lost.

Meaning of the Informal Sector of the Economy

- The term unorganised/informal sector is used interchangeably in the Indian context.

- It consists of small and medium enterprises and household proprietary and partnership establishments.

- The unorganised sector contributes over 44% to the country's gross value added (GVA) and employs nearly 75% of the workforce employed in non-agricultural enterprises.

- This means the sector accounts for almost half of India's economic output and more than three-fourths of employment.

- The share of the unorganised sector is highest in agriculture as the holdings are small and fragmented. This is followed by trade, construction, real estate, professional services, etc.

About the ASUSE

- The ASUSE was released for the 2021-22 and 2022-23 by the Union Ministry of Statistics and Programme Implementation (MoSPI).

- It carried out surveys for unincorporated non-agricultural establishments in three sectors: manufacturing, trade, and other services.

- Unincorporated enterprises are enterprises in the unorganised/informal sector, comprising MSMEs, household units including those with hired workers, and own-account enterprises.

- Manufacturing units other than those covered under the Factories Act 1948 and the organized manufacturing sector covered by the Annual Survey of Industries (ASI), have been surveyed.

- Under trade and other services, proprietary and partnership establishments (excluding LLPs), cooperatives, self-help groups, non-profit institutions, etc., are included.

Highlights of the ASUSE

- The number of workers employed in the informal sector in 2022-23 has dropped by 16.45 lakh or about 1.5 per cent to 10.96 crore compared to 11.13 crore in 2015-16.

- The number of unincorporated enterprises increased by 16.56 lakh from to 6.50 crore in 2022-23 from 6.33 crore in 2015-16.

- The real GVA of unincorporated sector enterprises grew by 6.9% in 2022-23, which was still lower than the pre-pandemic level.

A crucial employment indicator

- This is because the informal sector is closely watched for its employment generation capacity and absorption of the labor force (especially semi-skilled and unskilled labor).

Highlights the impact of 3 shocks on the informal sector

- The data available for the first time since 2015-16, provides an understanding of the impact of the 3 major exogenous shocks on the growth of unincorporated enterprises and the employment in these enterprises.

- These shocks are demonetization in November 2016, rollout of the Goods and Service Tax in July 2017, and the Covid-19 pandemic in March 2020.

Presents state-specific data

- Maharashtra, Bihar, Gujarat, MP, and Odisha recorded an increase in the informal employment between 2015-16 and 2022-23.

- UP, West Bengal, Tamil Nadu, Karnataka, and Andhra Pradesh registered a decline in the number of informal sector workers during the same period.

- These ten states account for nearly three-quarters of the informal sector workers employed in India.

Depicts a broad decline in employment quality

- Most new jobs in the sector were created in own-account enterprises rather than hired-worker units.

Matches with the Periodic Labour Force Survey (PLFS)

- As per PLFS 2022-23, there was an increase in workers in agriculture, and a decrease in manufacturing.

GS3/Science and Technology

Late Blight Disease

Source: Hindustan Times Why in news?

Why in news?

The Central Potato Research Institute (CPRI) has issued an advisory for potato farmers across the country, warning of a high risk of late blight disease in the crop due to changes in weather conditions.

- Late blight disease, a fungal infection is a significant threat to potato crops, causing substantial yield losses and reducing tuber quality. The disease is favoured by cool, moist weather conditions, making the current weather scenario conducive to its spread.

What is late blight disease?

- It is a disease of potato and tomato plants that is caused by the water mold Phytophthora infestans.

- The disease occurs in humid regions with temperatures ranging between 4 and 29 °C (40 and 80 °F). Hot dry weather checks its spread.

- Potato or tomato plants that are infected may rot within two weeks.

- When plants have become infected, lesions (round or irregularly shaped areas that range in colour from dark green to purplish black and resemble frost injury) appear on the leaves, petioles, and stems.

- A whitish growth of spore-producing structures may appear at the margin of the lesions on the underleaf surfaces. Secondary fungi and bacteria (particularly Erwinia species) often invade potato tubers and produce rotting that results in great losses during storage, transit, and marketing.

- The disease can be managed with a timely application of fungicide, though epidemics can occur rapidly once crops are infected.

- In addition to fungicide application, the CPRI advisory stresses the need for proper drainage in fields and preventing weed growth — which can in turn harbour the disease-causing fungus and increase the risk of infection in potato crops.

GS3/Economy

Intergenerational Equity as Tax Devolution Criterion

Source: The Hindu

Why in news?

The devolution of Union tax revenue to States sparks debate among politicians and economists, focusing on factors affecting the distribution of States’ shares.

- Current emphasis on intragenerational equity exacerbates intergenerational inequity within States.

- Integrating intergenerational equity into India’s horizontal distribution formula for tax devolution is crucial.

The Principles of Intergenerational Fiscal Equity and Mechanisms to Achieve It

- Equal Opportunities and Outcomes

- Every generation should have access to similar opportunities without being disadvantaged by past fiscal policies.

- Ensuring access to quality public services like education, healthcare, and infrastructure is vital.

- Sustainable Public Finance

- Governments should manage finances for long-term sustainability, avoiding excessive borrowing that burdens future taxpayers.

- Mechanisms to Achieve Intergenerational Fiscal Equity

- Taxation

- Ideally, tax revenues should cover current public expenditures, ensuring the current generation pays for the services it receives.

- Borrowing

- Borrowing should be judiciously used for projects benefiting multiple generations, avoiding excessive reliance leading to financial burden shifts.

- Savings and Investments

- Establishing sovereign wealth funds or savings mechanisms during economic surplus can finance public expenditures during downturns or invest in long-term projects.

- Taxation

Case Study to Understand Intergenerational Fiscal Equity: High-Income vs. Low-Income States

- High-Income States

- States like Tamil Nadu, Kerala, and Karnataka generate substantial own tax revenues but receive low Union financial transfers, leading to fiscal challenges.

- Low-Income States

- States like Bihar and Uttar Pradesh struggle to generate own tax revenues, relying heavily on Union transfers for higher public spending.

Fiscal Indicators and Equity

- Population and Area

- States with larger populations and areas demand more resources, justifying higher financial transfers for services.

- Per Capita Income

- Lower per capita income States receive more transfers to match service levels of higher-income States.

- Tax Effort and Fiscal Discipline

- Efficiency indicators like tax effort and fiscal discipline influence the distribution formula, rewarding better fiscal practices.

Challenges to Intragenerational Equity

- Economic Disparities

- Significant economic gaps between States hinder intragenerational equity, impacting fiscal balance.

- Public Expectations

- Citizens' expectations in high-income States may not align with lower Union financial transfers, leading to dissatisfaction.

- Efficiency vs. Equity

- The balance between efficiency and equity complicates optimal distribution formula design, rewarding fiscal responsibility.

Suggestions to Strengthen Intergenerational Fiscal Equity

- Reforming the Distribution Formula

- Finance Commission should include more fiscal variables to incentivize improved tax efforts and expenditure efficiency.

- Enhancing Fiscal Discipline

- Emphasizing fiscal discipline and responsible borrowing practices is crucial for long-term fiscal health.

- Promoting Balanced Development

- Investing in infrastructure, education, and healthcare in low-income States can reduce economic disparities and reliance on Union transfers.

Conclusion

- Intergenerational fiscal equity ensures fair distribution of economic opportunities across generations, requiring a balance between taxation, borrowing, and fiscal discipline.

- Reforming distribution formulas and promoting responsible fiscal practices can create a sustainable and equitable fiscal environment for future generations.

GS3/Economy

EC Releases Technical Instructions to Check EVM, VVPAT Burnt Memory

Source: Indian Express

Why in news?

The Election Commission of India (ECI) has issued a technical standard operating procedure (SOP) to verify burnt memory or microcontrollers in Electronic Voting Machines (EVMs) and Voter Verified Paper Audit Trail (VVPAT) devices. This SOP aligns with a recent Supreme Court ruling and aims to enhance the transparency and integrity of the electoral process by ensuring accurate verification of votes through electronic and paper means.

Burnt memory of EVMs and VVPAT units

- The burnt memory of Electronic Voting Machines (EVMs) and Voter Verified Paper Audit Trails (VVPATs) refers to the non-volatile memory within these devices where data is permanently stored, even when the device is turned off.

- This memory contains crucial information such as:

- For EVMs: Votes cast during elections, machine configurations, and operational details.

- For VVPATs: Printed records of votes cast, serving as a verifiable paper trail for electronic votes.

SC Verdict

- In its ruling on April 26, 2024, the Supreme Court upheld the use of Electronic Voting Machines (EVMs) and Voter Verified Paper Audit Trails (VVPATs) in the Lok Sabha elections.

- The Court dismissed the request to revert to paper ballots and conduct 100% counting of VVPAT slips.

- However, it allowed second- and third-placed candidates to request verification of burnt memories of EVMs and VVPATs for up to 5% of machines in an Assembly or Lok Sabha constituency segment.

- This verification will be carried out by engineers from the EVM manufacturers post the announcement of election results.

Administrative SOP released

- Earlier on June 1, the ECI published the administrative SOP for examining and validating the burnt memory of EVMs and VVPATs.

- An Administrative SOP defines standard procedures for organizational tasks to ensure consistency and compliance, outlining responsibilities and documentation.

- In contrast, a Technical SOP specifies technical processes and operations, presenting detailed step-by-step instructions to maintain quality and safety standards.

Verification Process

- The SOP delineates a comprehensive procedure for verifying the integrity of microcontrollers in EVMs and VVPATs.

- The ECI mentioned various technical methods for validating the accuracy of firmware burned into a microcontroller in research or secure manufacturing settings.

- Verification can be publicly conducted by utilizing multiple random test vectors as inputs and assessing the expected results.

Mock poll of up to 1,400 votes per machine

- A mock poll of up to 1,400 votes per machine will be conducted in the presence of candidates or their representatives.

- Mock polls, comprising a minimum of 50 votes per machine, are performed on polling day with the presence of candidates' polling agents, along with self-diagnosis and mutual authentication of the three EVM-VVPAT system components.

- If the machine results and VVPAT slips match, it indicates that the burnt memory or microcontrollers remain untampered.

Assigned Powers to Candidates

- Candidates can choose the polling stations, EVMs, BUs, CUs, and VVPATs they wish to have checked.

- The inspection will be carried out by trained engineers from the EVM manufacturers, Bharat Electronics Ltd (BEL), and Electronics Corporation of India Ltd (ECIL).

Start of Verification Process

- Verification of EVMs and VVPATs will commence only after confirming from the High Courts that no Election Petitions have been lodged for the relevant constituencies.

- Election Petitions can be filed by any candidate or voter within 45 days of the results announcement on June 4, setting July 19 as the deadline.

- 11 applications have been received, encompassing 118 polling stations or sets of EVMs and VVPATs.

- The SOP does not address the course of action in case of a discrepancy between EVM and VVPAT counts during verification.

|

38 videos|5293 docs|1118 tests

|

FAQs on UPSC Daily Current Affairs: 18 July 2024 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly

| 1. What is the U-WIN Portal and how does it aim to redraw the immunisation map? |  |

| 2. How do WHO and UNICEF estimates play a role in shaping immunisation strategies? |  |

| 3. What are some of the challenges associated with sub-caste reservations in the context of immunisation programmes? |  |

| 4. What significance does the discovery of a cave on the Moon hold for space exploration? |  |

| 5. How does the exploration of caves on other celestial bodies benefit human exploration? |  |