UPSC Daily Current Affairs: 7th September 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS3/Environment

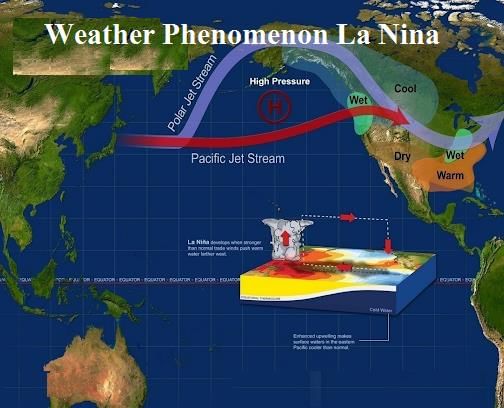

La Niña and its Impact on the Indian Climate

Source: Indian Express

Why in News?

This year's La Niña forecasts from all of the top international agencies were wildly inaccurate. In this context, there is a need to analyse the likely impact of delay in La Niña’s onset and why did global weather models get their predictions wrong.

What is the Phenomenon of the El Niño Southern Oscillation (ENSO)?

- The ENSO is a climatic occurrence characterized by variations in sea temperatures across the tropical Pacific Ocean, driven by atmospheric changes.

- ENSO consists of three distinct phases:

- Warm phase (El Niño)

- Cool phase (La Niña)

- Neutral phase

- These phases cycle irregularly, typically every two to seven years, significantly influencing global weather patterns.

What is El Niño and La Niña?

- El Niño, Spanish for “The Little Boy,” represents the warm phase of ENSO, with warmer waters spreading from west to east across the equatorial Pacific.

- La Niña, or “The Little Girl,” signifies the cool phase, characterized by cooler waters moving east-west in the Pacific.

- Both phenomena disrupt global weather, impacting ecosystems, agriculture, and economies.

Comparing El Niño, La Niña with Normal Conditions:

- During neutral conditions, the eastern Pacific is cooler than the western Pacific due to trade winds moving warm water westward and cooler water rising to the surface.

- In the El Niño phase, weakened trade winds result in warmer eastern Pacific waters.

- Conversely, in La Niña, strengthened trade winds push more water towards the western Pacific, leading to cooler eastern waters.

- In India, El Niño typically correlates with reduced monsoon rainfall, while La Niña tends to enhance monsoon activity.

- The impacts of both phenomena are exacerbated by climate change, leading to extreme weather events such as heat waves and heavy rainfall.

Latest Predictions of La Niña and Impact of Delayed Onset on the Indian Monsoon:

- Recent predictions indicate that signs of La Niña's onset may emerge by late September or early October, peaking in November and persisting through winter.

- La Niña's delayed onset may complicate rainfall patterns, but it doesn’t always predict negative outcomes for the monsoon.

- For instance, despite a predicted 109% above-normal rainfall, regional variations have led to deficient rainfall in many eastern and northeastern states.

- During the northeast monsoon, which occurs from October to December, La Niña usually does not favor rainfall but exceptions have been noted historically.

Cyclogenesis:

- In La Niña years, the north Indian Ocean sees heightened cyclone activity, particularly in May and November, resulting in storms that are often more intense and longer-lasting.

Winter Season:

- Historically, La Niña years have been associated with harsher and colder winters, influencing various climate conditions across India.

GS2/Polity

Judicial Appointments Can't Be Individual Decision - Supreme Court

Source: Hindustan Times

Why in news?

The Supreme Court ruled that a Chief Justice of a High Court does not have the authority to individually reconsider recommendations for a judge's elevation. Instead, any reconsideration of such recommendations must be done collectively by the High Court Collegium. The observations were made in a verdict granting relief to two District Judges from Himachal Pradesh, Chirag Bhanu Singh and Arvind Malhotra. Their candidatures for elevation to the Himachal Pradesh High Court were directed to be decided afresh by the High Court Collegium.

Article 217

of Indian Constitution covers the appointment and conditions of a High Court Judge. It states that every Judge of a High Court shall be appointed by the President through a warrant under his hand and seal, after consultation with the Chief Justice of India and the Governor of the State. In the case of appointing a Judge other than the Chief Justice, the Chief Justice of the High Court must also be consulted.

- The Chief Justice of the High Court is appointed based on the policy of having Chief Justices from outside.

Eligibility

- A person is not qualified for appointment as a Judge of a High Court unless they are a citizen of India and have either:

- Held a judicial office for at least ten years in the territory of India; or

- Been an advocate of a High Court in any specified State for at least ten years, or of two or more such Courts in succession.

- A High Court judge holds office until they are 62 years old.

- A Collegium, comprising the Chief Justice of India (CJI) and two senior-most judges, recommends names for the appointment of Judges of High Courts.

- This process is initiated by the Chief Justice of the concerned High Court.

- The Chief Justice must also consult their two senior-most puisne Judges before recommending a name for appointment to the High Court.

- The recommendation is sent to the Chief Minister, who advises the Governor to forward the proposal to the Union Law Minister.

Controversy over the Word Consultation

The constitutional provision granted the CJI and other judges the status of consultants while leaving the final decision of appointment to the executives. This has been interpreted differently by the Supreme Court, leading to the evolution of the Collegium system.

Evolution of Collegium System

- First Judges Case (1982)

- The Supreme Court held that "consultation" does not imply "concurrence."

- It gave primacy to the Executive in appointments.

- Second Judges Case (1993)

- The Court reversed its earlier ruling, changing the interpretation of consultation to mean concurrence.

- Advice given by the CJI became binding.

- The CJI must consider the views of their two senior-most colleagues.

- Third Judges Case (1998)

- The Court prioritized the CJI's opinion regarding judge appointments.

- The Chief Justice must consult four senior-most judges of the Supreme Court.

- All opinions from the collegium should be documented in writing.

Initial recommendation and decision of SC Collegium

- In December 2022, the Himachal Pradesh High Court Collegium recommended District Judges Chirag Bhanu Singh and Arvind Malhotra for elevation as judges of the High Court.

- However, the Supreme Court Collegium deferred consideration of their elevation in July 2023.

- In January 2024, the apex court referred the proposal for reconsideration to the Chief Justice of the High Court.

Ministry of Law and Justice's Intervention

- In January 2024, the Law and Justice Minister urged the High Court Chief Justice to submit fresh recommendations for the two judges against vacancies in the service quota.

High Court CJ's Actions and subsequent case in Supreme Court

- The Chief Justice of the High Court instead recommended two other names for elevation, ignoring Singh and Malhotra.

- This action was challenged by Singh and Malhotra before the Supreme Court, arguing that considering others ahead of them undermined their seniority and clean record.

- The Chief Justice had addressed the Supreme Court Collegium about the petitioners' suitability without collective consultation with other Collegium members.

Key highlights of the judgement by the Supreme Court in present case

- The process of judicial appointments is not the prerogative of a single individual.

- It is a collaborative and participatory process involving all Collegium members.

- The core principle is that the appointment process must reflect collective wisdom, incorporating diverse perspectives.

- This process promotes transparency and accountability.

Is judicial scrutiny of Collegium decisions permissible?

Through this judgement, the apex court concluded that limited judicial scrutiny of Collegium decisions is permissible to determine whether the decision was made after effective and collective consultation among its members.

- The Bench summarized the legal principles that emerged from precedents on this subject:

- "Lack of effective consultation" and "eligibility" fall within the scope of judicial review;

- "Suitability" is considered non-justiciable, thus the "content of consultation" falls outside the scope of judicial review.

GS2/International Relations

India – EU Bilateral Relationship

Source: DTE

Why in News?

A group of officials from the Defence Ministry and Ministry of External Affairs (MEA) are in Europe on a three-day study visit, facilitated by the EU delegation in India.

Historical Background:

- Diplomatic relations between India and the EU were officially established in 1962.

- Strategic engagement began in the early 2000s, highlighted by the 2004 India-EU Strategic Partnership.

- This partnership marked a significant expansion in cooperation across political, economic, and security domains.

Trade & Investment Relationship:

- The EU stands as India's third-largest trading partner, contributing to approximately 11% of India's overall trade in 2022.

- Bilateral trade in goods surpassed €115 billion in 2022, reflecting a notable increase from previous years.

- Key Exports from India: Pharmaceuticals, textiles, chemicals, and machinery.

- Key Imports from the EU: Engineering goods, chemicals, gems, and precious metals.

- EU companies are major investors in India, with cumulative Foreign Direct Investment (FDI) exceeding €87 billion from 2000 to 2022.

- Indian firms have been increasingly establishing their presence in Europe, particularly in IT, pharmaceuticals, and automobile sectors.

Strategic Cooperation:

- Climate Change and Clean Energy:

- Both India and the EU are dedicated to the Paris Agreement, collaborating on clean energy initiatives.

- Joint efforts include solar energy projects, energy storage solutions, and sustainable urban development.

- Security and Defense:

- There is a growing alignment in defense interests, particularly regarding maritime security in the Indo-Pacific.

- Both parties emphasize the importance of upholding the rule of law in maritime zones crucial for global trade.

- Digital and Technological Cooperation:

- Collaboration is focused on digitalization, cybersecurity, and emerging technologies such as artificial intelligence (AI).

- India is aligning its data protection laws with the EU’s General Data Protection Regulation (GDPR).

- Global Governance and Multilateralism:

- Both India and the EU advocate for a rules-based international order, supporting reforms in institutions like the UN and WTO.

- They emphasize the need for global governance systems to adapt to the realities of the 21st century.

Challenges & Way Forward:

- Despite advancements, challenges persist in trade barriers, regulatory discrepancies, and differing geopolitical stances.

- Delayed Free Trade Agreement:

- Negotiations for a Free Trade Agreement (FTA) initiated in 2007 have yet to conclude due to tariff and regulatory disagreements.

- Regulatory Differences:

- India's apprehensions regarding stringent EU standards on data protection and labor laws often conflict with its economic priorities.

- Geopolitical Divergence:

- While both sides value multilateralism, their perspectives on global issues like China and Russia can differ significantly.

- The EU’s firm stance on matters such as the Ukraine crisis may not always resonate with India's foreign policy approach.

- Human Rights and Political Disputes:

- The EU's focus on human rights can lead to tensions, as India views these issues as intrusions into its domestic affairs.

- Upcoming India-EU Summit in November 2024 is anticipated to be a vital platform for enhancing cooperation in climate action, digital governance, and defense.

News Summary:

- India and the EU are enhancing military-to-military engagements, concentrating on maritime security and defense cooperation.

- Recent study visits to Europe by Indian officials aim to strengthen ties through collaboration in the Indo-Pacific region.

- Discussions have included joint naval operations to ensure open maritime zones and promote regional stability.

- This reflects a commitment to address shared security challenges, particularly in the Indian Ocean region.

GS3/Economy

Stick to Fiscal Deficit as the Norm for Fiscal Prudence

Source: The Hindu

Why in News?

The management of fiscal deficit and government debt is critical for economic policy in India.

- A balance between government spending and revenues is essential for the country's economic health.

- Understanding the complexities of fiscal deficit and debt management is vital, especially in light of recent developments and historical contexts.

The 1980s Fiscal Crisis

- The 1980s were marked by significant economic challenges for India, with rising fiscal deficit and government debt.

- This led to a severe balance of payments crisis and a high ratio of interest payments to revenue receipts.

- To finance developmental expenditures, the government had to borrow increasingly, worsening the debt situation.

- This period illustrated the risks associated with persistent fiscal imbalances, creating a cycle of borrowing and debt repayment that hindered economic growth.

The 2024-25 Union Budget Fiscal Targets and Gaps in the Announcement

- The final Union Budget for 2024-25 acknowledged the urgent need to address fiscal imbalances.

- The finance minister set ambitious targets for reducing fiscal deficit and government debt.

- Starting from 2026-27, the government aims to ensure a declining path for central government debt as a percentage of GDP.

- The budget projected a reduction of fiscal deficit to 4.5% of GDP by 2025-26, down from 4.9% in 2024-25.

- At this target, the estimated debt-GDP ratio is around 54% by 2025-26, assuming a nominal GDP growth rate of 10.5% over the next two years.

Unclear Roadmap for Achieving Sustainable debt-GDP Ratio

- The government has not provided a clear plan for achieving a sustainable debt-GDP ratio in the long term.

- Abandoning the Fiscal Responsibility and Budget Management (FRBM) Act's 2018 targets for debt-GDP ratio indicates a shift in policy.

- The government now aims for a gradually declining debt-GDP ratio, which may extend far into the future.

An Overview of the Combined Fiscal Deficit and Its Economic Implications

- The fiscal responsibility framework in India includes both central and state governments.

- State governments must maintain a fiscal deficit target of 3% of their Gross State Domestic Product (GSDP) under their Fiscal Responsibility Legislations (FRLs).

- If both the central and state governments meet their targets of 4.5% and 3% of GDP respectively, the combined fiscal deficit could reach 7.5% of GDP for several years.

- This high combined deficit could significantly impact the broader economy, particularly regarding investment and economic growth.

Crowding Out Private Investment

- The crowding-out effect occurs when increased government borrowing leads to higher interest rates, which in turn reduces private sector investment.

- In the current context of declining household savings in India, this crowding-out effect may be particularly severe.

- For example, in 2022-23, household financial savings were only 5.3% of GDP, down from 7.6% in the previous four years (excluding the COVID-19 year of 2020-21).

- With household savings at 5.3% and approximately 2% of net foreign capital inflow, the available investible surplus of 7.3% would be fully absorbed by the government's 7.5% combined fiscal deficit.

Fiscal Imbalances and Long-term Economic Stability

- A high combined fiscal deficit raises concerns about long-term economic stability.

- Persistent fiscal imbalances can lead to a cycle of increasing debt and rising interest payments.

- As the government borrows more to finance deficits, debt levels rise, leading to higher interest payments.

- These payments consume a larger share of government revenue, limiting funds for essential services like infrastructure, education, and healthcare.

Risks of Fiscal Indiscipline at the State Level

- The central government's shift in fiscal policy may encourage fiscal indiscipline at the state level.

- State governments might interpret the relaxation of fiscal targets as a green light to increase their borrowing without adequate repayment plans.

- This could result in states accumulating higher debts, exacerbating the overall fiscal burden on the nation.

International Comparisons, Challenges and Policy Recommendations

- International comparisons show that India's interest payments to revenue receipts ratio is significantly higher than that of other countries with similar or higher government debt-GDP ratios.

- For instance, between 2015-19, Japan, the UK, and the US had interest payment to revenue receipts ratios of 5.5%, 6.6%, and 8.5%, respectively.

- In contrast, India's combined interest payment to revenue receipts ratio averaged 24% during the same period, with the central government's post-transfer ratio averaging 49%.

Policy Recommendation: The Need for Coordinated Fiscal Discipline

- To avoid negative outcomes, a coordinated approach to fiscal discipline between central and state governments is essential.

- While some flexibility in fiscal policy is necessary to address economic shocks or developmental needs, it should not compromise long-term fiscal sustainability.

- The central government should collaborate closely with states to ensure any relaxation of fiscal targets is temporary and paired with a clear plan for returning to sustainable debt levels.

- Additionally, the central government could provide incentives for states that maintain fiscal discipline, such as access to more grants or favorable borrowing conditions.

- Aligning the interests of central and state governments can lead to a more balanced and sustainable fiscal policy that fosters economic growth without compromising financial stability.

Conclusion

- The government's recent fiscal targets represent a positive step, but the absence of a clear roadmap for achieving a sustainable debt-GDP ratio raises concerns.

- High interest payments relative to revenue receipts, along with declining household financial savings, limit the investible surplus available for the private sector, potentially hindering economic growth.

- Moving forward, it is crucial for India to adopt a more disciplined fiscal approach, focusing on reducing fiscal deficit and maintaining sustainable debt-GDP ratios to ensure long-term economic stability.

GS2/Polity

Conservationists demand NTCA to withdraw relocation of forest-dwelling communities from tiger reserves

Source: DTE

Why in News?

Conservationist organizations across India have raised concerns over what they label as the "illegal" relocation of villagers from tiger reserves, as mandated by the National Tiger Conservation Authority (NTCA). A notification issued on June 19, 2024, has identified 89,808 families from 848 villages for relocation. The NTCA has instructed state authorities to prioritize the relocation of residents from core areas of tiger reserves, emphasizing the need for time-bound action plans for this process. Conservationists argue that this directive undermines the rights of forest-dwelling communities.

About

- The NTCA was established in 2006 under the Wildlife (Protection) Act, 1972. Its structure includes:

- Minister in charge of the Ministry of Environment and Forests (Chairperson)

- Minister of State in the Ministry of Environment and Forests (Vice-Chairperson)

- Three members of Parliament

- Secretary of the Ministry of Environment and Forests

- Other appointed members

- Nodal Ministry

- Ministry of Environment, Forest, and Climate Change (MoEFCC)

- Objectives

- Provide legal authority to Project Tiger for compliance with its directives.

- Enhance accountability between the Center and States in managing Tiger Reserves through Memoranda of Understanding.

- Facilitate parliamentary oversight.

- Address the livelihood interests of local communities surrounding Tiger Reserves.

- Powers and Functions

- Approve tiger conservation plans developed by State Governments.

- Evaluate and assess sustainable ecological practices within tiger reserves.

- Establish standards for tourism and guidelines for Project Tiger in core and buffer areas.

- Prevent diversion of tiger reserves for ecologically harmful uses without public interest justification and necessary approvals.

News Summary:

- The NTCA has directed 19 states to prioritize the relocation of villagers from core tiger zones, which has sparked significant opposition from conservation groups and activists.

- In a recent letter, the NTCA noted that 591 villages, home to 64,801 families, still reside in core tiger areas, raising concerns about the slow relocation progress affecting tiger conservation.

- Karnataka has already relocated 1,175 families from 81 villages since 1973 as part of these efforts.

Tiger Reserves and Core Zones

- A Tiger Reserve includes:

- A 'Core' or 'Critical Tiger Habitat' managed as an inviolate area.

- A 'Buffer' or peripheral area with lesser habitat protection.

- Core zones within tiger reserves are areas where:

- Human activities, such as hunting and the collection of forest products, are strictly prohibited.

- Buffer zones have regulated restrictions on human activities.

- India has 53 tiger reserves across 19 states, with 848 villages in core zones; 257 villages have been relocated since the inception of Project Tiger.

- The Wildlife Act mandates that core zones remain "inviolate" through voluntary relocation agreements.

Concerns Raised by Wildlife Activists

- Activists highlight that many residents belong to Adivasi and other forest-dwelling communities, who have rights to live in and utilize forest resources for their livelihoods, as protected by the Forest Rights Act, 2006 (FRA) and the Wildlife (Protection) Act, 1972 (WLPA).

- They argue that the proposed displacements could represent one of the largest such operations globally under the pretext of wildlife conservation.

- There are fears that this relocation could lead to conflicts between state authorities and Scheduled Tribes (STs) and other traditional forest dwellers (OTFDs) living within tiger reserves.

- This action places these communities at risk of economic and social insecurities, potential destitution, and disruption of their cultural identities.

- Activists also point out that the WLPA prohibits the apex tiger authority from issuing directives that infringe on local communities' rights, particularly those of Scheduled Tribes.

- Furthermore, they assert that this decision could undermine biodiversity and conservation efforts that these communities depend on for their livelihoods.

GS3/Economy

Financialisation

Source: DTE

Why in News?

Chief Economic Adviser (CEA) recently cautioned that financialisation might distort India’s macroeconomic outcomes.

Financialisation

Financialisation is a significant phenomenon in modern economies, representing the growing dominance and influence of the financial sector within a country's overall economic framework. Let's break down the key aspects of financialisation:

1. Expansion of the Financial Sector

Financialisation refers to the expansion and growing significance of the financial sector relative to the entire economy. This means that financial activities, such as banking, investment, and trading, are becoming increasingly central to economic operations.

2. Influence on Economic Policy

It involves the enhanced power of financial markets, institutions, and elites over economic policy and outcomes. This influence can shape government decisions, regulations, and overall economic direction.

3. Shift from Industrial to Financial Activities

Financialisation marks a shift away from traditional industrial activities, such as manufacturing, towards financial activities involving the trading, management, and speculation of financial assets. This reflects a broader transformation in what drives economic growth.

4. Increasing Diversity of Transactions

The term also captures the growing diversity of transactions and market participants, highlighting how financial activities are intersecting with various aspects of the economy and society. This includes a wider range of players involved in financial markets.

5. Shift from Industrial Capitalism

Financialisation has emerged as countries have moved away from industrial capitalism, where manufacturing was the primary driver of economic activity. This shift reflects broader changes in economic structure and priorities.

6. Impact on Macroeconomics and Microeconomics

Financialisation impacts both the macroeconomy and microeconomy by altering the structure and operation of financial markets. It also influences corporate behavior and economic policy, shaping how businesses operate and how economic decisions are made.

7. Income Disparities

Financialisation has led to a situation where incomes in the financial sector are increasing at a faster rate compared to other sectors of the economy. This highlights the growing importance and rewards associated with financial activities.

In summary, financialisation represents a profound shift in economic dynamics, where the financial sector plays a more central and influential role in shaping economic outcomes, policies, and income distributions. Understanding this process is crucial for grasping the complexities of contemporary economies.

GS2/Polity and Governance

National Company Law Appellate Tribunal (NCLAT)

Source: New Indian Express

Why in News?

The National Company Law Appellate Tribunal (NCLAT) temporarily halted the recent acquisition of power generating company Coastal Energen by a consortium led by Adani Power.

About National Company Law Appellate Tribunal (NCLAT):

The National Company Law Appellate Tribunal (NCLAT) is a quasi-judicial body established under Section 410 of the Companies Act, 2013. It was formed to hear appeals against the decisions made by the National Company Law Tribunal (NCLT), starting from June 1, 2016.

Objective

The main goal of NCLAT is to speed up the resolution of corporate disputes and to enhance transparency and effectiveness in corporate governance and insolvency matters in India.

Functions

- Hear appeals against orders issued by the NCLT under Section 61 of the Insolvency and Bankruptcy Code (IBC), 2016.

- Consider appeals against decisions made by the Insolvency and Bankruptcy Board of India (IBBI) under Sections 202 and 211 of the IBC.

- Review appeals against any directions or decisions made by the Competition Commission of India (CCI).

- Function as the Appellate Tribunal for appeals against orders from the National Financial Reporting Authority.

- Provide advisory opinions on legal issues referred by the President of India.

Headquarters

The headquarters of NCLAT is located in New Delhi.

Composition

NCLAT is made up of a chairperson along with judicial and technical members. These members are appointed by the Central Government based on their knowledge and experience in fields like law, finance, accountancy, management, and administration.

Disposing of Cases

When an appeal is received from someone unhappy with a decision, NCLAT will make orders after hearing the case, which may involve confirming, changing, or overturning the original order.

NCLAT must resolve the appeal within six months from the date it was received. Decisions made by NCLAT can be challenged in the Supreme Court.

Powers

NCLAT has the power to set its own rules and has similar powers to a civil court under the Code of Civil Procedure, 1908. These powers include:

- Summoning and questioning witnesses.

- Requesting documents to be presented.

- Accepting evidence given through affidavits.

- Issuing commissions for various purposes.

Any order made by NCLAT can be enforced like a court decree. Civil courts cannot hear any case regarding matters that NCLAT is authorized to decide under the Companies Act, 2013, or any other current law.

No court or other authority can grant an injunction against any action that NCLAT takes or should take under its powers granted by the law.

GS3/Science and Technology

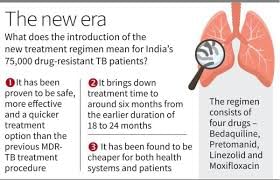

BPaLM Regimen

Source: The Hindu

Why in News?

The Union Health Ministry recently introduced the BPaLM regimen to treat Multidrug-Resistant Tuberculosis under the National TB Elimination Program.

About BPaLM Regimen:

- Objective: This is a new treatment plan for Multi-Drug-Resistant Tuberculosis (MDR-TB).

- It was launched by the Union Ministry of Health and Family Welfare as part of the National TB Elimination Program (NTEP).

- Composition:

- The treatment includes four medications: Bedaquiline, Pretomanid, Linezolid, and optionally, Moxifloxacin.

- Pretomanid is a new anti-TB drug that has been approved for use in India by the Central Drugs Standard Control Organization (CDSCO).

- Efficacy:

- The BPaLM regimen is safer and more effective than older MDR-TB treatments.

- It is an all-oral treatment with a low number of pills, making it easier for patients to follow.

- This regimen can cure drug-resistant TB in just six months, while previous treatments could take up to 20 months.

- It generally results in fewer side effects.

- National TB Elimination Program (NTEP):

- This is a public health program by the Government of India aimed at eliminating tuberculosis in the country.

- The program has a big goal of completely eradicating TB by 2025.

- NTEP is funded by the central government and works with state governments to share resources.

- It follows the daily DOTS (Directly Observed Treatment with Short-course Chemotherapy) strategy.

- The DOTS strategy ensures that patients with infectious TB are diagnosed and treated properly until they are cured, providing access to the full course of medications and monitoring their treatment.

- The program offers free and quality diagnosis and treatment services for tuberculosis throughout the country.

- NI-KSHAY Portal:

- NI-KSHAY (meaning "End TB") is a web-based system for managing TB patients under the National Tuberculosis Elimination Programme (NTEP).

|

44 videos|5271 docs|1113 tests

|