Valuation of Bonds and Shares | Management Optional Notes for UPSC PDF Download

| Table of contents |

|

| Bond |

|

| Bonds Key Characteristics |

|

| Bond Valuation |

|

| Share Valuation |

|

| Types of Share Values |

|

| Reasons for Valuation |

|

| Valuation Methods |

|

Bond

- A bond is a form of long-term debt instrument that provides the bondholder with predetermined periodic interest payments over a specific duration. In the realm of finance, a bond represents an obligation of the issuer to the bondholders. It functions as a debt security, wherein the issuer is indebted to the holders and is typically obligated to repay them with interest and/or principal at a later date, known as the maturity date.

- Interest payments are commonly made at fixed intervals, such as semi-annually, annually, or monthly. Additionally, bonds may be negotiable, allowing for the transfer of ownership in the secondary market. This liquidity feature implies that once the bond is stamped by transfer agents at the bank, it becomes highly tradable in the secondary market.

- It is established that bonds serve as loans provided by investors to entities, including corporations and governments. Bonds are issued by the debtor and acquired by the creditor, with the legal contract governing the loan referred to as a bond indenture.

- Traditionally, bonds are issued by various entities, including public institutions, financial institutions, corporations, and supranational organizations, in major markets. The issuance process commonly involves underwriting, where one or more securities firms or banks, forming a syndicate, purchase the entire bond issue from the issuer and subsequently resell them to investors. The underwriting firm bears the risk of being unable to sell the issue to end investors.

- Primary issuance is coordinated by book runners who facilitate the bond issuance, engage with investors directly, and advise the bond issuer on the timing and pricing of the bond issue. In the public announcement of bonds, known as tombstone ads, the book runner is prominently featured among all underwriters involved in the issuance. The willingness of book runners to underwrite must be determined prior to finalizing the terms of the bond issue, as there may be limited demand for the bonds.

In contrast, government bonds are typically issued through auctions, where both the general public and banks may bid for bonds in some cases, while in others, only market makers are allowed to bid. The overall rate of return on a bond is influenced by both the bond's terms and the price paid. While the terms of the bond, such as the coupon rate, are predetermined, the bond's price is determined by the market.

Bonds Key Characteristics

- The principal (also known as face or maturity) value represents the amount repaid (excluding interest) by the borrower to the lender (bondholder) upon the bond's maturity.

- The coupon rate determines the interest payments, calculated as the coupon rate multiplied by the principal value annually.

- Maturity denotes the remaining lifespan of a bond, diminishing over time. Original maturity refers to its maturity at issuance, with the issuer pledging to repay the principal value at the bond's maturity.

- A sinking fund involves repaying the principal (by buying bonds) before the bond matures.

- Exchangeable bonds can be converted into a predetermined number of company shares, typically common stock of the issuer.

- The call provision allows the issuer to repurchase the bonds (reimburse the loan) before maturity for a predetermined call price, often restricted in the initial years.

Bond Valuation

- Evaluating a bond requires estimating expected cash flows and a required rate of return, determined by the investor or the market's expected rate of return.

- The fair value of a bond is the present value of future coupon and principal payments. Initially, the coupon rate is set to align the bond's fair value closely with its par value. However, market conditions may cause deviations from par over time.

Market Dynamics

- Various factors, including prevailing interest rates, term length, and issuer creditworthiness, influence bond issuance terms. These conditions evolve over time, impacting bond market prices.

- Bond prices are quoted as a percentage of face value and may converge towards par as maturity approaches, termed "Pull to Par."

- Bonds may trade above par (premium) or below par (discount), reflecting market expectations regarding timely repayment.

- Market price is determined by discounting expected future payments at the bond's yield to maturity, which closely correlates with prevailing market interest rates.

- Yield measures such as current yield, yield to maturity, and yield to worst provide insights into bond returns.

- The relationship between yield and maturity duration is represented by the yield curve, which may vary across different bond markets.

- Bond markets operate through decentralized, dealer-based systems, where liquidity is provided by dealers and market participants. Dealers facilitate trades, earning income from bid/ask spreads rather than brokerage commissions.

Share Valuation

- Valuing shares entails adherence to various principles across different markets, yet a fundamental standard dictates that a share's worth is the price expected for a transaction to sell the shares. Market liquidity plays a pivotal role in determining whether shares can be sold at any given time. Typically, an actual sale transaction between a buyer and seller is regarded as the most reliable market indicator for the "true value" of shares at that particular moment.

- Shares often serve as collateral for securing loans. In cases where one company acquires a majority of another company's shares, valuing these shares becomes necessary. In instances where shares are bequeathed to survivors in a will, or when shares are held jointly by partners in a company undergoing dissolution, proper valuation of shares is essential for equitable distribution of partnership assets. Shares of private companies, not listed on stock exchanges, require valuation when shareholders wish to appraise them or when they are to be sold, for instance, to ascertain Gift Tax & Wealth Tax liabilities.

Types of Share Values

- Face Value: A company may divide its capital into shares valued at denominations such as $10, $50, or $100. Share capital is represented based on the Face Value of Shares, calculated as Share Capital divided by Total Number of Shares. This Face Value is typically printed on the share certificate. Shares may be issued at a discount or premium to their face value.

- Book Value: This value reflects the worth of an asset according to its balance sheet account balance. For assets, the value is derived from the original cost of the asset less any devaluation, amortization, or impairment costs recorded against it.

- Cost Value: Represented as the price at which shares are acquired, inclusive of purchase expenses such as brokerage and commission.

- Market Value: This value denotes the price at which shares are bought or sold in the market. It may be higher, lower, or equal to the face value.

- Capitalized Value: Capitalized Value of share = Capitalized Value of profit/Total no of share

- Fair Value: This represents the price of a share established in an open and unimpeded market by well-informed and willing parties conducting transactions at arm's length. These parties are fully informed and not compelled to transact.

- Yield Value: Also known as the Capitalized Value of Earning Capacity, this value of a share considers the standard rate of return in the industry along with the actual or anticipated rate of return of the company to determine its yield value.

Reasons for Valuation

- Mergers involving two or more companies.

- Absorption of a company into another entity.

- Valuation of shares when some shareholders withhold approval for company reconstruction.

- Distribution of partnership property among associates in a dissolved company where shares are held jointly.

- Assessment of shares offered as security for a loan.

- Conversion of shares from one type to another.

- Government takeover of a company necessitating compensation to shareholders.

- Determination of fair share price when transferring shares between members of a proprietary company.

Valuation Methods

Net Assets Value (NAV) Method: This approach, also known as the intrinsic value or breakup value method, focuses on estimating the share value during company liquidation. It involves calculating the market value of the company and subtracting amounts owed to debenture holders, preference shareholders, creditors, and other liabilities from the total asset value. The resulting amount is allocated to equity shareholders. Considerations include proper valuation of goodwill, elimination of fictitious assets, realization value of fixed assets, provision for bad debts and depreciation, consideration of unrecorded assets and liabilities, valuation of floating assets at market value, and deduction of external liabilities from asset value. The value per share is calculated as follows:

- Value Per Share = (Net Assets - Preference Share Capital) / Number Of Equity Shares

This method efficiently determines the rights of different types of shares and is suitable for companies facing liquidation or when future profits are uncertain.

Yield-Basis Method: This method determines share valuation based on the effective rate of return on investments, known as yield. Yield is expressed as a percentage and serves as the basis for share valuation.

Yield = Normal Profit/Capital Employed x 100

In the Yield-Basis method, shares are valued based on:

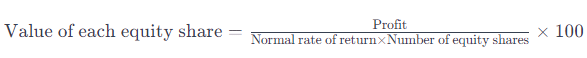

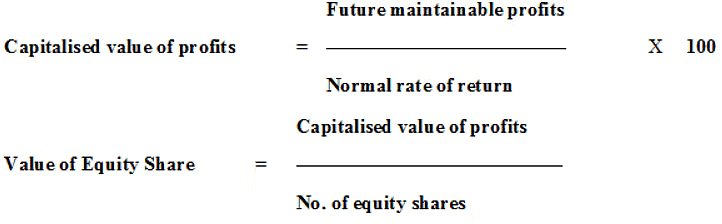

- Profit Basis: This approach entails determining profits using past average profit data. Subsequently, the capitalized value of profit is calculated based on the normal rate of return. This capitalized value of profit is then divided by the number of shares to ascertain the value of each share.

The procedure is as follows:

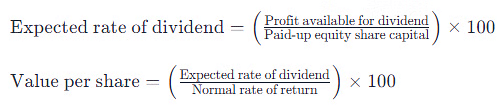

- Dividend Basis: Shares are valued in this approach based on expected dividends and the normal rate of return. The value per share is calculated using the following formula:

Valuation of shares may be conducted either based on the total amount of dividend or on the percentage or rate of dividend.

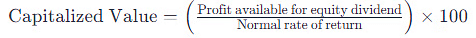

Valuation of shares may be conducted either based on the total amount of dividend or on the percentage or rate of dividend. - Earning Capacity (Capitalization) Method: This valuation method determines the value per share based on the disposable profit of the company, calculated by deducting reserves and taxes from net profit. The following steps are applied for determining the value per share under earning capacity:

Step 1: Calculate the profit available for dividends.

Step 2: Determine the capitalized value using the formula:

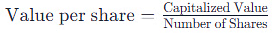

Step 3: Calculate the value per share using the formula:

In this method, the profit available for equity shareholders, as calculated under the capitalization method, is capitalized based on the normal rate of return. Then, the value of each equity share is ascertained by dividing the capitalized profit by the number of equity shares.

- Assessment of Earning Capacity: This approach is suitable only when ascertainable maintainable profit and a clear normal rate of return (NRR) can be determined. This feasibility is attainable when market information is readily accessible. However, in calculating the NRR, it's imperative to consider risk factors.

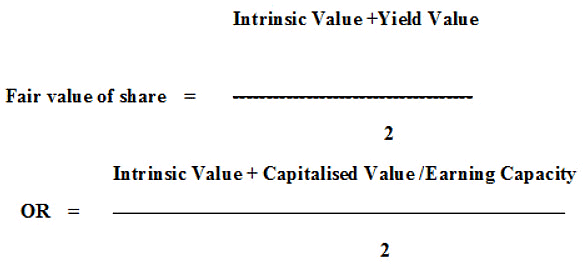

Average (Fair Value) Method: To address the limitations of any single valuation method for shares, the Fair Value Method is deemed the most appropriate approach. It essentially represents an average of the intrinsic value, yield value, or earning capacity methods. For valuing shares of investment companies for wealth tax purposes, the Fair Value Method is acknowledged by the government. It is particularly well-suited to manufacturing and other companies. The fair value can be calculated using the following formula:

Average (Fair Value) Method: To address the limitations of any single valuation method for shares, the Fair Value Method is deemed the most appropriate approach. It essentially represents an average of the intrinsic value, yield value, or earning capacity methods. For valuing shares of investment companies for wealth tax purposes, the Fair Value Method is acknowledged by the government. It is particularly well-suited to manufacturing and other companies. The fair value can be calculated using the following formula:

In summary, bonds and their alternatives, such as loan notes, debentures, and loan stock, serve as IOUs issued by governments and companies to raise finance. They are often referred to as fixed-income or fixed-interest securities, distinguishing them from equities by their consistent returns for investors (bondholders) at regular intervals. These fixed interest payments, known as bond coupons, contrast with the variable dividends paid on equities. Most corporate bonds are redeemable after a specified period. Valuation of shares entails analyzing financial and accounting data and relies on the evaluator's judgment, experience, and expertise.

FAQs on Valuation of Bonds and Shares - Management Optional Notes for UPSC

| 1. What are the key characteristics of bonds? |  |

| 2. How is bond valuation determined? |  |

| 3. What is share valuation? |  |

| 4. What are the types of share values? |  |

| 5. What are the reasons for conducting share valuation? |  |