Weekly Current Affairs (1st to 7th February 2023) Part - 2 | General Test Preparation for CUET UG - CUET Commerce PDF Download

| Table of contents |

|

| Government e-Marketplace |

|

| PM KUSUM |

|

| India's Fiscal Deficit Targets |

|

| National Commission for Scheduled Tribes |

|

| Hate Crimes in India |

|

Government e-Marketplace

Context: Government e-Marketplace achieves a Gross Merchandise Value (GMV) of Rs. 1.5 Lakh Crores.

- GeM has been effectively contributing to the government’s commitment of “Minimum Government, Maximum Governance”.

What is Gross Merchandise Value (GMV)?

- GMV refers to the value of goods sold via customer-to-customer or e-commerce platforms.

- It is calculated prior to the deduction of any fees or expenses.

- It is a measure of the growth of the business or use of the site to resell products owned by others through consignment.

What is the Government e-marketplace (GeM)?

About:

- The GeM is an online platform launched by the Ministry of Commerce and Industry, Government of India in 2016 to facilitate procurement of goods and services by various government departments and organisations.

- It is open to all government departments, public sector undertakings, autonomous bodies and other organisations.

- Currently, GeM stands at the third position after Singapore's GeBIZ.

- South Korea's KONEPS is the largest such platform in the world.

Significance:

- Boost to Digital Economy:

- The e-marketplace can promote the use of technology in government procurement processes, contributing to the growth of India's digital economy.

- In the last 6.5 years, GeM has revolutionised the ecosystem of public procurement in the country through technology, the digitization of processes, the digital integration of all stakeholders, and the use of analytics.

- Improved vendor participation:

- GeM can encourage more vendors, including small and medium enterprises, to participate in government procurement processes, leading to increased competition and better value for money for the government.

Transparency and Efficiency:

- A government e-marketplace can improve the transparency and efficiency of procurement processes by standardising and automating procedures, reducing the scope for corruption and human error.

- Last Mile Outreach: GeM has integrated with 1.5 lakh+ India Post offices and 5.2+ lakh Village Level Entrepreneurs (VLEs) via the Common Service Centres for last-mile outreach and service delivery.

Developments:

- Country of Origin Mandatory: Every time a new product is registered on GeM, sellers are required to list the Country of Origin.

- Bamboo Market Window: The National Bamboo Mission and the Government e-Marketplace (GeM) have collaborated to have a dedicated window on the GeM portal for marketing of the Bamboo Goods (Bamboo based products & Quality Planting Materials).

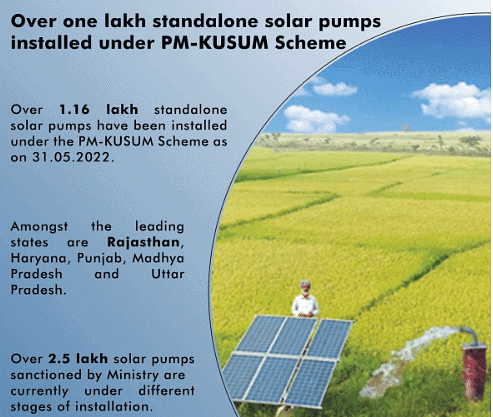

PM KUSUM

Context: The Ministry of New and Renewable Energy (MNRE) has extended the deadline to install 30,000 MW solar power capacity in rural India to March 2026 under PM-KUSUM (Pradhan Mantri Kisan Urja Suraksha Evam Uttham Mahabhiyan).

What is PM KUSUM?

About:

- The PM-KUSUM was launched by the MNRE in 2019, in order to endow installation of off-grid solar pumps in rural areas and reduce dependence on grid, in grid-connected areas.

Components:

- 10,000 MW of decentralized ground-mounted grid-connected renewable power plants.

- Installation 20 lakh solar-powered agriculture pumps

- Converting 15 lakh agriculture pumps, already connected to the grid, into solar.

Objective:

- It aims to enable farmers to set up solar power generation capacity on their arid lands and to sell it to the grid.

- It also seeks to increase the income of farmers by allowing them to sell surplus solar power to the grid.

Achievements:

What is the Significance of the Scheme?

- Increase Access to Energy: It incentivises the farmers to sell surplus solar energy to the states, which in turn will augment their income. The scheme is expected to increase access to electricity in rural areas and provide a reliable source of energy for agriculture and other rural activities

- Contain Climate Catastrophe: If farmers are able to sell surplus power, they will be incentivised to save power and, in turn, it will mean the reasonable and efficient use of groundwater. Also, expansion of the irrigation cover by providing decentralized solar-based irrigation and moving away from polluting diesel. When implemented fully, PM-KUSUM will lead to reducing carbon emissions by as much as 32 million tonnes of CO2 per annum.

- Employment and Empowerment: The scheme is expected to create job opportunities in the installation, maintenance, and operation of solar power projects. The scheme is expected to empower rural communities by giving them control over their own energy generation and distribution.

What are the Associated Challenges?

- Financial and Logistics Issue: The cost of setting up solar power projects can be high, and some farmers may not have access to the necessary financing. There is a matter of domestic availability of equipment itself. While pumps are not a challenge for domestic suppliers, the availability of solar pumps is still an issue.

- Depleting Water Tables: Due to power subsidies, the recurring cost of electricity is so low that farmers keep on pumping water and the water table is going down. In a solar installation, it becomes a more difficult job to upgrade to higher capacity pumps in case the water table falls because one will have to add new solar panels which are expensive.

- Regulatory Barriers and Stability: There may be regulatory barriers that prevent the smooth implementation of the scheme, such as restrictions on the connection of solar power projects to the grid. Integrating decentralized solar power projects into the grid may pose technical challenges and stability issues, which need to be addressed.

Way Forward

- Consensus between the Centre and States is the key to the success of this decentralised solar power scheme. Any reform in India’s power space cannot take place unless there is consensus between the Centre, States and stakeholders.

- Apart from switching to solar power, farmers should also switch over to drip irrigation mode which saves water and power with increased crop output.

- For effective implementation and serious participation by stakeholders, the scheme should be more attractive in terms of benchmark prices in view of the challenges on account of higher costs of implementation and comprehensive maintenance.

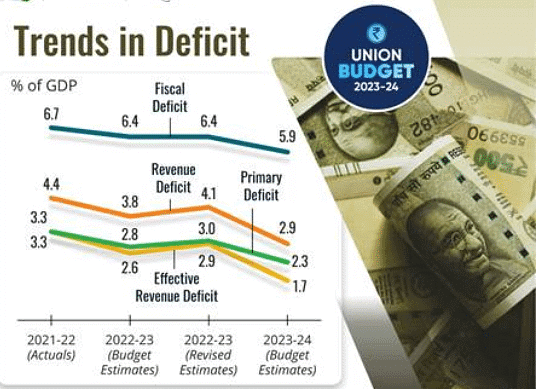

India's Fiscal Deficit Targets

Context: In the Union Budget for 2023-24, the government announced the adoption of relative fiscal prudence and projected a decline in fiscal deficit to 5.9% of gross domestic product (GDP) in FY24, compared with 6.4% in FY23.

- The government planned to continue on the path of fiscal consolidation and reach a fiscal deficit below 4.5% by 2025-26.

What is the Direction on Deficit Given in the Budget?

- In the revenue budget, the deficit was 4.1% of GDP in 2022-23 (revised estimate). In Union Budget 2023-24, revenue deficit is 2.9% of GDP.

- If interest payments are deducted from fiscal deficit, which is referred to as primary deficit, it stood at 3% of GDP in 2022-23 (RE).

- The primary deficit, which reflects the current fiscal stance devoid of past interest payment liabilities, is pegged at 2.3% of GDP in Union Budget 2023-24.

What are the Major Steps of Government Towards Fiscal Consolidation?

Reduced Subsidies:

- The government has reduced the amount of money allocated for food, fertiliser and petroleum subsidies.

- The food subsidy in 2022-23 (RE) was ₹2,87,194 crore. In 2023-24, it has been reduced to ₹1,97,350 crore.

- Similarly, the fertilizer subsidy in 2022-23 was ₹2,25,220 crore (RE); it has been reduced to ₹1,75,100 crore for FY24.

- The petroleum subsidy in 2022-23 was ₹9,171 crore (RE); it has declined to ₹2,257 crore in 2023-24 (Budget estimate/BE).

- The decrease in subsidies compared to the previous year is not as sharp, but it is still a positive step towards reaching a fiscal deficit target of 4.5% by 2025-26.

Capital Expenditure:

- In the Budget for 2023-24, capital spending is planned to rise to 3.3% of GDP, and the government has provided an interest-free loan of ₹1.3 lakh crore for 50 years to states to boost growth.

Debt Management:

- The majority of the fiscal deficit is financed through internal market borrowings, with a small portion coming from securities against savings, provident funds, and external debt.

- In the 2023 Union Budget, India's external debt is only 1% of the total fiscal deficit, which is estimated at ₹22,118 crore.

- The states are free to maintain a fiscal deficit of 3.5% of their Gross State Domestic Product (GSDP) with 0.5% tied to power sector reforms.

Why is Fiscal Consolidation Important for an Emerging Economy?

- Fiscal consolidation refers to the ways and means of narrowing the fiscal deficit. A government typically borrows to bridge the deficit. It will then have to allocate a part of its earnings to service the debt.

- The interest burden will increase as the debt increases. In the Budget for FY22, of the total government expenditure of over ₹34.83 lakh crore, more than 8.09 lakh crore (around 20%) went towards interest payment.

What is Fiscal Deficit?

About:

- Fiscal deficit is the difference between the government's total expenditure and its total revenue (excluding borrowings).

- It is an indicator of the extent to which the government must borrow in order to finance its operations and is expressed as a percentage of the country's Gross Domestic Product (GDP).

- A high fiscal deficit can lead to inflation, devaluation of the currency and an increase in the debt burden.

- While a lower fiscal deficit is seen as a positive sign of fiscal discipline and a healthy economy.

Positive Aspects of Fiscal Deficit:

- Increased Government Spending: Fiscal deficit enables the government to increase spending on public services, infrastructure, and other important areas that can stimulate economic growth.

- Finances Public Investments: The government can finance long-term investments, such as infrastructure projects, through fiscal deficit.

- Job Creation: Increased government spending can lead to job creation, which can help reduce unemployment and increase the standard of living.

Negative Aspects of Fiscal Deficit:

- Increased Debt Burden: A persistent high fiscal deficit leads to an increase in government debt, which puts pressure on future generations to repay the debt.

- Inflationary Pressure: Large fiscal deficits can lead to an increase in money supply and higher inflation, which reduces the purchasing power of the general public.

- Crowding out of Private Investment: The government may have to borrow heavily to finance the fiscal deficit, which can lead to a rise in interest rates, and make it difficult for the private sector to access credit, thus crowding out private investment.

- Balance of Payments Problems: If a country is running large fiscal deficits, it may have to borrow from foreign sources, which can lead to a decrease in foreign exchange reserves and put pressure on the balance of payments.

What are the Other Types of Deficits in India?

- Revenue Deficit: It refers to the excess of government’s revenue expenditure over revenue receipts.

- Revenue Deficit = Revenue expenditure – Revenue receipts

- Primary Deficit: Primary deficit equals fiscal deficit minus interest payments. This indicates the gap between the government’s expenditure requirements and its receipts, not taking into account the expenditure incurred on interest payments on loans taken during the previous years.

- Primary deficit = Fiscal deficit – Interest payments

- Effective Revenue Deficit: It is the difference between revenue deficit and grants for creation of capital assets.

- The concept of effective revenue deficit has been suggested by the Rangarajan Committee on Public Expenditure.

Conclusion

- India’s priority is to recover the economy through capital expenditure (capex). With increased government investment in infrastructure, private investment will also increase, boosting the economic (GDP) growth, and as a result the ratio of fiscal deficit to GDP will decrease.

National Commission for Scheduled Tribes

Context: The recent data presented by the Ministry of Tribal Affairs (MoTA) revealed that the National Commission for Scheduled Tribes (NCST) is currently functioning with less than 50% of its sanctioned strength.

What is the NCST?

- Formation: NCST was set up in 2004 by amending Article 338 and by inserting a new article 338A in the Constitution through the 89th Constitution Amendment Act, 2003. Hence, it is a constitutional body.

- By this amendment, the erstwhile National Commission for Scheduled Castes and Scheduled Tribes was replaced by two separate Commissions namely:

- the National Commission for Scheduled Castes (NCSC), and

- the NCST

- Objective: Article 338A inter-alia gives powers to the NCST to oversee the implementation of various safeguards provided to Scheduled Tribes (STs) under the Constitution or under any other law for time being in force or under any other order to the Government and to evaluate the working of such safeguards.

- Composition: It consists of a Chairperson, a Vice-Chairperson and 3 other Members who are appointed by the President by warrant under his hand and seal.

- At least one member should be a woman.

- The Chairperson, the Vice-Chairperson and the other Members hold office for a term of 3 years.

- The Chairperson has been given the rank of Union Cabinet Minister, the Vice Chairperson has the rank of a Minister of State and other Members have the rank of Secretary to the Government of India.

- The members are not eligible for appointments for more than two terms.

What are the Duties and Functions of the NCST?

- To investigate and monitor all matters relating to the safeguards provided for the STs under the Constitution or under any other law for the time being in force or under any order of the Government.

- To inquire into specific complaints with respect to the deprivation of rights and safeguards of the STs.

- To participate and advise in the planning process of the socio-economic development of the STs and to evaluate the progress of their development.

- The Commission shall provide reports on the operation of those safeguards to the President annually and as necessary.

- To make in such reports recommendations as to the measures that should be taken by the Union or any State for effective implementation of those safeguards.

- The President, subject to the provisions of any law made by Parliament, may, by rule, discharge any other functions relating to the protection, welfare, development, and advancement of the STs.

What are the Provisions Related to STs in India?

Definition:

- The Constitution of India does not define the criteria for recognition of STs. As per Census-1931, STs are termed as "backward tribes” living in the "Excluded" and "Partially Excluded" areas.

- The Government of India Act of 1935 called for the first time for representatives of "backward tribes" in provincial assemblies.

Constitutional Provisions:

- Article 366(25): It only provides a process to define STs:

- “STs means such tribes or tribal communities or parts of or groups within such tribes or tribal communities as are deemed under Article 342 to be Scheduled Tribes for the purposes of this Constitution.”

- Article 342(1): The President with respect to any State/UT (after consultation with the Governor in case of state) may specify the tribes/tribal communities/part of or groups within tribes/ tribal communities as a Scheduled Tribe in that State/UT.

- Fifth Schedule: It lays out provisions for the Administration and Control of Scheduled Areas and STs in states other than 6th Schedule States.

- Sixth Schedule: Deals with the administration of the tribal areas in Assam, Meghalaya, Tripura and Mizoram.

Statutory Provisions:

- Protection of Civil Rights Act, 1955 against Untouchability.

- Scheduled Castes and the Scheduled Tribes (Prevention of Atrocities) Act, 1989.

- Provisions of the Panchayats (Extension to the Scheduled Areas) Act, 1996.

- Scheduled Tribes and Other Traditional Forest Dwellers (Recognition of Forest Rights) Act, 2006.

Conclusion

- The vacancies should be immediately filled as there should be no reason now for any further delay since the recruitment rules have been suitably revised. Moreover, the lack of manpower is leading to difficulties in performing the functions as well which also makes it important to fill the vacancies immediately for the effective performance of the commission.

Hate Crimes in India

Context: Recently, the Supreme Court (SC) observed that there is a growing consensus around hate speech and stressed there is no scope for hate crimes on the basis of religion in a secular country like India. And, it is the primary duty of the State to protect citizens from hate crimes.

What are Hate Crimes?

About:

- Hate crimes refer to violent or abusive acts committed against individuals or groups based on their religion, caste, ethnicity, sexual orientation, or other identities.

- These crimes often involve acts of violence, intimidation, or threats, and they target individuals or groups who are perceived as being different or marginalized.

- The Indian Constitution guarantees equality and prohibits discrimination on the grounds of religion, race, caste, sex, or place of birth, (Article 14) but despite this, hate crimes remain a persistent problem in the country.

Indian Laws Against Hate Crimes:

- Hate crime is neither well defined in the Indian legal framework nor can it be easily reduced to a standard definition due to the myriad forms it can take.

- However, Hate speeches are dealt under IPC under Sections 153A, 153B, 295A, 298, 505(1) and 505(2) that declares that word, spoken or written, that promotes disharmony, hatred, or insults on basis of religion, ethnicity, culture, language, region, caste, community, race etc., is punishable under law.

Major Factors Responsible for Hate Crime:

- Religious and Ethnic Tensions: India is a diverse country with a multitude of different religious and ethnic groups. These tensions often lead to violence and hate crimes.

- Caste-based Discrimination: India has a long history of caste-based discrimination, which has contributed to the marginalization of certain groups and the perpetration of hate crimes against them.

- Lack of Political Will: Despite the presence of laws and regulations to address hate crimes, the lack of political will to enforce them effectively has created a permissive environment for such crimes to occur.

- Social Media and Misinformation: The spread of hate speech and misinformation on social media can further fuel tensions and contribute to the perpetration of hate crimes.

What are Possible Ways to Deal with Hate Crimes in India?

- Awareness Campaigns: The first step in addressing hate crime is to raise awareness about its harmful effects on individuals and society as a whole.

- Mass media campaigns and community outreach programs can be used to educate people about the consequences of hate crime and encourage them to report such incidents.

- Community Engagement: Communities can play an important role in addressing hate crime. This can be done by creating spaces where people can come together and have open and honest discussions about the issues that divide them.

- This can also help to build bridges between different communities and foster greater understanding and respect.

- Use of Technology: Technology can be used to improve reporting and tracking of hate crimes. This can include developing online reporting systems and using data analytics to identify trends and hotspots for hate crime.

- Restorative Justice Programs: Restorative justice programs aim to repair harm and build relationships between victims, offenders and the community.

- These programs can be used in cases of hate crime to promote healing and reconciliation between affected communities.

- Stiffer Penalties: Another way to deal with hate crime is to impose stiffer penalties on those who engage in such behaviour. This can serve as a deterrent to others who may be considering committing hate crimes.

|

164 videos|800 docs|1155 tests

|

FAQs on Weekly Current Affairs (1st to 7th February 2023) Part - 2 - General Test Preparation for CUET UG - CUET Commerce

| 1. What is the Government e-Marketplace? |  |

| 2. What is PM KUSUM? |  |

| 3. What are India's Fiscal Deficit Targets? |  |

| 4. What is the National Commission for Scheduled Tribes? |  |

| 5. What are Hate Crimes in India? |  |