Weekly Current Affairs (8th to 14th September 2024) Part - 1 | General Test Preparation for CUET UG - CUET Commerce PDF Download

GS2/International Relations

Prime Minister's Visits to Singapore and Brunei Darussalam

Why in News?

- Recently, the Prime Minister of India visited Brunei Darussalam and Singapore, leading to notable advancements in India's diplomatic and strategic relations with Southeast Asia.

What were the Key Outcomes of PM’s Visit to Brunei Darussalam?

- The Prime Minister toured the iconic Omar Ali Saifuddien Mosque in Bandar Seri Begawan, which symbolizes Brunei’s Islamic heritage and is named after the 28th Sultan of Brunei.

- India expressed gratitude for Brunei's assistance in hosting ISRO’s Telemetry Tracking and Telecommand (TTC) Station, discussing further collaboration under a renewed MoU.

- Both nations emphasized the need for peaceful resolution of disputes in the South China Sea, adhering to international laws such as UNCLOS 1982.

- They agreed to enhance cooperation in multilateral platforms such as the ASEAN-India Dialogue Relations, East Asia Summit, and the United Nations.

- Both leaders acknowledged the urgency of addressing climate change, with India backing Brunei's efforts, including the establishment of the ASEAN Centre for Climate Change.

- Previously, India cut back on oil imports from Brunei in favor of Russian supplies, but discussions on long-term collaboration in liquefied natural gas (LNG) have now started.

What were the Key Outcomes of PM’s Visit to Singapore?

- Semiconductor Ecosystem Partnership: An MoU was signed to create a robust semiconductor supply chain, marking a new chapter in bilateral cooperation. This is strategically important due to the global relevance of semiconductor technology.

- Comprehensive Strategic Partnership: India and Singapore have agreed to elevate their relationship to a 'Comprehensive Strategic Partnership,' expanding cooperation across various sectors.

- Cooperation in Sustainability: Both countries plan to work together on green hydrogen and ammonia projects, with a framework being established to support these initiatives.

- India has also granted an exemption for exporting non-Basmati white rice, which will help meet Singapore's food security needs.

- Digital Technologies: An MoU focusing on digital technologies has been signed to enhance cooperation in data, AI, and cybersecurity, including the establishment of a Cyber Policy Dialogue.

- Fintech Cooperation: Initiatives like India's UPI and Singapore's PayNow have been recognized for promoting seamless transactions and improving trade efficiency.

- Cultural Linkages: India announced the upcoming inauguration of the Thiruvalluvar Cultural Centre in Singapore to honor the legacy of the Tamil saint Thiruvalluvar, along with a commitment to strengthen cultural and community ties.

How are India’s Relations with Brunei Darussalam and Singapore?

Brunei Darussalam:

- Political Relations: Diplomatic relations were established in 1984, with strong cultural ties and membership in organizations like the United Nations and ASEAN.

- The Sultan of Brunei has been a strong proponent of closer India-Brunei ties and has supported India’s 'Look East' and 'Act East' policies.

- Brunei has backed India's international candidacies and played a crucial role in enhancing India-ASEAN relations as the ASEAN Country Coordinator from 2012 to 2015.

- Commercial Relations: India's main exports to Brunei include automobiles, rice, and spices. India imports approximately USD 500-600 million of crude oil from Brunei annually.

- Indian Community: The Indian diaspora in Brunei dates back to the 1930s, with many working in sectors like oil & gas and construction.

Singapore:

- Historical Connect: India and Singapore share a rich historical relationship that includes commerce and cultural connections dating back over a millennium.

- The modern relationship began with Stamford Raffles establishing a trading post in Singapore in 1819, which transitioned into a British colony.

- India was among the first nations to recognize Singapore's independence in 1965.

Trade and Economic Cooperation:

- Singapore is India's 6th largest trade partner, accounting for 3.2% of India's overall trade.

- Since 2018-19, Singapore has been the largest source of FDI in India, with significant investments in services and technology sectors.

- Commercial arrangements for RuPay card acceptance and UPI-Paynow linkage have been established, facilitating cross-border payments.

- Science and Technology Cooperation: Several Singaporean satellites have been launched, including the first indigenous micro-satellite in 2011.

- Multilateral Cooperation: Both countries are part of international initiatives like the International Solar Alliance and the Global Bio-fuel Alliance.

- Ethnic Indians make up about 9.1% of Singapore's population, with Tamil being one of the four official languages.

Way Forward

- India aims to enhance digital connectivity with Southeast Asia to foster collaboration in e-commerce and fintech.

- By leveraging its IT strengths, India seeks to position itself as a regional technology hub, offering expertise in software and digital innovation.

- India should focus on diversifying its supply chains to reduce dependence on China while enhancing regional trade and integration.

- Strengthening maritime security cooperation is essential to address common threats such as piracy and maritime terrorism.

- India may consider establishing a Maritime Southeast Asia–India Economic Corridor to improve regional connectivity and counter China's Belt and Road Initiative.

Mains Question:

Q. Analyze the significance of elevating India-Singapore relations to a Comprehensive Strategic Partnership. What are the expected benefits across different sectors? What are the strategic benefits for India in expanding its relationship with ASEAN countries under the Act East Policy?

GS3/Economy

Concerns in Asset Reconstruction Companies (ARCs)

Why in News?

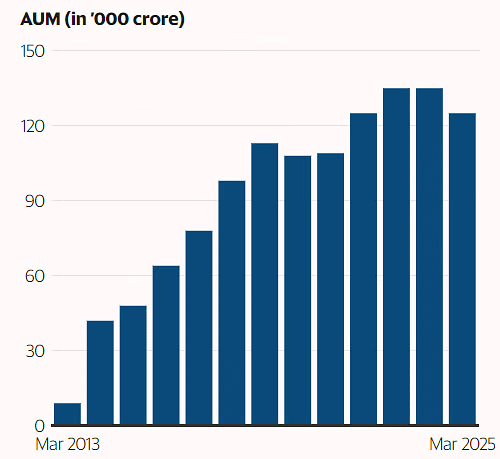

- Recently, Asset Reconstruction Companies (ARCs) have experienced a slowdown in growth due to Non-Performing Assets (NPAs) reaching a 12-year low of 2.8% in March 2024. Ratings agency Crisil projects that assets under management (AUM) by ARCs will contract by 7-10% in 2024-25 after remaining unchanged in 2023-24.

What are the Concerns of Asset Reconstruction Companies (ARCs)?

- Low Business Potential: The reduction in new non-performing corporate assets has compelled ARCs to pivot towards smaller, less lucrative retail loans. However, there has not been a significant rise in retail NPAs, further limiting ARCs' opportunities.

- Increased Investment Mandate: The Reserve Bank of India (RBI) mandated in October 2022 that ARCs must invest at least 15% of bank investments in security receipts or a minimum of 2.5% of total security receipts issued, whichever is greater.

- Net Owned Funds Requirements: In October 2022, the RBI raised the minimum net owned funds requirement for ARCs from Rs 100 crore to Rs 300 crore to ensure financial stability. This new requirement has imposed additional constraints on ARCs, with many struggling to meet the Rs 300 crore threshold, potentially leading to mergers or exits. Net-owned funds refer to the difference between what a company owns and what it owes.

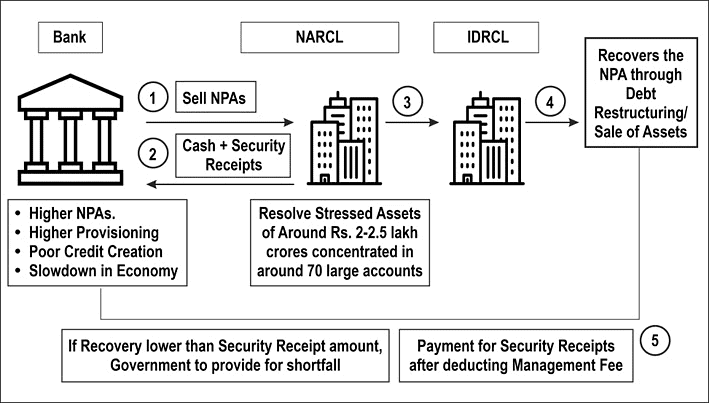

- Competition from NARCL: The creation of the state-owned National Asset Reconstruction Company Ltd (NARCL) poses a serious challenge, as NARCL offers products guaranteed by the government, making them more appealing to financial institutions.

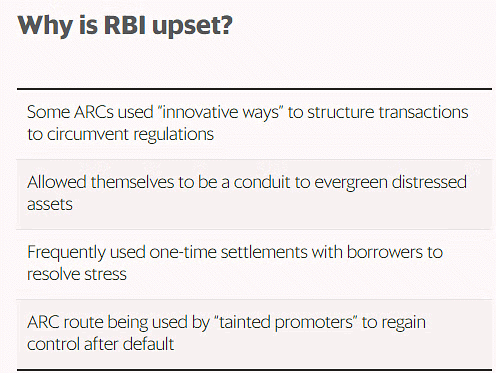

- Regulatory Challenges: The RBI has also mandated that ARCs require approval from an independent advisory committee for all settlement proposals, resulting in delays, particularly in retail loans. Advisory committees tend to be cautious to avoid future scrutiny, complicating the approval process. Additionally, increased regulatory scrutiny has affected major ARCs, exemplified by Edelweiss ARC being prohibited from new loans for violating regulations through related group loans.

- Trust Deficit: A trust deficit appears to have developed between the RBI and ARCs. The RBI has raised concerns that certain transactions might aid defaulting promoters in regaining control of their assets, which would violate Section 29A of the Insolvency and Bankruptcy Code (IBC). This section prohibits defaulting promoters from bidding for their insolvent firms.

What are ARCs?

- About: An Asset Reconstruction Company (ARC) is a specialized financial institution that purchases debts from banks at an agreed value and attempts to recover those debts independently.

- Background of ARCs: The concept of ARCs was introduced by the Narsimham Committee – II in 1998, leading to their establishment under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act, 2002). Currently, there are 27 ARCs registered with the RBI, including notable entities like NARCL, Edelweiss ARC, and Arcil.

- Registration and Regulation of ARCs: ARCs are registered under the Companies Act, 2013, and must also register with the RBI according to section 3 of the SARFAESI Act. They operate under RBI guidelines and regulations.

- Funding for ARCs: ARCs can raise the necessary funds to purchase NPAs from Qualified Buyers (QBs), which include entities such as insurance companies, banks, state financial and industrial development corporations, trustees or ARCs registered under SARFAESI, and asset management companies registered with SEBI.

Working of the ARCs:

- Asset Reconstruction: This process involves acquiring the rights of a bank or financial institution in loans, advances, debentures, bonds, guarantees, or other credit facilities for recovery purposes, collectively referred to as 'financial assistance'. ARCs purchase distressed loans at a discount, either for cash or a combination of cash and security receipts, which can be redeemed within eight years.

- Securitisation: This involves acquiring financial assets through the issuance of security receipts to Qualified Buyers.

What Measures Can Be Taken to Address the Challenges Faced by ARCs?

- Diversification of Asset Portfolios: ARCs should consider diversifying their asset portfolios by exploring opportunities beyond traditional corporate and retail loans, potentially including sectors such as infrastructure, MSMEs, and other stressed sectors that still show recovery potential.

- Improving Regulatory Transparency and Collaboration: ARCs should collaborate closely with regulatory bodies to ensure transparent operations and adherence to guidelines. Establishing a standard code of conduct could enhance trust and accountability.

- Enhancing Efficiency in Settlements: To mitigate delays caused by mandatory independent advisory committee approvals, ARCs could leverage technology, such as AI-driven analytics, to expedite evaluations while ensuring compliance.

- Adopting Strategic Competition with NARCL: Private ARCs should focus on differentiating their services by providing specialized solutions tailored to niche markets or by implementing faster recovery mechanisms.

Mains Question:

Q. Discuss the challenges faced by Asset Reconstruction Companies (ARCs) and suggest measures to enhance their effectiveness.

GS2/International Relations

India-UAE Relations

Why in News?

- Recently, India and the United Arab Emirates (UAE) held bilateral talks aimed at strengthening their ties and enhancing their Comprehensive Strategic Partnership. The crown prince of Abu Dhabi was received by India's Prime Minister at Hyderabad House in New Delhi. During this visit, both nations signed several agreements to expand their energy collaboration.

What are the Key Agreements Signed During the Visit?

Civil Nuclear Cooperation: A Memorandum of Understanding (MoU) was signed for civil nuclear cooperation, involving the Nuclear Power Corporation of India Limited (NPCIL) and the Emirates Nuclear Energy Company (ENEC) for the operation and maintenance of the Barakah Nuclear Power Plant, which is the first nuclear power plant in the Arab world located in Al Dhafra, Abu Dhabi.

Energy:

- LNG Supply: An MoU was established for a long-term supply of Liquefied Natural Gas (LNG) between the UAE and India.

- Strategic Petroleum Reserve (SPR): An MoU was inked with the India Strategic Petroleum Reserve Limited (ISPRL) for the supply of petroleum, which ensures a stable supply of crude oil during geopolitical uncertainties.

Food Parks: A MoU was signed with the Government of Gujarat for the development of food parks in India, as part of the I2U2 grouping that envisions food parks in Gujarat and Madhya Pradesh.

Why is the UAE Important for India?

- Strategic Political Partnership: The elevation of India-UAE relations to a comprehensive strategic partnership and the establishment of a strategic security dialogue reflect their growing political alignment.

- Bilateral Trade: The UAE is India's third-largest trading partner. The Comprehensive Economic Partnership Agreement (CEPA), signed in 2022, has significantly boosted trade, which increased from USD 72.9 billion (April 2021-Mar 2022) to USD 84.5 billion (April 2022-Mar 2023), showing a 16% year-on-year rise.

- Foreign Direct Investment (FDI): The UAE is the fourth largest investor in India, with FDI surging over three-fold to USD 3.35 billion in FY23 from USD 1.03 billion in FY22.

- Energy Security: The UAE is a crucial oil supplier for India, significantly contributing to India's energy security.

- Finance: The introduction of India's RuPay card and the Unified Payments Interface (UPI) in the UAE indicates growing financial collaboration, including a Local Currency Settlement (LCS) system to facilitate transactions in Indian Rupee and AED.

- Space Exploration: An MoU between ISRO and the UAE Space Agency (UAESA) was signed for cooperation in peaceful space exploration.

- Defence and Security Cooperation: Strengthened cooperation focusing on counter-terrorism, intelligence sharing, and joint military exercises, such as Exercise Desert Cyclone. The UAE's interest in Indian defence products, including BrahMos missiles and Akash air defence systems, has increased.

- Multilateral Engagements: The formation of the I2U2 grouping (India-Israel-UAE-US) and UAE's participation in the India-Middle East-Europe Economic Corridor (IMEC) highlight UAE's strategic significance in global engagements.

- Regional Stability: The UAE's role in the Abraham Accords and its diplomatic relations with Israel underscore its importance in fostering stability in the region, which is critical for India’s energy needs.

- Cultural and Diaspora Links: The large Indian diaspora in the UAE, approximately 3.5 million strong, serves as a vital connection between the two nations. Initiatives like the inauguration of the first Hindu temple in Abu Dhabi reflect shared values and enhance cultural ties.

- Cooperation During Covid-19: Throughout the pandemic, both nations supported each other with medical supplies and vaccines, strengthening their partnership in crisis situations.

What are the Challenges in India-UAE Relations?

- Limited Diversification of Trade Categories: While overall trade has increased, there has been limited progress in expanding into new sectors, with trade still concentrated in gems, jewellery, petroleum, and smartphones.

- Rising Import Costs: Imports from the UAE surged by 19% year-on-year to USD 53,231 million in FY23, affecting India's trade balance due to high dependency on specific categories.

- Non-Tariff Barriers: Indian exports face challenges such as the mandated Halal certification, which hampers the volume of processed food exports and limits market access.

- Human Rights Concerns: Issues related to the Kafala system, which significantly impacts migrant workers' rights, pose a major concern in India-UAE relations.

- Diplomatic Balancing Act: Navigating regional conflicts, notably the Israel-Hamas war and tensions between Iran and Arab nations, adds complexity to India's diplomatic efforts.

- Financial Support to Pakistan: The UAE's financial assistance to Pakistan raises concerns about potential anti-India activities, complicating relations.

Way Forward

- Promote Trade Diversification: Focus on emerging sectors like technology, renewable energy, and pharmaceuticals to create a balanced trade relationship.

- Strengthen Economic Ties: Explore joint ventures and partnerships to enhance economic collaboration and manage high import costs.

- Enhance Dialogue on Human Rights: Initiate discussions with UAE authorities to address and advocate for the rights and working conditions of migrant laborers.

- Focus on Areas of Common Interests: Engage in proactive diplomacy to align on mutual interests and ensure geopolitical tensions do not negatively affect bilateral relations.

Mains Question:

Q. Analyse the significance of the United Arab Emirates (UAE) in India's foreign policy strategy.

GS3/Environment

Uncommon Cyclones in the Arabian Sea

Why in News?

- Recently, the north Indian Ocean experienced a rare August cyclone named Asna, which has garnered significant attention due to its unusual timing and origin. Generally, this region, comprising the Arabian Sea and the Bay of Bengal, is less active concerning cyclone formation compared to other global oceanic areas. However, the occurrence of Asna has highlighted the increasing impact of climate change on cyclogenesis in this area.

What are the Factors Contributing to Cyclogenesis in the North Indian Ocean?

Oceanic Tunnels:

- The Indian Ocean features unique oceanic tunnels that link it with the Pacific and Southern Oceans.

- The Pacific Tunnel (Indonesian Throughflow) introduces warm water into the upper 500 meters of the Indian Ocean, which raises sea surface temperatures (SSTs) in the Arabian Sea, enhancing convection and moisture availability.

- While warm SSTs can fuel cyclone formation, they may be balanced by other limiting factors.

- The Southern Ocean Tunnel brings in cooler waters from depths greater than 1 kilometer, stabilizing the lower ocean layers and reducing vertical mixing of warmer surface waters.

- These cooler waters can lower SSTs and diminish the energy available for cyclone formation, potentially curtailing cyclonic activity.

Pre and Post-Monsoon Cyclones:

- The north Indian Ocean, which includes the Arabian Sea and the Bay of Bengal, experiences two distinct cyclone seasons: pre-monsoon (April to June) and post-monsoon (October to December).

- This dual-season phenomenon is unlike other regions that usually have a single cyclone season, influenced by unique climatic and oceanographic conditions such as monsoonal circulation and significant seasonal wind reversals.

- During pre-monsoon, cyclogenesis can occur in both the Arabian Sea and the Bay of Bengal due to warming and increased convection.

- In the post-monsoon season (October-December), the northeast monsoon and dry continental air tend to cool the Arabian Sea, reducing cyclone formation chances, while the Bay of Bengal remains more favorable for cyclones.

- Nonetheless, climate change is modifying the patterns and intensity of cyclones in the Indian Ocean.

How does Climate Change Impact the Indian Ocean?

Rapid Warming:

- Climate change is leading to a rapid increase in temperatures in the Indian Ocean.

- Warmer waters from the Pacific Ocean, along with increased heat influx, contribute to this warming trend.

- Changes in atmospheric winds and humidity, driven by global climate variations, further exacerbate the warming of the Indian Ocean.

Global Influence:

- The swift warming of the Indian Ocean affects heat uptake by the Pacific Ocean and the sinking of denser waters in the North Atlantic Ocean.

- Essentially, the Indian Ocean serves as a modulator of global climate variability, playing a crucial role in the overall heat balance during climate change.

Cyclogenesis Impact:

- The accelerated warming and associated climate changes significantly influence cyclone formation, frequency, and behavior, showcasing the region's distinct response to global warming.

Mains Question:

Q. Explain the factors contributing to cyclogenesis in the North Indian Ocean and the impact of climate change.

GS2/International Relations

India’s Hesitancy in Joining RCEP

Why in News?

- Recently, the World Bank's latest India Development Update suggested that India should reconsider its position on the Regional Comprehensive Economic Partnership (RCEP). However, an Indian think tank has dismissed this suggestion, arguing that it is based on flawed assumptions and outdated projections.

What is the World Bank's Analysis of India Opting out of the RCEP?

- Income Gains: The World Bank estimates that if India rejoins RCEP, its income could increase by USD 60 billion annually, whereas staying out could lead to a decline of USD 6 billion. These gains would benefit various sectors, including raw materials, light and advanced manufacturing, and services.

- Export Growth: Joining RCEP could potentially boost India's exports in services such as computing, finance, and marketing by 17%.

- Denial of Economic Gains: Without India, RCEP members could see an overall increase of USD 186 billion in the global economy, raising their GDP by 0.2%. The primary beneficiaries would be China (USD 85 billion), Japan (USD 48 billion), and South Korea (USD 23 billion). Consequently, India may miss out on significant economic benefits that could arise from RCEP.

- Trade Diversion Risks: Remaining outside RCEP could lead to trade diversion, where member countries shift their supply chains and increase internal competition, potentially harming India's exports to these nations.

- Potential New Members: Countries like Bangladesh and Sri Lanka have expressed interest in joining RCEP, which complicates India's position as it already has a Free Trade Agreement (FTA) with Sri Lanka.

What is the World Bank's Evaluation of India's Export Strategy and Trade Policy?

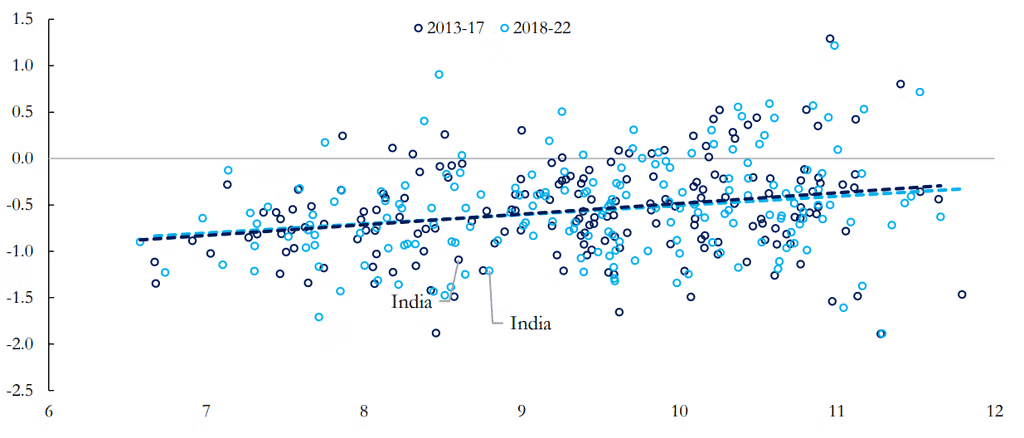

- Need for Export Diversification: India’s trade in goods as a percentage of GDP has been declining, and its participation in Global Value Chains (GVCs) has also dropped. This diversification can be achieved by expanding into labor-intensive sectors such as textiles, apparel, leather, and footwear. India's share in global exports of Apparel, Leather, Textiles, and Footwear (ALTF) rose from 0.9% in 2002 to a peak of 4.5% in 2013, but fell to 3.5% in 2022.

- Increased GVC Participation: By integrating into GVCs, India can expand its production variety, enhance competitiveness by accessing advanced technologies, and attract more Foreign Direct Investment (FDI) from multinationals.

- Balancing Liberalisation and Protectionism: India's trade policy has elements of both liberalisation and protectionism. Initiatives such as the National Logistics Policy 2022 aim to reduce logistics costs and improve trade facilitation, while there has been an increase in protectionist measures like higher tariffs and non-tariff barriers that limit India's trade openness.

- Trade Agreements: India's FTAs with countries like the UAE and Australia indicate a shift towards preferential trade agreements, yet India has refrained from joining large trade blocs like RCEP, despite the potential advantages.

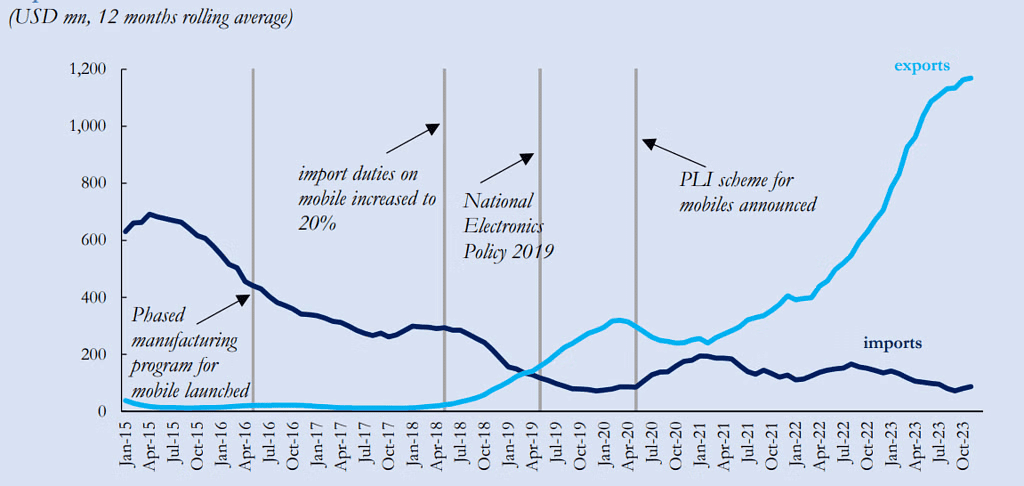

- Reevaluating India’s Tariffs and Industrial Policies: India has become a net exporter of mobile phones due to policies like the National Electronics Policy 2019 and the Production Linked Incentives (PLI) scheme 2020. However, the recent increases in import tariffs on key intermediary inputs pose a threat to the sector's competitiveness.

- Opportunities for India: The heightened perception of geopolitical risks has led companies to diversify their sourcing strategies, presenting an opportunity for India, which has a large workforce and an expanding manufacturing base.

Why is India Hesitant to Reconsider Joining RCEP?

- Flawed Assumptions in World Bank's Suggestion: The World Bank's projection of USD 60 billion in income gains by 2030 does not account for the fact that much of this would stem from increased imports, potentially leading to trade imbalances.

- Trade Deficits Among RCEP Members: Since RCEP's implementation, ASEAN's trade deficit with China has increased from USD 81.7 billion in 2020 to USD 135.6 billion in 2023. Similarly, Japan's deficit with China rose from USD 22.5 billion to USD 41.3 billion, and South Korea may experience a trade deficit with China for the first time in 2024.

- Overdependence on China-Centric Supply Chains: The growing trade deficits among RCEP countries highlight a reliance on Chinese supply chains, which poses risks, particularly in light of global disruptions such as those caused by the Covid-19 pandemic.

- Unfair Competition: By opting out of RCEP, India retains the flexibility to pursue other trade agreements that do not predominantly favor China or jeopardize its economic interests. India's trade deficit with China has reached significant levels in 2023-24.

- Alternative Trade Agreements: India has existing trade agreements with 13 of the 15 RCEP members, excluding New Zealand and China.

- "China Plus One" Strategy: India’s decision to avoid RCEP aligns with the global trend of adopting the "China Plus One" strategy, which aims to reduce dependence on China.

Way Forward

- Bilateral Free Trade Agreements (FTAs): Timely negotiations for a comprehensive FTA with new partners, such as the United Kingdom and the European Union, should be prioritized.

- Trade Agreements with Gulf Countries and Africa: India should actively pursue and expand trade agreements with Gulf Cooperation Council (GCC) nations and African countries, focusing on sectors like energy, infrastructure, and digital cooperation.

- Strengthening Existing Regional Groupings: India should advocate for regional trade integration within SAARC and aim to bolster BIMSTEC, which links South and Southeast Asia.

- Indo-Pacific Economic Framework (IPEF): India should complement its "Act East Policy" by engaging in IPEF to foster regional cooperation in trade, supply chain resilience, clean energy, and equitable economic practices.

- Self-Reliant India: The government should enhance domestic manufacturing capabilities and export potential by promoting initiatives like Make in India 2.0 and the Production Linked Incentive (PLI) Schemes.

Mains Question:

Q. Critically analyse India's decision to opt out of the Regional Comprehensive Economic Partnership (RCEP).

GS3/Economy

5 Years of Pradhan Mantri Kisan Maandhan Yojana

Why in News?

- Recently, the Pradhan Mantri Kisan Maandhan Yojana (PM-KMY), launched on 12th September 2019, has completed five successful years.

What is the Pradhan Mantri Kisan Maandhan Yojana (PM-KMY)?

- About: The PM-KMY was initiated to offer social security to small and marginal farmers, specifically those with land holdings of up to two hectares.

- Eligibility: The scheme is aimed at landholding farmers categorized as small and marginal.

Current Status:

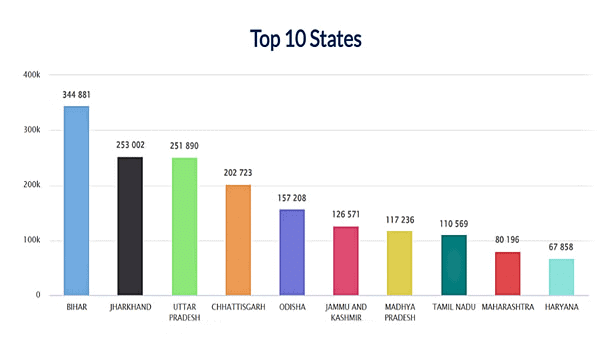

- As of August 2024, a total of 23.38 lakh farmers have enrolled in the scheme.

- Bihar and Jharkhand are leading states in terms of registrations.

- Uttar Pradesh, Chhattisgarh, and Odisha have recorded over 2.5 lakh, 2 lakh, and 1.5 lakh farmer registrations, respectively.

- This widespread participation indicates growing awareness and adoption of the scheme among small and marginal farmers, emphasizing its significance in providing financial stability to this vulnerable segment.

Key Benefits under PM-KMY:

- Monthly Contributions: Contributions vary from Rs 55 to Rs 200, depending on the age of the subscriber at the time of enrollment.

- Equal Government Contribution: The Central Government matches the subscriber's contributions to the pension fund.

- Minimum Assured Pension: Subscribers are guaranteed a minimum pension of Rs 3,000 per month upon reaching 60 years of age.

- Family Pension: In the event of the subscriber's death, the spouse is entitled to a family pension of Rs 1,500 per month, provided they are not already a beneficiary of the scheme.

- PM-KISAN Benefit: Small and Marginal Farmers (SMFs) can use their Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) benefits for voluntary contributions, with required authorization for auto-debit.

- Leaving the Pension Scheme: If a subscriber exits before reaching 60 years, they will receive their contributions along with accumulated interest. If a subscriber dies while receiving their pension, their spouse will receive a family pension equivalent to 50% of the subscriber's pension, which is Rs 1,500 per month.

- Upon the death of both the subscriber and the spouse, the remaining corpus will be returned to the fund.

- Management of Scheme: The scheme is managed by the Life Insurance Corporation of India (LIC), with registrations facilitated through Common Service Centres (CSCs) and State Governments.

What are the Key Initiatives of Government Related to Agriculture?

- Pradhan Mantri Fasal Bima Yojana (PMFBY)

- Soil Health Card Scheme

- Pradhan Mantri Krishi Sinchai Yojana (PMKSY)

- e-National Agriculture Market (e-NAM)

- Paramparagat Krishi Vikas Yojana (PKVY)

- Digital Agriculture Mission

- Unified Farmer Service Platform (UFSP)

- National e-Governance Plan in Agriculture (NeGP-A)

- Mission Organic Value Chain Development for North Eastern Region (MOVCDNER)

Conclusion

- Over five years of implementation, the PM-KMY has significantly empowered Small and Marginal Farmers (SMFs) across India.

- A notable achievement of the scheme is its contribution to the financial stability of farmers, who often face uncertain futures due to the seasonal and volatile nature of agriculture.

- By ensuring a pension for their retirement years, PM-KMY has addressed a critical gap in social security for the rural populace, highlighting its essential role in improving the quality of life for the nation’s "Annadata."

Mains Question:

Q. Discuss the impact of the Pradhan Mantri Kisan Maandhan Yojana (PM-KMY) on the financial security of Small and Marginal Farmers (SMFs) in India.

GS2/Polity

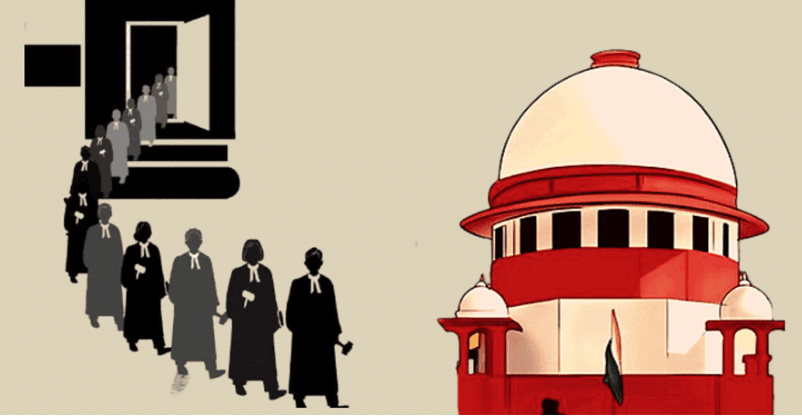

“Effective Consultation” in Judicial Appointments

Why in news?

- Recently, the Supreme Court (SC) emphasized the significance of seniority and the necessity of effective consultation in the appointment process for High Court judges. This ruling stemmed from a case concerning the Himachal Pradesh High Court (HC) collegium, where the SC identified a 'lack of effective consultation' as a valid reason for judicial review. Consequently, the court mandated a reconsideration of two judicial officers who were initially recommended for elevation, underscoring the need for procedural compliance.

What is the Background of Case and Supreme Court Ruling?

Background: In December 2022, the collegium of the Himachal Pradesh High Court put forward two District judges for elevation to High Court judges. However, the SC collegium requested a reassessment, leading to a further review. The HC collegium later recommended two different judicial officers, prompting the initially recommended judges to challenge this decision in the SC, claiming their seniority was disregarded.

Supreme Court’s Ruling:

- Maintainability: The SC examined whether it had the jurisdiction to review appointment recommendations by referencing the Second and Third Judges Cases. The court clarified that its review would focus solely on whether "effective consultation" had taken place following the SC collegium's resolution, without delving into the candidates' qualifications or suitability.

- Proper Procedure: The SC collegium had returned the recommendations to the Chief Justice of the HC, requesting a reconsideration of the names. It concluded that even though the resolution was directed to the HC Chief Justice, he could not independently make recommendations. Decisions must involve "collective consultation" among the Chief Justice and the two senior-most judges of the HC.

- This ruling reinforces the necessity for adherence to established procedures and emphasizes the importance of seniority, ensuring a fair and transparent process in the elevation of judges.

What is the Procedure for the Appointment of High Court Judges?

- Procedure: The process for appointing judges to the High Courts is governed by the collegium system, established through landmark cases such as the Second Judges Case (1993) and clarified in the Third Judges Case (1998). This system gives the judiciary the authority to recommend appointments and transfers to the Supreme Court and High Courts, while the government has a limited role.

Appointment of High Court Judges:

- The collegium comprises the Chief Justice of India (CJI) and the two senior-most judges of the Supreme Court.

- This collegium forms an opinion on candidates for High Court appointments, considering the views of the Chief Justice of the concerned High Court, senior Judges of the High Court, and Judges of the Supreme Court familiar with that High Court's affairs.

Memorandum of Procedure (MoP) for Appointment of High Court Judge:

- High Court Collegium Recommendation: The Chief Justice of the High Court, in consultation with the two senior-most judges of that court, recommends names for appointment.

- State-Level Review: Recommendations are forwarded to the Chief Minister and Governor for their views, although they do not have the authority to reject the recommendations.

- Central Government Process: The Governor sends the recommendations to the Union Minister of Law and Justice, who conducts a background check.

- Supreme Court Collegium Review: The recommendations are then submitted to the CJI, who consults the Supreme Court collegium. If approved, the names are forwarded to the President for final approval.

- The government's role is restricted to delaying appointments or raising concerns, but it cannot overturn the collegium's recommendations.

What is a Collegium System of Judicial Appointments?

About: The collegium system governs the appointment and transfer of judges in the Supreme Court and High Courts, evolving through judicial rulings rather than legislation or constitutional provisions.

Evolution of the System:

- First Judges Case (1981): Known as S.P. Gupta v. Union of India (1981), this case stated that the CJI’s recommendations on judicial appointments could be rejected for "cogent reasons," thereby giving the executive primacy over the judiciary in judicial appointments for 12 years.

- Second Judges Case (1993): In the case of Supreme Court Advocates-on-Record Association vs Union of India (1993), the SC introduced the collegium system, asserting that "consultation" implies "concurrence." This ruling made the SC collegium's recommendations binding on the central government and allowed the judiciary to appoint and transfer judges at higher levels. It clarified that the CJI's opinion should represent an institutional consensus formed with input from the two senior-most judges of the SC.

- Third Judges Case (1998): In response to a reference from the President under Article 143, the SC expanded the collegium to include five members: the CJI and four senior-most colleagues. It also specified two limited grounds for challenging a recommendation: lack of "effective consultation" and a candidate's ineligibility based on qualifications outlined in Articles 217 (High Court) and 124 (Supreme Court) of the Constitution.

Head of Collegium System: The SC collegium is led by the CJI and includes four other senior-most judges. The HC collegium is headed by its Chief Justice and includes four senior-most judges of that HC. Names recommended for appointment by a HC collegium are forwarded to the government only after receiving approval from the CJI and the SC collegium. Judges for the higher judiciary are appointed exclusively through the collegium system, with the government’s role limited to after collegium decisions.

What are the Demerits of the Collegium System?

- Lack of Transparency: The collegium system faces criticism for its lack of transparency, providing minimal public insight into the appointment process.

- Nepotism: Concerns exist over the influence of personal relationships within the judiciary, potentially leading to favoritism in appointments.

- Inefficiency: The absence of a permanent commission for judicial appointments may result in delays and inefficiencies in filling judicial vacancies.

Conclusion

The ongoing discussions regarding judicial appointments in India highlight the urgent need for reforms in the collegium system to improve transparency, accountability, and efficiency. Implementing measures such as revising the National Judicial Appointments Commission (NJAC) or adopting similar reforms could effectively address these issues and enhance the overall functioning of the judiciary.

GS3/Science and Technology

PM Surya Ghar—Muft Bijli Yojana

Why in News?

- Recently, the Ministry of New and Renewable Energy has released draft guidelines for the central financial assistance payment security mechanism under the PM Surya Ghar—Muft Bijli Yojana. In February 2024, the union cabinet approved the Rs 75,000 crore PM Surya Ghar—Muft Bijli Yojana, which aims to benefit 1 crore families.

What are the Key Highlights of the Draft Guidelines?

Models:

- The guidelines are issued under two models: the Renewable Energy Services Company (RESCO) model and the Utility Led Asset (ULA) model for the rooftop solar scheme.

Renewable Energy Services Company (RESCO) Model:

- RESCO develops and maintains rooftop solar systems on consumers' rooftops for a minimum of five years.

- Customers pay RESCO for the electricity generated and benefit from net metering.

- RESCO can arrange with distribution companies (DISCOMs) for selling generated power to the grid through power purchase agreements.

Utility Led Asset (ULA) Model:

- The state provides rooftop solar systems for a designated project period, after which ownership is transferred to the household.

Eligibility for Central Financial Assistance (CFA):

- Applicable for grid-connected rooftop solar systems on residential properties.

- Includes installations under group and virtual net metering.

- Households with pre-existing rooftop solar systems are not eligible under the RESCO and ULA models.

Payment Security Mechanism:

- A Rs 100 crore corpus will be established for financial stability and security of solar projects, managed by a national program implementation agency.

What is PM Surya Ghar-Muft Bijli Yojana?

About:

- A central scheme aimed at promoting solar rooftop systems by providing substantial financial subsidies and facilitating installation.

Objective:

- To provide free electricity to one crore households in India that opt for rooftop solar electricity units, allowing them to receive up to 300 units of free electricity each month.

Implementation Agencies:

- Executed at two levels: National Level managed by the National Programme Implementation Agency (NPIA) and State Level by State Implementation Agencies (SIAs), which include DISCOMs and state Power/Energy Departments.

- DISCOMs are responsible for facilitating measures to promote rooftop solar adoption, ensuring net meter availability, and conducting inspections and commissioning of installations.

Subsidy Structure:

- Subsidies to lower installation costs, capped at a maximum of 3 kW capacity:

- 60% subsidy for systems up to 2 kW capacity.

- 40% subsidy for systems between 2 kW and 3 kW capacity.

Additional Features of the Scheme:

- Model Solar Villages will be established in each district as demonstrations to promote rooftop solar uptake in rural areas.

- Incentives provided to Urban Local Bodies and Panchayati Raj Institutions to encourage rooftop solar installations in their areas.

What are Expected Benefits of PM Surya Ghar-Muft Bijli Yojana?

Economic Benefits:

- Households can reduce electricity bills and earn income by selling excess power to DISCOMs.

- A 3 kW system can generate over 300 units of electricity monthly, fulfilling the scheme's objectives for free electricity.

Solar Power Generation:

- The scheme aims to add 30 GW of solar capacity through residential rooftop installations, generating 1000 billion units of electricity over 25 years.

Low Carbon Emission:

- Expected to reduce emissions by 720 million tonnes, significantly aiding environmental sustainability.

Job Creation:

- Anticipated to create approximately 17 lakh direct jobs across sectors like manufacturing, logistics, supply chain management, sales, installation, and maintenance.

What are the Challenges in Implementation of the Scheme?

Household Reluctance:

- Resistance from households due to existing financial support from various states and union territories.

Restricted Space Use:

- Challenges in serving the 1-2 kW segment due to limited terrace space, uneven terrain, shading, low property ownership, and risks of solar panel theft.

Operational Strain on DISCOMs:

- Current net metering systems place a financial burden on DISCOMs, which are already facing significant losses.

- DISCOMs become unpaid storage for homeowners generating daytime energy but drawing from the grid at night.

Storage Integration:

- Absence of a mandate for storage systems with rooftop installations could lead to grid management challenges, like the "duck curve." The Duck Curve illustrates electricity demand from the grid on days with high solar energy production but low demand.

Quality Assurance Challenges:

- Customers struggle to assess the quality of installed systems, making them vulnerable to substandard services and performance issues.

Way Forward

Ensure Targeted Beneficiary Outreach:

- Collaborate with local bodies to develop strategies for reaching economically disadvantaged households consuming less than 200-300 units monthly.

Community Solar Projects:

- Promote projects that allow shared solar generation from a central plant, benefiting low-income and rural households unable to install rooftop systems.

Revise Net Metering:

- Consider Time-of-Use (TOU) pricing models, where consumers are charged based on energy consumption time, to alleviate grid strain from surplus daytime solar generation.

Mandate Storage Integration:

- Make storage integration compulsory for all rooftop solar installations to enhance grid stability and optimize surplus solar energy utilization.

Mains Question:

Q. Critically examine the challenges and opportunities associated with adopting solar energy production among small households in India.

|

164 videos|800 docs|1160 tests

|

FAQs on Weekly Current Affairs (8th to 14th September 2024) Part - 1 - General Test Preparation for CUET UG - CUET Commerce

| 1. What were the key outcomes of the Prime Minister's recent visits to Singapore and Brunei Darussalam? |  |

| 2. What challenges do Asset Reconstruction Companies (ARCs) face in India? |  |

| 3. How have India-UAE relations evolved in recent years? |  |

| 4. What factors contribute to the occurrence of uncommon cyclones in the Arabian Sea? |  |

| 5. Why is India hesitant to join the Regional Comprehensive Economic Partnership (RCEP)? |  |