Ramesh Singh Summary: Industry & Infrastructure- 1 | Indian Economy for UPSC CSE PDF Download

| Table of contents |

|

| Introduction |

|

| Review Of Industrial Policies upto 1986 |

|

| New Industrial Policy, 1991 |

|

| Disinvestment |

|

| MSME Sector |

|

| Industrial Sector |

|

| PLI Scheme |

|

Introduction

Western economies had already succeeded in industrialization before India gained independence. Upon independence, India needed to revive its economy from a severely deteriorated state.

Industry & Infrastructure

Industry & Infrastructure

- Challenges included widespread poverty, food shortages, healthcare deficiencies, etc., demanding immediate attention. Focus areas encompassed industry, infrastructure, science, technology, and higher education. These areas required substantial capital investment due to neglect during colonial rule.

- Rapid economic growth was a pressing necessity. India opted to prioritize the industrial sector as the 'prime moving force' for accelerated growth.

- The secondary sector was designated to lead the economy, a decision made by influential political figures in the 1930s. Given the government's active role in the economy, the industrial sector assumed a dominant state role.

- Government-owned enterprises (PSUs) were to be expanded significantly.

- The development of the Indian economy largely paralleled the growth of the government sector.

- The legacy of heavy state involvement persisted despite significant economic reforms in the early years.

- Industrial policies announced by governments shaped the fundamental nature and structure of the economy.

Review Of Industrial Policies upto 1986

- Industrial Policy Resolution. 1948

(i) Announced on 8 April, 1948 this was not only the first industrial policy statement of India, but also decided the model of the economic system (i.e., the mixed economy), too.

(ii) Some of the important industries were put under the Central List such as coal, power, railways, civil aviation, arms and ammunition, defence, etc.

(iii) Some other industries (usually of medium category) were put under a State List such as paper, medicines, textiles, cycles, rickshaws, two-wheelers, etc.

(iv) Rest of the industries (not covered by either the central or the state lists) were left open for private sector investment—with many of them having the provision of compulsory licencing. - Industrial Policy Resolution, 1956

(i) The government was encouraged by the impact of the industrial policy of 1948

(ii) Reservation of Industries - A clear-cut classification of industries (also known as the Reservation of Industries) were affected with three schedules

(a) Schedule A - This schedule had 17 industrial areas in which the Centre was given complete monopoly. The industries set up under this provision were known as the Central Public Sector Undertakings (CPSUs) later getting popularity as 'PSUs'

(b) Schedule B - There were 12 industrial areas put under this schedule in which the state governments were supposed to take up the initiatives with a more expansive follow up by the private sector.

(c) Schedule C - All industrial areas left out of Schedules A and B were put under this in which the private enterprises had the provisions to set up industries. Many of them had the provisions of licencing and have necessarily to fit into the framework of the social and economic policy of the state and were subject to control and regulation in terms of the Industries Development and Regulation (IDR) Act and other relevant legislations.

(iii) Provision of Licencing - One of the most important developments of independent India, the provision of compulsory licencing for industries, was cemented in this policy. All the schedule B industries and a number of schedule C industries came under this provision. This provision established the so-called 'Licence-Quota-Permit' regime (raj) in the economy.

(iv) Expansion o f the Public Sector - Expansion o f the public sector was pledged for the accelerated industrialisation and growth in the economy—glorification of government companies did start with this policy. The emphasis was on heavy industries. - Industrial Policy Resolution, 1969

(i) This was basically a licencing policy which aimed at solving the shortcomings of the licencing policy started by the Industrial Policy of 1956.

(ii) The experts and industrialists (new comers) complained that the industrial licencing policy was serving just the opposite purpose for which it was mooted.

(iii) A powerful industrial house was always able to procure fresh licences at the cost of a new budding entrepreneur.

(iv) The committees on industrial licencing policy review not only pointed out several shortcomings of the policy, but also accepted the useful role of industrial licencing. - Industrial Policy Resolution, 1973

(i) The Industrial Policy Statement of 1973 introduced some new thinking into the economy with major ones being as follows:

(a) A new classificatory term i.e., core industries was created. The industries which were of fundamental importance for the development of industries were put in this category such as iron and steel, cement, coal, crude oil, oil refining and electricity. In the future, these industries came to be known as basic industries, infrastructure industries in the country.

(b) Out of the six core industries defined by the policy, the private sector may apply for licences for the industries which were not a part of schedule A of the Industrial Policy, 1956. The private firms eligible to apply for such licences were supposed to have their total assets at ₹ 20 crore or more.

(c) Some industries were put under the reserved list in which only the small or medium industries could be set up.

(d) The concept of 'joint sector' was developed which allowed partnership among the Centre, state and the private sector while setting up some industries. The governments had the discretionary power to exit such ventures in future. Here, the government wanted to promote the private sector with state support.

(e) The Government of India had been facing the foreign exchange crunch during that time. To regulate foreign exchange the Foreign Exchange Regulation Act (FERA) was passed in 1973. Experts have called it a 'draconian' Act which hampered the growth and modernisation of Indian industries.

(f) A limited permission to foreign investment was given, with the multinational corporations (MNCs) being allowed to set up subsidiaries in the country. - Industrial Policy Resolution, 1977

(i) The Industrial Policy Statement of 1977 was chalked out by a different political set up from the past with a different political fervour— the dominant voice in the government was having an antilndira stance with an inclination towards the Gandhian-socialistic views towards the economy.

(ii) We see such elements in this policy statement:

(a) Foreign investment in the unnecessary areas were prohibited (opposite to the IPS of 1973 which promoted foreign investment via technology transfer in the areas of lack of capital or technology).

(b) Emphasis on village industries with a redefinition of the small and cottage industries.

(c) Decentralised industrialisation was given attention with the objective of linking the masses to the process of industrialisation.

(d) Democratic decentralisation got emphasised and the khadi and village industries were restructured. - Industrial Policy Resolution, 1980

(i) The year 1980 saw the return of the same political party at the Centre. The new government revised the Industrial Policy of 1977 with few exceptions in the Industrial Policy Resolution, 1980. The major initiatives of the policy were as given below:

(a) Foreign investment via the technology transfer route was allowed again (similar to the provisions of the IPS, 1973).

(b) The 'MRTP Limit' was revised upward to ₹50 crore to promote setting of bigger companies.

(c) The DICs were continued with.

(d) Industrial licencing was simplified.

(e) Overall liberal attitude followed towards the expansion of private industries - Industrial Policy Resolution, 1985 & 86

(i) The industrial policy resolutions announced by the governments in 1985 and 1986 were very much similar in nature and the latter tried to promote the initiative of the former. The main highlights of the policies are:

(a) Foreign investment was further simplified with more industrial areas being open for their entries. The dominant method of foreign investment remained as in the past, i.e., technology transfer, but now the equity holding of the MNCs in the Indian subsidiaries could be upto 49 per cent with the Indian partner holding the rest of the 51 per cent shares.

(b) The 'MRTP Limit' was revised upward to ₹100 crore— promoting the idea of bigger companies.

(c) The provision of industrial licencing was simplified. Compulsory licencing now remained for 64 industries only

(d) High level attention on the sunrise industries such as telecommunication, computerisation and electronics.

(e) Modernisation and the profitability aspects of public sector undertakings were emphasised.

(f) Industries based on imported raw materials got a boost.

(g) Under the overall regime of FERA, some relaxations concerning the use of foreign exchange was permitted so that essential technology could be assimilated into Indian industries and international standard could be achieved.

(h) The agriculture sector was attended with a new scientific approach with many technology missions being launched by the government.

New Industrial Policy, 1991

- It were the industrial policies of past which had shaped the nature and structure of the Indian economy.

- The need of the hour was to change the nature and structure of the economy by early 1990s.

- The Government of India decided to change the very nature of the industrial policy which will automatically lead to change in the nature and scope of the economy. And here came the New Industrial Policy of 1991.

- With this policy the government kickstarted the very process of reform in the economy, that is why the policy is taken more as a process than a policy.

- India's near miss with a serious balance of payments crisis was the proximate cause that started India's market liberalisation measures in 1991 followed by a gradualist approach.

- The major highlights of the policy are as follows:

(i) De-reservation of the Industries

(ii) De-licencing of the Industries

(iii) Abolition of the MRTP Limit

(iv) Promotion to Foreign Investment

(v) FERA Replaced by FEMA

(vi) Compulsion of Phased Production Abolished

(vii) Compulsion to Convert Loans into Shares Abolished

Disinvestment

- Government-owned firms, namely the public sector undertakings (PSUs) and public sector enterprises (PSEs), played a foundational role in India's development process.

- Realising the changed situations, the Government decided to 'redefine' (disinvestment and privatisation) the role for these firms once reform process began in 1991.

- By that time, the Government had invested a total of ₹2.4 lakh crores in 244 firms.

- The process of setting up new Government firms did not stop and by 2019, Government is invested with ₹16.41 lakh crores in a total number of 348 such firms.

- Disinvestment is the process of 'selling ownership' in a company. Technically, the term may be used in case of any company (i.e., privately-owned company), but in practice, it is used only in case of a government-owned company.

- The new government (UPA) dismantled the Ministry of Disinvestment and today only the Department of Disinvestment is taking care of the matter, working under the Ministry of Finance.

Types of Disinvestment

(i) Token Disinvestment : Disinvestment started in India with a high political caution— in a symbolic way known as the 'token' disinvestment (presently being called as 'minority stake sale'). The general policy was to sell the shares of the PSUs maximum upto the 49 per cent.

(ii) Strategic Disinvestment : In order to make disinvestment a process by which efficiency of the PSUs could be enhanced and the government could de-burden itself of the activities in which the private sector has developed better efficiency (so that the government could concentrate on the areas which have no attraction for the private sector such as social sector support for the poor masses), the government initiated the process of strategic disinvestment.

Current Disinvestment Policy

- India's disinvestment policy has evolved over time since it commenced in 1991. It has two major features— 'ideology' behind the policy and the 'policy' itself.

- The ideology behind the policy is

(i) Public ownership of PSUs to be promoted as they are wealth of nation.

(ii) Government to hold minimum 51 per cent shares in case of 'minority stake sale'.

(iii) Upto 50 per cent or more shares might be sold off under 'strategic disinvestment'. - The current policy of disinvestment followed by the government is as given below:

(i) Minority stake sale (the policy of November 2009 continues): Listed PSUs to be taken first to comply to minimum 25 % norm.

(ii) New PSUs to be listed which have earned net profit in three preceding consecutive years.

(iii) 'Follow-on' public offers on case by case basis once capital investment needed.

(iv) DIPAM (Department of Investment and Public Asset Management) to identify PSUs and suggest disinvestment in consultation with respective ministries. - Strategic Disinvestment i.e., selling 50 per cent or more shares of the PSUs (announced in February 2016):

(i) To be done through consultation among Ministries/Departments and NITI Aayog.

(ii) NITI Aayog to identify PSUs and advice on its different aspects.

(iii) CGD (Core Group of Secretaries on Disinvestment) to consider the recommendations of NITI Aayog to facilitate a decision by the CCEA (Cabinet Committee on Economic Affairs) and to supervise/monitor the implementation process

MSME Sector

- As per the SMSE Act, 2006 the MSME are classified in two classes— manufacturing and service enterprises— and they are defined in terms of investm ent in plant & machinery.

- The Micro, Small and Medium Enterprises (MSMEs) play a very vital role in the economy— 3.6 crore such units employ 8.05 crore people and contribute 37.5 per cent to the country's GDP.

- The sector has huge potential for helping address structural problems like, unemployment, regional imbalances, unequal distribution of national income and wealth.

- Due to comparatively low capital costs and their forward-back ward linkages with other sectors, they are headed to play a crucial role in the success of the Make in India initiative.

(i) UAM (Udyog Aadhar Memorandum) : The UAM scheme, notified in September 2015, to promote ease of doing business. Under it, entrepreneurs just need to file an online entrepreneurs' memorandum to get a unique Udyog Aadhaar Number (UAN)— a significant improvement over the earlier complex and cumbersome procedure.

(ii) Employment Exchange for Industries : To facilitate match making between prospective job seekers and employers an employment exchange for industries was set up in June 2015 (in line with Digital India).

(iii) Frame work for Revival and Rehabilitation of MSMEs : Under this (May 2015). banks need to constitute a Committee for Distressed MSMEs to prepare a Corrective Action Plan (CAP) for them.

(iv) ASPIRE (Promoting Innovation and Rural Entrepreneurs) : Launched in March 2015 with the objective of setting up a network of technology and incubation centres to accelerate entrepreneurship and promote start-ups for innovation and entrepreneurship in rural and agriculture-based industry.

Industrial Sector

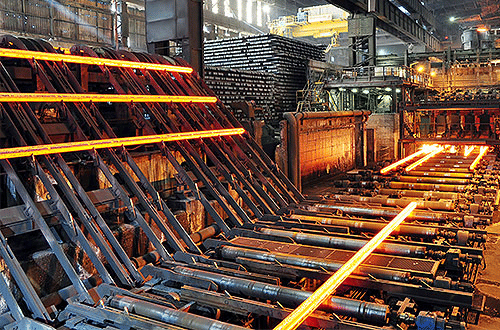

(i) Steel Industry

- Due to global and domestic factors Indian steel industry has been faced with certain problems in recent times.

- India is the 2nd biggest producer of steel in the world after China though there is big gap between their contribution in the global steel production (India's share at 6 per cent in comparison to China's share of 53.8 per cent).

- This has made major global steel producers to 'push ' steel products into Indian market, thus raising two major concerns:

(i) A surge in steel imports,

(ii) Interest of domestic steel industry hit hard.

(ii) Aluminium Industry

- Though India has been a major player in the global aluminium industry, in past few years it has been facing certain challenges due to global reasons.

- India is second largest producer (after China) and third largest consumer (after China) of aluminium in the world. Today, India produces around 4.5 MT (China-22 MT) and consumes 3.8 MT (China-23 MT, USA-5.5 MT).

- Global aluminium prices, like other metal prices, a recyclical and it is difficult to forecast when they will begin to move upwards. But the trend is expected to change when world industrial growth improves.

- India is avoiding custom duty to reduce import of aluminium because it may erode the competitiveness of downstream sectors like power, transport and construction.

(iii) Apparel and Footwear Sectors

- Since the industrial revolution, no country has become a major economy with out becoming an industrial power.

Apparel & Footwear Sector

Apparel & Footwear Sector - In case of India, industrial expansion had been not only stunted but largely capital- intensive .

- Sitting on the cusp of demographic dividend, India needs to generate jobs that are formal, productive and compatible to investment.

- Besides, the economy has to search for alternatives for promoting growth, exports and broader social transformation. In this case two sectors — apparel and leather & footwear.

PLI Scheme

- The government introduced a Production-Linked Incentive (PLI) scheme in March 2020 to boost domestic manufacturing and reduce import bills.

- Under this scheme, companies will receive incentives on their increased sales over a 5-year period.

- As of April 2023, 14 sectors have been included in the scheme with a total allocation of funds by the government.

- The sectors covered include Mobile Manufacturing, Specified Electronic Components, Critical Key Starting materials, Drug Intermediaries, Active Pharmaceutical Ingredients, Medical Devices, Advance Chemistry Cell Battery, Electronic Technology Products, Automobiles, Auto Components, Pharmaceutical Drugs, Telecom and Networking Products, Textile Products, Food Products, High Efficiency Solar PV Modules, White Goods (ACs and LED), Specialty Steel, Drone, and Drone Components.

- Incentives:

- Companies will receive incentives as a percentage of their production turnover and investment expenditures excluding land and building investments.

- The scheme aims to make Indian manufacturers globally competitive, attract investments, ensure efficiencies, create economies of scale, and integrate India into the global value chain.

- Impact:

- The PLI Scheme is expected to boost India's annual manufacturing capital expenditure by 15 to 20 percent from fiscal 2022-23, according to the Economic Survey 2022-23.

- It will benefit the MSME ecosystem in the country and lead to the development of a new supplier base in various sectors.

FDI POLICY MEASURES

- Foreign direct investment (FDI) is an important driver of economic growth which helps in — sustaining high growth rate, increasing productivity, a major source of non-debt financial resources, and employment generation.

- A favourable policy regime and sound business environment facilitate FDI flows. The government has taken various reforms to liberalizing and simplifying the FDI policy to provide ease of doing business climate in the country that will also lead to larger FDI inflows.

- A number of sectors have been liberalized, including defence, construction, broad casting, civil aviation, plantation, trading, private sector banking, satellite establishment and operation and credit information companies.

|

139 videos|431 docs|128 tests

|

FAQs on Ramesh Singh Summary: Industry & Infrastructure- 1 - Indian Economy for UPSC CSE

| 1. What is the significance of the New Industrial Policy of 1991? |  |

| 2. How does disinvestment impact the industrial sector in India? |  |

| 3. What are the key features of the PLI Scheme in India? |  |

| 4. How has the MSME sector contributed to the industrial growth in India? |  |

| 5. What were the key industrial policies implemented in India before 1986? |  |