Overview: Simple & Compound Interest | Quantitative Techniques for CLAT PDF Download

Simple Interest

Consider you have deposited Rs 100 for 2 years on 10% Simple interest per annum, then we have

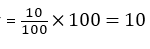

Simple interest for 1st year

Thus after one year amount will become = 100 + 10 = Rs 110

Simple interest for 2nd year

Here note that in 2nd year interest is not calculated on amount (Rs 110) but Principal i.e, Rs 100.

Thus Simple interest after two years =Rs 10 + Rs 10= Rs 20.

It can also be calculated be using formula –

Simple interest

- Here P = Principal / amount invested/amount borrowed.

- R = Rate of interest per annum.

- T =time in years.

- & the final Amount = Principal + Simple interest

Thus for above example Simple interest

Also the final amount will be Rs 20 + Rs 100 = Rs 120.

Note : If rate of interest is not given in per annum then change the time according to the period over which interest is given.

For example : If interest is given as 10 % per quarter for 2years , then the time will have to be changed into quarters.

Time = 2 years = 2× 4 = 8 quarters

Thus Simple interest on Rs 100

Basics of Compound Interest

Again Consider you have deposited Rs. 100 for 2 years on 10% Compound interest per annum, then we have.

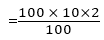

Compound interest after 1st year

Thus after one year amount will become = 100+ 10 = Rs 110

Compound interest for 2nd year

Here note that in 2nd year interest is calculated on amount ( Rs 110) and not on Principal i.e, Rs 100.

Thus Compound interest after two years = Rs 10+ Rs 11= Rs 21

Final Amount = 100+ 21 =Rs 121

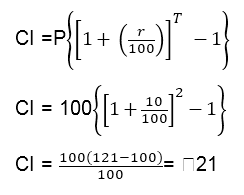

We can also find this using direct formula as given below-

For Amount we can use –

Note

When compound interest Compounded half yearly, then R% become and time T becomes 2T. For quarterly compounding we can change the rate and time accordingly

- Difference between SI and CI when Principal, Rate and time period is same

- For two years,

- For three years,

- For 1st year simple interest and Compound Interest will be same.

- If there are distinct ‘rates of interest’ for different years like R1 , R2 & R3 for 1st ,2nd and 3rd year respectively then we have

Let’s Take Some Previous Years Questions

Q1: A sum of 1600 gives a simple interest of 252 in 2 years and 3 months. Calculate the rate of interest per annum.

Sol: We know

Q2: A sum of money deposited at simple interest amounts to 880 in 2 years and to 920 in 3 years. Find the sum.

Sol: Amount after two years = Rs 880

Amount after three years = Rs 920

Thus interest obtained per year = 920- 880 = Rs 40

For two years interest = 40×2 = Rs 80

Therefore Principal = 880-80 = Rs 800

Q3: Find the rate of simple interest for which a sum of money becomes 5 times of itself in 8 years.

Sol: Let the principal be P

Since Sum becomes 5 times of itself.

Q4: In how many years will 2,000 amounts to 2420 at 10% per annum if Compounded annually?

Sol: T= 2 years

Q5: A sum becomes 4500 after two years and 6750 after four years at compound interest.Find the sum.

Sol: Let the principal be x

We have

Dividing B by A , we get

Comparing Equation A with C, we get

Sum = Rs 3000

|

51 videos|172 docs|73 tests

|

FAQs on Overview: Simple & Compound Interest - Quantitative Techniques for CLAT

| 1. What is simple interest? |  |

| 2. How is simple interest different from compound interest? |  |

| 3. How can I calculate the simple interest for a given loan or investment? |  |

| 4. Is simple interest commonly used in financial institutions? |  |

| 5. Can you provide an example of simple interest calculation? |  |