UPSC Daily Current Affairs - 12th January 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS-I

Demolition of Delhi’s Sunehri Masjid

Subject: Art and Culture

Why in News?

The Indian History Congress (IHC), a prominent body of historians, has recently taken a stand against the proposed demolition of the Sunehri Masjid, a late medieval mosque in New Delhi.

- Since 1984, the IHC has consistently advocated for the protection of monuments, emphasizing that all structures over 200 years old should be strictly preserved under the Protection of Monuments Act.

About Sunehri Masjid

| Details | |

| Location | Chandni Chowk, Old Delhi, India |

| Built By | Mughal noble Roshan-ud-Daula |

| Construction Period | 1721-1722 |

| Legend | In 1739, Persian invader Nadir Shah, ordered the invasion and plunder of Delhi city while standing in this mosque. |

| Dedication | Dedicated to Shah Bhik (spiritual mentor of Roshan-ud-Daula) |

| Architectural Style | Mughal Architecture |

| Architectural Features | Three golden-domed turrets, slender minarets, stucco decorations |

| Educational Role | Hosted Madrasa Aminia in 1897, later relocated to Kashmiri Gate in 1917 |

Source: The Hindu

GS-II

Unravelling the shift in India-Maldives Relations

Subject: International Relations

Why in News?

The Maldives, a nation known for its oceanic beauty, has recently been making headlines for political reasons.

- The core of these developments is the strained diplomatic relations with India, following undiplomatic remarks by members of Muizzu’s cabinet against Indian PM and Indians in general.

- This situation has led to significant changes in the Maldives’ foreign policy and its relationship with regional powers, particularly India and China.

Recent Diplomatic Fallout

- Incident Trigger: The diplomatic strain was triggered by disparaging remarks from Maldivian ministers against PM Narendra Modi and Indians.

- Maldives’ Response: The Maldivian government responded by dismissing the three ministers involved.

- Reaction in India: There has been a growing call in India to boycott the Maldives as a tourist destination and support Lakshadweep tourism instead.

Key Questions in the Maldives-India Relationship

[A] Decadal Ties

- The diplomatic and political relationship, built over six decades, is at risk.

- India’s historical ties with the Maldives date back to 1965, post-British control, with deep relationships across various sectors.

[B] Why does India need the Maldives?

- Strategic Location: The Maldives’ proximity to India’s west coast and its position in key sea-lanes makes it strategically important for maritime security.

- Defence Training: India has been a significant contributor to the Maldives’ defence training, with efforts to enhance maritime strength.

- China’s Influence: The growing Chinese presence in the Maldives, especially under President Xi Jinping’s Belt and Road Initiative, is a concern for India.

[C] Why does the Maldives need India?

- Daily Essentials: India is a crucial supplier of food, medicine, and construction materials to the Maldives.

- Education: India is a primary education provider for Maldivian students.

- Economic Dependence: India is among the Maldives’ top trading partners, with significant exports to the island nation.

- Disaster Assistance: India has historically been the first responder to crises in the Maldives, including the 2004 tsunami and the 2014 water crisis.

Political Changes in the Maldives

- Muizzu’s Rise to Power: Mohamed Muizzu, a former minister in Yameen’s government, won the presidential election with a campaign focusing on reducing Indian influence.

- Foreign Policy Shifts: President Muizzu’s first official visit was to Turkiye, breaking the tradition of visiting India first, and he has since visited China, signaling a pivot in foreign relations.

- Military Presence and Agreements: The Muizzu administration has requested the withdrawal of Indian military personnel and revoked a key agreement with India for conducting hydrographic surveys in Maldivian waters.

Recent Developments and Tensions

- Military Presence: Muizzu’s insistence on the withdrawal of Indian military personnel has been a point of contention.

- Defence Ties: The absence of a Maldivian representative at the Colombo Security Conclave and the revocation of a key water survey pact with India signal a cooling of defence relations.

- China’s Role: The Muizzu administration’s decisions appear to align with a closer relationship with Beijing, potentially aiding China’s marine surveys in the region.

Conclusion

- The recent political developments in the Maldives under President Mohamed Muizzu mark a significant shift in the island nation’s foreign policy, particularly in its relations with India.

- These changes, influenced by domestic politics and the growing influence of China, have implications for regional security and diplomacy.

- As the situation evolves, it remains to be seen how these shifts will impact the Maldives’ international relations and its role in the strategic Indian Ocean region.

Source: The Hindu

Swachh Survekshan Awards 2023: Surat, Indore are the cleanest cities

Subject: Polity and Governance

Why in News?

Surat in Gujarat and Indore in Madhya Pradesh have been jointly recognized as the cleanest cities in India at the Union Urban Affairs Ministry’s annual clean city awards 2023.

About Swachh Survekshan

- Swachh Survekshan, initiated by the Ministry of Housing and Urban Affairs (MoHUA) in 2016, serves as a competitive framework to promote urban sanitation improvements and citizen participation.

- Over time, Swachh Survekshan has grown to become the world’s largest urban sanitation survey.

- In the 2023 edition (SS 2023), emphasis is placed on source segregation of waste, increasing cities’ waste processing capacity, and reducing waste sent to dumpsites.

- SS 2023 introduces new indicators with added importance, focusing on phased plastic reduction, enhanced plastic waste management, “waste to wonder” parks, and zero-waste events.

- The ranking of wards within cities is encouraged through SS 2023.

- The survey assesses cities on dedicated indicators addressing issues such as ‘Open Urination’ (Yellow Spots) and ‘Open Spitting’ (Red Spots).

Highlights of the Clean City Awards 2023

- Top Rankings: Surat and Indore shared the top spot, with Navi Mumbai securing the third position in the cleanest cities category.

- Indore’s Continued Success: Remarkably, Indore has maintained its status as the cleanest city for the seventh consecutive year.

- Other Top Cities: The list of the top 10 cleanest cities also includes Greater Visakhapatnam, Bhopal, Vijayawada, New Delhi, Tirupati, Greater Hyderabad, and Pune.

State Rankings and Special Categories

- Maharashtra Leads: In the state rankings, Maharashtra emerged as the top performer, followed by Madhya Pradesh and Chhattisgarh.

- Smaller Cities and Cantonnement Boards: In cities with a population of less than one lakh, Sasvad and Lonavala in Maharashtra, and Patan in Chhattisgarh, were top performers. Mhow Cantonment Board in Madhya Pradesh was recognized as the cleanest cantonment board.

- Cleanest Ganga Towns: Varanasi and Prayagraj in Uttar Pradesh won awards for being the cleanest towns along the Ganga river.

Awards and Themes

- Swachh Survekshan Awards: Initiated by the Ministry of Housing and Urban Affairs (MoHUA) in 2016, these awards have become the world’s largest urban sanitation survey.

- Themes: The 2023 survey focused on the theme “Waste to Wealth,” while the upcoming 2024 survey will emphasize “Reduce, Reuse, and Recycle.”

Indore’s Journey to the Top

- Leap in Rankings: Indore’s remarkable journey from ranking 25th in 2016 to consistently holding the top position is noteworthy.

- Key Factors for Success: The city’s success is attributed to a sustainable system of garbage collection, processing, and disposal, along with citizen participation and innovative sanitation measures.

Indore’s Sanitation Initiatives

- Waste Segregation and Disposal: Indore revamped its sanitation and waste collection system, involving NGOs and changing routes for garbage disposal vehicles.

- Legacy Waste Management: The city efficiently cleared and treated large amounts of legacy waste at the Devguradiya ground.

- Infrastructure Development: Funds were allocated for constructing transfer stations and treatment plants for waste management.

- Community Engagement: Efforts were made to build sanitation habits among citizens, including the distribution of free dustbins and imposing fines for littering.

Source: The Hindu

Zero Defect Zero Effect (ZED) Scheme

Subject: Government Schemes

Why in News?

Zero Defect Zero Effect (ZED) scheme by the MSME Ministry has achieved the 1 lakh certification milestone, the ministry said recently.

About the Zero Defect Zero Effect (ZED):

- Launched in October 2016 and revamped in April 2022, the ZED scheme offers certification for environmentally conscious manufacturing under three certification levels (gold, silver, and bronze) classified according to 20 performance-based parameters such as quality management, timely delivery, process control, waste management, etc.

- The major objectives of the ZED Scheme are:

- To create proper awareness in MSMEs about ZED manufacturing and motivate them for the assessment of their enterprise for a ZED rating.

- To drive manufacturing with the adoption of Zero-Defect production processes without impacting the environment (Zero Effect).

- To encourage MSMEs to constantly upgrade their quality standards in products and processes.

- To support the “Make in India” campaign.

- Currently, the scheme is applicable for manufacturing MSMEs only.

- MSME Sustainable (ZED) Certification can be attained in three levels after registering and taking the ZED Pledge:

- Certification Level 1: BRONZE

- Certification Level 2: SILVER

- Certification Level 3: GOLD

Source: Financial Express

GS-III

|

Download the notes

UPSC Daily Current Affairs - 12th January 2024

|

Download as PDF |

Direct Tax Collections cross 80% of 2023-24 target

Subject: Economy

Why in News?

India’s net direct tax collections have achieved a significant milestone, reaching ₹14.7 lakh crore by January 10, which is over four-fifths of the fiscal year’s target.

- This performance indicates a robust growth of 19.4% compared to the same period in the previous fiscal year, showcasing the country’s strong economic recovery and efficient tax administration.

Overview of Tax Collection Performance

- Total Collections: The net direct tax collections stood at ₹14.7 lakh crore, marking an achievement of 80.61% of the budget estimates for the fiscal year 2023-24.

- Growth Rate: This represents a 19.41% increase over the net collections for the corresponding period of the last year.

- Gross Collection Growth: The gross direct tax collections rose by 16.77% to ₹17.18 lakh crore, with Personal Income Tax (PIT) inflows increasing by 26.11% and Corporate Income Tax (CIT) by 8.32%.

Detailed Analysis of Tax Collection

- Post-Refund Growth: After adjusting for refunds, the net growth in CIT collections was 12.37%, and PIT collections saw a rise of 27.26%.

- Increase in PIT and STT Receipts: Net of refunds, PIT and Securities Transaction Tax receipts were up by 27.22%.

What are Direct Taxes?

- A type of tax where the impact and the incidence fall under the same category can be defined as a Direct Tax.

- The tax is paid directly by the organization or an individual to the entity that has imposed the payment.

- The tax must be paid directly to the government and cannot be paid to anyone else.

Types of Direct Taxes

The various types of direct tax that are imposed in India are mentioned below:

(1) Income Tax:

- Depending on an individual’s age and earnings, income tax must be paid.

- Various tax slabs are determined by the Government of India which determines the amount of Income Tax that must be paid.

- The taxpayer must file Income Tax Returns (ITR) on a yearly basis.

- Individuals may receive a refund or might have to pay a tax depending on their ITR. Penalties are levied in case individuals do not file ITR.

(2) Wealth Tax:

- The tax must be paid on a yearly basis and depends on the ownership of properties and the market value of the property.

- In case an individual owns a property, wealth tax must be paid and does not depend on whether the property generates an income or not.

- Corporate taxpayers, Hindu Undivided Families (HUFs), and individuals must pay wealth tax depending on their residential status.

- Payment of wealth tax is exempt for assets like gold deposit bonds, stock holdings, house property, commercial property that have been rented for more than 300 days, and if the house property is owned for business and professional use.

(3) Estate Tax:

- It is also called Inheritance Tax and is paid based on the value of the estate or the money that an individual has left after his/her death.

(4) Corporate Tax:

- Domestic companies, apart from shareholders, will have to pay corporate tax.

- Foreign corporations who make an income in India will also have to pay corporate tax.

- Income earned via selling assets, technical service fees, dividends, royalties, or interest that is based in India is taxable.

- The below-mentioned taxes are also included under Corporate Tax:

- Securities Transaction Tax (STT): The tax must be paid for any income that is earned via taxable security transactions.

- Dividend Distribution Tax (DDT): In case any domestic companies declare, distribute, or are paid any amounts as dividends by shareholders, DDT is levied on them. However, DDT is not levied on foreign companies.

- Fringe Benefits Tax: For companies that provide fringe benefits for maids, drivers, etc., Fringe Benefits Tax is levied on them.

- Minimum Alternate Tax (MAT): For zero-tax companies that have accounts prepared according to the Companies Act, MAT is levied on them.

(5) Capital Gains Tax:

- It is a form of direct tax that is paid due to the income that is earned from the sale of assets or investments. Investments in farms, bonds, shares, businesses, art, and homes come under capital assets.

- Based on its holding period, tax can be classified into long-term and short-term.

- Any assets, apart from securities, that are sold within 36 months from the time they were acquired come under short-term gains.

- Long-term assets are levied if any income is generated from the sale of properties that have been held for a duration of more than 36 months.

Advantages of Direct Taxes

The main advantages of Direct Taxes in India are mentioned below:

- Economic and Social balance: The Government of India has launched well-balanced tax slabs depending on an individual’s earnings and age. The tax slabs are also determined based on the economic situation of the country. Exemptions are also put in place so that all income inequalities are balanced out.

- Productivity: As there is a growth in the number of people who work and community, the returns from direct taxes also increase. Therefore, direct taxes are considered to be very productive.

- Inflation is curbed: Tax is increased by the government during inflation. The increase in taxes reduces the necessity for goods and services, which leads to inflation to compress.

- Certainty: Due to the presence of direct taxes, there is a sense of certainty from the government and the taxpayer. The amount that must be paid and the amount that must be collected is known by the taxpayer and the government, respectively.

- Distribution of wealth is equal: Higher taxes are charged by the government to the individuals or organizations that can afford them. This extra money is used to help the poor and lower societies in India.

What are the disadvantages of direct taxes?

- Easily evadable: Not all are willing to pay their taxes to the government. Some are willing to submit a false return of income to evade tax. These individuals can easily conceal their incomes, with no accountability to the law of the land.

- Arbitrary: Taxes, if progressive, are fixed arbitrarily by the Finance Minister. If proportional, it creates a heavy burden on the poor.

- Disincentive: If there are high taxes, it does not allow an individual to save or invest, leading to the economic suffering of the country. It does not allow businesses/industries to grow, inflicting damage to them.

Source: The Hindu

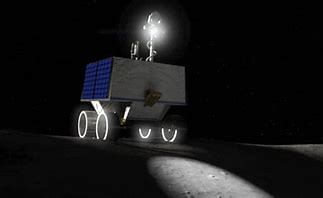

VIPER Rover

Subject: Science and Technology

Why in News?

NASA has invited people to send their names to the surface of the Moon aboard the agency’s first robotic lunar rover VIPER – short for Volatiles Investigating Polar Exploration Rover.

About the VIPER Rover:

- The Volatiles Investigating Polar Exploration Rover, or VIPER will get a close-up view of the location and concentration of ice and other resources at the Moon's South Pole.

- It is NASA's first mobile robotic mission to the Moon.

- It will directly analyse ice on the surface and subsurface of the Moon at varying depths and temperature conditions within four main soil environments.

- The data VIPER transmits back to Earth will be used to create resource maps, helping scientists determine the location and concentration of ice on the Moon and the forms it’s in, such as ice crystals or molecules chemically bound to other materials.

- It navigates across the rugged terrain of the lunar South Pole and gathers valuable data that will help us better understand the history of the Moon and the environment where NASA is planning to send Artemis astronauts.

- Mission duration:100 Earth days, covering 3 cycles of lunar day and night.

- It will land at the South Pole of the Moon in late 2024.

Source: Indian Express

Phytocannabinoids

Subject: Environment and Ecology

Why in News?

Scientists at CSIR-Indian Institute of Integrative Medicine (IIIM), Jammu, have found that tetrahydrocannabidiol (THCBD) which is phytocannabinoids, a class of compounds found in the cannabis plant, possess some hitherto unexplored antibiotic properties.

About Phytocannabinoids:

- Cannabinoids are a class of compounds found in the cannabis plant.

- The prefix ‘phyto’ in phytocannabinoid means it comes from a plant.

- Cannabinoids bind to receptors in the bodies of animals to produce a variety of neurological effects.

- The researchers extracted cannabidiol from a cannabis plant and made it react with hydrogen, using palladium as a catalyst.

- This process yielded a mixture of molecules with the same composition and order of atoms but different structures. One of them was THCBD.

Key facts about Antimicrobial resistance (AMR)

- Antimicrobial resistance (AMR) is one of the top global public health and development threats. It is estimated that bacterial AMR was directly responsible for 1.27 million global deaths in 2019 and contributed to 4.95 million deaths.

- The misuse and overuse of antimicrobials in humans, animals and plants are the main drivers in the development of drug-resistant pathogens.

- AMR affects countries in all regions and at all income levels. Its drivers and consequences are exacerbated by poverty and inequality, and low- and middle-income countries are most affected.

- AMR puts many of the gains of modern medicine at risk. It makes infections harder to treat and makes other medical procedures and treatments – such as surgery, caesarean sections and cancer chemotherapy – much riskier.

Source: The Hindu

Baleen whale

Subject: Environment and Ecology

Why in News?

Roughly 19 million years old fossil jaw bone of a baleen whale estimated to be around nine metres in length found recently.

About Baleen whales:

- These are any cetacean possessing unique epidermal modifications of the mouth called baleen, which is used to filter food from water.

- Most mammals have teeth in their mouth. Baleen whales are a strange exception.

- Baleen is a large rack of fine, hair-like keratin used to filter out small krill from the water.

- This structure enabled baleen whales to feed efficiently on enormous shoals of tiny zooplankton in productive parts of the ocean, which facilitated the evolution of larger and larger body sizes.

- Baleen whales are generally larger than toothed whales except for the sperm whale which is very big and has teeth.

- Many baleen whales migrate annually, travelling long distances between cold water feeding areas and warm water breeding areas.

- The large whale fossils from Australasia and South America seem to suggest that for most of the evolutionary history of baleen whales, whenever a large baleen whale shows up in the fossil record, it is in the Southern Hemisphere.

- Baleen whales are ecosystem engineers, their huge bodies consuming tremendous amounts of energy.

- Upon death, these whales provide an abundance of nutrients to deep-sea ecosystems.

- About Baleen whales:

- These are any cetacean possessing unique epidermal modifications of the mouth called baleen, which is used to filter food from water.

- Most mammals have teeth in their mouth. Baleen whales are a strange exception.

- Baleen is a large rack of fine, hair-like keratin used to filter out small krill from the water.

- This structure enabled baleen whales to feed efficiently on enormous shoals of tiny zooplankton in productive parts of the ocean, which facilitated the evolution of larger and larger body sizes.

- Baleen whales are generally larger than toothed whales except for the sperm whale which is very big and has teeth.

- Many baleen whales migrate annually, travelling long distances between cold water feeding areas and warm water breeding areas.

- The large whale fossils from Australasia and South America seem to suggest that for most of the evolutionary history of baleen whales, whenever a large baleen whale shows up in the fossil record, it is in the Southern Hemisphere.

- Baleen whales are ecosystem engineers, their huge bodies consuming tremendous amounts of energy.

- Upon death, these whales provide an abundance of nutrients to deep-sea ecosystems.

Source: The Hindu

|

39 videos|4560 docs|976 tests

|

FAQs on UPSC Daily Current Affairs - 12th January 2024 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly

| 1. What is the significance of the demolition of Delhi's Sunehri Masjid? |  |

| 2. What factors have contributed to the shift in India-Maldives relations? |  |

| 3. How are the Swachh Survekshan Awards 2023 determined? |  |

| 4. What is the Zero Defect Zero Effect (ZED) Scheme? |  |

| 5. What is the VIPER Rover and its significance? |  |