Market Structure: Duopoly | Economics Optional for UPSC PDF Download

| Table of contents |

|

| Cournot’s Duopoly Model |

|

| Chembelrin’s Duopoly Model |

|

| Bertrand’s Duopoly Model |

|

| Edgeworth’s Duopoly Model |

|

Cournot’s Duopoly Model

Augustin Cournot was a French economist. He was the first one to develop a formal duopoly model in the year 1838.

Assumptions of the Cournot Model

- Two firms, each owing artesian mineral water well.

- Both operate the wells at zero marginal cost.

- They face a demand curve with a constant negative slope.

- The competitor will not react to his decision of changing his price. This is also known as the behavioral assumption.

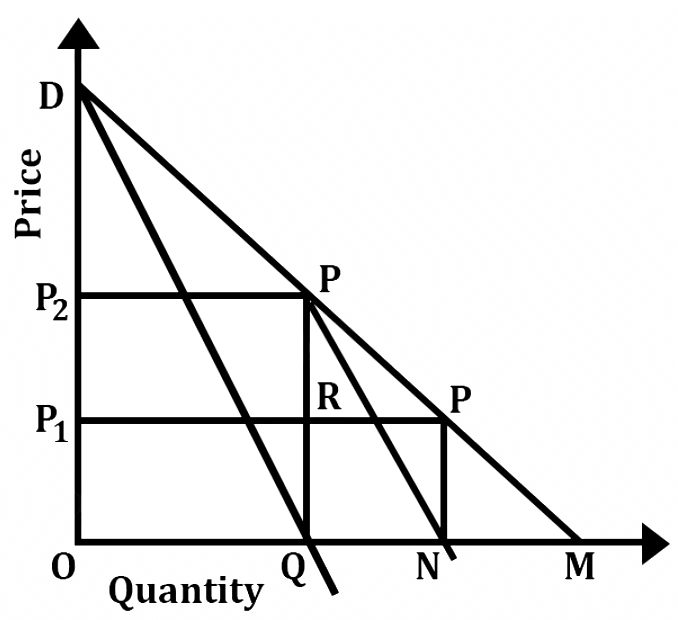

Diagrammatic Representation

- To start, suppose that there are only two firms, named, A and B. A is the only seller of the mineral water in the market. To maximize his profits or revenue, he sells the quantity OQ. Here, MC = 0 MR, the price at OP2. The total profit is OP2PQ.

- Now, when B enters the market and the market that is open to him is QM. QM is half of the total market. B assumes that A will not change his price and output since he is already making the maximum profit.

- To get maximum revenue, B sells ON at price OP1. with this, his total revenue is maximum at QRP’N.

- With the entry of B, the price falls to Op1. The expected profit of A falls OP1PQ. This induces A to adjust its price and output according to the changing conditions. Assuming that B will not change his output and price since he is making maximum profit.

- This is now B’s turn to react and the same thing will repeat as above.

- In the successive periods, this process of action and reaction continues. In such a way, A continues to lose its market share and B continues to gain. The final result is when both of their market shares are at one third.

- We can stretch the Cournot’s model of duopoly to the general oligopoly. For instance, if there are three sellers, the industry and the firm will be in equilibrium when each firm supplies 1/3rd of the market.

- Thus, three sellers together, supply 3/4th of the share of the market. And the 1/4th share remains unsupplied.

- The formula that determines the share of each seller in an oligopolistic market is – Q-f- (n+1) , where Q = market size and n = number of sellers.

- Cournot concluded that each seller ultimately supplies one-third of the market. Here, it charges the same price. This happens while one-third of the market is still unsupplied.

Criticism of Cournot’s Model

- Although his model yields a stable equilibrium, the Cournot’s model is criticized on the following grounds –

- The behavioral assumption is naive to the extent that it implies that firms continue to make wrong calculations about the competitor’s behavior. Each seller assumes that his rival will not change his price or output even though he continues to observe the opposite.

- The unrealistic assumption of the zero cost of production. In case, this assumption is not taken, it will not alter his position.

Chembelrin’s Duopoly Model

- This model recognizes the interdependence of the firms in the market. He argues that in the real world of oligopoly firms, the firms will not learn from their past experiences. Chamberlain makes the same assumptions as of the exponents of the old classical model.

- Chamberlain’s model is also based on the assumption of equal size with identical costs.

- However, his recognition of the interdependence of the firms in the oligopolistic market gave a result that was quite different from that of Cournot. Chamberlain argues that the firms are aware of the fact that their output or price will surely invite reactions from other firms.

- Therefore, the price-war is not visualized in the oligopolistic markets. With this, he also rules out the possibility of the firms adjusting their outputs over some time. Therefore, reaching an equilibrium, at an output level lower than that would be reached under monopoly.

- According to him, recognition of possible sharp reactions to an oligopolistic firm’s price or the output manipulations will avoid harmful competition amongst the firms in such a market. This would result in a stable industry equilibrium with monopoly price and output.

- He further believed that no collision is required to obtain this solution.

- In the case of farms in an oligopolistic market are aware of their mutual dependence and willing to learn from their past experiences. To maximize their individual and joint profits, they will charge the monopoly price.

The Chamberlin Model

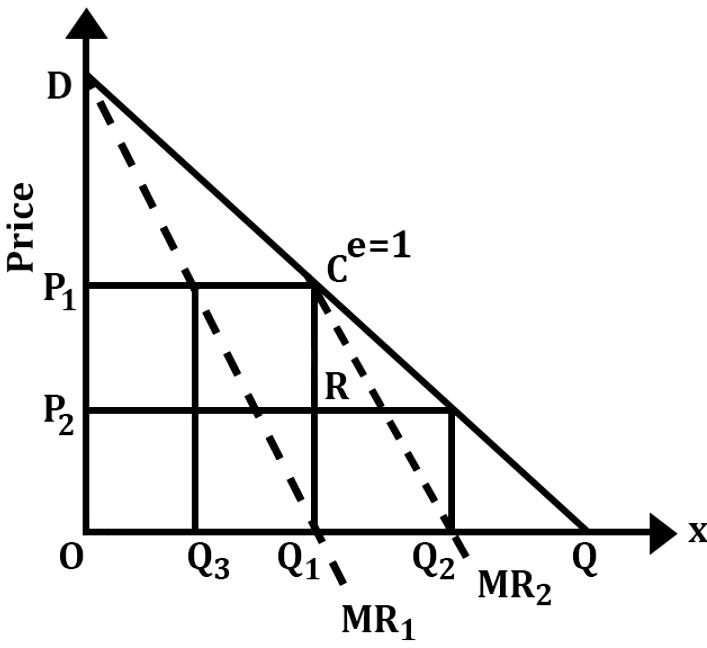

- Chamberlain’s model is explained in the framework of a duopoly market. Like Cournot, Chamberlain assumes linear demand for the product. For simplicity, an assumption is made that even in this case, the cost of producing the goods is zero.

- In the above figure, DQ is the market demand curve. If firm A enters the market, it will produce output OQ1 because, at this level of output, the marginal revenue is equal to marginal cost. The firm might charge OP1, which is the monopoly price.

- This will lead to the maximization of profits. At price OP, the elasticity of demand is unitary.

- If firm B enters the market at this stage, it considers its demand curve is CQ. It will produce Q1Q2 to maximize its profits. It will move to the price OP2.

- After realizing that it can no longer sell at QQ1 quantity, it decides to reduce the output to QQ3. Firm B continues to produce Q1Q2 quantity which is the same as Q3Q1. The industry output is OQ1and the price rises to OP1. Both the firms, A and B consider it an ideal situation.

- The joint output of both firms is monopoly output and they charge a monopoly price. Thus, considering this assumption, the market will be shared equally between the two firms.

Appraisal of the Model

- Chamberlin’s model is certainly more realistic than the other models. It assumes that the firms recognize the interdependence and then act in a manner that the monopoly solution is reached. In the real world of oligopoly, certain difficulties are faced in reaching this solution.

- In the absence of collusion, the firms should have a good knowledge of the market demand curve which is almost impossible to reach.

- Furthermore, he also ignores entry. In real practice, the oligopolistic markets are rarely closed. So, if we consider entry, it would not be certain that the stable monopoly solution will ever be reached.

Bertrand’s Duopoly Model

- Bertrand was a French Mathematician who developed his model of the duopoly in 1883. His model is different from that of Cournot in respect to its behavioral assumption.

- Under Bertrand’s model, each seller determines his price on the assumption that his rival’s price and not output remains constant.

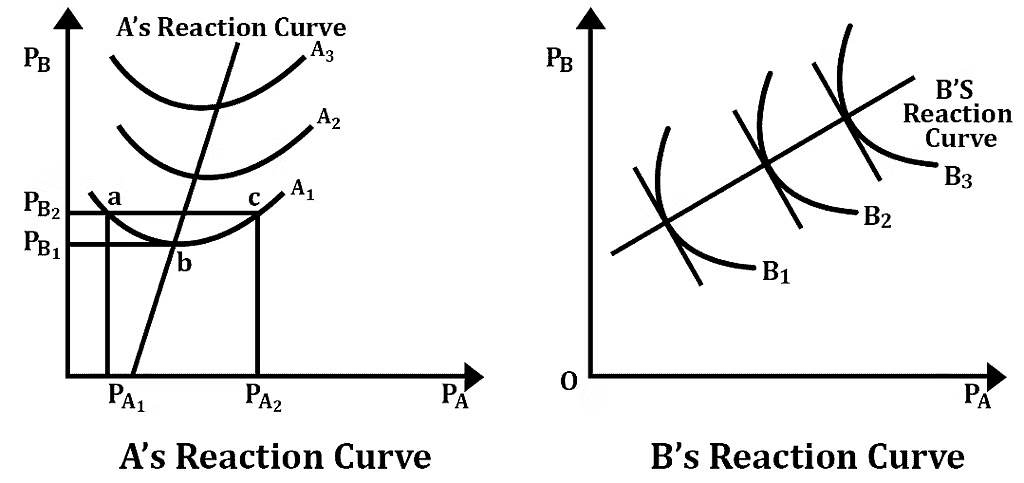

- Bertrand’s model focuses on price competition. His analytical tools are the reaction function of the duopolists. The reaction functions are derived based on the iso-profit curves.

- He assumed that there were only two firms, ie, A and B. The prices are measured along the horizontal and vertical axes.

- The iso-profit curves are drawn based on the prices of the two firms. The iso-profit curves of firm A are convex to its price axis and the curves of firm B are convex to PB.

- When the firm B reduces its price, A can either increase or reduce it. Firm A will reduce its price when he is at point c. It will raise its price when he is at point A. However, there is no limit to which the price adjustment is possible.

- The same applies to all other iso-profit curves. The equilibrium of the duopolists suggested by Bertrand’s Model may be obtained by putting together the reaction curves of firm A and firm B.

Criticism of the Model

- This model was criticized because it is the same as Cournot’s model. Bertrand’s implicit behavioral assumption that the firms don’t learn from their past experiences seems to be unrealistic.

- If the cost is assumed 0, the price will fluctuate between zero and the upper limit of price. It will not stabilize at a point.

Edgeworth’s Duopoly Model

Edgeworth’s Duopoly Model came up in 1897. He follows Bertrans’s assumption that each seller assumes his rival’s price instead of his output, to remain constant.

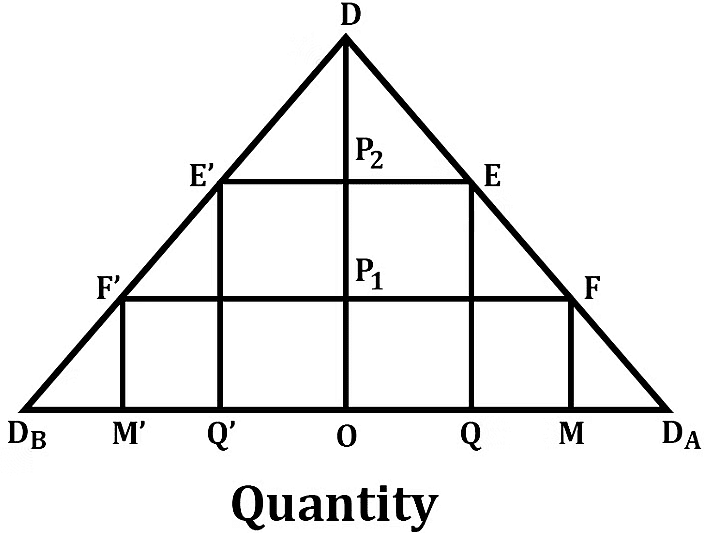

Representation of Edgeworth’s Model of Duopoly

- In the figure, we have to assume that there are two sellers. These firms, A and B face identical demand curves. A’s demand curve is DDB. Seller A has the maximum capacity of output OM and B has the maximum output capacity of OM’. ODA measures the price.

- To commence with, let us assume that A is the only seller in the market. He sells OQ and charges OP2.

- The monopoly cost under zero cost is equal to OP2EQ. Now if B enters the market, he assumes that A will not change his price since he is making maximum profit. Firm B sets its price slightly below A’s price and can sell his total output. Seller A, on the other hand, has his sales gone down.

- To regain his market, A sets his price slightly below the price of B. This creates a price-war between the sellers.

- The price-war takes the form of price-cutting which continues until price reaches OP1. At this level both the firms, A and B can sell their entire output- A sells OQ and B sells OQ. The price of OP1 can be stable. However. According to Edgeworth, price OP1 should not be stable.

- In all, Edgeworth’s model is based on a naive assumption that a rival will never change his price even after being proved repeatedly wrong. However, Edgeworth’s model is an improved version of Cournot’s model.

|

66 videos|222 docs|73 tests

|

FAQs on Market Structure: Duopoly - Economics Optional for UPSC

| 1. What is the Cournot's Duopoly Model? |  |

| 2. What is the Chembelrin's Duopoly Model? |  |

| 3. What is the Bertrand's Duopoly Model? |  |

| 4. What is Edgeworth's Duopoly Model? |  |

| 5. How do these duopoly models contribute to the understanding of market structures? |  |