Theories of Interest Rate Determination - 2 | Economics Optional for UPSC PDF Download

Classical Theory of Interest or Demand and Supply of Capital Theory of Interest

- This theory was expounded by eminent economists like Prof. Pigou, Prof. Marshall, Walras, Knight, etc. According to this theory, Interest is the reward for the productive use of the capital which is equal to the marginal productivity of physical capital.

- Therefore, those economists who hold the classical view have said that “the rate of Interest is determined by the supply and demand of capital. The supply of capital is governed by time preference and the demand for capital by the expected productivity of capital. Both time preference and productivity of capital depend upon waiting or saving. The theory is, therefore, also known as the supply and demand theory of waiting or saving.”

Demand for Capital

- Demand for capital implies the demand for savings. Investors agree to pay interest on these savings because the capital projects which will be undertaken with the use of these funds, will be so productive that the returns on investment realised will be in excess of the cost of borrowing, i.e., Interest.

- In short, capital is demanded because it is productive, i.e., it has the power to yield an income even after covering its cost, i.e., Interest. The marginal productivity curve of capital thus determines the demand curve for capital. This curve after a point is a downward-sloping curve. While deciding about an investment, the entrepreneur, however, compares the marginal productivity of capital with the prevailing market rate of Interest.

- Marginal Productivity of Capital = the marginal physical product of capital x the price of the product.

- When, the rate of Interest falls, the entrepreneur will be induced to invest more till marginal productivity of capital is equal to the rate of Interest. Thus, the investment demand expands when the Interest rate falls and it contracts when the Interest rate rises. As such, investment demand is regarded as the inverse function of the rate of Interest.

Supply of Capital

- Supply of capital depends basically on the availability of savings in the economy. Savings emerge out of the people‟s desire and capacity to save. To some classical economists like Senior, abstinence from consumption is essential for the act of saving while economists like Fisher. Stress that time preference is the basic consideration of the people who save.

- In both views the rate of Interest plays an important role in the determination of savings. The chemical economists commonly hold that the rate of saving is the direct function of the rate of Interest. That is, savings expand with the rise in the rate of Interest and when the rate of Interest falls, savings contract. It must be noted that the saving-function or the supply of savings curve is an upwardsloping curve.

Equilibrium Rate of Interest

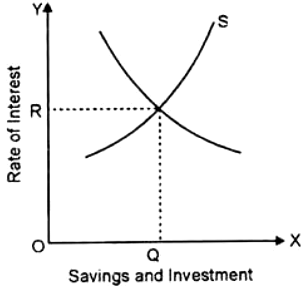

- The equilibrium rate of Interest is determined at that point at which both demand for and supply of capital are equal. In other words, at the point at which investment equals savings, the equilibrium rate of Interest is determined.

This has been shown by the diagram given below:

- In the figure given here OR is the equilibrium rate of Interest which is determined at the point at which the supply of savings curve intersects the investment demand curve, so that OQ amount of savings is supplied as well as invested. This implies that the demand for capital OQ is equal to the supply of capital OQ at the equilibrium rate of Interest OR.

- Indeed, the demand for capital is influenced by the productivity of capital and the supply of capital. In turn savings are conditioned by the thrift habits of the community. Thus, the classical theory of Interest implies that the real factor, thrift and productivity in the economy are the fundamental determinants of the rate of Interest.

Criticisms

The theory of Interest of the classical economists has been severely criticised by Keynes and others.

The important criticisms are as under:

- Interest is purely a monetary phenomenon: According to Keynes—Interest is purely a money phenomenon, a payment for the use of money and that the rate of Interest is a reward for parting with liquid cash (i.e., dishoarding) rather than a return on saving. Keynes has said that one can get interest by lending money which has not been saved but has been inherited from one‟s forefathers. It completely neglects the influence of monetary factors on the determination of the rate of Interest. The classical economists regarded money as a „veil‟ as a medium of exchange over goods and services. They failed to take into account money as a store of value.

- The theory of interest is confusing and indeterminate: Keynes has said that the classical theory of Interest is confusing and indeterminate. We cannot know the rate of Interest unless we know the savings and investment schedules which again, cannot be known unless the rate of Interest is known. Thus, it can be said that the theory fails to offer a determinate solution. This theory is unrealistic and inapplicable in a dynamic economy: Because it assumes that income not spend on consumption should necessarily be diverted to investment, it ignores the possibility of saving being hoarded. It fails to integrate monetary theory into the general body of economic theory.

- Classicists have described the rate of interest as an equilibrating factor between savings and investment: But according to Keynes, “the rate of interest is not the price which brings into equilibrium the demand for resources to invest with the readiness to abstain from present consumption. It is the price which equilibrates the desire to hold wealth in the form of cash.”

- This theory is narrow in scope: Because it ignores consumption loans and takes into account only the capital used for productive purposes.

- Keynes differs with the classical economists even over the very definition and determination of the rate of interest: Keynes has said that Interest is the reward of parting with liquidity for a specified period. He does not agree that Interest is determined by the demand for and supply of capital. With these arguments Keynes has completely dismissed the classical theory of Interest as absolutely wrong and inadequate. He has never been agreeable with the view of classists.

The Loan-Able Fund Theory of Interest

The Neo-classical or the Loan-able Fund Theory was expounded by the famous Swedish economist Knot Wick-sell. Further, this theory was elaborated by Ohlin, Roberson, Pigou and other new-classical economists. This theory is an attempt to improve upon the classical theory of Interest. According to this theory, the rate of Interest is the price of credit which is determined by the demand and supply for loanable funds.

In the words of Prof. Lerner

“It is the price which equates the supply of „Credit‟ or Saving Plus the Net increase in the amount of money in a period, to the demand for „credit‟ or investment Plus net „hoarding‟ in the period.”

Demand for Loan-able Funds:

The demand for loanable funds has primarily three sources:

- Government

- Businessmen, and

- Consumers who need them for purposes of investment, hoarding and consumption.

- The Government borrows funds for constructing public works or for war preparations or for public consumption (to maintain law and order, administration, justice, education, health, entertainment etc.). To compensate deficit budget during depression or to invest in and for other development purposes. Generally government demand for loanable funds is not affected by the Interest rate.

- The businessmen borrow for the purchase of capital goods and for starting investment projects. The businessmen or firms require different types of capital goods in order to run or expand their production. If the businessmen do not possess sufficient money to purchase these capital goods, they take loans.

- Businessmen investment demand for loanable funds depends on the quantity of their production. Generally, the interest and firm‟s investment demand for loanable funds has also inverse relationship. It means there will be less demand on higher Interest and more demand on lower Interest.

- The consumers take loans for consumption purposes. They prefer present consumption, they wish to purchase more consumption, goods than their present income allows and for that they take loans. They take loans to purchase mainly two types of consumption goods.

- First, durable consumption goods and secondly to purchase consumption goods of daily use and they generally open their accounts with the seller and go on purchasing goods on credit basis. Besides these they take loans for investment or speculative purposes also. Behind this they have profit motive.

Supply to Loanable Funds

- The supply of loanable funds comes from savings, dis-hoardings and bank credit. Private savings, individual and corporate are the main source of savings. Though personal savings depend upon the income level, yet taking the level of income as given, they are regarded as Interest elastic. The higher the rate of Interest, the greater will be the inducement to save and vice-versa.

- There is a positive relationship between Interest-rate and the supply of loanable funds. It means there will be more supply of loanable funds at higher interest and less supply on lower interest. Hence the supply curve of loanable funds will be an upward sloping curve from left to right.

Determination of Interest Rate

- The equilibrium between the demand for and supply of loanable funds (or the intersection between demand and supply curves of loanable funds) indicates the determination of the market rate of interest. It has been shown in the diagram given here.

- In the diagram demand curve for loanable funds (DL) and supply curve of loanable funds (SL) meet at point E. Therefore, E will be the equilibrium point and OR will be the equilibrium rate of interest. At this rate of interest demand for and supply of loanable funds both are equal to OL.

- Given the supply of loanable funds, if the demand for loanable funds rises, the Interest rate will also rise and if the demand for loanable funds falls, the Interest rate will also fall. Similarly, given the demand for loanable funds, Interest rate will rise with the fall in the supply of loanable funds and will fall with the rise in the supply of loanable funds. The equilibrium rate of interest is thus determined where SL = DL.

Criticisms

The important criticisms of this theory are as follows:

- It has been called as indeterminate theory: Prof. Hansen asserts that the loanable funds theory like the classical and the Keynesian theories of Interest are indeterminate. Because according to this theory Interest rate determination depends on savings. But saving depends on income, income depends on investment and investment itself depends on Interest rate.

- In this theory the equilibrium between demand for and supply of loanable funds cannot be brought by the changes in interest rate: Investment in the demand for loanable funds and savings in the supply of loanable funds are important elements. Both saving and investment are not so much influenced by Interest as they are influenced by the changes in incomelevels. Besides this, it is not essential that banks would necessarily change their Interest rate with the changes in demand for and supply of loan-able funds. Banks determine their Interest rate keeping in view so many factors and they would not like to make frequent changes in it. In this situation it would be difficult to bring equilibrium in demand for and supply of loan-able funds through the changes in the Interest rate.

- This theory exaggerates the effect of the rate of interest on savings: Regarding this theory critics argue that people usually save not for the sake of interest but out of precautionary motives and in that case, saving is Interestinelastic.

- Availability of Cash balance which is not elastic: The loanable funds theory states that the supply of loanable hands can be increased by releasing cash balances of savings and decreased by absorbing cash balances into savings. This implies that the cash balances are fairly elastic. But this does not seem to be correct view because the total cash balances available with the community are fixed and equal the total supply of money at any time. Whenever there are variations in the cash balances, they are, in fact, in the velocity of circulation of money, rather than in the amount of cash balances with community.

- Government influence on the demand: Government has an important influence on the demand for and supply of loanable funds. And it is not essential that government may always take the decisions in view of Interest rate. Rather government generally takes the decisions keeping in view the public Interest and not the Interest rate.

Is Loanable Funds Theory Superior over The Classical Theory? In-spite of the weaknesses, the loanable funds theory is better and more realistic than the classical theory on the following grounds:

- The loanable-funds theory is more realistic than the classical theory: The Loanable funds theory is stated in real as well as in money terms, whereas the classical theory is stated only in real terms. The rate of interest is a monetary phenomenon. Therefore, a theory stated in money terms seems more realistic.

- The loanable funds theory recognises the active role of money in a modern economy: To the classical school money is merely a „veil‟, a passive factor influencing the rate of interest. The loanable funds theory is superior because it regards money as an active factor in the determination of the Interest rate.

- Role of bank credit as a constituent of money supply: Classical school of thought neglects the role of bank credit as a constituent of money supply influencing the rate of Interest which is an important factor in the loanable funds theory

- Role of hoarding: The classicists are also of this opinion and they also do not consider the role of hoarding. By including the desire to hoard money in the demand for loanable funds, the loanable funds theory becomes more realistic and brings us nearer to Keynes‟s liquidity preference theory.

Keynes’s Liquidity Preference Theory of Interest or Interest is Purely a Monetary Phenomenon

- According to Keynes, Interest is purely a monetary phenomenon. It is the reward of not hoarding but the reward for parting with liquidity for the specified period. It is not the „Price‟ which brings into equilibrium the demand for resources to invest with the readiness to abstain from consumption. It is the „Price‟ which equilibrates the desire to hold wealth in the form of cash with the available quantity of cash.

- Here Liquidity Preference Theory is determined by the supply of and demand for money. Supply of money comes from banks and the government. On the other hand, demand for money is the preference for liquidity. According to Keynes people like to hoard money because it possesses liquidity.

- Hence, when somebody lends money he has to sacrifice this liquidity. A reward which is offered to make him prepared for parting with liquidity is called Interest. Therefore, in the eyes of Keynes—”Interest is the reward for parting with liquidity for a specific period.”

Liquidity Preference or Demand for Money

Liquidity preference means demand for cash or money. People prefer to keep their resources “Liquid”. It is because of this reason that among various forms of assets money is the most liquid form. Money can easily and quickly be changed in any form as and when we like. Suppose, you have a ten rupee note now you can change it into either wheat, rice, sugar, milk, book or in any other form you like. It is because of this feature of liquidity of money, people generally prefer to have cash money.

The desire for liquidity arises because of three motives:

- Transactions Motive: The transactions motive relates to “the need of cash for the current transactions of personal and business exchanges”. It is further divided into the income and business motives. The income motive is meant “to bridge the interval between the receipt of income and its disbursement”, and similarly, the business motive as “the interval between the time of incurring business costs and that of the receipt of the sale proceeds.” If the time between the incurring of expenditure and receipt of income is small, less cash will be held by the people for current transactions and vice-versa.

- Precautionary Motive: The precautionary motive relates to “the desire to provide for contingencies requiring sudden expenditures and for unforeseen opportunities of advantageous purchases.” Both individual and businessmen keep cash in reserve to meet unexpected needs. Individual hold some cash to provide for illness, accidents, unemployment and other unforeseen contingencies. Similarly, businessmen keep cash in reserve to tide over unfavorable conditions or to gain from unexpected deals.

- Speculative Motive: Money held under the speculative motive is for “securing profit from knowing better than market what the future will bring forth.” Individuals and businessmen have funds, after keeping enough for transactions and precautionary purposes, like to gain by investing in bonds. Money held for speculative purposes is a liquid store of value which can be invested at an opportune moment in Interest bearing bonds on securities. There is an inverse relationship between interest rate and the demand for money i.e., more demands for money at lower Interest rate and less demand at higher interest rate. Hence, the liquidity preferences curve becomes a downward sloping curve.

Supply of Money

- The supply of money refers to the total quantity of money in the country for all purposes at any time. Though the supply of money is a function of the rate of Interest to a degree, yet it is considered to be fixed by the monetary authorities, that is, the supply curve of money is taken as perfectly inelastic.

- The supply of money in an economy is determined by the policies of the government and the Central Bank of the country. It consists of coins, currency notes and bank deposits. The supply of money is not affected by the Interest rate, hence, the supply of money remains constant in the short period.

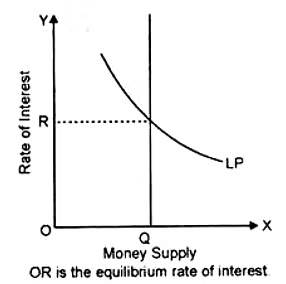

Determination of Interest Rate

- According to the Liquidity-Preference Theory the equilibrium rate of interest is determined by the interaction between the liquidity preference function (the demand for money) and the supply of money, as presented in figure below:

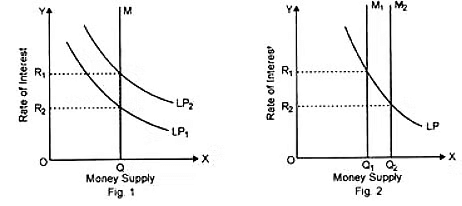

- OR is the equilibrium rate of interest. The theory further states that any change in the liquidity preferences function (LP) or change in money supply or changes in both respectively cause changes in the rate of interest. Thus as shown in figure below, it given the money supply the liquidity preference curve (LP) shifts from LP1 to LP2 implying thereby an increase in demand for money, the equilibrium rate of interest also rises from to R%.

- Similarly, assuming a given liquidity preference function (LP) as in fig. (b) when the money supply increases from M1 to the rate of interest falls from R1 to R2.

Its Criticisms

The following major criticisms have been levelled against the Keynesian Liquidity Preference theory of interest. By Hansen, Robertson, Knight and Hazlitt etc. This theory has been characterised as “a college bursar‟s theory”, “at best an inadequate and at worst a misleading account”.

|

66 videos|222 docs|73 tests

|

FAQs on Theories of Interest Rate Determination - 2 - Economics Optional for UPSC

| 1. What is the Classical Theory of Interest? |  |

| 2. How does the Demand and Supply of Capital Theory of Interest explain interest rate determination? |  |

| 3. What is the Loan-Able Fund Theory of Interest? |  |

| 4. What is Keynes's Liquidity Preference Theory of Interest? |  |

| 5. Is interest purely a monetary phenomenon according to Keynes's theory? |  |