Concepts of Value and Return - 2 | Management Optional Notes for UPSC PDF Download

Concept of Investment Risk

- The notion of "risk" is widely utilized within the investment realm. In everyday discourse, the term often suggests an unforeseen negative consequence. For instance, when labeling a certain route as risky to drive, one implies the potential for accidents. However, within the context of investments, risk carries a distinct connotation. It not only signifies the chance of adverse outcomes but also encompasses the probability of less favorable results. As commonly understood, risk and return exhibit an interconnected relationship. Investors acquire financial assets with the expectation of gaining profits, a decision predicated on anticipated returns, which may or may not materialize. Investment risk pertains to the possibility of experiencing unexpected negative or adverse returns.

- Virtually every decision involves some degree of risk, whether it's a manufacturing manager selecting equipment, a marketing manager devising an advertising campaign, or a finance manager overseeing a portfolio of assets, each grapples with uncertain cash flows. Financial analysis entails evaluating risks and factoring their potential impact into decision-making processes. The variability in returns from a security is theoretically considered risk, whereas a security offering consistent returns over time, backed by some form of guarantee, typically sovereign, is labeled a "risk-less" or "risk-free" security. Conversely, assets yielding inconsistent returns are deemed "risky."

For instance, consider the following options:

- Rs.1000, 12% 2020 Government of India Loan

- Rs.100, 14.5% 2005 TISCO Non-Convertible Debentures

- The Government Loan entails zero risk due to the stable nature of government systems, ensuring guaranteed interest and principal repayments. In contrast, TISCO debentures, despite protective measures in the form of corporate assets and sustained financial performance, carry a risk of underperformance and default.

- Investment risk often provokes anxiety among investors, particularly when markets fail to align with rational expectations, revealing significant risk components that many investors may overlook. Risk aversion is common among small investors in secondary markets, who seek predictable returns and feel disheartened when expectations are unmet. Consequently, they prefer low-return assets over volatile securities, prioritizing stability over potential gains.

- However, there are also risk-tolerant investors in the financial landscape, such as speculators, who pursue high returns despite lower certainty. Both risk-averse and risk-taking investors are vital for the functioning of secondary markets.

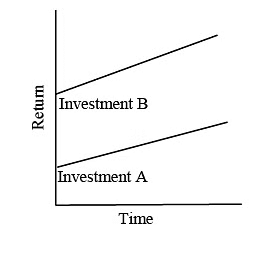

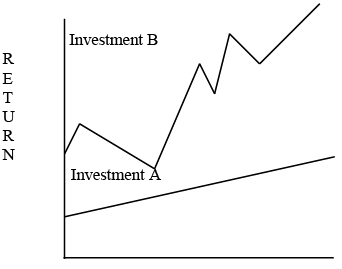

- Illustratively, in Figure (i), an investor presented with investment options would likely choose investment ‘B’ over ‘A’. Conversely, in Figure (ii), investment ‘A’ offers a consistent income stream. Comparing the two figures, investment ‘B’ is predictable in the former but variable in the latter. Despite the increased risk in the second scenario, investors may still opt for investment ‘B’ due to its higher potential return, reflecting the principle that greater risk often accompanies higher rewards.

Evolution of Risk Connotations

- In the twenty-first century, financial analysts relied on financial statement data to evaluate the risk associated with a company's securities. One common metric they used was the level of debt held by the company, seeing it as a broad indicator of risk. Their guiding principle was simple: the greater the debt, the higher the perceived risk of the securities. In their influential 1962 work titled "Security Analysis," Graham Dodd and Cottle, considered pioneers in the field of security analysis, emphasized the concept of the "margin of safety" as a measure of risk.

- They advocated for a method that assessed a security's intrinsic value, distinct from its market price. According to their approach, the intrinsic value of an asset should be determined by its earning potential and financial characteristics, irrespective of its current market valuation. The margin of safety was defined as the difference between the intrinsic value and the market price, with the underlying principle being that a larger margin of safety indicated lower risk.

- Various metrics, including standard deviation, range, semivariance, and mean absolute deviation, have been utilized to quantify risk over time. However, the standard deviation has emerged as the widely accepted measure due to its ability to provide probabilistic assessments across a broad spectrum of distributions.

- Investment risk is typically deconstructed into multiple components, which can be achieved through two primary methods. The first approach involves dividing total risk into systematic and unsystematic risk components, while the second approach entails breaking down total risk into distinct components, each with its own underlying causal factors. Pervasive risks such as inflation, interest rates, and market sentiment can impact all securities to varying degrees and are categorized as systematic risks. Conversely, risks specific to individual securities, such as financial and business risks, fall under the umbrella of unsystematic risk.

- Systematic risk, also known as market risk, is inherent to the market and cannot be eliminated. It encompasses factors like inflation and interest rates, which affect all enterprises simultaneously, leading to fluctuations in return variability. Investors must seek compensation for this risk factor when calculating their expected rate of return.

- On the other hand, non-systematic risk arises from firm-specific factors, such as the failure to secure a lucrative foreign contract or increased exposure to default risk on interest payments and debt obligations. This type of risk can be mitigated through diversification and is not factored into the calculation of expected or required rates of return.

Sources of Risk

Investment risk is a constant concern for investors, prompting inquiries into its nature and origins. To grasp the concept of risk, one must understand the various elements or sources to which investments are exposed. Variations in investment returns stem from diverse factors, each carrying its own level of risk. Now, let us delve into comprehending distinct risk sources.

Market Risk

- Market risk manifests as fluctuations in the market price of investments, particularly equity shares, even when a company's earnings remain unchanged. The causes for these price changes are multifaceted, often stemming from shifts in investors' sentiments toward equities triggered by various factors. This volatility in market prices directly impacts investment returns and is hence termed market risk. It arises from investors' reactions to key occurrences, encompassing social, political, economic, and firm-specific events.

- Additionally, market psychology plays a significant role, with bull and bear market phases influencing price movements. Business cycles, which coincide with economic expansion and contraction, also play a pivotal role in driving market fluctuations. Market risk can be further categorized as systematic or non-systematic, with systematic market risk driven by broad market trends affecting most stocks, while unsystematic risk is specific to certain securities and can be mitigated through diversification.

Interest-Rate Risk

- Interest rates wield significant influence over the returns on securities, impacting the expected or required rate of return. As interest rates fluctuate, so do the returns on various assets, including risk-free government securities and bonds. Interest-rate risk pertains to the variation in returns caused by changes in market prices of fixed-income products such as bonds and debentures.

- The prices of these securities move inversely to interest rates, meaning that when interest rates rise, bond and debenture prices decline, and vice versa. These changes in interest rates not only affect fixed-income securities directly but also indirectly impact equity share values.

Inflation Risk

- Inflation risk refers to the uncertainty surrounding the purchasing power of an asset due to changes in the general price level. It arises from the erosion of purchasing power over time as prices increase. This risk affects the expected returns from investments, particularly those providing cash interest or dividend income.

- If the rate of return fails to outpace the rate of inflation, investors may experience a decrease in real purchasing power despite nominal gains. This phenomenon highlights the importance of considering inflation when evaluating investment decisions, as simply increasing nominal wealth may not translate into increased real wealth when accounting for inflation's effects on purchasing power.

Business Risk

- Operating within an ever-evolving environment, business enterprises face fluctuating expected incomes. Changes in government policies, such as alterations to fertilizer subsidies, can adversely affect specific industries, while the actions of competitors, both domestic and foreign, can impact a broader range of businesses. Additionally, numerous external factors, while not attributable to any single source, influence operational environments.

- For instance, fluctuations in the business cycle can lead to significant earnings volatility for many companies, particularly those in industries like steel, automotive, and transportation. Distinguishing between systematic and non-systematic business risks can be challenging, highlighting the importance of diversifying portfolios across various industries to mitigate company-specific risk exposure.

Financial Risk

- Financial risk arises when a company's capital structure includes debt, introducing variability in income available to equity shareholders. While debt can enhance profitability during prosperous periods, it poses challenges during economic downturns, as fixed liabilities persist even in times of financial strain.

- Defaulting on debt obligations not only tarnishes a company's reputation but also hampers its ability to secure financing and retain key personnel. While debt can amplify returns in favorable conditions, excessive debt can expose investors to heightened financial risk.

Management Risk

- Management risk encompasses the variability in total return attributable to managerial decisions in companies where owners are not directly involved in day-to-day operations. Regardless of managerial expertise, the potential for errors or poor decision-making always exists.

- Missteps by executives can lead to significant financial repercussions, such as product obsolescence or mismanagement of legal challenges. Agency theory sheds light on the inherent conflict of interest between owners and hired managers, highlighting the importance of owner-managed companies in mitigating management risk.

Liquidity Risk

- Liquidity risk refers to the difficulty of selling assets without incurring significant price discounts or commissions. While highly liquid assets like currency and government securities can be easily sold at par value, less liquid assets, such as securities of smaller companies, may require selling at a discount, especially when large quantities are involved.

- Investors must carefully consider liquidity risk when selecting securities to ensure they can readily liquidate assets if needed.

Social or Regulatory Risk

- Social or regulatory risk arises from unfavorable legislation or regulatory environments that impact business operations. Industries may face challenges from government intervention, such as price controls or nationalization, which can erode profitability.

- Predicting social or regulatory risk is difficult, but businesses must anticipate potential challenges and adapt to changing political landscapes to mitigate associated risks.

Other Risks

- Monetary value risk and political environment risk are additional categories of risk, particularly prevalent in foreign investments.

- Investors must consider the potential risks associated with changes in foreign governments or nationalization of businesses when investing internationally. Assessing these risks against potential returns is crucial for informed investment decisions.

Risk Preferences

- Managers exhibit varying risk preferences, influencing their approach to risk management.

- While most managers are risk-averse and seek higher returns for increased risk exposure, some may display risk indifference or seek out risk for potential rewards.

- Establishing a universally accepted risk threshold is essential for effective risk management within organizations.

Types of Risk

The first three types of risks in investments—market risk, interest rate risk, and inflation risk—are external to the firm and thus beyond its control. These risks are pervasive and impact all businesses universally. Conversely, business and financial risks are internal and manageable within a specific corporation. This dichotomy leads to the classification of risk into systematic and unsystematic categories.

Systematic Risk: Systematic risk refers to the portion of return variability influenced by factors affecting all enterprises. Diversification offers no protection against systematic risk. Examples of systematic risk include:

- Changes in government interest rate policies

- Increases in corporate tax rates

- Large-scale deficit financing by the government

- Rise in inflation rates

- Implementation of restrictive credit policies by the central bank

- Failure to attract Foreign Institutional Investors (FIIs)

Unsystematic Risk: Unsystematic risk pertains to return variations resulting from factors specific to a particular firm, rather than affecting the entire market. Also known as unique risk, unsystematic risk can be fully mitigated through diversification. Examples of unsystematic risk include:

- Worker strikes within a company

- Departure of key R&D personnel

- Entry of a strong competitor into the market

- Loss of a major contract during bidding

- Breakthrough innovation within the company's processes

- Government imposing higher customs duties on company materials

- Difficulty in procuring sufficient raw materials

Total risk is the sum of systematic and unsystematic risk components since they are additive. Systematic risk is often assessed by comparing a stock's performance to the overall market performance across different scenarios. This comparison is facilitated by calculating a measure known as beta, where a stock's beta reflects its sensitivity to market movements. For instance, a stock with a beta of 1.50 is expected to experience a price change 1.5 times greater than the market's movement.

Risk vs. Uncertainty

While the terms risk and uncertainty are sometimes used interchangeably, they entail distinct connotations. Risk implies awareness of probable outcomes and associated probabilities, whereas uncertainty denotes a lack of clarity regarding potential occurrences. Investors aim to maximize expected returns within their risk tolerance thresholds, with risk contingent upon asset features, investment instruments, and strategies.

Causes of Risk:

Various factors contribute to risk in the investment realm, including:

- Incorrect investment methodologies, timing, or quantities

- Interest rate fluctuations

- Characteristics of investment instruments and industries

- National and international economic factors

- Natural disasters, among others.

Measuring Historical Return

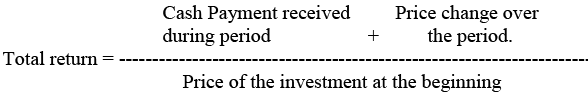

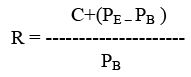

The total return on investment for a given period is:

The sum acquired over the duration may vary, either showing a positive or negative value. The discrepancy between the final and initial prices represents the rupee price alteration over time. This change can be either positive (indicating a higher ending price compared to the beginning), neutral (where the ending price equals the initial price), or negative (with the ending price lower than the starting price).

Where R= total return over the period

C= cash payment received during the period

Pe = ending price of the investment

Pb = beginning price

To illustrate, consider the following information for an equity stock:

- Price at the beginning of the year: Rs.70.00

- Dividend paid at the end of this year: Rs.5.00

- Price at the end of the year: Rs.80.00

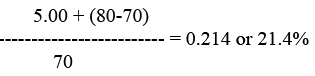

The total return on this stock is calculated as follows:

|

Download the notes

Concepts of Value and Return - 2

|

Download as PDF |

Measuring Historical Risk

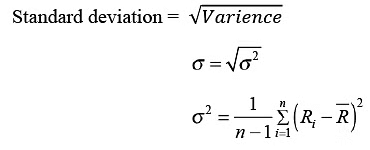

Risk signifies the likelihood of an investment's actual outcome deviating from its expected outcome or the presence of variability or dispersion. An asset with a consistent return is deemed risk-free. When examining the overall return of an equity stock across a certain period, understanding both the average return and the variability in returns becomes imperative. Variance and Standard Deviation emerge as the prevailing metrics for gauging risk in finance. These measures define historical risk as follows:

Where, σ2 = Variance of Return

Ri = return from the stock in period I(I=1,.. ,.,n)

R = average rate of return or mean of the returns

n = number of periods

σ = standard deviation

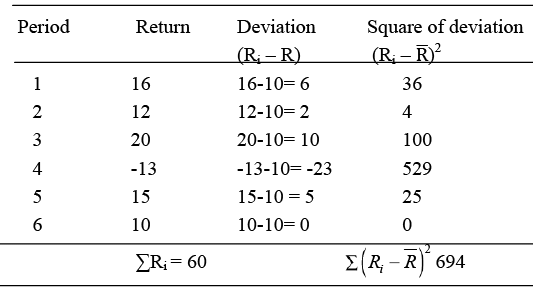

To illustrate, consider the initial rate of return is 16% and the returns from a stock over 6 years period are:

R1 =16%, R2 = 12%, R3 = 20%, R4 = -13%, R5 =15%, R6 = 10%

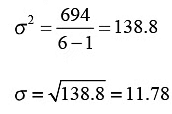

The variance and standard deviation of returns are calculated as below:

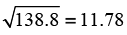

Variance = 138.8 and Standard deviation

Upon reviewing the calculations above, we observe the following insights:

- Variance is determined by the squared difference between individual values and their corresponding means. Consequently, values further from the mean exert a more pronounced influence on standard deviation compared to those closer to it.

- The standard deviation is obtained by taking the square root of the average of squared variances. This results in both the standard deviation and the mean being measured in the same units, facilitating direct comparison between them.

Measuring Expected Return And Risk

Up to this point, we've focused on historical (ex post facto) return and risk. Now, let's delve into anticipated (ex-ante) return and risk.

(i) Probability Distribution:

- When purchasing a stock, one must acknowledge the range of potential returns on the investment. These returns could vary from 5% to 15%, or even as high as 35%. Additionally, the probability associated with each potential return fluctuates. Therefore, it becomes essential to consider probability distributions. Probability serves as a representation of the likelihood of an event occurring.

- For instance, if there's an 80% chance that the market price of Stock A will rise in the next two weeks, it implies an 80% probability of an increase in Stock A's price within that timeframe, with a corresponding 20% chance of it remaining unchanged.

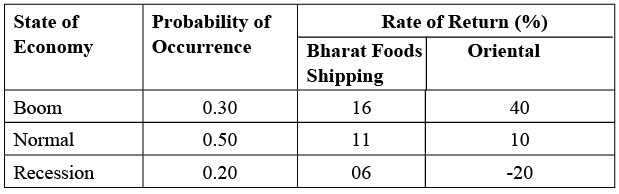

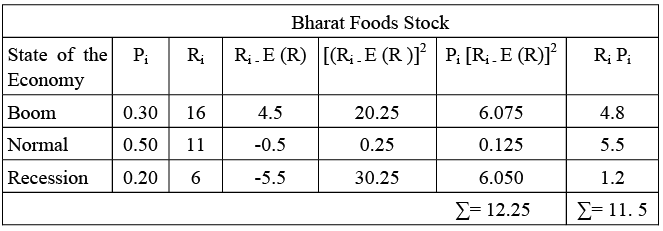

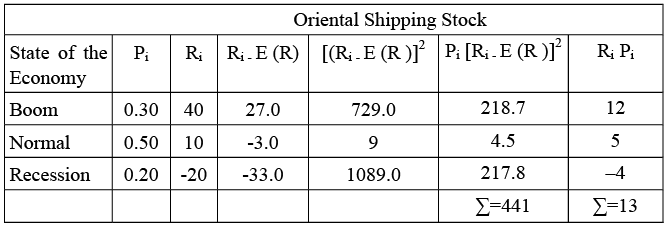

Another illustration of the concept of probability distribution could be presented. Consider the stock of Bharat Foods and the stock of Oriental Shipping. Based on the status of the economy, Bharat Foods stock could produce a return of 16%, 11%, or 06%, with certain probability associated with each. Based on the status of the economy, the second stock, Oriental Shipping stock, which is more volatile, might achieve a return of 40%, 10%, or -20% with the same odds. The following Exhibit shows the probability distributions of the returns for these two stocks:

You can compute two crucial parameters, the expected rate of return and the standard deviation of the rate of return, using the probability distribution of the rate of return.

You can compute two crucial parameters, the expected rate of return and the standard deviation of the rate of return, using the probability distribution of the rate of return.

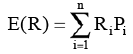

(ii) Expected Rate of Return: The expected rate of return is the weighted average of all possible returns multiplied by their respective probabilities. In symbols:

Where,

- E (R) = expected return from the stock

- Ri = return from stock under state i

- Pi = probability that the state i occurs

- n = number of possible states of the world

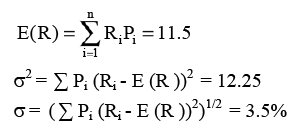

From the above equation, E(R) is the weighted average of possible outcomes - each outcome is weighted by the probability associated with it. The expected rate of return on Bharat Foods stock is:

- E(Rb) = (0.30) (.16%) + (0.50) (.11%) + (0.20) (6%) = 11.5%

- E(Rb)= .048+.055+.012=0.115=11.5%

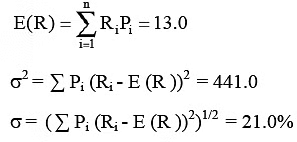

Similarly, the expected rate of return on Oriental Shipping stock is:

- E(Ro) = (0.30) (40%) + (0.50) (10%) + (0.20) (-20%) = 13.0%

- = .12+.05+ (-.04)=.13=13%

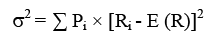

(iii) Standard Deviation of Return: The dispersion of a variable is referred to as risk. The variance or standard deviation are usually used to calculate it. The sum of the squares of the deviations of actual returns from the expected return, weighted by the related probabilities, is the variance of a probability distribution. In terms of symbols, Where,

Where,

- σ2 = Variance

- Ri =return for the ith possible outcome

- Pi = Probability associated with the ith possible outcome

- E (R ) = Expected return

Since variance is expressed as squared returns it is somewhat difficult to grasp. So, its square root, the standard deviation, is employed as an equivalent measure.

Solution: Taking expected return as 11.5%, we calculate:

Taking the expected return as 13%, we calculate:

Summary

- The majority of investors exhibit a preference for risk aversion, aiming to maximize returns while minimizing exposure to risks. It's commonly understood that higher risks may lead to greater potential rewards. Investors typically assess past experiences to gauge risk, adjusting their strategies to account for anticipated future changes.

- Subsequently, they construct subjective probability distributions to anticipate potential returns from proposed investments. The expected return and its variability are then estimated using these distributions, with the mean representing the expected value and the variance (or its square root, the standard deviation) indicating variability or risk.

- The mean-variance approach stands as a widely utilized method for risk assessment. It quantifies overall risk and identifies various factors contributing to total risk. To comprehensively understand the impact of these factors, a breakdown of total risk becomes necessary.

- In delineating the components influencing total risk, two primary categories emerge: factors generating non-diversifiable or systematic risk and those prompting non-diversifiable or unsystematic risk. Factors in the former group, such as interest rate fluctuations, inflation, and market sentiment, impact all businesses universally and can assist in determining the required rate of return.

- Conversely, factors like the business environment, financial leverage, management quality, liquidity, and default risk fall under the latter category, affecting specific businesses rather than all. Given their limited impact on a well-diversified portfolio, these sources of risk are generally deemed less concerning.

FAQs on Concepts of Value and Return - 2 - Management Optional Notes for UPSC

| 1. What is the concept of investment risk? |  |

| 2. How has the connotation of risk evolved over time? |  |

| 3. What are the sources of risk in investments? |  |

| 4. What are the different types of investment risk? |  |

| 5. How is historical return measured and why is it important in assessing investment risk? |  |