Management of working capital-Estimation and financing - 1 | Management Optional Notes for UPSC PDF Download

Introduction

- An analysis of the policy dimensions concerning monetary and credit policies has been undertaken. These developments are seen to impact the volume and accessibility of working capital within the country. Particularly, recent changes in the economic liberalization of the nation are anticipated to exert a significant influence on the operations of Indian industries.

- Today, Indian companies prioritize value maximization as their primary objective, and achieving this goal necessitates precise estimation of requirements. Both excessive and insufficient investment in working capital components can strain the objective function unnecessarily. Therefore, the finance manager must evaluate all factors that determine working capital needs from both theoretical and practical perspectives. Theoretical considerations sometimes outweigh the assessment methodology, while firms are often compelled to adhere to constraints imposed by lenders.

- Hence, the finance manager must take into account all factors affecting working capital, including cash, receivables, and inventories. Although certain models have been developed to ascertain the optimal investment in each working capital item, an aggregate approach is still under development. In the interim, companies rely on the concept of the operating cycle for their calculations. These and other related issues are discussed comprehensively in this unit.

Determination Of Working Capital Needs: Different Approaches

Determining the appropriate amount of working capital required to operate a business is approached in various ways. Theoreticians tend to construct models based on certain principles to estimate the optimal investment in working capital. On the other hand, lenders like banks and financial institutions base their decisions on production schedules and industry practices. There is also a call for adopting a strategic approach to decision-making that lies somewhere between these two perspectives. Let's delve into these theoretical issues to gain a deeper understanding of the subject matter.

Industry Norm Approach:

This approach operates on the assumption that every company is guided by industry practices. If the majority of units within a particular industry adopt a certain practice, other units are likely to follow suit, resulting in the establishment of an industry norm. This norm determines the standard level of investment in different current asset items. For example, the optimal level of investment in receivables is significantly influenced by industry practices. However, there are several challenges associated with this approach:

- Classifying units into specific industries can be complex, especially for multi-product firms.

- Determining an average to represent a particular industry is difficult, and the norms developed may lack accuracy.

- Averages may not be meaningful for all firms due to differences in their nature.

- Following industry norms may lead to imitative behavior and hinder innovation.

- This approach may also foster a rigid mentality and limit opportunities for excellence. For instance, if one unit can maintain its production schedule with a one-month raw material requirement while the industry norm is two months, there is no reason for the unit to conform to the two-month standard.

Due to these reasons, many do not consider the industry norm approach as a reliable benchmark for investing in current assets. However, it remains a traditional practice followed by many, including lenders, despite its illogical nature.

Economic Modeling Approach:

Model building has become increasingly important across various disciplines, with theoreticians striving for precision. The widespread use of quantitative techniques has facilitated the development of frameworks to test hypotheses. In the realm of finance, model building is also prevalent, with efforts focused on determining the optimal investment in inventory using models like the Economic Order Quantity (EOQ) model. This model has significant implications for purchasing raw materials, storing finished goods, and managing in-transit inventories.

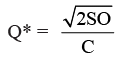

Where Q* = Optimum order quantity

S = Annual usage of material

O = Ordering costs per order

C = Carrying costs per unit

William J. Baumol has attempted to apply this inventory model to the determination of optimum cash balances that can be held by an enterprise. The transactions demand for money is sought to be analysed from this point of view. As per the model, the optimum level of cash is decided by the carrying cost of holding cash and the cost of transferring marketable securities to cash and vice- versa.

His equation is as follows:

C* = Optimum cash balance

b = Transaction costs per transaction

T = Total demand for cash

i = Interest rate

Similarly, the decision to sell to a particular account should be based objectively upon the application of profit maximising model. In this regard, Robert M. Soldofsky developed a model for Accounts receivable management. He has laid down the following formula for making a credit decision, leading to optimum investment in receivables.

Sell, when M – (b + Ti + c/o) ≥ 0

where M = Profit Margin

b = Probability of a credit sale becoming a bad debt

i = Interest rate

c = Costs per order of selling on credit as an implicit function of risk,

o = Order size

T = Time period

Though models are available to decide optimum investment in case of some important components of working capital, for many other items, no such modeling is attempted; nor is there an attempt at the aggregate level. Moreover, these models are subject to certain assumptions and conditions. Their utility comes under scrutiny for want of these assumptions turning out to be far from reality. For this and several other reasons, economic modeling is not much popular with Indian companies.

Strategic Choice Approach

- The Strategic Choice Approach differs from the industry norm approach and economic modeling approach in that it does not prescribe standard methods or benchmarks to follow. Unlike these methods, which recommend using specific yardsticks regardless of business size, industry nature, structure, or competition, the strategic choice approach acknowledges the diversity in business practices and advocates for the use of strategic decision-making in managing working capital.

- This approach recognizes that each business unit is unique in terms of its nature, opportunities, and environment, and therefore encourages businesses to adopt strategic behavior. The focus is on empowering the business unit to navigate competitive challenges and establish a strategic position in the market. Rather than adhering strictly to industry rules, firms are encouraged to set their own targets for working capital management.

- For example, if a firm aims to increase its market share from 20 percent to 40 percent, it may devise a credit policy tailored to achieve this objective. This could involve adjustments to existing credit terms, such as extending the credit period, increasing credit limits, or offering higher cash discounts. The strategic choice approach assumes a highly competitive environment and requires management to be willing to take risks.

- Success with this approach hinges on the management's ability to set realistic goals and develop appropriate strategies to attain them. Poor planning could result in significant challenges for the firm, potentially worse than those faced under previous methods. Nonetheless, the strategic choice approach represents an innovative approach to addressing working capital issues.

|

Download the notes

Management of working capital-Estimation and financing - 1

|

Download as PDF |

Factors Influencing Working Capital Determination

The working capital needs of a firm are influenced by various factors. While sales play a significant role, they alone do not determine the size of working capital. Instead, it is influenced by a multitude of economic factors impacting the business environment. Factors such as the nature of the firm's activities, the overall industrial health of the country, the availability of materials, and the condition of the money market all contribute to shaping the working capital requirements. Among these factors, the operating cycle holds particular importance.

Operating Cycle:

The operating cycle plays a crucial role in determining the investment in working capital components. It represents the time taken to complete each stage of operations related to working capital items. This concept helps illustrate the different stages of manufacturing activity and the corresponding investment required at each stage in working capital. The total working capital required is the sum of investments at each stage of the cycle. The four main stages include:

- Raw materials and inventory stage

- Work-in-progress stage

- Finished goods inventory stage

- Accounts receivable stage

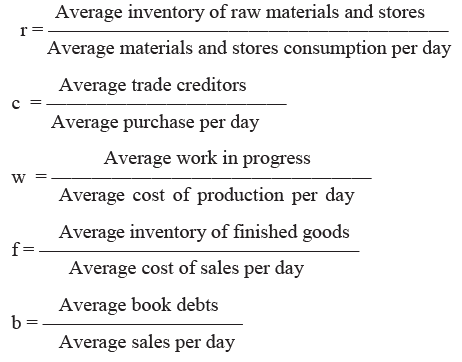

The operating cycle period in an enterprise is determined by the formula:

‘t’ = (r–c) + w + f + b,

where:

‘t’ = total period of the operating cycle in days

‘r’ = number of days of raw materials and inventory consumption

‘c’ = number of days of purchases included in trade creditors

‘w’ = number of days of cost of production in work-in-progress

‘f’ = number of days of cost of sales in finished goods

‘b’ = number of days of sales in accounts receivable

These computations provide insights into the length of the operating cycle and the corresponding working capital requirements at each stage.

Determining Average Inventory and Book Debts Level:

The average inventory or book debts level can be calculated by taking the mean between the relevant opening and closing balances for the year. Similarly, the average consumption, output, cost of sales, or sales per day can be obtained by dividing the respective annual figures by 365. Some authors and bank managers may use a range of 300-360 days as the denominator to account for operational days in a year.

Park and Gladson's Concept of Operating Cycle:

- The concept of the operating cycle (OC) was first comprehensively introduced by Park and Gladson. They aimed to establish the interconnectedness of current assets and liabilities as crucial determinants of working capital. Their research led them to challenge the universally accepted one-year temporal standard for classifying assets or liabilities as "current." They argued that the classification should be based on the nature of the core business activity.

- According to Park and Gladson, the concept of a "natural business year" should be considered, within which an activity cycle is completed. They proposed that the currentness of assets and liabilities should be determined based on the nature of the business's core activity, dictated by technological requirements and trading conventions.

- This concept of the "natural business year" was later adopted by the Accounting Principles Board of the American Institute of Certified Public Accountants in their definition of working capital.

Determining Working Capital Using Operating Cycle (OC)

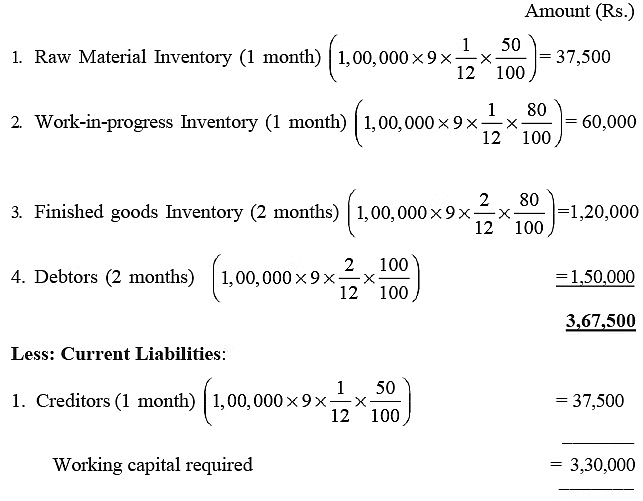

Now, let's proceed to calculate the necessary working capital for a firm using the aforementioned concept. Illustration 3.1: ABC Company's Annual Sales Plan for 2020

ABC Company aims to achieve annual sales of 100,000 units for the year 2020. The cost structure of the company, based on previous figures, is as follows:

- Materials: 50%

- Labor: 20%

- Overheads: 10%

Further Details:

- Raw materials are anticipated to be held in stores for an average of one month before being issued for production.

- Finished goods are expected to remain in the warehouse for an average of two months before being sold and dispatched to customers.

- Each unit of production will undergo a one-month processing period on average.

- Suppliers of raw materials offer a credit period of one month from the date of material delivery.

- Debtors are granted a credit period of two months from the date of goods sale.

- The selling price per unit is Rs. 9.

Production and sales follow a consistent pattern with no significant fluctuations. We need to determine the amount of working capital required to finance the activity level of 100,000 units for the year 2020.

Solution: Statement of Working Capital Required:

Current Assets - Theories and Approaches

Notes:

- Raw material inventory is expressed in raw material consumption.

- Work-in-progress inventory is expressed in cost of production (COP) where, COP is deemed to include materials, labour and overheads.

- Finished goods inventory is supposed to have been expressed in terms of cost of sales. Since separate details are not given, the figures are worked out on COP.

- Debtors are expressed in terms of total sales value.

- Creditors are expressed in terms of raw material consumption, since separate figures are not available for purchases.

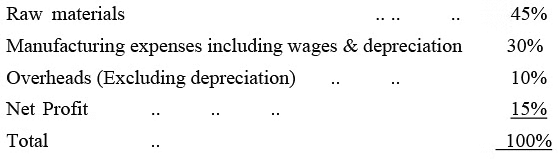

Illustration 3.2

A company plans to achieve annual sales of Rs.1,00,000. What would be its working capital requirements under the following conditions:

- The average period during which raw materials are kept in stock before being issued to factory - 2 months.

- The length of the production cycle i.e., the period from the date of receipt of raw materials by factory to the date of completion of goods - or say stock-in-process - 1/2 month.

- Average period during which finished goods are stocked pending sale- 1 month.

- The period of credit allowed to customers - 1 month.

The period of credit granted by suppliers of raw materials - 1 month. 6) The analysis of cost as a percentage of sales:

Cash available in business to meet urgent requirements is Rs.5,000.

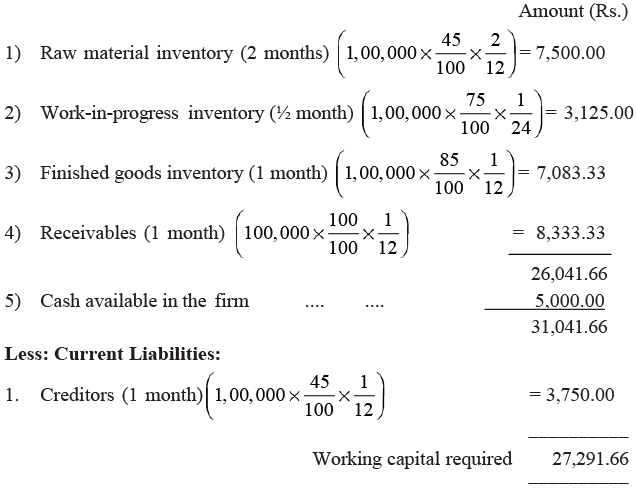

Solution:

Current Assets:

Notes: Workings are made as per assumptions given in Illustration- 3.1 excepting that the finished goods inventory is expressed in terms of cost of sales, which is considered to be inclusive of raw materials, manufacturing expenses and overheads.

Other Factors

In addition to the influence of operating cycle, there are a variety of factors that influence the determination of working capital. A brief explanation of the same is provided hereunder:

Business Nature:

- A company's working capital needs are closely tied to the nature of its business operations. Industries such as public utility services often collect payments in advance from consumers, using these funds to cover current asset requirements.

- As a result, such industries can operate with relatively lower working capital. Conversely, industries like cotton and jute may need to procure raw materials for the entire year during specific harvesting seasons, leading to increased working capital needs during those periods.

Risk Management Perspective:

The attitude of management towards risk also plays a significant role in determining the size of working capital in a company. While it's challenging to precisely define management's risk attitude, principles suggested by Walker offer a basis for policy formulation:

- Variations in working capital relative to sales impact the level of risk a firm assumes, increasing opportunities for gain or loss.

- Capital should be invested in each working capital component as long as the firm's equity position improves.

- The type of capital used to finance working capital directly influences the level of risk assumed, as well as opportunities for gain or loss and the cost of capital.

- Greater disparities between a firm's short-term debt instrument maturities and internally generated fund flows increase risk, and vice versa. In summary, these principles indicate that working capital size policies are contingent on the level of risk management is willing to embrace.

Business Growth and Expansion:

- It's reasonable to assume that growing business operations require larger amounts of working capital. However, there's no straightforward formula to establish a direct correlation between a company's business volume growth and its working capital expansion.

- Importantly, the need for increased working capital funds precedes rather than follows business activity growth. All else being equal, growth industries typically require more working capital than static ones.

Product Policies:

- Depending on the types of items manufactured, companies can adjust production schedules to counter the effects of seasonal fluctuations on working capital. The choice lies between varying output to align inventories with seasonal demands or maintaining a steady production rate and allowing inventory stocks to accumulate during offseasons.

- In the former scenario, inventories are kept at minimum levels, while in the latter, a balance is struck between production and inventory buildup.

- The alternative of maintaining a consistent manufacturing rate helps to mitigate the risk of significant fluctuations in production schedules. However, this approach results in increased inventory levels, which in turn introduces specific risks and costs.

Business Cycle Position:

- In addition to factors such as the nature of the business, manufacturing processes, and production policies, cyclical and seasonal variations also impact the size and dynamics of working capital. During the upswing of the business cycle and peak seasons of operation, a larger working capital amount is needed to bridge the gap between increased demand and receipts.

- Cyclical and seasonal changes predominantly affect working capital size through inventory levels. While opinions among economists differ regarding the behavior of inventory during business cycles, it's evident that cyclical changes influence working capital size.

Terms of Purchase and Sale:

- The terms of purchase and sale also significantly impact a business's working capital. For instance, if a company procures materials on credit and sells finished goods for cash, its working capital requirement is lower compared to a business following the opposite approach of cash purchases and credit sales.

- The management's discretion in setting credit terms, considering prevailing market conditions and industry practices, plays a crucial role in this regard.

Miscellaneous Factors:

- Apart from the aforementioned factors, various other elements such as operational efficiency, profit levels, management's dividend policies, depreciation and reserve practices, changes in price levels, shifts in product demand, competitive conditions, raw material supply uncertainties, government import policies, and business-related risks and contingencies also influence the working capital needs of a business.

FAQs on Management of working capital-Estimation and financing - 1 - Management Optional Notes for UPSC

| 1. What is the importance of determining working capital needs in financial management? |  |

| 2. What are the different approaches to determine working capital needs? |  |

| 3. What factors influence the determination of working capital? |  |

| 4. How is working capital estimation and financing managed? |  |

| 5. How can businesses benefit from effective working capital management? |  |