Costing and Budgetary Control Methods: Relevant Costing for Decision making | Management Optional Notes for UPSC PDF Download

Significance of Relevant Costing in Management Accounting

- In the realm of management accounting, the concept of relevant costing holds substantial importance as it pertains to costs that are pertinent to a specific decision. A relevant cost for a particular decision is one that undergoes a transformation when an alternative course of action is chosen. These costs are also referred to as differential costs.

- Extensive studies have shown that relevant costs play a crucial role in decision-making, as they make a noticeable difference in the outcome. Relevant costs are specifically related to a particular management decision and are expected to change in the future as a consequence of that decision. Some theorists define relevant costs as future costs that will vary among different alternatives. The primary objective of relevant costing is to determine the true cost associated with a business decision.

- This objective measure revolves around the actual cash outflows resulting from the execution of the decision. Relevant costing directs its focus solely on these aspects, disregarding other costs that do not impact future cash flows. The fundamental principles of relevant costing are straightforward, allowing managers to easily relate them to personal experiences involving financial decisions.

The Role of Relevant Costing in Decision-Making

- Theoretical literature emphasizes that relevant costing serves as a vital tool in the management accounting toolkit, aiding management teams in making crucial decisions. These decisions often revolve around determining whether to buy a component from an external vendor or produce it in-house, accepting a special order, setting a price for a special order, discontinuing a product line, or optimizing the use of scarce resources.

- According to the Chartered Institute of Management Accountants (CIMA), relevant costs are defined as "the costs appropriate to a specific management decision." A comprehensive study of relevant costs and benefits is instrumental in making informed decisions.

- To meet the criteria for relevancy, a cost must satisfy two key conditions: it should impact the future, and it should vary among available alternatives. Another group of theorists stresses that relevant costs are those that directly contribute to the decision-making process.

- The usefulness of costs is determined not only by their relevance but also by their precision. It is crucial to recognize that relevance and accuracy are distinct concepts. Costs can be correct but irrelevant, or they may be incorrect yet still relevant.

Understanding Relevant Costs in Decision-Making

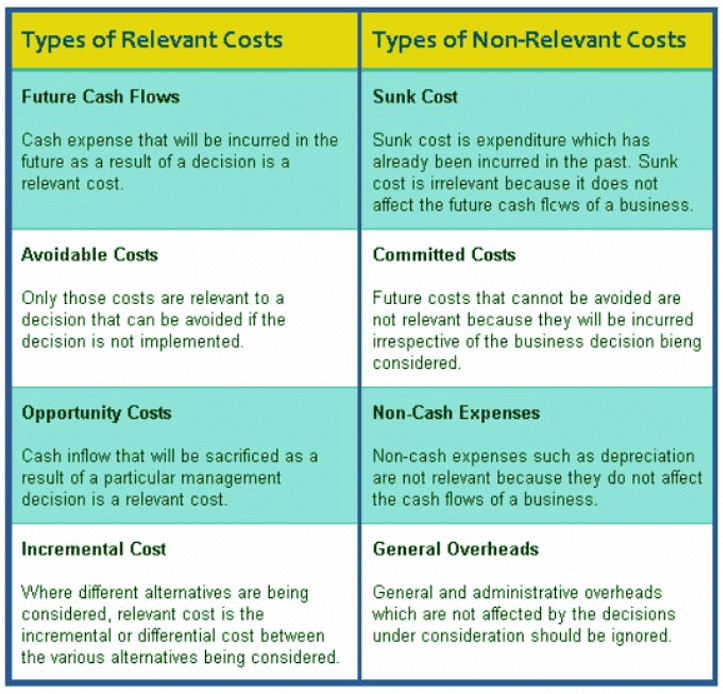

- Relevant information is characterized as the anticipated future costs and incomes that will exhibit variations among different alternatives. In the context of decision-making, relevant costs are those that would undergo changes due to the decision at hand, while irrelevant costs remain unaffected. Therefore, the investigative framework should solely incorporate relevant costs.

- A relevant cost is further defined as a cost whose magnitude will be influenced by the decision in question. Management should consider only future costs and revenues that will diverge under each alternative. In the realm of management accounting, a key aspect of relevant costs is their characteristic of being future costs that have not yet been incurred. For instance, the cost of material remains relevant as long as the material is not purchased. In deciding whether to acquire the material, one must choose whether to incur the cost or avoid it. Consequently, all relevant costs are inherently future costs.

- The determination of whether specific costs and profits are relevant depends on the decision context and the available options. When managers are choosing among different alternatives, they must concentrate on the costs and revenues that fluctuate across these alternatives – these are the relevant costs and revenues.

- The relevance of costs to decision alternatives is contingent on the specific situation, with the facts and policies explaining the context. It is firmly established that historical costs hold no relevance, and only future costs are considered pertinent. Additionally, all sunk costs are deemed irrelevant.

Identification of Relevant Costs in Decision-Making

- Differential Cost: A differential cost pertains to the disparity in cost items between two or more decision alternatives, often distinct projects or situations. If the same cost with the same amount is present in all alternatives, it is deemed irrelevant. Differential costs should be compared against differential revenues.

- Incremental or Marginal Cost: Relevant costing involves an incremental analysis, focusing solely on costs that vary between alternatives and disregarding sunk costs, which are costs that have already been incurred and cannot be altered. Incremental or marginal cost specifically relates to the cost associated with producing an additional unit. To make informed decisions, incremental costs must be juxtaposed with incremental revenues.

- Opportunity Cost: This represents the cost of the opportunities forgone. When an organization chooses a particular project, it must not overlook potential opportunities for other projects. A thorough evaluation of alternative opportunities is essential to determine the most advantageous option.

- Irrelevant Costs: In contrast to relevant costs, sunk costs are considered irrelevant. Sunk costs are expenditures that have already been made and, as such, will remain unchanged moving forward. These costs are associated with past decisions and cannot be altered based on future choices. Additionally, a cost that remains identical across all decisions is deemed immaterial.

Significance and Utility of Relevant Costing

The concept of relevant cost plays a crucial role in eliminating extraneous information during decision-making processes. By excluding irrelevant costs from consideration, management avoids being swayed by data that could potentially distort its decision. It's important to note that relevant cost is pertinent specifically to management accounting activities and does not find applicability in financial accounting, where spending decisions are not a part of the scope. While relevant costing proves to be a valuable tool in short-term financial decisions, it may not be prudent to solely base all pricing decisions on this approach. Long-term sustainability requires a pricing strategy that ensures an adequate profit margin above the total cost, not just the relevant cost.

Several instances illustrate the practical application of relevant costing, including:

- Competitive Pricing Decisions: Businesses utilize relevant costing to make informed decisions about pricing, especially in competitive markets.

- Make or Buy Decisions: When deciding whether to produce internally or purchase externally, relevant costing aids in evaluating the most cost-effective option.

- Further Processing Decisions: In scenarios where additional processing is considered, relevant costing helps assess the feasibility and financial implications.

However, for long-term financial decisions such as investment appraisal, disinvestments, and shutdown decisions, relevant costing might not be suitable. Many costs that may seem non-relevant in the short term can become avoidable and incremental when viewed in the long term. Nevertheless, even in long-term financial decisions, the fundamental principles of relevant costing can facilitate an objective appraisal.

Limitation of relevant costing

There are many limitations of relevant costing:

- For accurate and precise outcomes, careful consideration must be given to each cost element, whether explicit or implicit, before making assumptions in the solution.

- It is inappropriate to proceed based on assumptions within the context of relevant costing. The costs presented in the relevant cost statement are only valid at a specific level of activity. In relevant costing, the period of comparison is often incomplete or incomparable, according to experts.

- Unlike financial analysts who consider cash flow and its timing, the timing of cost and benefit is not deemed crucial in relevant costing. While relevant costing has limitations in handling time factors, it effectively serves the practical objective of profit.

- Another challenge in relevant costing lies in dealing with opportunity costs. The difficulty of estimating opportunity costs can be temporarily addressed by incorporating relevant costing solutions into the calculation of accounting rate of return, also known as average rate of return—a percentage return on investment.

Conclusion

In summary, decision-making is a fundamental aspect of both business and human life. However, in the context of business, informed decision-making is preferred over impulsive choices. Managers, prior to making decisions, should identify the variables influencing the decision and gather relevant information about these variables. Managerial accounting refers to relevant cost as the incremental and avoidable cost associated with implementing a business decision. Relevant cost analysis serves as an evaluation technique grounded in cost accounting principles, representing an enhanced application of these principles to business decisions. The key aspect of relevant costing lies in the ability to discern what is pertinent and what is not in the context of a business decision. This technique is applicable to various special or non-routine situations.

FAQs on Costing and Budgetary Control Methods: Relevant Costing for Decision making - Management Optional Notes for UPSC

| 1. What is relevant costing in management accounting? |  |

| 2. How does relevant costing play a role in decision-making? |  |

| 3. How can relevant costs be identified in decision-making? |  |

| 4. What is the significance and utility of relevant costing? |  |

| 5. How does relevant costing relate to costing and budgetary control methods? |  |