Money Markets: Participants, Structure, and Instruments | Commerce & Accountancy Optional Notes for UPSC PDF Download

Introduction

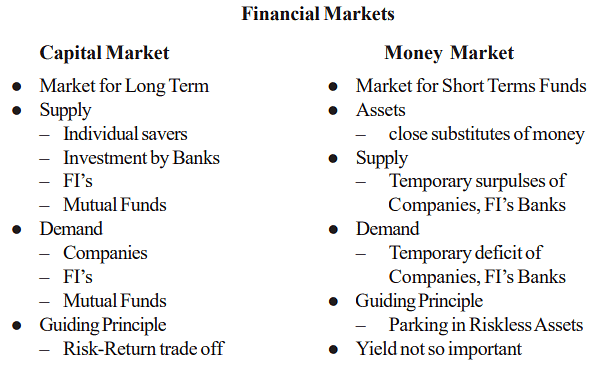

- The debt market is commonly divided into the money market, which deals with short-term debt maturing within a year, and the capital market, which focuses on long-term debt. This distinction arises because these sectors respond to different market dynamics and cater to diverse needs of market participants. This unit aims to explore the nature, operation, and advancements within the Money Market.

- Despite meticulous cash-flow planning by banks and financial institutions, they frequently encounter disparities between actual cash inflows and outflows on any given day. These shortfalls or surpluses are typically of a short-term nature. While commercial enterprises can rely on their banks to manage such situations, banks and financial institutions facing temporary shortages cannot defer their obligations and must meet them promptly to avoid triggering a run on the banks. Conversely, those with temporary surpluses seek very short-term investment opportunities, necessitating utmost safety and minimal risk.

- Any default or delay in such transactions could lead to unnecessary complications for these institutions. It's crucial to recognize that these "investments" are not traditional long-term investments but rather short-term deployment of funds in search of modest returns. Thus, investments in the money market are not guided by the conventional risk-return trade-off but instead prioritize safety and reliability. Money markets are distinctly separate from capital markets.

Functions and Features of Money Markets

The money market encompasses a marketplace for money and assets closely interchangeable with money. Put simply, it deals with assets that can be readily converted into cash without capital loss. It primarily caters to short-term funds, typically with maturities of up to one year. The money market is tasked with several key functions:

- Equilibrating Demand and Supply: It acts as a mechanism to balance the demand for and supply of short-term funds.

- Central Bank Intervention: It serves as a focal point for central bank involvement in influencing liquidity and overall interest rate levels in the economy.

- Access to Short-Term Funds: It facilitates accessible avenues for both providers and users of short-term funds to meet their borrowing and investment needs at an efficient market-clearing price.

Therefore, the money market serves as a vital platform for short-term fund transactions. By accommodating the surplus funds of lenders and the short-term needs of borrowers, ranging from overnight to one year, it plays a crucial role in financial markets. Additionally, it serves as a conduit for central bank interventions, enabling the implementation of monetary policy initiatives.

Evolution of Money Market in India since the mid-eighties

Acknowledging the necessity for financial system reforms in India, the Reserve Bank of India (RBI) established a committee to Review the Working of the Monetary System chaired by Shri Sukhamoy Chakravarty in 1985. While this committee provided comprehensive recommendations for financial system reforms, it emphasized the significance of the Money Markets as a distinct segment requiring in-depth examination. Consequently, the RBI formed a Working Group on Money Market chaired by Shri N. Vaghul, which presented its Report in 1987. Building upon these recommendations, the RBI initiated several measures in the 1980s to broaden and strengthen the money market. Key initiatives included:

- Establishment of the Discount and Finance House of India (DFHI) in 1988, jointly by the Reserve Bank of India, public sector banks, and financial institutions, to infuse liquidity into money market instruments and foster the development of a secondary market for such instruments. Subsequently, RBI divested its shareholding, leading to the takeover of DFHI by SBI and its merger with SBI Gilts to form SBI DFHI Ltd.

- Introduction of new money market instruments such as Commercial Paper, Certificates of Deposit, and Interbank Participation Certificates in 1988-89, aimed at broadening the array of available instruments.

- Gradual removal of the interest rate ceiling on call money from October 1988 to facilitate price discovery. Initially, DFHI's operations in the call/notice money market were exempted from the interest rate ceiling in 1988, followed by the complete withdrawal of the interest rate ceiling in May 1989 for all participants in the call/notice money market, interbank term money, rediscounting of commercial bills, and Interbank Participation Certificates without risk. Presently, most money market interest rates are predominantly determined by market forces.

Following this, institutions similar to DFHI, known as Primary Dealers (PDs), were permitted to be established. Presently, India has approximately 16 PDs, both in the public and private sectors. These PDs play a pivotal role in the money market as market makers, actively participating in Treasury Bills and Government Bonds auctions. Consequently, they engage in the purchase, holding, and sale of Government Debt (Primary Securities).

Money Market Instruments

As previously mentioned, institutions with temporary surpluses typically seek low-risk investments. Consequently, there is a need for specialized instruments in this market, known as Money Market Instruments. These instruments are outlined below.

Characteristics of Money Market Transactions:

- Short-Term Duration

- Utilization of Instruments with Minimal Risk

- Negligible Transaction Costs

- Absence of Transactional Hassles

- High Transaction Volumes

- Thus, the efficiency of the market relies on:

- Low-Cost Transactions

- Availability of Information

- Participation of a Large Number of Market Players

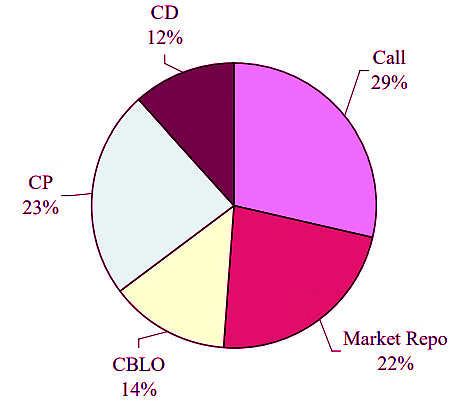

The following figure illustrates the distribution of various instruments within the total money market in India.

Call Money Market

Call Money Market

Call Money constitutes the overnight inter-bank funds market in India, characterized by the following features:

- Overnight funds or deposits are involved.

- Participants include banks, primary dealers, and restricted financial institutions.

- Demand and supply dynamics are driven by temporary surpluses or deficits of banks and primary dealers.

- While the market is deregulated and subject to market forces, participation is limited to banks and primary dealers.

- Transactions typically involve clean lending, in the form of a deposit.

- Interest rates are deregulated, determined by market forces, and exhibit volatility, with wide fluctuations even within a single day.

- High-value transactions are common, and brokers are not permitted.

Until 1990, the call/notice money market primarily served as an interbank market, with exceptions like UTI and LIC, which operated as lenders from 1971. RBI gradually liberalized entry into the call/notice money market to enhance liquidity. Behavior among banks in this market varies, with some active as borrowers, particularly foreign banks and new private sector banks, while others, notably public sector banks, are major lenders. RBI plays a significant role in moderating liquidity and volatility through repos, refinance operations, and changes in cash reserve ratio maintenance procedures. A reference rate called "MIBOR" (Mumbai Interbank Offer Rate), akin to LIBOR, has emerged through the National Stock Exchange and Reuters, serving as a benchmark in the overnight call money market.

Commercial Paper (CP)

- Commercial Paper is a money market instrument issued by highly rated corporates in the form of a discounted promissory note with a fixed maturity. It was introduced in India in 1989 to allow top-rated corporate borrowers to diversify their short-term borrowing sources and offer investors an additional instrument. The Reserve Bank stipulates the terms and conditions for CP issuance, including eligibility criteria, modes of issuance, maturity periods, denominations, and issuance procedures.

- CPs have no interest rate restrictions, and over time, various refinements have been made, such as easing restrictions on maturity and size, eliminating the requirement of minimum current ratio, and restoring working capital finance. Eligible entities, including corporates, primary dealers (PDs), and satellite dealers (SDs), can issue CPs with a minimum maturity period of 15 days and a maximum period of one year. There is no lock-in period for CP, and its issuance is often inversely related to money market rates.

Certificates of Deposit (CDs)

Certificates of Deposit represent securitized and tradable term deposits mobilized by banks, enabling ordinarily non-tradable deposits to become tradable. They were introduced in India in 1989, with the Reserve Bank stipulating eligibility criteria, maturity periods, size, transferability, reserve requirements, and other terms and conditions for issuance. CDs typically represent a relatively high-cost liability, and banks usually resort to this source when deposit growth is sluggish but credit demand is high.

Treasury Bills (T-Bills)

Treasury Bills are short-term government borrowing instruments crucial for government cash management. Key characteristics of T-Bills include:

- Short-term debt of the Government of India with a maturity of less than a year.

- Issued through the Reserve Bank of India (RBI) at a discount to face value and redeemed at face value.

- Available in maturities of 91, 182, and 364 days, issued via weekly or fortnightly auctions allowing competitive and non-competitive bids.

- Open to investment by anyone with a minimum investment requirement of Rs 25,000.

- Features a robust secondary market and is eligible for Reverse Repo transactions with the RBI.

T-Bills, being risk-free, serve as short-term benchmarks for pricing various floating-rate products and are preferred by central banks for market interventions to influence liquidity and short-term interest rates. Streamlined auction procedures ensure notified amounts for all auctions and acceptance of non-competitive bids outside the notified amounts.

Repurchase Agreements (Repos)/Ready Forward Transactions

A repurchase agreement, or repo, is a transaction where a participant immediately obtains funds by selling securities while simultaneously agreeing to repurchase the same or similar securities at a predetermined price after a specified period. Here are its key characteristics:

- Combination of a Ready Transaction and a Forward Deal: It involves the simultaneous sale of an asset today and an agreement to repurchase the same asset on a future date at a price fixed today.

Two Legs: The transaction comprises two parts:

- Sale: The asset is given, and rupees are received, with the title passing on 'day one.'

- Repurchase: Rupees are given, and the asset is received back, with the title restored on the maturity date.

Blend of Securities Purchase/Sale and Money Market Borrowing/Lending: Repos combine elements of both a securities purchase/sale operation and a money market borrowing/lending operation, typically representing lending on a collateralized basis.

- Use of Repo Rate: The contract terms are expressed in terms of a "repo rate," representing the money market borrowing/lending rate and helping to equilibrate demand and supply of short-term funds.

- Types of Repos: Two types of repos are prevalent - interbank repos and RBI repos. Interbank repos are permitted under regulated conditions, while RBI repos are utilized for liquidity absorption/injection.

- Eligibility Expansion: All government securities are now eligible for repo, and besides banks, primary dealers can undertake both repo/reverse repo transactions.

- Removal of Restrictions: RBI has removed the minimum period restriction for interbank repo transactions, enhancing liquidity adjustment flexibility.

Collateralized Borrowing and Lending Obligation (CBLOs)

CBLOs facilitate borrowing and lending funds against securities through a platform provided by the Clearing Corporation of India Ltd (CCIL). Here are its key features:

- Mechanism for Borrowing and Lending: CBLOs enable lenders and borrowers, including banks, primary dealers, financial institutions, mutual funds, non-banking finance companies, and corporates, to come together.

- Flexible Maturities: CBLOs have short maturities of up to 90 days, overcoming limitations of the repo market where obligations can only be settled on the due date.

- Tradable Nature: CBLO holders can sell, and investors can buy them at any time during their tenure.

- Auction-Based Trading: CBLOs are traded through auction screens called 'auction market,' with bids/offers matched based on the best quotations.

- Settlement Process: Net liabilities and receivables for each participant are settled at the end of the day, with borrowing limits determined by CCIL based on securities valuation after a 'haircut.'

- Effective Cash Management: CBLOs serve as a useful cash management instrument for banks and corporate firms.

Money Market Mutual Funds (MMMFs)

MMMFs were introduced in India in April 1991 to offer investors an additional short-term avenue and bring money market instruments within reach. Here are its key aspects:

- Portfolio Composition: MMMF portfolios consist of short-term money market instruments, offering investors yields close to short-term money market rates with adequate liquidity.

- Scheme Introduction: A detailed scheme for MMMFs was announced by the Reserve Bank in April 1992, following recommendations from a Task Force.

- Growth Dynamics: Despite the expectation of significant growth, MMMFs have experienced less growth than anticipated.

Factors Influencing Money Markets in India

Numerous factors influence and impact money markets in India, with the Reserve Bank of India (RBI) being the foremost influencer. Given its role in monetary policy, the RBI directly regulates the money market. Its primary objective is to maintain liquidity and short-term interest rates consistent with monetary policy goals, including price stability, adequate credit flow to productive sectors, and orderly conditions in the foreign exchange market. The RBI influences liquidity and interest rates through various mechanisms:

- RBI Intervention and Signaling through the Money Market

RBI Repo:

- Involves selling Government of India (GOI) bonds from its holdings and repurchasing them.

- Borrows from the market to absorb liquidity, influencing interest rates as a "floor."

RBI Reverse Repo:

- Involves buying GOI bonds into its holdings and selling them back.

- Lends to banks/Primary Dealers (PDs) to inject liquidity, influencing interest rates as a "ceiling."

Liquidity Adjustment Facility (LAF)

- Recommended by the Narasimham Committee, LAF operates in conjunction with Open Market Operations (OMO).

- Features daily reset of repo and reverse repo rates by the RBI.

- Conducted through auctions for borrowing or injecting funds.

- Ensures fine-tuning of money supply, liquidity, and interest rates.

- OMO sales or purchases by the RBI on its own account also influence liquidity.

LAF has a longer-term impact compared to other mechanisms.

- The essence of LAF lies in the RBI's continuous presence in the money market via repo operations. While reverse repos absorb excess liquidity at a specified rate (floor), repos inject liquidity at a set rate (ceiling). The floor and ceiling rates established by the repo window create an effective corridor for call money market operations. Adjustment of these rates reflects the RBI's policy stance on liquidity easing or tightening. While the repo window has effectively operated on the floor side, supplying liquidity at a cap rate considers various factors.

|

Download the notes

Money Markets: Participants, Structure, and Instruments

|

Download as PDF |

Money Market and Monetary Policy in India

- The relationship between the money market and monetary policy in India holds significant importance.

- A central bank aims to influence monetary conditions by managing liquidity through various instruments. In a regulated monetary and financial market environment, liquidity management primarily involves direct instruments such as adjusting cash reserve requirements, setting limits on refinance facilities, controlling interest rates, and imposing quantitative and qualitative credit restrictions. Consequently, the cost, accessibility, and direction of fund flows are directly influenced by the central bank.

- In contrast, in a deregulated and liberalized market setting, where interest rates are predominantly determined by market forces, the approach shifts. While the need to influence monetary conditions remains, it must be achieved mainly through market-based instruments like open market operations and refinance/discount/repo facilities. In this scenario, the central bank becomes integrated into the market dynamics, although it retains authority over primary liquidity.

- The efficacy of market-based indirect instruments hinges on the existence of a robust, liquid, and efficient money market seamlessly integrated with other financial market segments, notably government securities and foreign exchange markets. Such integration is essential for ensuring that monetary policy signals transmitted through money market interventions are effectively reflected in monetary conditions via the transmission channel of general interest rates.

- A deeper exploration of monetary policy will be undertaken in a subsequent unit of the course, providing a more detailed analysis of its mechanisms and impacts.

Conclusion

- Introduction to the short-term funding market, specifically focusing on India. It began by differentiating between capital markets and money markets, then proceeded to outline the key characteristics and functions of the money market.

- The unit then shifted its focus to the state of money markets in India, detailing their growth and development since the mid-1980s. It provided a thorough examination of various money market mechanisms operating within India.

- Subsequently, the unit delved into the factors influencing money market operations, highlighting the significant role of the Reserve Bank of India's policies as the primary driver of market dynamics.

- Finally, the unit briefly touched upon monetary policy and its implications for the money market.

|

180 videos|153 docs

|

FAQs on Money Markets: Participants, Structure, and Instruments - Commerce & Accountancy Optional Notes for UPSC

| 1. What are the functions and features of Money Markets? |  |

| 2. How has the Money Market evolved in India since the mid-eighties? |  |

| 3. What are some of the key Money Market instruments used in India? |  |

| 4. What factors influence Money Markets in India? |  |

| 5. How does the Money Market impact monetary policy in India? |  |