Overview of the Indian Contract Act 1872 | Civil Law for Judiciary Exams PDF Download

Introduction

- Enacted On: 25th April 1872

- Came into Force: 1st September 1872

- Purpose: To provide a legal framework governing contracts in India.

- Initial Scope:

- General Principles (Sections 1–75)

- Sale of Goods (Now under Sale of Goods Act, 1930)

- Partnership (Now under Indian Partnership Act, 1932)

Definition of a Contract (Section 2(h))

Definition: “An agreement enforceable by law is a contract.”

- Agreement: Formed by a valid offer and acceptance.

- Offer (Sec 2(a)): Proposal to enter into a contract.

- Acceptance (Sec 2(b)): Unequivocal consent to the offer.

- Enforceability: Creates legal obligations.

Key Formula:

- Agreement = Offer + Acceptance

- Contract = Agreement + Enforceability

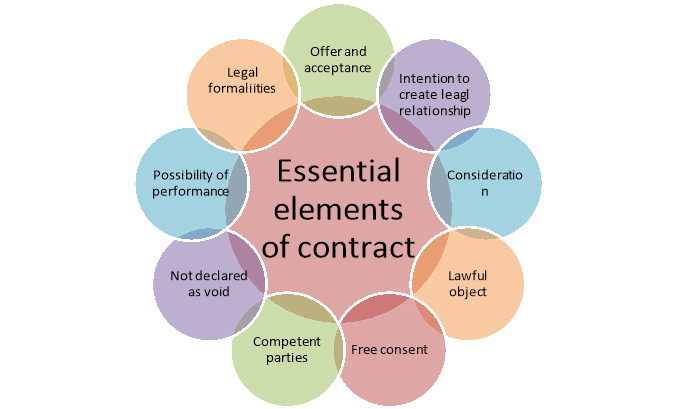

Essential Elements of a Valid Contract (Section 10)

1. Offer and Acceptance (Sections 2(a)–2(b))

- Offer: Clear, communicated, capable of acceptance.

- Acceptance: Must be absolute, unconditional, and communicated.

- Example: A offers to sell car to B for ₹5,00,000. B accepts.

2. Intention to Create Legal Relationship

- Must intend legal consequences.

- Example:Balfour v. Balfour (1919) – domestic agreement not enforceable.

3. Lawful Consideration (Section 2(d))

- Something of value exchanged; lawful and real.

- Example: A pays ₹1,000 to B, and B delivers goods.

4. Capacity to Contract (Section 11)

- Parties must be major (18+), of sound mind, and not disqualified.

- Incompetent: Minors, unsound mind, disqualified persons.

5. Free Consent (Sections 13–22)

Consent must be free from:

- Coercion (Sec 15)

- Undue Influence (Sec 16)

- Fraud (Sec 17)

- Misrepresentation (Sec 18)

- Mistake (Sec 20–22)

Non-free consent makes the contract voidable.

6. Lawful Object (Section 23)

- Object must not be illegal, immoral, or against public policy.

- Illegal objects make contract void.

7. Not Expressly Declared Void (Sections 23–30)

Must not be in restraint of:

- Marriage (Sec 26)

- Trade (Sec 27)

- Legal proceedings (Sec 28)

- Wagering agreements (Sec 30) are void.

8. Certainty and Possibility of Performance (Sections 29–36)

- Terms must be clear, definite.

- Performance must be possible.

- Contingent contracts are valid if event is possible.

Key Doctrines

A. Offer and Acceptance (Sections 2(a) and 2(b))

Offer (Section 2(a))

Definition: A proposal made by one person (the offeror) to another (the offeree) expressing willingness to enter into a contract on specific terms, with the intention that it will become binding once accepted.

Characteristics of a Valid Offer:

- Must be clear, definite, and capable of acceptance.

- Must be communicated to the offeree.

- Can be express (spoken or written) or implied (inferred from conduct).

- May be specific (made to a particular person) or general (made to the public at large).

- Must intend to create legal relations.

Types of Offers:

- Unilateral Offer: A promise in exchange for an act.

- Bilateral Offer: A promise in exchange for a promise.

Termination of Offer:

- Revocation by the offeror (before acceptance).

- Rejection by the offeree.

- Lapse of time (if time-bound).

- Failure of a condition precedent.

- Death or insanity of the offeror or offeree.

Case Law: Carlill v. Carbolic Smoke Ball Co. (1893)

- Facts: Company offered £100 for using their product and still contracting influenza. Mrs. Carlill did so and claimed the reward.

- Held: It was a unilateral offer accepted by performance. The deposit of £1,000 showed intention to be bound.

- Significance: General offers can be accepted by performing the required act; unilateral contracts are binding once performed.

Acceptance (Section 2(b))

Definition: When the offeree signifies assent to the terms of the offer.

Characteristics of Valid Acceptance:

- Must be absolute and unqualified.

- Must be communicated to the offeror.

- Must be made in the prescribed or reasonable mode.

- Must occur before revocation or lapse.

Rules for Acceptance:

- Silence is not acceptance unless agreed.

- Postal rule: Acceptance effective on posting.

- Instant communication: Acceptance effective on receipt.

Key Points: An offer + valid acceptance = agreement.

B. Consideration (Section 2(d))

Definition: Something given in return for a promise (quid pro quo).

Characteristics of Valid Consideration:

- Must be real and lawful.

- May move from promisee or any other person.

- Can be past, present, or future.

- Need not be adequate, but must be sufficient.

- Must be at the promisor's desire.

Case Laws:

- Chinnaya v. Ramaya (1882): Consideration may move from a third party.

- Currie v. Misa (1875): Consideration is benefit to one party or detriment to the other.

Exceptions (Section 25):

- Written and registered agreement of natural love and affection.

- Promise to compensate for past voluntary act.

- Promise to pay a time-barred debt.

C. Doctrine of Privity of Contract

Definition: Only parties to a contract can sue or be sued.

Case Law:

- Dunlop v. Selfridge (1915): Dunlop could not sue Selfridge due to lack of privity.

Exceptions:

- Beneficiary under a trust.

- Marriage settlement.

- Assignment of contract.

- Family arrangements.

- Acknowledged agent.

D. Free Consent (Sections 13–22)

Definition (Section 13): Parties agree upon the same thing in the same sense.

Vitiating Factors:

- Coercion (Sec 15): Threat or unlawful act. Contract is voidable.

- Undue Influence (Sec 16): Dominance exploited. Case: Raghunath Prasad v. Sarju Prasad (1924)

- Fraud (Sec 17): Intentional deception. Contract is voidable + damages possible.

- Misrepresentation (Sec 18): Innocent misstatement. Voidable but no damages.

- Mistake (Sec 20–22): Bilateral mistake = void; Unilateral mistake = valid unless induced.

Effects:

- Voidable: For coercion, undue influence, fraud, misrepresentation.

- Void: For bilateral mistake.

- Restitution: Benefits must be restored (Sec 64) if contract is rescinded.

Key Point: Free consent is essential for a valid contract and protects fairness in agreements.

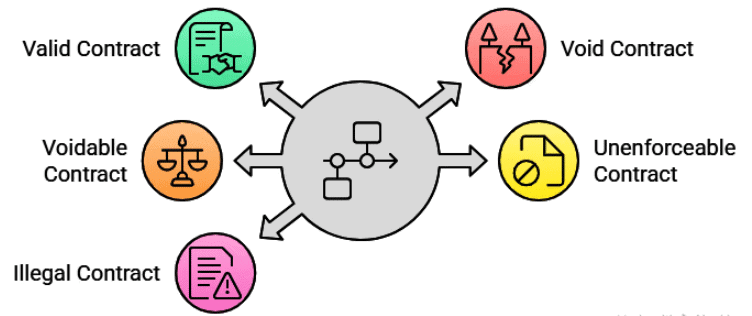

Types of Contracts under Indian Contract Act

Contracts can be classified based on enforceability into the following types:

Contracts can be classified based on enforceability into the following types:

1. Valid Contract

Definition: A contract that satisfies all the essential elements under Section 10 of the Indian Contract Act and is legally enforceable.

Characteristics:

- Free consent of parties

- Lawful consideration

- Lawful object

- Competent parties

- Not expressly declared void

- Intention to create legal relationship

Example: A agrees to sell his car to B for ₹1,00,000. Both agree voluntarily and fulfill legal requirements. This is a valid contract.

2. Void Contract

Definition: A contract that was valid at the time of formation but becomes unenforceable by law later, or is void ab initio (from the beginning).

Causes:

- Supervening impossibility (Section 56 – impossibility of performance)

- Illegality of object or consideration discovered later

- Lack of essential element like free consent or competence

Example: A contracts with B to sell a house, but before the transfer, the house is acquired by the government. The contract becomes void.

3. Voidable Contract

Definition: A contract that is valid and enforceable unless the aggrieved party chooses to void it due to certain defects like coercion, misrepresentation, undue influence, etc.

Causes:

- Coercion (Section 15)

- Undue Influence (Section 16)

- Fraud (Section 17)

- Misrepresentation (Section 18)

- Minor’s contract (if one party is not competent)

Example: A, under threat, agrees to sell his land to B. A may later rescind the contract. Hence, it is voidable at A’s option.

4. Unenforceable Contract

Definition: A contract that is otherwise valid but cannot be enforced due to some technical legal defect (e.g., lack of stamp duty, limitation period, improper documentation).

Characteristics:

- No remedy in court unless rectified

- Becomes enforceable when technical defect is removed

Example: A contract that is required to be in writing but is made orally — though valid, it is unenforceable until reduced to writing.

5. Illegal Contract

Definition: A contract whose object or consideration is unlawful, as per Sections 23 and 24 of the Indian Contract Act.

Characteristics:

- Void ab initio (from the beginning)

- No legal remedies are available

- Collateral agreements are also void

- Against public policy, morality, or involves criminal activities

Example: A contracts with B to smuggle goods across the border. Such a contract is illegal and cannot be enforced.

Performance of Contract (Sections 37–67)

The performance of a contract refers to the fulfillment of contractual obligations by the parties involved as per the agreed terms.

Section 37: Obligation of Parties to Contracts

According to Section 37 of the Indian Contract Act, the parties to a contract are bound to perform, or offer to perform, their respective promises, unless such performance is dispensed with or excused under the provisions of this Act or any other law.

Who Must Perform?

- Promisor: Generally, the promisor is bound to perform the contract.

- Agent: Performance can be done by the promisor or by an agent, unless personal skill or confidence is involved.

- Legal Representatives: In case of death of the promisor, legal heirs are bound unless the contract involves personal skill.

Example: A contracts to paint a portrait of B. Only A must perform it, not his agent or legal heir.

Types of Performance

- Actual Performance: When both parties fulfill their respective obligations.

- Attempted Performance (Tender): When the promisor offers to perform, but the promisee refuses to accept it.

Discharge of Contract by Performance (Sec 37–67)

A contract is said to be discharged when the obligations arising under the contract come to an end.

Modes of Discharge:

1. By Performance: Actual or attempted performance by all parties.

2. By Mutual Agreement: Novation, alteration, rescission, remission.

3. By Impossibility: Initial or supervening impossibility (Section 56).

4. By Breach of Contract: Actual or anticipatory breach.

5. By Operation of Law: Death, insolvency, or merger of rights.

Time as the Essence of Contract

Section 55 of the Indian Contract Act deals with the consequences of not performing a contract within the stipulated time.

- If time is of the essence: Delay makes the contract voidable at the option of the aggrieved party.

- If time is not of the essence: The contract is not voidable, but compensation for delay can be claimed.

Example: A agrees to deliver goods to B for Diwali. If delay defeats the purpose of the contract, B can treat it as voidable.

Breach of Contract and Remedies (Sections 73–75)

Breach of Contract

Definition: A breach of contract occurs when one party fails to perform their obligations under the contract, either wholly or partly, without lawful excuse, or refuses to perform before the performance is due (anticipatory breach).

Types of Breach:

- Actual Breach:Failure to perform obligations when performance is due.

- Example: A agrees to deliver goods to B on 1st April but fails to do so.

- Anticipatory Breach (Section 39):When a party declares their intention not to perform the contract before the performance is due.

- Example: A informs B on 15th March that they will not deliver goods due on 1st April.

- Effects: The other party can either terminate the contract immediately or wait until the due date.

Consequences of Breach:

- The aggrieved party is entitled to remedies under Sections 73–75 of the Indian Contract Act, 1872.

- The contract may be terminated, or damages may be claimed, depending on the nature of the breach.

Remedies for Breach of Contract

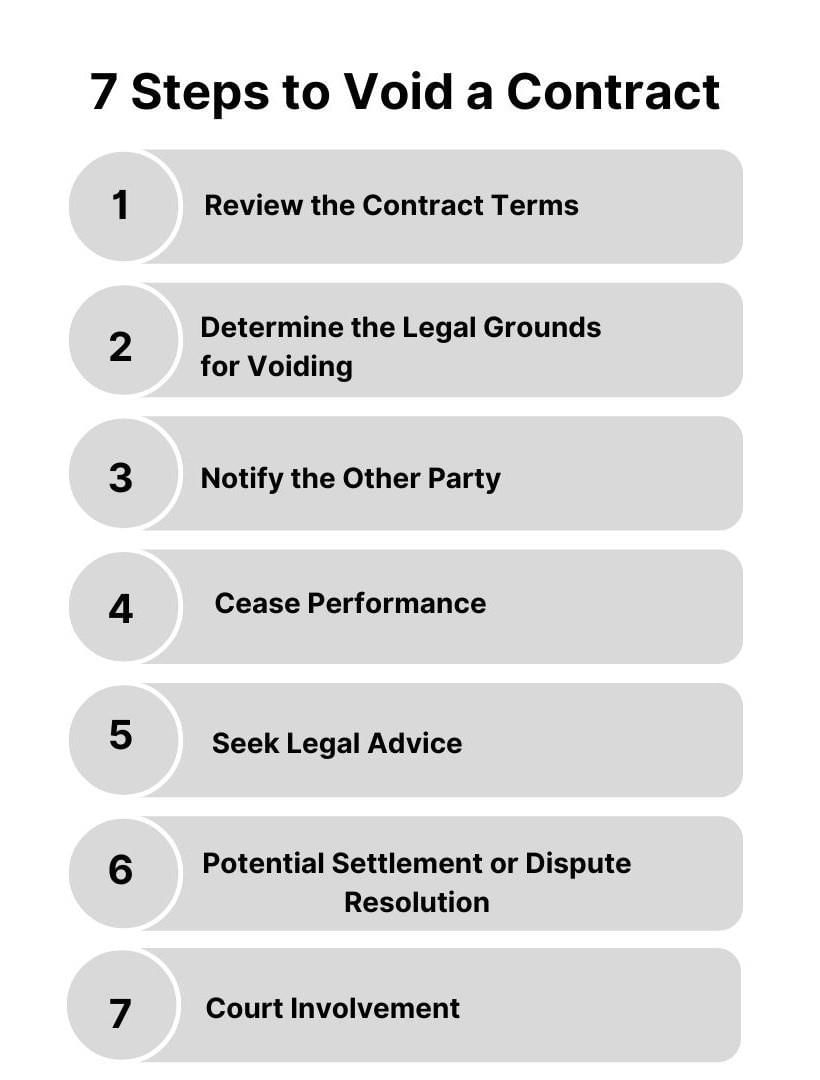

When a contract is breached, the aggrieved party can seek remedies to compensate for the loss or enforce the contract. The remedies under the Indian Contract Act, 1872, include:

2.1 Damages (Section 73)

Definition: Damages are monetary compensation awarded to the aggrieved party to cover the loss suffered due to the breach of contract. They are compensatory in nature, aimed at placing the aggrieved party in the position they would have been in had the contract been performed.

Types of Damages:

Compensatory Damages:To compensate for the actual loss suffered.- General/Ordinary Damages:Direct and natural consequences of the breach.

- Example: Loss of profit due to non-delivery of goods.

- Special Damages:Indirect losses that were foreseeable and within the contemplation of the parties at the time of contracting.

- Example: Loss of a specific business deal due to delayed delivery, if the breaching party was aware of the deal.

- Nominal Damages:Awarded when a breach occurs but no actual loss is suffered.

- Example: A minor technical breach with no financial impact.

- Exemplary/Punitive Damages: Rarely awarded in contract law; used to punish the breaching party for malicious or egregious conduct (not common in Indian law).

Rules for Awarding Damages (Section 73):

- Damages are awarded only for losses that are a direct and natural result of the breach or were reasonably foreseeable by both parties at the time of contracting (Hadley v. Baxendale, 1854).

- The aggrieved party must mitigate their loss by taking reasonable steps to minimize it.

- Damages cannot be claimed for remote or indirect losses unless specifically contemplated.

Case Law: Hadley v. Baxendale (1854)

- Facts: A mill’s crankshaft broke, and the carrier delayed delivering it for repair, causing the mill to remain idle. The mill owner claimed damages for loss of profits.

- Held: The carrier was liable only for damages that were a natural consequence of the delay or foreseeable at the time of contracting. Since the carrier was not informed of the mill’s dependency on the crankshaft, they were not liable for the loss of profits.

- Significance: Established the rule that damages are limited to those that are reasonably foreseeable or within the contemplation of the parties.

2.2 Specific Performance

Definition: A court order directing the breaching party to perform their contractual obligations. It is an equitable remedy granted when damages are inadequate.

Conditions for Specific Performance:

- The contract must be specific and certain.

- Damages must be an inadequate remedy (e.g., for unique goods or immovable property).

- Not granted for contracts involving personal services or continuous supervision.

Example: A agrees to sell a rare painting to B but later refuses. Since the painting is unique, B can seek specific performance to compel A to deliver it.

2.3 Injunction

Definition: A court order restraining a party from doing an act that breaches the contract (prohibitory injunction) or compelling them to perform a specific act (mandatory injunction).

Application:

- Commonly used to prevent a party from breaching a negative covenant (e.g., non-compete clause).

- Not granted if it indirectly enforces personal service contracts.

Example: A agrees not to work for a competitor but joins one. The employer can seek an injunction to restrain A from working for the competitor.

2.4 Restitution (Section 65)

Restitution Procedure

Restitution Procedure

Definition: When a contract is void or becomes void, any party who received a benefit under it must restore it to the other party.

Application:

- Applies to void contracts or contracts rescinded due to breach.

- Ensures no party is unjustly enriched.

Example: A pays B ₹10,000 as an advance for goods, but B fails to deliver. A can claim restitution of the ₹10,000.

Penalty vs. Liquidated Damages in Indian Law (Section 74)

Definition: Liquidated damages and penalties are sums stipulated in the contract to be paid in case of a breach. Section 74 of the Indian Contract Act, 1872, governs their enforceability.

Liquidated Damages:

- A genuine pre-estimate of the loss likely to be caused by the breach, agreed upon by the parties at the time of contracting.

- Reasonable and proportionate to the anticipated loss.

- Enforceable under Section 74, provided the actual loss is proved or the amount is reasonable.

Penalty:

- A sum stipulated to coerce performance or deter breach, not based on a genuine estimate of loss.

- Excessive or disproportionate to the actual loss.

- Not enforceable as such; courts award only reasonable compensation, not the penalty amount.

Distinction in Indian Law:

Aspect | Liquidated Damages | Penalty |

|---|---|---|

Purpose | To pre-estimate and compensate for actual loss. | To deter breach or coerce performance. |

Amount | Reasonable and proportionate to expected loss. | Excessive and disproportionate to loss. |

Enforceability | Enforceable if reasonable and actual loss is proved. | Not enforceable; courts award only reasonable compensation. |

Indian Law (Section 74) | Courts award the stipulated amount or less, based on actual loss. | Courts disregard the penalty and award reasonable compensation. |

Section 74 Rule:

- Indian law does not distinguish strictly between liquidated damages and penalties. Whether the stipulated sum is labeled as liquidated damages or a penalty, the court will award only reasonable compensation not exceeding the stipulated amount.

- The aggrieved party must prove actual loss, unless the loss is difficult to quantify.

Case Law: Fateh Chand v. Balkishan Dass (1963)

- Facts: A contract for the sale of property included a clause that ₹25,000 paid as earnest money would be forfeited on breach. The buyer defaulted, and the seller sought to retain the entire amount.

- Held: The forfeiture clause was a penalty. The seller was entitled to reasonable compensation for the actual loss suffered, not the entire ₹25,000.

- Significance: Established that courts will award only reasonable compensation under Section 74, regardless of whether the stipulated sum is a penalty or liquidated damages.

- Example: A contract stipulates that if A fails to deliver goods on time, they will pay B ₹50,000. If the actual loss to B is ₹20,000, the court will award only ₹20,000, regardless of whether the ₹50,000 was labeled as liquidated damages or a penalty.

Quantum Meruit

Definition: Quantum meruit (Latin for “as much as deserved”) is a remedy that allows a party to claim reasonable compensation for work done or services rendered under a contract when the contract is not fully performed or is void.

Application:

- Applies when a contract is discharged by breach, impossibility, or is discovered to be void.

- The claimant is entitled to payment for the work done or benefit provided, proportionate to the extent of performance.

- Based on the principle of preventing unjust enrichment.

Conditions for Quantum Meruit:

- Work or services must have been performed under a contract or with the expectation of payment.

- The other party must have received a benefit from the work.

- The contract must have been terminated or void, preventing full performance.

Scenarios Where Quantum Meruit Applies:

- Breach by the Other Party: If one party prevents the other from completing performance, the performing party can claim for work done. Example: A hires B to paint a house but terminates the contract after half the work is done. B can claim quantum meruit for the work completed.

- Void Contract: If a contract is discovered to be void, the party who performed can claim reasonable compensation. Example: A delivers goods under an agreement that is later found to be void. A can claim quantum meruit for the value of the goods.

- Partial Performance Accepted: If partial performance is accepted by the other party, the performing party can claim for the work done.

Case Law: Planche v. Colburn (1831)

- Facts: The plaintiff was contracted to write a book for a publisher but was prevented from completing it when the publisher abandoned the project. The plaintiff had already done significant work.

- Held: The plaintiff was entitled to quantum meruit for the work done, as the publisher’s breach prevented full performance.

- Significance: Established that a party can claim reasonable compensation for partial performance when the other party causes the breach.

Discharge of Contracts

A contract is discharged when the obligations under it are terminated, and the parties are released from their duties. Discharge of a contract can occur in various ways, as outlined below.

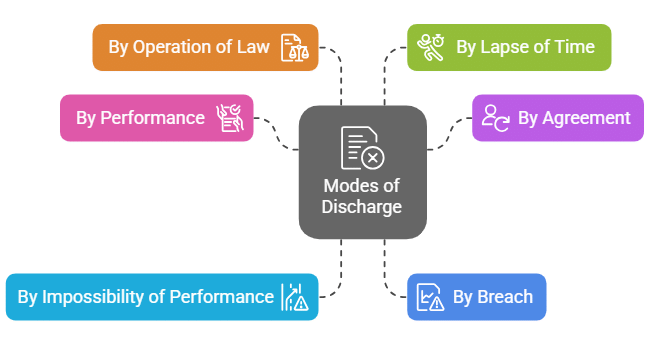

Modes of Discharge

- By Performance : A contract is discharged when both parties fulfill their obligations as per the terms.

Types of Performance:- Actual Performance: When obligations are fully performed.

- Attempted Performance (Tender): When one party offers to perform but the other refuses.

- Example: A agrees to deliver 100 kg of rice to B, and B agrees to pay ₹5000. If A delivers the rice and B pays the amount, the contract is discharged by performance.

- By Agreement: Parties may mutually agree to terminate the contract or alter its terms.

Methods:- Novation: Substituting a new contract for the old one.

- Rescission: Canceling the contract before performance is due.

- Alteration: Changing the terms of the contract with mutual consent.

- Remission: Accepting lesser performance than originally agreed.

- Waiver: Voluntarily relinquishing a right under the contract.

- Example: A and B agree that instead of delivering goods, A will pay B ₹10,000. This novation discharges the original contract.

- By Impossibility of Performance (Frustration): A contract becomes void if performance becomes impossible due to unforeseen events (Doctrine of Frustration).

Causes:- Destruction of subject matter.

- Change in law.

- Death or incapacity of a party (in personal contracts).

- Outbreak of war.

Example: A contracts to rent a hall for an event, but the hall is destroyed by fire. The contract is discharged due to impossibility.

- By Breach: A contract is discharged if one party fails to perform their obligations.

Types of Breach:- Actual Breach: Failure to perform when performance is due.

- Anticipatory Breach: Declaring an intention not to perform before the due date.

- Example: A agrees to deliver goods by June 1 but informs B on May 15 that they will not deliver. This anticipatory breach discharges the contract.

- By Operation of Law: A contract may be discharged due to legal reasons, such as:

- Merger: When a higher obligation absorbs a lower one.

- Insolvency: When a party is declared bankrupt.

- Unauthorized material alteration of the contract.

- Example: If A becomes insolvent, their contracts may be discharged by operation of law.

- By Lapse of Time: If a contract is not performed within the stipulated or reasonable time, it may be discharged.

- Example: A contract to deliver goods within 30 days lapses if not performed within that period.

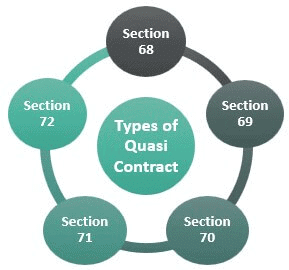

Quasi-Contracts

Quasi-contracts are not true contracts but obligations imposed by law to prevent unjust enrichment. They arise in the absence of an agreement, based on the principle of equity.

Features of Quasi-Contracts

- No mutual consent or agreement between parties.

- Imposed by law to ensure fairness.

- Based on the doctrine of unjust enrichment.

- Enforceable like a contract.

Types of Quasi-Contracts

(As per the Indian Contract Act, 1872, Sections 68–72)

- Supply of Necessaries (Section 68)

- If necessaries are supplied to a person incapable of contracting (e.g., minor), the supplier is entitled to reimbursement from the person’s property.

- Example:A supplies food to a minor. A can recover the cost from the minor’s property.

- Payment by an Interested Person (Section 69)

- A person who pays a debt they are not legally bound to pay, but has an interest in paying, can recover the amount from the person liable.

- Example:A tenant pays the landlord’s property tax to avoid seizure of the property. The tenant can recover the amount from the landlord.

- Obligation to Pay for Non-Gratuitous Acts (Section 70)

- If a person lawfully does something for another (not gratuitously) and the other benefits, the latter must compensate.

- Example:A repairs B’s house without request, and B benefits. B must pay A reasonable compensation.

- Responsibility of Finder of Goods (Section 71)

- A person who finds lost goods must take reasonable care of them and return them to the owner. They are entitled to reimbursement for expenses.

- Example:A finds B’s lost wallet and incurs expenses to return it. A can recover those expenses from B.

- Money Paid by Mistake or Under Coercion (Section 72)

- Money paid by mistake or under coercion must be repaid.

- Example:A pays B ₹5000 by mistake, thinking it was owed. B must return the amount.

Contingent Contracts

A contingent contract is a contract to do or not do something if some event, collateral to the contract, does or does not happen (Section 31, Indian Contract Act, 1872).

Features of Contingent Contracts

- Depends on the occurrence or non-occurrence of an uncertain future event.

- The event must be collateral (related but not part of the main obligation).

- Enforceable only when the contingent event occurs or does not occur, as per the contract.

Rules Governing Contingent Contracts

(As per Sections 32–36, Indian Contract Act, 1872)

- Contracts Dependent on an Event Happening (Section 32)

- Enforceable only if the specified event happens.

- Example:A agrees to pay B ₹10,000 if a ship arrives at port. The contract is enforceable only if the ship arrives.

- Contracts Dependent on an Event Not Happening (Section 33)

- Enforceable only if the specified event does not happen.

- Example:A agrees to pay B ₹5000 if a ship does not arrive. The contract is enforceable if the ship fails to arrive.

- Contracts Dependent on an Event Happening Within a Fixed Time (Section 35)

- Enforceable if the event happens within the specified time; otherwise, the contract becomes void.

- Example:A agrees to pay B if a ship arrives within 30 days. If the ship does not arrive in 30 days, the contract is void.

- Contracts Dependent on an Impossible Event (Section 36)

- Void, whether the impossibility was known or unknown at the time of contracting.

- Example:A agrees to pay B if the sun rises in the west. The contract is void.

- Contracts Where Performance Depends on a Party’s Will (Section 34)

- Not contingent if the event depends on a party’s discretion.

- Example:A agrees to pay B if A decides to sell his car. This is not a contingent contract.

Difference Between Contingent Contracts and Wagering Agreements

Aspect | Contingent Contract | Wagering Agreement |

|---|---|---|

Definition | Depends on an uncertain event, with a lawful purpose | Betting on an uncertain event, with no interest other than winning |

Legality | Valid and enforceable | Void under Section 30 |

Interest | Parties have an interest in the event | No interest except winning the bet |

Example | Insurance contract | Betting on a horse race |

Special Kinds of Contracts

Contract of Indemnity (Section 124)

A contract of indemnity is a promise by one party (the indemnifier) to save another party (the indemnified) from loss caused by the conduct of the promisor or any other person.

Key Features:

- Definition: The indemnifier undertakes to compensate the indemnified for any loss suffered due to specified causes.

- Scope: Only covers losses caused by the conduct of the promisor or a third party. It does not include losses due to events beyond human control (e.g., natural disasters).

- Rights of Indemnified: The indemnified can recover all damages, costs, and sums paid under a compromise, provided the compromise is not contrary to the indemnifier’s orders.

- Examples: Insurance contracts, where the insurer indemnifies the insured against losses.

Case Law:

Gajanan Moreshwar v Moreshwar Madan (1942): The court adopted a broader view of indemnity, holding that indemnity is not confined to losses caused by human agency alone but may extend to other specified causes, depending on the contract’s terms.

Contract of Guarantee (Section 126)

A contract of guarantee is a contract to perform the promise or discharge the liability of a third person in case of their default.

Key Features:

- Parties Involved:

- Principal Debtor: The person who is primarily liable.

- Creditor: The person to whom the guarantee is given.

- Surety: The person who gives the guarantee and undertakes to discharge the liability in case of default.

- Nature of Liability: The surety’s liability is co-extensive with that of the principal debtor (Section 128), meaning the surety is liable for the same amount as the debtor unless otherwise specified.

- Types of Guarantee:

- Specific Guarantee: For a single transaction.

- Continuing Guarantee: Extends to a series of transactions.

- Rights of Surety:

- Right to subrogation: Surety steps into the shoes of the creditor after paying the debt.

- Right to indemnity from the principal debtor.

- Right to contribution if there are co-sureties.

- Discharge of Surety: By revocation, death, variation in terms, release of the principal debtor, or impairment of the surety’s remedy.

Case Law:

Bank of Bihar v Damodar Prasad (1969): The court held that the surety’s liability is co-extensive with the principal debtor’s, and the creditor can proceed against the surety without first exhausting remedies against the debtor.

Bailment and Pledge (Sections 148–181)

A. Bailment (Section 148)

Bailment involves the delivery of goods by one person (bailor) to another (bailee) for a specific purpose, with the obligation to return the goods or dispose of them as per the bailor’s instructions.

Key Features:

Essentials:- Delivery of possession (actual or constructive).

- Delivery for a specific purpose (e.g., repair, safekeeping).

- Obligation to return the goods or deal with them as directed.

- Gratuitous: For the benefit of the bailor or bailee, without reward.

- Non-gratuitous: For reward (e.g., hire).

- Disclose defects in the goods.

- Bear extraordinary expenses.

- Indemnify the bailee for losses due to defective title.

- Take reasonable care of the goods.

- Not make unauthorized use of the goods.

- Not mix the goods with their own.

- Return the goods as per the contract.

- Rights of Bailee: Right to compensation, lien (particular or general), and to sue third parties for interference.

B. Pledge

Pledge is a special type of bailment where goods are delivered as security for the payment of a debt or performance of a promise.

Key Features:

Parties:- Pawnor: The person who pledges the goods.

- Pawnee: The person who receives the goods as security.

- Delivery of goods as security.

- Goods must be returned upon repayment of the debt or performance of the promise.

- Retain goods until the debt is paid.

- Sell the goods after giving notice to the pawnor.

- Recover any extraordinary expenses.

Rights of Pawnor: Redeem the goods before sale and enforce the pawnee’s duties.

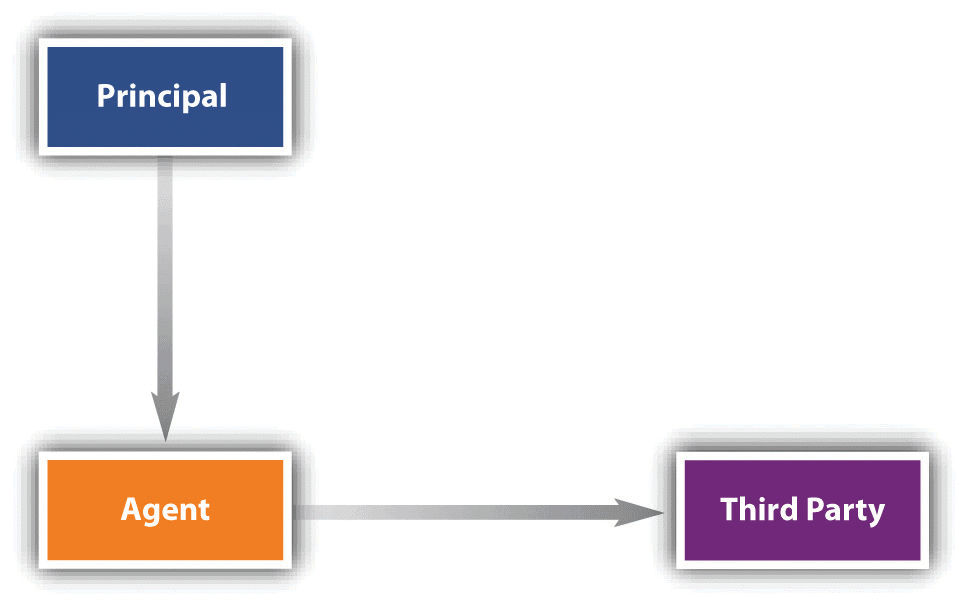

Contract of Agency (Sections 182–238)

A contract of agency is a relationship where one person (agent) acts on behalf of another (principal) and binds the principal by their actions within the scope of authority.

Key Features:

Parties:- Principal: The person who authorizes the agent.

- Agent: The person who acts on behalf of the principal.

- Express: By written or oral agreement.

- Implied: From conduct or circumstances.

- Necessity: When the agent acts in an emergency to protect the principal’s interests.

- Ratification: When the principal accepts the agent’s unauthorized act.

- Act within the scope of authority.

- Exercise skill and diligence.

- Avoid conflict of interest.

- Not delegate authority (unless permitted).

- Maintain accounts and render them to the principal.

- Right to remuneration.

- Right to lien on the principal’s property.

- Right to indemnity for lawful acts.

- Liability of Principal: The principal is liable for acts of the agent done within the scope of authority, whether express or implied.

- By act of parties: Revocation by the principal or renunciation by the agent.

- By operation of law: Death, insanity, insolvency, or expiry of the contract term.

Case Law:

Pannalal Jankidas v Mohanlal (1951): The court held that the principal is liable for the agent’s acts done within the scope of authority, even if the act causes loss, provided it was within the agent’s apparent authority.

Conclusion

The Indian Contract Act, 1872 provides a clear legal framework for forming, executing, and enforcing contracts. It ensures fairness, protects parties’ rights, and offers remedies in case of breach. By defining essential principles like offer, acceptance, consideration, and performance, the Act promotes trust and efficiency in business and personal agreements.

|

363 docs|256 tests

|

FAQs on Overview of the Indian Contract Act 1872 - Civil Law for Judiciary Exams

| 1. What is the definition of a contract under the Indian Contract Act, 1872? |  |

| 2. What are the key doctrines related to contracts in the Indian Contract Act? |  |

| 3. What are the different types of contracts recognized under the Indian Contract Act? |  |

| 4. What are the provisions related to the performance of contracts in the Indian Contract Act? |  |

| 5. What remedies are available for breach of contract under the Indian Contract Act? |  |