Judiciary Exams Exam > Judiciary Exams Notes > Civil Law for Judiciary Exams > Continuing Guarantee

Continuing Guarantee | Civil Law for Judiciary Exams PDF Download

Understanding Continuing Guarantee

- According to Section 129 of the Indian Contract Act, a Continuing Guarantee spans multiple transactions with a specific time frame, persisting even after the discharge of individual obligations. The Surety can restrict their liability based on time or amount.

- Continuing Guarantees can be Prospective (for future debts) or Retrospective (for existing debts). For instance:

T guarantees payment to Y for ten sacks of wheat within a month. After Y delivers eight sacks and G fails to pay, T is not liable for the remaining amount. - Section 6 of the Indian Contract Act defines a Contract of Guarantee involving a Surety, Principal Debtor, and Principle Creditor. For example, in a contract between T and Y, G acts as a surety for payment obligations.

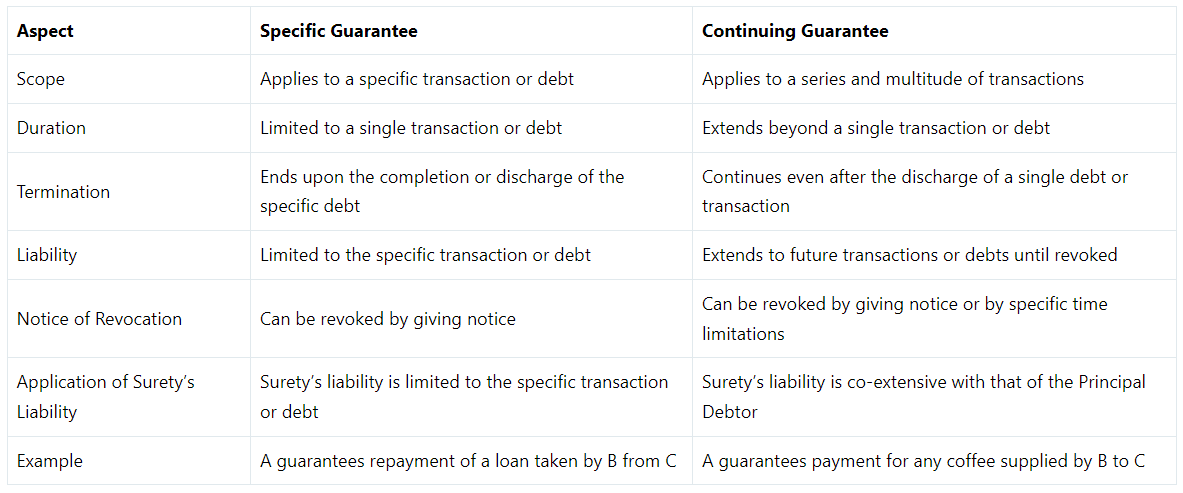

Difference Between Specific and Continuing Guarantee

Types of Contract of Guarantee:

- Specific Guarantee: This guarantee applies to a particular transaction or debt. For example, if A borrows Rs. 1 lakh from Yes Bank and C guarantees the repayment, C's liability ends once A repays the loan.

- Continuing Guarantee: This guarantee extends beyond a single transaction. For instance, if A guarantees payment to B, a coffee dealer, for coffee supplied to C up to Rs. 10,000, the liability continues even if multiple transactions occur.

Here is a table highlighting the differences between Specific Guarantee and Continuing Guarantee:

Nature of Continuing Guarantee Contract

- Definition of Continuing Guarantee: A Continuing Guarantee applies to a series of separate transactions and does not cover an entire consideration.

- Criteria for Determining a Continuing Guarantee: Whether a guarantee is continuing depends on the specific facts, circumstances, and intentions of each case, as highlighted in the Nottingham Hide Co vs. Bottrill case.

- Effect of Fraud or Misrepresentation: If contracts are based on fraud or misrepresentation by the creditor, involving material circumstances or the concealment of important facts, the contract becomes invalid and void.

- Liability of Guarantor: When the guarantor pays the debt, they step into the shoes of the creditor and acquire all rights the creditor had over the principal debtor.

- Continuing Guarantee for Future Transactions: Transactions entered into by the principal debtor until cancellation by the guarantor remain under the continuing guarantee. The guarantor can cancel a guarantee for future transactions by notifying the debtors.

- Impact of Guarantee Cancellation: While future transactions can be canceled, the liability of the guarantor for transactions entered into before the cancellation cannot be reduced.

Question for Continuing GuaranteeTry yourself: What is the main difference between a specific guarantee and a continuing guarantee?View Solution

Liability of the Surety Continuing Guarantee

- The liability of a Surety in a continuing guarantee is detailed in Section 128 of the Indian Contract Act, 1872. According to this section, the Surety's liability is equal to that of the Principal Debtor, unless stated otherwise in the contract.

- Essentially, the Surety is responsible for any transactions or dealings between the Creditor and the Principal Debtor. This means that the Surety is accountable for any amounts that may become due from these interactions.

- If the Surety wishes to be released from their liability, they can do so by revoking their guarantee. It's important to understand that the Surety's liability is secondary to the contract terms. Therefore, if the Principal Debtor is not held accountable, the Surety will also not be held accountable.

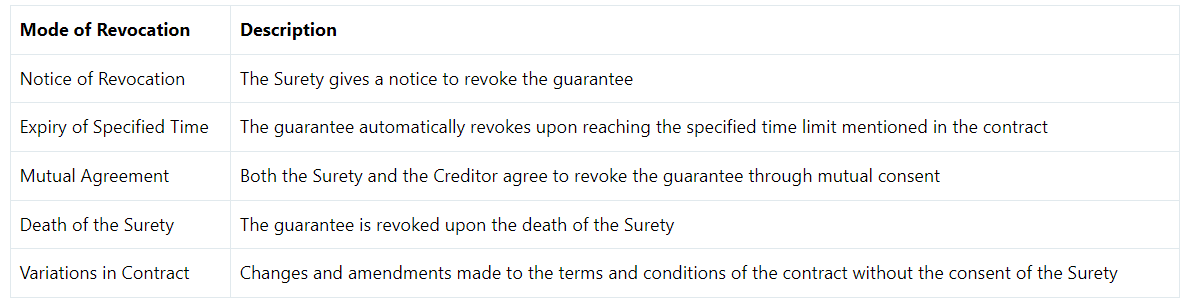

Different Modes of Revocation in Continuing Guarantee Contracts

Revocation by Giving a Notice

- Notifying the revocation does not release the Surety from ongoing transactions but applies to future dealings.

- For example, in the case of Offord v. Davies, even after revocation, the Surety was not liable for transactions conducted post-revocation.

Effects of the Death of the Surety

- Upon the Surety's death, the contract ends for future transactions, but prior transactions may still hold the Surety's heirs accountable.

- In Durga Priya Chowdhury v. Durga Pada Roy, the court ruled that the Surety's heirs could be held liable as per the contract terms even after the Surety's demise.

Changes in Contract Terms without Consent

- Any alterations to the contract without the Surety's approval can result in the termination of the guarantee.

- For instance, in Bishwanath Agarwal vs. State Bank of India, the Surety was not bound by changes made to the contract without their consent.

Conclusion

- A Continuing Guarantee in contract law is a crucial concept that goes beyond a single transaction or debt. It ensures creditor protection by making the Surety responsible for a series of transactions with the Principal Debtor. Unlike a Specific Guarantee that is limited to a particular transaction or debt and ends once it is fulfilled, a Continuing Guarantee remains in effect even after the completion of a single obligation.

- In a Continuing Guarantee, the Surety's liability matches that of the Principal Debtor, unless the contract specifies otherwise. This means the Surety can be held accountable for future transactions or debts between the Creditor and the Principal Debtor. The Surety has the ability to revoke the guarantee for future transactions by providing notice or adhering to the limitations outlined in the contract.

- Example: For instance, if Alice guarantees the payments of Bob's business loans as a continuing guarantee, she will be responsible for any future loans Bob takes even after his initial loan is repaid.

Question for Continuing GuaranteeTry yourself: What is the liability of the Surety in a continuing guarantee?View Solution

The document Continuing Guarantee | Civil Law for Judiciary Exams is a part of the Judiciary Exams Course Civil Law for Judiciary Exams.

All you need of Judiciary Exams at this link: Judiciary Exams

|

363 docs|256 tests

|

FAQs on Continuing Guarantee - Civil Law for Judiciary Exams

| 1. What is the difference between a specific guarantee and a continuing guarantee? |  |

Ans. A specific guarantee is limited to a single transaction or debt, while a continuing guarantee covers multiple transactions or debts over a period of time.

| 2. What is the nature of a continuing guarantee contract? |  |

Ans. A continuing guarantee is a type of guarantee where the guarantor agrees to be responsible for multiple transactions or debts that may arise in the future.

| 3. What is the liability of the surety in a continuing guarantee? |  |

Ans. In a continuing guarantee, the surety's liability extends to all transactions or debts covered by the guarantee until the guarantee is revoked or terminated.

| 4. What are the different modes of revocation in continuing guarantee contracts? |  |

Ans. A continuing guarantee can be revoked by giving notice to the creditor, by operation of law, or by the death or insolvency of the surety.

| 5. Can a continuing guarantee be revoked unilaterally by the guarantor? |  |

Ans. Yes, a continuing guarantee can be revoked unilaterally by the guarantor by giving notice to the creditor, unless there is a specific provision in the guarantee contract stating otherwise.

Related Searches