Difference Between Sale and Agreement to Sell | Civil Law for Judiciary Exams PDF Download

| Table of contents |

|

| Introduction |

|

| Sale |

|

| Agreement to Sell |

|

| Key Differences Between Sale and Agreement to Sell |

|

| Similarities Between Sale and Agreement to Sell |

|

| Summary on Sale vs Agreement to Sell |

|

Introduction

Understanding the difference between a sale and an agreement to sell is crucial in legal terms, as they have distinct meanings that can impact business transactions significantly.

- A sale refers to a situation where the ownership of goods is transferred immediately from the seller to the buyer.

- On the other hand, an agreement to sell signifies a future transfer of ownership, contingent upon certain conditions being met.

- For example, an agreement to sell becomes binding when the buyer pays a deposit, and the seller agrees to transfer ownership at a later date, provided specific conditions are fulfilled.

Sale

Section 4(1) of the Sale of Goods Act, 1930, defines a sale as a contract in which the seller transfers or agrees to transfer the ownership of goods to the buyer for a price. This transfer happens in the present, making it a fixed, conditional, and binding event for both parties involved.

Section 5 of the Sale of Goods Act explains the process of forming a contract of sale. While contracts of sale usually involve existing goods, they can also pertain to goods that are owned or possessed by the seller or future goods.

Advantages of a Sale

- Instant Ownership Transfer: When a sale is finalized, the buyer immediately gains ownership of the goods or services. This allows the buyer to have complete control and possession of the purchased items without any further conditions.

- Certainty and Legal Enforceability:. sale constitutes a legally binding contract with clear terms for both parties involved. These terms, including price, quantity, quality, and delivery, are usually agreed upon in advance, ensuring the transaction is certain and enforceable.

- Minimized Future Obligations: Once a sale is concluded, the seller typically has limited future responsibilities regarding the sold goods or services. This reduction in obligations and liabilities enables the seller to focus on other business activities.

- Immediate Payment: In most sales transactions, the buyer is required to make payment to the seller immediately. This provides the seller with instant cash flow, crucial for meeting financial commitments and investing in business growth.

- Risk Transfer: Upon completion of the sale, the risk associated with the goods or services usually shifts from the seller to the buyer. This means that any loss, damage, or decline in quality of the items becomes the buyer's responsibility, relieving the seller of potential risks and costs.

- Competitive Pricing Strategies: Sales often involve competitive pricing tactics, such as discounts, promotions, or incentives for bulk purchases. These strategies can attract more customers, increase sales volumes, and provide a competitive edge in the market, benefiting both sellers and buyers.

- Simplified Record-Keeping: Sales transactions are generally straightforward and easy to document. Sellers can maintain clear records of the sale, including invoices, receipts, and contracts, making accounting and record-keeping more manageable.

Disadvantages of a Sale

- Possible Revenue Loss: When products or services are sold at a discount during a sale, they might be sold for less than their full value. This could result in lower profit margins or even losses, especially if production or acquisition costs are not taken into account.

- Decreased Profit Potential: While sales can boost revenue, they don’t always lead to higher profits. If the costs associated with the sale, such as marketing expenses or the discounts offered, exceed the revenue generated, overall profitability may decline.

- Reduced Perceived Value: Frequent sales or substantial discounts can diminish the perceived value of a product or service. Customers may start associating the item with its discounted price, making it challenging to sell at the regular price in the future.

- Customer Expectation for Discounts: Regular sales can condition customers to expect discounts all the time. This creates difficulty when trying to revert to regular pricing, as customers may be reluctant to pay full price.

- Damage to Brand Reputation: Continuous sales or significant discounts might give the impression that a business is struggling or that its products are of inferior quality. This can damage the brand's reputation and perception in the market, making it harder to attract and retain customers in the long run.

- Inventory Management Challenges: Sales can drive up demand for certain products, necessitating effective inventory management. Inadequate monitoring or forecasting can lead to overstocking or stockouts, resulting in missed sales opportunities or increased holding costs.

Agreement to Sell

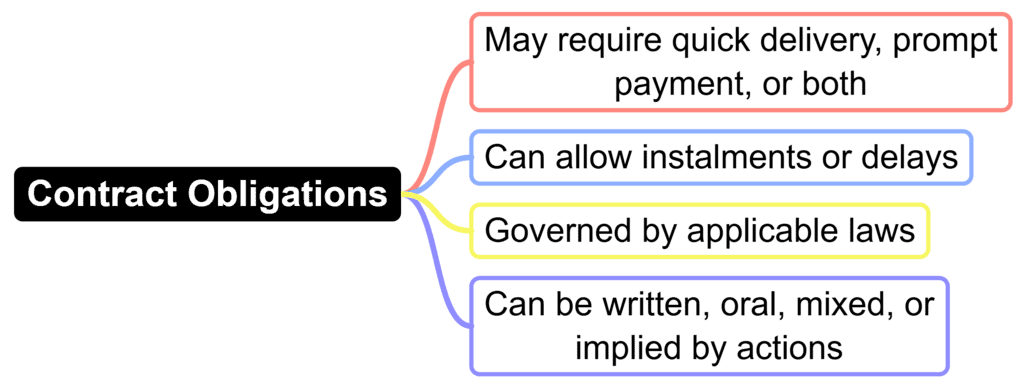

An agreement to sell refers to a situation where the ownership of goods is planned to be transferred at a later date or upon the fulfillment of certain conditions. This concept is outlined in section 4(3) of the relevant legal framework. Once the specified time elapses or the conditions for transfer are met, the agreement becomes a sale. Essentially, this agreement outlines the terms of the offer from the seller to the buyer.

Advantages of an Agreement to Sell

- Future Transaction Flexibility: An agreement to sell offers the flexibility needed for future transactions. It allows parties to negotiate terms without transferring ownership right away, which is particularly useful for complex deals.

- Protection for Both Parties: This type of agreement protects the interests of both the seller and the buyer. It outlines the terms, conditions, and obligations clearly before ownership is transferred, reducing the risk of disputes.

- Due Diligence Opportunity: An agreement to sell provides both parties with the opportunity to conduct thorough due diligence before finalizing the transaction. This involves assessing assets and liabilities, which helps in minimizing risks.

- Preservation of Ownership Rights: The seller retains ownership until all agreed-upon conditions are met. This is advantageous when the seller wants to maintain control over the assets until specific obligations are fulfilled.

- Future Performance Considerations: The agreement allows for conditions such as completing certain milestones or obtaining necessary approvals before the sale is finalized. This gives parties additional time to make necessary preparations.

- Potential for Higher Valuation: In some cases, an agreement to sell can lead to a higher selling price. By negotiating terms in advance, the seller can highlight the value of the assets, potentially resulting in a better price.

Disadvantages of an Agreement to Sell

- Uncertainty in Future Performance: An agreement to sell involves uncertainty regarding future performance. The actual transfer of ownership and fulfillment of the agreed-upon conditions may hinge on various factors, such as the occurrence of specific events or the satisfaction of particular requirements. This unpredictability can lead to delays or complications in completing the transaction.

- Risk of Non-Performance: There is a potential for one party to fail in meeting their obligations within an agreement to sell, resulting in a breach. This scenario can give rise to legal disputes, financial losses, and strain on business relationships. To mitigate this risk, it is crucial to establish clear terms and remedies within the agreement.

- Ongoing Ownership Risks: Since ownership is not transferred immediately in an agreement to sell, the seller retains the associated risks of the goods or services. These risks encompass damage, loss, or depreciation of assets. Until the conditions for transfer are satisfied, the specific terms of the agreement dictate how risks are managed between the parties involved.

- Market Condition Fluctuations: During the period of the agreement to sell, market conditions may fluctuate, potentially impacting the value or demand for the goods or services. The agreed-upon price might not align with the current market value, posing challenges in finalizing the transaction on mutually acceptable terms.

- Challenges in Securing Financing: Buyers seeking financing for an agreement to sell may encounter difficulties. Lenders might be reluctant to provide financing without the immediate transfer of ownership as collateral. This hesitance can complicate the buyer's efforts to secure the necessary funds for completing the transaction.

Key Differences Between Sale and Agreement to Sell

Basis | Sale | Agreement to Sell |

Nature of Transaction | Complete transfer of ownership of goods | Transfer of ownership to take place in future |

Legal Status | Immediate transfer of rights and property | Conditional transfer of rights and property |

Rights of Parties | Buyer becomes the owner of the goods | Buyer acquires a right to become the owner |

Transfer of Risk | Risk passes to the buyer at the time of sale | Risk remains with the seller until ownership transfer |

Performance | Seller must deliver the goods to the buyer | Seller promises to deliver the goods |

Delivery | Delivery is completed at the time of sale | Delivery is to take place at a future date |

Title to Goods | Title passes to the buyer at the time of sale | Title will pass to the buyer in the future |

Goods' Condition | Buyer accepts the goods in the current state | Buyer will accept the goods in the future |

Payment | Payment is made at the time of sale | Payment may be made at a future date |

Ownership | Ownership is immediately transferred | Ownership transfer is deferred |

Remedies | Buyer can sue for damages if breached | Buyer can sue for specific performance |

Insolvency | Goods are not available to the creditors | Goods may be available to the creditors |

Risk of Destruction | Risk of destruction passes to the buyer | Risk of destruction remains with the seller |

Termination | Is not possible unless both parties agree | Possible if agreed or under certain conditions |

Possession | Possession is transferred to the buyer | Possession may or may not be transferred |

Title Defects | Buyer gets goods with clear title | Buyer may get goods with a defective title |

Return of Goods | Buyer cannot return the goods | Buyer may return the goods under certain terms |

Warranty | Goods are sold with implied warranties | Goods may or may not have implied warranties |

Future Events | No impact on future events affecting goods | Future events can impact the agreement |

Liabilities | Seller is liable for any defects or damages | Seller may not be liable for future damages |

Passing of Property | Property passes at the time of sale | Property passes at a future agreed time |

Revocation | Is not possible unless both parties agree | Possible if agreed or under certain conditions |

Confidentiality | No obligation of confidentiality | Confidentiality clauses may be included |

Ownership Dispute | Buyer's ownership cannot be challenged | Buyer's ownership may be challenged |

Specific Performance | Is not possible unless both parties agree | Possible if agreed or under certain conditions |

Third-Party Rights | Third parties cannot claim rights to goods | Third parties may claim rights to goods |

Legal Formalities | No specific legal formalities required | Legal formalities may be required |

Risk Allocation | Risk is transferred to the buyer | Risk remains with the seller until ownership transfer |

Time of Contract | Contract is complete at the time of sale | Contract is established at the time of agreement |

Statutory Provisions | Subject to specific sale of goods laws | Subject to specific agreement to sell laws |

Similarities Between Sale and Agreement to Sell

- Both a sale and an agreement to sell involve a willing seller transferring goods or property to a willing buyer, usually for monetary payment.

- For both transactions, there must be an offer and acceptance on key terms such as price, delivery, and eligibility of goods.

- Both require the mental capacity and legal ability to enter into a contractual agreement.

- In an agreement to sell, it is crucial to specify the terms and conditions, as these define the rights and obligations of the parties.

- The legality of a sale or agreement to sell is vital for it to be enforceable.

- Clear accounting records documenting transaction details must be maintained for both.

- Related taxes may apply to either a sale or an agreement to sell.

- The fundamental elements required to form a valid commercial contract are consistent in both cases.

Summary on Sale vs Agreement to Sell

- Ownership Transfer: In a sale, ownership of goods changes hands immediately from the seller to the buyer. On the other hand, in an agreement to sell, the transfer is set for a future date, subject to specific conditions.

- Risks and Benefits: When a sale occurs, risks and benefits associated with the goods are transferred to the buyer. Conversely, in an agreement to sell, risks mostly remain with the seller until the actual transfer takes place.

- Legal Implications: Different legal rights, responsibilities, and remedies apply to sales and agreements to sell. Understanding this difference is crucial for businesses to navigate transactions effectively.

- Timing of Ownership Change: The distinction impacts the timing of when ownership shifts between parties and determines liability in scenarios such as damage to the goods before transfer.

|

363 docs|256 tests

|

FAQs on Difference Between Sale and Agreement to Sell - Civil Law for Judiciary Exams

| 1. What is the main difference between a sale and an agreement to sell? |  |

| 2. Can a sale be revoked once it has been completed? |  |

| 3. What are the key elements required for a valid sale or agreement to sell? |  |

| 4. How does a sale differ from a contract of sale? |  |

| 5. What are the consequences of breach of a sale agreement? |  |