Indian Polity: June 2024 UPSC Current Affairs | Current Affairs & General Knowledge - CLAT PDF Download

Bihar’s Demand for Special Category Status

Why in news?

Recently, the Bihar Chief Minister reiterated the State’s long-standing demand to be granted special category status by the Centre, a move that would increase the amount of tax revenues that the State gets from the Centre.

Why is Bihar Seeking Special Category Status (SCS)?

- Historical and Structural Challenges: Bihar faces significant economic challenges, including a lack of industrial development and limited investment opportunities. The bifurcation of the state led to the relocation of industries to Jharkhand, worsening employment and economic growth issues in Bihar.

- Natural Calamities: The state is prone to natural disasters such as floods in the northern region and severe droughts in the southern part. These recurring calamities disrupt agricultural activities, particularly affecting irrigation facilities and water supply, which are inadequate and impact livelihoods and economic stability.

- Lack of Infrastructure: Bihar's underdeveloped infrastructure hinders its overall progress, marked by poor road networks, limited access to healthcare, and challenges in educational facilities. In 2013, the Raghuram Rajan Committee, set up by the Centre, classified Bihar in the “least developed category.”

- Poverty and Social Development: Bihar has a high poverty rate, with a significant portion of the population living below the poverty line. A recent survey by NITI Aayog indicates that Bihar has the highest number of poor people, with 26.59% being multidimensionally poor in 2022-23, much higher than the national average of 11.28%. The per-capita GDP of Bihar is Rs. 60,000, compared to the national average of Rs. 1,69,496 for 2022-23. The state also lags in various human development indicators.

- Funding for Development: Seeking SCS is a way for Bihar to secure substantial financial assistance from the central government to address long-standing socio-economic challenges. The Bihar government estimates that granting special category status could provide an additional 2.5 lakh crore rupees over five years to spend on the welfare of 94 lakh crore poor families.

Arguments Against Bihar Receiving Special Category Status (SCS)

- Potential Negative Impact on Policy: Critics believe that increased funds for Bihar could encourage poor policy decisions and disadvantage well-performing states, as resources would be redirected to poorer states.

- Rule of Law Concerns: Bihar's historical challenges with rule of law have hindered its growth and investment potential.

- Fiscal Strain: The Central Government already allocates 42% of tax revenues to states, up from 32%, as per the 14th Finance Commission.Additional financial strain could impact national schemes and welfare programs.

- Impressive Growth Rates: Bihar is among India's fastest-growing states, with a 10.6% GDP growth rate in 2022-23, surpassing the national average of 7.2%.Per capita income also grew by 9.4% in real terms.

- Governance and Investment Climate: While more funds could provide short-term relief, sustainable long-term growth relies on better governance and an improved investment climate.

- Geographical Criteria: Bihar, despite meeting most criteria for SCS, lacks the necessary hilly terrain and geographical difficulties that typically justify such status.

- Central Government Stance: The Central Government, referencing the 14th Finance Commission report, has consistently denied SCS requests, recommending against granting this status to any state.

Other States Requesting Special Category Status (SCS)

- Andhra Pradesh: Since its bifurcation in 2014, Andhra Pradesh has been seeking SCS due to revenue losses following the transfer of Hyderabad to Telangana.

- Odisha: Odisha is also requesting SCS, citing its susceptibility to natural disasters like cyclones and its significant tribal population, which constitutes nearly 22% of the state.

What is a Special Category Status?

- About: SCS is a classification given by the Centre to assist the development of states that face geographical and socio-economic disadvantages.

- The Constitution does not make a provision for SCS and this classification was later done on the recommendations of the 5th Finance Commission in 1969.

- Status was first accorded to Jammu and Kashmir, Assam and Nagaland in 1969. Telangana is the newest State of India to be accorded the status.

- SCS is different from Special status which imparts enhanced legislative and political rights, while SCS deals with only economic and financial aspects.

- For instance, J&K used to have Special status before Article 370 was repealed.

Parameters (Based on Gadgil Formula):

- Hilly Terrain

- Low Population Density and/or Sizeable Share of Tribal Population

- Strategic Location along Borders with Neighbouring Countries

- Economic and Infrastructure Backwardness

- Nonviable Nature of State Finances

Benefits:

- The Centre pays 90% of the funds required in a Centrally-Sponsored Scheme to special category status states as against 60% or 75% in the case of other states, while the remaining funds are provided by the state governments.

- Unspent money in a financial year does not lapse and is carried forward.

- Significant concessions are provided to these states in excise and customs duties, income tax and corporate tax.

- 30% of the Centre’s Gross Budget goes to Special Category states.

Challenges:

- Resource Allocation: Granting SCS entails providing additional financial assistance to the state, which can strain the central government's resources.

- Dependency on Central Assistance: States with SCS often become heavily reliant on central assistance discouraging efforts toward self-sufficiency and independent economic growth strategies.

- Implementation Challenges: Even after the grant of SCS, there might be challenges in utilising the funds effectively due to administrative inefficiencies, corruption, or lack of proper planning.

Way Forward

- There is a need to revisit and refine the criteria for granting SCS to ensure fairness and transparency.

- In 2013, the Raghuram Rajan Committee set up by the Centre suggested a new methodology based on a ‘multi-dimensional index’ for devolving funds instead of a SCS, which can be revisited to address the State’s socio-economic backwardness.

- Implement policies that gradually reduce states' dependency on central assistance by promoting self-sufficiency and economic diversification. Encourage states to generate their revenue streams.

- Analysts suggest that Bihar needs a stronger rule of law for sustainable economic growth.

- Other steps need to be taken to encourage states to create comprehensive development plans including:

- Education Revamp: The recommendations of the RTE Forum, a consortium of experts focus on improving early childhood development (ICDS centres), teacher training, and pedagogy shifts towards a more interactive and technology-integrated approach.

- Skilling and Job Creation: Bihar's youth bulge needs skilled opportunities. Focus should be on skilling initiatives aligned with growing industries, alongside fostering entrepreneurship through programs like the SIPB (Single-window Investment Promotion Board) to attract businesses and create a job market.

- Infrastructure Development: Improved infrastructure is crucial for overall growth. The focus should be on better irrigation systems to tackle floods and droughts, alongside developing a robust transport network to connect rural and urban areas, attracting investment and boosting agricultural trade.

- Women's Empowerment and Social Inclusion: Bihar faces challenges with gender equality and social stratification. Initiatives focused on women's education, skill development, and financial inclusion alongside tackling social inequalities through stricter enforcement of laws and promoting social harmony.

Greater Authority to Panchayats

Why in News?The Ministry of Panchayati Raj commemorates the 24th of April every year as National Panchayati Raj Day (NPRD) marking the enactment of the Constitution (73rd Amendment) Act, 1992, which came into force on 24th April, 1993.

- National Colloquium on Grassroot Governance: The Ministry of Panchayati Raj (MoPR) is organizing this event to commemorate three decades since the 73rd Constitutional Amendment, as part of the National Panchayati Raj Day (NPRD) celebrations.

- Aims: The colloquium aims to promote dialogue and collaboration among various stakeholders, including officials from the Central and State Governments.

- Key Topics of Discussion: Discussions will center around the evolution of Good Governance principles in rural areas and strategies for strengthening Panchayati Raj Institutions (PRIs) to enhance public service delivery.

About Grassroot Governance in India - Panchayati Raj and Municipalities

- Grassroot Governance involves local residents actively participating in village governance, with the aim of empowering communities to take charge of their own governance.

- Involvement from the local population, including Panchayati Raj Institutions (PRIs),Self-Help Groups (SHGs), and community members, is crucial for achieving sustainable development and environmental goals.

- India has over 250,000 gram panchayats and more than 2,000 municipalities and municipal corporations, highlighting the extensive network of local governance.

- Local governments provide essential services such as potable water supply,sanitation, and solid waste management, which are vital for community well-being.

Evolution of Grassroot Governance in India

Pre-Independence Period

Municipal Corporation in Madras:

- In 1687, the establishment of a Municipal Corporation in Madras marked the inception of local governance in India.

Charter Act of 1793:

- This act provided a legal foundation for local bodies in India and facilitated the establishment of municipal administration in the presidency towns of Madras, Calcutta, and Bombay.

Lord Mayo’s Resolution of 1870:

- The resolution advocated for decentralization and aimed at strengthening municipal institutions by involving more Indians in these bodies.

Lord Ripon’s Resolution of 1882:

- This resolution promoted the decentralization of administration through the establishment of local self-governing institutions, and is often referred to as the Magna Carta of local government.

Royal Commission on Decentralisation 1907:

- The commission recommended the village as the basic unit of local self-government and proposed the establishment of panchayats in every village along with municipalities in urban areas.

Government of India Act, 1919:

- This act introduced Dyarchy in the provinces and made local self-government a transferred subject, enhancing the taxation powers of local bodies and extending the communal electorate to many municipalities.

Government of India Act, 1935:

- This act introduced a federal form of government, conferring Provincial Autonomy and envisaging self-government for the entire country.

Post-Independence Period

- Balwant Rai Mehta Committee: To examine the Community Development Programme (1952) and the National Extension Service (1953), the committee recommended the establishment of an organically linked three-tier panchayati raj system through indirect elections.

- Ashok Mehta Committee (1977): It recommended a two-tier system – zilla parishad and mandal panchayat(consisting of a group of villages with a total population of 15,000 to 20,000). District as the first point for decentralization under popular supervision below the state level.

Panchayati Raj

73rd Constitutional Amendment Act, 1992:

- This act constitutionalized the Panchayats and mandated all states to establish a three-tier system of Panchayati Raj, with Zilla Parishad at the district level,Panchayat Samiti at the block level, and Gram Panchayat at the village level. In smaller states with a population of less than 20 lakh, a two-tier system is required.

74th Constitutional Amendment Act:

- This amendment constitutionalized municipal local bodies, providing them constitutional status and making it mandatory for the government to constitute them.

- A uniform three-tier structure of urban local bodies, including Municipal Corporation,Municipal Councils, and Nagar Panchayats, was established.

Role of Panchayats in Grassroot Governance in India

- Constitutional Mandate: According to the Indian Constitution, panchayats are meant to function as self-governing bodies. The Constitution encourages state governments to strengthen these local representative institutions.

- Implementing Development Policies at the Grassroots: Panchayati Raj Institutions (PRIs) play a vital role in putting developmental policies into practice at the local level. They act as a link between the government and rural communities, promoting local involvement and driving sustainable development efforts.

- Catalysts of Local Development: Panchayats are responsible for creating economic development plans, promoting social justice, and managing local taxes and fees. They also help decentralize government functions, particularly financial responsibilities, to local levels.

- Monitoring Government Schemes: Panchayat members oversee various government programs, such as the Integrated Rural Development Programme (IRDP) and the Integrated Child Development Scheme (ICDS).

- Rural Development: PRIs develop Village Development Plans (VDPs) and implement projects based on local needs. They also act as implementing agencies for various Central and State government programs to ensure targeted delivery at the grassroots level.

- Agricultural Development: PRIs manage initiatives that enhance agricultural productivity and support sustainable farming practices. Successful cooperative initiatives, like Amul, have started at the Panchayat level.

- SDG Localisation: The Ministry of Panchayati Raj (MoPR) is promoting Sustainable Development Goals (SDGs) in partnership with PRIs across rural India.

- Providing Healthcare Facilities: Panchayats are essential in establishing and maintaining health centers, clinics, and dispensaries. They contribute to maternal and child health by promoting institutional deliveries and prenatal and postnatal care. Between 2021-22 and 2025-26, approximately ₹0.70 lakh crore was allocated for health in local governments, with ₹0.44 lakh crore for Rural Local Bodies (RLBs).

- Education: Panchayats work with schools and parents to boost enrollment and reduce drop-out rates. From 2018 to 2022, enrollment of children aged 6-14 in rural government schools increased across all States, with Odisha, Gujarat, and West Bengal achieving over 90% enrollment.

- Women Empowerment: Increased women’s participation in local governance has led to improved outcomes. Research in West Bengal and Rajasthan shows that women’s representation positively impacts the delivery of local public goods to marginalized communities. Article 243D of the Constitution ensures women’s involvement in PRIs by reserving at least one-third of seats for women.

How Are Local Bodies Funded?

Panchayati Raj

- Internal (or own-source revenue): Local bodies generate revenue through taxes like land or property tax, and non-tax sources such as rents and user fees.

- External Revenue Sources: Includes assigned revenue (taxes, duties, tolls, and fees collected by state and central governments for local bodies) and grants-in-aid and loans from various sources.

Challenges Faced by Grassroot Governance in India

- Functions: State governments have not devolved adequate functions to local bodies, affecting their efficiency.

- Creation of Parastatal Bodies: State governments have created parallel structures for project implementation, undermining local bodies’ responsibilities.

- Non-functionality of District Planning Committees (DPC): DPCs, required by the 74th amendment, are non-functional in many states, hindering integrated development planning.

- Finances: Most local bodies rely heavily on external funding, with 80% to 95% of revenue coming from external sources.

- Reasons for low internal revenue collection: Local bodies struggle to impose taxes due to unclear norms and lack of reliable records. State governments have not devolved sufficient taxation powers.

- Functionaries: Lack of support staff in panchayats affects service delivery.

- Poor Infrastructure: Many Gram Panchayats lack basic office buildings and necessary databases.

- Structural deficiencies: No secretarial support and limited technical knowledge hinder planning.

- Presence of Panch-Pati and Proxy representation: Issues with representation, particularly for women and Scheduled Castes/Scheduled Tribes.

- Impact of Seat Rotation on Female Political Careers: Seat rotation hampers women’s political careers by preventing continuity.

Concern pertaining to SFC (State Finance Commission):

- Delay in Constituting SFC: Many states have not timely constituted SFCs, depriving local self-governments of their share from the Consolidated Fund of the State.

- Non-Availability of Data: Lack of local government data hampers SFC operations, requiring data collection from scratch.

- Lack of expertise of SFC: SFCs often lack autonomy and expertise, limiting their effectiveness.

Government Initiatives to Strengthen Panchayati Raj Institutions (PRIs)

- e-Gram Swaraj e-Financial Management System: Enhances Panchayat credibility through better fund devolution.

- Rashtriya Gram Swaraj Abhiyan (RGSA) Scheme: Promotes participatory local planning at the Gram Panchayat level.

- Saansad Adarsh Gram Yojana: Aims for holistic village development.

- Panchayat Development Index (PDI): Measures progress on Local Sustainable Development Goals (LSDGs).

- Gram Urja Swaraj Abhiyaan: Focuses on renewable energy adoption in Gram Panchayats.

- International Centre for Audit of Local Governance (iCAL): Builds capacity for local government auditors.

Best Practices in Panchayati Ra Institution Implementation

- Andhra Pradesh: Established village secretariats for better service delivery.

- Karnataka: Created a separate bureaucratic cadre for Panchayats to enhance governance.

- Minimum Qualification Standards for Panchayat Elections: States like Rajasthan and Haryana have set standards to improve governance effectiveness.

Way Forward to Grassroot Governance in India

- Devolving 3Fs: State governments should devolve funds, functions, and functionaries to panchayats.

- Timely Establishment of State FC: Prompt establishment of State Finance Commissions is crucial.

- Following Principle of Subsidiarity: Higher levels of government should perform only those functions that cannot be effectively performed at the local level.

- Local Revenue Generation: PRIs should improve local revenue generation and resource efficiency.

- Social Empowerment Must Precede Political Empowerment: Ensure compliance with constitutional provisions in SFC appointments and recommendations.

- Capacity Building for Self-Governance: Training local representatives for effective policy planning and implementation.

- Improving Participation: Encouraging participation of panchayat representatives in gram sabha meetings.

- Technology in Local Governance: Utilizing ICT for improved governance, transparency, and citizen engagement.

Conclusion

India’s local governance system needs to be empowered in all three areas to ensure that power truly rests with the people, not just on paper, but also in practice.

Role of the Speaker

Why in news?

The upcoming session of the 18 Lok Sabha underscores the crucial role of the Speaker in the case of coalition government not only for the smooth functioning of the house but also for the balance of power between the ruling party and its allies, as well as the opposition.

What are the Key Facts About the Speaker in India?

- About:

- The Speaker is the constitutional and ceremonial head of the House.

- Each House of Parliament has its own presiding officer.

- There is a Speaker and a Deputy Speaker for the Lok Sabha and a Chairman and a Deputy Chairman for the Rajya Sabha.

- Assisted by the Secretary-General of the Lok Sabha and senior officers of the Secretariat on parliamentary activities, practice and procedure.

- In the absence of the Speaker, the discharges the functions.

- A member from the panel of Chairmen presides over the House in the absence of both the Speaker and the Deputy Speaker. However, member of the panel of chairpersons cannot preside over the house, when the office of the Speaker or the deputy speaker is vacant.

- Election:

- The House elects its presiding officer by a simple majority of members present, who vote in the House.

- Usually, a member belonging to the ruling party is elected as speaker whereas deputy speaker is elected from opposition party.

- There are also instances when members not belonging to the ruling party were elected to the office of the Speaker. GMC Balayogi and Manohar Joshi belonging to the non-ruling party served as the Speaker in the 12th and 13th Lok Sabha.

- When the is dissolved Speaker remains in his office till the first meeting of the new assembly when the new speaker is elected.

- Removal:

- The Constitution has given the Lower House authority to remove the Speaker if needed.

- The House can remove the Speaker through a resolution with notice of 14 days, passed by an effective majority as per Articles 94 of the Indian Constitution.

- The Speaker can also be removed on getting disqualified from being a Lok Sabha member as per sections 7 and 8 of the Representation of the People Act, 1951.

- Sources of Power and Duties:

- The Speaker of the Lok Sabha derives his powers and duties from three sources: Constitution of India, Rules of Procedure and Conduct of Business of Lok Sabha, Parliamentary Conventions (residuary powers that are unwritten or unspecified in the rules)

What are the Roles and Responsibilities of the Speaker?

- Presiding Over House Proceedings:

- Oversees the sessions of the Lower House, ensuring discipline and decorum among members.

- The Speaker decides the agenda for parliamentary meetings and interprets procedural rules. He/she permits motions such as adjournments, no-confidence and censure motions, ensuring orderly conduct.

- Enforcing Quorum and Disciplinary Action:

- In the absence of a quorum, the Speaker adjourns or suspends meetings until the required attendance is met.

- The speaker has the power to punish unruly behaviour and even disqualify members on grounds of defection under 10 schedule of the constitution.

- Constitution of Committees:

- The Committees of the House are constituted by the speaker and function under the speaker’s overall direction.

- The Chairmen of all Parliamentary Committees are nominated by Speaker Committees like the Business Advisory Committee, the General Purposes Committee and the Rules Committee, work directly under his Chairmanship.

- Privileges of the House:

- Guardian of the rights and privileges of the House, its Committees and members.

- It depends solely on the speaker to refer any question of privilege to the Committee of Privileges for examination, investigation and report.

What are the Issues Associated With the Office of the Speaker?

- Partisanship Issue:

- The Speaker, often belonging to the ruling party, are accused of bias. Supreme Court in Kihoto Hollohan versus Zachilhu case highlighted the instances where speakers have allegedly acted in favour of their party.

- Prioritising Party Interests over National Interest:

- Speakers have the power to restrict debates or discussions that could potentially affect the agenda of the political parties, if those discussions are crucial for the nation's well-being.

- Increased Disruptions and Stalling of Proceedings:

- A Speaker perceived as biased can lead to frustration and disruptions from the opposition ultimately hindering the functioning of Parliament.

- Bypassing Committees and Scrutiny:

- Rushing through bills without proper committee review can lead to poorly crafted legislation that hasn't received sufficient deliberation.

Way Forward

- Maintaining Stability:

- The Speaker's impartiality and fairness are critical, as they have to balance the complex dynamics of diverse political interests.

- Role in Resolving Disputes:

- In the case of a coalition government, where multiple parties with different ideologies and agendas come together, conflicts and disputes are inevitable.

- Impact on Legislative Outcomes:

- By controlling the legislative agenda, the Speaker can influence the passage of bills overall policy direction of the government.

- Ensuring Non-Partisanship:

- The practice of the Speaker who resigns from their political party to ensure complete non-partisanship can be explored further to uphold the Constitution's principle of separation of powers.

Conclusion

The Speaker of Lok Sabha is not just a presiding officer, they wield significant power in shaping the functioning of the House and influencing the balance between the ruling party and the opposition, especially in the case of coalition government. The Speaker's decisions and actions can have far-reaching consequences for the functioning and stability.

Pradhan Mantri Awas Yojana

Why in news?

- The Prime Minister became emotional and cried while speaking to a crowd.

- This event was held to announce the homes built under the Pradhan Mantri Awas Yojana-Urban Scheme.

- The Pradhan Mantri Awas Yojana – Urban (PMAY-Urban) Scheme aims to provide affordable housing in urban areas.

About:

- Pradhan Mantri Awas Yojana (PMAY) is a scheme that provides financial assistance for affordable housing.

- It aims to help low and moderate-income families across the country.

- The new government has agreed to a plan to build 3 crore more houses in both rural and urban areas under PMAY.

- The scheme has two main parts:

- PMAY-U: This part is for poor people living in cities.

- PMAY-G and PMAY-R: These parts are designed for poor people living in rural areas.

PMAY-U (Urban):

- Objective: To ensure housing for all in urban regions

- Beneficiaries: EWS, LIG, and MIG categories

- Subsidy Schemes:

- Credit Linked Subsidy Scheme: Provides interest subsidies on home loans

- In-Situ Slum Redevelopment: Utilizes land for housing eligible slum dwellers

- Affordable Housing in Partnership: Encourages collaborations for affordable housing

- Beneficiary-Led Construction: Offers financial aid for house construction

PMAY-G (Gramin):

- Objective: To provide pucca houses with basic amenities to all rural families without proper housing

- Identification: Done using the Socio-Economic and Caste Census (SECC) 2011

- Features:

- Financial Assistance: Rs. 1.2 lakh in plain areas and Rs. 1.3 lakh in hilly and difficult terrains

- Construction: Done by beneficiaries with government technical support

- Convergence with other schemes: Encourages collaboration with programs like Swachh Bharat Mission and MGNREGA

Proportional Representation Method of Election

Why in news?

The 2024 Lok Sabha election results have sparked discussions about the proportional representation method and its potential impact.

What is Proportional Representation?

- The Proportional Representation (PR) system guarantees that political parties are represented in proportion to their vote share.

- This system ensures equitable representation for all parties based on their voting percentages.

- Unlike majority or plurality systems, where only certain votes matter, PR ensures that every vote influences the outcome.

Use of PR system in other countries

- Presidential Democracies like Brazil and Argentina utilize the party list PR system.

- In Parliamentary Democracies such as South Africa, the Netherlands, Belgium, and Spain, the party list PR system is also prevalent.

Main Types of Proportional Representation

- Party-list PR: Voters vote for parties rather than individual candidates, with seats distributed proportional to vote shares.

- Types of Lists:

- Closed Lists: Voters can only vote for parties, not individual candidates.

- Open Lists: Voters can express preferences for individual candidates and vote for independents.

- Single Transferable Vote (STV): This system uses multi-member districts where voters rank candidates by preference.

- Mixed Member Proportional Representation (MMP): Combines elements of FPTP and PR systems.

Benefits of Proportional Representation

- Allows voters to select candidates across party lines.

- Ensures that votes for independent or less popular candidates are not wasted.

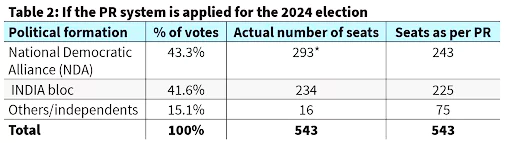

Implementing Proportional Representation in India

- As a federal nation, India could introduce the PR system at the State/Union Territory level.

- If applied to the 2024 election at this level, seat distributions would vary significantly.

Impact on Representation

- The PR system would align party representation with their respective vote shares.

- Examples:

- In Gujarat, Madhya Pradesh, and Chhattisgarh, the NDA would have different seat distributions under PR.

- In Odisha, the Biju Janata Dal would have secured seats based on their vote share.

- In Tamil Nadu, the seat allocation would have been different under PR.

Criticisms of Proportional Representation System

- Instability: PR might lead to instability as forming a majority government could be challenging.

- Proliferation of Parties: It could lead to the formation of regional or identity-based parties, potentially affecting voting patterns.

Comparison between FPTP and PR

Agnipath Scheme

Why in news?

The ruling-party government's ambitious Agnipath scheme, announced in June 2022, has been facing opposition from various political parties and Armed Forces veterans. Ongoing concerns highlight the scheme's impact on military recruitment and the welfare of soldiers.

What is Agnipath Scheme?

About:

- The term "Agniveer" translates to "Fire-Warriors" and is a new military rank.

- It is a scheme of recruiting army personnel below officer ranks such as soldiers, airmen, and sailors who are not commissioned officers to the Indian Armed Forces.

- They are recruited for a period of 4 years, after which, up to 25% of these recruits (called Agniveers), can join the services on a permanent commission (another 15 years), subject to merit and organizational requirements.

- At present, all sailors, airmen, and soldiers, except the technical cadre of the medical branch, are recruited to the services under this scheme.

Eligibility Criteria:

- Candidates between the age of 17.5 years to 23 years are eligible to apply (the upper age limit was increased from 21).

- Girls under the given age limit are open for the agnipath entry, while there is no such reservation for women under this scheme.

Pay & Benefits:

- Death on Duty: The family gets a combined sum of Rs 1 crore, which includes both the Seva Nidhi package and the soldier's unserved salary.

- Disability: An Agniveer can receive compensation up to Rs 44 lakh depending on the severity of the disability. This amount is provided only if the disability is caused by or worsened due to military service.

- Pensions: Agniveers won't receive a regular pension after their 4-year service, unlike soldiers in the traditional system. Only the 25% who get selected for permanent commission will be eligible for a pension.

Goal of Agnipath:

- This scheme is designed to keep the armed forces young, bring down the number of permanent soldiers in the military, leading to a significant reduction in the government's pension spending on defense forces.

Why was the Agnipath Scheme Introduced?

- Younger, Fitter Force: The government believes Agnipath will create a more agile fighting force due to the emphasis on younger recruits, translating to faster response times and better adaptation on the battlefield.

- Reduce Pension Bill: It also aims to lessen the burden of the ever-growing defense pension bill.

- Technological Integration: The scheme aims to leverage the tech-savviness of younger recruits to better integrate emerging technologies into the Armed Forces.

- Skilled Workforce for Civilian Sector: The government envisions Agniveers transitioning to the civilian workforce with valuable skills and discipline gained during their service.

What are the Issues Associated with Agnipath Scheme?

Lack of Retirement Benefits:

- The scheme provides a one-time payment of Rs 11.71 lakh on completion of 4-year tenure, but no gratuity or pension.

Short Service Duration:

- 4-year term is seen as inadequate, with concerns that recruits may lack the same motivation and training as permanent soldiers.

- Also, this duration is insufficient to train and skill soldiers in the long term as it may lead to skill and experience deficit in armed forces.

Age Limit Issues:

- The current upper age limit excluded many youths who could not apply due to lack of recruitment during the pandemic.

Unemployment Concerns:

- With limited permanent absorption (only 25%), the scheme is seen as exacerbating the already high youth unemployment in the country.

Perceived Political Motives:

- Experts believe the scheme was rushed through without adequate consultation, possibly as a political move ahead of elections. The lack of endorsement from defense forces also raises doubts.

Pension Bill Reduction:

- The scheme is seen as a way for the government to reduce its rising defense pension expenditure, prioritizing financial savings over long-term force building.

Way Forward

Raising the Age Limit and Permanent Retention Quota:

- There should be a longer service period to 7-8 years for Agniveers.

- Also, the entry age for technical roles should be increased to 23 years, regular service retention rate for Agniveers should be increased from current 25% to 60-70%.

Enhanced Entitlements and Benefits:

- Agniveers should be provided with a contributory pension scheme, generous gratuity, and ex-gratia for disability during training.

- They should be offered opportunities in other security forces, veteran status, and preference for government jobs, with a transparent, merit-based system for retaining Agniveers.

Implement Robust Skilling and Resettlement Programs:

- Comprehensive skilling and resettlement programs should be developed in collaboration with the private sector and government agencies to facilitate a smooth transition for Agniveers into civilian life.

- A legislation should also be made that mandates the compulsory absorption of Agniveers by private employers and corporations.

Raising Educational Standards:

- The educational requirements for Agniveers to should be raised from 10 to 10+2 and a more rigorous national entrance exam should be implemented.

Conclusion

The Agnipath scheme in India is a major reform in defense policy that changes the recruitment process for armed forces. Initial implementation shows positive signs in the motivation, intelligence, and physical standards of Agniveers recruited under the scheme. Human element is deemed more important than technological advancements in military operations, highlighting the need for character development and psychological well-being of Agniveers to align with unit pride and cohesion.

National Testing Agency

Why in news?

The Supreme Court on Tuesday refused to stay the counselling for admissions of students to medical colleges over alleged paper leak and irregularities in the National Eligibility cum Entrance Test (NEET) undergraduate (UG) examination 2024.

Overview:

- The National Testing Agency (NTA) was established in 2017 by the Ministry of Education as a premier, specialist, autonomous and self-sustained testing organization to conduct entrance examinations for admission/fellowship in higher educational institutions.

Functions:

- Conducting entrance examinations for admission to higher educational institutions

- Creating a question bank using modern techniques

- Establishing a strong research and development culture

- Collaborating with international organizations like ETS (Educational Testing Services)

- Undertaking any other examination entrusted to it by the Ministries/Departments of Government of India/State Governments

NEET:

- The NEET (National Eligibility cum Entrance Test) is an entrance examination for students who wish to pursue undergraduate medical courses (MBBS/BDS) and postgraduate courses (MD/MS) in government or private medical colleges.

Objective:

- To standardize the admission process for medical and dental courses across India, ensuring a uniform evaluation of candidates' eligibility.

The NTA conducts NEET on behalf of the Ministry of Education.

CIC Jurisdiction over MPLADS Funds

Why in news?

Recently, the Delhi High Court has ruled that the Central Information Commission (CIC) has no jurisdiction to comment on the utilisation of funds under the Members of Parliament Local Area Development Scheme (MPLADS).

Dimensions of the Article

Background of the Court's Ruling- The Central Information Commission (CIC) raised concerns about MPs saving MPLADS funds until the final year of their term.

- CIC suspected this tactic gave MPs an unfair advantage during elections.

MPLAD Scheme

- In 2018, CIC ordered guidelines for equal distribution of funds over MPs' five-year terms.

2018 CIC Order:

- CIC advised Ministry of Statistics and Programme Implementation (MoSPI) to prevent fund abuse by MPs.

Legal Challenge:

- MoSPI challenged CIC's ruling in Delhi High Court regarding a Right to Information (RTI) application.

No Jurisdiction:

- Delhi High Court ruled that CIC cannot comment on MPLADS fund utilization.

RTI Act Scope:

- RTI Act limits access to information under public authorities' control.

Section 18 of RTI Act:

- CIC can only address issues related to information sought under RTI Act or its dissipation.

Publication of Details:

- Court upheld CIC's instruction to publish fund details under RTI Act.

MPLAD Scheme:

- MPLADS is a Central Sector Scheme launched in 1993-94.

- MPs recommend works based on local needs in sectors like education, health, and sanitation.

- Funds are released directly to district authorities as grants in-aid.

Features:

- MPs get Rs. 5 crore per year for constituency development.

- MPs allocate funds for various development areas based on guidelines.

- District authorities oversee work execution under the scheme.

Execution of works:

- MPs recommend works to district authorities for implementation.

- District authorities select implementing agencies and monitor scheme execution.

NOTA Option in Indian Elections

Why in news?

The BJP’s Shankar Lalwani has secured victory in Indore with a significant margin of 10.09 lakh votes, garnering 12,26,751 votes. The nearest contender was NOTA, with 2,18,674 votes.

New Record

The exceptional outcome in Indore represents the highest number of votes ever received by the "None Of The Above" (NOTA) option in any constituency. The previous record was held by Gopalganj, Bihar, in 2019, with 51,660 NOTA votes.

Introduction of NOTA

The Supreme Court mandated the Election Commission of India (ECI) to introduce the NOTA option for voters in September 2013 to ensure voter choice confidentiality.

Voters Right to Secrecy

In 2004, the People’s Union for Civil Liberties (PUCL) petitioned the apex court to protect voters' right to secrecy from the ECI's Conduct of Elections Rules, 1961, which violated secrecy by recording the details of non-voters.

What happens if NOTA Receives the Highest Votes?

The Supreme Court is contemplating making elections void if NOTA gets the most votes in a constituency. The court directed the ECI to include a NOTA button in EVMs, aiming to uphold the electorate's will.

Conclusion

The surge in NOTA votes in Indore underscores growing voter dissatisfaction, underscoring the necessity for electoral reforms to ensure genuine representation and accountability.

Creation of Andhra Pradesh and Special Category Status

Why in news?Andhra Pradesh Demanding Special Category Status

Background

JDU and TDP, the key constituent units of the NDA government have put forth a demand of special status.

About Special Category Status (SCS):

- Special Category Status is a designation conferred by the central government to aid states with geographical and socio-economic challenges.

- Introduction: It was introduced In 1969, based on the recommendations of the Fifth Finance Commission of India.

Criteria for granting SCS:

- Difficult and hilly terrain

- Low population density and/ or a sizable tribal population

- Strategic location along borders

- Economic and infrastructural backwardness

- Non-viable nature of state finances

Financial Grants:

- Under the Gadgil-Mukherjee formula allocated approximately 30% of total central assistance to Special Category Status (SCS) States.

- However, with the abolition of the Planning Commission and changes in funding mechanisms, assistance is now part of the increased devolution of divisible pool funds for all states (increased to 41% in the 15th Finance Commission from 32%).

Centre- State Funding for schemes:

- In SCS States, the funding ratio for centrally sponsored schemes is favorable at 90:10 (Centre-State), compared to the 60:40 or 80:20 splits for general category states.

Schemes such as:

- Incentives for Investments: Several incentives to attract investments, including concessions in customs and excise duties, income tax, and corporate tax rates.

- Debt Management Privileges: These states can avail the benefit of debt-swapping and debt relief schemes by increasing the time period or giving exemption in interest rates.

- Carry forward provisions for Unspent Funds: Special category states enjoyed the provision where unspent funds in a fiscal year would not expire but instead be carried forward to the subsequent fiscal year.

Initial States with SCS (1969):

- Jammu, Kashmir, Assam, and Nagaland in 1969.

Current states with SCS:

- Himachal Pradesh, Manipur, Meghalaya, Sikkim, Tripura, Arunachal Pradesh, Mizoram, Uttarakhand were granted this status

- Telangana, the newest state of India accorded status.

Disagreement over Criteria:

- States disagree on the criteria for awarding Special Category Status (SCS).

- Uttarakhand, a Himalayan state bordering China, was granted SCS, while Jharkhand and Chhattisgarh were not awarded the same status despite lagging behind Uttarakhand in various growth indicators.

Inter-State Disparities:

- Providing special status to specific states could raise concerns about unequal economic and social structures, potentially exacerbating inter-state disparities.

Promotes Fiscal Irresponsibility:

- Debt-swapping and debt-relief initiatives indirectly incentivize states to exceed their capacity for servicing debt, resulting in prolonged liabilities.

Demand Chain Reaction:

- Giving special status to one state often prompts others to seek the same, leading to a series of requests and reducing the intended benefits.

Abolition:

- 14th Finance Commission abolished most states 'special category status', retaining it only for the Northeastern states and three hill states.

Reasons for Abolishing Special Category Status Since 2014

- Enhanced Devolution: The 14th Finance Commission raised the vertical devolution to states to 42%, up from 32% in the 13th Finance Commission.

- Revised Formula: The 14th Finance Commission introduced factors such as 'Forest and ecology' into the formula for horizontal devolution, so states with hilly and challenging terrain might see an uptick in devolution from the central government.

- Additional Grants: Apart from tax devolution, the Finance Commission recommends grants for local bodies, disaster management, revenue deficit, and other specified areas outlined in the government's Terms of Reference.

- Special Assistance: The central government extends support to states through mechanisms such as GST compensation to offset any tax revenue losses incurred due to the adoption of the GST system and interest-free loans for capital expenditure, lasting up to 50 years.

Why is Andhra Pradesh Demanding Special Category Status?

Bifurcation of the State: Since its division in 2014, Andhra Pradesh has sought Special Category Status, citing revenue loss resulting from the transfer of Hyderabad to Telangana

Higher Grant-in-Aid: SCS would mean higher grants-in-aid to the state government from the Centre.

Increase Employment: The governments of AP have argued that such special incentives are vital for the rapid industrialisation of the primarily agrarian state and would improve employment opportunities for the youth and the overall development of the state.

Encouraging Investments: Granting SCS would encourage investments in speciality hospitals, five-star hotels, manufacturing industries, high-value service industries such as IT, and premier institutions of higher education and research.

Way Forward

- Consensus on Criteria: A critical need for a general consensus among states regarding the principles guiding the grant of Special Category Status (SCS).

- Economic Policy integration: While SCS benefits act as a stimulus, the real impact rests on individual state economic policies.

- State Capacity Empowerment: States should recognize their industrial strengths, fostering a policy environment for self-reliance rather than excessive reliance on central support.

- Alternative Approach: Explore alternative approaches like the one suggested by the Raghuram Rajan Committee, emphasizing a 'multi-dimensional index' for fund allocation.

|

98 videos|961 docs|33 tests

|

FAQs on Indian Polity: June 2024 UPSC Current Affairs - Current Affairs & General Knowledge - CLAT

| 1. बिहार के विशेष श्रेणी का दर्जा क्या है और इसे प्राप्त करने की मांग क्यों की जा रही है? |  |

| 2. पंचायती राज संस्थाओं को अधिक अधिकार देने का क्या महत्व है? |  |

| 3. विधानसभा के अध्यक्ष की भूमिका क्या होती है? |  |

| 4. प्रधानमंत्री आवास योजना का उद्देश्य क्या है? |  |

| 5. NOTA विकल्प का भारतीय चुनावों में क्या महत्व है? |  |