NCERT Solution (Part - 4) - Accounting for Share Capital | Additional Study Material for Commerce PDF Download

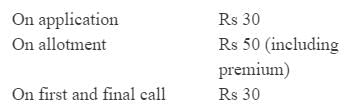

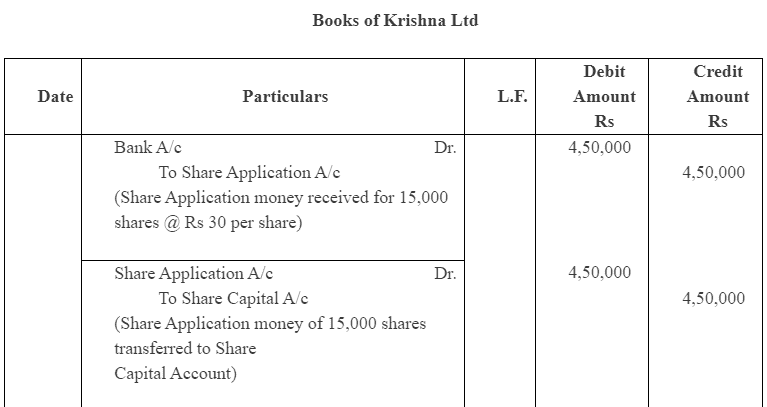

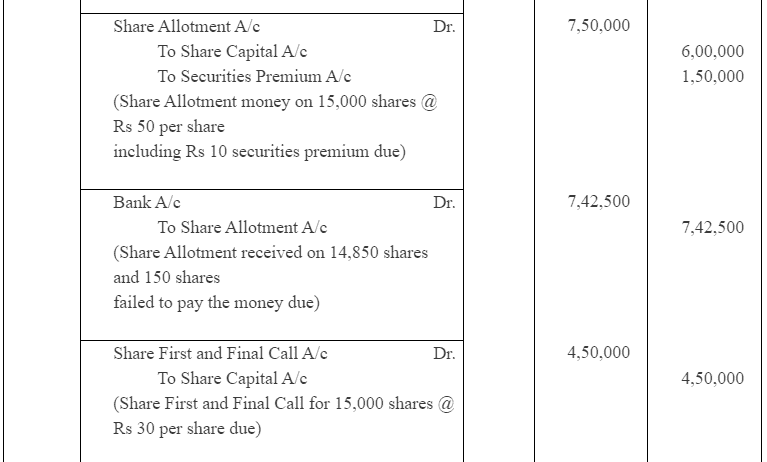

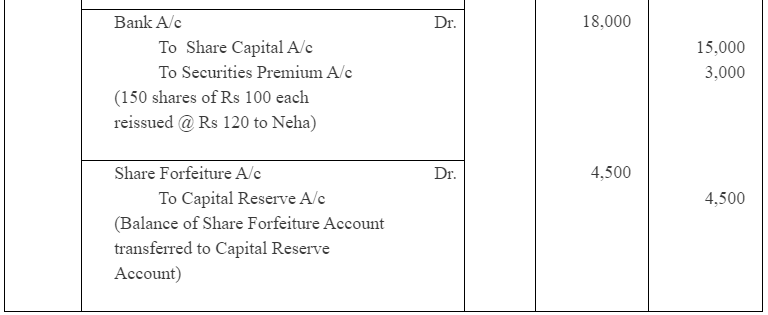

Question 12: Kishna Ltd issued 15,000 shares of Rs 100 each at a premium of Rs 10 per share, payable as follows:

All the shares subscribed and the company received all the money due, With the exception of the allotment and call money on 150 shares. These shares were forfeited and reissued to Neha as fully paid share of Rs 12 each.

Give journal entries in the books of the company.

Answer :

Note: In the solution, the reissued price of Rs 12 has been assumed as Rs 120 per share.

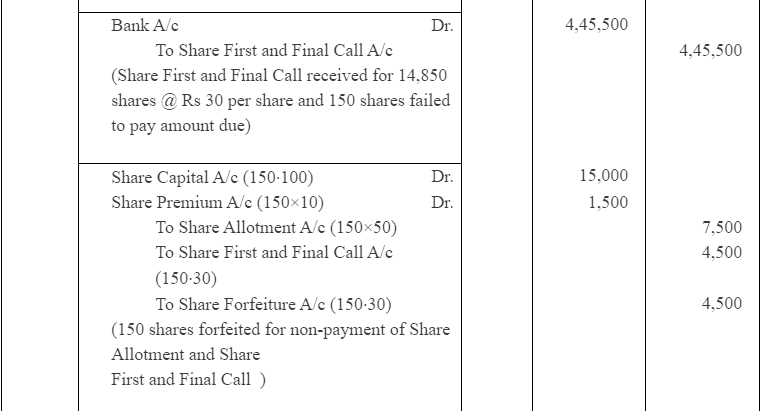

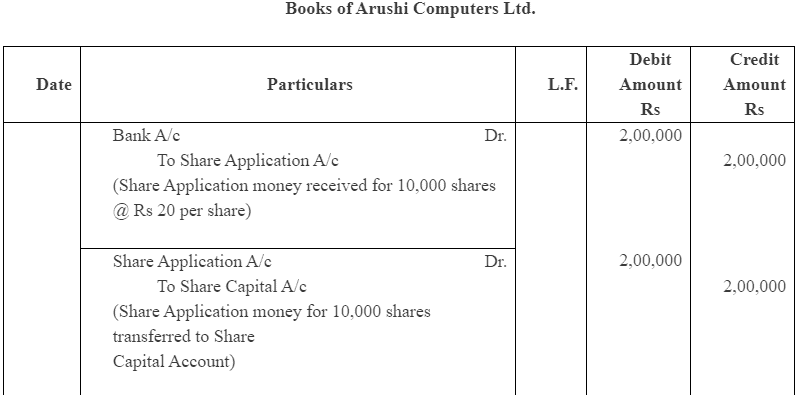

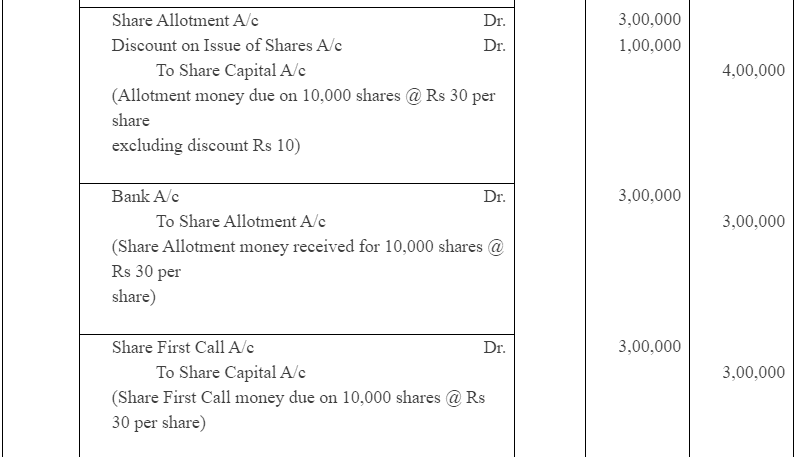

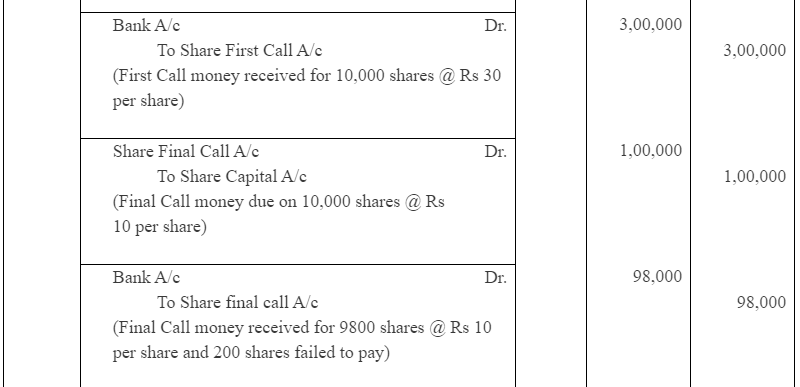

Question 13 : Arushi Computers Ltd issued 10,000 equity shares of Rs 100 each at 10% discount. The net amount payable as follows:

On application | Rs 20 |

On allotment | Rs 30 (Rs 40 – discount Rs 10) |

On first call | Rs 30 |

On final call | Rs 10 |

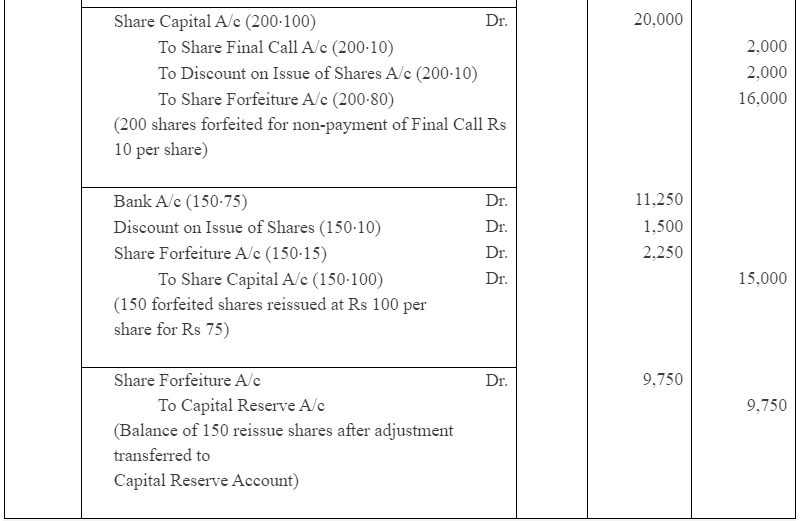

A shareholder holding 200 shares did not pay final call. His shares were forfeited. Out of these 150 shares were reissued to Ms. Sonia at Rs 75 per shares. Give Journal entries in the books of the company.

Answer :

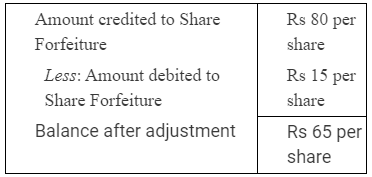

Working Notes:

Amount Transferred to Capital Reserve A/c

Amount transferred to Capital Reserve Account = Balance per share after adjustment × Number of shares reissued Rs 9,750 = Rs 65 × Rs 150 per share

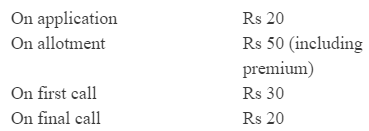

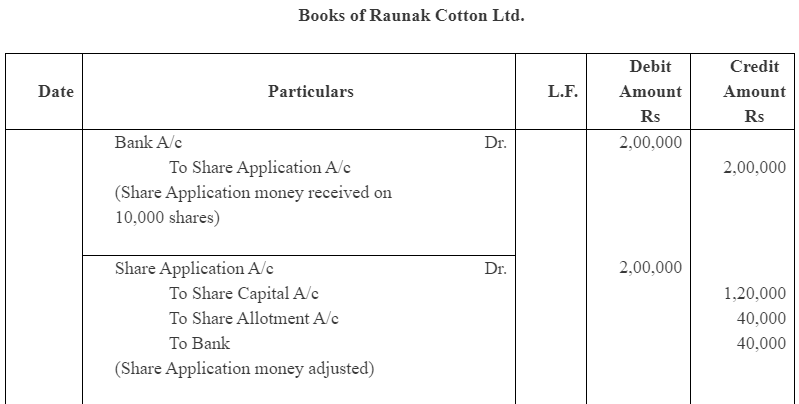

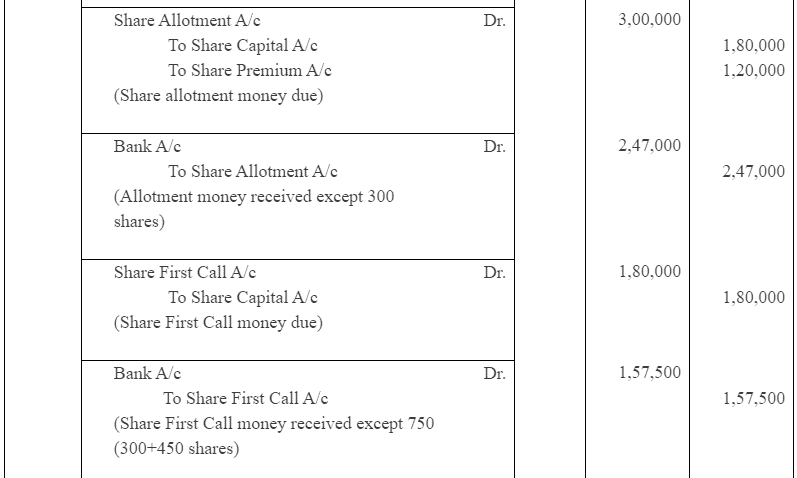

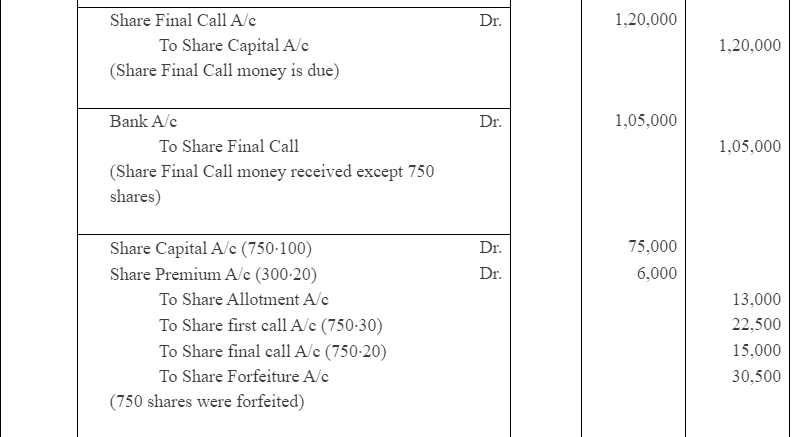

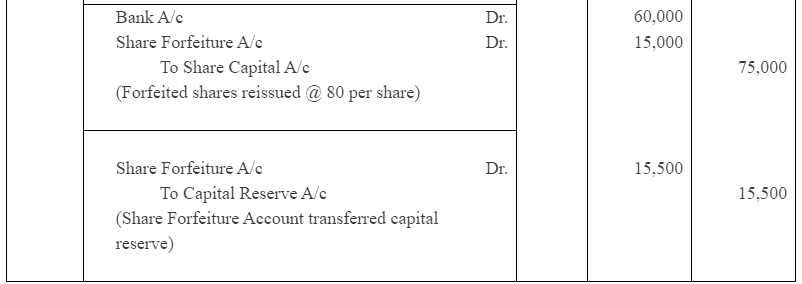

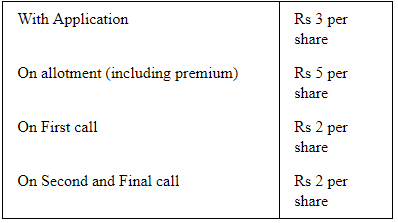

Question 14 : Raunak Cotton Ltd. issued a prospectus inviting applications for 6,000 equity shares of Rs 100 each at a premium of Rs 20 per shares, payable as follows:

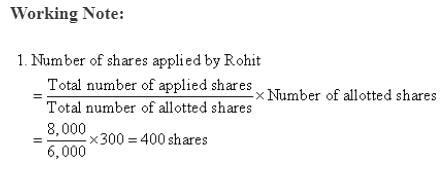

Applications were received for 10,000 shares and allotment was made Pro-rata to the applicants of 8,000 shares, the remaining applications Being refused. Money received in excess on the application was adjusted toward the amount due on allotment.

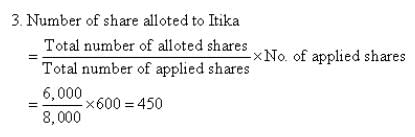

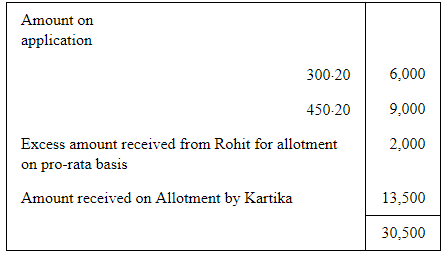

Rohit, to whom 300 shares were allotted failed to pay allotment and calls money, his shares were forfeited. Itika, who applied for 600 shares, failed to pay the two calls and her share were also forfeited. All these shares were sold to Kartika as fully paid for Rs 80 per shares.

Give journal entries in the books of the company.

Answer :

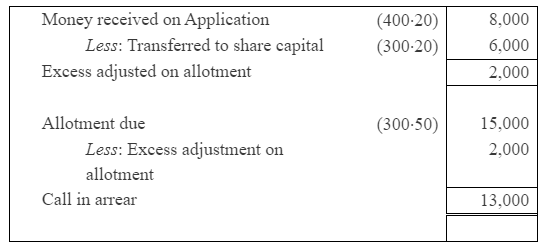

2. Call in arrears by Rohit on allotment

4. Share Forfeiture amount

Page No 68:

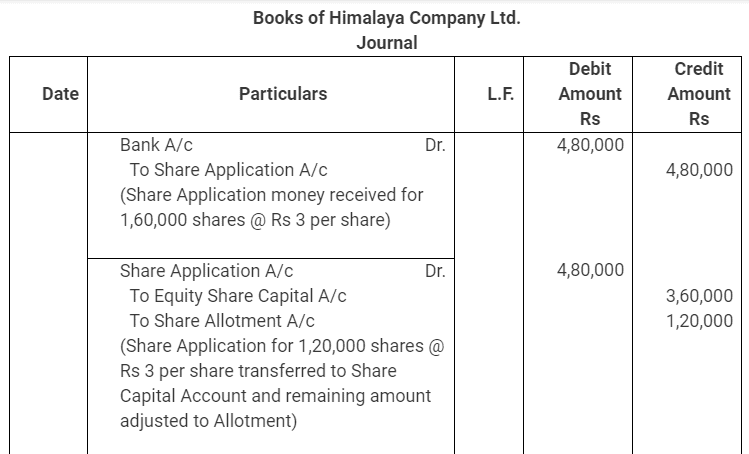

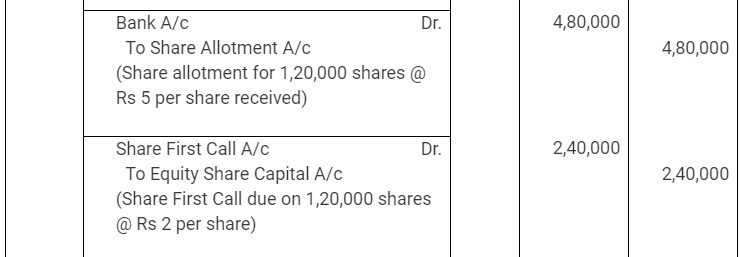

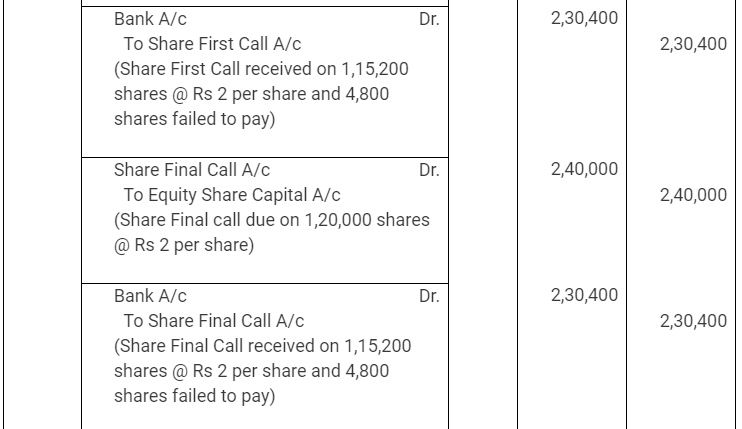

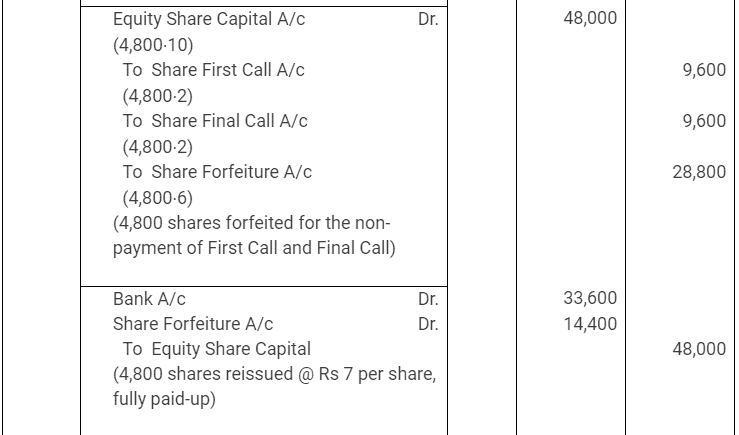

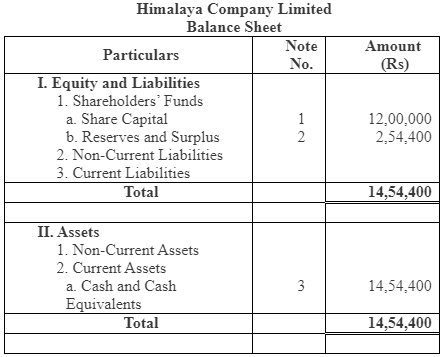

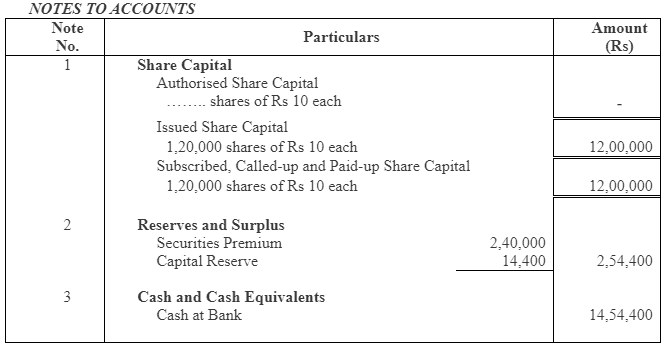

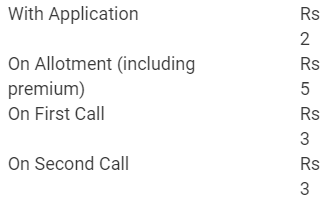

Question 15: Himalaya Company Limited issued for public subscription of 1,20,000 equity shares of Rs 10 each at a premium of Rs 2 per share payable as under :

Applications were received for 1,60,000 shares. Allotment was made on pro-rata basis. Excess money on application was adjusted against the amount due on allotment.

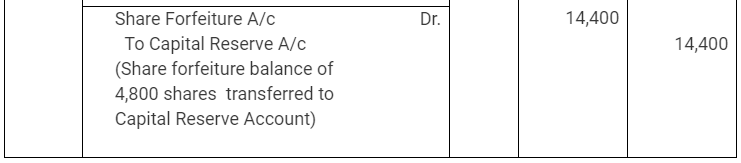

Rohan, whom 4,800 shares were allotted, failed to pay for the two calls. These shares were subsequently forfeited after the second call was made. All the shares forfeited were reissued to Teena as fully paid at Rs 7 per share.

Record journal entries in the books of the company to record these transactions relating to share capital. Also show the company’s balance sheet.

Answer:

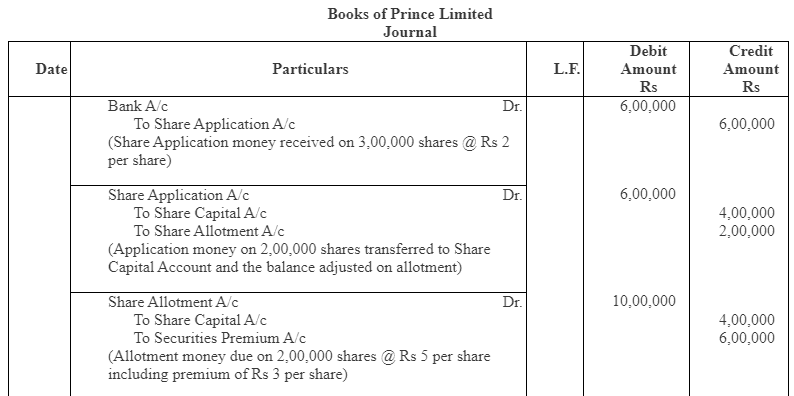

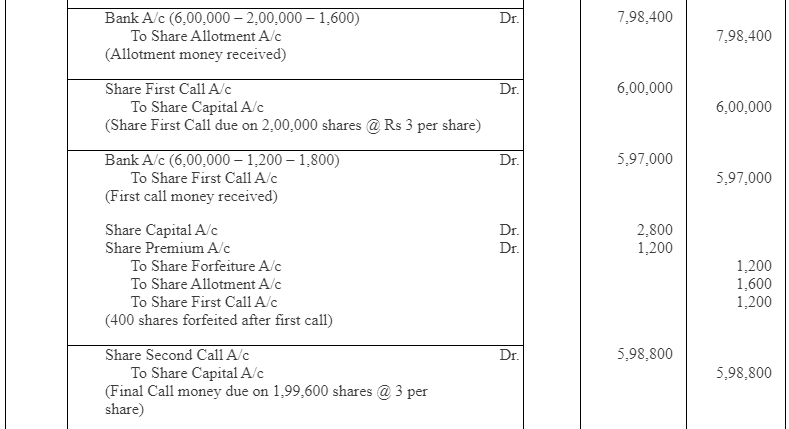

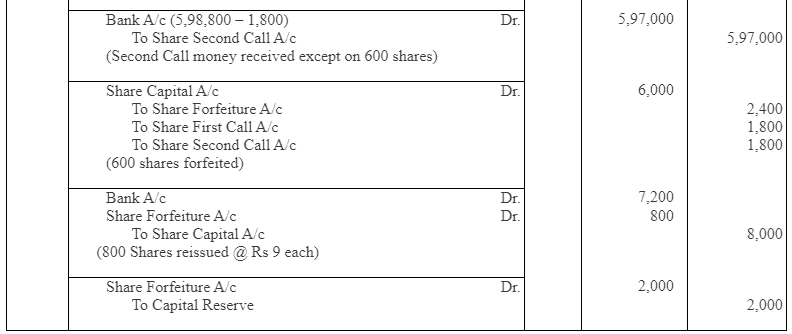

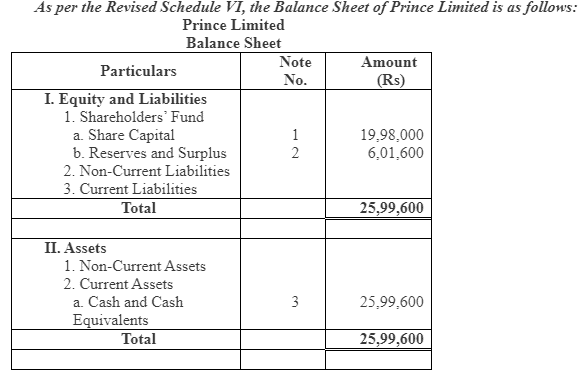

Question 16: Prince Limited issued a prospectus inviting applications for 2,00,000 equity shares of Rs 10 each at a premium of Rs 3 per share payable as follows :

Applications were received for 30,000 shares and allotment was made on pro-rata basis. Money overpaid on applications was adjusted to the amount due on allotment.

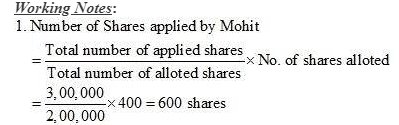

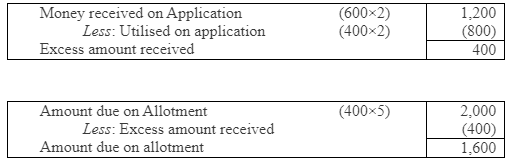

Mr. ‘Mohit’ whom 400 shares were allotted, failed to pay the allotment money and the first call, and her shares were forfeited after the first call. Mr. ‘Joly’, whom 600 shares were allotted, failed to pay for the two calls and hence, his shares were forfeited.

Of the shares forfeited, 800 shares were reissued to Supriya as fully paid for Rs 9 per share, the whole of Mr. Mohit’s shares being included.

Record journal entries in the books of the Company and prepare the Balance Sheet.

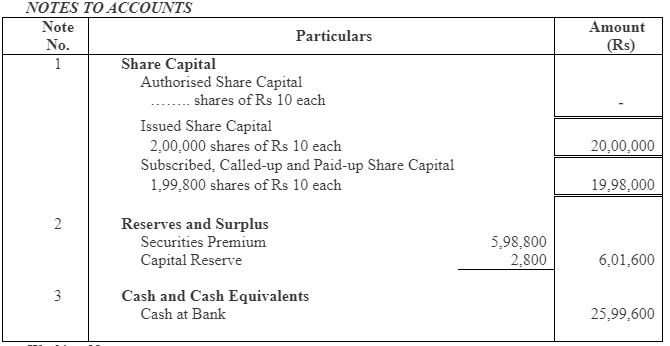

ANSWER:

Numerical Questions

Question 17:

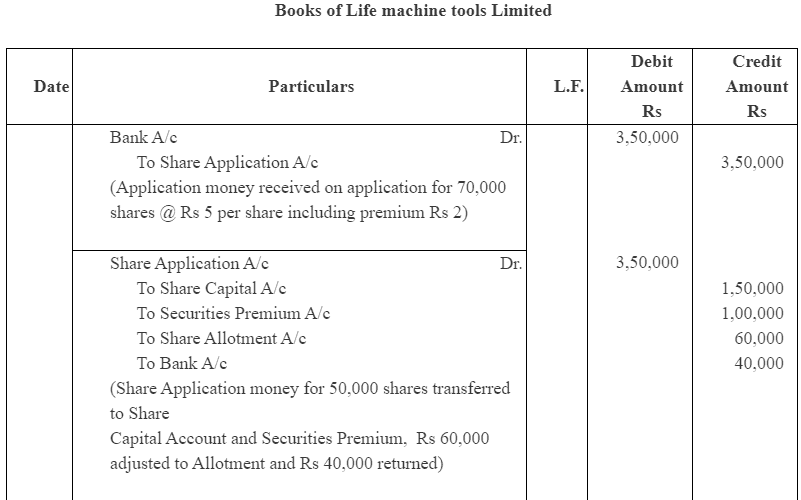

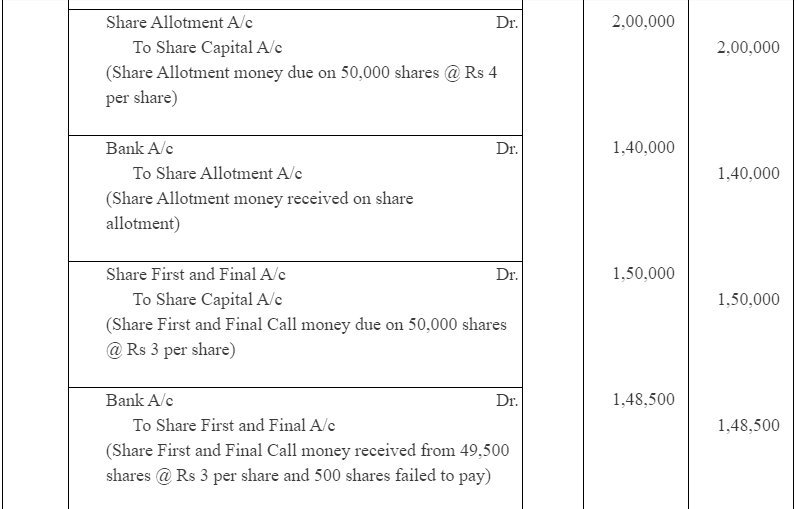

Life machine tools Limited, issued 50,000 equity shares of Rs 10 each at Rs 12 per share, payable at to Rs 5 on application (including premium), Rs 4 on allotment and the balance on the first and final call.

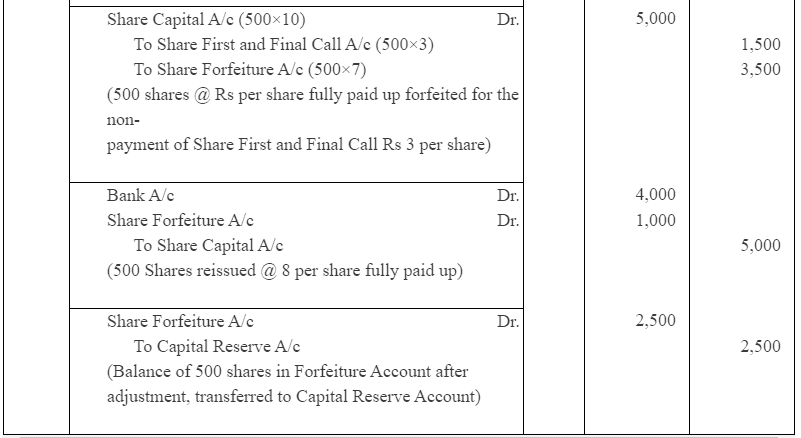

Applications for 70,000 shares had been received. Of the cash received, Rs 40,000 was returned and Rs 60,000 was applied to the amount due on allotment, the balance of which was paid. All shareholders paid the call due, with the exception of one share holder of 500 shares. These shares were forfeited and reissued as fully paid at Rs 8 per share. Journalise the transactions.

ANSWER:

|

4 videos|168 docs

|

FAQs on NCERT Solution (Part - 4) - Accounting for Share Capital - Additional Study Material for Commerce

| 1. What is share capital in accounting? |  |

| 2. How is share capital calculated? |  |

| 3. What are the types of share capital? |  |

| 4. How is share capital different from share premium? |  |

| 5. Can share capital be changed after it is initially recorded? |  |