All Exams >

CA Foundation >

Business Economics for CA Foundation >

All Questions

All questions of Business Economics Test for CA Foundation Exam

Which of the following is/are the most important input cost(s) in service industry?- a)Material

- b)Labour

- c)Both material and labour

- d)Overheads

Correct answer is option 'B'. Can you explain this answer?

Which of the following is/are the most important input cost(s) in service industry?

a)

Material

b)

Labour

c)

Both material and labour

d)

Overheads

|

Srsps answered |

Answer: B. Labour

The most important input cost in the service industry is labour. This is because:

- Services are often people-intensive, requiring a significant amount of human interaction and expertise to deliver value to customers.

- Labour costs are typically higher in the service industry compared to other industries, as it involves skilled professionals and specialized knowledge.

- Unlike manufacturing industries, where material costs can be a significant portion of the overall costs, service industries generally have lower material costs, as they primarily deal with intangible products and offerings.

- While overheads such as rent, utilities, and equipment are important, they do not usually outweigh the significance of labour costs in the service industry.

Therefore, labour is the most important input cost in the service industry, as it has the most significant impact on the quality and delivery of services provided to customers.

The burden of tax lies more/equally on ______ in a regressive taxation system.- a)poor class

- b)rich class

- c)midddle class

- d)all of these

Correct answer is option 'A'. Can you explain this answer?

The burden of tax lies more/equally on ______ in a regressive taxation system.

a)

poor class

b)

rich class

c)

midddle class

d)

all of these

|

|

Poonam Reddy answered |

Regressive Taxation System

- A regressive taxation system is one where the tax rate decreases as the taxable income increases.

- Under this system, the burden of tax is higher on lower-income groups, as they are required to pay a larger percentage of their income as taxes compared to higher-income groups.

The Burden of Tax in a Regressive Taxation System

- Poor class: The burden of tax lies more on the poor class in a regressive taxation system. This is because poor individuals pay a higher percentage of their income in taxes, which can lead to financial strain and limit their ability to meet basic needs.

- Rich class: The burden of tax is comparatively lower on the rich class, as they pay a smaller percentage of their income in taxes. This can lead to wealth accumulation and contribute to income inequality.

- Middle class: The burden of tax on the middle class is also relatively lower compared to the poor class but higher than the rich class. This can result in the middle class bearing a higher tax burden than they would under a progressive taxation system.

Conclusion

Under a regressive taxation system, the burden of tax lies more on the poor class, leading to negative impacts on their financial well-being and contributing to income inequality. In contrast, the rich class experiences a lower tax burden, allowing them to accumulate wealth more easily.

Till date, the Indian agriculture has been of ______ nature.- a)commercial

- b)advanced

- c)modern

- d)subsistence

Correct answer is option 'D'. Can you explain this answer?

Till date, the Indian agriculture has been of ______ nature.

a)

commercial

b)

advanced

c)

modern

d)

subsistence

|

|

Poonam Reddy answered |

Explanation:Indian agriculture has been of subsistence nature, which can be explained by the following points:1. Focus on meeting basic needs:- The primary objective of Indian agriculture has been to produce enough food to meet the needs of its large population.- Farmers grow crops mainly for their own consumption, and any surplus is sold in the market.2. Small and fragmented landholdings:- The majority of Indian farmers have small and fragmented landholdings, which makes it difficult to adopt modern and commercial farming techniques.- This results in low productivity and farmers mainly focus on producing enough to feed their families.3. Dependence on monsoons:- Indian agriculture is heavily dependent on monsoons, as a large percentage of the cultivated land is rainfed.- This makes agriculture vulnerable to the uncertainties of rainfall, leading to crop failures and low productivity.4. Limited use of modern technology:- Due to financial constraints and lack of awareness, many Indian farmers are still using traditional methods of farming.- The limited use of modern technology and agricultural practices contributes to the subsistence nature of Indian agriculture.5. Low level of commercialization:- The majority of Indian farmers are engaged in subsistence agriculture and produce mainly food crops.- The level of commercialization is low, with cash crops like cotton, jute, and sugarcane being produced on a relatively small scale.In conclusion, the Indian agriculture sector has been predominantly subsistence in nature due to its focus on meeting basic needs, small landholdings, dependence on monsoons, and limited use of modern technology. However, efforts are being made to transform Indian agriculture into a more modern and commercial sector through various government initiatives and the adoption of new technologies.

In _________ of estimation, national income is calculated by adding wages, rent, interest and profits.- a)product method

- b)income method

- c)expenditure method

- d)profit method

Correct answer is option 'B'. Can you explain this answer?

In _________ of estimation, national income is calculated by adding wages, rent, interest and profits.

a)

product method

b)

income method

c)

expenditure method

d)

profit method

|

|

Nikita Singh answered |

The Income Method measures national income from the side of payments made to the primary factors of production in the form of rent, wages, interest and profit for their productive services in an accounting year.

Which Indian state has the lowest density of population?- a)West Bengal

- b)Delhi

- c)Arunachal Pradesh

- d)Mizoram

Correct answer is option 'C'. Can you explain this answer?

Which Indian state has the lowest density of population?

a)

West Bengal

b)

Delhi

c)

Arunachal Pradesh

d)

Mizoram

|

|

Nikita Singh answered |

Answer: C. Arunachal PradeshExplanation:- Arunachal Pradesh has the lowest population density among Indian states.- Population density refers to the number of people living per square kilometer of land area.- According to the 2011 Census of India, Arunachal Pradesh has a population density of only 17 people per square kilometer.- This low population density is attributed to the state's large forest cover, mountainous terrain, and limited urbanization, which make it difficult for people to settle in large numbers.- On the other hand, states like West Bengal and Delhi have much higher population densities, with 1,029 and 11,297 people per square kilometer, respectively.

Who among the followings is concerned with `welfare definition` of economics?- a)Prof. MarshallCorrect Answer

- b)Prof. Samuelson

- c)Adam Smith

- d)Lord Robbins

Correct answer is option 'A'. Can you explain this answer?

Who among the followings is concerned with `welfare definition` of economics?

a)

Prof. MarshallCorrect Answer

b)

Prof. Samuelson

c)

Adam Smith

d)

Lord Robbins

|

Charvi Roy answered |

The Concerned Economist:

- The question asks who among the given options is concerned with the `welfare definition` of economics.

- This suggests that the question is referring to the different definitions of economics - some of which may prioritize efficiency, while others may prioritize equity and welfare.

- Therefore, the answer must be someone who is known to have advocated for or emphasized the importance of welfare in economics.

Prof. Marshall:

- This option is the correct answer because Alfred Marshall is known for his welfare-oriented approach to economics.

- Marshall believed that economics should not just focus on maximizing individual utility or profit, but should also consider the social welfare implications of economic activity.

- He introduced the concept of consumer surplus, which measures the difference between what a consumer is willing to pay for a good and what they actually pay, as a way to measure welfare gains from trade.

- Marshall also argued that economic policies should be evaluated based on their ability to improve social welfare, rather than just on their ability to promote economic growth or efficiency.

Prof. Samuelson:

- Although Paul Samuelson is a notable economist, he is not typically associated with the welfare definition of economics.

- Samuelson is known for his contributions to neoclassical economics, which emphasizes efficiency and rationality in economic decision-making.

- However, Samuelson did acknowledge the importance of welfare considerations in economics, particularly in his later work.

Adam Smith:

- Adam Smith is often considered the founder of modern economics, but his views on welfare are somewhat ambiguous.

- Smith believed that economic growth and efficiency were important goals, but he also recognized the importance of social welfare and justice.

- However, Smith's emphasis on the invisible hand and self-interest have led some to view him as a proponent of laissez-faire economics.

Lord Robbins:

- Lord Robbins is best known for his definition of economics as "the science which studies human behavior as a relationship between ends and scarce means which have alternative uses."

- While this definition does not explicitly prioritize welfare, Robbins did acknowledge the importance of ethical considerations in economics.

- Robbins argued that economics should not just describe how people behave, but should also consider how they ought to behave in order to achieve social welfare.

- The question asks who among the given options is concerned with the `welfare definition` of economics.

- This suggests that the question is referring to the different definitions of economics - some of which may prioritize efficiency, while others may prioritize equity and welfare.

- Therefore, the answer must be someone who is known to have advocated for or emphasized the importance of welfare in economics.

Prof. Marshall:

- This option is the correct answer because Alfred Marshall is known for his welfare-oriented approach to economics.

- Marshall believed that economics should not just focus on maximizing individual utility or profit, but should also consider the social welfare implications of economic activity.

- He introduced the concept of consumer surplus, which measures the difference between what a consumer is willing to pay for a good and what they actually pay, as a way to measure welfare gains from trade.

- Marshall also argued that economic policies should be evaluated based on their ability to improve social welfare, rather than just on their ability to promote economic growth or efficiency.

Prof. Samuelson:

- Although Paul Samuelson is a notable economist, he is not typically associated with the welfare definition of economics.

- Samuelson is known for his contributions to neoclassical economics, which emphasizes efficiency and rationality in economic decision-making.

- However, Samuelson did acknowledge the importance of welfare considerations in economics, particularly in his later work.

Adam Smith:

- Adam Smith is often considered the founder of modern economics, but his views on welfare are somewhat ambiguous.

- Smith believed that economic growth and efficiency were important goals, but he also recognized the importance of social welfare and justice.

- However, Smith's emphasis on the invisible hand and self-interest have led some to view him as a proponent of laissez-faire economics.

Lord Robbins:

- Lord Robbins is best known for his definition of economics as "the science which studies human behavior as a relationship between ends and scarce means which have alternative uses."

- While this definition does not explicitly prioritize welfare, Robbins did acknowledge the importance of ethical considerations in economics.

- Robbins argued that economics should not just describe how people behave, but should also consider how they ought to behave in order to achieve social welfare.

When lesser quantity is demanded with a rise in price, it is called ________ of demand.- a)increase

- b)decrease

- c)expansion

- d)contraction

Correct answer is option 'D'. Can you explain this answer?

When lesser quantity is demanded with a rise in price, it is called ________ of demand.

a)

increase

b)

decrease

c)

expansion

d)

contraction

|

|

Poonam Reddy answered |

Answer: D: ContractionExplanation:When lesser quantity is demanded with a rise in price, it is called contraction of demand. This concept is based on the law of demand, which states that the quantity demanded of a good or service is inversely related to its price.Key points to understand the contraction of demand:- Price increase: When the price of a good or service increases.- Lesser quantity demanded: The quantity demanded by consumers decreases due to the higher price.- Contraction: This decrease in quantity demanded is referred to as a contraction of demand.- Law of Demand: The contraction of demand is in line with the law of demand, which establishes a negative relationship between price and quantity demanded.

The agency functions of commercial banks do not include- a)collection of dividends

- b)providing loans

- c)collection of cheques and drafts

- d)acting as trustee or executor

Correct answer is option 'B'. Can you explain this answer?

The agency functions of commercial banks do not include

a)

collection of dividends

b)

providing loans

c)

collection of cheques and drafts

d)

acting as trustee or executor

|

|

Poonam Reddy answered |

The correct answer is B: providing loans.Explanation:Agency functions of commercial banks refer to the services that banks provide on behalf of their customers. These functions mainly involve assisting customers in managing their financial transactions and assets. Providing loans, however, is considered a primary function of commercial banks and not an agency function. Agency functions of commercial banks include:A: Collection of dividends- Commercial banks collect dividends on behalf of their customers from various investment sources such as stocks and bonds.C: Collection of cheques and drafts- Banks collect cheques and drafts for their customers, allowing them to receive payments from other parties.D: Acting as trustee or executor- Commercial banks can act as a trustee or executor for their customers by managing their estates, trusts, or other assets as per their instructions.In contrast, providing loans is a primary function of commercial banks, which involves lending money to customers for various purposes such as personal expenses, business investments, or buying property. This function is essential for the bank's profitability and does not fall under the category of agency functions.

Which of the following institutes is the apex body for rural credit and agricultural finance?- a)Reserve Bank of India

- b)Regional Rural Banks

- c)SIDBI

- d)NABARD

Correct answer is option 'D'. Can you explain this answer?

Which of the following institutes is the apex body for rural credit and agricultural finance?

a)

Reserve Bank of India

b)

Regional Rural Banks

c)

SIDBI

d)

NABARD

|

Charvi Roy answered |

NABARD (National Bank for Agriculture and Rural Development) is the apex body for rural credit and agricultural finance in India. It was established in 1982 under the provisions of the NABARD Act of 1981. The main objective of NABARD is to promote sustainable and equitable agriculture and rural prosperity through effective credit support, related services, institutional development and other innovative initiatives.

Functions of NABARD:

1. Credit functions: NABARD provides credit facilities to farmers, rural artisans, entrepreneurs, and other rural individuals and institutions through various schemes.

2. Development functions: NABARD provides development assistance to various institutions for the promotion of agriculture and rural development. It also provides technical assistance and consultancy services to various agencies.

3. Supervisory functions: NABARD supervises and regulates the functioning of regional rural banks, cooperative banks, and other rural financial institutions.

4. Investment functions: NABARD invests in various development projects, such as irrigation, rural roads, and rural electrification, to promote rural development.

Importance of NABARD:

1. NABARD plays a crucial role in rural development by providing credit and other financial services to farmers and other rural individuals and institutions.

2. It helps in the promotion of sustainable and equitable agriculture and rural prosperity.

3. It acts as a catalyst for rural development by providing technical assistance, consultancy services, and other innovative initiatives.

4. It ensures the smooth functioning of rural financial institutions by supervising and regulating their operations.

In conclusion, NABARD is the apex body for rural credit and agricultural finance in India, and it plays a crucial role in promoting sustainable and equitable agriculture and rural prosperity through effective credit support, related services, institutional development and other innovative initiatives.

Functions of NABARD:

1. Credit functions: NABARD provides credit facilities to farmers, rural artisans, entrepreneurs, and other rural individuals and institutions through various schemes.

2. Development functions: NABARD provides development assistance to various institutions for the promotion of agriculture and rural development. It also provides technical assistance and consultancy services to various agencies.

3. Supervisory functions: NABARD supervises and regulates the functioning of regional rural banks, cooperative banks, and other rural financial institutions.

4. Investment functions: NABARD invests in various development projects, such as irrigation, rural roads, and rural electrification, to promote rural development.

Importance of NABARD:

1. NABARD plays a crucial role in rural development by providing credit and other financial services to farmers and other rural individuals and institutions.

2. It helps in the promotion of sustainable and equitable agriculture and rural prosperity.

3. It acts as a catalyst for rural development by providing technical assistance, consultancy services, and other innovative initiatives.

4. It ensures the smooth functioning of rural financial institutions by supervising and regulating their operations.

In conclusion, NABARD is the apex body for rural credit and agricultural finance in India, and it plays a crucial role in promoting sustainable and equitable agriculture and rural prosperity through effective credit support, related services, institutional development and other innovative initiatives.

The term 'deposits with banks with maturity over one year' comes under ___ definition of money.- a)M-1

- b)M-2

- c)M-3

- d)M-4

Correct answer is option 'C'. Can you explain this answer?

The term 'deposits with banks with maturity over one year' comes under ___ definition of money.

a)

M-1

b)

M-2

c)

M-3

d)

M-4

|

Freedom Institute answered |

The term 'deposits with banks with maturity over one year' comes under the M-3 definition of money. Explanation:There are four measures of money in the economy, commonly referred to as M-1, M-2, M-3, and M-4. Each measure includes different components of the money supply:M-1:- Currency in circulation (coins and notes)- Demand deposits (checking accounts)- Traveler's checksM-2:- All components of M-1- Savings deposits- Small denomination time deposits (certificates of deposit less than $100,000)- Money market deposit accountsM-3:- All components of M-2- Large denomination time deposits (certificates of deposit of $100,000 or more)- Institutional money market funds- Deposits with banks with maturity over one yearM-4:- All components of M-3- Other liquid assets, such as Treasury bills and commercial paperThe term 'deposits with banks with maturity over one year' falls under the M-3 definition of money because it includes large denomination time deposits and other less liquid assets in addition to the components of M-2.

Which of the following is/are the internal or domestic source(s) of fund mobilisation for the government?- a)Grants

- b)Loans

- c)Deficit financing

- d)All of these

Correct answer is option 'C'. Can you explain this answer?

Which of the following is/are the internal or domestic source(s) of fund mobilisation for the government?

a)

Grants

b)

Loans

c)

Deficit financing

d)

All of these

|

|

Poonam Reddy answered |

Deficit financing is the primary domestic source of fund mobilization for the government. Here is an explanation:Deficit Financing:- Deficit financing refers to the government's practice of borrowing money to cover the gap between its revenue and expenditure.- This can be done through various means, such as issuing government bonds, taking loans from domestic banks, or printing more currency.- Deficit financing allows the government to meet its short-term financial obligations and invest in long-term projects that can stimulate economic growth.- However, excessive deficit financing can lead to inflation and a rise in public debt, which could negatively impact the economy in the long run.While grants and loans can provide funds to the government, they are usually considered external sources of funding, as they typically come from foreign governments or international organizations.

Most of the unemployment in India is- a)voluntary

- b)frictional

- c)structural

- d)temporary

Correct answer is option 'C'. Can you explain this answer?

Most of the unemployment in India is

a)

voluntary

b)

frictional

c)

structural

d)

temporary

|

|

Poonam Reddy answered |

Answer: C. StructuralExplanation:- Structural unemployment: This type of unemployment occurs when there is a mismatch between the skills that workers possess and the skills required for the available jobs. In India, a significant portion of the labor force is engaged in informal or unorganized sectors with limited skills and education, which makes it difficult for them to find appropriate jobs in the organized sector.- Reasons for structural unemployment in India: - Lack of quality education: Many people in India do not have access to quality education, which restricts their ability to acquire the skills needed for better employment opportunities. - Technological changes: Rapid technological advancements have led to a demand for skilled workers in various industries. Those who cannot adapt to these changes often find themselves unemployed. - Slow economic growth: India's economic growth has not been consistent, leading to fewer job opportunities in various sectors. - Rural-urban migration: Many people migrate from rural to urban areas in search of better job opportunities, but they often lack the necessary skills and education to find suitable employment.Other types of unemployment, such as voluntary, frictional, and temporary, do exist in India but are not as prevalent as structural unemployment. The primary focus needs to be on addressing the structural unemployment issue by investing in education and skill development programs, promoting industries and sectors with high employment potential, and creating a more inclusive labor market.

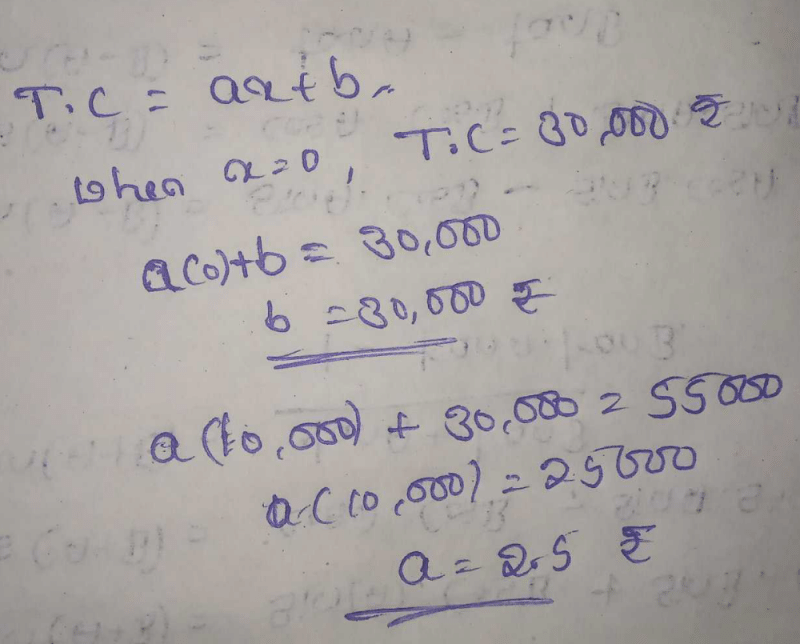

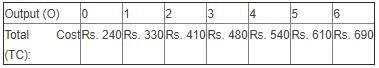

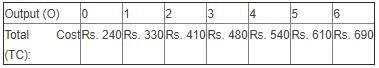

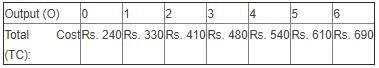

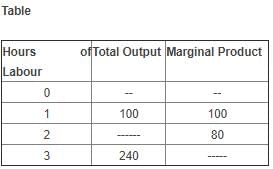

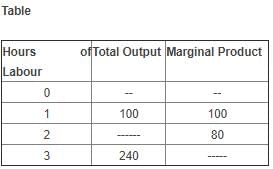

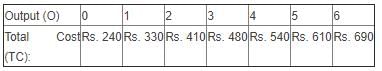

Directions: Use the table below to answer the question.

Q. The average fixed cost of two units of output is

Q. The average fixed cost of two units of output is

- a)Rs. 80

- b)Rs. 85

- c)Rs. 120

- d)Rs. 205

Correct answer is option 'C'. Can you explain this answer?

Directions: Use the table below to answer the question.

Q. The average fixed cost of two units of output is

a)

Rs. 80

b)

Rs. 85

c)

Rs. 120

d)

Rs. 205

|

Srsps answered |

Calculating Average Fixed Cost for Two Units of Output

- First, identify the fixed cost for producing two units of output from the table.

- From the table, find the total fixed cost for producing two units of output.

- Divide the total fixed cost by the number of units produced (in this case, 2) to calculate the average fixed cost per unit.

- According to the options provided, the average fixed cost of two units of output is Rs. 120

Price discrimination is the feature of which of the following competitions?- a)Perfect competition

- b)Oligopoly

- c)Monopoly

- d)Monopolistic competition

Correct answer is option 'C'. Can you explain this answer?

Price discrimination is the feature of which of the following competitions?

a)

Perfect competition

b)

Oligopoly

c)

Monopoly

d)

Monopolistic competition

|

Dhruba Choudhary answered |

Price Discrimination in Monopoly Competition

Definition of Price Discrimination

Price discrimination is a strategy of charging different prices from different customers for the same product or service. It is a common phenomenon in monopolistic competition and monopoly where firms have market power.

Monopoly Competition

In a monopoly, there is only one seller of a product or service in the market. Due to the lack of competition, the monopolist has the power to set the price of the product or service. The monopolist can use this power to charge different prices from different customers.

Conditions for Price Discrimination

For price discrimination to be successful, the following conditions must be met:

- The monopolist must have market power.

- The monopolist must be able to distinguish between different customer groups.

- The monopolist must be able to prevent resale of the product or service.

Types of Price Discrimination

Price discrimination can be of the following types:

- First Degree Price Discrimination: This is when the monopolist charges each customer the maximum price they are willing to pay for the product or service. This type of price discrimination is rare.

- Second Degree Price Discrimination: This is when the monopolist charges different prices based on the quantity of the product or service bought. For example, a bulk discount.

- Third Degree Price Discrimination: This is when the monopolist charges different prices based on the characteristics of the customer group. For example, a student discount.

Advantages and Disadvantages of Price Discrimination

Advantages:

- Increases revenue for the monopolist.

- Allows the monopolist to reach a wider customer base.

- Can be used to price discriminate against price-sensitive customers.

Disadvantages:

- Can lead to customer dissatisfaction and loss of goodwill.

- Can lead to regulatory intervention and legal action.

- Can lead to a reduction in consumer surplus.

Conclusion

In conclusion, price discrimination is a common feature of monopoly competition due to the market power of the monopolist. Price discrimination can be of different types and has its advantages and disadvantages.

Definition of Price Discrimination

Price discrimination is a strategy of charging different prices from different customers for the same product or service. It is a common phenomenon in monopolistic competition and monopoly where firms have market power.

Monopoly Competition

In a monopoly, there is only one seller of a product or service in the market. Due to the lack of competition, the monopolist has the power to set the price of the product or service. The monopolist can use this power to charge different prices from different customers.

Conditions for Price Discrimination

For price discrimination to be successful, the following conditions must be met:

- The monopolist must have market power.

- The monopolist must be able to distinguish between different customer groups.

- The monopolist must be able to prevent resale of the product or service.

Types of Price Discrimination

Price discrimination can be of the following types:

- First Degree Price Discrimination: This is when the monopolist charges each customer the maximum price they are willing to pay for the product or service. This type of price discrimination is rare.

- Second Degree Price Discrimination: This is when the monopolist charges different prices based on the quantity of the product or service bought. For example, a bulk discount.

- Third Degree Price Discrimination: This is when the monopolist charges different prices based on the characteristics of the customer group. For example, a student discount.

Advantages and Disadvantages of Price Discrimination

Advantages:

- Increases revenue for the monopolist.

- Allows the monopolist to reach a wider customer base.

- Can be used to price discriminate against price-sensitive customers.

Disadvantages:

- Can lead to customer dissatisfaction and loss of goodwill.

- Can lead to regulatory intervention and legal action.

- Can lead to a reduction in consumer surplus.

Conclusion

In conclusion, price discrimination is a common feature of monopoly competition due to the market power of the monopolist. Price discrimination can be of different types and has its advantages and disadvantages.

Balance of payment includes- a)visible items of imports and exports

- b)invisible items of imports and exports

- c)capital account transactions

- d)all of these

Correct answer is option 'D'. Can you explain this answer?

Balance of payment includes

a)

visible items of imports and exports

b)

invisible items of imports and exports

c)

capital account transactions

d)

all of these

|

Muskaan Tiwari answered |

Balance of Payment (BOP) is a statement that records all transactions between a country and the rest of the world over a period of time. It includes both visible and invisible items of imports and exports, as well as capital account transactions.

Visible Items of Imports and Exports:

Visible items refer to tangible goods that are traded between countries. These include goods such as raw materials, finished products, machinery, and vehicles. The value of visible items is recorded in the current account of the BOP.

Invisible Items of Imports and Exports:

Invisible items refer to intangible goods and services that are traded between countries. These include services such as tourism, transportation, and software exports. The value of invisible items is also recorded in the current account of the BOP.

Capital Account Transactions:

Capital account transactions refer to the movement of capital between countries. This includes investments in stocks, bonds, and real estate, as well as foreign direct investments. The value of capital account transactions is recorded in the capital account of the BOP.

All of These:

The BOP statement records all transactions between a country and the rest of the world, including visible and invisible items of imports and exports, as well as capital account transactions. Therefore, option 'D' is the correct answer.

In conclusion, the BOP statement is an important economic tool that reflects a country's economic activity with the rest of the world. It is important for policymakers to monitor the BOP to ensure that a country's economy is in a healthy state and to identify areas that require attention.

Visible Items of Imports and Exports:

Visible items refer to tangible goods that are traded between countries. These include goods such as raw materials, finished products, machinery, and vehicles. The value of visible items is recorded in the current account of the BOP.

Invisible Items of Imports and Exports:

Invisible items refer to intangible goods and services that are traded between countries. These include services such as tourism, transportation, and software exports. The value of invisible items is also recorded in the current account of the BOP.

Capital Account Transactions:

Capital account transactions refer to the movement of capital between countries. This includes investments in stocks, bonds, and real estate, as well as foreign direct investments. The value of capital account transactions is recorded in the capital account of the BOP.

All of These:

The BOP statement records all transactions between a country and the rest of the world, including visible and invisible items of imports and exports, as well as capital account transactions. Therefore, option 'D' is the correct answer.

In conclusion, the BOP statement is an important economic tool that reflects a country's economic activity with the rest of the world. It is important for policymakers to monitor the BOP to ensure that a country's economy is in a healthy state and to identify areas that require attention.

According to Dr. Marshall, the ________ element has a great relevance in the determination of price.- a)supply

- b)demand

- c)time

- d)money

Correct answer is option 'C'. Can you explain this answer?

According to Dr. Marshall, the ________ element has a great relevance in the determination of price.

a)

supply

b)

demand

c)

time

d)

money

|

Gaurav Chatterjee answered |

Understanding the Importance of Time in Pricing

In the context of pricing, time plays a pivotal role due to various reasons. Here’s an exploration of why time is essential in determining price:

Impact of Market Conditions

- Time influences market conditions which can change frequently due to various factors such as seasonality, economic cycles, and consumer trends.

- For example, demand for certain products may peak during holidays, leading to price increases.

Cost Considerations

- The cost of production can vary over time. Fluctuations in raw material prices, labor costs, and technological advancements can affect the overall cost structure, hence impacting pricing strategies.

- Companies may adjust prices based on long-term forecasts of these costs.

Consumer Behavior

- Consumer willingness to pay can change over time. Buyers may have different perceptions of value depending on current trends and their financial situation.

- Timing a product launch or sale strategically can maximize profit based on consumer readiness.

Pricing Strategies

- Businesses often employ time-based pricing strategies, such as dynamic pricing, which adjusts prices in real-time based on demand and supply conditions.

- Seasonal discounts or promotional periods are also time-sensitive approaches that can significantly affect pricing.

Conclusion

In conclusion, the element of time is crucial in pricing decisions. It intertwines with supply and demand dynamics, cost fluctuations, and consumer behavior, making it a significant factor that businesses must consider for effective pricing strategies. Recognizing the relevance of time allows companies to optimize their pricing models for better profitability and market alignment.

In the context of pricing, time plays a pivotal role due to various reasons. Here’s an exploration of why time is essential in determining price:

Impact of Market Conditions

- Time influences market conditions which can change frequently due to various factors such as seasonality, economic cycles, and consumer trends.

- For example, demand for certain products may peak during holidays, leading to price increases.

Cost Considerations

- The cost of production can vary over time. Fluctuations in raw material prices, labor costs, and technological advancements can affect the overall cost structure, hence impacting pricing strategies.

- Companies may adjust prices based on long-term forecasts of these costs.

Consumer Behavior

- Consumer willingness to pay can change over time. Buyers may have different perceptions of value depending on current trends and their financial situation.

- Timing a product launch or sale strategically can maximize profit based on consumer readiness.

Pricing Strategies

- Businesses often employ time-based pricing strategies, such as dynamic pricing, which adjusts prices in real-time based on demand and supply conditions.

- Seasonal discounts or promotional periods are also time-sensitive approaches that can significantly affect pricing.

Conclusion

In conclusion, the element of time is crucial in pricing decisions. It intertwines with supply and demand dynamics, cost fluctuations, and consumer behavior, making it a significant factor that businesses must consider for effective pricing strategies. Recognizing the relevance of time allows companies to optimize their pricing models for better profitability and market alignment.

Directions: In Econoville, there is one grocery shop, Ecoconvenience. It used to sell fresh milk at Rs. 20 per litre, at which price 400 litres of milk were sold per month. After some time, the price was raised to Rs. 30 per litre. Following the price rise:Only 200 litres of milk was sold every month.

The number of boxes of cereal customers bought went down from 280 to 240.

The number of packets of powered milk customers bought went up from 90 to 220 per month.The cross elasticity of monthly demand for powdered milk when the price of fresh milk increases from Rs. 20 to Rs. 30 per litre is equal to- a)+ 1.05

- b)- 1.05

- c)- 2.09

- d)+ 2.09

Correct answer is option 'D'. Can you explain this answer?

Directions: In Econoville, there is one grocery shop, Ecoconvenience. It used to sell fresh milk at Rs. 20 per litre, at which price 400 litres of milk were sold per month. After some time, the price was raised to Rs. 30 per litre. Following the price rise:

Only 200 litres of milk was sold every month.

The number of boxes of cereal customers bought went down from 280 to 240.

The number of packets of powered milk customers bought went up from 90 to 220 per month.

The number of boxes of cereal customers bought went down from 280 to 240.

The number of packets of powered milk customers bought went up from 90 to 220 per month.

The cross elasticity of monthly demand for powdered milk when the price of fresh milk increases from Rs. 20 to Rs. 30 per litre is equal to

a)

+ 1.05

b)

- 1.05

c)

- 2.09

d)

+ 2.09

|

Pranav Gupta answered |

Cross Elasticity of Demand Calculation

The cross elasticity of demand measures the responsiveness of demand for one good to changes in the price of another good. It is calculated using the following formula:

Cross Elasticity of Demand = (% Change in Quantity Demanded of Good A) / (% Change in Price of Good B)

Here, we need to calculate the cross elasticity of demand for powdered milk when the price of fresh milk increases from Rs. 20 to Rs. 30 per litre.

Step 1: Calculate the percentage change in the quantity demanded of powdered milk.

Initial Quantity Demanded of Powdered Milk = 90 packets

New Quantity Demanded of Powdered Milk = 220 packets

% Change in Quantity Demanded of Powdered Milk = ((New Quantity Demanded - Initial Quantity Demanded) / Initial Quantity Demanded) x 100

% Change in Quantity Demanded of Powdered Milk = ((220 - 90) / 90) x 100

% Change in Quantity Demanded of Powdered Milk = 144.44%

Step 2: Calculate the percentage change in the price of fresh milk.

Initial Price of Fresh Milk = Rs. 20 per litre

New Price of Fresh Milk = Rs. 30 per litre

% Change in Price of Fresh Milk = ((New Price - Initial Price) / Initial Price) x 100

% Change in Price of Fresh Milk = ((30 - 20) / 20) x 100

% Change in Price of Fresh Milk = 50%

Step 3: Calculate the cross elasticity of demand.

Cross Elasticity of Demand = (% Change in Quantity Demanded of Powdered Milk) / (% Change in Price of Fresh Milk)

Cross Elasticity of Demand = (144.44% / 50%)

Cross Elasticity of Demand = 2.89

Since the cross elasticity of demand is positive, we can conclude that powdered milk is a substitute for fresh milk. The correct answer is option 'D' (2.09), which may be a typo in the question.

The cross elasticity of demand measures the responsiveness of demand for one good to changes in the price of another good. It is calculated using the following formula:

Cross Elasticity of Demand = (% Change in Quantity Demanded of Good A) / (% Change in Price of Good B)

Here, we need to calculate the cross elasticity of demand for powdered milk when the price of fresh milk increases from Rs. 20 to Rs. 30 per litre.

Step 1: Calculate the percentage change in the quantity demanded of powdered milk.

Initial Quantity Demanded of Powdered Milk = 90 packets

New Quantity Demanded of Powdered Milk = 220 packets

% Change in Quantity Demanded of Powdered Milk = ((New Quantity Demanded - Initial Quantity Demanded) / Initial Quantity Demanded) x 100

% Change in Quantity Demanded of Powdered Milk = ((220 - 90) / 90) x 100

% Change in Quantity Demanded of Powdered Milk = 144.44%

Step 2: Calculate the percentage change in the price of fresh milk.

Initial Price of Fresh Milk = Rs. 20 per litre

New Price of Fresh Milk = Rs. 30 per litre

% Change in Price of Fresh Milk = ((New Price - Initial Price) / Initial Price) x 100

% Change in Price of Fresh Milk = ((30 - 20) / 20) x 100

% Change in Price of Fresh Milk = 50%

Step 3: Calculate the cross elasticity of demand.

Cross Elasticity of Demand = (% Change in Quantity Demanded of Powdered Milk) / (% Change in Price of Fresh Milk)

Cross Elasticity of Demand = (144.44% / 50%)

Cross Elasticity of Demand = 2.89

Since the cross elasticity of demand is positive, we can conclude that powdered milk is a substitute for fresh milk. The correct answer is option 'D' (2.09), which may be a typo in the question.

If the railways are making losses on passenger traffic they should lower their fares. The suggested remedy would only work if the demand for rail travel had a price elasticity of- a)zero

- b)greater than one

- c)one

- d)greater than onegreater than zero but less than one

Correct answer is option 'B'. Can you explain this answer?

If the railways are making losses on passenger traffic they should lower their fares. The suggested remedy would only work if the demand for rail travel had a price elasticity of

a)

zero

b)

greater than one

c)

one

d)

greater than onegreater than zero but less than one

|

|

Ishan Choudhury answered |

ANSWER

- b)greater than one

The 'suggested remedy' would only work if the 'demand for rail travel' had a 'price elasticity' of Greater than Zero and less than one. Explanation: If the railways decide to lower their fares their 'demand for rail' travel will

increaseIn case of perfect competition, the selling firm is- a)price taker

- b)price maker

- c)price leader

- d)none of these

Correct answer is option 'A'. Can you explain this answer?

In case of perfect competition, the selling firm is

a)

price taker

b)

price maker

c)

price leader

d)

none of these

|

Malavika Basak answered |

A perfectly competitive firm is a price taker, which means that it must accept the equilibrium price at which it sells goods. If a perfectly competitive firm attempts to charge even a tiny amount more than the market price, it will be unable to make any sales.

Giffen Paradox is applicable for- a)price demand

- b)income demand

- c)cross demand

- d)all of these

Correct answer is option 'B'. Can you explain this answer?

Giffen Paradox is applicable for

a)

price demand

b)

income demand

c)

cross demand

d)

all of these

|

Vaishnavi Joshi answered |

Giffen Paradox and its applicability to Income Demand

The Giffen Paradox is a phenomenon in which an increase in the price of a good leads to an increase in the quantity demanded of that good. This goes against the basic law of demand which states that the quantity demanded of a good decreases as the price increases. The paradox was first observed by Sir Robert Giffen, a Scottish economist.

Applicability to Income Demand

The Giffen Paradox is applicable to income demand, which refers to the relationship between the quantity demanded of a good and changes in income. In the case of a Giffen good, which is a product that has no close substitutes and is a significant portion of a consumer's budget, an increase in the price of the good leads to a decrease in the consumer's purchasing power. This, in turn, leads to a decrease in the quantity demanded of all goods except for the Giffen good.

In the case of a Giffen good, the income effect dominates the substitution effect, which is the tendency of consumers to switch to substitute goods when the price of a good increases. As a result, an increase in the price of the Giffen good leads to an increase in the quantity demanded of the good, as consumers are forced to allocate more of their income to the good.

Conclusion

In conclusion, the Giffen Paradox is applicable to income demand, and describes a situation where an increase in the price of a Giffen good leads to an increase in the quantity demanded of the good. This paradox is important in understanding consumer behavior and the relationship between price and demand.

The Giffen Paradox is a phenomenon in which an increase in the price of a good leads to an increase in the quantity demanded of that good. This goes against the basic law of demand which states that the quantity demanded of a good decreases as the price increases. The paradox was first observed by Sir Robert Giffen, a Scottish economist.

Applicability to Income Demand

The Giffen Paradox is applicable to income demand, which refers to the relationship between the quantity demanded of a good and changes in income. In the case of a Giffen good, which is a product that has no close substitutes and is a significant portion of a consumer's budget, an increase in the price of the good leads to a decrease in the consumer's purchasing power. This, in turn, leads to a decrease in the quantity demanded of all goods except for the Giffen good.

In the case of a Giffen good, the income effect dominates the substitution effect, which is the tendency of consumers to switch to substitute goods when the price of a good increases. As a result, an increase in the price of the Giffen good leads to an increase in the quantity demanded of the good, as consumers are forced to allocate more of their income to the good.

Conclusion

In conclusion, the Giffen Paradox is applicable to income demand, and describes a situation where an increase in the price of a Giffen good leads to an increase in the quantity demanded of the good. This paradox is important in understanding consumer behavior and the relationship between price and demand.

What is India`s rank in world population?

- a)Second

- b)First

- c)Third

- d)Fourth

Correct answer is option 'B'. Can you explain this answer?

What is India`s rank in world population?

a)

Second

b)

First

c)

Third

d)

Fourth

|

Rajveer Yadav answered |

India's Rank in World Population

India is the second-most populous country in the world after China. The country has a population of over 1.3 billion people, which is approximately 17.7% of the world's population.

Factors Contributing to India's Population

There are several factors contributing to India's high population growth, including:

1. High Fertility Rate: India has a high fertility rate, which is the average number of children born to a woman during her reproductive years. The fertility rate in India is around 2.2, which is higher than the global average of 1.7.

2. Lack of Awareness: There is a lack of awareness and access to family planning methods in many parts of the country. This leads to unplanned pregnancies and higher population growth.

3. Poverty: Poverty is a major factor contributing to high population growth in India. Many families believe that having more children will increase their chances of having a higher income in the future.

Impact of High Population on India

India's high population has several negative impacts on the country, including:

1. Strain on Resources: The high population puts a strain on the country's resources, including food, water, and energy.

2. Unemployment: The high population also contributes to high levels of unemployment in the country, as there are not enough jobs to support everyone.

3. Environmental Issues: The high population also leads to environmental issues, such as pollution and deforestation.

Conclusion

In conclusion, India is the second-most populous country in the world after China. The country's high population growth is due to several factors, including high fertility rates, lack of awareness, and poverty. The high population has several negative impacts on the country, including a strain on resources, high unemployment, and environmental issues.

India is the second-most populous country in the world after China. The country has a population of over 1.3 billion people, which is approximately 17.7% of the world's population.

Factors Contributing to India's Population

There are several factors contributing to India's high population growth, including:

1. High Fertility Rate: India has a high fertility rate, which is the average number of children born to a woman during her reproductive years. The fertility rate in India is around 2.2, which is higher than the global average of 1.7.

2. Lack of Awareness: There is a lack of awareness and access to family planning methods in many parts of the country. This leads to unplanned pregnancies and higher population growth.

3. Poverty: Poverty is a major factor contributing to high population growth in India. Many families believe that having more children will increase their chances of having a higher income in the future.

Impact of High Population on India

India's high population has several negative impacts on the country, including:

1. Strain on Resources: The high population puts a strain on the country's resources, including food, water, and energy.

2. Unemployment: The high population also contributes to high levels of unemployment in the country, as there are not enough jobs to support everyone.

3. Environmental Issues: The high population also leads to environmental issues, such as pollution and deforestation.

Conclusion

In conclusion, India is the second-most populous country in the world after China. The country's high population growth is due to several factors, including high fertility rates, lack of awareness, and poverty. The high population has several negative impacts on the country, including a strain on resources, high unemployment, and environmental issues.

Which of the following is/are not the quantitative measures of Central Bank?- a)Bank rate

- b)Open market operations

- c)Variable reserve ratios

- d)Rationing of credit

Correct answer is option 'D'. Can you explain this answer?

Which of the following is/are not the quantitative measures of Central Bank?

a)

Bank rate

b)

Open market operations

c)

Variable reserve ratios

d)

Rationing of credit

|

Arka Kaur answered |

Not Quantitative Measures of Central Bank

Rationing of Credit

Rationing of credit refers to the restriction of credit availability by the Central Bank. It is a qualitative measure of the Central Bank. The Central Bank may impose restrictions on the amount of credit that a commercial bank can lend to its customers. This is done to regulate the flow of credit and to prevent the economy from overheating.

Quantitative Measures of Central Bank

Bank Rate

Bank rate is the rate at which the Central Bank lends money to commercial banks. It is a quantitative measure of the Central Bank. The Central Bank uses the bank rate to control the money supply in the economy. An increase in the bank rate leads to a decrease in the money supply, and a decrease in the bank rate leads to an increase in the money supply.

Open Market Operations

Open market operations refer to the buying and selling of government securities by the Central Bank in the open market. It is a quantitative measure of the Central Bank. The Central Bank uses open market operations to control the money supply in the economy. If the Central Bank wants to decrease the money supply, it sells government securities in the open market, and if it wants to increase the money supply, it buys government securities in the open market.

Variable Reserve Ratios

Variable reserve ratios refer to the percentage of deposits that commercial banks are required to hold with the Central Bank. It is a quantitative measure of the Central Bank. The Central Bank uses variable reserve ratios to regulate the money supply in the economy. If the Central Bank wants to decrease the money supply, it increases the reserve ratio, and if it wants to increase the money supply, it decreases the reserve ratio.

Rationing of Credit

Rationing of credit refers to the restriction of credit availability by the Central Bank. It is a qualitative measure of the Central Bank. The Central Bank may impose restrictions on the amount of credit that a commercial bank can lend to its customers. This is done to regulate the flow of credit and to prevent the economy from overheating.

Quantitative Measures of Central Bank

Bank Rate

Bank rate is the rate at which the Central Bank lends money to commercial banks. It is a quantitative measure of the Central Bank. The Central Bank uses the bank rate to control the money supply in the economy. An increase in the bank rate leads to a decrease in the money supply, and a decrease in the bank rate leads to an increase in the money supply.

Open Market Operations

Open market operations refer to the buying and selling of government securities by the Central Bank in the open market. It is a quantitative measure of the Central Bank. The Central Bank uses open market operations to control the money supply in the economy. If the Central Bank wants to decrease the money supply, it sells government securities in the open market, and if it wants to increase the money supply, it buys government securities in the open market.

Variable Reserve Ratios

Variable reserve ratios refer to the percentage of deposits that commercial banks are required to hold with the Central Bank. It is a quantitative measure of the Central Bank. The Central Bank uses variable reserve ratios to regulate the money supply in the economy. If the Central Bank wants to decrease the money supply, it increases the reserve ratio, and if it wants to increase the money supply, it decreases the reserve ratio.

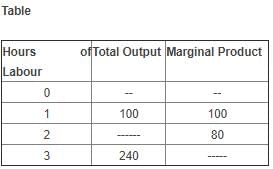

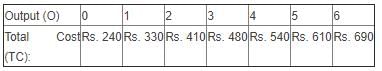

Directions: Use the table below to answer the question.

Q. The marginal cost of the sixth unit of output is

Q. The marginal cost of the sixth unit of output is- a)Rs. 133

- b)Rs. 75

- c)Rs. 80

- d)Rs. 450

Correct answer is option 'C'. Can you explain this answer?

Directions: Use the table below to answer the question.

Q. The marginal cost of the sixth unit of output is

a)

Rs. 133

b)

Rs. 75

c)

Rs. 80

d)

Rs. 450

|

Lekshmi Mehta answered |

Correct Answer :- c

Explanation : In the above table,

MC = 690 - 610 = 80.

Which of the following is true about monopolistic competition?- a)AR < MR

- b)AR > MR

- c)AR = MR

- d)None of these

Correct answer is option 'B'. Can you explain this answer?

Which of the following is true about monopolistic competition?

a)

AR < MR

b)

AR > MR

c)

AR = MR

d)

None of these

|

|

Poonam Reddy answered |

Answer: BExplanation:In monopolistic competition, the following is true:- AR > MR (Average Revenue is greater than Marginal Revenue)This situation occurs due to the following reasons:

- Downward Sloping Demand Curve: In monopolistic competition, there is a downward sloping demand curve. This means that in order to sell more units of a product, the firm has to lower the price. This results in a decrease in marginal revenue.

- Product Differentiation: Firms in monopolistic competition differentiate their products from their competitors'. This differentiation allows firms to have some degree of market power and charge a higher price than their marginal cost, resulting in a higher average revenue.

- Price Elasticity of Demand: In monopolistic competition, the demand for a firm's product is relatively elastic due to the presence of close substitutes. This means that a decrease in price leads to a proportionately larger increase in quantity demanded, resulting in a lower marginal revenue.

A discount store has a special offer on CDs. It reduces their price from Rs. 150 to Rs. 100. Suppose the store manager observes that the quantity demanded increases from 700 CDs to 1,300 CDs. What is the price elasticity of demand for CDs?(use arc elasticity)- a).8

- b)1.0

- c)1.25

- d)1.50

Correct answer is option 'D'. Can you explain this answer?

A discount store has a special offer on CDs. It reduces their price from Rs. 150 to Rs. 100. Suppose the store manager observes that the quantity demanded increases from 700 CDs to 1,300 CDs. What is the price elasticity of demand for CDs?(use arc elasticity)

a)

.8

b)

1.0

c)

1.25

d)

1.50

|

Hrishikesh Mukherjee answered |

To calculate the price elasticity of demand using the arc elasticity formula, we need to follow these steps:

Step 1: Calculate the percentage change in quantity demanded.

Percentage change in quantity demanded = ((New quantity demanded - Old quantity demanded) / ((New quantity demanded + Old quantity demanded) / 2)) * 100

Given that the old quantity demanded is 700 CDs and the new quantity demanded is 1,300 CDs:

Percentage change in quantity demanded = ((1,300 - 700) / ((1,300 + 700) / 2)) * 100

Percentage change in quantity demanded = (600 / 1,000) * 100

Percentage change in quantity demanded = 60%

Step 2: Calculate the percentage change in price.

Percentage change in price = ((New price - Old price) / ((New price + Old price) / 2)) * 100

Given that the old price is Rs. 150 and the new price is Rs. 100:

Percentage change in price = ((100 - 150) / ((100 + 150) / 2)) * 100

Percentage change in price = (-50 / 125) * 100

Percentage change in price = -40%

Step 3: Calculate the price elasticity of demand.

Price elasticity of demand = (Percentage change in quantity demanded) / (Percentage change in price)

Price elasticity of demand = 60% / -40%

Price elasticity of demand = -1.5

Since price elasticity of demand is negative, we take the absolute value to get a positive elasticity value.

Price elasticity of demand = |-1.5| = 1.5

Therefore, the price elasticity of demand for CDs is 1.5.

The correct answer is option D) 1.50.

Step 1: Calculate the percentage change in quantity demanded.

Percentage change in quantity demanded = ((New quantity demanded - Old quantity demanded) / ((New quantity demanded + Old quantity demanded) / 2)) * 100

Given that the old quantity demanded is 700 CDs and the new quantity demanded is 1,300 CDs:

Percentage change in quantity demanded = ((1,300 - 700) / ((1,300 + 700) / 2)) * 100

Percentage change in quantity demanded = (600 / 1,000) * 100

Percentage change in quantity demanded = 60%

Step 2: Calculate the percentage change in price.

Percentage change in price = ((New price - Old price) / ((New price + Old price) / 2)) * 100

Given that the old price is Rs. 150 and the new price is Rs. 100:

Percentage change in price = ((100 - 150) / ((100 + 150) / 2)) * 100

Percentage change in price = (-50 / 125) * 100

Percentage change in price = -40%

Step 3: Calculate the price elasticity of demand.

Price elasticity of demand = (Percentage change in quantity demanded) / (Percentage change in price)

Price elasticity of demand = 60% / -40%

Price elasticity of demand = -1.5

Since price elasticity of demand is negative, we take the absolute value to get a positive elasticity value.

Price elasticity of demand = |-1.5| = 1.5

Therefore, the price elasticity of demand for CDs is 1.5.

The correct answer is option D) 1.50.

Which of the following concepts of budget deficit has become practically redundant in India?- a)Fiscal deficit

- b)Budgetary deficit

- c)Primary deficit

- d)Revenue deficit

Correct answer is option 'B'. Can you explain this answer?

Which of the following concepts of budget deficit has become practically redundant in India?

a)

Fiscal deficit

b)

Budgetary deficit

c)

Primary deficit

d)

Revenue deficit

|

Anand Dasgupta answered |

Concepts of Budget Deficit in India

Budget deficit is the difference between the government's total expenditure and its total revenue. In India, there are four concepts of budget deficit, which are as follows:

1. Fiscal Deficit:

Fiscal deficit is the difference between the government's total expenditure and its total revenue, excluding borrowings. In other words, it is the amount of money that the government needs to borrow to meet its expenditure. Fiscal deficit is an important indicator of the government's borrowing requirements and its ability to repay debts. It is the most widely used concept of budget deficit in India.

2. Budgetary Deficit:

Budgetary deficit is the difference between the government's total expenditure and its total revenue, including borrowings. It is the amount of money that the government needs to borrow to meet its expenditure. Budgetary deficit was used in the past as the primary indicator of budget deficit in India.

3. Primary Deficit:

Primary deficit is the difference between the government's total expenditure and its total revenue, excluding interest payments on past borrowings. It is used to measure the government's ability to repay debts without taking on new loans. Primary deficit is an important indicator of the government's fiscal discipline.

4. Revenue Deficit:

Revenue deficit is the difference between the government's revenue expenditure and its revenue receipts. It indicates that the government is not able to meet its day-to-day expenses from its own revenue sources and needs to borrow money for the same.

Redundant Concept of Budget Deficit in India

Among the four concepts of budget deficit in India, the concept of budgetary deficit has become practically redundant. This is because budgetary deficit includes borrowings, which are already included in fiscal deficit. Therefore, budgetary deficit does not provide any additional information beyond fiscal deficit. As a result, the government of India stopped using budgetary deficit as a measure of budget deficit in 2017-18 budget.

Budget deficit is the difference between the government's total expenditure and its total revenue. In India, there are four concepts of budget deficit, which are as follows:

1. Fiscal Deficit:

Fiscal deficit is the difference between the government's total expenditure and its total revenue, excluding borrowings. In other words, it is the amount of money that the government needs to borrow to meet its expenditure. Fiscal deficit is an important indicator of the government's borrowing requirements and its ability to repay debts. It is the most widely used concept of budget deficit in India.

2. Budgetary Deficit:

Budgetary deficit is the difference between the government's total expenditure and its total revenue, including borrowings. It is the amount of money that the government needs to borrow to meet its expenditure. Budgetary deficit was used in the past as the primary indicator of budget deficit in India.

3. Primary Deficit:

Primary deficit is the difference between the government's total expenditure and its total revenue, excluding interest payments on past borrowings. It is used to measure the government's ability to repay debts without taking on new loans. Primary deficit is an important indicator of the government's fiscal discipline.

4. Revenue Deficit:

Revenue deficit is the difference between the government's revenue expenditure and its revenue receipts. It indicates that the government is not able to meet its day-to-day expenses from its own revenue sources and needs to borrow money for the same.

Redundant Concept of Budget Deficit in India

Among the four concepts of budget deficit in India, the concept of budgetary deficit has become practically redundant. This is because budgetary deficit includes borrowings, which are already included in fiscal deficit. Therefore, budgetary deficit does not provide any additional information beyond fiscal deficit. As a result, the government of India stopped using budgetary deficit as a measure of budget deficit in 2017-18 budget.

The demand of a product at the rate of  10 is 100 units. When the rate is decreased to

10 is 100 units. When the rate is decreased to  8 per unit, the demand rises to 130 units. What is the elasticity of demand according to the total expenditure method?

8 per unit, the demand rises to 130 units. What is the elasticity of demand according to the total expenditure method?- a)Unitary

- b)Less than unitary

- c)More than unitary

- d)None of these

Correct answer is option 'C'. Can you explain this answer?

The demand of a product at the rate of  10 is 100 units. When the rate is decreased to

10 is 100 units. When the rate is decreased to  8 per unit, the demand rises to 130 units. What is the elasticity of demand according to the total expenditure method?

8 per unit, the demand rises to 130 units. What is the elasticity of demand according to the total expenditure method?

10 is 100 units. When the rate is decreased to

10 is 100 units. When the rate is decreased to  8 per unit, the demand rises to 130 units. What is the elasticity of demand according to the total expenditure method?

8 per unit, the demand rises to 130 units. What is the elasticity of demand according to the total expenditure method?a)

Unitary

b)

Less than unitary

c)

More than unitary

d)

None of these

|

Freedom Institute answered |

- The total expenditure method analyzes elasticity by comparing changes in total revenue (price × quantity) when price changes.

- Initially: (10 times 100 = 1000).

- New scenario: (8 times 130 = 1040).

- Total revenue increased from 1000 to 1040 when the price decreased, indicating demand is elastic.

- Elasticity greater than one implies consumers' demand is highly responsive to price changes.

- Therefore, the elasticity of demand is more than unitary, thus the correct answer is C: More than unitary.

- Initially: (10 times 100 = 1000).

- New scenario: (8 times 130 = 1040).

- Total revenue increased from 1000 to 1040 when the price decreased, indicating demand is elastic.

- Elasticity greater than one implies consumers' demand is highly responsive to price changes.

- Therefore, the elasticity of demand is more than unitary, thus the correct answer is C: More than unitary.

Which of the following costs can never be zero?- a)Variable

- b)Fixed

- c)Prime

- d)All of these

Correct answer is option 'B'. Can you explain this answer?

Which of the following costs can never be zero?

a)

Variable

b)

Fixed

c)

Prime

d)

All of these

|

Ronak Kothari answered |

B ) fixed cost is the cost that can never be zero, we can understand it by the example:

Suppose if u are a manufacturer and u had purchased a land and on that u r producing a good and every year u have to a pay a property tax for that land and it doesn't how much quantities of goods u r producing u have to property tax whether u produce 1 good or 100 goods u have to pay the cost and If u don't even produce a good still u have to pay the cost and these types of cost which u have pay no matter what are know as Fixed cost and these Fixed cost can never be zero

Suppose if u are a manufacturer and u had purchased a land and on that u r producing a good and every year u have to a pay a property tax for that land and it doesn't how much quantities of goods u r producing u have to property tax whether u produce 1 good or 100 goods u have to pay the cost and If u don't even produce a good still u have to pay the cost and these types of cost which u have pay no matter what are know as Fixed cost and these Fixed cost can never be zero

The elasticity of demand for perishable goods such as milk, vegetables etc. is generally- a)perfectly elastic

- b)relatively elastic

- c)relatively inelastic

- d)zero elastic

Correct answer is option 'C'. Can you explain this answer?

The elasticity of demand for perishable goods such as milk, vegetables etc. is generally

a)

perfectly elastic

b)

relatively elastic

c)

relatively inelastic

d)

zero elastic

|

Arka Kaur answered |

The Elasticity of Demand for Perishable Goods

The elasticity of demand is a measure of the responsiveness of the quantity demanded of a good or service to changes in its price. The elasticity of demand for perishable goods such as milk, vegetables, and fruits is generally relatively inelastic, which means that the quantity demanded does not change significantly when the price changes.

Reasons for Relatively Inelastic Demand for Perishable Goods

1. Necessity: Perishable goods are often considered essential items that consumers need to buy regardless of the price. For example, people need to buy milk, fruits, and vegetables to meet their nutritional needs.

2. Limited Substitutes: Perishable goods often have limited substitutes, especially in the short term. For example, if the price of milk increases, consumers may not be able to switch to other beverages like juice or soda immediately.

3. Time Constraint: Perishable goods have a limited shelf life, and consumers need to consume them before they spoil. Therefore, consumers may not have the luxury of waiting for the price to decrease before making a purchase.

Implications of Relatively Inelastic Demand for Perishable Goods

1. Price Changes: Producers of perishable goods have limited flexibility in increasing or decreasing prices because it may not significantly affect the quantity demanded.

2. Supply Chain Management: Producers of perishable goods need to manage their supply chain efficiently to reduce spoilage and waste. They need to ensure that the right quantity of goods is produced, transported, and stored to meet consumer demand.

Conclusion

In conclusion, the elasticity of demand for perishable goods is generally relatively inelastic due to their necessity, limited substitutes, and time constraint. This has implications for pricing and supply chain management for producers of perishable goods.

The elasticity of demand is a measure of the responsiveness of the quantity demanded of a good or service to changes in its price. The elasticity of demand for perishable goods such as milk, vegetables, and fruits is generally relatively inelastic, which means that the quantity demanded does not change significantly when the price changes.

Reasons for Relatively Inelastic Demand for Perishable Goods

1. Necessity: Perishable goods are often considered essential items that consumers need to buy regardless of the price. For example, people need to buy milk, fruits, and vegetables to meet their nutritional needs.

2. Limited Substitutes: Perishable goods often have limited substitutes, especially in the short term. For example, if the price of milk increases, consumers may not be able to switch to other beverages like juice or soda immediately.

3. Time Constraint: Perishable goods have a limited shelf life, and consumers need to consume them before they spoil. Therefore, consumers may not have the luxury of waiting for the price to decrease before making a purchase.

Implications of Relatively Inelastic Demand for Perishable Goods

1. Price Changes: Producers of perishable goods have limited flexibility in increasing or decreasing prices because it may not significantly affect the quantity demanded.

2. Supply Chain Management: Producers of perishable goods need to manage their supply chain efficiently to reduce spoilage and waste. They need to ensure that the right quantity of goods is produced, transported, and stored to meet consumer demand.

Conclusion

In conclusion, the elasticity of demand for perishable goods is generally relatively inelastic due to their necessity, limited substitutes, and time constraint. This has implications for pricing and supply chain management for producers of perishable goods.

The quantitative measures by the Central Bank are also known as

- a)qualitative measures

- b)general measures

- c)quota measures

- d)selective measures

Correct answer is option 'B'. Can you explain this answer?

The quantitative measures by the Central Bank are also known as

a)

qualitative measures

b)

general measures

c)

quota measures

d)

selective measures

|

Moumita Bajaj answered |

Correct Answer :- a,d

Explanation : The methods used by the central bank to regulate the flows of credit into particular directions of the economy are called qualitative or selective methods of credit control. Unlike the quantitative methods, which affect the total volume of credit, the qualitative methods affect the types of credit, extended by the commercial banks; they affect the composition rather than the size of credit in the economy.

Which of the following industries has been excluded from the list of industries reserved for public sector?- a)Atomic energy

- b)Atomic minerals

- c)Railways

- d)Defense production

Correct answer is option 'D'. Can you explain this answer?

Which of the following industries has been excluded from the list of industries reserved for public sector?

a)

Atomic energy

b)

Atomic minerals

c)

Railways

d)

Defense production

|

Lakshmi Kaur answered |

**Explanation:**

The list of industries reserved for the public sector in India is mentioned in the Industrial Policy Resolution, 1956. These industries are considered to be of strategic importance and are intended to be owned and operated by the government. However, over the years, there have been changes and certain industries have been excluded from this list.

The correct answer to the given question is option 'D' - Defense production. Defense production is no longer reserved for the public sector and can also be undertaken by private companies.

**Reason for Exclusion:**

The decision to exclude defense production from the list of industries reserved for the public sector was taken to encourage private sector participation, promote competition, and enhance efficiency and innovation in the defense industry. This move was aimed at attracting foreign direct investment (FDI) in defense manufacturing, modernizing the defense forces, and reducing the country's dependency on imports for defense equipment.

**Impact of the Decision:**

The exclusion of defense production from the list of reserved industries has led to the establishment of joint ventures, collaborations, and partnerships between Indian and foreign companies in the defense sector. This has resulted in the transfer of technology, knowledge sharing, and increased indigenous defense production capabilities.

Private companies are now able to participate in defense tenders, bid for defense contracts, and contribute to the development and production of defense equipment. This has not only boosted the growth of the private sector but has also created opportunities for employment and skill development in the defense industry.