UPSC Exam > UPSC Questions > With reference to the monetary policy of the ...

Start Learning for Free

With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?

- a)Repo rate is always higher than the reverse repo rate.

- b)Repo rate may sometimes be lower than the reverse repo rate.

- c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.

- d)Cash Reserve Ratio is lower than SLR.

Correct answer is option 'B'. Can you explain this answer?

| FREE This question is part of | Download PDF Attempt this Test |

Verified Answer

With reference to the monetary policy of the Reserve bank of India, wh...

Most Upvoted Answer

With reference to the monetary policy of the Reserve bank of India, wh...

Explanation:

The monetary policy of the Reserve Bank of India (RBI) refers to the measures taken by the central bank to control inflation, stabilize the economy, and promote economic growth. It primarily involves managing key interest rates, such as the repo rate, reverse repo rate, Statutory Liquidity Ratio (SLR), and Cash Reserve Ratio (CRR).

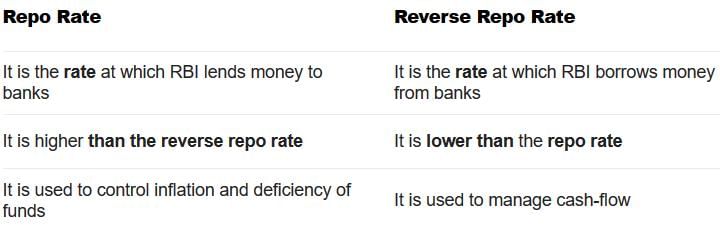

a) Repo rate is always higher than the reverse repo rate:

The repo rate is the rate at which the RBI lends money to commercial banks for a short duration, typically overnight. It is used by the RBI to control liquidity in the economy. The reverse repo rate, on the other hand, is the rate at which the RBI borrows money from commercial banks. It is used to drain excess liquidity from the system. In normal circumstances, the repo rate is higher than the reverse repo rate to incentivize banks to lend money to the RBI rather than keep it idle.

b) Repo rate may sometimes be lower than the reverse repo rate:

This statement is incorrect. In the normal course of monetary policy, the repo rate is always higher than the reverse repo rate. This is to encourage banks to lend money to the RBI, which helps in reducing liquidity in the economy. However, in exceptional circumstances or during specific policy interventions, the RBI may reduce the repo rate below the reverse repo rate to provide additional liquidity to the banking system.

c) The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate:

The Statutory Liquidity Ratio (SLR) is the percentage of net demand and time liabilities that banks are required to maintain in the form of liquid assets, such as cash, gold, or government securities. It is a tool used by the RBI to regulate the credit flow in the economy. The SLR is typically higher than the repo and reverse repo rates as it ensures that banks maintain a certain level of liquidity to meet their obligations.

d) Cash Reserve Ratio is lower than SLR:

The Cash Reserve Ratio (CRR) is the percentage of net demand and time liabilities that banks are required to maintain as cash reserves with the RBI. It is a tool used by the RBI to control inflation and curb excessive lending. The CRR is usually lower than the SLR as it specifically focuses on cash reserves, whereas the SLR includes a broader range of liquid assets.

Conclusion:

Option B is incorrect because in normal circumstances, the repo rate is always higher than the reverse repo rate.

The monetary policy of the Reserve Bank of India (RBI) refers to the measures taken by the central bank to control inflation, stabilize the economy, and promote economic growth. It primarily involves managing key interest rates, such as the repo rate, reverse repo rate, Statutory Liquidity Ratio (SLR), and Cash Reserve Ratio (CRR).

a) Repo rate is always higher than the reverse repo rate:

The repo rate is the rate at which the RBI lends money to commercial banks for a short duration, typically overnight. It is used by the RBI to control liquidity in the economy. The reverse repo rate, on the other hand, is the rate at which the RBI borrows money from commercial banks. It is used to drain excess liquidity from the system. In normal circumstances, the repo rate is higher than the reverse repo rate to incentivize banks to lend money to the RBI rather than keep it idle.

b) Repo rate may sometimes be lower than the reverse repo rate:

This statement is incorrect. In the normal course of monetary policy, the repo rate is always higher than the reverse repo rate. This is to encourage banks to lend money to the RBI, which helps in reducing liquidity in the economy. However, in exceptional circumstances or during specific policy interventions, the RBI may reduce the repo rate below the reverse repo rate to provide additional liquidity to the banking system.

c) The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate:

The Statutory Liquidity Ratio (SLR) is the percentage of net demand and time liabilities that banks are required to maintain in the form of liquid assets, such as cash, gold, or government securities. It is a tool used by the RBI to regulate the credit flow in the economy. The SLR is typically higher than the repo and reverse repo rates as it ensures that banks maintain a certain level of liquidity to meet their obligations.

d) Cash Reserve Ratio is lower than SLR:

The Cash Reserve Ratio (CRR) is the percentage of net demand and time liabilities that banks are required to maintain as cash reserves with the RBI. It is a tool used by the RBI to control inflation and curb excessive lending. The CRR is usually lower than the SLR as it specifically focuses on cash reserves, whereas the SLR includes a broader range of liquid assets.

Conclusion:

Option B is incorrect because in normal circumstances, the repo rate is always higher than the reverse repo rate.

Attention UPSC Students!

To make sure you are not studying endlessly, EduRev has designed UPSC study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in UPSC.

|

Explore Courses for UPSC exam

|

|

Similar UPSC Doubts

With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer?

Question Description

With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer? for UPSC 2024 is part of UPSC preparation. The Question and answers have been prepared according to the UPSC exam syllabus. Information about With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer? covers all topics & solutions for UPSC 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer?.

With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer? for UPSC 2024 is part of UPSC preparation. The Question and answers have been prepared according to the UPSC exam syllabus. Information about With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer? covers all topics & solutions for UPSC 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer?.

Solutions for With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer? in English & in Hindi are available as part of our courses for UPSC.

Download more important topics, notes, lectures and mock test series for UPSC Exam by signing up for free.

Here you can find the meaning of With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer? defined & explained in the simplest way possible. Besides giving the explanation of

With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer?, a detailed solution for With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer? has been provided alongside types of With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer? theory, EduRev gives you an

ample number of questions to practice With reference to the monetary policy of the Reserve bank of India, which of the statement given below is incorrect?a)Repo rate is always higher than the reverse repo rate.b)Repo rate may sometimes be lower than the reverse repo rate.c)The Statutory Liquidity Ratio (SLR) is often higher than the repo and reverse repo rate.d)Cash Reserve Ratio is lower than SLR.Correct answer is option 'B'. Can you explain this answer? tests, examples and also practice UPSC tests.

|

Explore Courses for UPSC exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.