UPSC Exam > UPSC Questions > Consider the following important sources of ...

Start Learning for Free

Consider the following important sources of tax revenue for the Central Government:

I. Corporation tax

II. Taxes on income other than corporation tax

III. Customs

IV. Union excise duties

Which one of the following is the correct descending order in terms of gross tax revenue?

- a)I-II-IV-III

- b)I-II-III-IV

- c)III-I-II-IV

- d)II-III-I-IV

Correct answer is option 'B'. Can you explain this answer?

| FREE This question is part of | Download PDF Attempt this Test |

Most Upvoted Answer

Consider the following important sources of tax revenue for the Centr...

Correct answer: B) I-II-III-IV

Explanation:

The correct descending order in terms of gross tax revenue for the Central Government is as follows:

I. Corporation tax

II. Taxes on income other than corporation tax

III. Customs

IV. Union excise duties

Let's understand each source of tax revenue in detail:

I. Corporation tax:

- Corporation tax is a direct tax imposed on the income of corporations or companies.

- It is levied on the profits earned by companies during a financial year.

- This tax is an important source of revenue for the Central Government as it contributes a significant portion to the overall tax revenue.

II. Taxes on income other than corporation tax:

- This category includes various direct taxes levied on individuals and other entities apart from corporations.

- It includes income tax, which is levied on the income earned by individuals, as well as taxes on capital gains, dividends, and other sources of income.

- These taxes are an important source of revenue for the Central Government as they contribute a significant portion to the overall tax revenue.

III. Customs:

- Customs duty is a type of indirect tax levied on goods imported into or exported out of a country.

- It is imposed to protect domestic industries, regulate imports and exports, and generate revenue for the government.

- Customs duty is an important source of revenue for the Central Government, especially in countries with significant international trade.

IV. Union excise duties:

- Union excise duty is an indirect tax levied on the production or manufacture of goods within the country.

- It is imposed on goods such as alcohol, tobacco, petroleum products, and certain luxury items.

- Union excise duties are an important source of revenue for the Central Government, especially for goods that are in high demand or are subject to high rates of taxation.

Descending order of gross tax revenue:

Based on the above explanations, the correct descending order in terms of gross tax revenue for the Central Government is I-II-III-IV:

- Corporation tax (I) contributes a significant portion to the overall tax revenue.

- Taxes on income other than corporation tax (II) also contribute a significant portion to the overall tax revenue.

- Customs (III) generate revenue through imports and exports.

- Union excise duties (IV) generate revenue through production and manufacture of goods within the country.

Hence, the correct answer is option B) I-II-III-IV.

Explanation:

The correct descending order in terms of gross tax revenue for the Central Government is as follows:

I. Corporation tax

II. Taxes on income other than corporation tax

III. Customs

IV. Union excise duties

Let's understand each source of tax revenue in detail:

I. Corporation tax:

- Corporation tax is a direct tax imposed on the income of corporations or companies.

- It is levied on the profits earned by companies during a financial year.

- This tax is an important source of revenue for the Central Government as it contributes a significant portion to the overall tax revenue.

II. Taxes on income other than corporation tax:

- This category includes various direct taxes levied on individuals and other entities apart from corporations.

- It includes income tax, which is levied on the income earned by individuals, as well as taxes on capital gains, dividends, and other sources of income.

- These taxes are an important source of revenue for the Central Government as they contribute a significant portion to the overall tax revenue.

III. Customs:

- Customs duty is a type of indirect tax levied on goods imported into or exported out of a country.

- It is imposed to protect domestic industries, regulate imports and exports, and generate revenue for the government.

- Customs duty is an important source of revenue for the Central Government, especially in countries with significant international trade.

IV. Union excise duties:

- Union excise duty is an indirect tax levied on the production or manufacture of goods within the country.

- It is imposed on goods such as alcohol, tobacco, petroleum products, and certain luxury items.

- Union excise duties are an important source of revenue for the Central Government, especially for goods that are in high demand or are subject to high rates of taxation.

Descending order of gross tax revenue:

Based on the above explanations, the correct descending order in terms of gross tax revenue for the Central Government is I-II-III-IV:

- Corporation tax (I) contributes a significant portion to the overall tax revenue.

- Taxes on income other than corporation tax (II) also contribute a significant portion to the overall tax revenue.

- Customs (III) generate revenue through imports and exports.

- Union excise duties (IV) generate revenue through production and manufacture of goods within the country.

Hence, the correct answer is option B) I-II-III-IV.

Free Test

FREE

| Start Free Test |

Community Answer

Consider the following important sources of tax revenue for the Centr...

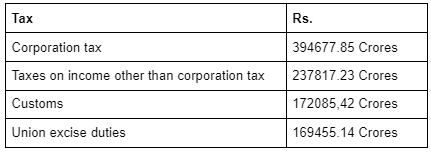

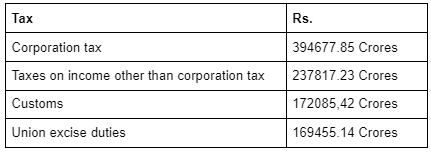

According to the Central Budget 2015-16, the details of revenues received by various top departments in 2013-14 are as follows.

Hence, the correct option is (b).

Attention UPSC Students!

To make sure you are not studying endlessly, EduRev has designed UPSC study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in UPSC.

|

Explore Courses for UPSC exam

|

|

Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer?

Question Description

Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer? for UPSC 2024 is part of UPSC preparation. The Question and answers have been prepared according to the UPSC exam syllabus. Information about Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer? covers all topics & solutions for UPSC 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer?.

Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer? for UPSC 2024 is part of UPSC preparation. The Question and answers have been prepared according to the UPSC exam syllabus. Information about Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer? covers all topics & solutions for UPSC 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer?.

Solutions for Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer? in English & in Hindi are available as part of our courses for UPSC.

Download more important topics, notes, lectures and mock test series for UPSC Exam by signing up for free.

Here you can find the meaning of Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer? defined & explained in the simplest way possible. Besides giving the explanation of

Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer?, a detailed solution for Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer? has been provided alongside types of Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer? theory, EduRev gives you an

ample number of questions to practice Consider the following important sources of tax revenue for the Central Government:I. Corporation taxII. Taxes on income other than corporation taxIII. CustomsIV. Union excise dutiesWhich one of the following is the correct descending order in terms of gross tax revenue?a)I-II-IV-IIIb)I-II-III-IVc)III-I-II-IVd)II-III-I-IVCorrect answer is option 'B'. Can you explain this answer? tests, examples and also practice UPSC tests.

|

Explore Courses for UPSC exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.