UPSC Exam > UPSC Notes > Indian Economy for UPSC CSE > Cheat Sheet: Indian Financial Market

Cheat Sheet: Indian Financial Market | Indian Economy for UPSC CSE PDF Download

Introduction

The Indian financial market is broadly divided into Money Market and Capital Market. It facilitates the mobilization of savings, allocation of capital, and management of risk, playing a key role in economic growth.

Money Market in India

Market for short-term funds and financial instruments with maturity ≤ 1 year.

Key Instruments:

- Treasury Bills (T-Bills) – Issued by GoI for 91/182/364 days.

- Commercial Paper (CP) – Issued by corporates, short-term unsecured.

- Certificates of Deposit (CD) – Issued by banks, negotiable time deposits.

- Call Money Market – Very short-term borrowing (overnight to 14 days) between banks.

Key Institutions:

- RBI – Regulator.

- DFHI (Discount and Finance House of India) – Established in 1988 to develop the secondary market in money market instruments.

Capital Market in India

Deals with long-term funding via debt and equity instruments.

Segments:

- Primary Market – New securities issued via IPOs, FPOs.

- Secondary Market – Existing securities traded (e.g., NSE, BSE).

- Instruments: Equity shares, debentures, bonds, mutual funds, derivatives.

Financial Intermediaries

- Banks – Channelize savings to investments.

- NBFCs – Provide loans, leasing, hire purchase etc.

- Insurance Companies – Mobilize long-term funds via premiums.

- Mutual Funds – Pool funds from investors, invest in capital markets.

- Pension Funds – Long-term savings for retirement, e.g., NPS.

Mutual Funds

Regulated by SEBI.

Types:

- Equity Funds, Debt Funds, Hybrid Funds, Index Funds.

- Help in financial inclusion and retail investor participation.

Project Financing in India

Sources:

- Financial Institutions (NABARD, SIDBI, EXIM Bank)

- Commercial Banks

- NBFCs

Modes:

- Debt Financing, Equity Financing, PPP Models.

Financial Institutions

Development Financial Institutions (DFIs):

- SIDBI – For MSMEs.

- NABARD – For agriculture and rural development.

- NHB – For housing finance.

- EXIM Bank – For international trade.

IFSC (GIFT City) – India's global financial services hub.

Banking Industry

Structure: Public Sector Banks, Private Banks, Foreign Banks, RRBs, Cooperative Banks.

Recent Developments:

- Digital Banking Units (DBUs) launched.

- Merger of PSBs for efficiency.

- Focus on financial inclusion through PMJDY.

Insurance Industry

- Regulated by IRDAI.

- Life Insurance: LIC + private players.

- General Insurance: Covers health, vehicle, property etc.

- Recent Reforms:

- FDI limit increased to 74%.

- Digital policies promoted.

Securities Market

- Regulated by SEBI.

- Stock Exchanges: NSE, BSE.

- Instruments: Equity, Derivatives, ETFs, Bonds.

- Investor protection through Investor Education and Protection Fund (IEPF).

Financial Regulation in India

Regulators:

- RBI – Banks, NBFCs, Money Market.

- SEBI – Capital Market.

- IRDAI – Insurance.

- PFRDA – Pension Funds.

FSDC (Financial Stability and Development Council):

- Set up in 2010.

- Headed by Finance Minister.

- Ensures coordination among regulators.

- Focuses on systemic risk management, financial inclusion, financial literacy.

Recent Initiatives and Reforms (as of 2025)

- Unified Regulatory Framework for fintechs being debated.

- Digital Rupee (CBDC) pilot expanded.

- GIFT City developments accelerating financial globalization.

- SEBI’s tightening of disclosure norms to enhance transparency.

- Retail Participation in government securities via RBI Retail Direct.

- Indian Bond Market reforms to deepen corporate debt market.

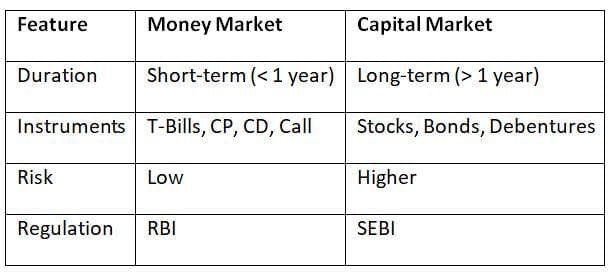

Quick Comparison: Money Market vs Capital Market

The document Cheat Sheet: Indian Financial Market | Indian Economy for UPSC CSE is a part of the UPSC Course Indian Economy for UPSC CSE.

All you need of UPSC at this link: UPSC

|

108 videos|425 docs|128 tests

|

FAQs on Cheat Sheet: Indian Financial Market - Indian Economy for UPSC CSE

| 1. What are the key differences between the money market and the capital market in India? |  |

Ans. The money market in India is primarily used for short-term borrowing and lending, typically with maturities of one year or less. Instruments in the money market include Treasury bills, commercial papers, and certificates of deposit. In contrast, the capital market is focused on long-term financing, with instruments such as stocks and bonds, which have maturities exceeding one year. The money market provides liquidity and funding for the government and financial institutions, while the capital market helps companies raise funds for expansion and growth.

| 2. How do financial intermediaries function within the Indian financial market? |  |

Ans. Financial intermediaries play a crucial role in the Indian financial market by channeling funds from savers to borrowers. They include banks, insurance companies, mutual funds, and pension funds. These intermediaries assess the creditworthiness of borrowers, provide risk management products, and facilitate investment opportunities. By pooling resources, they enable greater access to capital for businesses and individuals, thereby contributing to economic growth and stability.

| 3. What are the main types of mutual funds available in India, and how do they differ? |  |

Ans. In India, mutual funds can be categorized into several types, including equity funds, debt funds, hybrid funds, and liquid funds. Equity funds invest primarily in stocks and aim for capital appreciation, while debt funds invest in fixed income securities and focus on regular income. Hybrid funds combine both equity and debt investments to balance risk and returns. Liquid funds are short-term debt funds that provide high liquidity and are suitable for parking funds temporarily. Each type has different risk-return profiles, catering to various investor needs.

| 4. What role do financial institutions play in project financing in India? |  |

Ans. Financial institutions in India, such as banks and development finance institutions, play a vital role in project financing by providing long-term loans and financial support for infrastructure and industrial projects. They assess the viability and risk of projects, often requiring detailed project reports and feasibility studies. These institutions also offer advisory services and help in structuring financing solutions that include equity, debt, and hybrid instruments, facilitating the successful implementation of large-scale projects in the economy.

| 5. How has the banking industry evolved in India, particularly in terms of regulation and technology? |  |

Ans. The banking industry in India has undergone significant evolution, particularly with the introduction of regulatory reforms and technological advancements. The establishment of the Reserve Bank of India as the central bank has provided a framework for monetary policy and regulation. The liberalization of the banking sector in the 1990s led to the entry of private and foreign banks, enhancing competition. Furthermore, technology has transformed banking operations through digital banking, mobile apps, and online services, improving customer accessibility and operational efficiency while ensuring compliance with regulatory standards.

Related Searches