UPSC Exam > UPSC Notes > Indian Economy for UPSC CSE > Cheat Sheet: Public Finance in India

Cheat Sheet: Public Finance in India | Indian Economy for UPSC CSE PDF Download

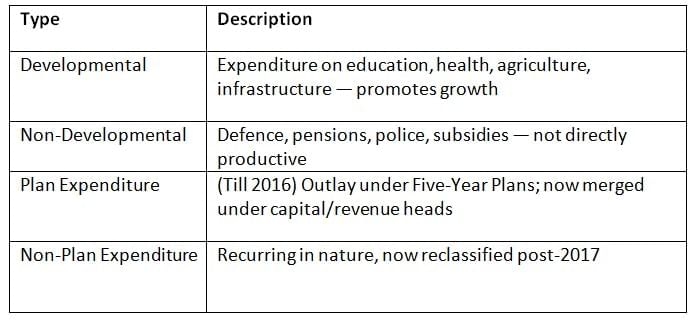

Classification of Government Expenditure

Since 2017–18, classification is now based on Revenue & Capital Expenditure.

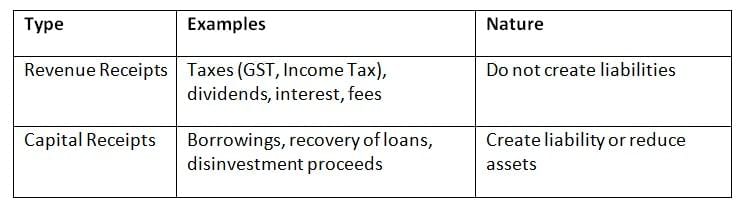

Government Receipts

- Tax Revenue = Direct (Income Tax, Corp Tax) + Indirect (GST, Customs)

- Non-Tax Revenue = Dividends, interest, fees from govt. services

Budget Documents and Types

- Revenue Budget: Revenue Receipts + Revenue Expenditure

- Capital Budget: Capital Receipts + Capital Expenditure

- Types of Budgets:

- Balanced: Receipts = Expenditure

- Surplus: Receipts > Expenditure

- Deficit: Expenditure > Receipts

- Gender Budgeting: Focused on women's welfare and empowerment

- Zero-Based Budgeting: Every item justified from zero annually

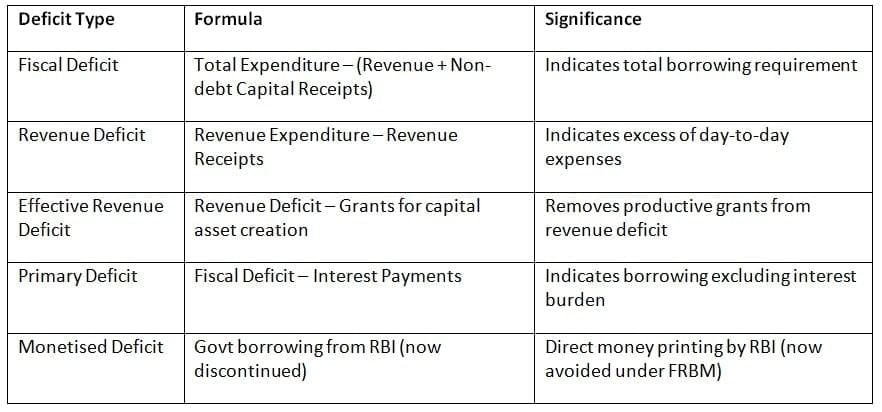

Budget Deficits

Fiscal Responsibility and Budget Management (FRBM) Act, 2003

Enacted to ensure fiscal discipline and macroeconomic stability

Key targets (original):

- Fiscal Deficit ≤ 3% of GDP

- Eliminate Revenue Deficit

- No RBI borrowing (monetised deficit banned)

N.K. Singh Committee Recommendations:

- Debt-to-GDP Target: Combined 60% (Centre 40%, States 20%)

- Fiscal Council: Independent advisory body

- Escape Clause: 0.5% deviation allowed during economic distress

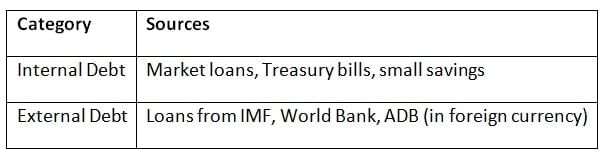

Public Debt

- Managed by the RBI but proposal exists for an Independent Debt Management Agency (PDMA)

- Debt sustainability is judged by interest-payment-to-GDP and debt-to-GDP ratios

Deficit Financing in India

Main Sources:

- Market borrowings (G-Secs, T-Bills)

- Small savings schemes (NSC, PPF)

- Disinvestment proceeds (non-debt capital)

- External loans (limited use)

Monetary Financing (RBI borrowing) has been curbed post-FRBM Act.

Government Budgeting Process (as per Article 112 of Constitution)

- Annual Financial Statement (AFS): Union Budget

- Finance Bill: Contains taxation proposals

- Appropriation Bill: Authorises govt. to withdraw money

- Demand for Grants: For ministries/programs

- Supplementary Budget: For extra/unforeseen expenditure

The document Cheat Sheet: Public Finance in India | Indian Economy for UPSC CSE is a part of the UPSC Course Indian Economy for UPSC CSE.

All you need of UPSC at this link: UPSC

|

108 videos|425 docs|128 tests

|

FAQs on Cheat Sheet: Public Finance in India - Indian Economy for UPSC CSE

| 1. What are the different classifications of government expenditure in India? |  |

Ans.Government expenditure in India can be classified into two main categories: revenue expenditure and capital expenditure. Revenue expenditure refers to the spending on day-to-day operations and services that do not lead to the creation of assets, such as salaries, subsidies, and interest payments. Capital expenditure, on the other hand, involves spending on assets that will provide benefits over a longer period, such as infrastructure projects and investments in public enterprises.

| 2. What are government receipts, and how do they contribute to public finance? |  |

Ans.Government receipts are the income generated by the government from various sources, which can be classified into tax and non-tax revenues. Tax revenues include direct taxes like income tax and indirect taxes like GST, while non-tax revenues may include fees, fines, and profits from public sector enterprises. These receipts are crucial for financing government expenditure and managing the fiscal balance.

| 3. What is the significance of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003 in India? |  |

Ans.The FRBM Act, 2003 was enacted to promote fiscal discipline by setting targets for the government to reduce fiscal deficits and public debt. The Act aims to ensure transparency in fiscal operations and sustainability of government finances, thereby enhancing the credibility of the economy. It mandates the government to present a medium-term fiscal policy statement and to achieve specified fiscal targets.

| 4. How does the government budgeting process work as per Article 112 of the Indian Constitution? |  |

Ans.According to Article 112 of the Indian Constitution, the government is required to present an annual budget to the Parliament, detailing the estimated receipts and expenditure for the upcoming fiscal year. The budget must be presented before the beginning of the financial year and must be approved by the Parliament. It outlines the government's financial plan, including revenue and capital expenditures, and is crucial for maintaining fiscal discipline.

| 5. What is deficit financing, and how is it applied in India? |  |

Ans.Deficit financing refers to the practice of funding government expenditure by borrowing rather than through revenue generation. In India, it is used to cover budget deficits when government expenditures exceed receipts. This can be done through issuing government securities or loans. While it can stimulate economic growth, excessive deficit financing may lead to inflation and increased public debt if not managed properly.

Related Searches